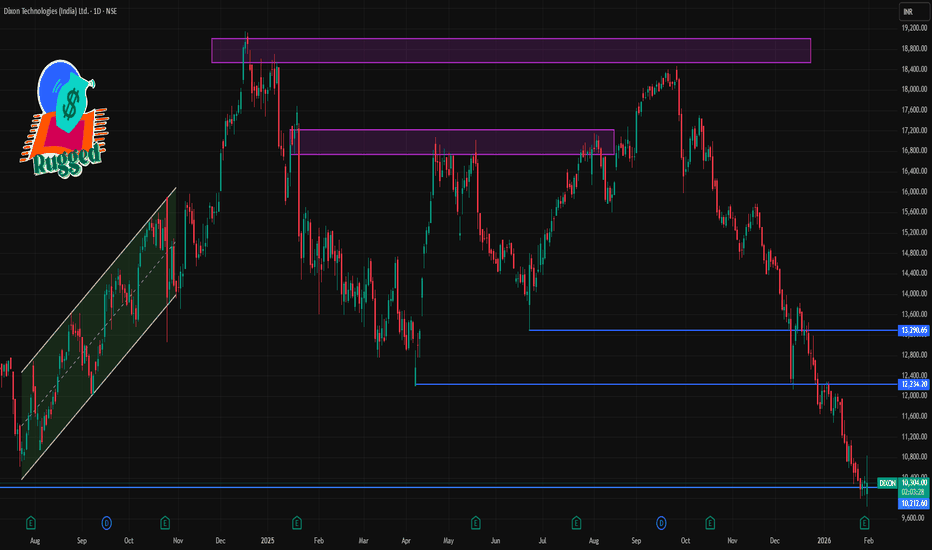

DIXON 1 Day Time Frame 📊 Current Price Snapshot (Daily)

Latest traded price: ~₹10,300 – ₹10,460 approx on NSE/BSE (mid-day range).

Today’s price range: ₹9,835 (low) – ₹10,843 (high).

52-week range: ₹9,835 – ₹18,471.

Bias: The stock remains below key short-term averages (e.g., 20/50/100-day EMAs), indicating a bearish daily trend until price successfully closes above resistance levels.

📈 Daily Pivot & Technical Levels (1-Day Time Frame)

🔹 Pivot Point (Daily Centre)

• Pivot: ~₹10,276 – ₹10,496 (central reference for today’s bias)

🚧 Resistance Levels (Upside)

1. R1: ~₹10,496 – ₹10,500 (1st resistance zone)

2. R2: ~₹10,656 – ₹10,660 (daily push-back region)

3. R3: ~₹10,876 – ₹10,880 (higher barrier)

👉 A sustained daily close above ~₹10,500–₹10,650 is needed to reduce near-term bearish momentum.

📉 Support Levels (Downside)

1. S1: ~₹10,116 – ₹10,120 (initial support)

2. S2: ~₹9,896 – ₹9,900 (secondary cushion)

3. S3: ~₹9,736 – ₹9,740 (deeper support)

👉 Breach of ₹9,900 and then ₹9,740 could expand downside risk on the daily chart.

💡 Quick Trading Reference — Today

Bullish bias resume only if price closes above:

✔️ ₹10,500 (initial breakout)

✔️ ₹10,650+ (confirmation of relief rally)

Bearish pressure sustained while below these:

⏬ ₹10,116 → first downside target

⏬ ₹9,896 – ₹9,740 → strong support zones

Chartist

CUBEXTUB 1 Week Time Frame 📊 Current Price Context

Latest trading range (approx): ₹99–₹103 per share.

📈 Weekly Key Levels (Approximate)

🎯 Resistance Levels

These are areas where upside price movement may slow or reverse:

1. First Resistance: ~₹108–₹109 — near recent pivot resistance.

2. Next Resistance: ~₹113–₹116 — upper weekly resistance zone.

3. Higher Target: ~₹118–₹120+ — longer weekly resistance/extension.

📉 Support Levels

These are areas where price may find buying interest or a bounce:

1. Immediate Support: ~₹101–₹102 — just below recent price and short‑term pivot support.

2. Secondary Support: ~₹98–₹99 — next downside zone.

3. Lower Support: ~₹94–₹95 — deeper support if weakness continues.

📌 Weekly Pivot Reference

Pivot Level (central reference): ~₹106 — roughly the fulcrum of bulls vs. bears this week.

🛠 How to Use These Levels (Weekly Basis)

Bullish scenario:

✅ If the weekly close breaks and holds above ₹108–₹109, next resistance targets of ₹113–₹116 become active.

Bearish scenario:

❌ Failure below ₹101–₹102 could open the path toward ₹98–₹95 support.

Range bias:

🟡 Price may oscillate between ₹101–₹113 in the absence of a decisive trend signal.

ELECON 1 Day Time Frame 📊 Live/Recent Price (India Market)

Approx. share price: ~₹479–₹515 range today (prices vary across live sources/delays).

Previous close was around ₹497–₹499.

Intraday price range seen: ~₹480 (low) to ₹517 (high).

📈 Key One‑Day Pivot & Levels

(Useful for short‑term trading/entry‑exit zones)

Pivot Points (daily):

Pivot (central) ~ ₹485–₹494 — reference mid‑point for today’s trend.

Resistance Levels:

R1: ~ ₹495–₹500 — first hurdle above current price.

R2: ~ ₹509–₹510 — next resistance / potential target on upside.

R3: ~ ₹518–₹524 — stronger upside barrier.

Support Levels:

S1: ~ ₹476–₹477 — nearest intraday support.

S2: ~ ₹470–₹471 — next downside buffer.

S3: ~ ₹461–₹462 — deeper support zone.

Pivot and fib levels are often calculated using previous day’s high‑low‑close prices to forecast intraday turning points.

📌 Summary for Today’s 1‑Day View

Bullish bias

✔ Close above R1 (~₹495) could push price toward R2 (~₹509–₹510) and R3 (~₹518–₹524).

Bearish caution

✘ A break below S1 (~₹476) might expose S2 (~₹470) and then S3 (~₹461) supports.

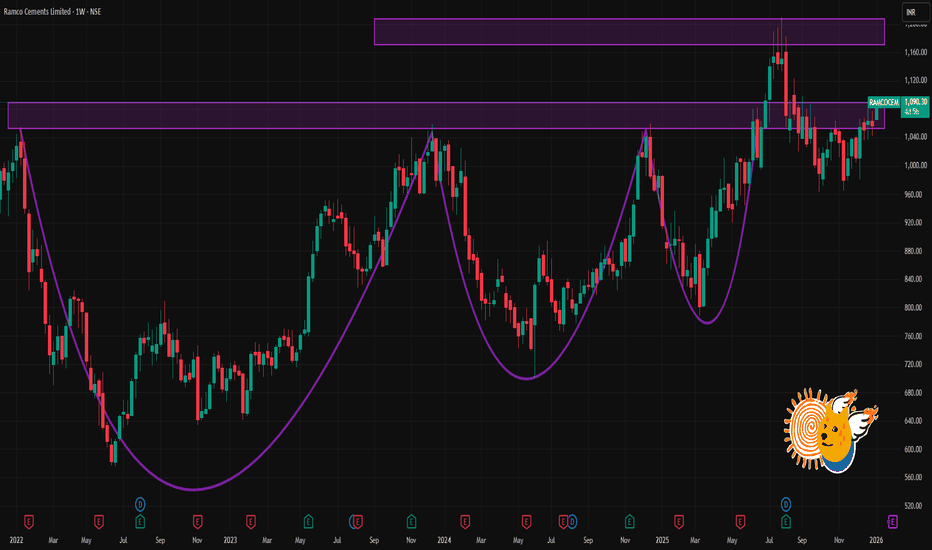

RAMCOCEM 1 Week Time Frame📌 Current Price (Approx)

~₹1,060 per share (latest trading range) — stock has been trading around this level recently.

📉 1-Week Key Levels (Support & Resistance)

🔹 Support Levels

Support 1: ~₹1,050 — short-term support zone.

Support 2: ~₹1,040–₹1,042 — secondary support.

Support 3: ~₹1,032–₹1,035 — deeper weekly support.

👉 If price closes below ₹1,040 on weekly basis, it may signal short-term weakness.

🔺 Resistance Levels

Resistance 1: ~₹1,068–₹1,070 — first near-term hurdle.

Resistance 2: ~₹1,077–₹1,078 — higher weekly resistance.

Resistance 3: ~₹1,087–₹1,093 — extended resistance zone.

👉 Break above ₹1,070–₹1,078 could open room toward ~₹1,087–₹1,093+ levels this week.

📊 Weekly Price Action Summary

Price has been trading near ~₹1,060 range, making this region a pivotal short-term level.

Short-term oscillators and technical ratings are mixed/neutral to mild buy.

Bullish bias this week if price stays above ₹1,050–₹1,055 and takes out ₹1,070+.

Bearish tilt if price closes below ₹1,040–₹1,050 on a weekly chart.

📍 Summary: 1-Week Levels

Level Type Price Zone

Major Support ₹1,050

Next Support ₹1,040–₹1,042

Lower Support ₹1,032–₹1,035

First Resistance ₹1,068–₹1,070

Higher Resistance ₹1,077–₹1,078

Extended Resistance ₹1,087–₹1,093+

Coforge-A perfect watchlist stock!Coforge is an IT services company providing end-to-end software solutions and services and is among the top-20 Indian software exporters according to Screener data. Stock has give 20% compounded sales growth in last 5 years which is quite remarkable.

Hence, It can be a good stock to be kept in watchlist for medium to long term.

Stock had given breakout of cup and handle pattern in weekly time frame and is now retesting the same.

Stock has formed a kind of morning star pattern at the retest support zone. Need to watch if it sustains above this zone.

As you can see, retest zone also coincides with 50% fib retracement which makes it even stronger.

If we see good buying in this stock from here, we can see ATH levels soon and even bigger levels in coming years.

However, If stock goes below 61.8% retracement, it is not advisable to hold.

Ethereum looks really bullish wooowHELLO dear Treaders :

After a very long time, ETH has reached the declining trend line that you can see in the chart and looks strongly bullish.

Since Nov 2021, when the bear market began and the price of bitcoin and others alt-coins started to drop from their all-time high, ETH price has hit this trend line, twice (as you can see in chart).

The first time, the price hit the decreasing trend line was at USD 3570, in Apr 2022 and the second time happened today at USD 1700.

In my opinion, ETH can reach higher prices after this bear market and in my point of view, there is a great opportunity to buy ETH at USD 1700 in spot (You can consider this buy position for your future trading but do not over leverage your positon!)

In daily time frame, ETH can break USD 1700 and start a new bull run.

The first ETH strong resistance line is around 2630/2650 and therefor until we reach that price point, do not over leverage your positions and be careful about future trading.

SUNTECKWait And Watch ??

Look for Low risk, High reward, and High Probability setups-

Things to Remember while Trading with the Trend

1. Know what the trend is.

2. The best trades are made in the direction of the trend.

3. Assume that the main trendline or moving average will hold.

4. The longer the moving average is, the better it defines the trend.

5. Wait for the pullback.

6. Don’t chase the market.

7. Don’t fight the market.

8. Even in the strongest trends there should be some retracement.

9. The closer the market is to the trendline, the better the risk/reward ratio is.

10. Use ADX to determine the strength of the trend.

11. Higher the level of ADX , the stronger the trend, below 20 consider the market to be choppy

12. Hold trades longer in a strong trend.

13. Wait for confirmation of a trendline breaking before reversing position.

14. Know where the Support levels are.

15. Place stops outside the Support levels.

Thank You..