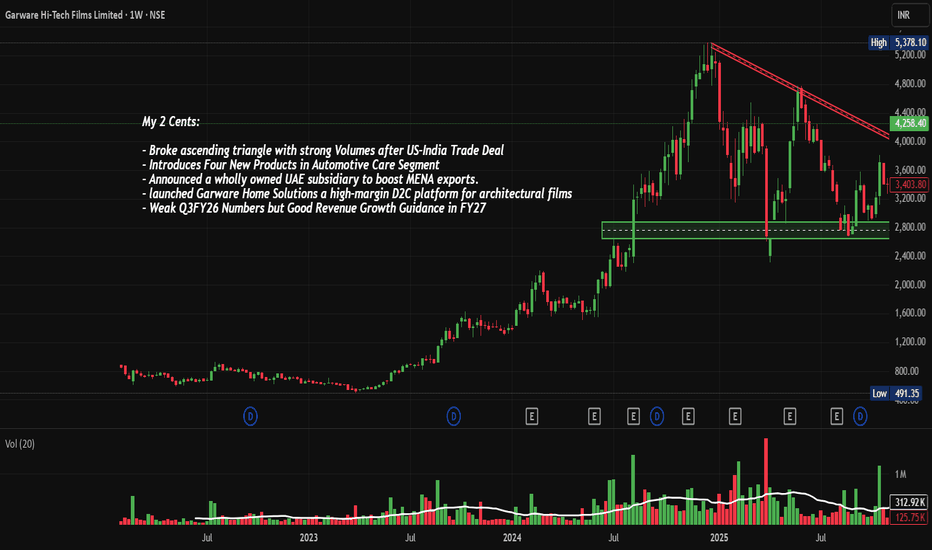

GRWRHITECH: Descending Triangle Breakout, Chart of the WeekDouble Bottom or Dead Cat Bounce? Why Garware's Next Move Could Make or Break Your Portfolio. From ₹5,378 to ₹2,600:How a 38% Profit Crash and 50% US Tariffs Brought This Market Leader to Its Knees, and what changed now? Let's Understand in the "Chart of the Week"

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Price Action:

The weekly chart of Garware Hi-Tech Films reveals a dramatic shift from a strong uptrend to a well-defined downtrend. The stock reached an all-time high of ₹5,378.10 before experiencing a severe correction of approximately 50% to current levels around ₹4,258.40.

Key observations:

- Strong ascending triangle pattern formation that broke out with substantial volume support post US-India trade deal announcement

- A clear transition from bullish momentum to bearish trend following the peak in early 2025

- Formation of a descending channel marked by two parallel red trendlines acting as dynamic resistance

- Recent price action showing a potential base formation in the ₹2,600-₹2,800 zone

Base Identification:

Primary Accumulation Base (2023-2024):

A significant consolidation zone between ₹2,600-₹2,800 levels spanning from mid-2024 through early 2025. This horizontal support zone, represents a critical demand area where the stock found support multiple times. This base served as the launchpad for the subsequent rally toward all-time highs.

Current Potential Base Formation:

The stock is currently retesting the same ₹2,600-₹2,800 zone, suggesting the possibility of a double-bottom formation. This level has shown initial signs of buying interest with recent green candles emerging.

Volume Spread Analysis:

Volume patterns reveal critical insights into the stock's price movements:

Breakout Volume Surge:

The ascending triangle breakout was accompanied by exceptional volume spikes (1.45M shares), indicating strong institutional participation and conviction in the upward move. This validates the breakout's legitimacy.

Distribution Phase:

During the rally to all-time highs, volume began to taper off at higher price levels, suggesting waning buying interest and potential distribution by smart money. This is a classic warning sign of trend exhaustion.

Recent Volume Characteristics:

- Volume has been declining during the correction phase, indicating a lack of panic selling

- Recent green candles show renewed volume interest at the support zone (1.45M shares in the latest sessions)

- The 20-day average volume of 384.69K shares is being exceeded during recent trading, suggesting accumulation at lower levels

Delivery Volume Analysis:

Recent reports indicate that delivery volume surged by 226.02% on February 2, 2026, signalling strong investor conviction rather than speculative trading. This is typically a positive sign for medium to long-term holders.

Key Support Levels:

Immediate Support: ₹2,600-₹2,800 (Primary demand zone)

This level represents the previous accumulation base and has demonstrated strong buyer interest historically. The zone has witnessed multiple tests and held firm during the consolidation period.

Secondary Support: ₹2,400

If the primary support fails to hold, the next major support lies around ₹2,400, which aligns with previous consolidation lows from the 2023-2024 period.

Critical Support: ₹2,000

The psychological level of ₹2,000 serves as the last line of defence before the stock could test significantly lower levels.

Key Resistance Levels:

Immediate Resistance: ₹3,200-₹3,400

The first major resistance zone where the stock has faced selling pressure during the recent downtrend. This area corresponds to the breakdown point from the ascending triangle.

Major Resistance: ₹3,800-₹4,000

A significant supply zone where multiple price rejections have occurred during the correction phase. This level also aligns with the 50% Fibonacci retracement of the entire rally.

Strong Resistance: ₹4,600-₹4,800

The descending trendline resistance (upper red line) currently intersects around these levels and represents a formidable barrier to upward movement.

All-Time High Resistance: ₹5,378.10

The psychological barrier where profit-booking intensified and marked the beginning of the current correction.

Technical Pattern Analysis:

Ascending Triangle Breakout (Completed):

The stock formed a well-defined ascending triangle pattern with higher lows and a flat resistance around ₹2,800. The breakout occurred with exceptionally strong volume (visible in the volume bars showing spikes of 1.45M shares), validating the pattern. This breakout was likely triggered by the US-India trade deal announcement.

Potential Double Bottom Formation:

The stock is attempting to form a double bottom pattern at the ₹2,600-₹2,800 support zone. A successful hold at these levels with a subsequent rally above ₹3,400 could validate this reversal pattern.

Critical Technical Levels Summary:

Key Level to Watch: ₹2,600

This is the make-or-break level. A decisive close below this support on heavy volume would signal continuation of the downtrend toward ₹2,400 or lower. Conversely, a strong bounce with volume confirmation could trigger a rally toward ₹3,200-₹3,400.

Reversal Confirmation Levels:

- ₹3,400: Break above would negate the descending channel's lower boundary

- ₹3,800: Reclaim would suggest intermediate trend reversal

- ₹4,200: Breaking this level would confirm the bearish phase is over

Fundamental and Sectoral Backdrop

Company Overview

Business Profile:

Garware Hi-Tech Films Limited is a leading global manufacturer of speciality performance polyester films with fully integrated "chip-to-film" operations. Founded in 1957, the company has transitioned from commodity polyester films to premium, high-margin speciality films.

Core Product Segments:

1. Paint Protection Films (PPF) - Automotive protection against chips and scratches (25% of revenue in Q3 FY26)

2. Sun Control Window Films - For automotive, architectural, and commercial applications

3. BOPET Films - Speciality films for packaging, thermal lamination, insulation

4. Architectural Films - For buildings and commercial spaces

Geographic Presence:

The company exports to over 90 countries across 5 continents, with the USA being the largest market, contributing 77% of revenues. The company has subsidiaries in the USA and the UK to service international clients.

Recent Financial Performance

The Q3 FY26 results (Disappointing) represent the weakest quarterly performance in recent periods, with margins at multi-quarter lows. The 38.87% QoQ profit decline has raised serious concerns about near-term demand dynamics and operational efficiency.

Growth Initiatives and Strategic Developments:

Capacity Expansion:

Paint Protection Film (PPF): The company has doubled its PPF capacity to 60 million square feet by 2026, positioning itself to capture growing demand in the automotive protection segment.

TPU Line: A new Thermoplastic Polyurethane production line is planned for commissioning in October 2026, requiring capex of ₹118 crore.

New Business Initiatives:

Garware Home Solutions: A direct-to-consumer (D2C) platform for architectural films launched with the first studio in Mumbai. This represents a strategic move to tap the domestic consumer market.

UAE Subsidiary: The board approved the establishment of a wholly-owned subsidiary in the UAE to strengthen export capabilities in the MENA region and expand international market presence.

Global Application Studios: Two new studios opened in the Middle East to enhance customer engagement and provide tailored solutions.

Product Launches:

The company introduced four new products in the automotive care segment, though specific details are not publicly disclosed in recent announcements.

Management Guidance and Outlook:

Forward-Looking Targets:

Revenue CAGR: 15-20% for FY26 and beyond

EBITDA Margins: Target range of 22-25%

Export Share: Increase to over 70% of total revenue

Value-Added Products: Aim for 85%+ contribution to overall sales

Strategic Focus Areas:

1. Increasing penetration in the US PPF market, particularly given the opportunity arising from XPEL's supplier realignment

2. Building the Indian PPF market through applicator training and studio expansion

3. Expanding the architectural films business, targeting ₹500 crore revenue within 3 years

4. Growing non-US markets by approximately 20% to reduce geographical concentration risk

Sectoral Context:

Industry Segment:

Garware operates in the Plastic Products - Industrial sector, specifically within the speciality films and packaging segment.

Sector Performance:

The packaging segment has shown moderate strength, gaining 9.07% recently, indicating sectoral tailwinds. However, the speciality films industry faces challenges from:

- Raw material price volatility (petrochemical derivatives linked to crude oil)

- Intense competition from global manufacturers

- Product commoditization in certain segments

- Regulatory changes affecting automotive and architectural applications

Market Position:

Garware is recognized as the world's No.1 vertically integrated "chip-to-film" manufacturing company. In India, it is the only manufacturer of Paint Protection Films, giving it a monopolistic advantage in the domestic market.

The speciality films market is experiencing growth driven by:

- Increasing automotive sales and premiumization

- Growing awareness about vehicle protection

- Rising demand for energy-efficient building solutions

- Expansion of packaging applications

Key Business Risks and Challenges:

US Tariff Impact:

The company faces significant headwinds from increased US tariffs (mentioned as rising to 50% in earnings calls). The PPF segment, contributing 25% of revenues, is most impacted due to high per-unit prices that amplify tariff effects.

Management Strategy: The company is managing this by sharing costs with customers while absorbing portions internally, and exploring supply chain diversification options outside the US.

Geographic Concentration:

With 77% of revenues from exports and the USA being the dominant market, the company faces concentration risk from:

- US economic slowdowns

- Trade policy changes

- Currency fluctuations

- Competitive pressures in key markets

Raw Material Volatility:

As petrochemical derivatives form the raw material base, any sharp increase in crude oil prices can compress gross margins, particularly in the commodity-linked Industrial Products Division (IPD).

Weak Q3 Performance:

The latest quarter showed alarming deterioration:

- Lowest revenue and operating profit in recent quarters

- Margin compression to multi-quarter lows

- Earnings declining 28.70% versus the previous four-quarter average

- Volume and demand pressures across segments

Competitive Advantages:

Vertical Integration:

The complete "chip-to-film" integration provides cost advantages, quality control, and supply chain resilience that competitors lacking this capability cannot match.

Technology Leadership:

Proprietary nano-dispersion technology and continuous R&D investment enable differentiated products with higher margins. The company holds technology leadership in dyed polyester films globally.

Distribution Network:

Established presence in 90+ countries with subsidiaries in key markets (USA, UK) and new expansion in the UAE provides strong distribution capabilities.

Domestic Market Monopoly:

Being India's only PPF manufacturer provides pricing power and first-mover advantage in the rapidly growing domestic automotive protection market.

Strong Balance Sheet:

Zero debt position (as per some reports) provides financial flexibility for growth investments and capacity expansion without leverage concerns.

Recent Stock Price Volatility Drivers:

Upper Circuit Hits:

On February 3, 2026, the stock hit a 20% upper circuit at ₹3,908.6, demonstrating extreme speculative interest. This followed similar sharp moves on January 22 (7.92% surge) and February 1 (8.1% gain), creating a two-day cumulative return of 32.34%. On Back of US-India Trade Deal News

My 2 Cents:

The technical chart tells a story of euphoria followed by harsh reality. The ascending triangle breakout captured optimism around growth initiatives and the US market opportunity, but the subsequent 50% correction reflects deteriorating fundamentals becoming apparent through weak Q3 results. But again Guidance is Strong and Trade Deal is Done.

Critical Questions for Investors:

1. Does the ₹2,600-₹2,800 support a genuine accumulation zone or a temporary pause before further decline?

2. Can management execute the turnaround needed to achieve 22-25% EBITDA margins given current headwinds?

3. Will the tariff situation stabilize or continue pressuring the crucial US market?

4. Are the recent circuit moves indicating smart money accumulation or retail speculation?

Scenarios to Monitor:

Bull Case Scenario:

- Operating margins recover toward 18-19% levels

- New capacity comes online successfully with a strong order book

- Stock holds ₹2,600 support and breaks above ₹3,400 with volume

- Technical pattern shifts from descending channel to ascending structure

Bear Case Scenario:

- Margins remain compressed below 16-17%

- US tariff pressures may intensify, impacting the PPF segment further

- Stock breaks below ₹2,600 support decisively

- Volumes remain elevated on the downside, confirming distribution

Base Case Scenario:

- Consolidation continues in ₹2,600-₹3,400 range for several quarters

- Gradual margin improvement but no sharp recovery

- Mixed quarterly results creating volatility

- Technical pattern remains range-bound until a clear fundamental catalyst emerges

Key Events and Data Points to Watch:

Immediate Term:

- Price action at ₹2,600 support zone - hold or break?

- Volume characteristics during any breakout attempt

- Q4 FY26 results (expected May 2026)

Medium Term:

- TPU line commissioning (October 2026)

- UAE subsidiary operational metrics

- Architectural films segment revenue trajectory toward ₹500 crore target

- Management commentary on US tariff mitigation strategies

Long Term:

- Achievement of 15-20% revenue CAGR guidance

- Margin expansion to 22-25% range

- Export share increasing to 70%+

- Value-added products reaching 85%+ contribution

For New Investors:

The current juncture offers a risk-reward scenario heavily dependent on one's conviction in management's turnaround ability. The technical setup suggests waiting for:

- Decisive break above ₹3,400 with volume for trend reversal confirmation

- Q4 results showing tangible improvement before committing capital

- Stabilization of support at ₹2,600 with multiple successful tests

For Existing Holders:

Those sitting on long-term gains should consider the deteriorating fundamentals seriously. The 38.87% quarterly profit decline and margin compression to multi-quarter lows suggest the worst may not be over. Risk management suggests:

- Partial profit booking at rallies toward ₹3,200-₹3,400

- Strict stop-loss below ₹2,500 to protect capital

- Reassessing holdings post Q4 FY26 results

So, Garware Hi-Tech Films presents a fascinating case study of a fundamentally strong business facing near-term headwinds. The technical chart reflects this dichotomy - a powerful long-term wealth creator now grappling with serious operational challenges.

The ₹2,600-₹2,800 support zone represents a critical decision point. If this level holds with improving fundamentals in Q4, the stock could stage a meaningful recovery. However, failure to defend this support or continued fundamental deterioration could trigger a deeper correction toward ₹2,000 or below.

The company's strategic initiatives (capacity expansion, geographic diversification, D2C platform) are directionally correct, but execution against the backdrop of US tariff pressures and margin compression will determine whether the current support becomes a launchpad or a false floor.

Given the high-risk, high-reward nature of the current setup, investors should approach with caution, maintain strict risk management discipline, and wait for clearer signals - both technical and fundamental - before making significant allocation decisions.

The coming quarter's results and price action at the ₹2,600 level will likely determine whether this speciality films giant can reclaim its former glory or faces an extended period of consolidation and repair.

Full Coverage on my Mid-Week Newsletter coming Wednesday.

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Chartoftheweek

GMDC 1 Day Time Frame from NSE data:

📊 Daily Pivot & Key Levels (1D Timeframe)

📌 Daily Pivot Point (PP): ₹606.73 – This is the central bias level. Above this suggests short-term bullish control; below may signal weakness.

💥 Resistance Levels (Upside)

R1: ₹627.46 – first major resistance above the pivot

R2: ₹640.38 – medium-term barrier

R3: ₹661.11 – stronger supply zone / higher target

🛡️ Support Levels (Downside)

S1: ₹593.81 – immediate daily support

S2: ₹573.08 – deeper pullback level

S3: ₹560.16 – stronger lower support area

✔ How to use these levels (Daily view):

📈 Bullish conditions:

If price sustains above Pivot (₹606.73) → bias turns bullish

Stronger breakout confirmation if price closes above R1/R2 with volume

📉 Bearish conditions:

If price breaks below S1 (₹593.81) → watch for next supports (S2/S3)

Failure at resistance zones can lead to pullbacks

💡 Summary Daily Chart Levels (1D)

Level Price (Approx)

R3 661

R2 640

R1 627

Pivot 606

S1 594

S2 573

S3 560

(Levels rounded for clarity)

AUROPHARMA 1 Week Time Frame 📊 Weekly Support & Resistance (Key Levels)

Weekly Pivot (approx): ~₹1,180–1,190 area (reference level for weekly bias)

Resistance Levels:

R1: ~₹1,215–1,220 – first major upside hurdle (weekly)

R2: ~₹1,250–1,260 – possible next resistance above R1

R3: ~₹1,275–1,280+ – strong weekly supply zone if bullish momentum continues

Support Levels:

S1: ~₹1,155–1,160 – initial weekly support zone

S2: ~₹1,130–1,140 – deeper support if weekly price corrects further

S3: ~₹1,100 – structural support and breakdown zone for bears

📉 Weekly Momentum & Trend Signals

Weekly indicators (RSI, MACD, SMA) suggest mixed to slightly bullish bias, with price trading around medium‑term moving averages — not extremely overbought or oversold.

Earlier weekly data also showed strong weekly moving average support near ~₹1,100–1,140 range.

🧠 How to Use These Levels

Bullish Scenario: A clean weekly close above ~₹1,215–1,220 can open room toward ₹1,250–1,280+.

Bearish Scenario: Weekly rejection and close below ~₹1,155–1,160 may see support tests around ₹1,130 and ₹1,100.

Use these in combination with weekly candlestick patterns (like closes beyond support/resistance) to confirm breakouts or breakdowns.

⚠️ Note: Technical levels change with price action. These are indicative ranges based on recent weekly pivot computations and should be complemented with your own charting or broker platform data for precise decision making.

DIXON 1 Day Time Frame 📍 Live Price Snapshot

🔹 Approx Current Price: ~₹11,566 (INR) (up strong recently)

🔹 52-Week Range: ~₹9,835 – ₹18,471

📊 Daily Pivot & Support/Resistance Levels (1D Timeframe)

These are commonly used by traders to judge intraday/daily trend bias, entry/exit zones, and key price reactions:

Level Price (Approx) Type

R3 ₹11,551 – ₹11,600 Major Resistance

R2 ₹11,375 – ₹11,380 Resistance Zone

R1 ₹11,203 Near-Term Resistance

Pivot ~₹11,027 Daily Center / Bias Level

S1 ₹10,855 Support

S2 ₹10,679 Support Zone

S3 ₹10,507 Strong Support

👉 Price above Pivot & R1–R3: Bullish bias

👉 Price below Pivot & heading toward S1–S3: Bearish/neutral pressure

These are classic pivot levels updated for today’s trading range.

📈 Short-Term Technical Structure

Bullish / Positive signs:

Price recently moved above short EMAs (e.g., 5-, 9-day), showing short-term strength.

RSI around mid-range suggests room to run upside without overbought stress.

Bearish / Caution flags:

Longer moving averages (50/100/200) still overhead as resistance — trending bias remains cautious.

Technicals from some chart views still show a weak structure on daily if price fails below pivot.

📌 How to Use These Levels Today

✔ Bullish bias only if price sustains above pivot (~₹11,027)

✔ Near-term breakout zone: Clear move above R2 (~₹11,375) / R3 (~₹11,550)

✔ Support watches: Monitor S1 (~₹10,855) and S2 (~₹10,680) for pullbacks

✔ Break below S3 (~₹10,507) — could signal deeper intraday bearish pressure

🧠 Quick Context

Shares recently rebounded and are above short-term EMAs, indicating some short-term strength.

Overall broader market influences (mid-cap pressure / sector flow) still matter for this stock’s direction.

Price near multimonth lows, so risk and volatility remain elevated.

KAYNES 1 Week View 📌 Current Price Context

• Latest traded price around ₹3,640–₹3,720 on NSE (live varies by exchange and time) — showing recent rebound after volatility.

📈 Weekly Pivot & Support/Resistance Levels (1-Week Timeframe)

📍 Weekly Pivot Reference

• Weekly Pivot Point (central level): ~₹3,702 (midpoint guiding sentiment)

🔼 Weekly Resistance Levels (Upside)

• R1: ~₹3,734 – ₹3,745

• R2: ~₹3,760 – ₹3,770

• R3: ~₹3,790 – ₹3,880

🔽 Weekly Support Levels (Downside)

• S1: ~₹3,675 – ₹3,678

• S2: ~₹3,640 – ₹3,635

• S3: ~₹3,280 – ₹3,280+ (broader deeper support zone)

📊 How Traders Interpret These Weekly Levels

Bullish Signals (Weekly Close Above)

✅ A weekly close above R1 (~₹3,740+) supports continuation of near-term recovery.

➡ Next upside targets become R2 (~₹3,760–₹3,770) and then R3 (~₹3,790–₹3,880) as next resistance layers.

Bearish Signals (Weekly Break Below)

⚠ Break and weekly close below S1 (~₹3,675) increases risk of deeper weakness, with S2 (~₹3,635) and S3 (~₹3,280) as key downside floors.

Neutral/Range Scenario

↔ If price holds between S1–R1 (~₹3,675–₹3,745), expect sideways/consolidation before a clear breakout direction takes shape.

📌 Key Notes on Trend & Structure

• Price is below longer historical mid/long-term averages, reflecting a wider downtrend from prior highs, but short-term technicals show stabilization and bounce risk.

• Recent volatility (big swings) suggests support/resistance zones matter more than trend at the moment — breakouts through these weekly levels tend to signal next directional move.

🧠 Practical Weekly Trade Levels

Level Type Approx Zone

Weekly Pivot ~₹3,702

Resistance R1 ~₹3,734–₹3,745

Resistance R2 ~₹3,760–₹3,770

Resistance R3 ~₹3,790–₹3,880

Support S1 ~₹3,675–₹3,678

Support S2 ~₹3,635–₹3,640

Support S3 ~₹3,280+

🧾 Quick Takeaway

Bullish weekly bias if price closes above ₹3,740–₹3,760 with momentum.

Bearish pressure remains if weekly closes below ₹3,675–₹3,640.

Range trade likely between those pivot bands until directional breakout occurs.

HDFCBANK 1 Week Time Frame 📌 Current Reference Price (approx): ~₹920–₹950 range recently after weekly sessions.

📉 Weekly Pivot & Key Levels (based on weekly pivot analysis)

(derived from pivot calculations for the weekly timeframe)

Pivot Point (Weekly)

Weekly Pivot (Central): ~₹945.47

Resistance Levels (Weekly)

R1: ~₹961.68

R2: ~₹981.92

R3: ~₹~1,000+ (higher band extensions)

Support Levels (Weekly)

S1: ~₹925.23

S2: ~₹909.02

S3: ~₹888.78

(Lower supports if breakdown continues)

These levels are pivot‑based and often watched by traders for entry/exit or stop placements.

🔎 Additional Reference Points

📊 52‑Week Range

High: ~₹1,020.50

Low: ~₹830.55

This gives broader context on where the weekly levels sit within the yearly trend.

📈 Recent Weekly Price Action

Weekly charts show HDFC Bank stock has been trading below its recent highs with some volatility and is within a range on weekly bars — this means weekly support/resistance bands can act as possible bounce zones or breakout triggers.

📌 Weekly Trading Bias and Key Zones to Watch

Bullish Scenario (weekly close above pivot):

A weekly close above ~₹961–₹965 may open momentum toward ₹980‑₹1,000+ zone.

Neutral / Range:

Price stuck between ~₹925 and ₹961 suggests sideways consolidation.

Bearish Scenario (weekly break below support):

Weekly close below ~₹909–₹888 could open deeper downside toward the 52‑week low zone near ₹830‑₹850.

⚠️ Notes

These levels are technical references, not buy/sell advice.

Market news, volume, macro cues & overall Bank Nifty moves can influence weekly levels significantly.

Always consider your risk tolerance and use stop‑loss orders appropriately.

ASIANPAINT 1 Day Time Frame 📊 Current Price (approx): ₹2,402 – ₹2,410 (NSE intraday/daily) as of latest market data.

🔁 Daily Pivot Levels

Pivot (central reference): ~₹2,379–₹2,380

Resistance Levels:

• R1: ~₹2,416–₹2,417

• R2: ~₹2,475–₹2,476

• R3: ~₹2,512–₹2,513

Support Levels:

• S1: ~₹2,320–₹2,321

• S2: ~₹2,283–₹2,284

• S3: ~₹2,224–₹2,225

(from classic daily pivot structure)

📈 How to Use These Levels (Daily Basis)

Bullish scenario (if buyers strong):

Sustained break above R1 (~₹2,416) targets R2 (~₹2,475) & then R3 (~₹2,512).

Neutral / sideways zone:

Price hovering between Pivot (~₹2,380) and R1 (~₹2,416) suggests range‑bound moves.

Bearish scenario (if selling pressure):

Break below S1 (~₹2,320) can open path towards S2 (~₹2,283) and then S3 (~₹2,224).

📌 Short‑Term Technical Snapshot

Asian Paints price action has been under pressure recently as technical indicators show muted momentum and the stock trading below several moving averages (20‑day/50‑day) reflecting short‑term neutral to weak bias.

Always combine pivot levels with volume and price action signals (e.g., breakouts with confirmation) for better trade decisions.

SHARDACROP: Strong Q3, Descending Trainlge BO, Chart of the WeekFrom Descending Triangle Breakout to Q3FY26 Glory: Why Sharda Cropchem's Could Be Your Next Big Move Lets Understand in "Chart of the Week"

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Price Action Analysis:

Long-Term Trend Overview:

- The stock has demonstrated a multi-year uptrend from 2021 levels around 300-350 to current levels near 1,035

- A significant rally occurred from mid-2021 to early 2025, where the stock surged from approximately 350 to an all-time high of 1,181

- Post the January 2025 peak, the stock has entered a consolidation phase with a descending triangle pattern formation

- Current price of 1,035.85 (as of January 31, 2026) represents a 28.46% gain, showing strong momentum recovery

Recent Price Action Characteristics:

- The stock made an all-time high of 1,181 in early January 2025

- Following the peak, a corrective phase ensued with the formation of lower highs

- A clear descending trendline can be observed connecting the highs from January 2025 peak through subsequent rallies

- The stock found support multiple times around the 750-800 zone, establishing this as a critical demand area

- On January 31, 2026, the stock broke above the descending trendline with a strong bullish candle supported by robust volumes (11.25M shares traded)

Key Technical Patterns:

- Descending Triangle Pattern: The chart clearly shows a descending triangle structure with lower highs and a flat support base around 750-800

- Trendline Break: The recent price action has broken through the descending resistance trendline, which is a classic bullish reversal signal

- The breakout was accompanied by good volumes of 2.03M (shown in green), indicating strong buying interest

- The price action suggests a potential trend reversal from the consolidation phase to a new uptrend

Volume Spread Analysis:

Volume Trends and Characteristics:

- The volume chart shows sporadic high-volume days during the entire period

- The recent breakout candle is accompanied by elevated volumes of 11.25M shares

- Volume of 11M is above average, confirming the validity of the breakout

- Historical volume spikes are observed during significant price movements, both up and down

Volume-Price Correlation:

- During the 2021-2022 rally, several high-volume green bars supported the upward price movement

- The consolidation phase from January 2025 to January 2026 saw relatively lower volumes, typical of a basing pattern

- The recent breakout is validated by the volume surge, a positive technical sign

- Absence of high red volume (selling pressure) during the breakout indicates limited supply

Volume Implications:

- The volume profile suggests strong institutional participation during key price movements

- The current breakout with good volume indicates conviction among buyers

- Sustained volumes above the 2-3M range would confirm continued buying interest

- Any pullback on lower volumes would be healthier and offer better entry opportunities

Support and Resistance Analysis:

Major Support Levels:

- Primary Support Zone: 750-800 (tested multiple times during the consolidation phase, proving to be a strong demand zone)

- Secondary Support: 700 (psychological level and previous consolidation area)

- Critical Support: 600-650 (major swing low from mid-2024, breaking this would invalidate the bullish structure)

- Long-term Support: 500 (aligns with historical resistance turned support from early 2024)

Major Resistance Levels:

- Immediate Resistance: 1,100 (previous consolidation high and psychological barrier)

- All-Time High Resistance: 1,181 (needs to be reclaimed for continuation of uptrend)

- Potential Resistance: 1,200-1,250 (psychological round numbers)

- The broken descending trendline around 900-950 zone may now act as support on any pullbacks

Base Formation Analysis:

- The stock has formed a strong multi-week base between 750 and 800

- This base structure resembles a consolidation platform after a strong uptrend

- The base formation duration provides strong foundation for the next leg up

- The base is indicating accumulation rather than distribution

Technical Pattern Analysis:

Descending Triangle Breakdown and Resolution:

- Pattern Formation: The descending triangle started forming from the January 2025 high at 1,181

- Pattern Characteristics: Lower highs (descending resistance) meeting horizontal support at 750-800

- Pattern Resolution: The recent upward breakout from the descending trendline on January 31, 2026

- Breakout Confirmation: Strong bullish candle with +28.46% gain and volume of 11.25M shares

Short-Term Trend Assessment:

- The recent breakout candle establishes a strong bullish bias in the short term

- The stock has moved from a downtrend (within the triangle) to potentially starting a new uptrend

- Higher high formation above 1,035 would confirm the trend reversal

- The immediate trend is bullish with the breakout above both the trendline and the 900-950 resistance cluster

Medium-Term Outlook:

- The stock needs to sustain above 950-1,000 levels to confirm medium-term bullish structure

- A move above the previous high of 1,181 would resume the primary uptrend

Long-Term Perspective:

- The overall structure from 2021 remains bullish with higher lows and higher highs

- The current consolidation is a healthy correction within a larger uptrend

- Long-term investors can view the 750-800 zone as a strong accumulation area

- The secular trend in the agrochemical sector supports the long-term bullish thesis

Fundamental and Business Overview:

Company Profile and Business Model:

- Sharda Cropchem Ltd is engaged in the marketing and distribution of agrochemicals globally

- The company operates an asset-light business model, focusing on identifying generic molecules, preparing dossiers, seeking registrations, and marketing through distributors

- Core product portfolio includes formulations and generic active ingredients across fungicide, herbicide, and insecticide segments

- The company also operates a non-agrochemicals business including conveyor belts, V-belts, dyes, and industrial chemicals

Geographic Revenue Distribution:

- Europe: Contributes approximately 53% of agrochemical revenue, making it the largest market

- NAFTA (North America): Accounts for around 34% of agrochemical business

- Latin America (LatAm): Represents about 9-10% with high growth potential

- Rest of World: Includes India and other emerging markets

- The company has a presence across 80+ countries with over 150 distributors in India alone

Registration Portfolio and Competitive Moat:

- The company has 2,821 active product registrations globally as of March 2023

- Strong pipeline of 1,143 registrations under process, mainly in EU, US, and LatAm

- The registration process serves as a significant entry barrier due to high costs, complexity, and time requirements

- The company invests approximately 350-400 crores per annum toward new product registrations

- Registrations in highly regulated markets (EU, US) provide sustainable competitive advantages

Recent Financial Performance:

Q3 FY26 Results Highlights (Quarter Ended December 2025)

- Net Sales: Rs 1,288.76 crores, representing 38.7% YoY growth

- Net Profit: Rs 145.12 crores, a stellar 365.87% YoY surge from Rs 31.15 crores in Q3 FY25

- PAT Margin: Expanded dramatically to 11.26% from 3.35% in Q3 FY25, a gain of 791 basis points

- Gross Profit Margin: Stood at 20.32%, significantly improved from 12.36% in Q3 FY25

- The margin expansion reflects improved product mix, better pricing realization, and effective cost management

Nine-Month FY26 Performance (April-December 2025):

- Consolidated Net Sales: Rs 3,202.68 crores, up 27.57% YoY

- Net Profit: Rs 362.21 crores, representing 257.33% YoY growth

- ROCE: Impressive 20.85% for the nine-month period, the highest recorded in recent periods

- The company declared an interim dividend of Rs 6 per share

- Strong cash generation and zero-debt balance sheet underscore financial strength

Financial Trend and Quality Metrics:

- Five-year Sales CAGR: 17.65%, demonstrating consistent top-line growth

- Five-year EBIT CAGR: 21.17%, showing strong operational leverage

- Debt Status: Company is almost debt-free, providing financial flexibility

- EBIT to Interest Coverage: Average of 100 times, indicating negligible debt burden

- Return on Equity: Currently at 9.89% over last 3 years (considered low, but improving)

Sectoral and Industry Backdrop:

Indian Agrochemical Market Overview

- Market Size: The Indian agrochemical market is valued at approximately USD 8-9 billion in 2025

- Growth Trajectory: Expected to grow at a CAGR of 5.5-7.5% during 2026-2032 period

- Market Drivers: Rising population, increasing food demand, agricultural intensification, and government support

- India is ranked as one of the top 10 consumers and producers of agrochemicals globally

Market Dynamics and Growth Drivers:

- Food Security Imperative: India's population projected to reach 1.5 billion by 2030, necessitating enhanced agricultural productivity

- Crop Loss Prevention: Annual crop losses due to pests, weeds, and diseases estimated at 15-25%, valued at USD 10-15 billion

- Land Constraints: Declining arable land per capita due to urbanization drives need for yield optimization

- Technology Adoption: Increasing adoption of precision farming, drone spraying, and fertigation systems

- Export Opportunity: India's status as a net exporter strengthened by global demand for generic agrochemicals

Government Initiatives and Policy Support

- Make in India: Government recognizes agrochemical industry as one of top 12 industries for global leadership

- Subsidy Programs: Continued support through fertilizer subsidies (INR 3.68 lakh crore committed till March 2025)

- PM-PRANAM Scheme: Launched in 2023 to incentivize balanced fertilizer use and alternative technologies

- Drone Subsidies: Up to 40% subsidy on drone purchases for precision spraying

- Digital Infrastructure: Integration of land records, soil health cards, and farmer databases to facilitate input access

Segment-wise Market Trends

- Fertilizers: Hold 55% market share, driven by high applicability across all cropping systems

- Pesticides: Growing at faster CAGR of 10.52% through 2030, with focus on herbicides and fungicides

- Insecticides: Dominate with 72.5% of pesticide market due to tropical climate and pest pressure

- Biopesticides: Emerging segment accounting for 15% of market, driven by sustainability focus

- Regional Dynamics: South India projected to show highest growth due to horticulture and high-value crop expansion

Industry Challenges and Headwinds:

- Chinese Dependence: High reliance on Chinese suppliers for raw materials and active ingredients

- Import Dependency: Trade deficit of around USD 31 billion in chemicals sector due to infrastructure bottlenecks

- Pricing Pressure: Competition from low-priced Chinese products putting pressure on realizations

- Regulatory Complexity: Increasing cost of registrations and re-registrations in developed markets

- Working Capital Intensity: Large inventory and receivables requirements due to wide product portfolio and geography

Competitive Positioning and Business Strengths:

Sharda's Competitive Advantages:

- Asset-Light Model: Focus on registration, marketing, and distribution rather than manufacturing

- Registration Moat: 2,821 active registrations create significant barriers to entry

- Global Footprint: Presence in 80+ countries with diversified revenue streams

- Developed Market Focus: 83-85% revenue from Europe and NAFTA, which are high-value, stable markets

- Debt-Free Balance Sheet: Provides financial flexibility for growth investments

Business Model Strengths:

- Third-Party Manufacturing: Partnerships with manufacturers allow capital-efficient scaling

- Diversified Portfolio: Over 200 products across multiple crop protection categories

- Strong Pipeline: 1,143 registrations in process ensure future revenue visibility

- Direct Sales Force: Building own sales teams in key markets (Europe, US, Canada, Mexico) in addition to distributors

- Non-Agro Diversification: 17% revenue from non-agrochemical business reduces concentration risk

Strategic Positioning in Generic Agrochemicals:

- Generic Focus: Targets off-patent molecules where 75% market share is still held by innovators

- Value Proposition: Offers cost-competitive alternatives to multinational brands

- Regulatory Expertise: Proven capability in navigating complex registration processes in developed markets

- Customer Relationships: Supplies to MNCs as well as end customers, providing multiple revenue channels

- Quality Compliance: Meets stringent regulatory standards of EU and US markets

Valuation Metrics:

- P/E Ratio: Trading at 20x trailing earnings, below industry average of 29x

- EV/EBITDA: 10.61x appears reasonable given the 365.87% profit growth trajectory

- PEG Ratio: 0.18 suggests the stock is significantly undervalued relative to its growth

- Dividend Yield: 0.91% with conservative payout ratio of 84.89% for FY25

Key Strengths:

- Strong quarterly momentum with 365.87% YoY profit growth in Q3 FY26

- Expanding margins (PAT margin up 791 bps YoY) indicating operational improvement

- Record ROCE of 20.85% demonstrating efficient capital deployment

- Zero-debt balance sheet providing safety and growth flexibility

- Technical breakout from year-long consolidation backed by strong volumes

Risk Factors and Concerns:

- Dependence on Chinese Suppliers: Raw material sourcing concentrated in China exposes to currency and policy risks

- Competitive Pricing: Generic nature of business faces pricing pressure from both innovators and other generic players

- Working Capital Intensity: High debtors of 165 days and large inventory requirements

- Regulatory Risks: Stroke of pen risk where simplified registration processes could erode competitive moat

- MNC Competition: Large multinationals with better brand equity and distributor relationships

- Seasonality: 35-40% revenue and 50-55% profit concentrated in certain quarters

Management Guidance and Outlook:

- FY26 Guidance: Company targets 15%+ topline growth with EBITDA margins in 15-18% range

- Capex Plans: Rs 400-450 crore planned investment in registrations for FY26

- Registration Pipeline: Focus on strengthening portfolio across Europe, NAFTA, and LatAm

- Margin Trajectory: Gross margins expected to stabilize around 30-35% range with input cost normalization

- Geographic Expansion: Continued strengthening of sales force in key markets

Sectoral Tailwinds Supporting Growth:

- Indian agrochemical market growing at 5.5-7.5% CAGR through 2032

- Global demand for generic agrochemicals increasing as patents expire

- Government support through Make in India and agricultural modernization programs

- Increasing adoption of precision farming and technology-driven agriculture

- Export opportunities expanding as India becomes a preferred sourcing destination

Monitoring Parameters:

- Volume Consistency: Weekly volumes should sustain above 1.5-2M for continued momentum

- Support Holding: 750-800 zone must hold on any pullbacks

- Quarterly Results: Track margin trends and volume growth in subsequent quarters

- Sectoral Trends: Monitor agrochemical industry news, Chinese raw material prices, and global demand

- Competitive Action: Watch for pricing pressures or market share changes

My 2 Cents:

- Sharda Cropchem has broken out of a descending triangle pattern with strong volumes

- The 750-800 support zone has proven to be a robust demand area tested multiple times

- Volume-backed breakout on January 31, 2026 (+28.46%) confirms buying conviction

- The stock is transitioning from consolidation to a potential new uptrend

- The stock presents a compelling combination of technical breakout and fundamental improvement

- Strong quarterly numbers have acted as a catalyst for the technical pattern resolution

- Valuation at 20x P/E with PEG of 0.18 suggests room for re-rating

- The 750-800 base provides a strong foundation for the next leg of upward movement

Full Coverage on my Mid-Week Newsletter coming Wednesday.

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

JAMNAAUTO 1 Day Time Frame • Last close: ~₹124 – ₹124.36 on NSE/BSE.

• Recent daily range: Low ~₹116.60 – High ~₹126.55.

📊 Daily Support & Resistance Levels (Key Zones)

Pivot Point (Daily)

Daily Pivot ~ ₹120 – ₹123.55: Key reference for intraday bias — above is bullish, below is bearish.

Resistance Levels

R1: ~ ₹125–₹125.32 – first hurdle above pivot.

R2: ~ ₹128–₹128.38 – stronger resistance near recent swing highs.

R3: ~ ₹130–₹130.15 – extended upside pivot.

Support Levels

S1: ~ ₹120 – ₹120.49 – first support near pivot/MA levels.

S2: ~ ₹118.5 – ₹118.72 – next layer of downside support.

S3: ~ ₹115.5 – ₹115.66 – deeper support zone.

These pivot-derived levels are commonly used for intraday and next-day trading reference.

📈 What Technical Indicators Suggest (Daily)

Moving Averages / Momentum

Short-term MAs around 20–50 DMA are near the pivot zone, indicating mixed momentum around the current price.

On some technical panels, oscillators like RSI may be neutral or slightly bearish/bullish depending on the source — indicating no strong momentum bias right now.

🧠 How to Use This for a 1-Day View

Bullish Bias (short-term) if:

✔ Price sustains above daily pivot (~₹122–123)

✔ Break of R2 (~₹128–₹128.4) with volume

Bearish / Caution if:

❌ Price closes below S1 (~₹120)

❌ Momentum indicators turn down from resistance

⚠️ Risk & Notes

These levels are technical guides — not investment advice.

Price can gap on news earnings, market sentiment, or sector moves.

Always combine with your own risk management (stop-loss, position sizing).

MTARTECH 1 Week Time Frame 📊 Current Price Snapshot

MTAR Technologies closed around ₹2,931–₹2,932 recently.

📈 Weekly Pivot & Support/Resistance Levels

(Important zones likely to act as reference over ~1 week)

🔹 Pivot Levels

These are calculated based on recent price activity and help gauge short-term bias:

Central Pivot ≈ ₹2,909–₹2,954 (key balance level)

🔹 Resistance Levels

Potential upside barriers where price may slow/reverse:

₹2,995–₹3,031 near short-term upper range

₹3,100–₹3,178 next resistance cluster

Above ₹3,200 breakout target (longer weekly/extension)

🔻 Support Levels

Important zones to watch if price pulls back:

₹2,741–₹2,762 area (S1) — near immediate short-term support

₹2,562–₹2,600 range (S2) — strong secondary support

₹2,461–₹2,500 (S3/S4) — deeper pullback zone

These resistances/supports are based on pivot point calculations & Fibonacci extensions covering multiple pivot methods.

📊 Technical Indicators (Short-Term Context)

Moving averages (20, 50, 100, 200 DMA) are largely bullish in daily/weekly analysis, supporting upward momentum.

RSI is near bullish territory but approaching overbought on shorter frames — indicating possible consolidation ahead.

Some technical tools show short-term buy signals; others show neutral — indicating range movement with upside bias.

📌 How to Use These Levels

Bullish Scenario:

➡ Price sustaining above the pivot (~₹2,890-₹2,950) suggests continuation toward ₹3,000 → ₹3,100+ resistance levels.

Bearish/Retracement Scenario:

➡ Failure below pivot or key support near ₹2,740 could trigger pullbacks toward ₹2,600 → ₹2,500 support zones.

This setup works well for 3–7 day trading or planning entry/exit zones.

INDIANB 1 Month Time Frame 📌 Current Price Context (as of latest trading)

Indian Bank is trading near ₹910–₹920 levels on NSE.

📈 1‑Month Key Resistance Levels (Upside)

These are the levels where price may face selling pressure or reversal if bulls weaken:

R1 — ₹918–₹920 — immediate resistance area just above current trade.

R2 — ₹927–₹930 — secondary resistance zone.

R3 — ₹935–₹940 — further upside resistance zone for continuation moves.

Summary: Immediate upside capped around ~₹918–₹930. Break and close above this band can signal stronger bullish continuation.

📉 1‑Month Key Support Levels (Downside)

Important levels that can act as rebound zones on pullbacks:

S1 — ~₹880–₹885 — first meaningful support near recent swing lows.

S2 — ~₹860–₹865 — secondary support from broader short‑term structure.

S3 — ~₹830–₹835 — major zone where bigger trend buyers may step in.

Summary: Minor supports start ~₹880, stronger support cluster around ~₹860‑₹835.

📊 Pivot / Neutral Reference

Pivot around ~₹907–₹910 — current central reference area.

Price above pivot suggests bullish bias, below could tilt neutral to bearish within the month.

📌 Interpretation For 1‑Month View

Bullish scenario:

Holds above ₹900–₹910 pivot → targeting ₹927–₹940 zone.

Neutral / consolidation:

Trading between ₹880–₹910.

Bearish risk:

Break below ₹860–₹845 could open deeper correction toward ₹830.

TDPOWERSYS 1 Day Time Frame 📊 Live/Intraday Summary (Today’s Trading)

• Current price: ~₹735 – ₹745* (showing a strong upside on the day).

• Day’s high: ₹767.95.

• Day’s low: ₹642.30.

• Previous close: ₹676.90.

• Range (1‑day): ₹642.30 – ₹767.95.

• Volume: Several million shares traded (indicating active intraday participation).

• Circuit limits: Upper ₹812.25 / Lower ₹541.55.

📈 Intraday Price Behavior (1‑Day Chart Insight)

Although I can’t draw the live chart, major market data sources show the stock rising significantly above its previous close, with intraday volatility spanning over ₹125+, suggesting strong buying interest today.

🔎 What this means for your 1‑day view

The stock opened lower near ₹661 and trended up strongly, testing higher intraday levels toward ₹767+ — a bullish intraday range.

Today’s range and levels are useful for intraday support/resistance as:

• Support: ~₹640 – ₹660 (earlier day lows).

• Resistance: ~₹760 – ₹770 (near today’s high).

⚠️ Notes

• Market prices intraday change rapidly — data above reflects the latest available snapshot for today’s session.

• If you’re planning trades, check real‑time charts from your broker or a live market platform (e.g., NSE/BSE or charting tools like Chartink).

IDEA 1 Day Time Frame📈 Current Snapshot (Daily)

📍 Approx Price Range Today: ₹10.00 – ₹11.00 per share (indicating recent heavy trading and a bounce)

📍 RSI (Daily): ~38.5 – showing slightly weak momentum but not deeply oversold yet

📍 50 / 100 / 200 DMA: ~₹10.58 / ₹9.94 / ₹9.34 – price around these averages suggests mixed consolidation near crucial pivot zones

🔑 1-Day Key Levels (Pivots)

✔ Pivot Point

Pivot: ~ ₹9.98 → Daily balance point (trend bias flips above / below)

🟢 Support Levels

S1: ~ ₹9.75 → 1st immediate support

S2: ~ ₹9.46 → secondary support zone

S3: ~ ₹9.23 → lower daily support

👉 Below ₹9.23 — increased bearish risk on intraday breakdown.

🔴 Resistance Levels

R1: ~ ₹10.27 → first resistance

R2: ~ ₹10.50 → near daily average resistance

R3: ~ ₹10.79 – ₹11.00 → stronger daily resistance & psychological level

👉 Sustained move above ~₹10.50-₹10.80 can shift short-term bias toward recovery.

📌 Important Context (Market News)

Today’s market action showed a strong positive catalyst: Vodafone Idea shares surged ~13% to ~₹11.36 on Jan 30 2026 after management revealed a large turnaround plan including ₹45,000 cr capex strategy and AGR relief news — indicating significant bullish sentiment shift.

Recent fundamentals: Q3 loss narrowed and ARPU increased, which supports sentiment.

These news catalysts can influence price reaction at key technical levels, so combine them with the pivot levels above for better context.

GRSE 1 Day Time Frame 📈 Live Price & Intraday Range (as of mid‑session)

Current Price (approx): ₹ 2,570 – ₹ 2,573 (NSE) — showing a positive move vs previous close.

Today’s High: ~₹ 2,647.90

Today’s Low: ~₹ 2,550.00

This indicates bullish participation intraday so far.

📌 Intraday Pivot & Support / Resistance Levels

Based on standard pivot calculation using the previous session’s range:

Pivot Point (PP): ~₹ 2,480.8

Resistance Levels:

R1: ~₹ 2,565.9

R2: ~₹ 2,613.1

R3: ~₹ 2,698.2

Support Levels:

S1: ~₹ 2,433.6

S2: ~₹ 2,348.5

S3: ~₹ 2,301.3

📌 Interpretation (Day Trading)

Above pivot (~₹ 2,480): bullish bias for the session.

Key breakout trigger: above R1/R2 levels (~₹ 2,565–2,613).

Downside support zones: around ₹ 2,433 then ₹ 2,348 if sellers step in.

🧠 How Traders Use These Levels Today

✅ Bullish scenario:

If the stock sustains above R1 (~₹ 2,566) and R2 (~₹ 2,613) with volume, buyers could push towards R3 (~₹ 2,698).

❗ If price weakens below S1/S2 (~₹ 2,433 / ₹ 2,348), short‑term downward pressure could emerge.

📍 Pivot (~₹ 2,480) is the key “bull vs bear” session decision level — staying above it generally suggests bulls are in control.

⚠️ Quick Risk Notes

These are intraday technical levels, not investment advice.

Stock prices can move fast; levels won’t guarantee direction.

Combine with volume and real‑time charts for best intraday decisions.

ECLERX 1 Day Time Frame 📍 Current Price Snapshot (Daily)

As of the latest available trading data:

• ECLERX daily price: ~₹4,710–₹4,740 region (intraday update) — fluctuating with bullish momentum near recent highs.

📊 Daily Technical Levels (Key Support & Resistance)

Classic Pivot Levels (Daily)

Based on recent pivot calculations from multiple technical sources:

Resistance

R3: ~₹4,748

R2: ~₹4,710–₹4,687

R1: ~₹4,626–₹4,649

Pivot Point: ~₹4,649

Support

S1: ~₹4,588–₹4,588

S2: ~₹4,561–₹4,611

S3: ~₹4,565 and lower

(values approximate based on classic & fibonacci pivot methods)

Simplified pivot zone (short)

Resistance Zone: ~₹4,710–₹4,750

Support Zone: ~₹4,560–₹4,590

Major pivot: ~₹4,648 (neutral decision level)

Additional Support / Resistance Levels (Alternate Sources)

From trendlyne / pivot screens:

• First Resistance: ~₹4,386–₹4,451

• Second Resistance: ~₹4,550–₹4,555

• Third Resistance: ~₹4,621–₹4,622

• Support Zones: ~₹4,254–₹4,215 and deeper ~₹4,161–₹4,111 if broader pullbacks occur.

👉 These can be useful as secondary trigger levels if price action tests below pivot or breaks above immediate resistance.

📌 How to Use These Levels Today

Bullish bias

➡ A daily close above ₹4,710–₹4,750 resistance cluster suggests continuation toward recent highs (potential next zone in higher time frames).

Bearish/Correction risk

➡ Weak price action below ₹4,590–₹4,560 support on the daily can expose the next support band around ₹4,500–₹4,450.

Key pivot confirmation

➡ The central range around ₹4,640–₹4,650 serves as a daily pivot — sustained trading above supports bullish control, below introduces caution.

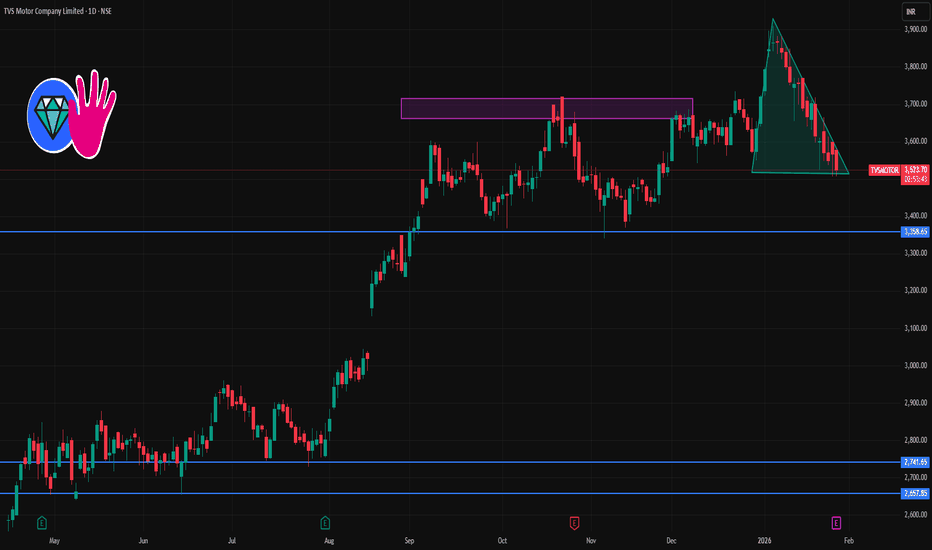

TVSMOTOR 1 Day Time Frame 📊 Current Approx Price Range (recent trading): ~₹3,525 – ₹3,560 area according to community chart insights.

🔑 1‑Day Timeframe — Key Levels

📈 Resistance Levels (Upside Targets)

₹3,550 – ₹3,560: near‑term resistance zone — a breakout above this may indicate bullish continuation.

₹3,600: psychological resistance.

₹3,640 – ₹3,650: stronger resistance above.

📉 Support Levels (Downside)

₹3,510 – ₹3,520: immediate support zone — watches trade reaction here intraday.

₹3,480 – ₹3,490: short‑term support below.

₹3,400 – ₹3,450: deeper support zone if weakness extends.

📌 Intraday & Pivot‑style Levels

Some classic pivot/levels from historical pivot calculations (may be slightly outdated but useful as reference):

R1 ~ ₹3,594, R2 ~ ₹3,622, R3 ~ ₹3,647 (classic pivot levels).

S1 ~ ₹3,541, S2 ~ ₹3,516, S3 ~ ₹3,488 (support pivots).

📊 How to Interpret These Levels

Bullish scenario: Maintaining above ₹3,520‑₹3,530 and breaking above ₹3,560‑₹3,600 could signal continuation higher.

Bearish scenario: Failure to hold ₹3,510 and drop below ₹3,480 may increase downside risk toward ₹3,400‑₹3,450.

CONCOR 1 Day Time Frame 📊 CONCOR — 1‑Day Time Frame Key Levels (Indicative)

Current Price (recent session)

• ~₹478–₹480 (down intraday) — trading near session lows.

🔁 Pivot & Classic Levels (from standard technical calculation)

These are typical pivot/SR levels used by traders for one‑day setups:

Pivot Point: ~₹520

➡️ The central reference level where bias may shift.

If price trades above this level intraday → bullish bias; below → bearish bias.

Resistance Levels:

• R1: ~₹524

• R2: ~₹527

• R3: ~₹531

➡️ Levels where selling pressure may emerge if price rallies.

Support Levels:

• S1: ~₹516

• S2: ~₹513

• S3: ~₹509

➡️ Key intraday levels where buyers may step in on pullbacks.

📉 Today’s Range & Observations

Day’s High: ~₹497–₹498

Day’s Low: ~₹477–₹478

➡️ CONCOR is trading nearer its session low, showing short‑term selling pressure.

52‑Week Context:

• 52‑week low ~₹472–₹478

• 52‑week high ~₹652 (prior broader trend)

📌 How Traders Use These Levels (1 Day Time Frame)

Bullish Scenarios (intraday):

✔ If price breaks above Pivot (~₹520) with volume → potential move toward R1 ~₹524 and beyond.

✔ Strength above R1/R2 indicates buyers stepping in.

Bearish Scenarios (intraday):

✔ Price staying below pivot and failing at R1/R2 → continuation lower.

✔ Breakdown below S1 (~₹516) and S2/S3 amplifies downside pressure.

KFINTECH 1 Week Tme Frame 📌 Current Price Context

Last close / recent price: ~₹1,018–₹1,019 per share on NSE.

The stock has been weakening over the past week (down ~‑4‑5%).

Price range today: high ~₹1,053 / low ~₹1,016.

📊 Key Pivot & Weekly Levels (1‑Week Focus)

🔹 Pivot (Reference)

Weekly pivot: ~₹1,024 area (central weekly level).

📉 Support Levels (Downside Zones)

Level Price Area What it Means

Near‑term support (S1) ₹1,006 Immediate floor — first downside buffer.

Short support (S2) ₹978–₹980 Next support if selling accelerates.

Deeper support (S3) ₹955–₹960 Stronger lower support on weekly chart.

Below ~₹1,006 weakens short‑term structure and increases bearish risk.

📈 Resistance Levels (Upside Barriers)

Level Price Area What it Means

R1 ₹1,056 Immediate resistance — key 1‑week upside test.

R2 ₹1,079 Secondary barrier — sellers often near here.

R3/Strong resistance ₹1,106–₹1,110 Major breakout zone above recent range.

Above ~₹1,056–₹1,060 would signal less bearish pressure and possibly range recovery.

🔍 Quick Reference Levels (1‑Week)

Support: ~₹1,006 → ₹978 → ₹955

Pivot: ~₹1,024

Resistance: ~₹1,056 → ₹1,079 → ₹1,106+

DIXON 1 Day Time Frame 📉 Intraday Price Action (Today’s Range)

Day’s Range: ~₹10,274 – ₹10,790

This indicates where the stock has been trading so far today.

📊 Key Intraday Levels for 1‑Day Time Frame

🟢 Support Levels

S1: ~₹10,545 – ₹10,550

S2: ~₹10,359 – ₹10,360

S3: ~₹10,016 – ₹10,020

🔴 Resistance Levels

R1: ~₹11,070 – ₹11,075

R2: ~₹11,410 – ₹11,420

R3: ~₹11,600 – ₹11,605

These pivot‑derived support/resistance levels are typical for intraday reference (classic pivot methodology).

🧠 How to Use These Levels (Intraday)

Bullish bias: A sustained break above R1 ~₹11,070 with volume can open moves toward R2 ~₹11,410.

Bearish bias: If price loses S1 ~₹10,545, next support guards are S2 ~₹10,360 and S3 ~₹10,016.

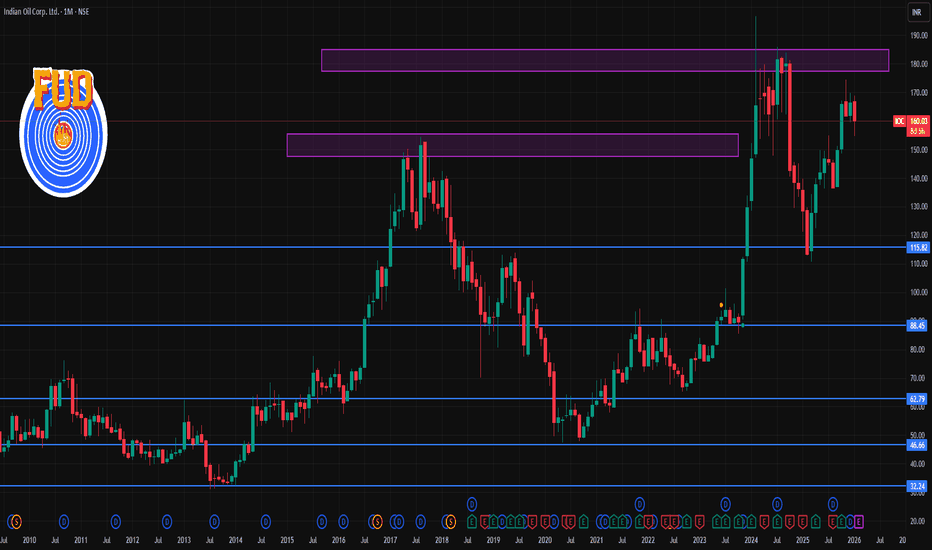

IOC 1 Month Time Frame 📌 CURRENT PRICE (as of 22 Jan 2026)

IOC share price: ~₹159.9 per share (NSE/BSE).

📊 1‑Month Technical Levels (Current & Accurate)

Resistance (Upside Levels)

These are levels where price may find selling pressure in the near term:

R1 – Immediate Resistance: ~₹160.6–₹162.5

R2 – Mid Resistance: ~₹162.5–₹163.9

R3 – Higher Resistance: ~₹164–₹165.2

A broader longer‑range resistance zone near ₹170–₹171+ remains significant if the market strengthens.

Why these matter:

Resistance levels show where the stock has historically paused or reversed on recent charts — useful for targets or exits.

Support (Downside Levels)

These are key near‑term supporting price zones:

S1 – Immediate Support: ~₹156.8–₹159.4

S2 – Secondary Support: ~₹154.7–₹157.9

S3 – Deeper Support: ~₹152.9–₹155.0

Note: If price breaks below ~₹155, it could signal further weakness in the short term.

🧠 How to Use These Levels

Swing traders: Use support zones for entry zones and resistance levels as targets.

Breakouts: A clear close above ₹164–₹165 could open room toward the ₹170+ zone.

Breakdown: A close below ₹155 could escalate selling into deeper support.

CUBEXTUB 1 Week Time Frame 📊 Current Price Context

Latest trading range (approx): ₹99–₹103 per share.

📈 Weekly Key Levels (Approximate)

🎯 Resistance Levels

These are areas where upside price movement may slow or reverse:

1. First Resistance: ~₹108–₹109 — near recent pivot resistance.

2. Next Resistance: ~₹113–₹116 — upper weekly resistance zone.

3. Higher Target: ~₹118–₹120+ — longer weekly resistance/extension.

📉 Support Levels

These are areas where price may find buying interest or a bounce:

1. Immediate Support: ~₹101–₹102 — just below recent price and short‑term pivot support.

2. Secondary Support: ~₹98–₹99 — next downside zone.

3. Lower Support: ~₹94–₹95 — deeper support if weakness continues.

📌 Weekly Pivot Reference

Pivot Level (central reference): ~₹106 — roughly the fulcrum of bulls vs. bears this week.

🛠 How to Use These Levels (Weekly Basis)

Bullish scenario:

✅ If the weekly close breaks and holds above ₹108–₹109, next resistance targets of ₹113–₹116 become active.

Bearish scenario:

❌ Failure below ₹101–₹102 could open the path toward ₹98–₹95 support.

Range bias:

🟡 Price may oscillate between ₹101–₹113 in the absence of a decisive trend signal.

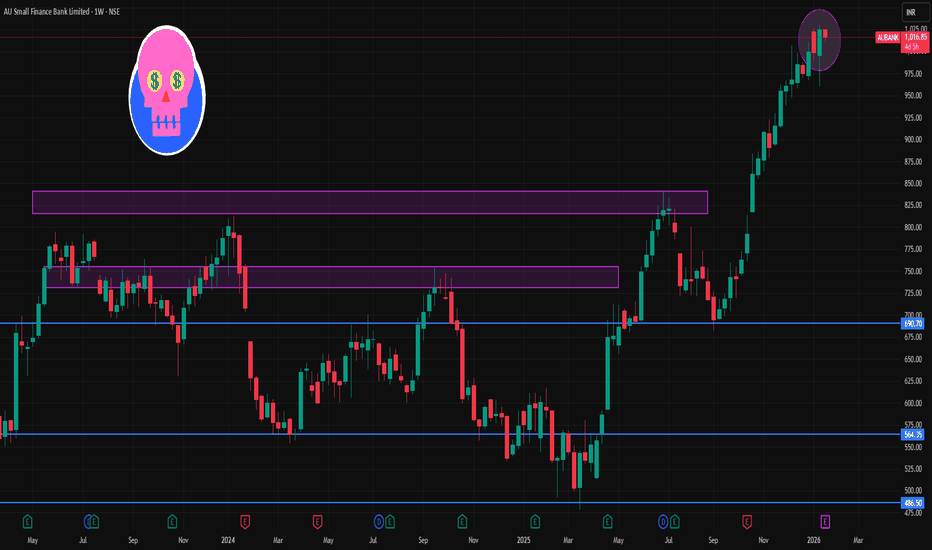

AUBANK 1 Week Time Frame 📌 1‑Week (Current) Key Levels

📍 Current Price Context

The stock has been trading around ₹1,020–₹1,030 area recently on NSE technical feeds.

🧱 Resistance Levels (Upside Targets)

1. Immediate Resistance (R1): ~₹1,050.35 – first barrier on the upside.

2. Major Resistance (R2): ~₹1,075.30 – next meaningful supply zone.

3. Higher Resistance (R3): ~₹1,120.65 – extended bullish breakout territory.

🛡️ Support Levels (Downside Defenses)

1. Immediate Support (S1): ~₹980.05 – crucial for weekly structure.

2. Major Support (S2): ~₹934.70 – deeper correction zone if S1 breaks.

3. Lower Support (S3): ~₹909.75 – extended bearish support for the week.

📊 Weekly Trading Range Projection

Bearish range: ~₹909–₹980

Bullish range: ~₹1,050–₹1,120 +

Price needs to hold above ₹980 weekly close to maintain bullish bias for the week.

📈 Trend & Indicators (Weekly)

Moving averages and oscillators on short‑term charts show neutral to mildly bullish momentum around ₹1,020–₹1,030.

EMA & SMA structures on daily charts support trend continuation if above key moving averages.

🔎 How to Use These Levels This Week

📌 Bullish setup:

Break and sustain above ~₹1,050 → potential run to ~₹1,075 → ₹1,120.

📌 Bearish setup:

Close below ~₹980 support → target ~₹935 → ₹910 on a deeper correction.

📌 Neutral / Swing range:

Between ₹980 and ₹1,050 → sideways action and range trades.

JTLIND: 3 year Downtrend Trendline Breakout, Chart of the WeekFrom ₹138 to ₹50: Why This Old Multi-Bagger Steel Stock Just Hit 20% Upper Circuit, Breaking 3-Year Downtrend and Getting a Big Order. Let's Understand in "Chart of The Week"

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Price Action:

- Current Price: ₹72.29

- 52W High: ₹138.30

- 52W Low: ₹21.79

- The stock has recently broken above a critical downward trendline that had been in effect since mid-2024, showing strong reversal momentum with 15x average volume spike

Volume Spread Analysis:

Volume Characteristics:

- Average Volume: 1.42M shares

- Recent Spike: 21.33M shares (15x average)

- This represents exceptional institutional participation and strong momentum buying

- Historical volume spikes occurred during the 2021-2023 rally phase, suggesting similar strong hands accumulation

Volume Patterns:

- Volume dried up significantly during the downtrend, reaching multi-year lows near the ₹50 base

- This "spring" action with low volume at support followed by explosive volume on breakout is a classic Wyckoff accumulation pattern

- The volume bar chart shows distinct phases: high volume during 2023 rally, declining volume during correction, and massive spike on recent breakout

Volume-Price Correlation:

- The stock showed positive volume-price correlation during the breakout, confirming institutional buying

- Previous high-volume days in 2023 coincided with price rallies, suggesting volume leads price for this stock

- Current volume expansion suggests a potential multi-week rally ahead

Base Formation and Support Levels:

- Primary Base: ₹50-55 zone (marked with horizontal green dashed line)

- This base represents a critical accumulation zone where most institutional hands exchanged during the 2021-2022 period

- The stock tested this support multiple times between 2021-2022 before the explosive rally to ₹138

- Recent re-test of this base in late 2025/early 2026 at ₹50-52 suggests strong institutional buying interest

- Secondary Support: ₹21-22 zone represents the absolute low and panic bottom

Resistance Levels:

- Immediate Resistance: ₹80-85 zone

- Major Resistance: ₹95-100 (previous consolidation area in mid-2025)

- Critical Resistance: ₹110-115 zone

- Ultimate Resistance: ₹120-125 (prior to all-time high of ₹138.30)

Trendline Analysis:

- A clear downward trendline has been connecting lower highs since the peak at ₹138.30

- This trendline acted as resistance throughout 2024-2025, rejecting multiple bounce attempts

- Recent breakout above this trendline with massive volume confirms trend reversal

- The breakout occurred at approximately ₹60-62 level, suggesting the downtrend has been structurally broken

Breakout Confirmation:

- The recent 40% single-day rally with 20% upper circuit suggests strong momentum

- Breakout above the descending trendline with volume confirmation is a textbook bullish signal

- The stock reclaimed the ₹70 level, which previously acted as support-turned-resistance

Sectoral Backdrop:

Industry Overview:

- JTL Industries operates in the Steel Pipes & Tubes manufacturing sector, specifically focused on Electric Resistance Welded (ERW) pipes

- The company is positioned in the Basic Materials sector, under Steel & Iron Products subsector

- It serves critical end-use industries including Infrastructure, Oil & Gas, Power Transmission, Water Management, and Construction

Market Position:

- JTL is among the top 5 steel tube manufacturers in India and the largest ERW pipe manufacturer in North India

- Current manufacturing capacity: 9,36,000 MTPA (Metric Tons Per Annum) across 4 state-of-the-art facilities

- Geographic presence: Pan-India domestic market plus exports to 20+ countries across 5 continents

- Product portfolio: 1,200+ SKUs covering MS Black pipes, Galvanized pipes, Hollow sections, Solar mounting structures, Transmission towers, and specialty products

Sectoral Growth Drivers:

- Infrastructure Boom: India's infrastructure spending is accelerating with massive government projects including Bharatmala (34,800 km highways), PM-AWAS housing program, and Smart Cities 2.0

- Steel Demand Growth: India's steel demand is projected to grow at approximately 9% CAGR during 2025-2026, the highest globally according to World Steel Association

- Pipe Market Expansion: The Indian steel pipes market is expected to grow from USD 32.88 billion (2023) to USD 37.69 billion by 2030 at a CAGR of 6.43%

- Government Policy Support: Production Linked Incentive (PLI) scheme for specialty steel worth ₹27,106 crore and preferential procurement mandates support domestic manufacturers

- Power Sector Growth: Significant investments in power transmission infrastructure across India creating sustained demand for transmission towers and related products

Sector Challenges:

- Raw Material Volatility: Steel prices remain subject to global commodity cycles, coal costs, and iron ore price fluctuations

- Chinese Competition: China's steel oversupply and export surge create pricing pressure

- Environmental Regulations: EU's Carbon Border Adjustment Mechanism (CBAM) effective 2026 could add USD 80-397 per ton cost to exports

- Working Capital Intensity: Industry characterized by high working capital requirements (JTL's working capital days increased from 100 to 147 days)

Fundamental Backdrop:

Business Model:

- Integrated manufacturer of ERW steel pipes with backward integration capabilities

- Recent acquisition of 67% stake in Nabha Steels & Metals adds 2 lakh MT HRC (Hot Rolled Coil) capacity

- Diversified customer base across B2B, B2G, OEMs, and international markets reduces concentration risk

- Distribution network of 800+ dealers/distributors ensures strong market reach

Recent Corporate Actions:

- Major Order Win: Secured significant order from Punjab State Transmission Corporation Limited (PSTCL) for manufacturing 220kV transmission tower material and substation structures

- Execution Timeline: Order to be completed within FY 2025-26

- Strategic Significance: This order reinforces JTL's positioning in the power transmission infrastructure segment

- Stock Impact: The PSTCL order announcement triggered a 20% upper circuit rally, demonstrating market confidence

Financial Performance Snapshot:

- Q2 FY26 Revenue: ₹371 crores (down 22% YoY from ₹480 crores)

- Q2 FY26 EBITDA: ₹29 crores

- EBITDA Margin: Improved to 8% (from 6% YoY)

- EBITDA per ton: Increased 29% YoY to ₹4,247

- Market Capitalization: Approximately ₹2,360 crores

- Sales Mix: 88% domestic, 12% exports

Operational Efficiency Metrics:

- Despite revenue decline, operational efficiency has improved as evidenced by EBITDA margin expansion

- Higher EBITDA per ton suggests better realization and product mix optimization

- Working capital pressure visible with debtor days increasing from 40.1 to 52.8 days

Growth Catalysts:

- Capacity Expansion: With acquired Nabha Steels capacity, total capacity stands at 6 lakh MT for pipes + 2.5 lakh MT HRC + 1 lakh MT long products

- Product Diversification: Expansion into solar mounting structures, transmission towers, and specialty products reduces cyclicality

- Export Growth Potential: Recognition as "Star Export House" by Government of India supports international expansion

- Green Transition: Focus on sustainable practices and potential for green steel production aligns with global trends

Management & Governance:

- Promoter holding remains stable with recent inter-se transfers within promoter group

- ISO 9001:2015 certified operations demonstrating quality commitment

- Established in 1991, providing 30+ years of industry expertise

- Leadership under Pranav Singla (Executive Director) has articulated growth strategy and export targets

Competitive Landscape:

- Key competitors include APL Apollo Tubes, Rama Steel Tubes, Hi-Tech Pipes, Sambhv Steel

- Industry seeing consolidation with smaller players struggling with working capital and raw material costs

- JTL's integrated model and backward integration through Nabha Steels acquisition provides competitive advantage

Valuation Considerations:

- 5-Year Returns: Stock has delivered 312% returns over 5 years vs NIFTY 50's 79%

- Despite recent correction from ₹138 to ₹50, long-term value creation trajectory remains intact

- Current levels around ₹72 offer attractive entry for investors with 2-3 year horizon

- Recent order wins and capacity additions support earnings growth potential

Bull Case:

- Technical breakout from multi-month downtrend with exceptional volume confirmation

- Strong sectoral tailwinds from India's infrastructure boom and 9% steel demand growth

- Recent PSTCL order validates competitive positioning and execution capabilities

- Improved operational efficiency despite revenue headwinds

- Capacity expansion and backward integration strengthen margin profile

- Government policy support through PLI schemes and procurement preferences

Bear Case:

- Revenue declined 11% YoY in Q2 FY26, indicating near-term demand challenges

- Working capital pressure with increased debtor and working capital days

- Raw material cost volatility remains a persistent risk

- Global trade uncertainties and potential CBAM impact on exports

- Chinese steel oversupply creating pricing pressure

- Technical pattern needs confirmation with sustained trading above ₹65-70 zone

Key Monitorables:

- Quarterly revenue and EBITDA trend in coming quarters

- Execution and revenue recognition from PSTCL order

- Raw material cost trends and margin sustainability

- Order book build-up from infrastructure projects

- Working capital management improvements

- Technical price action: Holding above ₹65-70 support zone would confirm bullish reversal

My 2 Cents:

NSE:JTLIND presents an interesting technical setup following the breakout from a prolonged downtrend, supported by a major order win and improving operational metrics. The stock's 15x volume spike and 20% upper circuit rally suggest strong institutional interest resuming after extended consolidation at the ₹50-55 base.

From a sectoral perspective, the company is well-positioned to benefit from India's infrastructure boom, power transmission expansion, and robust steel demand growth. The recent PSTCL order validates its competitive capabilities in the high-value transmission infrastructure segment.

Full Coverage on my Mid-Week Newsletter coming Wednesday.

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.