NIFTY – Bearish Structure Playing Out as AnticipatedIn my previous posts, I had clearly highlighted the possibility of a trend shift and warned that the ongoing price action could resolve to the downside. Over the last few sessions, price has started to play out exactly along those lines.

1. Bearish crossover (mini death cross)

A bearish crossover between the short-term and medium-term moving averages has now occurred. This was already anticipated and mentioned in earlier posts, and it marks a loss of bullish momentum after the ATH zone.

2. Clean breakdown below key support

Price has decisively broken below an important support and trendline structure. This confirms the bearish bias and strengthens the view that the broader market is under distribution rather than accumulation.

3. Next immediate support zone

The marked zone below acts as the next immediate support, where we may expect temporary consolidation or a technical bounce. However, unless there is strong follow-through buying, this should be treated cautiously.

4. Caution on bullish moves

Any signs of bullishness from here are likely to be temporary retracements, which may eventually trigger further sell-offs.

➡️ Avoid fresh swing longs until overall market sentiment turns favorable.

➡️ Existing positions should be managed with strict stop-losses and disciplined risk management.

The market is behaving in line with what was discussed earlier. Until structure changes and strength is proven, the risk remains on the downside. Patience and capital protection are more important than chasing trades in such phases.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

Chart Patterns

DIXON 1 Day Time Frame 📉 Intraday Price Action (Today’s Range)

Day’s Range: ~₹10,274 – ₹10,790

This indicates where the stock has been trading so far today.

📊 Key Intraday Levels for 1‑Day Time Frame

🟢 Support Levels

S1: ~₹10,545 – ₹10,550

S2: ~₹10,359 – ₹10,360

S3: ~₹10,016 – ₹10,020

🔴 Resistance Levels

R1: ~₹11,070 – ₹11,075

R2: ~₹11,410 – ₹11,420

R3: ~₹11,600 – ₹11,605

These pivot‑derived support/resistance levels are typical for intraday reference (classic pivot methodology).

🧠 How to Use These Levels (Intraday)

Bullish bias: A sustained break above R1 ~₹11,070 with volume can open moves toward R2 ~₹11,410.

Bearish bias: If price loses S1 ~₹10,545, next support guards are S2 ~₹10,360 and S3 ~₹10,016.

JINDALSTEL 1 Day Time Frame 📊 Current Price Snapshot

The stock has been trading around ~₹1,030–₹1,070 on recent sessions.

🔑 Daily Pivot & Key Levels (1‑Day Time Frame)

🔼 Resistance Levels

R1: ~₹1,053–₹1,063

R2: ~₹1,062–₹1,071

R3: ~₹1,070–₹1,079+

These are potential daily resistance zones where price may slow or reverse on the upside.

🔁 Pivot/Reference Level

Daily Pivot (central level): ~₹1,045–₹1,046

This is the equilibrium reference; above this suggests slightly bullish bias, below suggests bearish bias for the day.

🔽 Support Levels

S1: ~₹1,034–₹1,056

S2: ~₹1,025–₹1,048

S3: ~₹1,015–₹1,041

These are key intraday support zones where the stock may find buying interest.

📈 How to Use These Levels Today

Bullish scenario: If price holds above the pivot and clears R1/R2 (~₹1,053–₹1,071) with volume, it may test R3 (~₹1,078+).

Bearish scenario: If it breaks below S2 (~₹1,025), watch for deeper pullbacks toward S3 (~₹1,015).

Range‑bound: If staying between pivot and S1/R1, expect sideways movement.

(Typical pivot logic — not investment advice.)

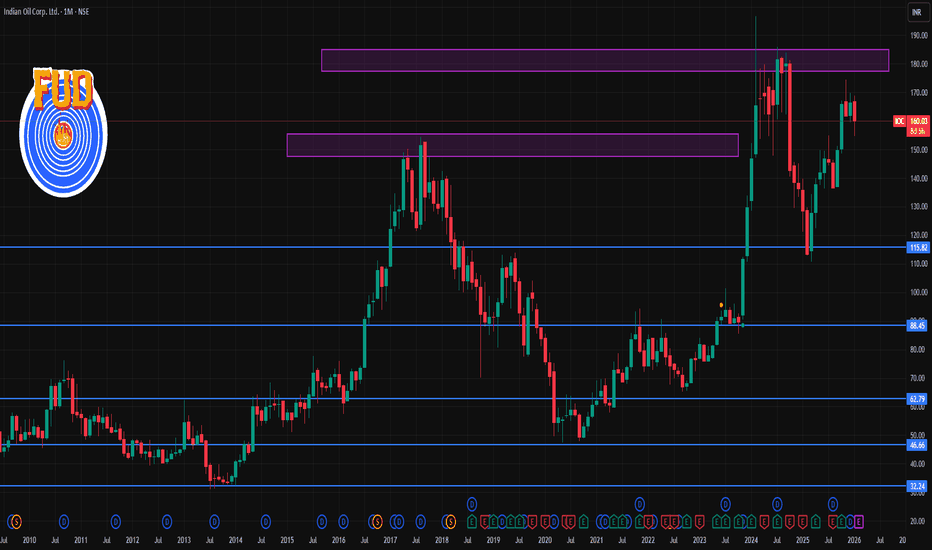

IOC 1 Month Time Frame 📌 CURRENT PRICE (as of 22 Jan 2026)

IOC share price: ~₹159.9 per share (NSE/BSE).

📊 1‑Month Technical Levels (Current & Accurate)

Resistance (Upside Levels)

These are levels where price may find selling pressure in the near term:

R1 – Immediate Resistance: ~₹160.6–₹162.5

R2 – Mid Resistance: ~₹162.5–₹163.9

R3 – Higher Resistance: ~₹164–₹165.2

A broader longer‑range resistance zone near ₹170–₹171+ remains significant if the market strengthens.

Why these matter:

Resistance levels show where the stock has historically paused or reversed on recent charts — useful for targets or exits.

Support (Downside Levels)

These are key near‑term supporting price zones:

S1 – Immediate Support: ~₹156.8–₹159.4

S2 – Secondary Support: ~₹154.7–₹157.9

S3 – Deeper Support: ~₹152.9–₹155.0

Note: If price breaks below ~₹155, it could signal further weakness in the short term.

🧠 How to Use These Levels

Swing traders: Use support zones for entry zones and resistance levels as targets.

Breakouts: A clear close above ₹164–₹165 could open room toward the ₹170+ zone.

Breakdown: A close below ₹155 could escalate selling into deeper support.

Real Knowledge of Candle Patterns Types of Candlestick Patterns

Candlestick patterns fall into three groups:

1. Reversal Patterns

Signal a potential change in trend.

2. Continuation Patterns

Indicate the trend will likely continue.

3. Indecision Patterns

Show lack of conviction and potential upcoming moves.

RICOAUTO 1 Week Time Frame 📊 Current Price Snapshot

The stock is trading around ₹115–₹122 range recently.

📈 Key Levels for 1-Week Time Frame

🔵 Resistance Levels (Upside Targets)

1. ~₹121–₹122 — Immediate resistance zone (short-term pivot region).

2. ~₹126–₹127 — Next resistance zone where sellers may appear.

3. ~₹129–₹132 — Higher resistance area, a target if momentum improves.

📌 If price breaks and sustains above ₹122–₹126 with volume, near-term bullish continuation could occur.

🔻 Support Levels (Downside Defense)

1. ~₹113–₹114 — First technical support.

2. ~₹110 — Secondary near-term support.

3. ~₹105–₹106 — Stronger lower support zone if selling accelerates.

📌 A close below ₹110 in daily charts often signals deeper pullbacks.

📌 What Traders Are Watching

Some technical analysts have noted support around ₹120–₹123 with stop-loss/entry zones for short-term trades (e.g., stop-loss near ₹114–₹115).

⚠️ Risk Notes

Short-term technical signals (like moving averages) currently show weak to selling bias on intraday/daily charts.

Broader market conditions and sector movement can heavily influence price direction.

Real Knowledge Chart Patterns Why Candlestick Patterns Matter

Candlestick patterns matter because they reflect real-time trader behavior:

Are bulls becoming aggressive?

Are bears weakening?

Is a reversal coming?

Is the trend gaining strength?

Are institutions absorbing liquidity?

In Volume Profile or Market Structure context:

A candle pattern near value areas confirms reversals.

A candle pattern at breakout zones confirms continuation.

A candle pattern after liquidity grabs confirms orderflow shift.

XAUUSD – Trendline broken, focus on Buying liquidityMarket Context

After a strong impulsive rally, Gold has broken below the short-term ascending trendline, signaling a technical correction and liquidity rebalancing phase. However, the higher-timeframe structure remains intact, and the current decline is still viewed as corrective rather than a trend reversal.

From a fundamental perspective, safe-haven demand and a cautious monetary policy outlook continue to support Gold. This keeps deeper pullbacks attractive for institutional accumulation rather than aggressive selling.

Structure & Price Action (H1)

Short-term bullish trendline has been broken → transition into a corrective phase.

No confirmed bearish CHoCH on H1 at this stage.

Price is rotating within a range, targeting liquidity pools below.

Multiple Demand + Liquidity + H1 GAP zones are located beneath current price.

Upper zones remain Supply / Liquidity Sell areas for potential reactions.

Key Levels to Watch

Supply / Liquidity Sell: 4,949 – 4,874

Mid reaction zone: 4,824

Primary BUY zone: 4,755 – 4,729

Deep BUY zone (H1 GAP – Liquidity): 4,665 – 4,600

Trading Plan – MMF Style

Primary Scenario – Buy at Discount

Look for BUY setups at:

BUY zone 1: 4,755 – 4,729

BUY zone 2: 4,665 – 4,600 (H1 GAP & liquidity)

Entries only after clear bullish reactions and structure holding.

Avoid premature entries while price remains mid-range.

Upside Targets

TP1: 4,824

TP2: 4,874

TP3: 4,949 (upper liquidity sweep)

Alternative Scenario

If price fails to reach lower zones and holds above 4,824, wait for a break & retest to re-enter BUY positions in trend direction.

Invalidation

An H1 close below 4,600 invalidates the BUY bias.

Stand aside and reassess overall market structure.

Summary

The broader bullish bias remains intact, while the current move represents a healthy pullback for liquidity absorption. The optimal strategy is patience—BUY at discounted zones with confirmation, not by chasing price.

XAUUSD – Short-Term Trendline Broken, Focus on Buying Liquidity Market Context

After a strong impulsive rally, Gold has broken below the short-term ascending trendline, signaling a technical correction and liquidity rebalancing phase. However, the higher-timeframe structure remains intact, and the current decline is still viewed as corrective rather than a trend reversal.

From a fundamental perspective, safe-haven demand and a cautious monetary policy outlook continue to support Gold. This keeps deeper pullbacks attractive for institutional accumulation rather than aggressive selling.

Structure & Price Action (H1)

Short-term bullish trendline has been broken → transition into a corrective phase.

No confirmed bearish CHoCH on H1 at this stage.

Price is rotating within a range, targeting liquidity pools below.

Multiple Demand + Liquidity + H1 GAP zones are located beneath current price.

Upper zones remain Supply / Liquidity Sell areas for potential reactions.

Key Levels to Watch

Supply / Liquidity Sell: 4,949 – 4,874

Mid reaction zone: 4,824

Primary BUY zone: 4,755 – 4,729

Deep BUY zone (H1 GAP – Liquidity): 4,665 – 4,600

Trading Plan – MMF Style

Primary Scenario – Buy at Discount

Look for BUY setups at:

BUY zone 1: 4,755 – 4,729

BUY zone 2: 4,665 – 4,600 (H1 GAP & liquidity)

Entries only after clear bullish reactions and structure holding.

Avoid premature entries while price remains mid-range.

Upside Targets

TP1: 4,824

TP2: 4,874

TP3: 4,949 (upper liquidity sweep)

Alternative Scenario

If price fails to reach lower zones and holds above 4,824, wait for a break & retest to re-enter BUY positions in trend direction.

Invalidation

An H1 close below 4,600 invalidates the BUY bias.

Stand aside and reassess overall market structure.

Summary

The broader bullish bias remains intact, while the current move represents a healthy pullback for liquidity absorption. The optimal strategy is patience—BUY at discounted zones with confirmation, not by chasing price.

Indian Derivatives on Power & Energy MarketsFocus on VPPA and OTC Structures

India’s power and energy markets are undergoing a structural transformation driven by renewable energy expansion, power market reforms, decarbonization goals, and increasing participation from corporates and financial players. Alongside physical electricity trading, derivative instruments—especially Virtual Power Purchase Agreements (VPPAs) and OTC energy derivatives—are emerging as essential tools for price risk management, revenue stability, and sustainability compliance.

Unlike mature power derivative markets such as Europe or the US, India’s energy derivatives ecosystem is still nascent but evolving rapidly, shaped by regulatory caution, exchange-based reforms, and corporate demand for green power.

1. Evolution of Power Markets in India

Historically, India’s electricity sector operated under long-term physical PPAs between generators and state distribution companies (DISCOMs). Prices were regulated, and price risk was minimal.

Key changes over the last decade:

Rapid growth in renewable energy (solar, wind)

Introduction of power exchanges (IEX, PXIL)

Move towards market-based economic dispatch (MBED)

Entry of corporates as power buyers

Volatility in spot and real-time electricity prices

This shift has created a strong need for hedging instruments similar to commodities, interest rates, or FX derivatives.

2. What Are Power & Energy Derivatives?

Power and energy derivatives are financial contracts whose value is linked to:

Electricity prices (spot, day-ahead, real-time)

Renewable energy output

Fuel prices (coal, gas)

Emission or renewable attributes

They help participants:

Hedge price volatility

Lock in long-term power costs

Stabilize revenues for renewable generators

Meet ESG and decarbonization targets

In India, derivatives are primarily OTC-based, with limited exchange-traded participation.

3. Virtual Power Purchase Agreements (VPPA)

What is a VPPA?

A VPPA is a financial (non-physical) contract where:

A corporate buyer agrees to a fixed price for renewable power

The generator sells electricity into the market at floating prices

The difference between the fixed VPPA price and market price is financially settled

No physical delivery of electricity occurs

In essence, a VPPA is a Contract for Difference (CfD) applied to power.

VPPA Structure in the Indian Context

Parties involved:

Renewable energy generator (solar/wind)

Corporate buyer (IT firms, data centers, manufacturing, MNCs)

Power exchange or market price reference

Settlement and billing agent

Cash flow example:

VPPA strike price: ₹4.00/unit

Market price: ₹3.50/unit

→ Corporate pays generator ₹0.50/unit

Market price: ₹4.50/unit

→ Generator pays corporate ₹0.50/unit

The physical electricity continues to be sold independently in the market.

Why VPPAs Matter in India

Corporate Renewable Demand

Large Indian and global corporates operating in India want renewable sourcing without dealing with:

Open access complexity

State-level cross-subsidy charges

Transmission constraints

Price Hedging

Corporates hedge long-term power costs while generators hedge revenue volatility.

ESG and RE100 Commitments

VPPAs allow companies to claim renewable procurement benefits without physical delivery.

Financing Renewable Projects

Stable VPPA cash flows improve bankability for renewable projects.

Regulatory Status of VPPAs in India

VPPAs are not explicitly regulated by CERC/SEBI yet

Typically structured as private OTC financial contracts

Settlement references:

Day-Ahead Market (DAM)

Real-Time Market (RTM)

Legal clarity is evolving; contracts are carefully drafted to avoid being classified as speculative derivatives

India is moving cautiously compared to global markets.

4. OTC (Over-the-Counter) Energy Derivatives in India

What Are OTC Energy Derivatives?

OTC derivatives are bilateral contracts negotiated privately between parties, not traded on exchanges.

Common OTC instruments in Indian energy markets:

Fixed-for-floating power swaps

Renewable generation hedges

Fuel cost pass-through hedges

Long-term price floors and caps

Key OTC Power Derivative Structures

1. Fixed-Price Power Swap

Buyer pays fixed power price

Seller pays floating market price

Used by DISCOMs and large consumers

2. Price Cap and Floor Contracts

Protects buyers from price spikes

Protects generators from price crashes

3. Load Following Contracts

Settlement based on actual consumption profile

Useful for data centers and industrial users

4. Renewable Output-Linked Swaps

Settlement linked to actual solar/wind generation

Manages intermittency risk

Participants in OTC Energy Derivatives

Renewable power producers

Thermal power generators

Large industrial consumers

Corporates with ESG mandates

Energy trading companies

Financial intermediaries (limited)

Banks currently play a minimal role due to regulatory ambiguity.

5. Exchange-Traded vs OTC Derivatives in India

Aspect Exchange-Traded OTC

Transparency High Low

Customization Limited High

Counterparty Risk Low Higher

Regulation Strong Evolving

Liquidity Low (India) Moderate

Indian power exchanges currently focus on spot, term-ahead, and real-time markets, while derivatives remain mostly OTC.

6. Key Challenges in Indian Power Derivatives

Regulatory Uncertainty

Unclear demarcation between power contracts and financial derivatives.

SEBI vs CERC Jurisdiction

Power contracts fall under CERC, financial derivatives under SEBI—overlap creates hesitation.

DISCOM Financial Stress

Weak creditworthiness limits participation.

Low Market Depth

Limited liquidity restricts price discovery.

Accounting & Tax Treatment

Unclear GST and accounting classification for VPPA settlements.

7. Future Outlook of Power Derivatives in India

The long-term outlook is structurally bullish:

Market-Based Economic Dispatch will increase price volatility

Renewable penetration >50% by 2030 increases intermittency

Corporate green demand continues to rise

Power futures and options are expected on exchanges

Green attributes and carbon-linked derivatives may emerge

India is likely to follow a hybrid model:

OTC dominance initially

Gradual migration to regulated exchange-based derivatives

8. Strategic Importance for Investors and Traders

For traders and institutional investors:

Power derivatives offer non-correlated returns

Seasonal and weather-driven volatility creates opportunities

Renewable intermittency increases optionality value

For corporates:

VPPAs act as both hedging tools and ESG instruments

For generators:

Stable revenues improve project valuation and refinancing ability

Conclusion

Indian derivatives in power and energy markets—especially VPPAs and OTC contracts—represent the next phase of financial sophistication in the country’s energy transition. While regulatory clarity is still evolving, the economic need for price risk management, renewable integration, and corporate sustainability ensures sustained growth.

As India moves toward a more market-driven power system, energy derivatives will shift from optional tools to essential financial infrastructure, shaping how electricity is priced, traded, and financed in the coming decade.

Crypto Regulation & Digital Assets (Context-Specific)Understanding Digital Assets and Cryptocurrencies

Digital assets broadly refer to assets represented in digital form using distributed ledger technology (DLT) or blockchain. These include cryptocurrencies (Bitcoin, Ethereum), stablecoins (USDT, USDC), utility tokens, security tokens, non-fungible tokens (NFTs), and tokenized real-world assets such as bonds or real estate. Cryptocurrencies operate on decentralized networks without central intermediaries, which is both their core innovation and the primary regulatory challenge.

Unlike traditional assets, crypto assets can be transferred globally within minutes, are often pseudonymous, and operate outside conventional banking rails. This disrupts existing regulatory frameworks designed for centralized intermediaries such as banks, exchanges, and clearing corporations.

Why Regulation Is Necessary

Crypto regulation is driven by several key concerns:

Investor Protection – Extreme price volatility, market manipulation, fraud, and lack of disclosure have led to significant retail investor losses.

Financial Stability – Large-scale adoption of unregulated crypto assets could pose systemic risks, especially if linked with traditional finance.

Money Laundering & Illicit Finance – Pseudonymity and cross-border transfers raise concerns around AML/CFT compliance.

Consumer Protection – Exchange failures, hacks, and loss of private keys can permanently erase user funds.

Monetary Sovereignty – Widespread crypto usage may undermine central banks’ control over monetary policy.

However, over-regulation risks stifling innovation, pushing activity into informal or offshore markets. Hence, regulators aim for a calibrated approach.

Global Regulatory Approaches: A Comparative View

Crypto regulation varies significantly across jurisdictions:

United States adopts a fragmented, enforcement-driven approach. Agencies like the SEC, CFTC, and FinCEN regulate crypto depending on whether assets are classified as securities, commodities, or payment instruments. Regulatory uncertainty remains high, especially around token classification.

European Union has taken a structured route through the Markets in Crypto-Assets (MiCA) framework, offering legal clarity, licensing norms, and consumer protection across member states.

China has imposed a near-complete ban on private cryptocurrencies while aggressively developing its digital yuan (e-CNY), reflecting a state-centric model.

Japan and Singapore represent balanced models, allowing crypto innovation under strict licensing, custody, and disclosure rules.

Emerging markets often focus on capital controls, financial stability, and consumer risks due to higher retail participation.

These differences highlight that regulation is shaped by economic priorities and risk tolerance.

India’s Context-Specific Regulatory Stance

India provides a clear example of context-specific crypto regulation. Rather than banning cryptocurrencies outright, India has adopted a restrictive but permissive approach:

Cryptocurrencies are not legal tender, but trading and holding are allowed.

A 30% tax on crypto gains and 1% TDS on transactions aim to track activity and curb speculation.

Crypto exchanges must comply with KYC, AML, and reporting norms under the Prevention of Money Laundering Act (PMLA).

Advertising and investor communication are monitored to prevent misleading claims.

This framework reflects India’s priorities: protecting retail investors, preventing misuse for illicit finance, and safeguarding monetary sovereignty, while still allowing blockchain innovation. India’s push for a Digital Rupee (CBDC) further reinforces the distinction between state-backed digital money and private crypto assets.

DeFi, NFTs, and New Regulatory Challenges

Beyond cryptocurrencies, regulators face challenges in newer segments:

DeFi platforms operate without centralized intermediaries, making accountability and compliance difficult. Smart contracts replace institutions, raising questions about liability and governance.

NFTs blur the line between art, collectibles, and financial assets. While many NFTs are cultural or creative, others resemble speculative investment products.

Stablecoins pose systemic risks if widely adopted, especially when backed by opaque reserves. Global regulators increasingly demand reserve transparency and redemption guarantees.

Context matters here: countries with advanced financial markets focus on systemic risk, while others prioritize consumer protection and capital controls.

CBDCs vs Cryptocurrencies

Central Bank Digital Currencies represent the regulatory counterbalance to private crypto assets. CBDCs aim to combine the efficiency of digital payments with the trust and stability of central banks. For governments, CBDCs offer better transaction traceability, reduced cash dependence, and improved financial inclusion.

In contrast to decentralized cryptocurrencies, CBDCs are centralized, regulated, and aligned with monetary policy. Many regulators view CBDCs not as replacements but as alternatives that reduce the need for private crypto adoption, especially for payments.

The Future of Crypto Regulation

The future of crypto regulation is likely to be principle-based rather than prohibition-based. Key trends include:

Clear classification of digital assets (payment tokens, utility tokens, security tokens).

Licensing and capital adequacy norms for exchanges and custodians.

Strong custody, audit, and disclosure requirements.

Global coordination through bodies like the FATF to manage cross-border risks.

Regulation of intermediaries rather than protocols, especially in DeFi.

Importantly, regulators are increasingly adopting a “same risk, same regulation” approach, ensuring that crypto activities posing similar risks to traditional finance are regulated comparably.

Conclusion

Crypto regulation and digital assets cannot be governed by a one-size-fits-all framework. Each country’s approach reflects its economic maturity, financial stability concerns, technological adoption, and policy objectives. While excessive regulation can suppress innovation, under-regulation can expose economies to financial and consumer risks. The optimal path lies in context-specific, adaptive regulation that evolves alongside technology.

Algorithmic Strategies for Cross-Asset Futures1. Concept of Cross-Asset Futures Trading

Cross-asset futures trading involves taking positions in two or more futures contracts from different asset classes based on statistical, macroeconomic, or structural relationships. Instead of predicting absolute price direction, these strategies often focus on relative value, correlation, or transmission of information across markets.

For example:

Bond yields rising may negatively impact equity index futures.

Crude oil futures may influence inflation expectations and currency futures.

Gold futures may react to movements in real yields and USD futures.

Algorithms systematically quantify and trade these relationships at scale.

2. Asset Classes Commonly Used

Cross-asset futures strategies typically span:

Equity Index Futures (S&P 500, Nifty 50, Nasdaq, DAX)

Interest Rate Futures (Treasury futures, Gilt futures)

Commodity Futures (Crude oil, gold, copper, agricultural products)

Currency Futures (USD, EUR, JPY, INR)

Volatility Futures (VIX)

The diversity of instruments improves portfolio robustness and diversification.

3. Core Types of Cross-Asset Algorithmic Strategies

A. Inter-Market Spread Trading

Inter-market spread strategies exploit pricing relationships between futures in different asset classes.

Examples:

Long equity index futures and short bond futures during reflationary phases.

Long copper futures and short gold futures to express a “risk-on” view.

Algorithms monitor historical spreads, z-scores, and cointegration metrics to identify deviations from equilibrium and execute trades when spreads are statistically stretched.

Key tools:

Cointegration analysis

Z-score normalization

Kalman filters for dynamic spreads

B. Macro-Driven Regime Strategies

These algorithms classify the macro environment into regimes such as:

Growth acceleration

Inflation shock

Deflation risk

Risk-off crisis

Each regime has predefined cross-asset positioning rules.

Example:

Inflationary regime: Long commodities, short bonds, selective equity exposure.

Risk-off regime: Long bond futures, long gold futures, short equity futures.

Machine learning classifiers or rule-based macro indicators (PMI, CPI, yield curve slope) are often used for regime detection.

C. Correlation and Breakdown Strategies

Cross-asset correlations are not static. Algorithms monitor rolling correlations between assets and trade correlation breakdowns.

Example:

If equities and bonds suddenly turn positively correlated during stress, the model adjusts hedges or exploits the shift.

These strategies are especially effective during crisis periods when traditional correlations fail.

Common methods:

Rolling correlation matrices

Principal Component Analysis (PCA)

Dynamic Conditional Correlation (DCC-GARCH)

D. Lead-Lag Strategies

Some markets react faster to new information than others. Algorithms identify leading assets and trade lagging ones.

Examples:

Currency futures reacting before equity futures to rate expectations.

Energy futures leading inflation-sensitive bond futures.

High-frequency or medium-frequency data is used to detect causality using:

Granger causality tests

Transfer entropy

Time-shifted regressions

E. Risk Parity and Volatility Targeting

Cross-asset futures portfolios often use risk parity, where capital allocation is based on volatility rather than notional value.

Key characteristics:

Lower allocation to volatile assets like equities

Higher allocation to stable assets like bonds

Continuous rebalancing based on realized volatility

Algorithms dynamically adjust exposure so that each asset class contributes equally to portfolio risk.

F. Statistical Arbitrage Across Asset Classes

These strategies treat futures contracts as components of a statistical system rather than economic instruments.

Examples:

Mean-reversion between commodity indices and equity indices

Cross-sectional ranking of futures returns across asset classes

Models may include:

Multivariate regression

Factor models

Machine learning clustering techniques

4. Data and Infrastructure Requirements

Cross-asset futures strategies are data-intensive.

Required data:

Futures price data (continuous contracts)

Macro data (rates, inflation, growth indicators)

Volatility indices

Correlation and covariance matrices

Infrastructure:

Low-latency execution for intraday strategies

Robust backtesting engines

Risk management and margin optimization systems

Institutional-grade systems are preferred due to the complexity of managing multiple asset classes.

5. Risk Management in Cross-Asset Algorithms

Risk management is central to cross-asset futures trading.

Key risks:

Correlation breakdown risk

Leverage and margin risk

Liquidity risk during stress events

Model overfitting

Risk controls:

Portfolio-level drawdown limits

Volatility scaling

Stop-loss at spread and portfolio level

Stress testing across historical crises

Many strategies cap risk at the portfolio level rather than individual trades, reflecting the interconnected nature of assets.

6. Advantages of Cross-Asset Futures Strategies

Diversification across asset classes

Ability to profit in both trending and sideways markets

Reduced reliance on single-market direction

Strong performance during macro regime shifts

Capital efficiency due to futures leverage

These advantages make cross-asset strategies attractive for institutional portfolios.

7. Limitations and Challenges

Despite their strengths, these strategies face challenges:

Changing macro relationships

Data quality issues across asset classes

High complexity and maintenance cost

Regulatory and margin changes affecting futures trading

Models must be continuously monitored and adapted.

8. Future Trends

The future of cross-asset futures algorithms includes:

AI-driven regime detection

Alternative data integration (shipping, satellite, flows)

Real-time macro nowcasting

Improved tail-risk hedging models

As global markets become more interconnected, cross-asset algorithms will become even more relevant.

Conclusion

Algorithmic strategies for cross-asset futures represent one of the most sophisticated forms of systematic trading. By exploiting relationships across equities, bonds, commodities, currencies, and volatility, these strategies move beyond single-market forecasting toward a holistic view of global financial systems. When combined with robust risk management, disciplined execution, and adaptive models, cross-asset futures algorithms can deliver consistent, diversified performance across market cycles.

Renewable Energy Certificates & Carbon Credits1. What Are Renewable Energy Certificates (RECs)?

Definition

A Renewable Energy Certificate (REC) represents the environmental attributes of electricity generated from renewable sources such as solar, wind, hydro, biomass, or geothermal. One REC is issued for every 1 megawatt-hour (MWh) of renewable electricity generated and supplied to the grid.

When renewable power is produced, two components are created:

Physical electricity (indistinguishable once on the grid)

Environmental benefit (tracked separately through RECs)

The REC allows the renewable benefit to be claimed, traded, or retired, even if the actual electricity is consumed elsewhere.

2. Purpose of RECs

RECs exist primarily to:

Promote renewable energy adoption

Enable compliance with renewable energy mandates

Allow organizations to claim renewable energy usage

Support corporate sustainability and ESG goals

Because electricity on the grid is a mix of sources, RECs solve the attribution problem—allowing buyers to say, “We used renewable electricity,” even if electrons came from mixed sources.

3. Types of REC Markets

a) Compliance RECs

These are used to meet government-mandated renewable obligations, such as:

Renewable Purchase Obligations (RPOs) in India

Renewable Portfolio Standards (RPS) in the US

Utilities and obligated entities must procure a certain percentage of power from renewable sources or purchase RECs to comply.

b) Voluntary RECs

Corporates, institutions, and individuals purchase these to:

Reduce their carbon footprint

Meet net-zero or carbon neutrality commitments

Enhance brand sustainability credentials

4. How REC Markets Work

Renewable generator produces electricity

REC is issued by a registry

REC is sold to buyers

Buyer retires the REC to claim renewable usage

Once retired, a REC cannot be resold, ensuring no double counting.

5. Benefits and Limitations of RECs

Benefits

Encourages renewable project viability

Provides additional revenue to clean energy producers

Enables corporate climate action

Transparent and standardized tracking

Limitations

RECs do not directly reduce emissions; they support cleaner generation

Risk of greenwashing if used without broader decarbonization

Impact depends on market integrity and additionality

6. What Are Carbon Credits?

Definition

A carbon credit represents the reduction, removal, or avoidance of 1 metric tonne of carbon dioxide (CO₂) or equivalent greenhouse gases (CO₂e).

Carbon credits are generated by projects that:

Reduce emissions (e.g., energy efficiency)

Avoid emissions (e.g., clean cooking stoves)

Remove carbon (e.g., afforestation, carbon capture)

7. Purpose of Carbon Credits

Carbon credits exist to:

Put a price on carbon emissions

Encourage emission reductions where they are cheapest

Help entities offset unavoidable emissions

Support climate finance in developing regions

They are especially useful for hard-to-abate sectors like aviation, cement, steel, and shipping.

8. Types of Carbon Markets

a) Compliance Carbon Markets

Governed by regulations such as:

Emissions Trading Systems (ETS)

Cap-and-Trade programs

Governments cap total emissions and allocate or auction allowances. Companies exceeding limits must buy credits.

b) Voluntary Carbon Markets (VCM)

Corporations and individuals voluntarily purchase credits to:

Offset emissions

Achieve carbon neutrality

Support sustainability initiatives

Credits are certified by standards like Verra, Gold Standard, or national registries.

9. How Carbon Credits Are Created

Project is designed (e.g., wind farm, forest conservation)

Emission reductions are calculated using approved methodologies

Independent verification is conducted

Credits are issued

Credits are sold and eventually retired

Key principles include additionality, permanence, measurability, and no double counting.

10. Benefits and Challenges of Carbon Credits

Benefits

Cost-effective emission reductions

Mobilizes private climate finance

Encourages innovation and clean technologies

Supports sustainable development goals (SDGs)

Challenges

Concerns about quality and credibility

Risk of overstated reductions

Permanence risks (e.g., forest fires)

Complexity in measurement and verification

11. Key Differences Between RECs and Carbon Credits

Aspect RECs Carbon Credits

Unit 1 MWh renewable electricity 1 tonne CO₂e

Purpose Promote renewable energy Offset or reduce emissions

Market Electricity & sustainability Climate & emissions

Emission Impact Indirect Direct

Usage Claim “We used renewable energy” “We offset emissions”

12. Role in Corporate ESG and Net-Zero Strategies

Modern climate strategies typically follow a hierarchy:

Avoid emissions

Reduce emissions

Replace fossil energy with renewables (RECs)

Offset residual emissions (Carbon Credits)

RECs help decarbonize Scope 2 emissions (electricity), while carbon credits often address Scope 1 and Scope 3 residuals.

13. Future Outlook

The role of RECs and carbon credits is expanding due to:

Global net-zero commitments

Increasing carbon disclosure regulations

Growth in ESG investing

Rising corporate accountability

However, future markets will demand:

Higher transparency

Stronger standards

Better alignment with real-world emission reductions

Governments are also exploring Article 6 mechanisms under the Paris Agreement, which could reshape international carbon trading.

14. Conclusion

Renewable Energy Certificates and Carbon Credits are powerful yet distinct climate instruments. RECs accelerate the transition to clean electricity by monetizing renewable attributes, while carbon credits enable emissions reductions beyond organizational boundaries. When used responsibly—not as substitutes for direct decarbonization but as complementary tools—they play a crucial role in achieving global climate goals.

NIFTY – Price Returns to Structure as Budget ApproachesThis is a structural pullback within a well-defined rising channel, not a random fall.

Price has respected this channel multiple times in the past, and the current move is a return toward the lower trendline support, which has historically acted as a demand zone.

Such pullbacks are normal and healthy in trending markets. They help reset sentiment, shake out weak hands, and rebuild structure before the next directional move.

The Union Budget is approaching, which naturally increases volatility and uncertainty. During such events, markets often move first and explain later. That’s why reacting is more important than predicting here.

If price holds and stabilizes near this trend support, it keeps the broader trend intact and opens the door for continuation once clarity returns.

If the structure fails decisively, the chart itself will signal that—no assumptions needed.

For now, this is a wait-and-watch zone, where patience, structure, and price behavior matter more than opinions or headlines.

CONSOLIDATION IN STOCKS ? Lets Elobrate Base Chart ADANIENSOLConsolidation in technical analysis refers to a period when a stock trades within a tight range, showing indecision between buyers and sellers. It’s important because breakouts from consolidation often signal strong moves. Traders typically enter after a confirmed breakout, manage risk with stop-losses, and remember that patience and discipline are key takeaways.

📊 What is Consolidation in Technical Analysis?

Definition: Consolidation occurs when a stock’s price moves sideways within a defined range of support and resistance, reflecting market indecision.

Visual Pattern: Prices form horizontal channels, triangles, or rectangles.

Market Psychology: Buyers and sellers are balanced, waiting for new information or momentum before committing.

🌟 Importance of Consolidation

Signals Pause Before Trend Continuation or Reversal: Consolidation often precedes major moves.

Helps Identify Breakout Opportunities: Traders watch for volume spikes and price moves beyond support/resistance.

Reduces Noise: It filters out random fluctuations, giving clearer entry signals.

🎯 When to Enter Stocks

Breakout Entry: Enter after price breaks above resistance (bullish) or below support (bearish).

Confirmation Needed: Look for increased trading volume to validate the breakout.

Avoid Premature Entry: Entering inside the consolidation range can lead to false signals.

⚖️ Risk Management After Entry

Stop-Loss Placement:

For long trades: just below support.

For short trades: just above resistance.

Position Sizing: Risk only a small percentage of capital per trade (commonly 1–2%).

Trailing Stops: Adjust stops as the trend develops to lock in profits.

Avoid Overtrading: Consolidation can last longer than expected; patience is crucial.

🧠 Investor/Trader Key Takeaways

Patience Pays: Consolidation is a waiting game; don’t rush entries.

Volume is Critical: Breakouts without volume often fail.

Discipline in Risk Management: Always define risk before entering.

Adaptability: Consolidation can lead to continuation or reversal—be prepared for both.

Mindset: Treat consolidation as preparation, not stagnation.

👉 The essence: Consolidation is the calm before the storm. Smart traders wait for the breakout, confirm with volume, and manage risk tightly. Different consolidation patterns are like triangles, flags, rectangles

Silver - Trendline Longs Silver retested the Trendline bulls - on 75m chart.

Strong Support - $74

R1 $75.50-$76.50

R2 $77.5-$78.0

Close above $79 Bulls r in full control

10-12% up move from there should be overnight.

Buy at CMP $76

SL $74 on daily close.

If can’t wait for daily close System SL $73.50 for not getting out in SL hunt.

Jammu & Kashmir Bank (J&KBANK) By KRS CHARTS22nd January 2026 / 9:36 AM

Why J&KBANK ?

1. Clear Trend is visible with all the parameters.

2. 4th Wave Retracement was healthy enough to continue further for 5th .📈

3. Smaller TF Flag Breakout with Accumulations is visible at the bottom of 4th wave.

4. Favorable R/R min 1:3.

5. Stock is sustaining above 100 EMA in Major Time frames.

Targets are mentioned with SL below Flag ✅

NIFTY KEY LEVELS FOR 22.01.2026NIFTY KEY LEVELS FOR 22.01.2026

Timeframe: 3 Minutes

Unable to post on time due to a technical glitch. Sorry for the delayed post.

If the candle stays above the pivot point, it is considered a bullish bias; if it remains below, it indicates a bearish bias. Price may reverse near Resistance 1 or Support 1. If it moves further, the next potential reversal zone is near Resistance 2 or Support 2. If these levels are also broken, we can expect the trend.

When a support or resistance level is broken, it often reverses its role; a broken resistance becomes the new support, and a broken support becomes the new resistance.

If the range(R2-S2) is narrow, the market may become volatile or trend strongly. If the range is wide, the market is more likely to remain sideways

please like and share my idea if you find it helpful

📢 Disclaimer

I am not a SEBI-registered financial adviser.

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments.

Please consult with your SEBI-registered financial advisor before making any trading or investment decisions.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

#NIFTY Intraday Support and Resistance Levels - 22/01/2026A gap-up opening is expected in Nifty, indicating a short-term relief bounce after the recent sharp decline and high volatility seen over the last few sessions. This gap-up suggests that buying interest has emerged near the lower demand zones, but the broader trend still remains weak and corrective, so traders should stay cautious and avoid assuming a full trend reversal too early. The market structure clearly shows lower highs and lower lows on the higher timeframe, which means the current upside move should be treated as a pullback within a downtrend unless key resistance levels are reclaimed with strong follow-through.

From a price-action perspective, the 25250–25300 zone is acting as an important reversal and decision-making area. If Nifty manages to sustain above 25250, it may attract short-covering and fresh buying, leading to a gradual upside move towards 25350, followed by 25400 and 25450+. This move will largely depend on whether the gap-up is defended in the first 30–45 minutes of trade. A strong bullish candle with volume confirmation above this zone would support a reversal long setup, but traders should trail profits aggressively as overhead supply is still heavy.

On the downside, the 25200–25250 range remains a critical resistance-turned-supply zone. Any rejection from this area, especially if accompanied by weak candles or long upper wicks, can invite selling pressure. In such a scenario, short positions near 25250–25200 may push the index back towards 25100, then 25050, and potentially 25000. If selling intensifies and Nifty breaks decisively below 24950, the downside could extend further towards 24850, 24800, and even 24750, confirming bearish continuation.

Overall, while the gap-up opening brings short-term positivity, the broader bias remains cautious to bearish unless Nifty sustains above higher resistance levels. Traders should focus on level-based trading, avoid chasing the gap, and wait for confirmation near key zones before taking positions. Intraday volatility is expected to remain high, making risk management and disciplined execution far more important than aggressive directional bets.

SUN PHARMA Near Key Demand | High-Probability Swing Buy ZoneTimeframe: Daily

Current Spot Price: ~₹1,701

🔍 Technical Structure & Chart Logic

Sun Pharma remains in a broader consolidation with higher-timeframe strength, holding firmly above the 200-DMA (~₹1,649).

The recent decline is a healthy corrective ABC structure:

Wave (a): Initial decline from the recent swing high

Wave (b): Corrective pullback

Wave (c): Decline into the Golden Retracement Zone (50%–61.8%)

The Golden Retracement Zone (₹1,612 – ₹1,698) overlaps with:

Prior demand base

Rising 200-DMA

Breakout retest region

This zone acts as a high-probability accumulation area for swing buyers.

🟢 Swing Trade – Buying Strategy (Cash / Futures)

✅ Best Buying Zone (As per Chart):

₹1,669 – ₹1,682

Secondary accumulation allowed on dips toward ₹1,620–₹1,650

🎯 Swing Targets:

Target 1: ₹1,780

Target 2: ₹1,880

Major Target Zone: ₹1,970 – ₹2,000

🛑 Swing Stop Loss (Strict):

₹1,607 – Daily candle close below

The swing structure remains valid as long as price holds above the golden retracement zone.

🟡 Options Trade – January Expiry Strategy

📌 Directional Bias: Buy-on-dips | Moderately Bullish

▶️ Call Option Setup

Buy: 1700 CE or 1750 CE (January Expiry)

Entry Logic:

Near ₹1,670–₹1,700 on stabilization

OR on strong hourly close above ₹1,720

🎯 Option Targets (Spot-Based):

₹1,780 → partial profit booking

₹1,880 → trail SL

Momentum continuation may extend toward ₹1,970+

🛑 Options Stop Loss:

Spot-based: Hourly close below ₹1,650

OR

35–40% premium stop loss

Prefer ATM / slightly ITM strikes to reduce theta decay risk.

⚠️ Risk & Invalidation Levels

Hourly acceptance below ₹1,650 indicates weakness.

Daily close below ₹1,607 invalidates the bullish swing view.

Below this, price may revisit deeper consolidation supports.

📌 Conclusion

Sun Pharma is testing a textbook golden retracement + 200-DMA confluence zone. This setup favors swing accumulation with defined risk, while January expiry options offer a controlled way to participate in the potential upside.

⚠️ Disclaimer

This analysis is for educational purposes only. I am not a SEBI-registered analyst. Please manage risk responsibly.

#BANKNIFTY PE & CE Levels(22/01/2026)A slightly gap-up opening is expected in Bank Nifty, indicating a mild positive sentiment after the recent sharp sell-off and recovery from lower levels. However, despite the gap-up bias, the broader structure still reflects high volatility and a weak-to-range-bound trend, so traders should avoid aggressive directional bets at the open and wait for price confirmation around key levels.

Market Structure & Price Context

Bank Nifty has witnessed a strong bearish impulse in the previous sessions, followed by a sharp bounce from the lower demand zone near 58,550–58,450. This bounce looks more like a technical pullback rather than a confirmed trend reversal. The index is now trading below major resistance zones, suggesting that upside may remain capped unless key levels are decisively reclaimed.

The slightly gap-up opening is likely to test nearby resistance areas quickly. If the gap sustains with follow-through buying, short-term upside moves are possible; otherwise, selling pressure may re-emerge from higher levels.

Key Resistance Zones (Sell on Rise / Short Bias Areas)

- 59,450–59,500: This is a crucial supply zone and previous breakdown area. Any move towards this level without strong volume confirmation may face selling pressure.

- Above 59,450, if price shows rejection or bearish candles, PE buying / short trades can be considered with targets around 59,250 → 59,150 → 59,050.

- A decisive breakout and sustain above 59,500 would weaken the bearish bias and open the door for a larger pullback.

Reversal Buy Zone (Intraday / Short-term Bounce Setup)

- 59,050–59,100 is an important reversal demand zone.

- If Bank Nifty holds above this zone and shows bullish confirmation (strong candles, higher low formation), a reversal Buy CE setup is possible.

- Upside targets for this move are 59,250 → 59,350 → 59,450+.

- This trade should be treated as a counter-trend or pullback trade, so strict stop-loss discipline is essential.

Breakdown & Bearish Continuation Levels

- Below 58,950–58,900, selling pressure may increase again.

- PE buying below 58,950–58,900 can be planned with targets at 58,750 → 58,650 → 58,550.

- A further breakdown below 58,450 would confirm bearish continuation and may drag the index towards 58,250 → 58,150 → 58,050 in the coming sessions.

Trading Approach for the Day

- Expect initial volatility due to the slightly gap-up opening.

- Avoid trading immediately at the open; let the first 15–30 minutes define direction.

- Focus on level-based trades, not emotional entries.

- Prefer sell-on-rise strategy near resistance unless the index shows strong acceptance above 59,500.

- Keep position sizes light and trail profits aggressively due to fast intraday swings.

Overall View

The broader trend remains bearish to sideways, with the current gap-up likely to be a relief move rather than a trend change. Clear directional strength will only emerge if Bank Nifty sustains above major resistance or breaks decisively below key supports. Until then, disciplined, level-driven trading with strict risk management is the best approach.

Nifty 50 - What Next?According to the study pattern, all important levels are marked on the chart.

A rising parallel channel has been formed since June 24. Also, another parallel channel is formed since April 25. At the moment, the price is at the lower level of the inner parallel channel. If the price sustains above the lower level, it may go up. The above targets may be 25700/ 26800 and 27100.

The setup fails if the price sustains below the yellow trendline (marked on the chart).

This is not buying or selling advice in any form. This is only my view, shared only for learning and sharing purposes.

Your views are welcome.