BTCUSD Bullish Structure: New Demand, Resistance & UpsideBTCUSD shows a continuation of the broader bullish trend after a strong impulsive move higher, followed by a healthy pullback and consolidation. Price previously respected the rising structure and confirmed bullish strength with a clear Break of Structure , indicating trend continuation rather than reversal. The recent highs formed a new resistance area around 97,800–98,300, where selling pressure appeared and slowed momentum. This zone remains a key upside barrier and may trigger short-term reactions if retested.

On the downside, a fresh demand zone is established near 94,000–94,600, aligned with prior consolidation and strong buyer response. This area acts as a major support and potential buy zone, especially if price shows acceptance and bullish confirmation. As long as BTCUSD holds above this demand, the market structure remains bullish.

Current price action suggests accumulation above support, with higher lows forming inside the range. A sustained hold above demand may open the path for a renewed push toward resistance and potentially higher levels. A clean break below demand would weaken bullish structure and shift focus toward deeper support. Overall bias stays bullish while price remains above the marked demand zone, with volatility expected near key levels.

Disclaimer: This analysis is for educational purposes only. It is not financial advice. Trading involves risk and uncertainty.

Chart Patterns

Gold Analysis & Trading Strategy | January 20-21✅ 4-Hour Chart (H4) Trend Analysis

Gold has continued a strong rally since launching from the 4537 area, forming a classic bullish structure with both higher highs and higher lows. Price remains firmly above the MA5 / MA10 / MA20 moving average system, finding support on pullbacks to the MAs, which confirms that the medium-term bullish trend remains intact. That said, the recent upside momentum has been relatively fast, and price has entered a high-sensitivity zone driven by prior resistance and market sentiment. Although no reversal signals are present for now, short-term technical digestion and pullbacks are possible, making it inadvisable to chase prices at this stage.

✅ 1-Hour Chart (H1) Trend Analysis

On the short-term timeframe, price maintains a rising consolidation structure, repeatedly stabilizing above the 4700 level. Bulls remain in control, but upside momentum is beginning to slow at the margin. The price action continues to follow a pullback-to-MA5 / MA10 and resume higher rhythm, indicating that the trend is still healthy but has shifted from a one-sided rally to a step-by-step upward advance. As long as pullbacks hold in the 4705–4715 zone, the overall structure remains bullish; however, a break below 4695 would increase the risk of a deeper correction and require tighter risk control.

🔴 Resistance Levels

4758–4765 / 4775

🟢 Support Levels

4715–4705 / 4695 / 4650

✅ Trading Strategy Reference

🔰 Trend-Following Approach (Primary Strategy)

📍 Wait for price to pull back into the 4715–4705 zone

📍 Enter long positions in batches after stabilization

Condition: H1 structure remains intact and pullbacks show clear signs of support

🔰 Defensive Approach (Risk Control)

📍 If price breaks below 4695 and fails to recover quickly

📍 Actively reduce exposure or exit positions and wait for a new structural confirmation

✅ Trend Summary

👉 Medium-term trend (H4): Strong bullish trend remains intact

👉 Short-term condition (H1): High-level consolidation + slowing momentum

👉 Core strategy: Buy pullbacks only, avoid chasing highs

👉 Key structural level: Above 4700 remains bullish; caution is required if 4695 is broken

NIFTY 50 | Bullish Structure vs Bearish Candles — What Next?Pure Price Action & Volume Study

Index: NIFTY 50

Timeframe: Weekly

Method: Price Action + Volume

🔍 Market Structure

On the weekly timeframe, NIFTY 50 continues to form a VCP (Volatility Contraction Pattern) — a structurally bullish setup that generally supports higher prices once resolved correctly.

However, recent candle behaviour introduces a clear warning sign.

🕯️ Candlestick + Volume Analysis

The last two weekly candles are Hanging Man formations. Both candles printed with identical weekly volumes (~1.23B). Hanging Man is a reversal pattern when it appears near resistance

Important clarity:

Hanging Man ≠ Hammer

Hammer forms near support (bullish)

Hanging Man forms near resistance (potential weakness)

This suggests supply entering the market despite a bullish broader structure.

⚖️ How to Read the Conflict

Chart pattern: Bullish (VCP intact)

Candlestick signal: Bearish (Hanging Man + matching volume)

When structure and candles diverge, markets often choose sideways or corrective price action before the next directional move.

📉 Probable Price Path

There is a reasonable probability of:

A move back toward 25,700 (low of the recent weekly candle)

Or a deeper retracement into the nearest weekly support zone around 25,300

This pullback could help form a small rounding base, strengthening the existing VCP before another attempt toward 26,000

📊 Bias & Key Levels

View: Bearish → Sideways

Bullish only if:

Price breaks and sustains above ATH 26,325

Preferably with a strong weekly body candle, not a wick-based breakout

Until that happens, upside remains unconfirmed.

🧠 Final Thought

This is a classic “structure vs signal” situation:

Bullish patterns need bearish candles to get resolved first.

Patience is part of price action.

⚠️ Disclaimer:

This analysis is for educational purposes only. Not a trading or investment recommendation. Markets are risky—always manage risk and position size carefully.

👍 If this idea added value, boost it, follow for more pure price-action studies, and comment with the next stock or index you’d like analysed.

Gold (XAUUSD) – 1H | Short AnalysisTrend: Short-term bullish, strong impulsive move from ~4660 → 4745.

Current: Mild pullback / profit booking near highs (~4725).

Resistance: 4745–4760 zone (supply visible).

Support: 4700–4685 (immediate), deeper 4660.

Bias:

Above 4700 → pullback buy possible, trend intact.

Below 4685 → deeper correction likely.

View: Bullish structure, but expect consolidation or shallow retrace before next move.

KFINTECH – Daily | Compression → Breakout SetupKFINTECH has been in a long consolidation phase after a strong move and is now trading near an important demand zone. Price is forming higher lows, indicating selling pressure is reducing.

This setup looks like a build-up before a directional move.

🔹 Trend: Neutral → Turning bullish

🔹 Support Zone: Lower grey area (demand)

🔹 Resistance Zones: Upper grey areas

🔹 Entry Idea: Buy on confirmation / sustained hold above support

🔹 Stop Loss: Below demand zone

🔹 Targets:

Target 1: First resistance

Target 2: Upper resistance / range high

📌 Why this setup is strong:

Price respecting demand zone multiple times

Higher lows show accumulation

Risk is limited, reward is larger

Clean structure with clear invalidation

📈 A breakout and hold above the immediate resistance can lead to strong upside expansion.

⚠️ If price breaks below the demand zone, this view becomes invalid.

💡 Patience is key. Best trades come after consolidation.

ETHUSD – Daily Timeframe AnalysisETH is currently trading in an upward trend, forming higher lows, which shows bullish strength in the market. Price is respecting the ascending trendline, indicating buyers are still in control.

🔹 Entry Zone:

Price is reacting near the trendline support, making this a buy-on-dip opportunity.

🔹 Stop Loss:

Placed below the recent support zone to protect against trend failure.

🔹 Targets:

Target 1: Previous resistance / minor supply zone

Target 2: Major resistance area above (strong selling zone)

🔹 Market Structure:

Higher Highs & Higher Lows ✅

Trendline support holding ✅

Bullish continuation setup 🚀

⚠️ Risk Management:

Always wait for confirmation and manage position size properly. This setup works best if the trendline continues to hold.

📌 Bias: Bullish

📌 Timeframe: 1D

📌 Asset: ETHUSD

Trend line Break + Retest Logic (Swing Trading)Trend line breakout followed by retest is a high-probability swing setup. Sustaining above broken resistance signals upside continuation, while rejection after breakdown confirms further downside. Patience for retest separates traders from gamblers.

🔵 Upside Scenario (Bullish)

Condition

Price breaks above the upper trendline (range / resistance)

Break should be on good volume

Price comes back to retest the same broken line

Retest holds (no strong rejection candle)

Confirmation

Higher low on retest

Bullish candle (hammer / bullish engulfing)

RSI holds above 45–50

Outcome

➡️ High probability move on the upside

➡️ This is what your blue arrows are showing

Rule

Old resistance becomes new support

🔴 Downside Scenario (Bearish)

Condition

Price breaks below the lower rising trendline

Breakdown with strong bearish candle

Price retests the broken trendline from below

Retest fails (rejection)

Confirmation

Lower high formation

Bearish candle near retest

RSI stays below 50

Outcome

➡️ High probability downside continuation

➡️ Your blue + red arrows reflect this correctly

Rule

Old support becomes new resistance

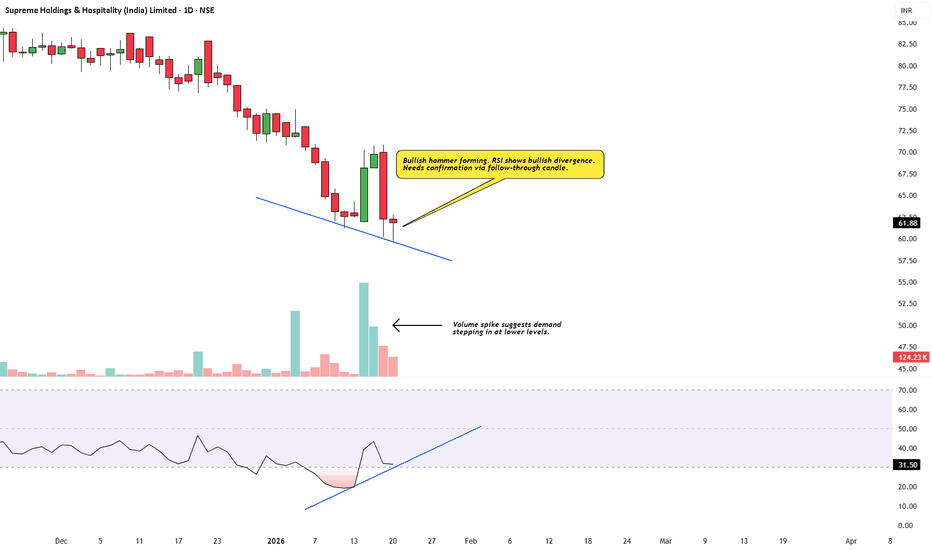

Supreme Holdings Flashes a Hammer After the SelloffSupreme Holdings has formed a bullish hammer after a sharp downtrend , supported by bullish RSI divergence and a volume spike , indicating demand emerging at lower levels. This opens the door for a short-term bounce , while the broader trend remains weak.

Price action from here will decide whether this develops into something more or fades as a corrective move.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

USDCAD 4HR T/F ANALYSIS----

usdcad 4hr t/f analysis----- after parallel channel breakdown we can measure marked supply which are repeated here so after supply complete then we can see demand from reversal portion and wait for also bullish candle on reversal portion it`s a confirmation to get right trade ok let`s see---

PCR Trading Strategies How to Trade Options

Many brokers today allow access to options trading for qualified customers. If you want access to options trading, you will have to be approved for both margin and options with your broker.

Once approved, there are four basic things you can do with options:

Buy (long) calls

Sell (short) calls

Buy (long) puts

Sell (short) puts

Nifty - What happens next?The price has broken the 25500 zone and the lower trend line of the channel. Now the important support levels as per the daily chart are 25020, 24900, 24600 and 24500. The price has to bounce from the 24600 or 24500 zone.

In the smaller time frame, the price is testing the lower trend line, and I expect 25400 to act as resistance if the price has a pullback.

25000 is a psychological level, and the price will be volatile at that level.

As of now bank Nifty and Metal index have not fallen much and had a small pullback. But if these indices show more bearishness, then the fall will be fast.

Always do your analysis before taking any trade.

Reliance: Big Stock, Big Structure, Slow DecisionsReliance Industries is trading within a well-defined long-term rising channel on the higher timeframe.

The recent decline looks like a pullback within structure, not a breakdown. Price is currently in the upper-to-mid part of the channel, leaving room for mean reversion toward the major rising trendline support.

This is not a fast-moving stock, and such moves usually take time and patience. The expectation is not an immediate fall, but a gradual drift or consolidation that may eventually bring price closer to the long-term support zone.

Until price reaches that zone, the chart remains a wait-and-watch setup. The real decision-making area lies near the lower trendline, where price reaction will matter more than prediction.

AUTO Sector vs Hero MotoCorp – Structure Test at a Crucial ZoneThis analysis combines sector context (AUTO Index) with stock-level structure (Hero MotoCorp) to understand the bigger picture.

AUTO Index:

The index has been moving inside a rising channel and is currently pulling back after a strong rally. Price is now approaching the lower half of the channel, where reactions become important. This looks more like cooling within structure, not a breakdown yet.

Hero MotoCorp:

On the stock level, price is reacting near a rising trendline support, which has acted as a demand zone in the past. The stock is holding structure while the sector is cooling — this relative behavior is worth observing.

Key takeaway:

When sector and stock both reach important structural zones together, reaction matters more than prediction. Strength here can lead to continuation; failure may open room for deeper consolidation.

No indicators, no forecasts — just price, structure, and patience.

Nifty - Expiry day analysis Jan 20The price rejected the 25600 zone in the opening and fall towards 25500. In the afternoon session, it tested 25600 again. This movement has created a descending channel. The channel has zig zag movement, so trade carefully.

Buy above 25680 with the stop loss of 25620 for the targets 25720, 25760, 25820 and 25860.

Sell below 25580 with the stop loss of 25630 for the targets 25540, 25500, 25460 and 25400.

Expected expiry day range is 25400 to 25800.

Always do your analysis before taking any trade,

XAUUSD/GOLD 4H SELL LIMIT PROJECTION 20.01.26Resistance / Sell Zone

4755.588 = RESISTANCE ATH (Main sell area)

✅ Entry Plan

SELL LIMIT around 4750 – 4756

Only take sell if price obeys trendline (rejection / wick / bearish candle)

🟩 Targets (Support Zones)

TP1: ~4700 (Day Low Support S1)

TP2: ~4666.195 (Day Low Support S2)

🛑 Stop Loss

Above ATH zone: ~4779.491

🧠 Trade Logic (Simple)

Price is in an up channel but reached ATH resistance.

So expectation: pullback move down to daily supports.

Risk Ratio: 1:4 (as marked)

Part 3 Institutional Option Trading Vs. Technical AnalysisCore Concepts for Beginners

The "Premium": This is the non-refundable fee paid by the buyer to the seller (writer) to acquire the option.

Strike Price: The predetermined price at which the underlying asset can be bought or sold.

Expiry Date: The "shelf life" of the contract; if not used by this date, the option becomes worthless.

The Underlying: The asset the option is based on, such as a stock, index (like Nifty 50), or ETF.

The Two Types of Options

Call Options: Give you the right to buy an asset. Investors typically buy calls when they have a bullish outlook, expecting the price to rise.

Put Options: Give you the right to sell an asset. These are used when you have a bearish outlook, expecting the price to fall, or to "insure" an existing portfolio.

Part 2 Institutional Option Trading Vs. Technical AnalysisWhy do People Trade Options?

People trade options for many different reasons. Since we are focusing on

options basics today, we will focus on the most common reasons.

1. Leverage: As stated on the last slide, one option contract controls 100

shares of the underlying’s stock

2. Capital outlay: You can purchase an option for significantly less than

purchasing the

Sbicards looks bullish?!!!yes!!!

Sbicards has been travelling inside a expanding channel pattern making successive highs and higher highs and lows and higher lows.

In daily time frame too stock is seen bullish

View changes to bearish on making the lower low(sl level- 829.65)

better to enter after 15 min Volume breakout out as shown

Nothing much more to explain as everything seems clear on looking @ chart!!!

Just my view...not a tip nor advice!!!!

Thank you,

mmjimm

BNB/USDT 4‑hour chartTrade Plan

Buy: 912–914 USDT (~27.34 BNB)

Set Stop-Loss: 905 USDT (risk ~7 USDT per coin → 27.34 × 7 ≈ 191.4 USDT risk = ~₹19k / leverage-free, manageable)

Take Profit:

First partial TP: 925 USDT → close ~50%

Final TP: 935–938 USDT → close remaining 50%

Risk/Reward:

Risk per BNB: 7 USDT

Potential reward: 21–24 USDT per BNB

R/R ratio ~3:1, good for swing trade