Any idea where it is headed?KO (coca-cola) looks in wave 5 of its primary degree. We have concluded wave 4 near $ 21 in Apr 2009.

Now the wave 5th is in progression, lets see whether it follow the sequence.

The information provided in this analysis is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities. Past performance is not indicative of future results. Investing involves risk, and there is no guarantee that any investment strategy will be successful.

It is strongly recommended that you consult with a qualified financial advisor before making any investment decisions.

Cola

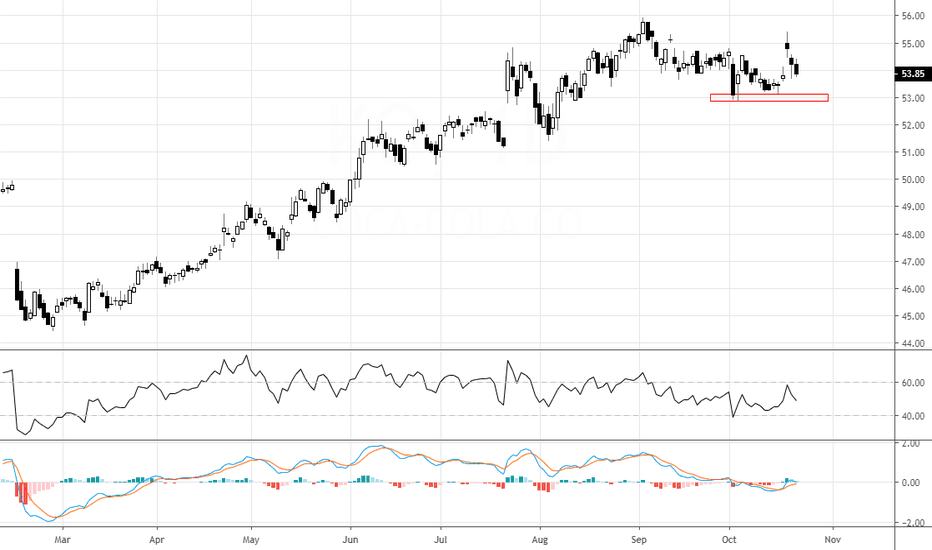

Coca Cola may get bitter here!The stock is in a dominant trend up. Recently a lower high and lower low price pattern has been noticed on the daily charts. The RSI also seems to have shifted the range from bullish 80-40 zones to neutral 60-40 zones in the past few weeks. Important support levels are marked on the charts. Breaking them may result into corrections. The degree of the corrections are still not predictable, but the RSI forewarns. To get more insights into RSI visit www.prorsi.com