Data Patterns (D): Strongly Bullish, Fundamentally Driven BOThis is a high-conviction breakout event. The stock has decisively broken its 17-month angular resistance, driven by blockbuster quarterly earnings. All indicators are aligned, but the stock now faces its final horizontal resistance, which will determine the next major leg up.

🚀 1. The Fundamental Catalyst (The "Why")

Today's move is not speculative. It is a direct response to record-breaking Q2 2026 earnings :

- Revenue: Surged 238% year-over-year to ₹307.46 crore.

- Net Profit: Grew 62.5% year-over-year to ₹49.19 crore.

- Market Reaction: The gap-up open and +7.56% surge on 6.29 Million in volume confirms massive institutional interest.

📈 2. The Long-Term Context (The Setup)

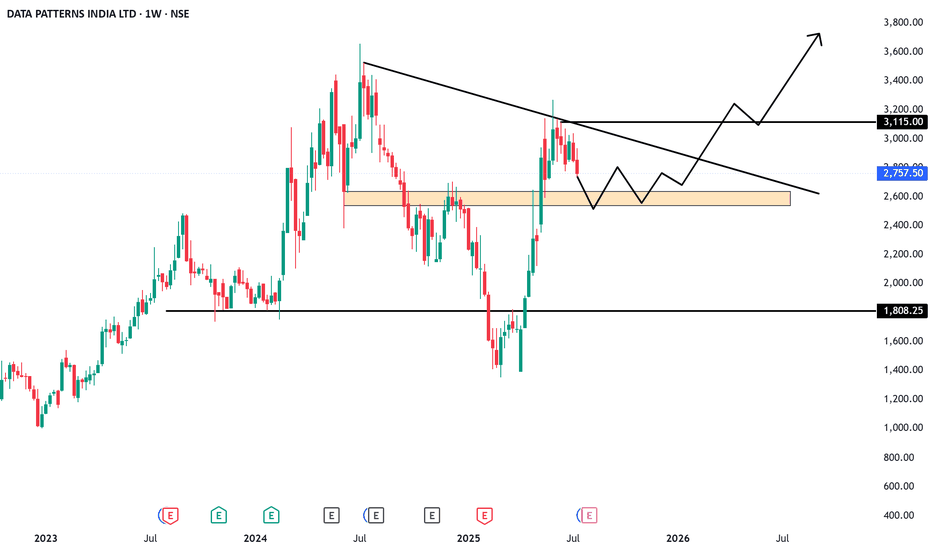

- The 2024-2025 Correction: After its ATH in July 2024 , the stock entered a long-term downtrend.

- The Reversal: This trend found its bottom in March 2025 , and the stock began its recovery.

- The Angular Resistance: This recovery was capped by the angular resistance trendline from the July 2024 ATH.

- Drying Volume: Volume was drying up during the consolidation since May 2025—a classic sign of accumulation.

🎯 3. The Dual Resistance Battle

- Part 1 (CLEARED): Today, the stock gapped up and closed decisively above the 17-month angular resistance trendline. This is a significant bullish victory.

- Part 2 (THE NEXT HURDLE): The stock now faces a major horizontal resistance at ₹3,141 . This level is the last line of defense for the bears.

📊 4. Confluence of Bullish Indicators

This breakout is supported by a rare "trifecta" of bullish signals across all timeframes:

- EMAs: Short-term Exponential Moving Averages are in a "PCO" (Price Crossover) state on the Daily, Weekly, and Monthly charts .

- RSI: The Relative Strength Index is rising on the Daily, Weekly, and Monthly charts .

This alignment of all three timeframes gives the breakout very high technical validity.

🧠 5. Future Scenarios & Key Levels to Watch

🐂 The Bullish Case (Confirmation)

- Trigger: A decisive, high-volume close above the horizontal resistance at ₹3,141 .

- Target: This would confirm the start of a new bull run, and the target of ₹3,445 is the next logical objective.

🐻 The Pullback Case (Healthy Re-test)

- Trigger: If the stock is rejected at ₹3,141 or needs to pause after its big run.

- Support: The price would likely fall to re-test the angular trendline it just broke, at the identified level of ₹2,817 . A "bounce" off this level would be a textbook, healthy confirmation of the new support.

Datapatterns

Data Patterns cmp 2825 by Daily Chart viewData Patterns cmp 2825 by Daily Chart view

* Support Zone 2585 to 2685 Price Band

* Resistance Zone 2935 to 3065 Price Band

* Stock has made a near tight and contracting VCP pattern

* Falling Resistance Trendline Breakout in the making process

* Darvas Box pattern with price trending between 2375 to 2935

* Bullish Rounding Bottom formed by the Resistance Zone neckline

* Volumes spiking intermittently by good numbers over past few weeks

Data Patterns: Brain behind India’s missile, radar & ISRO tech.NSE:DATAPATTNS

🏢 Company Overview:

Data Patterns is a vertically integrated defense and aerospace electronics solutions provider. It designs, develops, manufactures, and tests advanced electronic systems used in:

Radar, Electronic Warfare

Avionics, Missile Systems

Satcom, Communication & Surveillance

It’s one of the few Indian defense electronics companies with end-to-end capabilities—from design to delivery.

📈 Fundamental Analysis:

✅ Key Financials (FY24-25 Estimates):

Market Cap ₹13,000+ Cr

Revenue (FY24) ₹480–500 Cr

EBITDA Margin ~38%

PAT Margin ~28–30%

ROE / ROCE 25%+ / 30%+

Debt to Equity 0 (Debt-free)

P/E Ratio ~70x (Premium)

🧩 Strengths:

Strong order book visibility with over ₹900 Cr+ backlog.

In-house R&D and full control over hardware + software.

Supplied systems to ISRO, DRDO, BEL, HAL — proven credibility.

High margin & asset-light business model.

⚠️ Risks:

Heavy dependency on government contracts (lumpy revenue).

High valuations — pricing in future growth.

Competition from global defense OEMs and local PSU giants.

📊 Technical Analysis (As of July 2025):

🧾 Price Action Summary:

CMP: ₹2,880 (Example)

52-Week Range: ₹1,650 – ₹2,980

Trend: Strong uptrend since Jan 2025

Support Zone: ₹2,550 – ₹2,650

Resistance: ₹3,000 (psychological and technical resistance)

🔍 Indicators:

200 EMA: ₹2,200 (Stock trading well above long-term average)

MACD: Positive with histogram expanding

RSI: 71 – Overbought, watch for pullbacks

Volume: Spikes near breakout levels – confirms strength

📉 Short-Term View:

Likely to consolidate near ₹2,800–₹3,000

Fresh breakout above ₹3,000 may lead to ₹3,400–₹3,600 zone

🚀 Future Growth Prospects:

🛰️ 1. Defense Capex Boom:

Indian Government’s “Atmanirbhar Bharat” push & higher defense budget directly benefits defense tech firms like Data Patterns.

🧠 2. R&D & IP-Led Growth:

Owns IP of most products – high operating leverage and export potential.

🌍 3. Export Market Entry:

Partnering with foreign OEMs; growing traction in South-East Asia, Middle East.

🛠️ 4. Order Book Strength:

High-margin orders across radar, avionics, and missile sub-systems.

Client base includes DRDO, BrahMos, BEL, ISRO, HAL – strong pipeline ahead.

📝 Conclusion:

Parameter Verdict

Fundamentals 🔵 Very Strong (Debt-free, high ROCE)

Technicals 🟢 Bullish (Watch ₹3,000 zone)

Valuation 🟡 Expensive but justified by moat

Long-Term View ✅ Positive – IP-driven defense electronics play

Short-Term View 🔄 Wait for breakout or buy on dips near ₹2,600

=====================================================

=====================================================

⚠️ Disclaimer:

This analysis is for educational and informational purposes only.

We are not SEBI-registered analysts or advisors.

This is our personal view based on available data and market trends.

Please consult your SEBI-registered investment advisor before making any investment or trading decisions.

You are solely responsible for any financial decisions you make based on this content.

========================

Trade Secrets By Pratik

========================

DATA PATTERNS INDIA LTD BREAKOUT STOCK🚨 Breakout Watch: Data Pattern 🚨

Bullish above ₹2980 (Closing Basis)

📍 CMP: ₹2865 | 🎯 Short-Term Target: ₹3500–₹4000

❌ Pattern Negated Below: ₹2450

Price trades firmly above the 50D / 100D / 200D MAs, confirming long-term strength.

RSI remains in the bullish zone across all timeframes (Daily: 69.7 | Weekly: 66.96 | Monthly: 60.04).

ADX at 35.14 with a wide DMI spread of 64.37% signals a strong bullish trend.

Stock is above the Ichimoku Cloud with a solid bullish crossover (Tenkan > Kijun).

Bollinger Bands and Donchian Channel show high-range potential with nearly 48% width each.

🔥 Watch for breakout above ₹2980 — upside momentum looks strong!

📉 Invalid below ₹2450

(For Educational Purpose Only)

Data Patterns - Trendline BO with High Vol. - Chart of the MonthNSE:DATAPATTNS showed good price action this month, breaking the trendline with high volumes, showcasing strength in this market. Defence Industry Stocks are showing relative strength and looking to continue that further, qualifying for my Chart of the Month.

About:

NSE:DATAPATTNS is one of the fastest-growing companies in the Defence and Aerospace Electronics sector in India. It is among the few vertically integrated defence

and aerospace electronics solutions providers catering to the indigenously developed defence products industry. It is focused on in-house development and manufacturing facilities led by innovation and design, and development efforts. It has been in business for over 35 years. It has supplied products catering to all the platforms, viz., space, air, land and sea, including products for LCA-Tejas.

Trade Setup:

Buy on Dips near Trendline Support or the base for Positional Traders and on breakout of the candle high for Swing Traders.

Target:

Around ATH Zones, ideally, if sustained,d can go further up.

Stop Loss:

Entry Candle Low For Swing Traders and Base Marked for Positional Traders.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FLLOW for more

👍BOOST if useful

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Data Patterns, a defence and aerospace proxy ready to move?-In a very long base, last time it breakout long base gave 80% move in just 20 days. (always read history of stock how it move, how to form base, how it react to moving averages, how volumes come etc etc)

-from strong sector (sector is always imp as strong sector's stocks move faster)

-Good shakeout and Fake-out also there means kicking weak players by hunting their SLs (stoplosses)

-Inside Bar on latest candle

-Volatility contraction

DATAPATTNS - Weekly Chart Analysis, CMP-2698Breaking out of 25 week long base of 30% range, the stock is showing strength after sustaining above it for the 2 weeks now. On the monthly timeframe it has retraced to 38.20% and shown strength thereafter. On the daily timeframe we see it taking dynamic support of all the key moving averages and coming out of the resistance and retesting it again.

So now, 2372-2485 shall act as a support and on the downside the risk will be weekly close below these levels. But ideally 2250 shall be kept as risk level where a weekly close below this would negate our view in this counter.

On the upper side 3220 - 3625 - 4140 are the levels as per the trend fib that can be tested in the long term.

Disclaimer: I am not SEBI registered analyst. Also, the view shared above is my personal analysis and not a buy or sell recommendation. It is shared for learning and educational purpose. If you intend to trade or invest in this counter that i would suggest you to do your due diligence and seek guidance from your financial advisor.

DATA PATTERNS Data Patterns (India) Ltd is vertically integrated defence and aerospace electronics solutions provider. The Company manufactures electronic boards and systems.

Note:

1. Views are personal and for educational purposes only. Recheck and take the trade as per your RR.

2. Always remember SL is your lifeline, not the big target...

3. Follow us for more patterns and like, share so that we feel it is helpful to many and share more patterns...

3. Views given here is not a tip rather it is for educational purpose... Aftermarket opens, the condition might change so learn to handle different conditions...

Keep an eye ladies and gentlemen. Cheers and Happy Trading