Will $ETH Drop Below $1,000 Before Heading to $7,000+? Will CRYPTOCAP:ETH Drop Below $1,000 Before Heading to $7,000+?

🟣 Historically, #ETH respected the 0.5 Fib retracement in bull markets – In the last bull run, ETH retraced to 0.5 Fib at $89 — then exploded to $4,867

🟣 That’s +56,000% in just 1.5 years!

This cycle, the 0.5 Fib level sits around $661. With the monthly trendline breakdown, the big question is:

Will #Ethereum dip below $1,000 and test $700 before making a new ATH?

If ETH reaches sub-$1,000 zones, I'm personally buying heavy and holding for 1–2 years. No FA – just Fib, patience & conviction.

ETH will reward those who ride the wave, not fear the dip.

Hold strong. Next 1–2 years = massive opportunity.

ETH-D

SOLANA Weekly Chart Breakdown–2020 Fractal Signals Massive Bull#SOLANA Weekly Chart Breakdown – 2020 Fractal Signals Massive Rally Ahead!

CRYPTOCAP:SOL is trading at $114.35, currently sitting on a key Fibonacci 0.382 support zone ($100–$115). This area has historically acted as a strong bounce level and is perfect for early accumulation.

If this zone fails, the next major support is the golden pocket ($50–$72) — also marked as Support 2, aligning with the 0.618 Fib retracement.

Historically, this level triggered a 2,100% rally back in 2020-21. If this fractal pattern repeats, we could be looking at a future target near $1,000+.

Breakout level to watch:

▪️ $186 = Bullish confirmation

▪️ $296 = Previous ATH

▪️ $1,011 = Fibonacci-based bull cycle target

Accumulation Plan:

▪️ Zone 1: $100–$115 → Light spot entries

▪️ Zone 2: $50–$72 → Heavy long-term accumulation

✅ Holding above $100 keeps the bullish structure intact.

✅ Break above $186 = start of the next bull wave.

Smart accumulation now can lead to 10x+ returns in the upcoming cycle!

It's All About SO/USDT Overview.

Bitcoin Short played out perfectly and Down 7%Bitcoin Short played out perfectly.

Price respected the SMC chart structure — 4H candle failed to close above FVG + -OB zone.

Post Trump Tariff news, market triggered high-leverage stop hunts with a fake pump before a sharp dump.

📉 Entry: $88,440 ✅

📈 Exit: $82,200 ✅

✅ ~7% move captured. Trade closed in profit.

EOS Broke Out After Months — But Is This Just the Beginning?NYSE:EOS Broke Out After Months — But Is This Just the Beginning?

#EOS was once a top-tier asset, trading above $15. However, due to consistent development delays and unmet commitments, the price structure gradually broke down, eventually bottoming near the $0.40 zone — a key historical demand area.

Recent Development: EOS witnessed a sharp rally of +94% in the last month, with a strong +26% daily candle, backed by bullish news:

✅ Formation of Vaulta Banking Advisory Council (includes ex-Binance Canada CEO)

✅ CMO Tristan Dickinson teased a major upcoming announcement

Current Market Structure:

▶️ Price broke out of a long-term accumulation range

▶️ Volume spike confirms genuine interest

▶️ However, one FVG (Fair Value Gap) is still unfilled between $0.60–$0.50 zone on the 4H chart

Ideal Entry Zone (Pullback Play):

▶️ Watch for a retest near $0.60–$0.50

▶️ FVG fill + potential bullish OB (Order Block) = Confluence zone for long setups

🛑 Invalidation / Stop-Loss:

▶️ Breakdown below $0.43 on high volume will invalidate the structure

▶️ SL is wide, but RR (Risk-Reward) setup is favorable for swing traders

Long-Term Upside Targets:

First target: $0.95–$1.10 (range high breakout)

Mid-term target: $1.45+

Long-term potential if fundamentals sustain

⚠️ Manage your position size. NFA | DYOR | Risk Management is Key

ELong

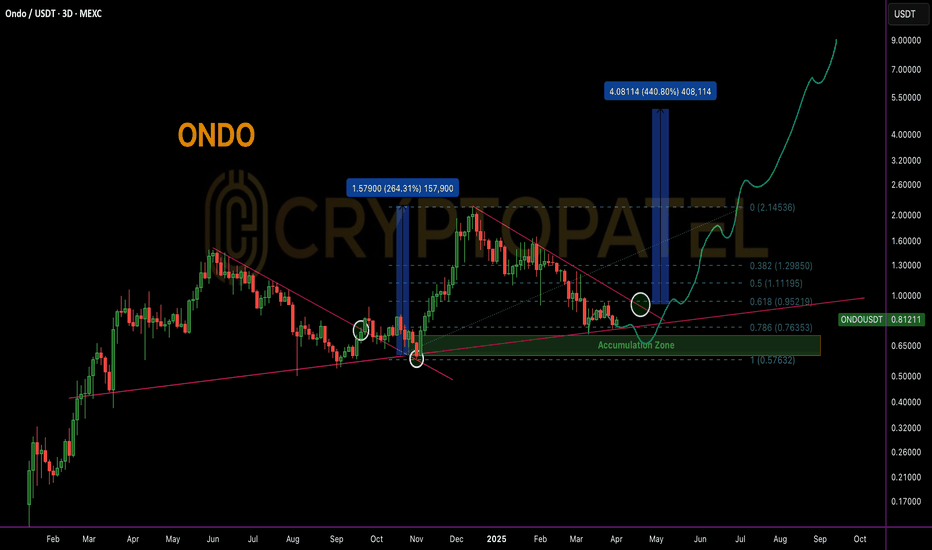

$ONDO Near Golden Entry Zone: Is $ONDO Ready for a 5x Move?LSE:ONDO Technical Analysis & Bull Market Outlook

LSE:ONDO is currently trading near a key accumulation zone, aligning with the 0.786 Fibonacci retracement level, which historically signals a high-probability bounce area in strong trending markets.

Accumulation Strategy

Ideal accumulation zone lies between $0.80 - $0.60. DCA (Dollar-Cost Averaging) approach recommended on major dips for optimal positioning before the breakout confirmation.

Historical Breakout Behavior

In the last HTF (High Time Frame) breakout, ONDO delivered a +200% move post-breakout. Based on current consolidation and market structure, a potential 400%-500% upside is anticipated if similar breakout structure plays out.

Upside Targets in Bull Case: $2/$5/$10

Why Still Bullish?

* Clean structure on daily and 4H TFs.

* Strong demand near 0.786 FIB.

* Institutional interest confirmed:

Trump’s World Liberty Finance acquired 342,002 LSE:ONDO , investing $505,218 at an average entry of ~$1.47 — current price is trading ~45% lower, indicating strong long-term conviction.

Not financial advice. Strictly TA-based view. Manage risk accordingly.

$TON Alert: FVG, Accumulation Range & Bullish Roadmap ExplainedCRYPTOCAP:TON Traders Alert: FVG Zone, Accumulation Range & Bullish Roadmap Explained!

#TONCOIN is currently trading around $3.90, up +27% from our earlier entry near $3.20.

🔹 Scalpers may consider booking partial profits at current levels due to short-term resistance zones.

Key Levels:

🔹 Support: $2.50, $2.95–$3.33 (FVG zone), $2.50 (major demand zone)

🔹 Resistance: $4.15 – $4.50 (next breakout levels)

FVG Zone (Daily TF): $3.33 – $2.95

If price revisits this imbalance zone, it may offer a high-probability entry opportunity.

Long-Term View: As the native token of Telegram’s TON blockchain, #TON has strong utility. If adoption continues, potential upside targets could be:

Targets: Mid-Term: $10+ | Long-Term: $50 – $100

Accumulation Zone (for long-term investors): $3.50 – $2.50

Price bounced strongly from $2.50, confirming it as a solid base.

⚠️ This is not financial advice. Always DYOR before investing.

$SEI/USDT- Long-Term Technical Setup and $5 Potential in BullRun📊 $SEI/USDT – Long-Term Technical Setup

NYSE:SEI is holding strong at the $0.18 support zone, showing early signs of accumulation. This level has historically acted as a demand area, making it a key zone to watch.

🔹 Structure: Forming higher lows – bullish trend intact

🔹 Volume: Accumulation pressure building

🔹 Sentiment: Backed by large-scale buyers (e.g., Trump’s World Liberty)

📈 Long-Term Targets:

➡️ $0.45 → $1.00 → $2 / $3 / $5 (macro targets similar to CRYPTOCAP:SUI )

🛑 Invalidation: Close below $0.15

⚠️ Not financial advice. DYOR.

#SEI #CryptoTA #Altcoins #DYOR #TechnicalAnalysis

ETH/BTC – 70% Drop Achieved | Perfect Short ExecutionETH/BTC – 70% Drop Achieved | Perfect Short Execution

As projected in my analysis dated 10th Nov 2022, ETH/BTC has completed the anticipated 70% correction from the top.

Short Entry: 0.075 BTC ✅

TP1: 0.055 BTC – ✅

TP2: 0.037 BTC – ✅

TP3: 0.023 BTC – ✅

All targets achieved with precision.

Bearish structure played out as expected.

Current Outlook:

CRYPTOCAP:ETH Price has now entered a historical demand zone, coinciding with major multi-year support levels.

Accumulation Phase Activated –

Starting to scale into long positions from current levels, targeting mid-to-long term reversal setup.

Patience required – this could be the base of the next macro leg up.

Note: NFA & DYOR

#Ethereum

#Ethereum Is Down Now, But History Says a $10K Rally Is Coming…#Ethereum Is Down Now, But History Says a $10K Rally Is Coming…

1⃣ CRYPTOCAP:ETH rallied 228x post-2016 BTC halving

2⃣ ETH did 27x post-2020 halving

3⃣ Currently -57% from ATH post-2024 halving

📅 Projection: Q4 2025 ATH

🔼 Target Range: $7,000 - $10,000

Based on cyclical trend extension, Fibonacci macro structure, and historical BTC-ETH correlation.

What’s your ETH EOY 2025 target? RT & Comments if you Agree👇

#Altseason

Note: This is Not financial Advice so DYOR before Investing.

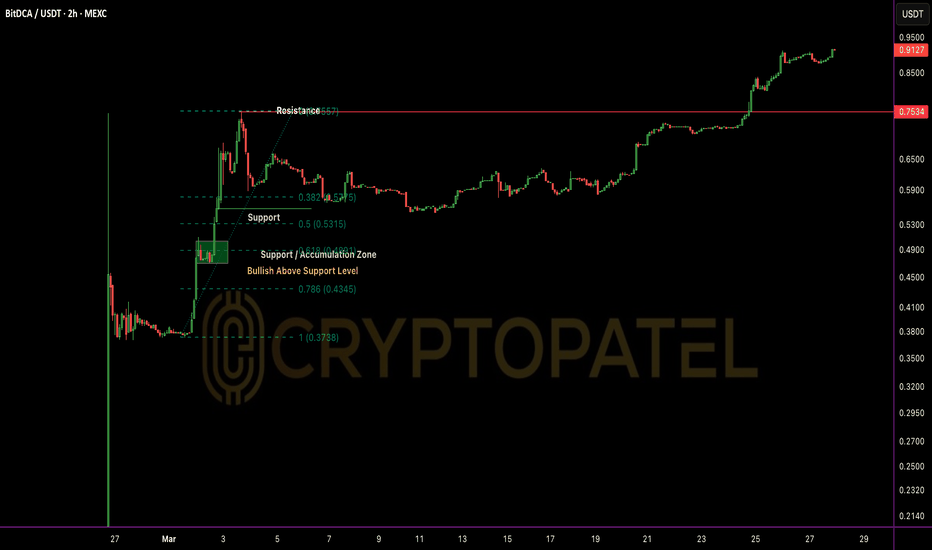

BDCA/USDT 9x up from Listing and 2x form Dip EntryECONOMICS:BDCA Update 🔥

Price just printed a fresh ATH at $0.92, marking a 9x move from pre-listing entry ($0.10) and a 2x rally since our chart-based call at $0.45.

Strong momentum, bullish structure intact.

Expecting further continuation in the short-to-mid term 🚀

#BDCA #CryptoGems #TechnicalAnalysis #Altcoins

NFA & DYOR

ETH - Target 2200 - BullishETH has fallen a lot and taking support and move is bullish in line with BTC move. At these great levels buying, accumulating and investing in ETH is safe and for traders once the fourth wave is complete price is easy to see 2200 for fifth wave. ETH is good buy now. I expect small correction in BTC to complete and rise again or above 88K . Even if BTC correction is bigger ETH may not fall much since it has fallen a lot so its better to long in ETH more than in BTC now.

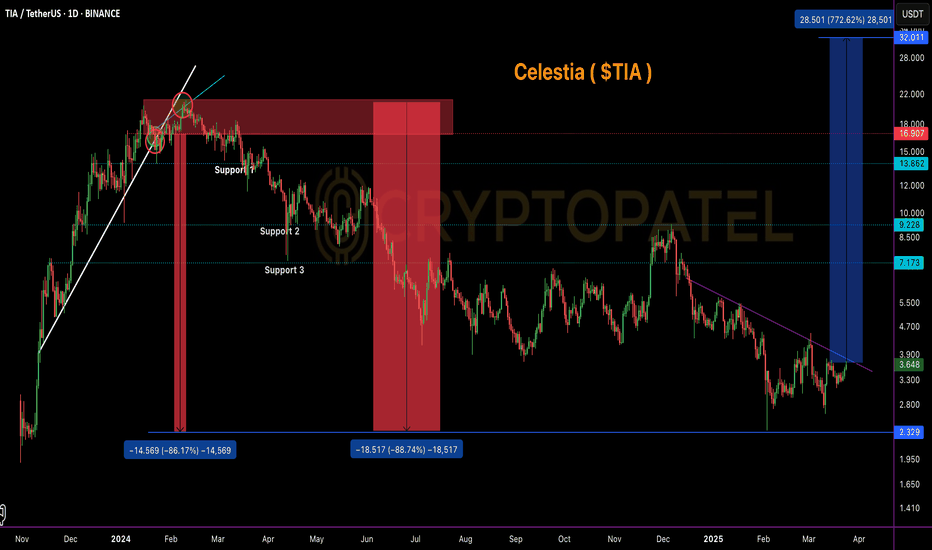

$TIA dropped ~86% from our short entry zone!LSE:TIA Massive Profit Update – Short Call Hit Perfectly 🔥

LSE:TIA dropped ~86% from our short entry zone!

We shared a short setup for LSE:TIA at the $17–$20 range. After a textbook retest rejection, price began its downward move and has now dumped all the way to $2.36, hitting a massive -86% from the top of our short zone. ✅

Current Technical Outlook (Accumulation Zone):

Based on chart structure and historical support levels, we are now entering a potential accumulation range between $3.60 – $2.50.

Long-Term Outlook:

If this zone holds, we could see a strong recovery in the coming months with possible upside targets in the $20–$40 range in the long run.

🚨 Note: This is not financial advice. Always DYOR (Do Your Own Research) before investing or trading.

Ethereum Accumulation Alert! 🚀 Ethereum Accumulation Alert! 🔥

Ethereum is entering a potential spring accumulation zone, presenting a solid long-term opportunity.

📉 Buy Zone: $1,900 – $1,550

🎯 Targets: $5,000 / $7,500 / $10,000

🔹 Key Support: $1,550 – Holding above this level keeps the bullish structure intact.

🔹 Breakdown Risk: If ETH loses $1,550, expect further downside toward sub-$1,000, where the next strong entry lies.

📊 Smart money is accumulating—don’t miss the dip!

#Ethereum #CryptoTrading #Accumulation #ETH #NFA #DYOR

Why Buy Bitcoin? ( Detail Post about $1M Target )Why Buy Bitcoin?

It’s hard to ignore Larry Fink and BlackRock.

At Davos, Fink said: "Bitcoin could hit $500K to $700K."

Meanwhile, top experts are making bold predictions:

🔹 Tim Draper: $250K by end of 2025

🔹 Michael Saylor: BTC = World's largest asset in 48 months

🔹 Peter Brandt: $120K – $200K by Sept 2025

🔹 Chamath: $500K by Oct 2025, $1M by 2040

🔹 Max Keiser: $200K by end of 2024

🔹 Bernstein: $200K by 2025

🔹 Fidelity: SEED_TVCODER77_ETHBTCDATA:1B per BTC by 2038-2040

🔹 Hal Finney: $10M per BTC long-term

Waiting for the headline: "Bitcoin ‘PLUNGES’ from $1,001,000 to $985,000." – CZ Binance

Are you paying attention yet? 🚀

NFA & DYOR

SEI/USDT 20x Potential from Accumulation ZoneNYSE:SEI Accumulation Zone – High Potential Trade

🔹 -76% from recent high, making it a prime accumulation zone.

🔹 My Accumulation Zone: $0.20 – $0.15

🔹 Upside Potential: Chart indicates an easy move to $0.50—if it breaks, expect a major rally!

🔹 Long-Term Targets: $1/$3/$5/$10

🔹 Catalyst Alert: Even #TRUMP is accumulating #SEI adding strong bullish momentum!

Strategy: Accumulate on dips, take profits strategically, and hold a portion for long-term gains.

#Altcoins #NFA

Will $KAITO go down -50% downside move?$KAITO Price Action Update

$KAITO is currently trading at $1.58, holding strong above the key $1.45 support level.

🔹 Key Levels to Watch:

✅ Support: $1.45 – Holding above this level could trigger a strong upside rally, targeting the $1.75 resistance and beyond.

❌ Break Below Support: If $1.45 fails, a 30-50% downside move is possible.

🚀 A decisive move above $1.75 could open doors for further gains. Keep a close watch on these levels for potential opportunities.

🔍 Stay informed, manage risk, and trade wisely.

📢 DYOR – This is not financial advice!

#KAITO #CryptoTrading #MarketUpdate #TechnicalAnalysis

$ATH Technical Outlook: Accumulation Opportunity? TSX:ATH Technical Outlook: Accumulation Opportunity? 🚀

#ATH is trading at $0.037, below key resistance at $0.045 – bearish unless it breaks above. A breakout could push it to $0.09 and beyond.

🔹 Accumulation Zone: $0.037 – $0.020

🔹 Targets: $0.1 / $0.3 / $0.5 / $1

Solid project, good dip-buying opportunity. Watch key levels & manage risk!

Not Financial Advice – DYOR! 🚀

#aethir #Alts

Will Ethereum Fall below $1500 or Ready to $8000 ?#Ethereum Fresh Weekly Analysis

🔹 Current Trend: CRYPTOCAP:ETH has dropped -51% in the last 3 months, signaling a major retracement.

🔹 Key Support Zone: Trading above $2000-$1900, a crucial accumulation zone for this bull market.

🔹 Upside Targets: If #ETH holds this support, we could see $6000 / $8000 / $10,000 in the coming months.

🔹 Risk Factor: If ETH fails to hold $2000, expect a potential dip towards $1500—a key level for long-term accumulation.

Smart Strategy:

✅ Accumulate ETH on dips instead of chasing tops.

✅ Wealth is built by buying in bear markets and selling in bull cycles.

✅ Long-term holders should focus on accumulation, not panic selling.

IMO ETH/USDT has strong potential in this bull cycle—buy smart, hold strong!

Note: Not Financial Advice so DYOR