Bitcoin Bulls vs Bears — Battle Zones Mapped Out#Bitcoin Bulls vs Bears — Battle Zones Mapped Out

🔰 $105K–$106.7K = Bearish Order Block:

Below this zone = CRYPTOCAP:BTC stays bearish unless HTF closes above $106.7K

🔰 Next Moves:

▪️ Likely retest $105K–$106K before next leg ↓

▪️ Target: $97K–$95K zone

🔰 Key Levels:

✅ Holding 0.618 Fib (support)

✅ Unfilled FVG: $97K–$98.3K

✅ Bullish OBs: $95.7K–$97K | $93.5K–$94.7K

If $97,000 holds strong → Expect BIG bounce!

ETH

BTC Breakdown or Bounce? Key Levels You Need to Watch!BTC Breakdown or Bounce? Key Levels You Need to Watch!

#Bitcoin 4H Chart Analysis – SMC Overview:

BTC is currently in a short-term downtrend, respecting a descending channel and showing clear bearish structure.

🔴 Bearish Signs:

Price rejected from 2 major Bearish Order Blocks:

▶️ $106K–$104K

▶️ $111K–$109K

Breaks of Structure (BOS) and Change of Character (CHoCH) confirm trend shift to bearish Couldn’t hold the 0.382 Fibonacci level at $104.4K — now testing the 0.5 Fib at $102.2K

🟢 Key Support Zones (Potential Reversal Areas):

1️⃣ $100K Zone

✔️ 0.618 Fib level

✔️ Unfilled Fair Value Gap (FVG)

🔍 Possible bullish reaction from here

2️⃣ $97K Zone

✔️ 0.786 Fib

✔️ Bullish Order Block (OB)

✔️ Another FVG

💥 Strong confluence — good probability of reversal

3️⃣ $93K Zone

✔️ Deep Bullish OB

🛡️ Last strong support if $97K fails

🔼 If bulls reclaim control: We need a clear CHoCH above $104.5K to confirm bullish shift

⚠️ Tip: Mark these zones. Use alerts. Let the price come to you — don’t force trades.

📢 Share if useful & stay updated

BITCOIN WARNING – $104K IS KEY🚨 BITCOIN WARNING – $104K IS KEY

#Bitcoin is showing signs of weakness on the 4H chart! Let’s break it down:

🔻 Trend Shift Detected:

Recent CHoCH and BOS suggest the uptrend is over. Market structure has turned bearish.

Key Levels to Watch:

▪️ Support at $104K is being tested again. If it breaks, we may see a drop.

▪️ Next major targets:

➤ $100.5K (Unfilled Fair Value Gap)

➤ $98K – Strong demand zone

➤ $96.6K – Bullish Order Block + FVG confluence

Why It Matters:

▪️ Price rejected hard from the $107K zone (supply + FVG)

▪️ Liquidity was grabbed from Equal Highs

▪️ Now it’s hunting lower liquidity near $100K

⚠️ If $104K fails, get ready for a quick drop to $100.5K or even $96.6K

Plan: Short-term bearish unless BTC breaks back above $106K with volume.

Stay alert — volatility incoming!

TRBUSDT SMC Chart Analysis – 4H Timeframe🚨 TRBUSDT SMC Chart Analysis – 4H Timeframe 🚨

What’s Happening?

TRB is moving in a well-defined bullish structure — with multiple Breaks of Structure (BOS) and a confirmed Change of Character (CHoCH) from the lows.

Smart Money appears to be in control — hunting liquidity and filling key imbalances.

🟪 4 Unfilled Fair Value Gaps (FVGs) on the Chart:

1️⃣ $52.5 – $53.0 → Being filled now — breakout or rejection zone

2️⃣ $45.0 – $49.0 → Major demand zone — perfect for re-entries

3️⃣ $39.5 – $42.0 → If deeper retrace comes, expect reaction here

4️⃣ $36.5 – $37.8 → Extreme demand zone — last line before structure shifts

Equilibrium Zone: ~$48.50

This is the midpoint of the move. If price retests and holds → bullish continuation likely

Upside Targets:

🔼 $56 → First resistance

🔼 $69–$70 → Weak High / Liquidity Target

🔼 Above $70 → Premium Price Zone for profit-taking

Downside Risk?

If price breaks below $45 structure, expect a pullback to $42 or even $37 FVGs.

Smart Money Play:

Smart entries are near FVGs.

Exit targets near liquidity highs.

Bias = Bullish unless structure breaks down.

If TRB holds $48–49, expect a breakout toward $70.

Drop your trade plan below! 👇

Intraday Long Setup | June 3rd 2025 | Valid Until Daily ClosePrice is retracing to a strong pivot zone (marked by the red box).

Structure remains bullish with potential for continuation after pullback.

The green box represents a high-probability long opportunity with tight risk control.

Watch for price reaction within the red zone. Entry only if confirmation (e.g., bullish engulfing, strong wick rejections) appears.

The setup expires at end of the daily candle close.

WIF Just Flipped Bullish — Is This the Start of the Next Big AltWIF Just Flipped Bullish — Is This the Start of the Next Big Alt Rally?

WIF just bounced hard from the $0.80 demand zone and flipped structure bullish with a clear CHoCH!

Smart Money is back — and they’ve left their footprint.

Here’s What’s Cooking:

🔹 CHoCH Confirmed ✅

🔹 Bullish OB at $0.93–$0.96 respected ✅

🔹 Price aiming for $1.13–$1.42 — major liquidity zones

🔹 This isn’t random. It’s Smart Money accumulation, and the next leg up could be explosive.

⚠️ Don’t chase. Wait for confirmation around $1.13 zone and plan accordingly.

Breakout = 🚀

Rejection = Watch for retest.

High-Probability Play

This chart is loaded with confluences. If you're sleeping on it… you might miss one of the cleanest moves of the week.

📢 ACTION TIME:

✅ Save the chart

✅ Share with your crew

✅ Stay updated — we’re tracking this live

Comment “WIF🔥” if you're watching this move!

SYRUP/USDT About to Explode? Here’s What Smart Money is Doing!SYRUP/USDT About to Explode? Here’s What Smart Money is Doing!

After weeks of sideways action, SYRUP just flipped bullish from a strong demand zone near $0.34.

It broke structure, reclaimed key levels, and is now eyeing the $0.44–$0.46 weak high zone!

This move looks like a classic Smart Money re-accumulation setup — and it’s gaining momentum fast!

Key Signals:

✅ Strong CHoCH + BOS combo

✅ Equal lows protected (liquidity trap avoided)

✅ Massive green candles + volume spike

✅ Next resistance: $0.46 — if broken, clean sky above!

Watch Closely:

If price reclaims $0.4450 with volume, we might see a breakout rally!

Short-Term Target: $0.46+

Strong Support: $0.38 and $0.34 zones

Don’t sleep on this move! Track, set alerts, and trade smart.

Your edge is in the knowledge — not the hype.

NFA & DYOR

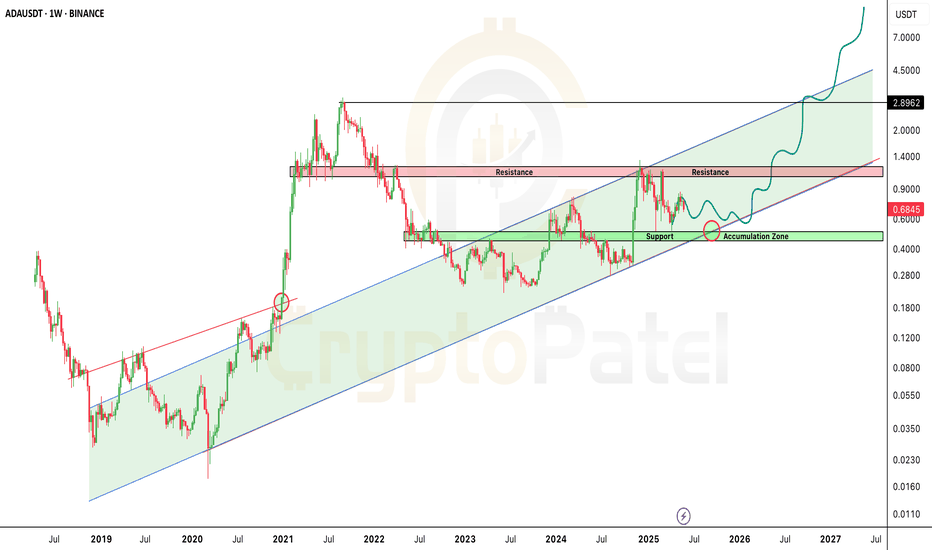

ADA Sitting on Strong Support — Next Big Move Loading?🚨 ADA Sitting on Strong Support — Next Big Move Loading?

Cardano has dropped to around $0.68, but guess what? It's sitting on a major support zone in a long-term bullish channel!

🟩 Accumulation Zone: $0.60–$0.40

This is where smart money enters… historically a STRONG buy zone!

🟥 Next Resistance: $1–$1.20

Break that — and ADA could fly toward $5–$10+ in the coming bull run!

The chart is screaming MEGA RUN ahead — if you're bullish on ADA long-term, this might be your signal.

Not financial advice, but the setup looks Strong.

Ethereum Breakout UpdateETHEREUM AT A BREAKOUT POINT

CRYPTOCAP:ETH is sitting right on its key trendline support. What happens next could be BIG!

🔵 If support holds → $3,000+ is coming!

🔻 If it breaks → ETH could dip to $2,000 before the next pump!

This is the moment where patience meets opportunity.

Don’t chase — wait for the move and ride the wave!

Ethereum Macro Chart Breakdown – Eyeing $10K+ Targets! Ethereum Macro Chart Breakdown – Eyeing $10K+ Targets!

Let’s zoom out and look at the bigger picture for CRYPTOCAP:ETH – this isn't just a pump; it’s a potential parabolic supercycle forming.

Technical Outlook:

Fractal Pattern Analysis

Ethereum is following a similar macro-structure to its 2017–2021 cycle, where after a long consolidation and accumulation phase, it exploded nearly 30x from bottom to top.

Current price action mirrors the post-2019 structure, and we’re at the same breakout stage right now.

Fibonacci Projections

Using the Fibonacci extension from the previous bear market low to the bull market top, and applying the same ratio from the 2022 bottom:

🔹 1.618 Fib = ~$10,000

🔹 2.618 Fib = ~$14,000

These targets align with Q4 2025–Q1 2026, based on previous cycle timings.

Structural Support

ETH is now trading above its 100-week EMA and holding bullish structure on higher timeframes. Previous resistance at $2,500 has flipped into strong support.

Momentum & Fundamentals

🔹 Layer 2 scaling is booming (Arbitrum, Base, zkSync)

🔹 Institutional ETH ETFs are launching

🔹 ETH powers Web3, DeFi, AI infra, RWAs, and more

🔹 Ultra-sound money supply dynamics + staking yield

🔹 Ecosystem growth is organic and robust

Projected Targets:

🎯 Short/Mid-Term (Q4 2025): $10,000 – $14,000

🚀 Ultra Long-Term (2029–2030): $40,000 – $50,000

If you still believe ETH is “just another altcoin,” you’re missing the bigger picture. Ethereum isn’t a meme — it’s the backbone of digital value, smart contracts, and future finance.

I’m long and accumulating ETH on dips. This isn’t just a trade — it’s a conviction play.

🗨️ Drop your ETH target in the comments 👇

🔁 Share this with someone sleeping on ETH!

Note: This is NFA So DYOR

ALTCOIN SEASON LOADING🚨 ALTCOIN SEASON LOADING...

The ETH/BTC pair just gave a major bullish signal

✅ Up 45% in 1 month

✅ Reclaiming strength after long consolidation

✅ Leading the way for ALTCOINS to fly

This is not just bullish for Ethereum — it's even more bullish for other altcoins 👇

Short-term Retracement Expected:

I'm watching 0.022–0.020 BTC as a key accumulation zone on ETH/BTC

That’s the area where smart money will reload before the next leg up.

My Bull Run Target: 0.08 BTC per ETH

If we hit that, it’s time to start rotating profits from ETH into other alts.

Altseason isn’t coming...

It’s already warming up.

Is $WLD the Next 10x Altcoin This Bull Run? Is MIL:WLD the Next 10x Altcoin This Bull Run? 🚀

Based on the chart, this looks like a good time to start accumulating.

👉 My zone: $1.21–$1.00

👉 Bull target this cycle: $10

Strong bullish structure above $0.60 — but don’t forget: risk management is key.

#Altcoin #Worldcoin

Bearish Setup Loading on Solana? Bearish Setup Loading on Solana? Watch This Key Level Closely

Solana just retested the breakdown zone after losing key support — currently sitting in a danger zone.

Short Interest Zone: $180 – $190

If this area holds as resistance, we could see another move below $150 soon.

Bearish Setup Invalidation: Break above $200 will flip this bias.

Long-Term View? I’m still super bullish on SOLANA in the bigger picture — my long-term target remains $1000 🚀

Risk Management is Key

Never trade without a STOP LOSS — protect your capital.

This is NOT financial advice — DYOR before investing.

Let the chart guide you, not emotions. Stay sharp.

ETHEREUM MEGA CYCLE ALERT🚨 ETHEREUM MEGA CYCLE ALERT 🚨

CRYPTOCAP:ETH just bounced from the same support zone that sparked its last bull run 🔥

This could be the start of Wave 5 — and if history repeats…

🎯 Target: $10,000 ETH

Last time this pattern showed up? ETH went 10x.

Don’t fade the chart.

👉 Like & Retweet if you’re riding this wave

👇 Tag a friend who’s still sleeping on ETH!

Ethereum Golden Crossed so What Next? $5000?🚨 CHART ALERT: CRYPTOCAP:ETH just flashed a GOLDEN CROSS on the 12H after months of bleeding!

Last time we saw a DEATH CROSS, #Ethereum crashed -57%.

Now it's doing the opposite — this could be the start of a massive pump! 🚀

TARGET? Maybe $3,800-$5000+ soon! 📈

$SEI to $2? Trump-backed + Institutional Buys = Next Altcoin NYSE:SEI to $2? Trump-backed + Institutional Buys = Next Altcoin Rocket!

#SEI already pumped +100% from our entry! Hope you enjoyed the ride.

But I’m still massively bullish on this setup.

▶️ Price is consolidating near strong support at $0.20–$0.14

▶️ This is a golden accumulation zone for the next leg up!

▶️ Backed by Trump’s Liberty Financial & multiple institutional buys

▶️ My targets for this bull run: $1 → $2 → $3 → $4

Still early. Still bullish. Still time.

Note: Not Financial Advice so Do your Own Research before investing.

#Altcoins

HBAR/USDT Chart Analysis and Price ProjectionMassive CRYPTOCAP:HBAR Rally Loading – Only If This Zone Holds!

Price is holding the critical support at $0.130 — a confirmed base here could trigger a major upside move toward $0.50–$1 🚀

▶️ Accumulation Zone: $0.180–$0.160

▶️ Invalid below $0.124

▶️ Above = ultra bullish structure in play!

$ETH Pullback Loading: Is $1,800 the Next Big Buy Zone?Ethereum (ETH/USDT) Technical Outlook – Dip Analysis

After a strong bullish impulse breaking the downtrend, ETH is now entering a corrective phase.

Key Observation: Price has filled a major FVG (Fair Value Gap) near $2,500 and is showing signs of rejection.

🔻 Short-Term Bias: Bearish Retracement

We anticipate a pullback into the lower FVG zone between $1,854–$2,186, aligning with the +OB (Order Block) at ~$1,854-$1790 — a strong demand zone.

🟩 Buyers may step in here, making it a potential accumulation zone before the next leg up.

If this zone holds, ETH could resume its uptrend targeting the upper OB/FVG zone near $3,400–$3,600.

Strategy: Watch for bullish confirmation in the $1,800–$2,000 zone for potential long setups.

EOS Super bullish toward $10 because WLFI Buying$EOS/USDT Weekly Technical Breakdown

🔰 Price Action:

EOS is currently trading at $0.85, following a rejection from the key weekly resistance zone between $1.24–$1.31. This zone has acted as a historical supply area, and the failure to break above it has triggered a short-term corrective move.

🔰 Bullish Development:

EOS has recently broken out of a multi-year falling wedge pattern, signaling a potential long-term trend reversal. Post-breakout, the asset is now retesting lower levels — a common occurrence before continuation.

🔰 Key Demand Zones:

Primary Accumulation Zone: $0.83–$0.69

Major Weekly Support: $0.47–$0.40

These zones coincide with historical consolidation and low-volume nodes, making them ideal for long-term positioning.

🔰 Institutional Interest:

Trump-backed World Liberty Financial has accumulated 3.64M NYSE:EOS for 3M USDT, with an average entry at $0.824 — aligning perfectly with the current range. This reinforces the strength of the accumulation zone and may signal smart money inflow.

🔰 Upside Resistances to Monitor: $2.87 / $5.03 / $10.57 / ATH: $14.90

NYSE:EOS is showing signs of structural reversal on the HTF. As long as the price holds above the $0.69 base, bullish continuation remains valid. A reclaim and weekly close above $1.31 could trigger the next impulsive leg toward $5+.

Ethereum (ETH) – Early Recovery Setup After Liquidity SweepEthereum has printed a bullish deviation below key liquidity ($1,500) and reclaimed the 20-day EMA, flipping prior resistance into support — a classic signal of early reversal momentum.

We're now watching for a pullback into the $2,100–$2,200 demand zone to offer an optimal spot entry before a potential move into higher timeframe targets.

🔹 Entry Zone:

$2,100 – $2,200 (pullback into reclaimed support/demand)

🎯 Take Profit Targets:

🥇 $3,000

🥈 $3,500

🥉 $3,900

🛑 Stop Loss:

Close below $2,000 (to invalidate reclaim of structure)

BTC Bulls Must Defend $103K… Or Say Hello to $99K Again Bitcoin completed a clear 5-wave Elliott Impulse and is now forming an ascending wedge (abcde structure), typically hinting at a possible correction.

Key Levels to Watch:

🔴 Key Bull Level: $103,085 – must hold to maintain bullish structure

🟠 Support 1: $99,265 – breach = deeper pullback

🟡 Support 2: $95,965 – last stronghold for bulls

Outlook:

🔼 A breakout above the wedge = continuation toward $110K+

🔽 Breakdown below $103K = expect correction toward lower supports

Strategy:

➡️ Wait for confirmation. A wedge breakdown = potential short trade setup.

➡️ Breakout = bullish continuation. Always manage risk wisely.

Stay sharp, traders!

The Next Big L2 Gem? $ARB Is Breaking Out —Why It Could it 10x🚨 The Next Big L2 Gem? AMEX:ARB Is Breaking Out — Here's Why It Could 10x+ 🚨

🔰 What is Arbitrum?

Arbitrum is Ethereum’s top Layer-2 scaling solution using Optimistic Rollups.

It powers faster, cheaper transactions without compromising security.

🔰 Ecosystem Highlights

▶️ Arbitrum One – DeFi & dApps

▶️ Arbitrum Nova – Gaming & Social apps

▶️ Hosts major projects: Uniswap, Aave, GMX

▶️ Among the top L2s by TVL dominance

🔰 Tech & Innovation

▶️ Runs on fraud-proof optimistic rollups

▶️ Nitro upgrade boosted throughput + cut gas fees

▶️ Gives near-Ethereum experience with 10x lower costs

🔰 Tokenomics

▶️ Total Supply: 10B ARB

▶️ Airdrop: 1.162B (11.6%) to users & DAOs

▶️ Remaining: Treasury + future ecosystem rewards

➡️ Small circulating supply = potential supply squeeze on demand surge

🔰 Backers & Partnerships

▶️ Built by Offchain Labs

▶️ Investors: Lightspeed, Pantera, Coinbase Ventures

▶️ Listed on Binance, Coinbase, KuCoin

▶️ Integrated by top Ethereum protocols (Uniswap, etc.)

🔰 TECHNICAL BREAKDOWN: ARB/USDT HTF Chart

✅ Accumulation Zone: $0.29–$0.42

▶️ Above $0.4028 = momentum shift zone into Super Bullish

▶️ Next resistance: $0.48–$0.52 (watch for breakout!)

▶️ Targets: $1.10 / $1.71 / $2.19 / $5

⚠️ Hold above $0.2942 to keep setup valid

✅ Strong volume + higher lows = bullish confirmation

▶️ DYOR | NFA

🔰 Why 10x–50x Is Possible

▶️ Top Ethereum L2 by usage

▶️ Real utility, not meme hype

▶️ Limited unlocked supply = buyer advantage

▶️ L2 sector will explode if ETH demand grows

▶️ Could capture a huge chunk of ETH's scaling market

🔰 Final Take

▶️ AMEX:ARB is more than hype — it's infrastructure.

▶️ In a bull market, this is the kind of setup that runs hard.

▶️ Keep it tight on your watchlist.