EUR/USD) support level pullback Technical AnalysisHELLO 👋 Dear friend Euro USD Traders

Technical analysis of the EUR/USD (Euro vs US Dollar) on the 4-hour timeframe. Here's a summary of the idea and setup shown:H

---

1. Key Levels:

Support Level: Around 1.1330–1.1280 — price has bounced from this level several times, indicating strong demand.

Resistance Level: Around 1.1427 — this is the immediate target zone.

Resistance Level 2: At 1.1570, the extended target area.

---

2. Current Price Behavior:

Price is currently above the 50 EMA and near the middle of the range.

The chart projects a potential bullish move after a slight pullback toward the support level.

This projected move suggests:

A bounce off support.

A breakout above the immediate resistance at 1.1427.

Continuation toward the upper resistance at 1.1570.

---

3. EMA Analysis:

EMA 50 (blue): Price is above it, suggesting short-term bullish momentum.

EMA 200 (red): Located much lower, confirming the overall longer-term bullish bias is still intact.

---

4. Price Projection:

Target 1: 1.1427 (approx. +1.33% from breakout).

Target 2: 1.1570 (total gain approx. +2.5%).

---

5. Trading Idea Summary:

Bullish Idea (Buy Setup):

Entry: Near support zone (around 1.1330–1.1280).

Targets: 1.1427 (TP1), 1.1570 (TP2).

Stop-loss: Below 1.1280, to protect against a breakdown.

Risk/Reward: Good potential, especially if entering near support.

Eurousdsignal

EUR/USD) Big Support level Analysis Read The ChaptianSMC Trading point update

Technical analysis of EUR/USD on the 1-hour timeframe. The idea centers around a potential reversal from a major support zone, aiming for higher resistance targets. Here's a detailed breakdown:

---

1. Big Support Level

A strong horizontal support zone is highlighted around 1.1275–1.1290.

Price is currently reacting off this level, suggesting a potential bullish reversal.

2. EMA 200 as Resistance

The 200-period EMA (~1.1346) is above current price, possibly acting as a dynamic resistance.

A break and hold above it could confirm bullish momentum.

3. Resistance Levels & Target Points

The first target is the 1.14367 resistance level, a clear supply zone.

The second target point is around 1.15622, aligned with a previous major high and strong resistance zone.

4. RSI Indicator

RSI is at 44.02, indicating neutral to slightly oversold conditions—this supports a potential bullish move, especially from support.

5. Forecast Path

The chart projects a likely pullback and breakout pattern:

Rebound from the support zone.

Break through EMA 200 and minor resistance.

Rally toward first and second targets.

Mr SMC Trading point

---

Summary of the Idea:

This is a trend-reversal-to-continuation setup, with EUR/USD expected to rise from a key support area toward 1.14367, and potentially 1.15622, provided price holds above the support and breaks the EMA 200.

Pales support boost 🚀 analysis follow)

EUR/USD) one side of breakout and move Read The ChaptianSMC Trading point update

technical analysis of the EUR/USD currency pair on the 1-hour timeframe, showing two ptential scenarios based on price behavior around a key supply zone.

1. Key Levels:

Resistance/Target Point (Upper): ~1.15729

Supply Zone (Current Price Area): ~1.14100–1.14500

Support Level/Target Point (Lower): ~1.12658

200 EMA: ~1.13581 acting as dynamic support

2. Current Price:

EURUSD is trading at 1.14167, just above the 200 EMA and at the bottom edge of the supply zone.

3. Scenarios Outlined:

Bullish Scenario:

If price breaks and holds above the supply zone, it may continue toward the upper resistance level at 1.15729.

This move would be supported by bullish momentum and potentially a breakout strategy.

Bearish Scenario:

If price rejects the supply zone and fails to break above convincingly, a reversal is expected.

The target for this bearish move is the support zone near 1.12658.

4. Indicators:

RSI (Relative Strength Index): Around 49, neutral zone but potentially recovering from oversold.

Suggests indecision, with momentum that could swing either way depending on price action at the supply zone.

Mr SMC Trading point

Trade Ideas:

Long Trade Setup (Breakout):

Entry: Break and retest above ~1.14500.

Target: ~1.15729.

Stop Loss: Below ~1.14100.

Short Trade Setup (Rejection):

Entry: Rejection candle formation around 1.14300–1.14500.

Target: ~1.12658.

Stop Loss: Above ~1.14700.

Overall Idea:

This is a dual-scenario setup, where the market structure at the current supply zone will determine direction. The chart encourages traders to wait for confirmation before committing to either a breakout or a reversal strategy.

Pales support boost 🚀 analysis follow)

EUR/USD) resistance level rejected) Analysis Read The ChaptianSMC Trading point update

updated chart provides a more refined bearish outlook for EUR/USD. Here's the idea behind this analysis:

---

Market Structure Overview:

Resistance Level: ~1.14292

Mid Support Zone: ~1.13500

Major Support (Target Point): ~1.12658

Current Price: 1.13787

---

Indicators:

EMA 200 (1.12174): Price is above the 200 EMA, indicating an overall bullish bias, but that may be weakening.

RSI (14): Around 54.37, slightly bullish but neutral—no strong momentum.

---

Trading Idea:

1. Short-Term Bullish Move:

Price is expected to rise to test the resistance level around 1.14292.

2. Bearish Reversal at Resistance:

From there, a rejection is anticipated, leading to a drop back to the mid support (~1.13500).

3. Break Below Mid Support:

If the price fails to hold the mid support zone, a breakdown is likely to continue toward the target point at 1.12658, which aligns with the previous big support level.

Mr SMC Trading point

---

Strategy Suggestion:

Sell Setup 1: At resistance (~1.14292), with confirmation like bearish candles or divergence on RSI.

Sell Setup 2: On breakdown and retest of the 1.13500 support zone.

Take Profit: Target at 1.12658.

Stop Loss: Above 1.14300 or above the most recent swing high.

---

Pales support boost 🚀 analysis follow)

EUR /USD) resistance level rejected support level Read The ChaptSMC Trading point update

analysis of the EUR/USD currency pair on a 1-hour timeframe, and it presents a potential bearish setup. Here's a breakdown of the idea:

Key Elements:

Resistance Zone (around 1.14182):

The price is currently approaching a marked resistance area. The analysis suggests this could be a turning point where price may reverse.

Projected Movement (Black Arrows):

The chart predicts a double top formation or a rejection from the resistance level, followed by a strong move downward.

Target Point:

The drop is expected to reach the key support zone around 1.10942, aligning with a previous structure and a potential liquidity zone.

EMA 200 (around 1.10389):

Price remains well above the 200 EMA, suggesting the trend is still bullish overall, but the setup targets a potential correction or short-term reversal.

RSI Indicator (~60):

RSI is above 60 but not overbought yet. This supports the idea that there's room for one more push up into resistance before a drop.

Mr SMC Trading point

Summary of the Idea:

1. Watch for price reaction around 1.14182.

2. If there's a clear rejection or double top, a short position may be considered.

3. Target area is around 1.10942.

4. The setup assumes a corrective move in a broader bullish trend.

plase support boost 🚀 analysis follow)

EUR /USD) bullish flag Analysis Read The ChaptianSMC Trading point update

This is a bullish technical analysis on the EUR/USD pair (2-hour chart), projecting a long opportunity based on price action and market structure.

---

Key Elements of the Chart:

1. Strong Key Support Zone:

Marked around 1.09273, acting as a critical base.

Price previously reacted strongly from this level, confirming it as a high-probability support area.

2. Bullish Channel:

The pair is moving within an ascending parallel channel.

Price is currently rebounding off the lower channel trendline, suggesting upward continuation.

3. Breakout & Retest Pattern:

A small flag/pennant correction is shown after a strong bullish impulse.

Expected breakout from this flag will lead to continuation toward the upper resistance.

4. Target Zone:

1.12977 is marked as the final target point, around 2.55% (281.4 pips) away from the current price.

Previous high structure adds confluence to this target.

5. RSI (14):

RSI is hovering around 50.5, indicating neutral momentum but room for upside.

No clear divergence, but aligned with a possible bullish continuation.

6. 200 EMA (1.08501):

The price is above the 200 EMA, supporting the bullish bias.

Mr SMC Trading point

---

Conclusion/Idea:

This analysis suggests a long setup on EUR/USD, with:

Entry idea near the key support (1.09273),

Bullish flag breakout in progress,

Target near 1.12977,

Risk management advised below support or lower channel.

Bullish Bias: Price structure, EMA support, and trend channel favor a long setup.

---

Pales support boost 🚀 analysis follow)

EUR/USD Bearish Correction: Resistance Rejection & Support TargeTrading point update

This chart provides a technical analysis of EUR/USD on the 3-hour timeframe with key insights:

Analysis & Expectations

1. Overbought Condition & Rejection

Price reached a strong resistance zone (highlighted in yellow) around 1.11425 - 1.10751, leading to a sharp rejection.

The RSI is in the overbought zone (~68.43) and showing a downward slope, indicating a potential bearish correction.

Mr SMC Trading point

2. Expected Bearish Correction

A potential drop is expected toward the support level around 1.08501 - 1.07925, aligning with past price action.

The 200 EMA (1.07757) also serves as a significant support level, reinforcing a possible retracement.

3. Target Levels

Short-term Bearish Target: 1.08501 (Support level)

Key Support Zone: 1.07925 - 1.07757 (Near 200 EMA)

Conclusion

The analysis suggests a bearish retracement after the strong bullish move. Traders may look for short opportunities targeting the support level and 200 EMA while watching for confirmation signals before entering.

Pales support boost 🚀 analysis follow)

EUROUSDT TRADING POINT UPDATE >READ THE CHAPTIAN Buddy'S dear friend

SMC Trading Signals Update 🗾🗺️ Euro USD Traders SMC-Trading Point update you on New technical analysis setup for Euro USD ) Euro USD Technical patterns support level pullback up trend 📈🚀 1.08254 strong 🪨 support level target 🎯 point Resistance level 1.09580 good luck 💯💯

Key Resistance level 1.09580

Key Support 1.08254

Mr SMC Trading point

Palee support boost 🚀 analysis follow)

GOLD TRADING POINT UPDATE >READ THE CHPTAIAN Buddy'S dear friend 👋.

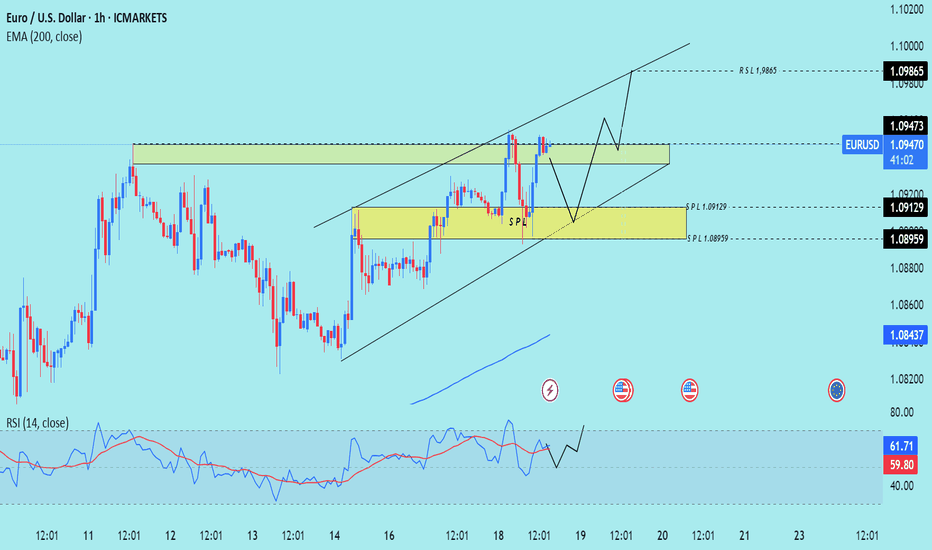

SMC Trading Signals Update 🗾🗺️ Euro USD Traders SMC-Trading Point update you on New technical analysis setup for Euro USD) Euro USD still going to bullish trend 🚀 analysis update 1.09483 rejected point below 👇 trend following support level again back up trand 1.09129 - 1.08959 support level buying zone ☺️ 🥂

Target 🎯 point 1.09865 good luck 💯💯🤞

Key Resistance level 1.09476 + 1.09865

Key Support level 1.09129 - 1.08959

Mr SMC Trading point

Pales support boost analysis follow)

EUR/USD Analysis: Bullish Breakout Towards 1.09524EUR/USD 30-Minute Analysis – Potential Bullish Breakout Towards 1.09524 📈

Key Observations:

Support Level: Around 1.08700, acting as a critical area for price action.

Resistance Zones: A key resistance area is visible around 1.09000 before reaching the target of 1.09524.

Moving Averages:

The 30 EMA (red) at 1.08747 is currently near price action, indicating short-term dynamic support.

The 200 EMA (blue) at 1.08601 suggests a broader trend still in transition.

Trendlines & Structure:

A downward trendline has been broken, and price is now retesting previous resistance-turned-support.

The expectation is a bounce from the support area leading to a potential bullish move.

Potential Trade Setup:

Bullish Scenario: If price holds above the 1.08700 support, a push toward 1.09524 could be expected.

Bearish Scenario: A failure to hold the support may indicate a return to the 1.08600 region.

EUROUSD TRADING POINT UPDATE > READ THE CHPTIANBuddy'S dear friend

SMC Trading Signals Update 🗾🗺️ SMC-Trading Point update you on New technical analysis setup for Euro USD) Euro USD) Technical patterns choch looking for Bullish patterns support level 1.0866 Resistance level 1.09361 ) good luck guys 🤝

Key Resistance level 1.09361+ 1.09483

Key Support level 1.08802 - 1.08666

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

EUROUSD TRADING POINT UPDATE > READ THE CAPTAI NBuddy'S dear friend 👋

Euro USD Trading Signals 🗺️🗾 Update Euro USD Traders SMC-Trading Point ☝️ looking back up trand now 1H candle. Follow a small trade entry technical analysis setup

Small target we'll see 1.03808

Mr SMC Trading point

Support 💫 My hard analysis Setup like And Following 🤝 that star ✨ game 🎯

EUR/USD TRADE STEPUP :-Today Euro made it 4 months $1.04958 and also November 2023 euro made its low $ 1.04477 after multiple times tested this level.today euro made daily time frame on insider candle .if euro breaks yesterday high than much possibly euro can drive up side move to $1.06824 levels.

stay tuned with me for more updates:-

Global Markets Face DownturnGlobal markets are experiencing a decline, with early indications suggesting that Wall Street may open lower. The Dow futures are down 129.00 points, the S&P 500 futures are declining by 19.50 points, and the Nasdaq 100 futures are sliding by 82.75 points as of 8:00 am ET.

On Monday, the major US stock indexes mostly finished higher, with the Nasdaq gaining 0.7 percent, the S&P 500 inching up slightly, and the Dow slipping by 0.2 percent.

Today, the Labor Department will release the Job Openings and Labor Turnover Survey (JOLTS) report for August, which could be a significant event. The consensus is for 8.75 million job openings, slightly lower than July's figure.

Asian stocks also fell sharply today, with Hong Kong's Hang Seng index tumbling by 2.69 percent. Chinese markets remained closed for the holidays, and Japanese shares also declined.

Australian markets dropped after the Reserve Bank of Australia kept interest rates steady but highlighted the possibility of further policy tightening to control inflation.

European shares are also trading negatively, with France's CAC 40, Germany's DAX, England's FTSE 100, and the Swiss Market Index all declining. The Euro Stoxx 50, which represents leading companies in the Eurozone, is also down.

Additionally, there will be a 52-week Treasury bill auction held later today.