EUR/JPY Potential Bullish Continuation EUR/JPY Potential Bullish Continuation 📈🔍

📊 Technical Overview:

The EUR/JPY chart presents a bullish channel structure, indicating an overall upward trend. Price action respected the channel boundaries with multiple confirmations before the latest bearish correction.

🔹 Structure Highlights:

🔵 Ascending Channel: Price moved steadily within an upward-sloping channel.

🟠 Support Rebound: A strong bullish candle formed on June 20th after touching the lower boundary — a clear support confirmation.

🔴 Recent Rejection: On July 1st, price tested the upper channel resistance and faced rejection, forming a bearish engulfing candle.

🟫 Support Zone Marked: Around the 167.800 level, this zone has been tested multiple times, indicating a possible demand area.

🔁 Current Scenario:

The pair has broken down from the internal trendline (light brown line) and is heading toward the support zone. A bullish bounce from this area may lead to a rally toward the Target Point at ~172.000 🎯.

📌 Key Levels:

Support Zone: 167.600 – 168.000

Resistance Zone: 170.500 – 172.000

Current Price: 168.994

📈 Outlook:

If support holds and bullish momentum returns, there's potential for a move toward the target area at the top of the channel. However, a break below the support zone could invalidate the bullish scenario and suggest a deeper correction.

🧠 Conclusion:

Wait for bullish confirmation near support before considering long positions. A clean break and retest of the support zone could signal a continuation of the upward trend.

Eurusdbreakout

EUR/USD Bullish Continuation Analysis EUR/USD Bullish Continuation Analysis 🚀💶

📊 Chart Summary:

The EUR/USD pair is demonstrating a strong bullish structure with consistent higher highs and higher lows. Recent price action shows a breakout above the 1.16386 resistance level, now acting as support 🛡️. The market is currently retracing and might retest this new support zone before continuing its upward move toward the target.

🔍 Key Observations:

🔸 Bullish Structure:

Multiple bullish impulses have formed a clean staircase pattern (🔼⬆️), indicating sustained buying momentum.

🔸 Support Zone 🟦 (1.13200 - 1.14000):

This zone has been tested multiple times, confirming its strength and the base of this bullish rally.

🔸 Breakout & Retest 🟠:

Price broke above the 1.16386 resistance level, pulled back slightly (highlighted by the orange circle), and now looks ready for a potential continuation to the upside.

🔸 Target 🎯: 1.18010

A clear target has been set based on measured move or resistance projection. If the price respects the current structure, we may see a continuation toward this level.

✅ Trade Outlook:

Bias: Bullish 📈

Entry Zone: Around 1.16386 (upon bullish confirmation)

Target 🎯: 1.18010

Invalidation ❌: Break below 1.1600 with bearish momentum

🧠 Technical Tip:

Always wait for confirmation on the retest before entering. Wick rejections or bullish engulfing candles at the support zone can provide additional entry confidence. 🔍✅

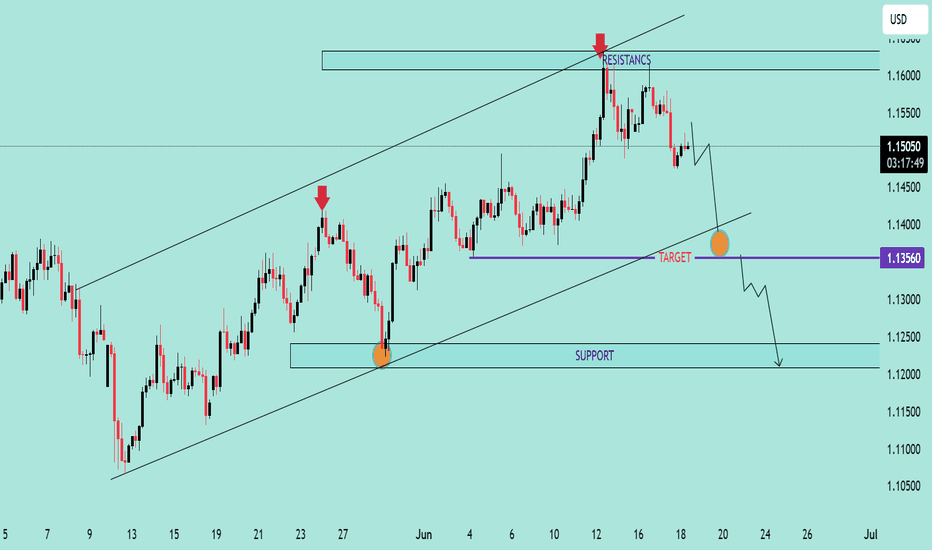

EUR/USD Potential Rejection from ResistanceTechnical Overview:

The EUR/USD chart exhibits signs of a bearish reversal pattern forming near a key resistance zone (1.15800 - 1.16000), highlighted with repeated rejection wicks (🔴 red arrows). Price is currently trading at 1.15222, after failing to hold above the neckline of the rounded bottom pattern.

🔍 Key Observations:

🔺 Resistance Zone: Strong resistance has been confirmed multiple times (red arrows), indicating sellers are active at the top.

🟠 Double Top / Head & Shoulders Behavior: Price action shows topping formations (highlighted with orange circles), suggesting exhaustion of bullish momentum.

📉 Bearish Breakdown Possibility:

Price rejected near neckline and is showing bearish candle formations.

Breakdown from the current consolidation zone could push price toward the target zone at 1.14491, marked in purple.

This aligns with previous support structure, reinforcing a technical downside projection.

🔻 Support Zone: Around 1.13800 - 1.14000 is a strong area of demand and may act as the next bounce point if the bearish move continues.

📐 Chart Pattern Structure:

Rounded bottom formed earlier, but the failure to continue higher and breakout suggests a false breakout trap for buyers.

Downward sloping trendline broke, but now price is struggling to sustain above previous highs.

📌 Conclusion:

⚠️ Caution for bulls as price shows signs of weakness at resistance. A move below 1.15000 may initiate further downside toward 1.14491 and possibly lower. Short-term traders can watch for confirmation candles near this zone for entries.

📅 Short-Term Bias: Bearish

🎯 Target: 1.14491

⛔️ Invalidation: Strong breakout above 1.16000

EUR/USD Bullish Reversal Breakout Pattern EUR/USD Bullish Reversal Breakout Pattern 🚀📈

📊 Technical Analysis Summary:

The chart illustrates a strong bullish reversal pattern forming on the EUR/USD pair:

🔹 Double Bottom Formation (🔶🔶):

Two clear bottom zones are marked with orange circles near the 1.14400–1.14500 area, indicating strong buying interest and support.

The second bottom confirms the double bottom pattern, often a precursor to an upward trend.

🔹 Support Zone (📉):

Firm support around 1.14450, as highlighted on the chart.

Price has respected this zone twice, bouncing back with bullish momentum each time.

🔹 Neckline Breakout (🔼):

Price is approaching the neckline zone at 1.16087, which acts as the bullish target.

A break and close above this neckline will confirm the reversal and open the way toward the resistance zone around 1.16500.

🔹 Projected Move (🎯):

If the neckline breaks, price is expected to surge towards 1.16500, aligning with the historical resistance.

This move completes the measured target projection from the double bottom structure.

🔹 Bullish Structure:

Higher lows and strong bullish candles are reinforcing the uptrend momentum.

Curved trajectory shows accumulation followed by a breakout phase.

📌 Key Levels to Watch:

Support: 1.14450 – 1.14500

Neckline/Target: 1.16087

Resistance: 1.16500

🛑 Invalidation:

A strong breakdown below support (1.14450) would invalidate this bullish setup.

✅ Conclusion:

EUR/USD is exhibiting a textbook bullish reversal setup with a potential breakout above 1.16087 likely to trigger further upside toward 1.16500. Ideal scenario for bullish entries on

EUR/USD Potential Reversal from Resistance Zone –Bearish OutlookThe EUR/USD pair has been trading within a well-defined ascending channel for several weeks. Price recently tested a strong resistance zone near 1.15850 – 1.16000, which aligns with the upper boundary of the channel and a previously marked supply area.

Key observations:

The price action shows signs of rejection from the resistance zone with a potential double-top or fakeout pattern forming.

A projected bearish trajectory is marked, suggesting a possible break below the channel support.

Immediate bearish targets are set at key demand zones around 1.14500, 1.12500, and further down to 1.10500.

A large red arrow indicates the strong downside bias if the price confirms the breakdown.

Conclusion:

If EUR/USD fails to sustain above the 1.15850 resistance zone and breaks below the ascending channel, a strong bearish correction is anticipated. Traders should watch for confirmation of the breakdown before entering short positions.

EUR/USD Bearish Reversal in Channel EUR/USD Bearish Reversal in Channel 📉🔻

📊 Technical Analysis Overview:

The EUR/USD pair is showing clear bearish pressure after hitting a key resistance zone near 1.16500, which aligns with the upper boundary of the ascending channel 📐.

🔺 Resistance Area:

Price reacted strongly to the 1.16500–1.16000 resistance zone (marked with red arrows ⬇️).

Double rejection near this level confirms seller dominance.

📉 Bearish Structure:

Price is forming lower highs, suggesting weakening bullish momentum.

The current pattern implies a potential head and shoulders or rising wedge breakdown.

🎯 Target Levels:

Primary Target: 1.13560 🔽 (short-term key support marked in purple).

Extended Target: 1.12000–1.12500 zone 🧲 (major support area at the lower boundary of the channel).

📎 Support Zone:

Historical bounce region around 1.12000–1.12500 is a strong demand area.

🔍 Conclusion:

If price breaks below 1.13560, it opens the path for a deeper drop toward the broader support range. Traders should monitor for confirmation signals below that level 📉🚨.

⚠️ Recommendation:

Bearish bias remains valid unless price breaks back above 1.15500. Look for pullbacks for short entries. Tight risk management advised! 💼📉

EUR/USD TRADE STEPUP :-Today Euro made it 4 months $1.04958 and also November 2023 euro made its low $ 1.04477 after multiple times tested this level.today euro made daily time frame on insider candle .if euro breaks yesterday high than much possibly euro can drive up side move to $1.06824 levels.

stay tuned with me for more updates:-

Huge Falling Wedge & Double Bottom It's important to note that the behavior of the EURUSD pair can be influenced by a wide range of factors such as global economic conditions, political developments, supply and demand, and market sentiment. Therefore, it's important to do your own research, analyze the market conditions, and consult with a qualified financial advisor before making any investment decisions.

However, I can provide an explanation of the chart patterns you mentioned, which are the falling wedge pattern and the double bottom pattern.

The falling wedge pattern is a bullish chart pattern that occurs when the price of an asset is trading within a downward sloping channel but with a contracting range. This pattern is characterized by a series of lower highs and lower lows that form two converging trendlines that slope downward. The falling wedge pattern is formed when the price reaches a support level and starts to consolidate, with the lows getting higher and higher while the highs maintain their level, indicating that the sellers are losing momentum. Once the price breaks above the upper trendline of the wedge pattern, it can indicate a trend reversal, and traders may consider buying the asset.

The double bottom pattern is also a bullish chart pattern that occurs when the price of an asset forms two distinct lows at approximately the same price level, separated by a high. This pattern is formed when the price reaches a support level, bounces off it, and then falls back to the same level before bouncing again. The double bottom pattern indicates a potential trend reversal, and traders may consider buying the asset.

It's important to note that chart patterns are just one of the many tools used by traders to analyze the market, and they should not be relied on exclusively for investment decisions. Additionally, it's essential to use risk management techniques, such as setting stop-loss orders, to limit potential losses if the trade does not go as expected.

In summary, the falling wedge and double bottom patterns are bullish chart patterns that can occur in the EURUSD pair or any other asset, and they indicate a potential trend reversal. However, investors should conduct thorough research and analysis and consult with a financial advisor before making any investment decisions based on chart patterns. The FED news can also influence the price of the US dollar, but it's important to keep in mind that market conditions can change rapidly, and it's crucial to constantly monitor the price movements of the asset and adjust investment strategies accordingly.

EUR/USD to Tackle Fed Fear and Eye $1.08 on Easing Bank CrisisIt is a relatively busy day ahead for the EUR/USD. ZEW Economic Sentiment figures for Germany and the Eurozone will draw interest today. Following the collapse of Silicon Valley Bank and Signature Bank (SBNY), economic sentiment figures are likely to weaken.

Economists forecast the German Economic Sentiment Index to fall from 28.1 to 17.1 in March, with the Eurozone Economic Sentiment Index to slide from 29.7 to 16.0.

This morning, the EUR/USD was down 0.03% to $1.07144. A mixed start to the day saw the EUR/USD rise to an early high of $1.07260 before falling to a low of $1.07096.

The EUR/USD needs to avoid the $1.0693 pivot to target the First Major Resistance Level (R1) at $1.0755. A move through the Monday high of $1.07308 would signal a bullish session. However, the EUR/USD would need hawkish ECB chatter and better-than-expected ZEW Economic Sentiment numbers to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0793 and resistance at $1.08. The Third Major Resistance Level (R3) sits at $1.0892.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0655 into play. However, barring a risk-off-fueled sell-off, the EUR/USD pair should avoid sub-$1.06 and the Second Major Support Level (S2) at $1.0593. The Third Major Support Level (S3) sits at $1.0494.

Looking at the EMAs and the 4-hourly chart, the EMAs send bullish signals. The EUR/USD sits above the 50-day EMA ($1.06562). The 50-day EMA pulled away from the 200-day EMA, with the 100-day EMA converging on the 200-day EMA, delivering bullish signals.

A hold above the 50-day EMA ($1.06562) would support a breakout from R1 ($1.0755) to give the bulls a run at R2 ($1.0793) and $1.08. However, a fall through the 50-day EMA ($1.06562) would bring S1 ($1.0655) and the 200-day ($1.06533) and 100-day ($1.06517) EMAs into play. A fall through the 50-day EMA would send a bearish signal.

EURUSD Forecast 01/03/2023The EUR/USD needs to move through the $1.0597 pivot to target the First Major Resistance Level (R1) at $1.0621 and the Tuesday high of $1.06453. A return to $1.06 would signal a bullish session. However, the EUR/USD would need the stats and the ECB chatter to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0670 and resistance at $1.07. The Third Major Resistance Level (R3) sits at $1.0743.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0548 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0524 should limit the downside. The Third Major Support Level (S3) sits at $1.0451.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06213). The 50-day EMA slipped back from the 200-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through R1 ($1.0621) and the 50-day EMA ($1.06213) would give the bulls a run at the 100-day EMA ($1.06665) and R2 ($1.0670). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06213) would leave the Major Support Levels in play.

Effect Of GFK Consumer Sentiment Index On EURUSDEURUSD dropped by almost 0.06% as inflation fears increased due to Fed's latest statements.

Possible effects for traders

Today, Germany will release the second assessment of Q4 GDP and the GFK Consumer Sentiment Index. Another important event is the U.S. PCE report for January. Overall, the Fed seems ready to continue further rate hikes, supporting the U.S. dollar.

The EURUSD fell due to high demand for the U.S. dollar and returned to the levels of the year's beginning. The pair remained below 1.06000 within the Asian session, opening a potential for a downside correction to 1.05200. Still, today's economic reports may push EURUSD towards 1.07000.

EURUSD (June 14, 2021 [IST])EURUSD Deep to the Ground.

EUR/USD is Severely Dropping its Potential Momentum

Today Again there is a very low chance of survival.

Again EUR/USD could be defeated by Bears.

Unexpected Drop has happened at 11 June, 2021.

The Reason for the Panic Drop could be the Inflation News.

Almost at 11, June, 2021 EUR/USD faced a near death experience.

Today chances are low to gain the momentum back.

Because, still the traders sentiment are bearish.

1.21862 will serve as Resistance and 1.21061 will Serve as Support.

At the time of writing the Support has been Broken.

Again a Drop to be expected today.

Overall Strength (BEARISH)

Thanks for using your Valuable time. Leave a like which helps me to do better. Follow me for Daily Signals,

Get updates on, FOREX, Stocks, INDICES, Crypto, #--CFD's to be expected soon. (Share to your Market Friends)

EUR/USD TECH-SHEETghstocktrading.webnode.com

EUR/USD TECH-SHEET

EUR/USD: performed only +1.53% for the year 2018, in which 16th February 2018 top 1.2557 consider to be the year top whereas 12th November 2018 bottom 1.1214 consider to be year low. EUR/USD completed (+or-) 1343 pip.

If it breaks 1.1491

Buy @t Entry: 1.1491

Stop Loss: 1.1234

Target 1: 1.1523

Target 2: 1.1528

Target 3: 1.1534

Target 4: 1.1542

Target 5: 1.1555

Target 6: 1.1577

Target 7: 1.1620

Target 8: 1.1748

EURUSD -More Upside PossibleLast Week EURUSD was very volatile. Price has recovered from 1.13000 level. and Showing strength for Upside.This Week price can move upside for 1.15000 and 1.17000 levels as well.My Views are bullish for this week on EURUSD. * Always Move stoploss to cost if price moves more than 50 pips.*