EURUSD This weekEUR/USD is extending its sideways trading in the European session on Thursday. The pair lingers near three-month lows, as the US Dollar clings to recent gains amid a risk-off market profile. EU/ US data and Fedspeak awaited.

The EUR/GBP cross gains momentum above the mid-0.8500s during the early European session on Thursday. The cross currently trades near 0.8576, unchanged for the day.

The latest data revealed on Thursday that German Industrial Production (IP) for July fell -2.1% YoY from a 1.5% drop (revised from a 1.5% drop) in the previous month. On a monthly basis, the figure dropped 0.8% versus a 1.4% decline in June and below the expectation of a 0.5% drop. However, the Pound Sterling (GBP) is weakened against the Euro as the Bank of England (BoE) Governor Andrew Bailey's dovish remark on Wednesday that the central bank is much closer to ending its hiking cycle.

Eurusdbuy

Eur/Usd update (A conditional Buy)price hovering near the higher time frame demand area had given signal of choc previous condering it as bullish change we waited for new confirmation the latest low we saw was at 1.06859, so if the price goes below this area and makes a wick forcing price to close above 1.06859 then this is confirmation of liquidity sweep and we can enter long

fyi - this is just a insight im providing through similar scenario i have seen , also keep track on dxy if dxy starts making lower high and lower low in 1h time frame then other usd related pair will get benifits also EURO

this liquidity sweep is likely to happen in london session

LONG SETUP ON EUR/USDprice made a choc on higher time frame so we are likely expecting the price to pullback at the area swing low where the buyer stepped in and will target the high of pullback

considering the price from current level the trade indicates fair value of 1:2 on risk to reward

buy 1.07915

sl 1.07500

target 1.08700

note that this demand zone can be temporary as our main demand zone as per earlier analysis is still non mitigated at the level of 1.0660

EURUSD 2h analysis long Trade Idea:

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 : 4

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

EURUSD LONG IDEAHey before you trade #DYOR I’m sharing my idea which is based on technical analysis for more accuracy you can check news or event update.

EURUSD 1Hr Chart analysis current price is given breakout on 1hr chart, as per 4hr trend retesting is complete, for target and new retrace are you can check chart I share.

You need to wait for retrace area to break and create new HH.

Follow Like Share

Thank you

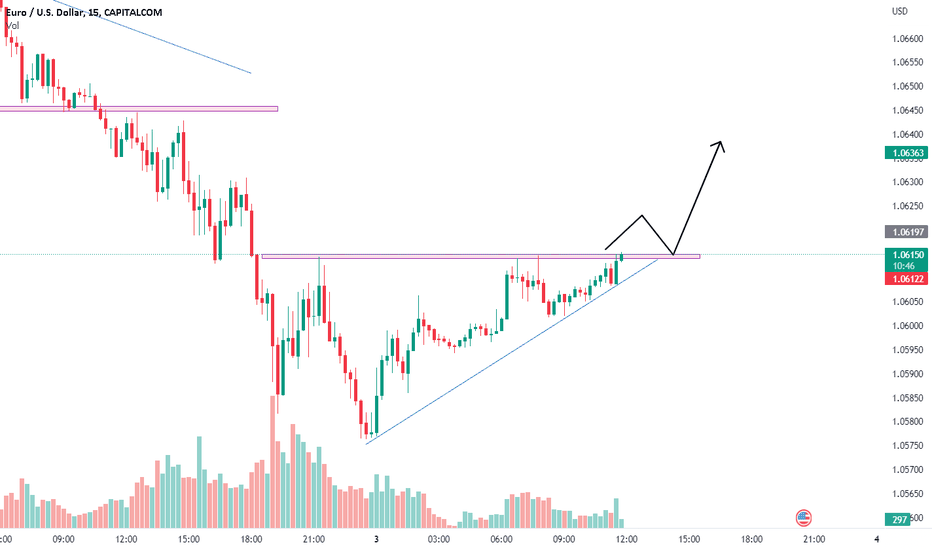

EURUSD Long Trade IdeaThe EURUSD gave a channel break and went straight towards the resistance zone.

If the first resistance zone breaks, then the central resistance zone has a chance to touch it.

Every dip is a buying opportunity.

--------Disclaimer-----------

Charts are for educational purposes. Non-advisory, discretional.

EUR/USD long The pair has broken out from the flag pattern and also has broken above a key level. The closest resistance now is at the 1.1085 zones. There is a good chance that the pair goes till there. It will also have an impact on the eur/cad pair which has been in a range. There is a good chance that now even that pair breaks out from the range. Stop for EUR/USD can be at 1.0943

Huge Falling Wedge & Double Bottom It's important to note that the behavior of the EURUSD pair can be influenced by a wide range of factors such as global economic conditions, political developments, supply and demand, and market sentiment. Therefore, it's important to do your own research, analyze the market conditions, and consult with a qualified financial advisor before making any investment decisions.

However, I can provide an explanation of the chart patterns you mentioned, which are the falling wedge pattern and the double bottom pattern.

The falling wedge pattern is a bullish chart pattern that occurs when the price of an asset is trading within a downward sloping channel but with a contracting range. This pattern is characterized by a series of lower highs and lower lows that form two converging trendlines that slope downward. The falling wedge pattern is formed when the price reaches a support level and starts to consolidate, with the lows getting higher and higher while the highs maintain their level, indicating that the sellers are losing momentum. Once the price breaks above the upper trendline of the wedge pattern, it can indicate a trend reversal, and traders may consider buying the asset.

The double bottom pattern is also a bullish chart pattern that occurs when the price of an asset forms two distinct lows at approximately the same price level, separated by a high. This pattern is formed when the price reaches a support level, bounces off it, and then falls back to the same level before bouncing again. The double bottom pattern indicates a potential trend reversal, and traders may consider buying the asset.

It's important to note that chart patterns are just one of the many tools used by traders to analyze the market, and they should not be relied on exclusively for investment decisions. Additionally, it's essential to use risk management techniques, such as setting stop-loss orders, to limit potential losses if the trade does not go as expected.

In summary, the falling wedge and double bottom patterns are bullish chart patterns that can occur in the EURUSD pair or any other asset, and they indicate a potential trend reversal. However, investors should conduct thorough research and analysis and consult with a financial advisor before making any investment decisions based on chart patterns. The FED news can also influence the price of the US dollar, but it's important to keep in mind that market conditions can change rapidly, and it's crucial to constantly monitor the price movements of the asset and adjust investment strategies accordingly.

EURUSD Forecast 01/03/2023The EUR/USD needs to move through the $1.0597 pivot to target the First Major Resistance Level (R1) at $1.0621 and the Tuesday high of $1.06453. A return to $1.06 would signal a bullish session. However, the EUR/USD would need the stats and the ECB chatter to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0670 and resistance at $1.07. The Third Major Resistance Level (R3) sits at $1.0743.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0548 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0524 should limit the downside. The Third Major Support Level (S3) sits at $1.0451.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.06213). The 50-day EMA slipped back from the 200-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through R1 ($1.0621) and the 50-day EMA ($1.06213) would give the bulls a run at the 100-day EMA ($1.06665) and R2 ($1.0670). A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.06213) would leave the Major Support Levels in play.

Effect Of GFK Consumer Sentiment Index On EURUSDEURUSD dropped by almost 0.06% as inflation fears increased due to Fed's latest statements.

Possible effects for traders

Today, Germany will release the second assessment of Q4 GDP and the GFK Consumer Sentiment Index. Another important event is the U.S. PCE report for January. Overall, the Fed seems ready to continue further rate hikes, supporting the U.S. dollar.

The EURUSD fell due to high demand for the U.S. dollar and returned to the levels of the year's beginning. The pair remained below 1.06000 within the Asian session, opening a potential for a downside correction to 1.05200. Still, today's economic reports may push EURUSD towards 1.07000.

EURUSD Forecast for 21st Feb,2023Its having a lot of selling pressure and due to some dumb reasons bulls are not stepping in. It was very much hilarious to see how it kept on bouncing from 1.07 level. Anyways please keep in mind the following levels for any trade set up today.

20th Feb

DH - 1.07045

DL- 1.06701

21ST FEB

PIVOT - 1.0686

R1-1.0703, S1- 1.0668

R2-1.0721, S2- 1.0652

R3- 1.0755, S3- 1.0618

* Needs to move though 1.0668 and pivot to target 1.0703 and 1.07045.

* Return to 1.07 Level will give a bullish signal

* Failure to move through S1 and Pivot can bring it down to 1.0652

* Levels below 1.06 shall be avoided to avoid major sell off

* 1.0618 level shall limit the sell off

* A move through 1.0668 would support the breakthrough from 1.0703 and 1.07057 and can give a bull run to 1.0721 and 1.07305

* Failure to move through 1.07057 can bring it down to the support levels.

IF YOU LIKE OUR WORK PLEASE SUPPORT US WITH LIKES AND FOLLOW. THANKS

EURUSD Forecast 20th Feb,2023Today we may see a small correction and then again a rally into a Bull Section. Please pay attention to the mentioned levels for any trade set up.

18th Feb

DH - 1.06986

DL - 1.06126

20TH FEB,2023

R1- 1.0724, S1- 1.0638

R2- 1.0754

R3- 1.0840, S3 - 1.0583

The EUR/USD needs to avoid a fall through the $1.0668 pivot to target the First Major Resistance Level (R1) at $1.0724. A return to $1.07 would signal a bullish session. However, the EUR/USD would need ECB member chatter and today’s stats to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0754. The Third Major Resistance Level (R3) sits at $1.0840.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0638 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.06 and the third Major Support Level (S3) at $1.0583.

Looking at the EMAs and the 4-hourly chart, the EMAs send a bearish signal. The EUR/USD sits below the 50-day EMA ($1.07131). Following the bearish cross on Wednesday, the 50-day EMA pulled further back from the 200-day EMA, with the 100-day EMA narrowing to the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.07131) and R1 ($1.0724) would give the bulls a run at the 200-day ($1.07328) and the 100-day ($1.07456) EMAs. A move through the 50-day EMA would send a bullish signal. However, failure to move through the 50-day EMA ($1.07159) would leave the Major Support Levels in play