EURUSD | 15M | Smart Money Concept OutlookMarket Structure:

Price is currently delivering a short-term bullish repricing following a displacement from the internal range low near 1.1775. The sequence of higher highs and higher lows confirms an intraday shift in structure, suggesting that buy-side liquidity has been engineered to facilitate a move into premium pricing.

Liquidity Narrative:

The recent impulsive leg cleared multiple internal liquidity pools, including prior equal highs and resting stop clusters. Price is now trading directly into a well-defined supply zone that aligns with a higher-timeframe premium array. This region is a classic smart money distribution pocket where late buyers often become liquidity for institutional positioning.

Order Flow & Imbalance:

The rally shows clear displacement characteristics with minimal overlap, leaving behind inefficiencies that may act as a magnet should price rotate lower. Additionally, the current consolidation beneath resistance resembles a potential buy-side liquidity build-up. A sweep of these highs would complete the liquidity engineering phase before a probable bearish expansion.

POI (Point of Interest):

Premium supply zone: ~1.1830 to 1.1845

Internal resistance acting as a distribution ledge

Untapped sell-side liquidity resting below 1.1780

Execution Model:

The preferred scenario involves a liquidity sweep above the short-term highs followed by bearish market structure shift on the lower timeframe. Confirmation through displacement and fair value gap formation would strengthen the short thesis.

Draw on Liquidity:

If the distribution unfolds as anticipated, price is likely to rebalance toward the sell-side liquidity pool near 1.1775, completing a premium-to-discount delivery cycle.

Invalidation:

Sustained acceptance above the supply zone with strong displacement would indicate continuation, signaling that the market is seeking higher external liquidity rather than distributing.

Summary:

Price is trading in premium territory after a liquidity-driven expansion. The environment favors patience, allowing smart money to reveal intent. Watch the highs carefully; what appears as breakout fuel often becomes the trapdoor.

Eurusdoutlook

EUR/USD – 1H EURUSD is trading at a discounted price area after a sharp impulsive sell-off, where price has swept sell-side liquidity (LA) and is now stabilizing near equal lows. The recent bearish leg looks exhaustive, suggesting downside momentum is weakening.

Price is currently holding above a key intraday demand / liquidity pocket, forming a base that favors a mean-reversion move rather than continuation lower.

Key Structure & Narrative

Sell-side liquidity taken below prior lows (LA)

Bearish impulse completed, followed by compression and basing

Discount zone respected, aligning with smart-money accumulation logic

Upside Scenario (Primary Bias)

A bullish displacement from current levels can open a path toward the prior H1 supply / imbalance zone (blue)

Acceptance above this zone may lead to a trend continuation toward the higher-timeframe premium area, with projected targets near the 1.2050–1.2080 region

Pullbacks during the move are expected to be corrective, not impulsive

Invalidation

Sustained acceptance below the liquidity sweep low would invalidate the bullish thesis and imply further downside exploration

📌 Bias: Bullish reversal from sell-side liquidity

📌 Framework: Liquidity sweep → accumulation → displacement → expansion

📌 Market State: Transition from markdown to re-accumulation

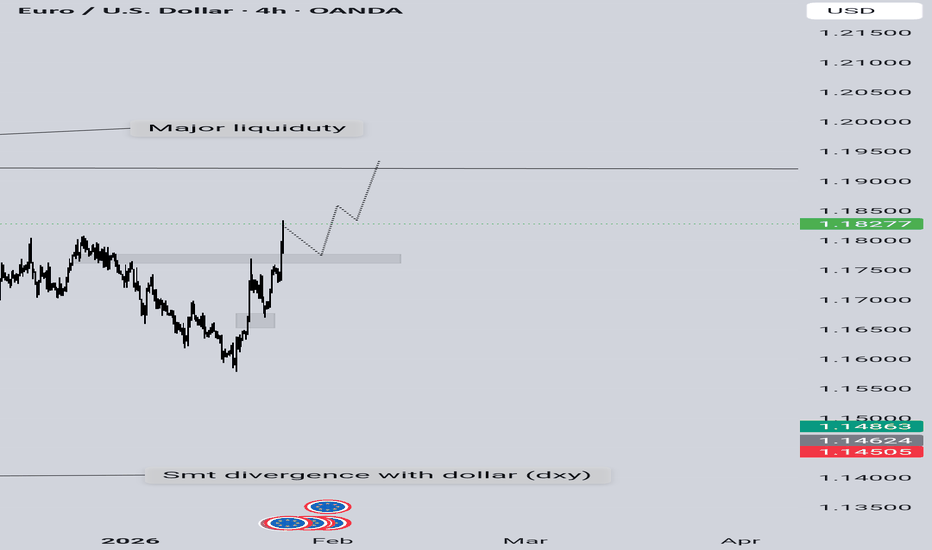

EURUSD HTF BIAS CLARITYThe dollar is free falling as we can see , the eurusd on the other hand is also close to its closest liquidity and major high,

As there is a smt divergence, we can clearly look at eurusd as it didn't make a low but Gbpusd had it , eur/usd is clearly more strong component.

I've made a path , besides it the trade idea will invalidate.

Aligned Timeframes - 3months<1day<4hour.

EURUSD – 15M | Liquidity Sweep → Demand Reaction →Mean ReversionPrice delivered a clean sell-side liquidity sweep into a higher-timeframe demand zone.

Displacement down exhausted, followed by acceptance and stabilization inside value.

Current structure suggests:

Sell-side taken ✔️

Price reacting from HTF demand ✔️

Expectation: mean reversion toward premium / EQ highs

Plan:

Longs favored only after confirmation on LTF

Ideal entry: sweep + reclaim of intraday lows

Targets aligned toward prior supply / liquidity resting above

Invalidation: clean breakdown and acceptance below demand

Bias stays bullish as long as demand holds.

EURUSD – Clean HTF Discount Zone Re-test With Bullish ContinuatiPrice has returned into a deep HTF discount zone, and the reaction from this area aligns well with my overarching bullish narrative. The marked zones represent the regions where I want to see LTF confirmational behavior before considering any long entries.

The structure remains intact as long as price holds above the lower boundary of the zone. A decisive close below that level will invalidate the bullish bias completely and shift the entire directional expectation.

Bullish Path:

• Price taps into the discount zone

• LTF confirms accumulation / BOS

• Price pushes toward the mid-structure continuation level

• Final objective lies near the upper liquidity pool (DOL), assuming underlying conditions remain unchanged

Key Levels Noted on the Chart:

• Entry Interest: All highlighted zones (LTF confirmation required)

• Mid-structure Expectation: Level where I want price to show EDD for continuation

• Final DOL Target: Only if macro conditions remain aligned

• Bias Invalidation: A clean close below the lower major zone

⚠️ ENTRY CONDITION (IMPORTANT):

I will execute the trade only if the LTF mirrors the structural behavior I’m expecting from the HTF.

No LTF confirmation = No trade.

EURUSD - BEARS BACK IN CONTROL?Symbol - EURUSD

EURUSD continues to extend its downward trajectory, maintaining a locally bearish market structure. A decisive breakdown of the nearest support level could accelerate the sell-off, paving the way for fresh lows.

The US dollar remains firm, while the pair shifts its medium-term direction following a breakout from consolidation. The overall structure remains weak, and the decline may extend toward the 1.1400 region.

The primary focus remains on the ongoing consolidation forming within the broader downtrend. Sustained trading below 1.1588 and a daily close beneath 1.1557 would reinforce bearish sentiment, potentially triggering a move toward the liquidity zone at 1.1460 – 1.1400

Resistance levels: 1.1588, 1.1630

Support levels: 1.1557, 1.1461

On the daily timeframe, the market has confirmed a reversal in trend, with a local bearish distribution phase developing. The area of liquidity that may attract price activity lies below 1.1400, suggesting that a medium-term decline remains probable if the price closes beneath 1.1557

Market Sentiment: Optimism for Euro – But Here’s My Plan According to last CME report, there’s clear bullish sentiment across major currencies trading against the US dollar.

We’re seeing naked calls placed at multiple levels above current prices:

1.38 on GBP

1.295 on CHF

In other words: options traders are pricing in further USD weakness.

This aligns with earlier signals:

1.The JPY 'Butterfly' (still active)

2. The EUR 'Ratio spread' — also still in play

So what’s my move today?

✅ First: I exited all positions this morning.

No overexposure ahead of the Fed decision.

🎯 Now: I’m watching for long entries near the ER zone (see chart).

Notably, just below ER low boundary - put at 1.185 (act as support), which appeared in the report.

The option is worth ~$900K — not huge, but significant enough to catch my eye.

I’ll watch closely — and only enter if price respects it.

EURUSD(20250912) Today's AnalysisMarket News:

U.S. initial jobless claims surged to 263,000 in the week ending September 6, reaching a near four-year high. Traders are fully pricing in three Federal Reserve interest rate cuts by the end of 2025.

Technical Analysis:

Today's Buy/Sell Levels:

1.1712

Support and Resistance Levels:

1.1798

1.1766

1.1745

1.1679

1.1658

1.1626

Trading Strategy:

If the price breaks above 1.1745, consider entering a buy position, with the first target price at 1.1766.

If the price breaks below 1.1712, consider entering a sell position, with the first target price at 1.1679

EURUSD(20250909) Today's AnalysisMarket News:

New York Fed Survey: Consumers expect unemployment and job losses to rise, and the Fed is expected to cut interest rates next week.

Technical Analysis:

Today's Buy/Sell Levels:

1.1743

Support and Resistance Levels:

1.1804

1.1781

1.1766

1.1719

1.1704

1.1681

Trading Strategy:

If the price breaks above 1.1766, consider buying, with the first target price at 1.1781.

If the price breaks below 1.1743, consider selling, with the first target price at 1.1719

EURUSD(20250905) Today's AnalysisMarket News:

The US August "Non-Farm Payrolls" report came in at 54,000, below the expected 65,000. The previous figure was revised up from 104,000 to 106,000. Initial jobless claims rose unexpectedly to 237,000 last week, the highest level since June.

Technical Analysis:

Today's Buy/Sell Levels:

1.1648

Support and Resistance Levels:

1.1688

1.1673

1.1664

1.1633

1.1624

1.1609

Trading Strategy:

On a breakout above 1.1648, consider a buy entry, with the first target at 1.1664.

On a breakout below 1.1633, consider a sell entry, with the first target at 1.1624.

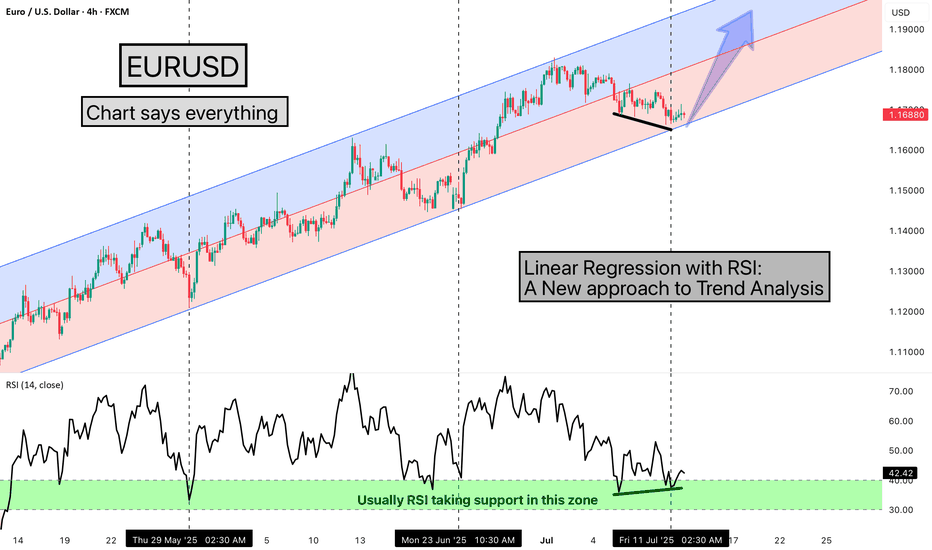

Linear Regression with RSI: A New approach to Trend AnalysisHello Friends,

Welcome to RK_Chaarts,

Today we are going to learn one Method of analysing the chart, here we are using EURUSD chart, and the method we're using is very simple & interesting, We are using the Linear Regression Trend Channel & Relative Strength Index (RSI), What happens in this method, is that we identify a particular zone where the price is making a one-sided move, like if the price is trending upwards, making higher highs and higher lows. We then apply a regression channel to it, and within that channel, we set internal deviation for the upper and lower sides, like 2 or 2.5 or 3 etc., whatever setting it takes.

In this chart, we can clearly see that the 2.5 setting is forming a complete channel, which we've applied for the last two months, from 12th May 2025, when the uptrend started. We've used the 4-hour time frame chart and the RSI. Every time the price hits the bottom of the channel, we can see that the RSI also enters the same zone, between 30-40, and from there, it bounces back.

Currently, the price has again hit the bottom of the regression channel, and the RSI has also gone below 40, between 30-40. And the good thing is that we're seeing a positive divergence in the RSI. So, there's a high possibility that the price might bounce back from here.

It's worth watching what happens next in the market. Nothing is guaranteed here; everything is a game of probabilities. This is one method that we often use, and its results have given us a very good experience. So, let's see what happens next in this chart. This observation is also a good learning experience, which we often encounter, 7-8 times out of 10, in favor of the market, but sometimes it doesn't work, maybe 2-3 times, when the trend changes. So, let's see what happens next.

This post is shared purely for educational purpose & it’s Not a trading advice.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

EUR/USD 4H Analysis – Bearish Outlook with Key Levels📉 EUR/USD 4H Analysis – Bearish Outlook with Key Levels 📊

🔍 Overview:

The EUR/USD pair on the 4-hour chart is showing signs of a potential bearish reversal after testing a strong resistance zone near 1.16000. Price action has rejected this area twice (🔴), confirming it as a significant supply zone. The chart now suggests a descending move toward the strong support zone around 1.12000.

🔑 Key Levels:

🟡 Resistance Zone: 1.15700 – 1.16000

Multiple rejections indicate strong selling pressure.

🟦 Mini Support: Around 1.14550

A minor level where price could react short-term, but not a major barrier.

🔻 Mid-Level Target: 1.13653

Potential bounce zone before continuation downward.

🟥 Strong Support Zone: 1.11500 – 1.12200

Previously held as a launch point for a major rally in May; likely to be tested again.

📈 Scenario Outlook:

Bearish Path Expected:

Price is forming a series of lower highs and appears to be losing bullish momentum.

Target Path (Blue Arrows):

A potential drop toward the 1.13653 level is expected, followed by a deeper drop toward the strong support.

Rebound Possibility:

If the strong support holds, we could see a strong bullish bounce 🔄, potentially creating a longer-term buying opportunity.

💡 Conclusion:

EUR/USD is currently in a correction phase. Traders should watch for a confirmed break below 1.14550 for bearish continuation 📉. A drop to the 1.12000 zone may offer a high-probability reversal setup 📊📍.

🔔 Trading Tip:

Use caution around mini support; aggressive sellers may enter on any weak bounce. Wait for confirmation before entering positions. 🧠📉

EURUSD - FALSE BREAKOUT MAY TRIGGER CORRECTIONSymbol - EURUSD

CMP - 1.1431

EURUSD is appreciating amid a weakening US dollar. However, the pair is facing significant resistance and exhibiting signs of a false breakout, which may precede a corrective movement.

EURUSD is currently testing a key resistance zone within a distribution phase and displaying characteristics of a potential false breakout. While the broader market structure remains bullish - evidenced by the pair breaching local resistance and establishing new highs. The failure to sustain upward momentum and the price consolidating below the 1.1418 level may act as a catalyst for a correction. Concurrently, the US dollar is approaching a support level and may initiate a rebound, exerting downward pressure on EURUSD.

Resistance levels: 1.1440, 1.1424, 1.1418

Support levels: 1.1384, 1.1343

Should the currency pair fail to establish a firm position above 1.1424 during the ongoing resistance retest, the likelihood of a downward consolidation increases, potentially presenting an opportunity for short positioning. The anticipated correction could extend toward the identified support zones before the broader uptrend resumes.

EUR/USD 4H Chart Analysis – May 29, 2025🔍 Market Structure Overview

Current Price: 1.12753

Key Zone: Price is hovering at a critical resistance-turned-support area.

🧱 Key Levels

Resistance Zone: 1.15639 (🔝 Main Target)

Support Zone: 1.10736 (🔻 Main Target)

Intermediate Zones:

Target One (Bullish): 1.14139 📈

Target One (Bearish): 1.11687 📉

🔄 Scenario Outlook

📈 Bullish Scenario:

If price holds above the 1.1275 zone, we could see a climb towards:

1.14139 (minor target)

1.15639 (major resistance & final target)

🚀 Breakout above could indicate continuation of higher highs.

📉 Bearish Scenario:

Failure to hold above 1.1275 could push price lower:

First support at 1.11687

Final drop towards 1.10736 support zone

🪓 Breakdown could confirm lower low structure.

🧠 Conclusion

This is a decision point zone. Wait for confirmation before jumping in. A strong bullish or bearish candle at this level will dictate the next move. Risk management is key here! 🎯

EURUSD Chart Analysis : An Elliott Wave Approach Hello friends, welcome to RK Charts!

Today, we'll analyse the EURUSD chart using Elliot Waves. This study is based on Elliot Wave theory and structure, which enables multiple possibilities. Please note that the possibilities outlined here are not definitive predictions, but rather potential scenarios.

The provided information is for educational purposes only and should not be considered trading advice. There is a risk of being completely wrong, and users are warned not to trade or invest solely based on this study.

We are not responsible for any profits or losses incurred. Individuals should consult a financial advisor before making any trading or investment decisions.

Now, let's dive into the analysis. According to Elliot Wave principles, we're currently in a corrective pattern, which consists of ((A)), ((B)) and ((C)) patterns. We've completed ((A)) and ((B)) and are now unfolding ((C)).

Within ((C)) we expect five sub-divisions, labeled as intermediate waves (blue bracketed): blue (1), (2), (3), (4) & (5). Almost four of these sub-divisions are completed, and we've just begun the (5).

We've set an invalidation point at 1.1065, which is the recent low. If this low is not breached, we'll likely continue unfolding the (5) wave of ((C)), which should break above the high of wave (3).

However, if the low is breached, it's possible that wave (4) is undergoing a double correction.

Both scenarios are possible, and we'll continue to monitor the market's unfold.

Scenario 1

Scenario 2

This study is a deep dive into Elliot Wave counts, aligned with the rules and principles of Elliot Wave theory, as well as higher time frame and higher degree analysis.

I hope this analysis based on Elliot Wave theory has helped you understand the chart better and learn something new. Please keep in mind that this is for educational purposes only.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Charts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Monstrous Volatility following Tariffs and NFP ForecastsHello Traders, It's that time of the month! :D Not what you are thinking.. But It's NFP Week! What an eventful week it's been already for the Euro. 450 Pips and we still have 3 more trading sessions to complete. I looked back two years and still did not find a week of matched volatility. A Major upside push has seen EurUsd tear it's way back from the depths of near Par (1.04) to well back inside the Monthly range between 1.104 and 1.056.

Trump Tarriff speeches, and fueled further by weak U.S. ADP data on Wednesday has given the Euro a monstrous exscuse to gain more value than it's seen in Years aginagst the dollar. Prepare for a wild end of the week with Jobs data forecasted to improve slighlty across the past data point.

What prices do we like moving into NFP day?

-Bullish targets are a tap into 1.08740, Weekly Resistaance Level

-Bearish targets could be 1.074

Otherwise we have some 1hr and 4hr Zones in the middle which could provide good risk/reward trade ideas.

Please leave a Rocket if you enjoyed and Follow for more Analysis.

EURUSD - PRE BREAKOUT CONSOLIDATION - ASCENDING TRIANGLESymbol - EURUSD

CMP - 1.0485

The EURUSD pair continues to display bullish signals, suggesting the potential for sustained upward movement. However, significant resistance lies ahead, and the market is currently undergoing a pre-breakout consolidation phase. The U.S. dollar is experiencing a corrective phase, influenced by economic data, domestic political developments, and indications from both President Trump and Federal Reserve Chairman Jerome Powell regarding the possibility of an imminent interest rate cut.

The euro is benefiting from the weakening dollar, though the duration of this trend remains uncertain, particularly in the context of the ongoing trade tensions between the U.S. and Europe.

From a technical perspective, the current chart suggests a bullish outlook. An ascending triangle is forming within the prevailing uptrend, generally indicative of market optimism. Key focus is placed on the pattern’s base, with resistance located at the 1.0530 level.

Support levels: 1.0450, 1.0400

Resistance levels: 1.0530

Should the dollar continue its downward trajectory, the pair is poised for potential growth. A retest of the trend support level, possibly marked by a false breakout, could occur before a decisive breakout. A successful breakout and sustained consolidation above the 1.0530 resistance level may trigger further upward movement.

EURUSD - EXPECTING UPSIDE AFTER BREAKOUT OF RESISTANCESymbol - EURUSD

CMP 1.0360

EURUSD is attempting to capitalize on the recent correction in the U.S. dollar. The price is currently undergoing a retest of consolidation resistance, aiming for a potential breakout and further upward movement. Following an initial attempt to breach the downtrend resistance, the price entered a consolidation phase, establishing a range between 1.0530 and 1.0210. Within this setup, a local consolidation channel has formed, with the price testing the resistance at 1.0380 The market is still in the process of confirming a trend reversal and seeking to strengthen in the context of the dollar's correction.

The fundamental landscape remains complex, influenced by the Trump's ongoing tariff dispute and the broader economic crisis.

Resistance Levels: 1.0380, 1.0530

Support Levels: 1.0330, 1.0210

A breakout above the 1.0380 resistance level, followed by price consolidation above this area, could signal further growth, driven by the distribution of the accumulated potential.

EUR/USD Daily Chart Analysis – Smart Money Perspective

Current Market Bias: Bearish

The price action indicates that the overall structure remains bearish, with lower highs and lower lows being formed. Despite recent bullish retracements, the price has failed to break key resistance levels, signaling that sellers remain in control.

Key Areas on the Chart:

1. Order Block (OB) & Fair Value Gap (FVG) Zone:

• The highlighted gray zone represents an order block (OB), which is a supply area where institutions likely placed large sell orders.

• The presence of a fair value gap (FVG) within this zone indicates an inefficiency in price, making it a strong area for potential reversals.

• Price recently tapped into this area and reacted downward, confirming bearish momentum.

2. Liquidity Grab Possibility:

• The lower dashed line represents a previous swing low, where liquidity (stop-loss orders) is likely resting.

• Smart Money often seeks liquidity before reversing or continuing trends.

• There is a high probability that price will sweep this low before any potential bullish move occurs.

3. Market Structure Shift for a Bullish Setup:

• Although the bias remains bearish, a market structure shift (MSS) is required before considering any long (buy) setups.

• A key level to watch is 1.05351, where a break above could signal a reversal.

• Until then, selling pressure is likely to dominate.

Conclusion & Trade Plan:

• Bearish bias remains active.

• Price might sweep the previous low to grab liquidity before a potential reversal.

• A confirmed market structure shift above 1.05351 is required for bullish confirmation.

• Until that happens, traders should focus on shorting opportunities near supply zones or order blocks.

Final Thought:

By following Smart Money Concepts (SMC), traders can align their trades with institutional movements. Patience is key—wait for confirmations before entering positions. Keep an eye on liquidity sweeps and market structure shifts for the best trade setups.

What Next In EURUSD

Key Levels:

1. Resistance Levels:

o The red supply zone above (around 1.04500) represents a key resistance area.

Price has rejected this level in the past, showing that sellers are active there.

o Another small resistance zone is identified near 1.04390 from previous candles.

2. Support Levels:

o The light blue demand zone below (1.04126) acts as a significant support area.

Buyers stepped in here previously, causing a rally.

o A second support level is near 1.04100, aligning with

the current price's point of interest (POI).

________________________________________

Market Behavior:

1. Range-Bound Price Action:

o The note on the chart mentions that the price was in a range yesterday. This is evident as

price oscillates between the resistance zone (1.04500) and

the demand/support zone (1.04126).

o Breakout confirmation (upward or downward) is crucial for clarity on the next trend.

2. Current Price:

o The price is currently testing the demand zone (POI Level). If it holds, we may see a

bounce back toward resistance at 1.04500.

________________________________________

💡 Technical Indicators:

1. Exponential Moving Average (EMA):

o The price is hovering near the blue EMA line, which is likely a 50-period EMA. This suggests

a mixed market sentiment where buyers and sellers are evenly matched.

o A strong price reaction above or below the EMA can indicate the next potential trend.

________________________________________

📊 Supply and Demand Zones:

1. Supply Zone:

o The red supply zone at the top indicates strong selling pressure. Price will need strong

momentum to break through it.

2. Demand Zone:

o The light blue demand zone has seen active buyers before. It's a critical level for bulls to

maintain to avoid further downside.

________________________________________

📊 Trading Plan:

1. For Buyers:

o Wait for a bullish reaction from the demand zone (1.04126) and a possible breakout above

the range (1.04500) to target higher levels.

o A bounce off the EMA would also signal bullish momentum.

2. For Sellers:

o Look for a rejection at the resistance zone (1.04500) or a confirmed break below the

demand zone at 1.04126 for shorting opportunities.

________________________________________

⚠️Recommendation:

• Wait for Breakout:

o Avoid trading in the current range until a breakout occurs, as it is unclear if the price will

move higher or lower.

o Monitor for volume and candlestick patterns at key levels (rejections or breakouts).

This chart currently exhibits consolidation, requiring a patient approach for clarity on the

next directional move.

👉 Always follow TP/SL to protect your capital and maximize profits!

Stay tuned for updates once the confirmations are in place!

Please support me with your likes and comments to motivate me to share more

analysis with you and share your opinion about the possible trend of this chart

with me !

📢Best Regards , Silver Wolf Traders Community

Disclaimer: This is for educational purposes only.

Always trade responsibly and manage your risk effectively

EURUSD - PRICE ACTION CONFIRMS TREND REVERSALSymbol - EURUSD

The EURUSD currency pair has broken its previous trend, emerging from a consolidation phase and reaching new highs, which signals a definitive shift in market direction. The primary focus now shifts to the resistance zones, where significant market struggles are expected. The ongoing correction of the US dollar, largely driven by political and geopolitical factors, presents opportunities within the forex market. The EURUSD has been strengthening for the past month, suggesting promising prospects, particularly if the dollar's correction continues. This week, attention is on the Federal Reserve's rate decision and the inflation meeting, which could provide further support for the current market movement.

From a technical perspective, the key support level to watch is at 1.0445. If the bulls are able to maintain this support, the price may move towards the 1.0600 - 1.0700 range in the short to medium term.

Resistance levels: 1.0530, 1.0610

Support level: 1.0445

The price has already tested the 1.0445 level. A potential false breakdown could occur, aimed at capturing liquidity, after which the pair is likely to resume its upward momentum, driven by renewed interest from buyers in the euro.

EURUSD - TREND CHANGED ?EURUSD is poised for a potential bullish rally, having broken the extended downtrend and entering a phase of consolidation, which could provide an opportunity for further upward momentum. Although the broader global trend remains bearish, it is premature to discuss a trend reversal, as the price is still facing significant resistance at 1.0440. However, a consolidation base is forming in this area, and if the US dollar continues its corrective movement, EURUSD may have the potential to confirm a trend shift. Should the bulls manage to surpass 1.0448 and establish a firm position above this level, a move towards 1.0610 and potentially higher could be in the cards.

Resistance levels: 1.0450, 1.0610

Support levels: 1.0330, 1.0225

From a technical standpoint, attention is on the immediate level of 1.0450. A breakout and sustained trading above this zone could present an ideal entry point for long positions.