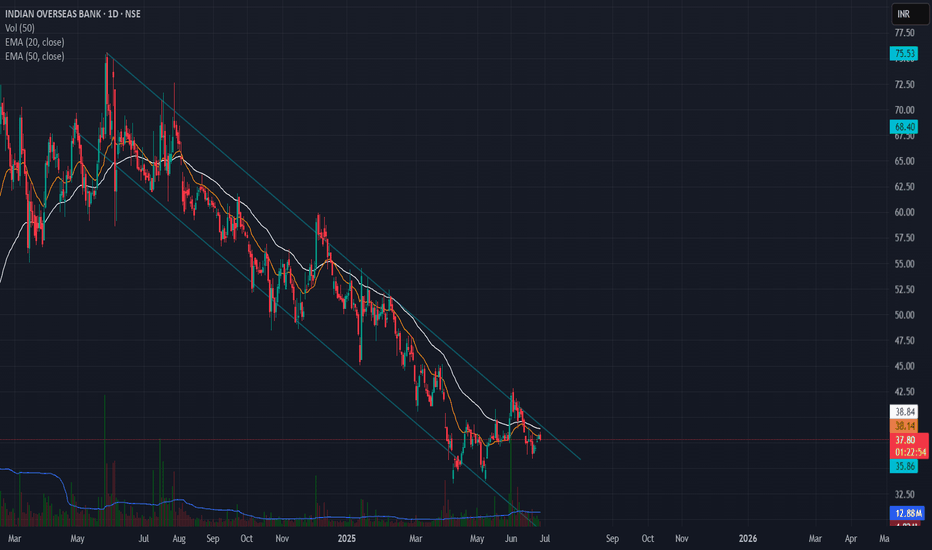

Indian Overseas Bank (IOB) - Falling Channel Breakout Setup📈 Indian Overseas Bank (IOB) – Falling Channel Breakout Setup

Watching a classic falling channel on the daily timeframe with multiple touches on both trendlines. Recent breakout above ~38.8 confirms the channel break.

✅ Planned Trade Details:

- Entry above 38.8 (confirmation)

- Stop-loss: 35.90

- ATR-based stop option: ~37.45 for tighter risk control

- Target zone: 48.80 based on channel height projection

Volume confirmation and follow-through will be key for validating the breakout. Tracking this for a positional swing trade.

Fallingchannelbreakout

Falling Channel Pattern in Indian Overseas Bank📉 IOB (Indian Overseas Bank) - Falling Channel Setup

🔍 Daily Chart Analysis – June 26, 2025

IOB has been trading within a well-defined falling channel since early 2024. Price is currently testing the upper boundary of the channel but hasn’t confirmed a breakout yet.

🔑 Key Observations:

Structure: Clearly respecting the falling channel.

Moving Averages: Price is hovering around short-term EMAs (20 & 50) and below the both EMA, indicating weak momentum.

Volume: No significant volume surge yet to support a breakout.

Confirmation needed: A close above the trendline (~₹39–40) with volume would be an early sign of bullish reversal.

🎯 Watch for:

Breakout above ₹40 with increased volume = potential short-term rally.

Failure to break may result in retesting lower channel support near ₹33–34.

🧠 Adding this to my breakout watchlist. Will reassess if it closes outside the channel.

KALAMANDIR : Falling Channel pattern#KALAMANDIR #chartpatterntrading #fallingchannelpattern #channelbreakout #breakoutstock

KALAMANDIR : Swing Trade

>> Breakout stock

>> Falling Channel pattern breakout

>> Good Strength & Volume Buildup

>> Stock in Momentum

Swing Traders can lock profits @10% & keep trailing

Disc : Stock Charts shared are for Learning purpose, not a Trade recommendation

Consult a SEBI Registered Advisor before taking position in it.