XAUUSD (H2) – Buying priority todayGold holds above 4,400 on safe-haven flows | Trade liquidity, don’t chase

Quick summary

Gold started the week with strong momentum and pushed above 4,400 during the Asian session as global markets rotated into safe-haven assets. Geopolitical risk is the key driver after reports of US ground strikes in Venezuela and the detention of President Nicolás Maduro and his wife. With that backdrop, my plan today is simple: prioritize BUY setups at liquidity zones, and avoid FOMO while the price is elevated.

1) Macro context: Why gold is supported

When geopolitical risk escalates, capital typically flows into gold.

Headline-driven sessions often bring:

✅ fast pumps, ✅ liquidity sweeps, ✅ larger wicks/spreads.

➡️ The safest execution is waiting for pullbacks into predefined buy zones, not chasing highs.

2) Technical view (based on your chart)

On H2, gold has bounced sharply and your chart highlights clear execution areas:

Key levels for today

✅ Buy zone: 4340 – 4345 (trend/structure pullback zone)

✅ Strong Liquidity: lower support band (marked on chart)

✅ Sell zone: 4436 – 4440 (near-term supply / reaction area)

✅ Sell swing / target: 4515 – 4520 (higher objective / profit-taking zone)

3) Trading plan (Liam style: trade the level)

Scenario A (priority): BUY the pullback into 4340–4345

✅ Buy: 4340 – 4345

SL (guide): below the zone (adjust to spread / lower TF structure)

TP1: 4400 – 4410

TP2: 4436 – 4440

TP3: 4515 – 4520 (if momentum continues with headlines)

Logic: 4340–4345 offers a cleaner R:R than chasing above 4,400.

Scenario B: If the price holds above 4,400 and only dips lightly

Look for a buy only on clear holding signals near the closest support/strong liquidity (M15–H1).

Still not recommending FOMO entries in headline volatility.

Scenario C: SELL reaction (scalp) at supply

✅ If price tags 4436–4440 and shows weakness:

Sell scalp: 4436 – 4440

SL: above the zone

TP: back toward 4400–4380

Logic: This is a near-term supply area — good for quick profit-taking, not a long-term reversal call.

4) Notes (avoid getting swept)

The Asian session can spike hard on headlines → wait for pullback confirmations.

Reduce size if spreads widen.

Only execute when price hits the level and prints a clear reaction (rejection / engulf / MSS).

What’s your plan today: buying the 4340–4345 pullback, or waiting for price to push into 4515–4520 before reassessing?

Fibomatrix

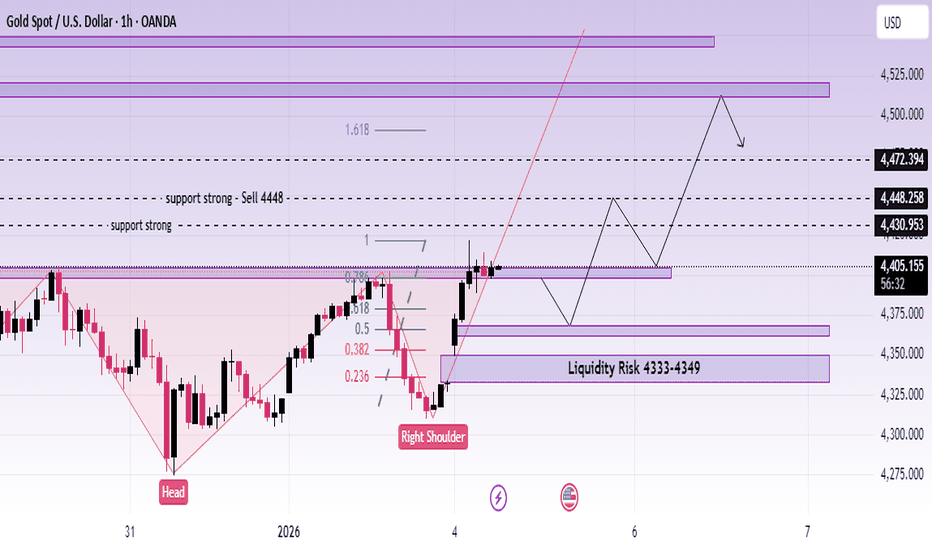

XAUUSD (H1) – Inverse Head & Shoulders formingLana focuses on pullback buys above key liquidity 💛

Quick overview

Timeframe: H1

Pattern: Inverse Head & Shoulders confirmed on the chart

Bias: Bullish continuation while price holds above neckline

Strategy: Buy pullbacks into liquidity zones, avoid chasing highs

Technical view – Inverse Head & Shoulders

On H1, gold has completed a clean Inverse Head & Shoulders structure:

Left shoulder: Formed after the first sharp sell-off

Head: Deeper liquidity sweep, followed by strong rejection

Right shoulder: Higher low, showing weakening selling pressure

Neckline: Around the 4030–4040 resistance zone (now being tested)

The recent breakout and strong follow-through suggest buyers have regained control. As long as price holds above the neckline, the structure favors continuation to the upside.

Key levels Lana is watching

Primary buy zone – Pullback entry

Buy: 4363 – 4367

This area aligns with prior structure support and sits inside a healthy pullback zone. If price revisits and shows acceptance, it offers a good risk-to-reward buy.

Liquidity risk zone – Deeper pullback

Liquidity risk: 4333 – 4349

If volatility increases and price sweeps deeper liquidity, this zone becomes the secondary area to watch for bullish absorption.

Upside targets & resistance

High liquidity area: 4512 – 4517

ATH zone: Above the previous all-time high

These zones are expected to attract profit-taking or short-term reactions, so Lana avoids chasing price near these levels.

Fundamental context (market drivers)

Geopolitics: Rising tension after comments about potential military intervention in Colombia adds background support for gold as a safe haven.

Goldman Sachs: Views Venezuela-related developments as having limited impact on oil, keeping broader commodity sentiment stable.

ISM Manufacturing PMI (US): Any sign of slowing manufacturing can pressure USD and indirectly support gold.

Overall, fundamentals remain supportive for gold, reinforcing the bullish technical structure.

Trading plan (Lana’s approach)

Prefer buying pullbacks into 4363–4367 while structure holds.

Be patient if price dips into 4333–4349 and wait for confirmation before entering.

If price falls back below the neckline and fails to reclaim it, Lana steps aside and reassesses.

This is Lana’s personal market view and not financial advice. Please manage your own risk before trading. 💛

XAUUSD (H2) – Liam Plan (Jan 02)Price is compressing in a structure, wait for the trendline break to choose direction 🎯

Quick summary

After the strong bearish BOS, gold is rebounding and compressing inside a diagonal structure (triangle/flag-like). Today the clean approach is confirmation trading:

SELL only after a confirmed break of the trendline (4348–4350) as marked on your chart.

SELL reactions at the upper supply / VAL zones (4460–4463 and 4513–4518).

BUY is secondary — only if price holds the 4400–4405 key support and shows a clear reaction on lower timeframes.

Macro backdrop (CME FedWatch)

Probability Fed holds rates in January: 85.1%

Probability of a 25 bps cut in January: 14.9%

By March: probability of 25 bps cumulative cut: 51.2%, hold 42.8%, 50 bps cut 5.9%

👉 This keeps markets sensitive to USD / yields expectations. Gold can bounce technically, but volatility spikes are likely — so we stick to levels + confirmation.

Key Levels (from your chart)

✅ Sell zone 1: 4513 – 4518

✅ Sell VAL: 4460 – 4463

✅ Reaction / flip zone: 4400 – 4405

✅ Breakdown trigger: 4348 – 4350 (sell upon confirmed trendline breakout)

Trading scenarios (Liam style: trade the level)

1) SELL scenarios (priority)

A. SELL on trendline breakdown confirmation

Trigger: clean break + close below 4348–4350

Entry: sell the retest back into the broken trendline

TP1: 4320–4305

TP2: 4260–4240

TP3: deeper extension (towards the 41xx area) if momentum expands

Logic: This is the clearest “trend confirmation” on your chart. No chasing — let price confirm first.

B. SELL reaction at supply

Sell: 4460–4463 (VAL)

Stronger sell: 4513–4518 (premium supply)

Only sell with visible weakness / rejection on M15–H1.

2) BUY scenario (secondary – reaction only)

Buy zone: 4400–4405

Condition: hold the zone + print higher lows on lower TF

TP: 4460 → 4513 (scale out)

Logic: This is a key support/flip area. If it holds, price can rotate up to test supply above before the next decision.

Key notes

Compression often creates false breaks — don’t trade mid-range.

Two clean plays only: break 4348–4350 to sell with confirmation, or retrace to 4460/4513 to sell the reaction.

What’s your bias today: selling the 4348 breakdown, or waiting for 4460–4463 for a cleaner pullback sell?

XAUUSD (H1) – Liam View: Strong Bullish Breakout→ short-term bearish shift, prefer selling the pullback | Quick reaction buy at 4330–4333

Quick summary

Gold just printed a very aggressive dump with clear BOS (Break of Structure) — a short-term bearish shift is now in play. Price is currently in a technical rebound, so the cleaner plan is:

Don’t chase shorts at the lows

Wait for a pullback into 4458–4462 to sell from a premium supply zone

If price sweeps back down, look for a quick reaction buy at 4330–4333

1) Technical view (based on your chart)

The sell-off looks like a classic liquidity dump: large bearish candles, multiple supports broken → confirms bearish pressure intraday.

After a dump, the market often retraces into supply (re-distribution) before the next leg.

The 4330–4333 area is marked as a support that already “tested liquidity” — it can still provide a bounce, but it’s more of a scalp zone, not a full reversal yet.

2) Key Levels

✅ Sell zone: 4458 – 4462 (supply / pullback short)

✅ Buy zone: 4330 – 4333 (support / quick reaction)

3) Trading scenarios (Liam style: trade the level)

Scenario A (priority): SELL the pullback

✅ Sell: 4458 – 4462

SL guide: 4470 (or above the most recent lower-TF swing high)

TP1: 4400 – 4390

TP2: 4333

TP3: extension lower if structure continues to break down

Logic: After a strong BOS, 4458–4462 is where you get a better short entry — avoid selling late.

Scenario B: BUY reaction at support (scalp only)

✅ Buy: 4330 – 4333

SL guide: 4322–4325

TP: 4370 → 4400 (scale out)

Logic: This zone can spark a technical bounce. Only buy with clear holding signals on lower timeframes (M5–M15) — no catching falling knives.

4) Confirmation rules (avoid noise)

If price reaches 4458–4462 and fails to reclaim above → SELL bias stays strong.

If 4330 breaks and closes below → stop looking for buys and focus on pullback sells.

5) Risk notes

No mid-range entries — only act at 4330–4333 or 4458–4462.

Risk per trade: max 1–2%.

After a dump, spreads and wicks can expand — reduce size.

Which side are you leaning today: selling 4458–4462, or waiting for 4330–4333 to buy the reaction bounce?

XAUUSD (H1) – Early-week Selling biasSharp drop from ATH, look to sell the pullback into resistance & liquidity

Strategy summary

Gold opened the week with a fast sell-off (roughly a $20 drop intraday), signalling strong profit-taking after the All-Time High sweep. With the current structure, my focus is SELL on pullbacks, using the trendline / resistance zones and nearby liquidity clusters as execution areas.

1) Technical read (H1 – based on your chart)

All-Time High remains a major psychological ceiling. After an ATH sweep, a corrective leg is common.

Price is trading below the Buyside Liquidity band, which often gets retested before the next directional move.

Key levels on your chart:

Sell zone: 4494 – 4497 (main pullback sell area)

Strong Liquidity: around 4474 (reaction / decision point)

Lower liquidity supports: 4441 – 4444 and 4403 – 4406 (areas to watch for reactions)

2) Trade plan (Liam style: trade the level)

Scenario A (priority): SELL the pullback

✅ Sell zone: 4494 – 4497

SL (guide): above the zone (refine on lower TF / spread)

TP1: 4474

TP2: 4441 – 4444

TP3: 4403 – 4406

Logic: This is a clean resistance / pullback area. Selling the reaction is safer than chasing shorts at the lows.

Scenario B: BUY reaction at lower liquidity (scalp only)

If the sell leg extends into support, you can consider a short-term bounce trade:

Buy: 4441 – 4444 (quick reaction zone)

Deeper buy: 4403 – 4406 (better value zone)

Only take buys with clear holding signals on lower timeframes — no catching falling knives.

3) Macro context (news) – why gold is swinging

The sharp move lower suggests markets are re-pricing risk after an extended rally.

US–Israel tensions are elevated, with Trump and Netanyahu reportedly clashing over Gaza, Iran and post-war order — geopolitical risk can trigger fast liquidity-driven swings.

In headline-driven sessions, gold often runs a two-step pattern: liquidity sweep → correction → direction. That’s why I’m sticking to level-based execution and avoiding FOMO.

4) Risk notes

Don’t chase shorts during heavy red candles.

Focus on 4494–4497 for shorts and scale out at the TP levels.

Max risk per trade: 1–2%.

What’s your bias for this week: selling the 4494–4497 pullback, or waiting for 444x/440x to buy a reaction bounce?

XAUUSD (H4) – Weekly StrategyBull trend still in control | Buy the pullback at 4430, sell reaction at 4573, target 4685

Weekly strategy snapshot

On H4, gold is still holding a strong bullish structure inside the rising channel. Price has already expanded higher, so next week I’m not chasing — I’m prioritizing a trend buy on pullback into liquidity. Above, the 1.618 Fibonacci zone is a clean area for a reaction sell / profit-taking.

1) Technical view (based on your chart)

H4 structure remains bullish: higher highs + higher lows.

Price is extended after the breakout, so mid-range entries are risky.

The chart clearly marks Sellside Liquidity – Buy 4430 as the key “reload” area.

Upside zones: Sell 4573 (Fibo 1.618) and the extension target 4685.

2) Key Levels for next week

✅ Buy zone (Sellside Liquidity): 4430

✅ Sell reaction (Fibo 1.618): 4573

✅ Extension target: 4685

3) Weekly trading scenarios (Liam style: trade the level)

Scenario A (priority): BUY the pullback with the trend

✅ Buy: around 4430 (wait for a liquidity sweep + reaction)

SL (guide): below the 4430 zone (refine on lower TF / spread)

TP1: 4530 – 4540

TP2: 4573

TP3: 4685 (if momentum continues)

Logic: After a breakout, price often returns to “collect liquidity” before the next leg higher. 4430 is the cleanest dip-buy location on this structure.

Scenario B: SELL reaction at premium Fibonacci (short-term)

✅ Sell: around 4573

SL (guide): above the zone

TP: back toward value / potentially toward 4430 if a clear correction develops

Logic: 4573 is a premium area where profit-taking often shows up. This is a reaction sell — not a long-term bearish bias.

4) Macro context (from your news) & gold impact

Trump’s comments on tariffs, a sharper reduction in the trade deficit, and strong GDP messaging can keep markets sensitive to USD / yields expectations. That can create sharp intraday swings.

At the same time, policy and geopolitical uncertainty still supports safe-haven demand — which is why the best approach remains: follow the trend, enter at liquidity.

5) Risk notes

Don’t chase at highs.

Only act at the levels: 4430 or 4573.

Max risk per trade: 1–2%.

What’s your bias for next week: buying the 4430 pullback, or waiting for 4573 to sell the reaction?

XAUUSD (H1) – Trading Buy LiquidityStay bullish with the rising channel, buy the pullback into liquidity

Quick view

Gold is still moving inside a rising channel. After the strong impulsive push, price is now consolidating / compressing. For today, I’m prioritizing BUY setups at liquidity + trendline retests, while keeping a reaction SELL plan at the premium Fibonacci zone above.

Macro context (why volatility can stay elevated)

Trump signing a record number of executive orders and the growing shift of power towards the executive branch increases policy uncertainty (tariffs, federal cuts, geopolitical moves). In uncertain environments, flows often rotate into safe-haven assets like gold. That said, this kind of headline risk can also move the USD sharply, so the best approach is still: trade the levels, not emotions.

Key Levels (from your chart)

✅ Buy zone Liquidity: 4410 – 4413

✅ Buy trendline retest: 4480 – 4483

✅ Sell zone (Fibo 1.618): 4603 – 4606

Today’s trading scenarios (Liam style: trade the level)

1) BUY scenario (priority)

A. Trendline retest = best structural entry

Buy: 4480 – 4483

SL: below the zone (guide: 4472–4475, adjust on lower TF / spread)

TP1: 4515 – 4520

TP2: 4580 – 4600

B. Deeper liquidity buy (if we get a sweep)

Buy: 4410 – 4413

SL: below the zone (guide: 4402–4405)

TP: 4480 → 4520

Logic: These are the cleanest liquidity areas on the chart. No chasing mid-range — I only act when price returns to the zone and reacts.

2) SELL scenario (reaction only — no chasing)

Sell: 4603 – 4606

SL: 4612

TP1: 4550

TP2: 4483

Logic: The 1.618 premium zone often attracts profit-taking. I only sell if price taps the zone and shows clear weakness on the lower timeframe.

Notes

If price keeps holding the trendline and printing higher lows → BUY bias remains stronger.

If we break the trendline and fail to reclaim it → reduce size and wait for a fresh structure.

Which side are you leaning today: buying the pullback, or waiting for 4603–4606 to sell the reaction?

XAUUSD – Bullish Channel AnalysisLana stays bullish, waiting for pullbacks to buy 💛

Quick summary

Trend: Clearly bullish, price is moving inside a well-defined rising channel

Timeframe: H1

Current state: Price is near the upper part of the channel, so a psychological reaction near Fibonacci extension is possible

Strategy: No chasing. Lana prefers buying pullbacks into value/liquidity zones

Market context

Gold remains strong into year-end, even as liquidity becomes thinner. The current push higher looks very momentum-driven, and Fibonacci extension areas often act as short-term “reaction zones” before the next directional decision.

On the longer-term side, bold forecasts like Jim Rickards’ view (gold potentially reaching very high levels in 2026) show that bullish sentiment in precious metals is still alive. Still, for Lana, short-term trading must follow structure and zones, not headlines.

Technical view: price inside a rising channel

On the chart, gold is respecting a clean ascending channel, consistently printing higher lows.

Key observations:

The upper Fibonacci extension area around 4603–4607 is a psychological barrier, where a short-term pullback can happen.

The best entries are usually found when price returns to value areas inside the channel, not at the top.

Key levels Lana is watching

Primary buy zone – Value Area (VL)

Buy: 4482 – 4485

This is a value area inside the rising channel. If price pulls back here and structure holds, continuation to the upside becomes more likely.

Deeper buy zone – Liquidity POC

Buy: 4419 – 4422 (POC)

This level shows heavy prior accumulation on the Volume Profile. If year-end liquidity causes a deeper shakeout, this zone becomes a safer area to look for buys.

Trading notes

4603–4607 is a psychological resistance zone — not a place to chase longs.

Only buy when price reaches the planned zone and shows confirmation on the lower timeframe.

With thin liquidity: reduce position size and keep risk tight.

Lana’s note 🌿

The trend is strong, but patience at the right entry matters more than catching every move. Lana follows structure, not emotions.

GOLD | Is This the FINAL Short Setup Before the Next Move? Welcome Traders!

Forget the noise — focus on structure and sentiment. Gold is holding firm near $3,950, but the macro backdrop just got tighter.

The question now: Can demand strength beat Powell’s new hawkish tone?

1. Market Insight – Powell vs. Demand

Two forces are pulling Gold in opposite directions:

🐻 Bearish Catalyst:

Powell hinted that another rate cut in December is unlikely, and the Fed plans to continue balance sheet reduction — strengthening the USD and weighing on non-yielding assets like Gold.

🐂 Bullish Support:

Persistent central bank demand and ETF inflows continue to provide a safety net, tightening overall Gold supply.

🎯 Outlook:

Expect sideways compression before a potential breakout. We’re stalking the strategic Sell Zone to align with the bearish fundamentals.

📊 2. Structure Check – Where Bears Wait

The market is approaching a major confluence zone:

SELL LIMIT Zone: $4,057 — intersection of the descending trendline and key horizontal resistance.

Immediate Support: $4,005 — target for the first leg down.

3. Action Plan – The Short Sniper Setup

Entry: SELL LIMIT $4,057

Stop-Loss: just above the descending trendline

TP1: $4,005 (short-term support retest)

Extended Target: $3,938 if breakdown accelerat

Powell’s hawkish tone is clear — but will bears finally take control from $4,057$, or will central bank demand defend the rally?

GOLD DIP ALERT! Sniping the $3,89x FIBO Floor Ahead of FOMC!FranCi$$_FiboMatrix Quick Insight (H1/M30 Focus)

Welcome Traders! Gold paused its sell-off near $4,065 as safe-haven demand returned pre-FOMC. Dovish Fed expectations are weakening the USD, setting the stage for a major rally. This is the final BUY ON DIPS setup!

🧠 INSIGHT & LOGIC

Fundamental Anchor: Weak US inflation and strong expectations for a Fed rate cut are the key drivers limiting downside. Long-term bias is Bullish.

Technical Focus: We are tracking the final deep correction to the $3,89x zone (Fibo 1.5 - 1.618 Extension). This is the ultimate technical floor for the ATH rally.

Action Plan: WAIT for the price to hit this extreme zone and confirm reversal (H1/M30).

🎯 KEY ACTION ZONES

🔥 CRITICAL BUY: $3,89x region ($3,881.435$).

Strategy: BUY on confirmation here.

TP TARGET 1: $4,037.647 (Immediate Resistance).

TP TARGET 2: $4,232.374 (Major Structural Resistance).

SL MANDATE: Place SL safely below the 1.618 Fibo zone.

Patience is key. Do NOT rush the entry! Is the $3,89x$ floor strong enough for the ATH rally? 👇

$4,005 BROKEN! GOLD READY FOR CPI COLLAPSEFranCi$$_FiboMatrix Emergency Action Plan (H1 Focus)

Welcome Traders! Gold (XAU/USD) has attracted sellers and is now trading below $4,100. With the US CPI release looming, the DOWNSIDE BREAKDOWN is our highest conviction scenario!

1. Market Snapshot

Current State: Gold is consolidating in a Sideway Zone between $4,159 (Resistance) and $4,005 (Critical Support).

Pressure: The recent break below $4,100$ and the recovering USD are key bearish factors.

The Catalyst: US CPI today. A hot inflation print will fuel the USD and shatter the $4,005$ floor.

Dominant Risk: Break below $4,005.438$ confirms the major bearish trend targeting $3,889$.

2. MAIN TRADING PLAN: Breakdown Scenario (SHORT) 💰

We are setting the trap to execute the SELL trade immediately upon the decisive breach of the $4,005$ Support.

Activate SHORT: Breakdown below $4,005.438$. (Wait for H1 close confirmation).

STOP-LOSS (SL): $4,159.686$. Placed safely above the Sideway Resistance.

TAKE-PROFIT 1 (TP1): $3,938.128 (Fibo Target).

TAKE-PROFIT 2 (TP2): $3,889.330 (Ultimate Structural Target).

3. Contingency Scenario (LONG) ⬆️

Activate LONG: Only if Gold decisively breaks $4,159.686$ (Breakout Zone) and targets $4,237.334.

Note: High-risk counter-trend trade, likely requiring a major negative surprise from the CPI report.

Community Interaction 🚀

The CPI is coming! Will the data be hot enough to smash $4,005$? Or is the Sideway Zone here to stay?

Drop your priority scenario NOW! 👇

SELLOFF IMMINENT GOLD TRAPP Final Warning Before $4000 COLLAPSEWelcome Traders! The Gold market (XAU/USD) is tightly constrained, and the pressure from the USD, combined with the technical breakdown risk, makes the SHORT scenario our highest conviction trade!

1. Sharp Technical Analysis

The H1 chart confirms a Bearish Consolidation structure after the steep drop from $4,370$. The price is locked in a high-stakes "No-Trade Zone".

Dominant Trend: BEARISH (following the breakdown of the Double Top pattern at $4,100$).

Consolidation Range (No-Trade Zone): Price is squeezed between $4,005 (Support) and $4,159 (Resistance).

Bear Flag Warning: A highly probable Bear Flag pattern is forming, suggesting an explosive downside move upon breakout.

Action Mandate: WAIT FOR THE BREAKDOWN CONFIRMATION!

2. Fundamental Analysis: USD Fueling the Drop

USD Strength: The USD sustained its upward momentum, increasing the burden on Gold. While a slight pullback occurred at the US open, the overall positive USD momentum remains a significant bearish factor.

Impact: Consistent USD demand makes a decisive break above $4,159$ highly unlikely. This heavily favors the scenario where Gold breaches the critical $4,000$ support.

3. MAIN TRADING PLAN: Breakdown Scenario (SHORT)

We are setting the trap to execute the SELL trade immediately upon the decisive breach of the $4,005$ Support.

Activate SHORT: Breakdown below $4,005$. Confirm with an H1 candle closing decisively beneath this level.

STOP-LOSS (SL): $4,159$. Placed safely above the No-Trade Zone Resistance.

TAKE-PROFIT 1 (TP1): $3,955.772. The next structural support target.

TAKE-PROFIT 2 (TP2): $3,889.251. The final objective, aligning with the larger pattern target.

Contingency Scenario (LONG)

Activate LONG: ONLY if Gold decisively breaks $4,159$ (Breakout Zone) and targets $4,332.127.

Note: This is a counter-trend, high-risk trade requiring massive news to justify.

Community Interaction 🚀

Are you ready for the break? Will Gold collapse to $3,889$ or surprise us with a break of $4,159$?

Drop your priority scenario NOW! 👇

GOLD PULLBACK: $4330 SLIDE! Sniping the Fibo BUY Zone🎯 Macro Summary & Bias: USD Stability Triggers Profit-Taking

Gold is extending its corrective slide from the all-time high zone, hitting around $4,331 - $4,330.

Primary Headwind: The US Dollar (USD) attracted buyers for three consecutive days, causing stability which triggered profit-taking in the overbought Gold market.

Long-Term Support: DXY trades slightly negatively due to the US government shutdown and trade tensions, keeping the long-term bullish outlook intact.

Technical Bias: The market is in a deep correction/profit-taking phase. Our focus is strictly on finding the FIBO BUY REACT ZONES to join the underlying bullish trend. DO NOT CHASE THE SELL MOVE.

📊 In-Depth Technical Analysis (H1): Pinpointing the FIBO Reaction Levels

Based on the current corrective structure and the Fibo/Volume zones defined on image_ddd575.png, we have our strategic levels:

1. Strategic SELL Zones (FIBO SELL REACT ZONES):

These are current resistance areas for short-term rejection or supply zone testing:

REACTION FIBO SELL ZONE 4340 - 4320: Current resistance. Look for a SCALP SELL opportunity if the price rejects this zone.

REACTION SELL ZONE - Big Volume for Sell Side 435x: Major supply/liquidity zone if price attempts a deeper retracement.

2. Strategic BUY Zones (FIBO BUY REACT ZONE):

These are the most critical Fibo support zones for initiating Long entries:

REACTION FIBO BUY ZONE 4270 - 4265: The first crucial Fibo Retracement support.

REACTION BUY ZONE - Big Volume For Buy Side 4230 - 4220: The high-volume demand zone and optimal entry point for the major Long trade.

📈 TODAY'S ACTION PLAN

Primary Action (Prioritize BUY): Wait for the price to correct to the REACTION FIBO BUY ZONE 4270 - 4265 or 4230 - 4220.

Long Entry: Execute the BUY entry only upon confirmed reversal candles (H1/M30/M15).

Scalp SELL Action: If the price strongly rejects the 4340 - 4320 zone, a quick SCALP SELL targeting the nearest BUY ZONE can be considered.

Targets (TP): Aim for the highs and the 435x Sell Zone for the Longs.

⚠️ Risk Warning

Risk Management: Always place a safe Stop Loss (SL) below the nearest active BUY ZONE. DO NOT OVERLEVERAGE in this corrective phase.

Wishing all FranCi$$_FiboMatrix traders a disciplined and victorious day!