Bearish Pullback Into Resistance, Downside Target in FocusMarket Structure

Price previously made a strong impulsive drop, followed by a rounded bottom / corrective recovery.

That recovery looks corrective, not impulsive (overlapping candles, curved structure), suggesting a bearish continuation setup rather than a trend reversal.

Key Zones

Major Resistance (≈ 5,100 – 5,130)

This zone previously acted as support, then flipped to resistance (classic S/R flip).

Price is projected to retest this zone before rejecting.

Support / Target Zone (≈ 4,750)

Strong demand zone where price previously reacted sharply.

Labeled clearly as the downside target.

Pattern & Bias

The white projection suggests a pullback → lower high → continuation down.

This resembles a bearish retracement into resistance, aligned with:

Prior breakdown level

Failure to reclaim key resistance

Momentum on the right side is weaker than the prior sell-off → bearish divergence in structure.

Trade Idea (Based on the Drawing)

Bias: Bearish below resistance

Entry Area: Near the resistance zone (~5,100)

Invalidation: Clean break and hold above resistance

Target: Support zone around ~4,750

Summary

Gold appears to be in a bearish continuation phase, with price likely retracing into resistance before rolling over. As long as resistance holds, the path of least resistance remains downward toward the marked support.

If you want, I can:

Forex

XAUUSD H1 – Pullback at Demand, Bulls Ready for Next Move?Gold is trading in a high-volatility recovery phase after the recent selloff, with price now pulling back into a clear H1 demand zone. This is a reaction-based market, where structure + fundamentals must align before continuation.

📌 Market Context (Fundamentals)

Gold remains highly sensitive to macro headlines as markets reassess:

Fed rate path expectations

US data momentum vs. slowing growth signals

Ongoing safe-haven demand on volatility spikes

No clear hawkish shift so far → downside moves look corrective, not impulsive.

➡️ Bias: Wait for confirmation at demand, not chase price.

📊 H1 Structure & Technicals

Prior selloff has lost momentum

Price is forming a technical pullback, holding above the last reaction low

Current move = rebalancing phase within a broader recovery

Key demand aligns with Fibonacci discount area

🎯 Key Trading Zones (H1)

🟢 BUY Zone (Primary Demand):

4,720 – 4,700

(Strong reaction base + discount zone)

❌ Invalidation:

H1 close below 4,700 → bullish recovery is invalidated

🎯 Upside Targets

TP1: 5,080 (first recovery resistance)

TP2: 5,345 (major H1 extension / liquidity target)

BTCUSD (1H) – Range Support Bounce | Bullish Reversal SetupBTCUSD (1H) – Range Support Bounce | Bullish Reversal Setup

Bitcoin is trading on the 1-hour timeframe after completing a corrective decline and forming a clear range structure. Price has recently reacted strongly from the lower demand/support zone, indicating buyer interest at this level.

Technical Breakdown:

Support Zone: Price bounced from a well-defined green demand area, aligning with a cyclical low and previous accumulation.

Structure Shift: After making a higher low, BTC is attempting to reclaim the mid-range, suggesting a short-term bullish reversal.

ALMA Indicator: Price is stabilizing around the ALMA, which often acts as a dynamic trend filter. Holding above it favors upside continuation.

Cycle Projection: The curved projection highlights a potential move toward the upper range resistance, following previous cyclical behavior.

Momentum: The oscillator shows recovery from oversold conditions, supporting the bullish bounce scenario.

Trade Idea:

Entry: Near current levels or on a minor pullback above the support zone

Target: Upper resistance / range high area

Invalidation: A clean break and close below the demand zone would invalidate the bullish setup

Bias:

📈 Bullish toward range high, as long as price holds above support.

⚠️ Always wait for confirmation and manage risk accordingly.

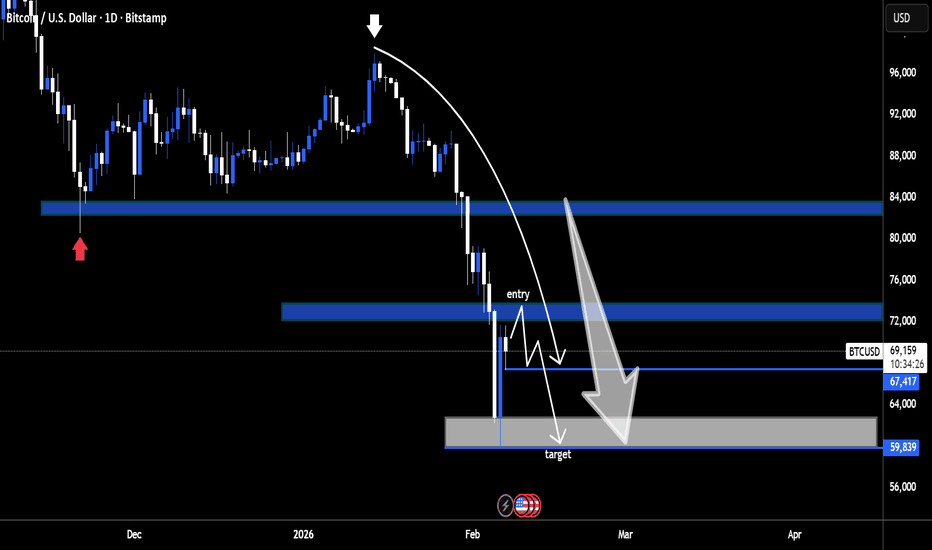

BTCUSD Daily – Bearish Breakdown & Sell-the-Retests Setup

Here’s what the chart is saying, clean and to the point:

Market Structure

Clear distribution → breakdown sequence on the daily.

Price topped near the mid-90Ks, rolled over, and lost the 83–84K demand zone (former support marked in blue).

That loss flipped market structure firmly bearish.

Key Levels

Major breakdown level: ~83–84K (prior demand → resistance)

Supply / entry zone: ~72–74K (blue zone labeled “entry”)

Current support: ~67.4K (thin blue line)

Primary target: ~60–62K (grey demand zone)

Price Action Logic

The vertical sell-off into ~67K suggests impulsive bearish strength, not exhaustion.

The projected path shows a dead-cat bounce / consolidation into ~72–74K.

That zone aligns with:

Prior consolidation

Bearish retest logic

Likely supply from trapped longs

Trade Thesis (as illustrated)

Bias: Short

Entry idea: Sell a rejection in the 72–74K zone

Invalidation: Strong daily close back above ~75K

Target: 60–62K demand (first meaningful higher-timeframe support)

Big Picture

Unless BTC reclaims the 80K+ region quickly, this chart favors continuation lower, not a V-shaped recovery. The structure says rallies are for selling, not buying.

XAUUSD H1 – Trendline retest may trigger next bullish moveMarket Context (Macro → Flow) Gold remains highly sensitive to macro headlines as markets continue to price in policy uncertainty around the Fed path and real yields. While no major shock hit today, flows show defensive positioning returning on dips, keeping gold supported despite recent volatility. ➡️ This environment favors buying on the reaction, not chasing breakouts.

Technical Structure (H1)

Price is still trading below a descending trendline, but momentum to the downside is weakening.

Current move is a technical pullback into Fibonacci discount + structure support.

No confirmed bearish continuation — sellers are losing follow-through.

➡️ This is a decision zone, where reaction will define the next leg.

Key Trading Zones & Levels

🔹 BUY ZONE (Reaction Area): 4,880 – 4,870 (Trendline support + Fib 0.618–0.786 + prior reaction zone)

🔹 Invalidation: H1 close below 4,820 → bullish idea weakens

Upside Targets (If Bullish Reaction Holds): 🎯 TP1: 5,070 🎯 TP2: 5,333 (1.618 extension / major recovery target)

Execution Notes

No blind entries → wait for bullish candle reaction or higher-low confirmation

Expect volatility spikes; manage size accordingly

Structure > headlines

Summary Gold is compressing at a high-confluence support zone. If buyers defend this area, a strong recovery leg toward 5,070 → 5,333 is in play. If not, patience beats prediction.

📌 Trade reactions, not expectations.

UPDATE ON "XAUUSD" BULLISH IDEA Symbol + Timeframes: XAUUSD— HTF (Daily) & ITF (H4)**

Bias: Bullish (as long as price holds above key DAILY FAIR VALUE GAP)

Structure: – Higher lows intact on HTF and SHORTS LIQUIDATED

– Intermediate pullbacks respecting demand zones

Key Levels: – Support: 4820.360

Context: – Price reacting to confluence (fair value gap + structural support)

Plan: – Look for corrective pullback to support for continuation setups , current buy setup would be inbetween 4820-4815.

– Targets based on structural levels - (I) 5090.890 (ii) 5567 (iii) 5599

This is analysis, not trade advice.

Bearish Pullback From Key Resistance, Targets Below

Overall structure

Gold is in a short-term bearish correction after a strong impulsive sell-off. The left side of the chart shows a distribution → breakdown → liquidity sweep, followed by a corrective bounce that is now losing steam.

Key zones & story the chart tells

Major Resistance Zone (≈ 5,105 – 5,213)

This blue zone previously acted as support, then flipped to resistance. Price has revisited it and failed to reclaim, confirming a classic support → resistance flip.

Entry Area (around 5,100)

The pullback into resistance aligns with:

Lower-high structure

Bearish reaction after a corrective rally

Rejection near prior consolidation

This is the logical short entry zone, as marked.

Fair Value Gap (FVG)

The rally partially filled the FVG but failed to continue higher — another sign of weak bullish intent.

Notice the white projected path: price is respecting a corrective wave rather than impulsive buying.

Targets

1st Target: ~4,750

Prior reaction level and mid-range liquidity. Likely pause or partial take-profit zone.

2nd Target / Support: ~4,586

Strong demand zone and previous base. This is the main downside objective if bearish momentum continues.

Bias summary

Bias: Bearish below 5,105

Invalidation: Clean break and hold above 5,213

Market logic:

Distribution → breakdown → pullback into resistance → continuation lower

Big picture takeaway

This is a textbook pullback-short setup after a strong bearish impulse. As long as gold remains capped below the resistance band, the path of least resistance points down toward 4,750 and potentially 4,586.

BTCUSD (1H) – Bearish Continuation | Trendline Breakdown IdeaMarket Structure

Bitcoin remains in a clear descending channel on the 1H timeframe. Price has consistently respected the downward sloping trendline, confirming a strong bearish structure with lower highs and lower lows.

Technical Confluence

Trendline Resistance (Red): Multiple rejections validate seller dominance.

Auto Pitchfork: Price is trading below the median line, indicating continuation toward the lower parallel.

Dynamic Support (Green): The recent breakdown below channel support signals bearish continuation rather than a reversal.

Balance of Power (BoP): Reading around -0.38 reflects sustained selling pressure with no bullish divergence.

Price Action

A brief consolidation failed to hold, followed by a strong bearish impulse that broke key intraday support. The current move suggests momentum-driven continuation, not exhaustion.

Trade Idea

Bias: Bearish

Sell Zone: Pullback toward broken support / descending trendline

Targets:

First target: Previous minor low

Extended target: Lower pitchfork boundary / demand zone

Invalidation: Sustained close above the descending trendline

Conclusion

As long as BTC remains below the descending trendline and pitchfork median, the path of least resistance is downward. Any retracement into resistance is likely to be a selling opportunity unless market structure shifts.

Always manage risk and wait for confirmation.

Bearish Rejection From Supply, Targets Below

Market Structure

Price previously made a blow-off top (sharp impulsive high, marked by the red arrow), followed by a strong bearish reversal, breaking short-term structure.

The subsequent bounce formed a lower high, confirming a bearish market structure shift on the intraday timeframe.

Key Zones

Gray zone (≈ 4,880–4,950): Former demand → now supply / resistance.

Price retested this area and rejected, which is classic bearish continuation behavior.

Blue zone (≈ 4,520–4,600): Major support / demand zone from the prior swing low.

Trade Idea Logic (as drawn)

Entry: Short on rejection from the gray supply zone after weak bullish retracement.

1st Target: Around 4,714 — interim support / liquidity pool.

2nd Target: The blue support zone — completion of the bearish leg and likely reaction area.

Price Action Clues

Retracement into resistance was corrective (overlapping candles), not impulsive → favors sellers.

Failure to reclaim the gray zone = sellers still in control.

Momentum points downward, aligning with the projected path.

Invalidation

A clean 45-min close and hold above the gray supply zone would weaken the bearish bias and suggest deeper consolidation or reversal.

USDCHF Is Not Weak – It’s Testing Support!USD/CHF is currently trading inside a well-defined rising channel, and the recent move lower looks more like a pullback into trend support rather than a breakdown.

For me, this is typical behavior in trending markets. Strong moves don’t continue in a straight line, price pulls back, tests support, and then decides the next direction based on reaction.

As long as the rising support holds, the broader structure remains intact. The next move will depend on how price behaves from this zone, not on short-term volatility.

This is a structure observation, not a prediction.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk.

XAUUSD – Bullish Reversal from Demand Zone (H1)Gold (XAUUSD) was previously trading inside a well-defined ascending channel, indicating a strong bullish trend. After reaching the upper boundary, price faced a sharp bearish correction and broke down from the channel.

Following this drop, price found strong support near the 5,000 demand zone, where buyers entered aggressively. From this area, price formed a V-shaped / rounded bottom recovery, signaling a shift in momentum from bearish to bullish.

Currently, price has reclaimed and is holding above the demand zone, showing strong bullish continuation. As long as price remains above this zone, the upside bias remains intact.

Trade Bias: Bullish above the demand zone

Entry Zone: Demand zone retest or bullish continuation

Targets:

Target 1: 5,120

Target 2: 5,198

Invalidation:

A strong break and close below the demand zone would invalidate the bullish setup.

This setup aligns with demand–supply dynamics, trend continuation, and a momentum shift, favoring buyers in the near term.

(Gold) 45-Minute Chart — Support Hold & Upside Retest Scenario

Chart Analysis:

Market Structure:

Gold is in a short-term corrective phase after a strong bearish impulse. Price made a lower low, then started forming higher lows, suggesting a potential short-term recovery within a broader downtrend.

Key Support Zone (Red):

The marked support around 4,850–4,900 has been respected multiple times. Buyers stepped in aggressively here, confirming it as a demand zone. The current price is consolidating just above this area, which is constructive.

Resistance Zone (Green):

The resistance around 5,150–5,200 aligns with a prior breakdown area and supply imbalance. This zone is the logical upside target if bullish momentum continues.

Price Behavior:

After bouncing from support, price is grinding higher with smaller candles, indicating controlled buying rather than impulsive selling. This favors a pullback-and-push scenario rather than immediate rejection.

Bullish Scenario (as drawn):

A successful hold above support, followed by a clean push, opens the door for a move toward the resistance zone (target). A brief dip into support with rejection wicks would strengthen this bias.

Invalidation:

A strong close below the support zone would invalidate the bullish setup and expose price to further downside continuation.

Bias:

🔹 Short-term bullish toward resistance

🔹 Medium-term still cautious / corrective

Chart Analysis — Rounded Bottom Reversal Toward Key ResistanceMarket Structure

Price formed a rounded bottom (cup-like reversal) after a sharp selloff, signaling exhaustion from sellers and a gradual shift to buyers.

The lowest point (circled) shows strong demand absorption, followed by higher lows → early trend reversal behavior.

Key Levels

Support zone: ~4,890–4,950

This area held firmly and acted as the base for the bounce. Buyers consistently defended it.

Entry zone: Just above support

The pullback into prior support + bullish reaction suggests a safe long entry on confirmation.

Mid resistance: ~5,100

Price already reclaimed this zone, flipping it from resistance into short-term support.

Major resistance / target: ~5,210–5,250

This is the next liquidity zone and logical profit target, aligned with previous supply.

Momentum & Price Action

The white projected path shows a bullish continuation scenario:

Break and hold above 5,100

Brief consolidation / retest

Push toward the upper resistance band

No immediate signs of distribution yet; momentum favors continuation unless price loses the support zone.

Bias

Bullish while above ~4,950

Invalidation if price accepts back below support with strong bearish candles.

Trade Idea Summary

Bias: 📈 Bullish continuation

Entry: Support retest / bullish confirmation

Target: 5,210–5,250

Risk: Breakdown below support

XAUUSD (Gold) – H1 Chart Idea & AnalysisGold previously printed a strong impulsive rally, followed by an aggressive sell-off that broke short-term structure. After the sharp drop, price formed a volatility spike and is now in a corrective phase, retracing into a key supply / resistance zone.

Key Zones

Entry Zone (Sell Area): ~4,880 – 4,930

This zone aligns with prior consolidation and acts as a bearish order block where sellers previously stepped in.

Target Zone: ~5,000 – 5,060

This is the next major liquidity pool / imbalance zone above, marked as the profit target on the chart.

Trade Bias

Primary Bias: Short-term bullish retracement into resistance, followed by potential bearish reaction.

Price is currently testing the entry zone, suggesting a sell-from-resistance setup if bearish confirmation appears.

Technical Confluence

Retracement after an impulsive bearish move

Previous support flipped into resistance

Presence of imbalance / supply zone

Corrective structure rather than impulsive bullish continuation

Trade Plan

Entry: Sell within the marked resistance zone

Invalidation: Strong H1 close above the zone

Target: Upper marked target zone (partial or full, depending on risk management)

Summary

This setup is based on a corrective pullback into a strong resistance area after a sharp bearish displacement. As long as price remains below the resistance zone, the probability favors a rejection and continuation move. Wait for confirmation and manage risk strictly.

USDJPY Pullback Explained: Trend Support in Focus!For me, USDJPY is still behaving like a healthy uptrend, not a market that is rolling over. Price has been respecting a clear rising channel structure, with buyers consistently defending higher lows.

The recent move lower looks more like a pullback into major trend support rather than a sign of weakness. This is exactly how strong trends usually behave, they pause, retrace, and then decide the next leg based on support reaction.

From a broader perspective:

On the fundamental side, currencies are currently adjusting to shifting rate expectations and global risk sentiment. In such phases, trends rarely reverse immediately. Instead, price often retraces into key levels before continuing or changing structure.

What I’m watching now:

As long as the rising channel and demand zone hold, the overall structure remains intact. The next move will largely depend on how price reacts at this support, not on short-term volatility.

This is not a trade call, it’s an observation of market behavior and structure.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk.

XAUUSD (H3) – Liam PlanXAUUSD (H3) – Liam Plan

Safe-haven bid is back, but structure is still corrective | Trade the zones, not the headlines

Quick summary

Gold is up for a second day as US–Iran tensions revive safe-haven demand. At the same time, expectations for Fed rate cuts keep the USD on the defensive, which typically supports non-yielding assets like gold. However, with ADP and ISM Services PMI ahead, short-term volatility can spike fast — and that’s exactly where gold tends to run liquidity before choosing direction.

My approach: respect the macro tailwind, but execute based on structure.

Macro context

Gold usually benefits when:

geopolitical risk rises (risk-off flows),

rate-cut expectations increase (lower real yields),

the USD weakens or struggles to sustain a bounce.

That said, pre-data sessions often produce fake moves. The market will likely “test” both sides before committing.

Technical view (H3 – based on the chart)

Price rebounded sharply from the recent low, but the overall swing structure is still in a correction / rebalancing phase after a major impulse down.

Key zones on the chart:

Major supply / premium target: 5570 – 5580 This is the clear “sell reaction” zone if price expands higher.

Current decision area: around 5050 – 5100 Price is pushing back into a key mid-range level — where continuation must prove acceptance.

Deep demand / liquidity base: 4408, then 4329 If the market fails to hold higher supports, these are the next magnets for sell-side liquidity.

This is a classic: bounce → retest → decide environment.

Trading scenarios (Liam style: trade the level) Scenario A: Continuation bounce

If price holds above the current base and continues to reclaim levels:

Upside rotation can extend toward 5200 → 5400 → 5570–5580

Expect reactions near each resistance band, especially approaching premium.

Logic: safe-haven flows + softer USD can fuel continuation, but only if price accepts above the mid-range.

Scenario B: Rejection and rotation lower

If price fails to hold above 5050–5100 and prints rejection:

Expect a pullback back into prior demand

Deeper continuation opens toward 4408, then 4329

Logic: corrective rallies often redistribute before the next leg lower, especially around major data.

Execution notes

With ADP + ISM ahead, avoid chasing candles.

Wait for price to tag the zone and show a clear reaction.

Trade smaller if spreads widen.

My focus: If price accepts above the mid-range, I’ll respect the bounce. If it rejects, I’ll treat the move as a corrective rally and look for rotation lower. Either way, I’m trading levels — not headlines.

— Liam

Gold flipped structure — real reversal or liquidity trap?Gold has just delivered a clear structural shift after weeks of heavy downside pressure — but this is not the time to chase.

Market Structure (M30)

Price printed a bullish CHoCH, ending the prior bearish sequence.

Followed by a BOS to the upside, confirming short-term bullish control.

Momentum is strong, but price is now approaching a key reaction zone.

Key Zones to Watch

FVG Support: ~4,950 – 4,980

→ Ideal area for pullback continuation if bullish structure holds.

Mid Resistance / Reaction: ~5,100 – 5,150

→ Expect volatility and possible shakeout.

Upper Target Zone: 5,270 – 5,450

→ Fibonacci 0.5 → 0.786 retracement of the prior sell-off.

Trading Scenarios

Bullish continuation:

Wait for pullback into FVG + higher low → continuation toward 5,27x → 5,45x.

Failure scenario:

Loss of FVG + M30 close back below ~4,95x → bullish structure invalid, range or reversal risk.

🧠 Trading Mind

This is a reaction market, not a prediction market.

After a structure flip, pullbacks pay — breakouts trap.

GOLD BULLISH OR BEARISH?Gold is bouncing — but context matters.

After a strong selloff, price is now retracing into a key resistance zone, not breaking structure. This is where many traders get trapped chasing a “bottom” while smart money distributes.

Market Structure

Clear downtrend: Lower Highs & Lower Lows remain intact

Current move = retracement, not impulsive bullish continuation

Price is reacting below the descending trendline

Key Technical Zone

FVG / Supply zone around 5.26x → high-probability reaction area

This zone aligns with retracement levels and prior imbalance

If–Then Scenarios

If price rejects 5.26x:

→ Downtrend continuation toward 4.63x → 4.51x → 4.40x

If price breaks and holds above 5.26x (H1 close):

→ Bearish bias weakens, wait for new structure before trading

Trading Mindset

This is distribution after a selloff, not accumulation.

Don’t confuse a bounce with a trend change.

📌 Strong trends don’t reverse quietly — they test patience first.

(XAUUSD) – Bearish Continuation From Major Supply Zone (45m)

Market Structure

Clear trend reversal from the highs → strong impulsive sell-off.

The curved marking shows a distribution/top formation, followed by aggressive downside momentum.

Overall structure is lower highs & lower lows → bears in control.

Key Zones

Resistance / Supply Zone (~4,700–4,750)

Previous support flipped into resistance.

Price has retested this zone multiple times and failed to break above → strong seller presence.

Target / Demand Zone (~4,350)

Prior demand area and liquidity pool.

Logical downside objective if resistance continues to hold.

Entry Logic (as drawn)

Short entry after rejection inside the resistance zone.

Confirmation comes from:

Weak bullish candles

Long upper wicks

Failure to reclaim the zone

Price Action Read

The small bounces are corrective pullbacks, not reversals.

Each push up is being sold → classic bearish continuation / pullback-to-supply setup.

Bias & Expectation

Bias: Bearish

Expectation:

Rejection from resistance → continuation toward 4,350 target

Invalidation if price accepts and closes above the resistance zone

Summary

This chart shows a textbook support-to-resistance flip after a strong sell-off. As long as price remains below the highlighted resistance, the path of least resistance is down, targeting the lower demand zone.

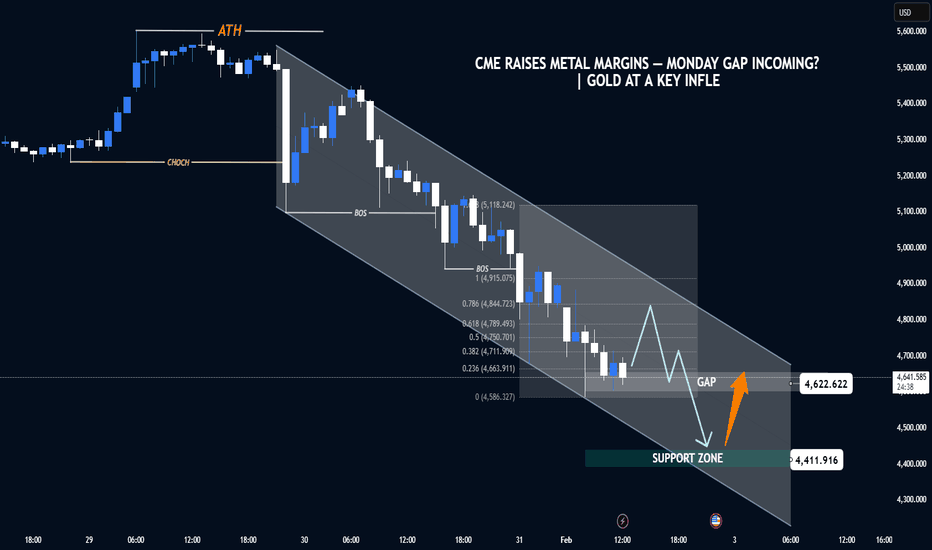

CME raises metal margins, Monday gap risk? Gold key influence.Gold is no longer trending freely — it’s correcting with structure.

After printing ATH, XAUUSD delivered a clear CHoCH, followed by a sequence of bearish BOS, confirming a controlled pullback, not panic selling. Price is now respecting a descending corrective channel, which typically appears before the market decides its next major leg.

🧠 Fundamental Context (Flow > Headlines)

CME raised margin requirements for metals

Higher margins = forced position reduction for leveraged traders

This often creates liquidity-driven gaps at the weekly open

Important: this is mechanical pressure, not a macro trend flip

➡️ Expect volatility first, clarity later.

📊 Technical Structure (HTF → LTF)

ATH rejection + CHOCH = bullish momentum paused

Multiple BOS inside the channel = distribution phase

Price is compressing toward key liquidity zones

🔑 Key Levels to Watch

5,090 – 5,120: Upper channel / sell-side reaction zone

4,620 GAP area: High-probability liquidity magnet if Monday gaps

4,410 Support zone: HTF demand & channel base (critical level)

🎯 Scenarios (If – Then)

If Monday gaps into 4,620

→ Expect sharp moves and fake breaks

→ Wait for acceptance / absorption before any long bias

If price loses 4,620 cleanly

→ Next draw = 4,410 support

If price reclaims 4,900+ quickly

→ Gap likely becomes a trap → squeeze back into range

EURUSD - 4H - SHORTFOREXCOM:EURUSD

Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. wait for more Smart Money to develop before taking any position . I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied...

Keep trading

Hustle hard

Markets can be Unpredictable, research before trading.

Disclaimer: This trade idea is based on Smart money concept and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions. Informational only!!!

Trump speaks tonight — Gold at decision point.Market Context (H1–H4)

Gold remains in a broader bullish structure, but short-term price action has shifted into a decision phase after rejecting ATH. The sharp drop created a displacement leg, followed by a corrective bounce — typical post-event behavior.

Structurally:

HTF trend is still upward (ascending channel intact)

No confirmed HTF bearish reversal yet

Current move looks like rebalancing, not trend failure

Fundamental Context

Trump’s speech tonight is the key volatility trigger

Any geopolitical / USD-impacting rhetoric can cause:

A liquidity sweep before direction

Or a direct continuation if risk-off sentiment returns

Market is likely positioning → expect fake moves before clarity

Technical Breakdown

ATH: recent distribution, not yet reclaimed

FVG (upper): potential reaction zone for sellers if price rallies

Mid Zone (~5090–5120): short-term decision / balance area

Strong Demand (~4980–5000): HTF buy zone, aligns with trendline & prior BOS base

Trading Scenarios (If–Then)

If price holds above 5090–5120 → look for continuation into FVG, then ATH test

If price sweeps below 5090 but reclaims → classic liquidity grab → BUY continuation

If price breaks and holds below 5000 (H1 close) → deeper pullback, bullish bias pauses (not flips yet)

Key Takeaway

This is not the place to chase.

Trade reactions, not headlines.

Let Trump speak → let liquidity show → then follow structure.

Bias: Bullish continuation unless strong demand fails.

Gold retraces after surge – trend remains intact.Quick Context

Recent geopolitical uncertainty continues to support safe-haven flows. Gold has already delivered a strong bullish impulse, and the current move looks like a healthy correction, not a reversal.

Technical Snapshot (H1–H4)

Strong bullish impulse already completed

Current price action = controlled retracement

No bearish CHoCH, no structural breakdown

Market is resetting momentum after expansion

This is typical impulse → retrace → continuation behavior.

Key Levels to Watch

Buy Zone: 5,180 – 5,160

Invalidation: H1 close below 5,120

Upside continuation targets:

5,300

5,360

Extension toward 5,440+

If – Then Logic

If price holds above 5,160 → expect continuation higher

If price sweeps into 5,180–5,160 and reacts → buy-the-dip opportunity

Only if H1 closes below 5,120 → bullish bias weakens

Bottom Line

Gold is not reversing — it is reloading.

Pullbacks are part of trend strength.

Wait for reaction, not confirmation at the highs.