XAUUSD (H4) – Trendline break confirmedXAUUSD (H4) – TRENDLINE BREAK CONFIRMED, NOW IT’S ALL ABOUT BUYING THE DIP.

Macro context

Safe-haven flows are still supporting precious metals as geopolitical uncertainty rises. Headlines around the US–Venezuela situation and political pushback can keep price action reactive, meaning sharp spikes and liquidity sweeps are very possible before the market commits to the next leg.

Technical view (H4)

The bullish structure remains intact: higher highs + higher lows.

Price has broken the trendline/resistance and is holding above the “buy resistance” area around 4550 → a positive sign for continuation.

The 1.618 Fibonacci extension above is a major liquidity magnet, but also a zone where short-term profit-taking can trigger a pullback.

Key levels

Pivot support: 4550–4545

Deeper support: 4475–4455 (balance area inside the rising channel)

Target resistance: 4760–4770 (Fibo 1.618 / “sell Fibonacci” zone)

Trading scenarios

Scenario 1: Trend-following BUY (preferred)

Entry: Buy pullback 4552–4560

SL: 4540

TP1: 4635–4660

TP2: 4720–4740

TP3: 4760–4770

Plan: wait for a clean reaction at the new support after the breakout, then ride the trend.

Scenario 2: Safer BUY after a deeper liquidity sweep

If price dumps hard on thin liquidity/news:

Entry: Buy 4475–4455

SL: 4435

TP: 4550 → 4635 → 4760

Scenario 3: Reaction SELL (short-term only)

Only if there’s a clear rejection at the highs:

Sell zone: 4760–4770

SL: 4785

TP: 4685 → 4635 → 4550

Conclusion

H4 bias stays bullish after the trendline break. The best approach is no chasing — wait for a dip into 4550 to buy with structure. SELL is only a tactical reaction if price rejects hard at the 1.618 extension.

👉 Follow LiamTradingFX to get my XAUUSD plans early every day.

Forex

XAUUSD | 15M | Channel Resistance Rejection – Short SetupGold price is trading inside a well-defined ascending channel. Price has now reached the upper channel resistance, aligning with a previous intraday high / supply zone, where selling pressure is visible.

A rejection from this area suggests a potential short-term bearish move, with price likely to rotate back toward the mid / lower channel support.

Technical Structure

Overall structure: Ascending channel

Entry zone: Upper channel resistance

Confirmation: Rejection wicks + loss of momentum

Bias: Short / Pullback trade

Trade Idea

Sell near resistance after confirmation

Stop-loss above channel high

Targets toward channel support / demand area

This setup is based purely on price action and market structure.

Wait for proper confirmation before entering.

⚠️ Not financial advice. Manage risk accordingly.

Market Update: Gold The Battle at 4600After an explosive breakout to new all time highs, Gold is currently in a classic breather phase, sustaining its position remarkably well above the previous ATH. We are seeing a high-tight consolidation essentially a Bullish Flag forming on the daily chart. This suggests that the market is merely digesting recent gains and building the necessary energy for the next leg higher. Despite the broader bullish sentiment fueled by recent geopolitical tensions in Iran and the "Powell Probe" investigation into the Fed, the bulls have hit a temporary ceiling.

The 4600 level has emerged as the immediate line in the sand. On a daily closing basis, we are seeing consistent rejection here; the price is struggling to print a solid candle body above this psychological milestone. For a high conviction continuation, we need to see a clear daily close above 4600. Once this horizontal resistance is cleared, the structural path opens up toward the Monthly R2 at 4731.

On the flip side, the downside remains well protected. The Monthly R1 (4526) area is our primary support zone. As long as we hold above this on a daily close basis, the buy the dip mentality remains the dominant play. The mix of sticky CPI data and safe haven rotation keeps the floor solid, even if the bullish wave continuation requires a bit more patience.

XAUUSD H4 – Correction, then ExpansionXAUUSD H4 – Pullback Then Continuation Using Fibonacci and Key Levels

Gold remains in a strong bullish trend on H4, but the current structure suggests the market needs a pullback into liquidity before the next expansion leg.

Market View

The recent rally has pushed price into premium territory, which often triggers short-term profit-taking.

Fibonacci extensions are acting as liquidity magnets: 2.618 is a key reaction zone, while 3.618 is the next expansion target.

Main approach: wait for the pullback into support/buy zones, then follow the trend.

Key Levels to Watch

Near resistance: 4546–4550 (reaction zone / key resistance)

Sell reaction zone: 4632–4637 (Fibonacci 2.618, likely to cause volatility)

Expansion target: 4707 (Fibonacci 3.618)

Buy liquidity zone: 4445–4449 (best buy area in this structure)

Strong support: 4408 (critical defensive support)

Scenario 1 – Shallow Pullback, Then Push Higher

Idea: price pulls back lightly, holds structure, and resumes the uptrend quickly.

Preferred pullback zone: 4546–4550

Expectation: move back up toward 4632–4637, and if absorbed, extend toward 4707

Confirmation to watch: H4 candles hold above 4546–4550 with clear buying response (rejection wicks, strong closes, momentum return)

Scenario 2 – Deeper Pullback to Sweep Liquidity, Then Strong Rally

Idea: price sweeps deeper into the best demand zone before the next major leg.

Deep pullback zone: 4445–4449

Expectation: bounce back to 4546–4550 → then push to 4632–4637 → and potentially extend to 4707

Confirmation to watch: strong reaction at 4445–4449 (buyers absorb, structure holds, no clean breakdown)

Important Notes

4632–4637 is a sensitive zone where profit-taking and sharp swings can appear before continuation.

If price breaks and holds below 4445–4449, shift focus to 4408 to judge whether the bullish structure is still being defended.

Conclusion

The main trend is still bullish, but the best edge comes from waiting for a pullback and buying at key levels. Focus zones: 4546–4550 (shallow pullback) and 4445–4449 (deep pullback with better R:R). If Fibonacci expansion continues, the next upside target is 4707.

If you share the same view, follow me to get the next updates earlier.

USDCHF – M15 | Sell-Side Sweep → Reactive Bounce Price engineered a clean sell-side liquidity run, flushing range lows with displacement. The reaction that followed is corrective, not impulsive. What we’re seeing now is relief buying into discount, not a trend reversal.

Current bounce is unfolding inside prior inefficiency / mitigation, with structure still bearish on the execution timeframe.

Market Read

Range distribution → sharp sell-side sweep

Bounce = mitigation of bearish orderflow

No bullish displacement, only overlap

Execution Bias

Shorts favored on retracement into the marked supply / imbalance

Invalidation only on strong M15 acceptance above the green high

Targets

Recent sell-side lows

Extension into external liquidity below

Deeper discount if momentum expands

XAUUSD: Bullish Breakout Confirmed? New ATH in Play!As anticipated in our weekly analysis, Gold started the week with a bang, opening with a positive gap and aggressively smashing through the previous All Time High of 4550. We are currently trading in "uncharted territory," and the price action is screaming bullish across all major timeframes.

🔍 Market Context & Drivers

The surge isn't just technical; the fundamental backdrop is fueling this "fear trade":

Geopolitical Flare-up: Tensions are peaking as the U.S. considers military options in Iran following recent unrest, alongside ongoing frictions in Venezuela.

Safe-Haven Inflow: Growing concerns over the Federal Reserve’s independence and the U.S. Supreme Court’s upcoming ruling on tariffs (expected Wednesday) are pushing investors toward the safety of gold.

Dovish Tailwinds: Last Friday's soft NFP data (only 50k jobs added) has cemented expectations for further Fed rate cuts, lowering the opportunity cost for holding Gold.

🛠 Trading Strategy

The trend is clearly your friend here. Since we have successfully breached the 4550 barrier, the focus shifts to the Daily Close.

The Confirmation: We need a solid Daily candle closing above 4550. This validates the breakout and traps the late sellers.

Buy the Dip: If we see a retest of the 4550-4540 area, it’s a high-probability "buy on dip" zone.

The Target: Once the breakout is confirmed, our primary objective is the Monthly R2 at 4731, with a secondary long-term target eyeing the 5000 milestone.

Immediate Target// 4731 Monthly R2 Pivot & psychological extension.

Breakout Zone// 4550 Previous ATH; Must close above this on the Daily to confirm.

Primary Support// 4550 - 4540 The "Flip Zone" (Old Resistance becoming New Support).

Major Support// 4500 Psychological handle & secondary structural floor.

XAUUSD H4 – Gold Trading Strategy Next Week(Liquidity-Based Levels)

Gold is heading into a key decision week as price returns to a major reaction area. The market is currently best traded by waiting for liquidity reactions at the highlighted zones, rather than chasing moves in the middle of the range.

1) H4 Technical Context

Price has recovered and is now retesting a key pivot region around the 4.45xx area.

The chart shows clear supply zones overhead, while the 4445–4449 zone stands out as the highest-probability buying reaction area.

If price holds this buying zone, the preferred path is continuation higher toward the upper supply region near 4632–4637.

2) Key Levels to Watch

Main BUY zone: 4445 – 4449

Liquidity confluence area with strong probability of bullish reaction if structure remains intact.

Mid resistance: 4550 – 4560

A reaction zone where buyers may take partial profits and where price behavior matters.

Target SELL zone (scalping): 4632 – 4637

Strong overhead supply. Ideal for short-term selling reactions if price rallies sharply and shows rejection.

Strong support: around 4408

If the main buying zone fails, this level becomes the next key area that defines whether the pullback deepens.

3) PRIORITY SCENARIO – Main Plan (Buy with Structure)

Next week’s primary strategy remains trend-following, but execution should be level-based.

Buy area: 4445–4449

Best confirmation: H4/H1 candles hold the zone and close back above it without a strong breakdown.

Upside expectations: push toward 4550–4560 first, then extend toward 4632–4637.

4) ALTERNATIVE SCENARIO – If the Buy Zone Fails

If price breaks 4445–4449 cleanly and accepts below it:

A deeper correction can develop toward 4408 and potentially lower.

In that case, the plan is to wait for a clear reaction at support before looking for the next long setup.

5) SELL Scenario – Short-Term Only

Selling is not the primary strategy. It is only considered as a short-term scalp at premium supply.

Sell zone: 4632–4637

Only sell on clear rejection signals such as strong wicks, failed breakout, or a lower-timeframe structure shift.

6) Weekly Summary

Focus zone: 4445–4449 is the key decision area

Hold above it → prefer BUY toward 4550–4560 and 4632–4637

Lose it → watch 4408 for deeper correction reaction

Sell ideas are scalps only at the upper supply zone

NGAS (Natural Gas) – Technical Analysis | 2HFX:NGAS

Channel support line hit: Price has reacted exactly from the lower boundary of the falling channel, indicating structural support is respected.

New low not aggressive : The recent breakdown didn’t show strong momentum or expansion in range → signs of selling exhaustion, not panic.

Demand zone respected : Buyers stepped in from the marked demand area, confirming willingness to defend this zone.

Overall structure suggests short-term mean reversion / pullback rather than continuation of sharp downside.

📉 Trade Plan

🟢 Buy Zone: 3.42 – 3.46

⛔ Stop Loss: 3.32

🎯 Targets:

T1: 3.63, T2: 3.89, T3: 4.10.

Keep Learning, Happy Trading.

XAUUSD (H1) – Following the bullish channelpatience before continuation ✨

Market structure

Gold remains in a well-defined ascending channel on the H1 timeframe. Despite recent intraday pullbacks, the overall structure is still bullish with higher highs and higher lows preserved. Current price action shows consolidation inside the channel rather than any sign of trend reversal.

Technical outlook (Lana’s view)

Price is rotating around the midline of the rising channel, indicating healthy digestion after the previous impulsive leg.

The recent pullback appears to be a controlled correction, likely aimed at collecting buy-side liquidity before the next expansion.

Market is still respecting structure and trendline support — no breakdown confirmed so far.

Key levels to watch

Buy-side focus

FVG Buy zone: 4434 – 4437

A clean reaction here could offer a good continuation entry within the trend.

Major buy zone: 4400 – 4404

This is the stronger demand area aligned with channel support and previous structure.

Sell-side reaction (short-term only)

4512 – 4515

This zone aligns with Fibonacci extension and channel resistance, where short-term profit-taking or reactions may appear.

Scenario outlook

As long as price holds above the lower channel boundary, bullish continuation remains the primary scenario.

A pullback into FVG or the lower buy zone followed by confirmation would favor another push toward channel highs and liquidity above.

Only a clean break and acceptance below 4400 would force a reassessment of the bullish bias.

Lana’s trading mindset 💛

No chasing price near resistance.

Let price come back into value zones inside the channel.

Trade reactions, not predictions.

Trend is your friend — until structure says otherwise.

This analysis reflects a personal technical perspective for educational purposes only. Always manage risk carefully.

XAUUSD (H3) – Liam StrategyTrendline break confirms the uptrend ✅ | Buy the discount, scalp-sell at ATH

Quick overview

On the H3 chart, the story is clean: price has broken the bearish trendline and held structure after a clear BOS, which keeps the bias bullish for continuation.

But the best execution is still the same: no FOMO. I’d rather buy from discount liquidity zones than chase mid-range candles.

Key Levels (from your chart)

✅ Buy Zone 1 (re-buy): 4434 – 4437

✅ Buy Zone 2 (liquidity imbalance): 4340 – 4343 (deep sweep zone)

✅ ATH Sell scalping: 4560 (main profit-taking / reaction sell)

Technical read (Liam style)

Breaking through the trend confirms uptrend: the trendline break signals buyers are back in control.

4434–4437 is the clean re-entry area: a logical pullback zone with better R:R.

If volatility spikes and price hunts liquidity, 4340–4343 is the “best value” area to look for a strong reaction.

Trading scenarios

✅ Scenario A (priority): BUY the pullback at 4434–4437

Entry: 4434 – 4437

SL: below 4426 (or below the most recent H1/H3 swing low)

TP1: 4485 – 4500

TP2: 4560 (ATH – main target)

Logic: Uptrend confirmation is in place — I only want the pullback entry, not a chase.

✅ Scenario B (deep buy): If price sweeps down into 4340–4343

Entry: 4340 – 4343

SL: below 4330

TP: 4434 → 4500 → 4560

Logic: This is the “sweet spot” if the market does a liquidity reset before pushing higher again.

⚠️ Scenario C (scalp only): SELL reaction at ATH 4560

Entry: 4560 (only if we see clear rejection / weakness)

SL: above the sweep high

TP: 4520 → 4500 (quick scalp)

Note: This is a scalp idea at ATH — not a long-term bearish call while the bullish structure is intact.

Key notes

Avoid entries mid-range. Only execute at 4434–4437 or 4340–4343.

Wait for confirmation on M15–H1 (rejection / engulf / MSS).

Risk management: 1–2% per idea, scale out into ATH.

Are you waiting for the 4434 pullback buy, or hoping for a deeper sweep into 4340 for the cleanest entry? 👀

XAUUSD Technical Pullback Within Uptrend Awaiting Next Expansion📌 Market Context (H1)

Gold has completed a strong bullish impulse and is now entering a technical pullback phase after reacting from the upper resistance zone.

The current decline does not signal a trend reversal yet and is still considered corrective in nature.

Price is consolidating within a converging structure:

Medium-term ascending trendline

Short-term supply and demand zones

→ This suggests the market may continue liquidity sweeps on both sides before committing to the next directional move.

📊 Structure & Key Technicals

Overall H1 bias remains bullish, as long as the key demand zone below is respected.

The pullback from the top is a rebalancing move, not a confirmed bearish shift.

4,333 – 4,350 acts as a strong demand zone (previous bullish base + liquidity).

Upper resistance at 4,477 – 4,494 is currently capping price in the short term.

🎯 Trading Plan – MMF Style

🔹 Primary Scenario – Trend-Following BUY

Look for BUY opportunities at: 4,350 – 4,333

Conditions: clear bullish reaction, structure holding, avoid entries in the middle of the range.

Upside targets:

TP1: 4,424

TP2: 4,449

TP3: 4,477

TP4: 4,494

🔹 Alternative Scenario – Continuation BUY

If price does not pull back and instead breaks and holds above 4,477, wait for a retest to BUY with trend continuation.

❌ Invalidation

If an H1 candle closes decisively below 4,333, bullish scenarios are invalidated and the structure must be reassessed.

🔎 Summary

Gold is currently in a healthy corrective phase within a broader uptrend. No clear reversal signals are present yet.

The optimal approach is to wait patiently for discounted prices, confirm structure, and execute only when the market shows commitment.

MMF – Trade structure, not emotion.

XAUUSD Pullback to Demand Zone @ 4400 - 4390Gold (XAUUSD) faced a strong rejection from the 4500 supply zone, triggering a healthy corrective move. Price is now approaching a key demand area between 4400 – 4390, where buyers are expected to step in.

If this support holds, we anticipate a bullish bounce with upside targets at 4425, 4435, and 4450.

This zone could offer a high-probability buy setup for short-term to intraday traders, provided bullish confirmation appears.

📌 Disclaimer:

This analysis is for educational purposes only and is not financial advice. Always manage risk and follow your trading plan.

Your feedback drives our content and keeps everyone trading smarter. Let’s make those pips together! 🚀

Happy Trading,

– The InvestPro Team

XAUUSD – Bullish Structure Intact, Focus on Pullback BUY📌 Market Context

Gold continues to trade within a bullish short-term structure after completing a corrective leg and forming a clear higher low. The recent consolidation below resistance suggests the market is in a rebalancing phase, not a reversal.

From a fundamental standpoint, the USD remains under pressure amid cautious risk sentiment and expectations of softer monetary conditions, which keeps gold supported on pullbacks.

📊 Technical Structure (H1)

Market structure remains HH – HL, bullish bias intact.

Price is consolidating below key resistance after an impulsive leg up.

Current price action reflects liquidity absorption before the next expansion.

Key observations from the chart:

Prior sell-off failed to break the bullish structure.

Demand zones below are holding well.

Fibonacci retracement aligns with demand, reinforcing buy-side interest.

🔑 Key Levels to Watch

Major Resistance:

• 4,534

• 4,503

Intraday Resistance / Reaction Zone:

• 4,477

Key BUY Zones:

• 4,452

• 4,397 (main demand & structure support)

🎯 Trading Plan – MMF Approach

Primary Scenario (BUY the Pullback):

Prefer BUY setups on pullbacks into 4,452 → 4,397.

Look for bullish confirmation (reaction, rejection, momentum shift).

Targets:

→ TP1: 4,477

→ TP2: 4,503

→ TP3: 4,534

Alternative Scenario:

If price fails to hold above 4,397 on H1 close, stand aside and reassess structure before taking new positions.

⚠️ Risk Management Notes

Avoid chasing price near resistance.

Let the market come back into discount zones.

Follow structure, not emotions.

EURUSD – Liquidity Sweep + Break of Descending ChannelTimeframe: 1H

Bias: Bullish Reversal

Concepts Used: Liquidity Sweep • Discount Pricing • Reversal Structure • FVG • Channel Break

Trade Idea Summary

EURUSD has swept major sell-side liquidity below the previous swing low and immediately reacted from a deep discount demand zone. After the liquidity grab, price broke out of the descending channel, indicating a possible shift toward bullish order flow.

if Price also tap into an imbalance (FVG) and has shown a clean corrective retest of the breakout level.

All these confluences point toward a higher probability long continuation.

🟢 Long Setup Details

Entry: 1.17140 – 1.17160

Stop Loss: 1.16830 (below the liquidity sweep zone)

Take Profit: 1.17800 (premium zone / upper imbalance fill)

Risk-to-Reward: Approx. 1:3.5

Trade Narrative

✔ Price took out liquidity below the major lows

✔ Strong bullish displacement afterwards

✔ Retesting the channel trendline + equilibrium zone

✔ Price trading from discount toward premium

✔ Clean inefficiency above acting as magnet

As long as EURUSD holds above the retest zone, bullish continuation toward the premium area is expected.

This setup remains valid until price breaks below the liquidity sweep low.

Disclaimer: For Educational Purpose

Gold (XAUUSD) Rejects 4470 Resistance – Short-Term Sell SetupGold (XAUUSD) has shown a clear rejection from the 4470 resistance zone, signaling potential short-term exhaustion after the recent rally.

This area has acted as a strong supply zone, increasing the probability of profit booking / corrective pullback before any continuation to the upside.

📉 Trade Idea:

Look for sell opportunities in the 4462 – 4472 zone, aligning with the marked resistance and price rejection.

Targets and risk levels are clearly outlined on the chart.

⚠️ This is a counter-trend / pullback trade, best suited for intraday or short-term traders. Manage risk accordingly.

📌 Disclaimer:

This analysis is for educational purposes only and is not financial advice. Always manage risk and follow your trading plan.

Your feedback drives our content and keeps everyone trading smarter. Let’s make those pips together! 🚀

Happy Trading,

– The InvestPro Team

XAUUSD (H2) – Buying priority todayGold holds above 4,400 on safe-haven flows | Trade liquidity, don’t chase

Quick summary

Gold started the week with strong momentum and pushed above 4,400 during the Asian session as global markets rotated into safe-haven assets. Geopolitical risk is the key driver after reports of US ground strikes in Venezuela and the detention of President Nicolás Maduro and his wife. With that backdrop, my plan today is simple: prioritize BUY setups at liquidity zones, and avoid FOMO while the price is elevated.

1) Macro context: Why gold is supported

When geopolitical risk escalates, capital typically flows into gold.

Headline-driven sessions often bring:

✅ fast pumps, ✅ liquidity sweeps, ✅ larger wicks/spreads.

➡️ The safest execution is waiting for pullbacks into predefined buy zones, not chasing highs.

2) Technical view (based on your chart)

On H2, gold has bounced sharply and your chart highlights clear execution areas:

Key levels for today

✅ Buy zone: 4340 – 4345 (trend/structure pullback zone)

✅ Strong Liquidity: lower support band (marked on chart)

✅ Sell zone: 4436 – 4440 (near-term supply / reaction area)

✅ Sell swing / target: 4515 – 4520 (higher objective / profit-taking zone)

3) Trading plan (Liam style: trade the level)

Scenario A (priority): BUY the pullback into 4340–4345

✅ Buy: 4340 – 4345

SL (guide): below the zone (adjust to spread / lower TF structure)

TP1: 4400 – 4410

TP2: 4436 – 4440

TP3: 4515 – 4520 (if momentum continues with headlines)

Logic: 4340–4345 offers a cleaner R:R than chasing above 4,400.

Scenario B: If the price holds above 4,400 and only dips lightly

Look for a buy only on clear holding signals near the closest support/strong liquidity (M15–H1).

Still not recommending FOMO entries in headline volatility.

Scenario C: SELL reaction (scalp) at supply

✅ If price tags 4436–4440 and shows weakness:

Sell scalp: 4436 – 4440

SL: above the zone

TP: back toward 4400–4380

Logic: This is a near-term supply area — good for quick profit-taking, not a long-term reversal call.

4) Notes (avoid getting swept)

The Asian session can spike hard on headlines → wait for pullback confirmations.

Reduce size if spreads widen.

Only execute when price hits the level and prints a clear reaction (rejection / engulf / MSS).

What’s your plan today: buying the 4340–4345 pullback, or waiting for price to push into 4515–4520 before reassessing?

XAUUSD Bullish Continuation | Buy the Dip @ 4400 - 4375Gold (XAUUSD) has delivered a strong bullish impulse following heightened geopolitical tensions involving the US and Venezuela. Price is holding firmly above the 4400 key support zone, signaling sustained bullish strength.

As long as gold maintains acceptance above this level, the bias remains bullish, with upside targets at 4440 and 4470.

We are patiently waiting for a healthy pullback toward support to look for high-probability buy opportunities in line with the prevailing trend.

📌 Disclaimer:

This analysis is for educational purposes only and is not financial advice. Always manage risk and follow your trading plan.

Your feedback drives our content and keeps everyone trading smarter. Let’s make those pips together! 🚀

Happy Trading,

– The InvestPro Team

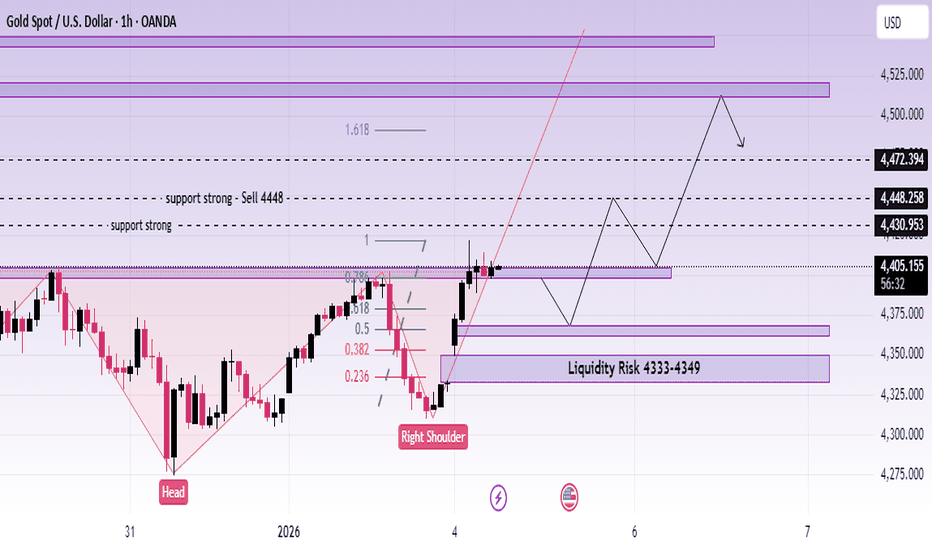

XAUUSD (H1) – Inverse Head & Shoulders formingLana focuses on pullback buys above key liquidity 💛

Quick overview

Timeframe: H1

Pattern: Inverse Head & Shoulders confirmed on the chart

Bias: Bullish continuation while price holds above neckline

Strategy: Buy pullbacks into liquidity zones, avoid chasing highs

Technical view – Inverse Head & Shoulders

On H1, gold has completed a clean Inverse Head & Shoulders structure:

Left shoulder: Formed after the first sharp sell-off

Head: Deeper liquidity sweep, followed by strong rejection

Right shoulder: Higher low, showing weakening selling pressure

Neckline: Around the 4030–4040 resistance zone (now being tested)

The recent breakout and strong follow-through suggest buyers have regained control. As long as price holds above the neckline, the structure favors continuation to the upside.

Key levels Lana is watching

Primary buy zone – Pullback entry

Buy: 4363 – 4367

This area aligns with prior structure support and sits inside a healthy pullback zone. If price revisits and shows acceptance, it offers a good risk-to-reward buy.

Liquidity risk zone – Deeper pullback

Liquidity risk: 4333 – 4349

If volatility increases and price sweeps deeper liquidity, this zone becomes the secondary area to watch for bullish absorption.

Upside targets & resistance

High liquidity area: 4512 – 4517

ATH zone: Above the previous all-time high

These zones are expected to attract profit-taking or short-term reactions, so Lana avoids chasing price near these levels.

Fundamental context (market drivers)

Geopolitics: Rising tension after comments about potential military intervention in Colombia adds background support for gold as a safe haven.

Goldman Sachs: Views Venezuela-related developments as having limited impact on oil, keeping broader commodity sentiment stable.

ISM Manufacturing PMI (US): Any sign of slowing manufacturing can pressure USD and indirectly support gold.

Overall, fundamentals remain supportive for gold, reinforcing the bullish technical structure.

Trading plan (Lana’s approach)

Prefer buying pullbacks into 4363–4367 while structure holds.

Be patient if price dips into 4333–4349 and wait for confirmation before entering.

If price falls back below the neckline and fails to reclaim it, Lana steps aside and reassesses.

This is Lana’s personal market view and not financial advice. Please manage your own risk before trading. 💛

XAUUSD (D1) – Elliott ABC pattern activeLana sells the pullback, waits to buy at major liquidity 💛

Quick summary

Timeframe: Daily (D1)

Elliott view: Price is likely developing an ABC corrective structure after a strong rally

Strategy: Sell the B-wave pullback into supply, buy only when price returns to strong liquidity

Context: Precious metals started 2026 strong, but short-term volatility and re-accumulation swings are still expected

Fundamental backdrop (supports the bigger trend)

Gold and silver opened 2026 with strong momentum, extending the best run since the late 1970s. Goldman Sachs remains bullish on precious metals and continues to highlight an aggressive long-term target (around $4,900 for gold).

Lana’s key point: the long-term bull cycle can remain intact, but the market still needs healthy corrections to reset liquidity and build new structure.

Technical view (D1) – Elliott ABC structure

On the Daily chart, after the powerful top, gold dropped sharply, forming a clean Wave A. The current structure suggests:

Wave B: a corrective rebound into resistance/supply

Wave C: a potential move back down into liquidity zones before the next major direction is confirmed

This ABC lens helps avoid getting trapped when the news looks bullish, but price is still in a corrective phase.

Key levels from the chart

1) Sell zone (B-wave supply)

Sell: 4435 – 4440

This zone aligns with marked resistance and a Fibonacci pullback cluster (0.236 / 0.382). If price retraces here and shows rejection, it’s a strong area to look for B-wave selling pressure.

2) Buy zone (major liquidity – potential C-wave completion)

Buy Liquidity: 4196 – 4200

This is the strongest liquidity area on the chart. If Wave C plays out, Lana will look for buying opportunities here with clearer risk control.

3) Deeper accumulation liquidity

Accumulate liquidity: the lower accumulation area highlighted on the chart

If the market sweeps deeper than expected, this is the region where longer-term buyers may step in.

Trading plan (Lana’s approach)

Primary idea: Sell rallies into 4435–4440 if price shows weakness (B-wave rejection).

Primary buy plan: Wait for price to revisit 4196–4200 and confirm support (liquidity absorption).

If price breaks and holds above the sell zone, Lana stops selling and waits for a new structure to form.

Note on early-year behavior

The first weeks of the year often bring “messy” moves as liquidity returns and positioning resets. Lana will only trade at planned zones and avoid entries in the middle of the range.

This is Lana’s personal market view and not financial advice.

NZDJPY – Imbalance + Liquidity Sweep + Mean Reversion SetupNZDJPY recently took out a major liquidity level around 90.907, sweeping the equal lows resting below that zone. This sweep created a fake breakout of structure, indicating that the downside move was engineered to capture liquidity rather than continue lower.

After the liquidity grab, price immediately reversed back inside the previous range, showing rejection from the sweep level. This confirms a liquidity sweep + BOS failure, a strong signal that the market is shifting direction.

Price is now correcting back toward its mean value, reacting to the inefficiencies left behind. There is a clear imbalance zone above, and price is actively rebalancing that inefficiency.

Furthermore, NZDJPY has an equilibrium structure near 90.20, which acts as a magnet for price during mean reversion phases. This equilibrium zone aligns with the discounted area of the current micro-range, creating a high-probability retracement target.

XAUUSD (H2) – Liam Plan (Jan 02)Price is compressing in a structure, wait for the trendline break to choose direction 🎯

Quick summary

After the strong bearish BOS, gold is rebounding and compressing inside a diagonal structure (triangle/flag-like). Today the clean approach is confirmation trading:

SELL only after a confirmed break of the trendline (4348–4350) as marked on your chart.

SELL reactions at the upper supply / VAL zones (4460–4463 and 4513–4518).

BUY is secondary — only if price holds the 4400–4405 key support and shows a clear reaction on lower timeframes.

Macro backdrop (CME FedWatch)

Probability Fed holds rates in January: 85.1%

Probability of a 25 bps cut in January: 14.9%

By March: probability of 25 bps cumulative cut: 51.2%, hold 42.8%, 50 bps cut 5.9%

👉 This keeps markets sensitive to USD / yields expectations. Gold can bounce technically, but volatility spikes are likely — so we stick to levels + confirmation.

Key Levels (from your chart)

✅ Sell zone 1: 4513 – 4518

✅ Sell VAL: 4460 – 4463

✅ Reaction / flip zone: 4400 – 4405

✅ Breakdown trigger: 4348 – 4350 (sell upon confirmed trendline breakout)

Trading scenarios (Liam style: trade the level)

1) SELL scenarios (priority)

A. SELL on trendline breakdown confirmation

Trigger: clean break + close below 4348–4350

Entry: sell the retest back into the broken trendline

TP1: 4320–4305

TP2: 4260–4240

TP3: deeper extension (towards the 41xx area) if momentum expands

Logic: This is the clearest “trend confirmation” on your chart. No chasing — let price confirm first.

B. SELL reaction at supply

Sell: 4460–4463 (VAL)

Stronger sell: 4513–4518 (premium supply)

Only sell with visible weakness / rejection on M15–H1.

2) BUY scenario (secondary – reaction only)

Buy zone: 4400–4405

Condition: hold the zone + print higher lows on lower TF

TP: 4460 → 4513 (scale out)

Logic: This is a key support/flip area. If it holds, price can rotate up to test supply above before the next decision.

Key notes

Compression often creates false breaks — don’t trade mid-range.

Two clean plays only: break 4348–4350 to sell with confirmation, or retrace to 4460/4513 to sell the reaction.

What’s your bias today: selling the 4348 breakdown, or waiting for 4460–4463 for a cleaner pullback sell?

XAUUSD (H1) – Liam View: Strong Bullish Breakout→ short-term bearish shift, prefer selling the pullback | Quick reaction buy at 4330–4333

Quick summary

Gold just printed a very aggressive dump with clear BOS (Break of Structure) — a short-term bearish shift is now in play. Price is currently in a technical rebound, so the cleaner plan is:

Don’t chase shorts at the lows

Wait for a pullback into 4458–4462 to sell from a premium supply zone

If price sweeps back down, look for a quick reaction buy at 4330–4333

1) Technical view (based on your chart)

The sell-off looks like a classic liquidity dump: large bearish candles, multiple supports broken → confirms bearish pressure intraday.

After a dump, the market often retraces into supply (re-distribution) before the next leg.

The 4330–4333 area is marked as a support that already “tested liquidity” — it can still provide a bounce, but it’s more of a scalp zone, not a full reversal yet.

2) Key Levels

✅ Sell zone: 4458 – 4462 (supply / pullback short)

✅ Buy zone: 4330 – 4333 (support / quick reaction)

3) Trading scenarios (Liam style: trade the level)

Scenario A (priority): SELL the pullback

✅ Sell: 4458 – 4462

SL guide: 4470 (or above the most recent lower-TF swing high)

TP1: 4400 – 4390

TP2: 4333

TP3: extension lower if structure continues to break down

Logic: After a strong BOS, 4458–4462 is where you get a better short entry — avoid selling late.

Scenario B: BUY reaction at support (scalp only)

✅ Buy: 4330 – 4333

SL guide: 4322–4325

TP: 4370 → 4400 (scale out)

Logic: This zone can spark a technical bounce. Only buy with clear holding signals on lower timeframes (M5–M15) — no catching falling knives.

4) Confirmation rules (avoid noise)

If price reaches 4458–4462 and fails to reclaim above → SELL bias stays strong.

If 4330 breaks and closes below → stop looking for buys and focus on pullback sells.

5) Risk notes

No mid-range entries — only act at 4330–4333 or 4458–4462.

Risk per trade: max 1–2%.

After a dump, spreads and wicks can expand — reduce size.

Which side are you leaning today: selling 4458–4462, or waiting for 4330–4333 to buy the reaction bounce?

XAUUSD (H1) – Bearish Correction After ATHLana focuses on selling rallies, waiting for a deeper buying zone 💛

Quick overview

Market state: Sharp sell-off after failing to hold above ATH

Timeframe: H1

Current structure: Strong bearish impulse → corrective rebound in progress

Intraday bias: Sell on pullbacks, buy only at major support

Technical picture (based on the chart)

Gold printed a clear distribution top near ATH, followed by a strong bearish displacement. This move broke the short-term bullish structure and shifted momentum to the downside.

Price is now attempting a technical rebound, but so far this looks corrective rather than impulsive. As long as price stays below key resistance, Lana treats this as a sell-the-rally environment.

Key observations:

Strong bearish candle confirms loss of bullish control

Current rebound is moving into prior liquidity + Fibonacci reaction zone

Market is likely building a lower high before the next move

Key levels to trade

Sell zone – priority setup

Sell: 4392 – 4395

This zone aligns with:

Prior structure resistance

Fibonacci retracement area

Liquidity resting above current price

If price reaches this zone and shows rejection, Lana will look for sell continuation.

Buy zone – only at strong support

Buy: 4275 – 4278

This is a higher-timeframe support zone and the first area where buyers may attempt to step back in. Lana only considers buys here if price shows clear reaction and stabilization.

Intraday scenarios

Scenario 1 – Rejection at resistance (preferred)

Price retraces into 4392–4395, fails to break higher, and rolls over → continuation to the downside, targeting deeper liquidity.

Scenario 2 – Deeper correction then recovery

If selling pressure extends, price may sweep liquidity into 4275–4278 before forming a base for a larger rebound into the new year.

Market tone

The recent move reflects profit-taking and risk reduction after an extended rally. With year-end liquidity thinning out, price action can remain volatile and deceptive, making zone-based trading essential.

This analysis reflects Lana’s technical view and is not financial advice. Always manage your own risk and wait for confirmation before entering trades 💛