Technical Trading Technical trading is a broader style that is not necessarily limited to trading. Generally, a technician uses historical patterns of trading data to predict what might happen to stocks in the future. This is the same method practiced by economists and meteorologists: looking to the past for insight into the future.

Forex

Database Trading **Database trading**, often referred to as **algorithmic trading** or **quantitative trading**, involves using large sets of structured data to make trading decisions and execute trades automatically. It relies heavily on databases to store, process, and analyze market data (historical prices, volumes, order books, etc.) and other relevant information (like economic indicators, news, etc.). The goal is to identify patterns, trends, or anomalies that can be leveraged for profitable trading strategies.

XAUUSD PLAN – MAY 28 |WATCHING FOMC + EU TRADE TENSIONS XAUUSD PLAN – MAY 28 | GOLD REBOUNDS SLIGHTLY BUT REMAINS UNDER PRESSURE | WATCHING FOMC + EU TRADE TENSIONS

Gold staged a mild technical recovery after last week’s heavy sell-off of nearly $100. While the bounce offers short-term opportunities, overall structure remains under bearish pressure unless bulls can reclaim the upper distribution zone.

🌍 MACRO CONTEXT – TRADE POLICY & MONETARY UNCERTAINTY:

Trump has delayed the 50% tariff on EU goods until July, calling recent trade talks “positive.”

In response, US 10-year yields spiked back above 4.55%, signaling market expectations for prolonged high interest rates.

Meanwhile, the Fed has announced a 10% workforce cut due to ongoing operational losses from interest payments — a rare move that underscores deeper fiscal constraints.

➡️ With mixed risk sentiment and no clear policy direction, Gold remains a safe-haven focus — but vulnerable in the short-term if yields and the dollar continue to rise.

📈 TECHNICAL OUTLOOK (H1):

Gold is currently trading below the 3,335–3,346 resistance zone, which has repeatedly rejected bullish attempts.

If price fails to reclaim this zone, we could see renewed bearish momentum toward the lower FVG support.

The Fair Value Gap near 3,248 remains a major zone of interest if sellers regain control.

🔍 TRADE PLAN – UPDATED LEVELS:

🔻 SELL ZONE: 3,344 – 3,346

Stop Loss: 3,350

Take Profit: 3,340 – 3,336 – 3,332 – 3,328 – 3,324 – 3,320

🔻 SELL SCALP: 3,326 – 3,328

Stop Loss: 3,332

Take Profit: 3,322 – 3,318 – 3,314 – 3,310 – 3,305 – 3,300

🔵 BUY SCALP: 3,278 – 3,276

Stop Loss: 3,272

Take Profit: 3,282 – 3,286 – 3,290 – 3,294 – 3,298 – 3,302 – 3,310

🔵 BUY ZONE: 3,246 – 3,244

Stop Loss: 3,240

Take Profit: 3,250 – 3,254 – 3,258 – 3,262 – 3,266 – 3,270 – 3,280

📌 STRATEGY TIP:

Avoid mid-range entries. Let price come to your zones. Prioritize confirmed reactions, especially near structural levels like 3,335 and 3,248.

NIFTY BANK INDEX📊 1-Hour Support & Resistance Levels (Classic Pivot Points)

Based on the latest technical analysis, the key support and resistance levels for the Nifty Bank Index on a 1-hour timeframe are:

Support Levels:

S1: ₹55,261.10

S2: ₹55,105.20

S3: ₹54,974.85

Resistance Levels:

R1: ₹55,547.35

R2: ₹55,677.70

R3: ₹55,833.60

These levels are derived from the price range of the previous trading day.

🔍 Technical Indicators Overview

Relative Strength Index (RSI): Currently, the RSI is hovering around 60, indicating a neutral to slightly bullish momentum.

Moving Averages: The index is trading above its 5-day and 10-day simple moving averages, suggesting a short-term bullish trend.

MACD (12,26): The MACD line is above the signal line, indicating positive momentum.

📈 Market Sentiment

The technical indicators collectively suggest a cautiously bullish sentiment for the Nifty Bank Index. However, the RSI indicates that the index is approaching overbought territory, which may lead to a short-term correction. Investors should monitor the support and resistance levels closely for potential breakout or pullback scenarios.

Please note that stock market investments are subject to market risks, and it's essential to conduct thorough research or consult with a financial advisor before making investment decisions.

NIFTY 50 INDEXAs of May 29, 2025, the Nifty 50 Index is trading at 24,752.45, reflecting a 0.00% change from the previous close.

📊 15-Minute Support & Resistance Levels (Classic Pivot Points)

Based on the latest technical analysis, the key support and resistance levels for the Nifty 50 Index on a 15-minute timeframe are:

Support Levels:

S1: 24,784.57

S2: 24,704.93

S3: 24,657.47

Resistance Levels:

R1: 24,911.67

R2: 24,959.13

R3: 25,038.77

These levels are derived from the price range of the previous trading day.

🔍 Market Sentiment

The technical indicators suggest that the Nifty 50 Index is currently in a consolidation phase. Traders should monitor the support and resistance levels closely for potential breakout or pullback scenarios. A sustained move above the resistance levels may indicate bullish momentum, while a drop below the support levels could signal bearish sentiment.

Please note that stock market investments are subject to market risks, and it's essential to conduct thorough research or consult with a financial advisor before making investment decisions.

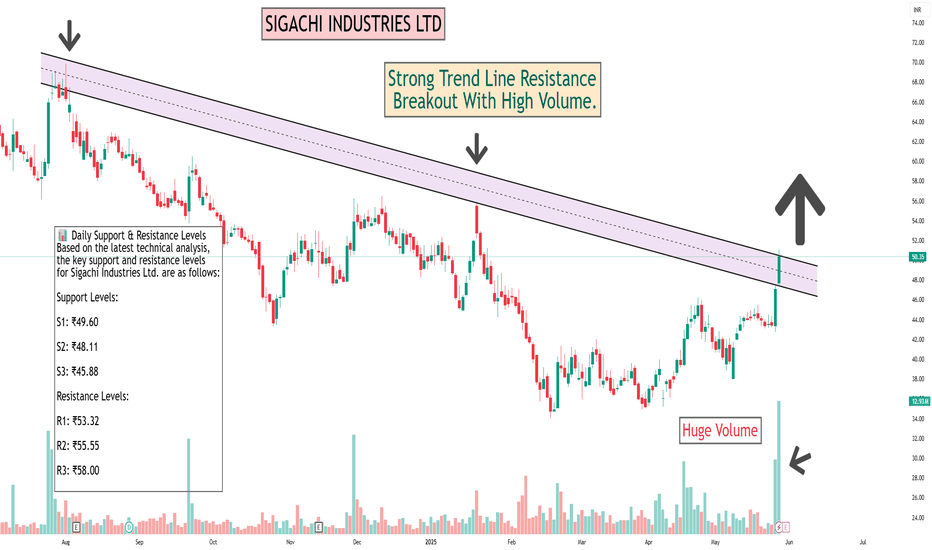

SIGACHI INDUSTRIES LTDAs of May 29, 2025, Sigachi Industries Ltd. (NSE: SIGACHI) is trading at ₹50.35, reflecting a 6.95% increase over the previous close.

📊 Daily Support & Resistance Levels

Based on the latest technical analysis, the key support and resistance levels for Sigachi Industries Ltd. are as follows:

Support Levels:

S1: ₹49.60

S2: ₹48.11

S3: ₹45.88

Resistance Levels:

R1: ₹53.32

R2: ₹55.55

R3: ₹58.00

These levels are derived from pivot point calculations based on the previous trading day's price range.

🔍 Technical Indicators Overview

Relative Strength Index (RSI): The RSI is currently at 87, indicating that the stock is in overbought territory. This suggests that the stock may be due for a short-term correction.

Moving Averages: Sigachi Industries is trading above its 5-day, 10-day, 20-day, 50-day, 100-day, and 200-day simple and exponential moving averages, indicating a strong bullish trend.

MACD (12,26): The MACD is currently at 2.15, suggesting bullish momentum.

📈 Market Sentiment

The technical indicators collectively suggest a strong bullish sentiment for Sigachi Industries Ltd. However, the RSI indicates that the stock is in overbought territory, which may lead to a short-term correction. Investors should monitor the support and resistance levels closely for potential breakout or pullback scenarios.

Please note that stock market investments are subject to market risks, and it's essential to conduct thorough research or consult with a financial advisor before making investment decisions.

RAIL VIKAS NIGAM LTDAs of May 29, 2025, Rail Vikas Nigam Ltd. (NSE: RVNL) is trading at approximately ₹416.15, reflecting a 0.85% increase over the previous close.

📊 30-Minute Support & Resistance Levels

Based on recent technical analysis and pivot point calculations, the following support and resistance levels are identified for RVNL:

Support Levels:

S1: ₹411.93

S2: ₹407.72

S3: ₹401.43

Resistance Levels:

R1: ₹422.43

R2: ₹428.72

R3: ₹432.93

These levels are derived from the price range of the previous trading day.

🔍 Technical Indicators Overview

Relative Strength Index (RSI): The RSI is currently hovering around 70, indicating that the stock is approaching overbought territory.

Moving Averages: RVNL is trading above its 5-day, 10-day, 20-day, 50-day, 100-day, and 200-day simple and exponential moving averages, indicating a strong bullish trend.

📈 Market Sentiment

The technical indicators collectively suggest a strong bullish sentiment for Rail Vikas Nigam Ltd. However, the RSI indicates that the stock is approaching overbought territory, which may lead to a short-term correction. Investors should monitor the support and resistance levels closely for potential breakout or pullback scenarios.

Please note that stock market investments are subject to market risks, and it's essential to conduct thorough research or consult with a financial advisor before making investment decisions.

GLAXO SMITHKLINE PHARMA LTDAs of May 29, 2025, GlaxoSmithKline Pharmaceuticals Ltd. (NSE: GLAXO) is trading at ₹3,348.20, reflecting a 7.38% increase over the previous close.

📊 Daily Support & Resistance Levels

Based on the latest technical analysis, the key support and resistance levels are:

Support Levels:

S1: ₹3,174.33

S2: ₹2,998.67

S3: ₹2,887.83

Resistance Levels:

R1: ₹3,460.83

R2: ₹3,571.67

R3: ₹3,747.33

These levels are derived from the price range of the previous trading day.

🔍 Technical Indicators Overview

Relative Strength Index (RSI): The RSI is currently hovering around 70, indicating that the stock is approaching overbought territory.

Moving Averages: GLAXO is trading above its 5-day, 10-day, 20-day, 50-day, 100-day, and 200-day simple and exponential moving averages, indicating a strong bullish trend.

📈 Market Sentiment

The technical indicators collectively suggest a strong bullish sentiment for GlaxoSmithKline Pharmaceuticals Ltd. However, the RSI indicates that the stock is approaching overbought territory, which may lead to a short-term correction. Investors should monitor the support and resistance levels closely for potential breakout or pullback scenarios.

Please note that stock market investments are subject to market risks, and it's essential to conduct thorough research or consult with a financial advisor before making investment decisions.

ITC LTD#ITC

STOCK NAME: ITC LTD (NSE)

CHART ANALYSIS: Symmetrical triangle within an uptrend channel.

Approaching apex, breakout or breakdown will give major move. Trading near critical support.

TREND: Consolidation inside Medium-term Uptrend

SUPPORT: 413/*398

RESISTANCE: *428/440/455

TRADE SETUP:

BUY above 428 | SL 416 | Targets 440 / €455

X SELL below *413 | SL 423 | Targets ₹400 / €388

I AM NOT SEBI REGISTERED. THIS IS ONLY FOR EDUCATIONAL PURPOSE.

SCHNEIDER ELECTRIC INFRAAs of May 29, 2025, Schneider Electric Infrastructure Ltd. (NSE: SCHNEIDER) is trading at ₹778.70, reflecting an 11.57% increase over the past 24 hours .

📊 Daily Support & Resistance Levels

Based on the latest technical analysis, the key support and resistance levels are:

Support Levels:

S1: ₹719.30

S2: ₹659.90

S3: ₹623.85

Resistance Levels:

R1: ₹814.75

R2: ₹850.80

R3: ₹910.20

These levels are derived from the price range of the previous trading day .

🔍 Technical Indicators Overview

Relative Strength Index (RSI): 79.38 – Indicates overbought conditions.

MACD (12,26): 27.62 – Suggests bullish momentum.

ADX: 28.53 – Points to a strong trend.

Stochastic Oscillator: 90.63 – Suggests overbought territory.

Rate of Change (ROC): 25.57 – Indicates strong upward momentum.

Supertrend: 634.53 – Below current price, indicating bullish trend.

Parabolic SAR (PSAR): 646.47 – Below current price, supporting bullish sentiment.

These indicators collectively suggest a strong bullish trend for Schneider Electric Infrastructure Ltd. .

📈 Market Sentiment

The technical indicators collectively suggest a strong bullish sentiment for Schneider Electric Infrastructure Ltd. However, the RSI and Stochastic Oscillator indicate that the stock is in overbought territory, which may lead to a short-term correction. Investors should monitor the support and resistance levels closely for potential breakout or pullback scenarios.

Please note that stock market investments are subject to market risks, and it's essential to conduct thorough research or consult with a financial advisor before making investment decisions.

KIRL OSKAR INDUSTRIES LTDAs of May 28, 2025, Kirloskar Industries Ltd. (NSE: KIRLOSIND) is trading at ₹3,739.20, marking a 6.03% increase from the previous close .

📊 Daily Support & Resistance Levels (Classic Pivot Points)

Based on the latest technical analysis, the key support and resistance levels are:

Support Levels:

S1: ₹3,666.70

S2: ₹3,630.20

S3: ₹3,607.00

Resistance Levels:

R1: ₹3,726.40

R2: ₹3,749.60

R3: ₹3,786.10

These levels are derived from the price range of the previous trading day .

📈 Technical Indicators Overview

Relative Strength Index (RSI): 77.5 – Indicates overbought conditions.

MACD (12,26): 47.84 – Suggests bullish momentum.

Commodity Channel Index (CCI): 165.79 – Points to strong upward movement.

Moving Averages: The stock is trading above its 5-day, 10-day, 20-day, 50-day, 100-day, and 200-day simple and exponential moving averages, indicating a strong bullish trend .

🔍 Market Sentiment

The technical indicators collectively suggest a strong bullish sentiment for Kirloskar Industries Ltd. However, the RSI indicates that the stock is in overbought territory, which may lead to a short-term correction. Investors should monitor the support and resistance levels closely for potential breakout or pullback scenarios.

Please note that stock market investments are subject to market risks, and it's essential to conduct thorough research or consult with a financial advisor before making investment decisions.

MANGLORE REFINERY & PETROCHEMICALS LIMITEDAs of May 29, 2025, Mangalore Refinery & Petrochemicals Ltd. (MRPL) is trading at ₹148.83, reflecting a 5.82% increase over the past 24 hours .

📊 Daily Support & Resistance Levels

Based on technical indicators and pivot point analysis, here are the key support and resistance levels for MRPL:

Support Levels:

₹135.08 – Identified as a significant support level across multiple analyses .

₹138.76 – Another support level noted in recent technical assessments .

₹142.37 – Derived from Fibonacci retracement levels .

Resistance Levels:

₹153.75 – Recognized as a primary resistance point .

₹158.68 – A higher resistance level based on pivot point calculations .

₹165.55 – An upper resistance level identified through standard pivot analysis .

🔍 Technical Indicators Overview

Relative Strength Index (RSI): The RSI is currently hovering around 50, indicating a neutral momentum. Values between 45 and 55 suggest a lack of strong bullish or bearish trends .

Moving Averages: MRPL is trading above its 200-day Exponential Moving Average (EMA), which is generally considered a bullish sign, suggesting potential upward momentum .

📈 Market Sentiment

The recent price movement and technical indicators suggest that MRPL is experiencing a neutral to mildly bullish trend. Traders should monitor the support and resistance levels closely for potential breakout or breakdown scenarios.

Please note that stock market investments are subject to market risks, and it's essential to conduct thorough research or consult with a financial advisor before making investment decisions.

Gold Major Support in Focus: Will It Hold or Slide Further?Gold is testing a major support zone around 3260–3280 after breaking down from trendline support and following up with another red candle.

This breakdown suggests that the recent bullish momentum has faded, and now we have to wait to see if this support can hold. If it doesn’t, the next downside target looks to be around 3130–3155, with even 3000 as a longer-term possibility if the pressure continues. Right now, I’m staying out of any trades, preferring to wait and see if this support zone can provide a bounce or if we’re heading for deeper levels. The price action isn’t giving any clear reversal signs at current area as of now and wee have to assess this on week closing basis.

GOLD TRADING INSIDE COMPRESSION ZONE WAITING FOR A CLEAR BREAK XAUUSD PLAN – MAY 27 | GOLD TRADING INSIDE A COMPRESSION ZONE – WAITING FOR A CLEAR BREAKOUT

Gold continues to consolidate below the 3,364 resistance zone after a rejection late last week. The market is currently trading within a compression range, preparing for a breakout – but direction still depends heavily on macro triggers and technical structure.

🌍 MACRO CONTEXT:

U.S. 10-year yields remain above 4.5%, keeping the dollar stable and applying short-term pressure on precious metals.

The Fed’s cost-cutting moves and operational losses are raising deeper concerns about long-term monetary stability.

Risk sentiment is mixed, and institutional money continues to flow cautiously into gold as a long-term value hedge, especially with equities showing signs of exhaustion.

📈 TECHNICAL OUTLOOK (H1):

Price failed to break through the 3,345–3,364 resistance zone, triggering a pullback toward the mid-range.

Key support around 3,311 is now being tested – a decisive level that could determine whether bulls can regain momentum or bears take control.

If price breaks below 3,311, we could see a deeper dip toward the 3,298–3,288 demand zone, which may offer a better re-entry for buyers.

On the upside, a confirmed break above 3,364 could open the door for a move into the Fair Value Gap toward 3,407.

🔹 TRADE SETUPS:

🔵 BUY SCALP

Entry: 3,314 – 3,312

Stop Loss: 3,308

Take Profit Targets:

3,318 – 3,322 – 3,326 – 3,330 – 3,340 – 3,350

🔵 BUY ZONE

Entry: 3,298 – 3,296

Stop Loss: 3,292

Take Profit Targets:

3,302 – 3,306 – 3,310 – 3,314 – 3,320 – 3,330

🔻 SELL SCALP

Entry: 3,346 – 3,348

Stop Loss: 3,350

Take Profit Targets:

3,342 – 3,338 – 3,334 – 3,330 – 3,320 – 3,310

🔻 SELL ZONE

Entry: 3,364 – 3,366

Stop Loss: 3,370

Take Profit Targets:

3,360 – 3,356 – 3,352 – 3,348 – 3,344 – 3,340 – 3,330

📌 Note:

Price is trading in the mid-range of a larger structure. Best opportunities remain near the edges of support/resistance with confirmation. Avoid overtrading in the middle zone. Let the market come to your areas of value.

💬 If you found this plan helpful, Like + Comment + Follow for daily GOLD strategies from the MMF Team.

Divergence SecretsDivergence trading identifies potential trend reversals or continuations by comparing price action with a technical indicator. When a price makes a new high or low, but an indicator doesn't confirm it, a divergence emerges, suggesting a possible shift in momentum. Traders use this information to make more informed decisions about entering or exiting trades.

Institutional Trading part 4Institutional trading refers to the buying and selling of securities on behalf of large organizations or institutions like mutual funds, pension funds, and insurance companies. These institutions manage money for a group of people, often trading in large volumes that can significantly impact the market.

Price Action Trading Price action trading is a strategy where traders make decisions based on the price movements of an asset, rather than relying on technical indicators or other external factors. It involves analyzing historical price patterns and movements to identify potential trading opportunities and predict future price direction.

PCR ( Put Call Ratio) Trading StrategyThe Put Call Ratio (PCR) is a market sentiment indicator calculated by dividing the total volume of put options by the total volume of call options. It's used to gauge whether traders are predominantly betting on a market decline (puts) or rise (calls). A high PCR suggests bearish sentiment, while a low PCR indicates bullish sentiment.

Gold Analysis Update: Bulls Holding Strong Above 3330Gold has been holding steady above the major pivot level at 3330, with price action continuing to create higher highs and showing strong respect for the ascending trendline support. This tells us that the bulls remain firmly in control. Currently, there’s no major rejection around these levels, and the volume is still supportive of the move higher, with no clear signs of exhaustion yet.

I’m also keeping an eye on the Fibonacci retracement levels visible on the chart: price is above the 0.786 mark at 3369 and could push towards the 1.0 level at 3436 if momentum remains strong.

Overview of Financial Markets Financial markets, from the name itself, are a type of marketplace that provides an avenue for the sale and purchase of assets such as bonds, stocks, foreign exchange, and derivatives. Often, they are called by different names, including “Wall Street” and “capital market,” but all of them still mean one and the same thing. Simply put, businesses and investors can go to financial markets to raise money to grow their business and to make more money, respectively.

NETWEB TECH INDIA LIMITED#NETWEB BREAKOUT

Cmp: 1896

Support: 1800

Target: 1960/2010

View: bullish

Chart: daily

| Netweb Technologies India is trading 5.51% upper at Rs 1,896.60 as compared to its last closing price. Netweb Technologies India has been trading in the price range of 1,959.75 & 1,823.95. Netweb Technologies India has given -34.03% in this year & -1.85% in the last 5 days. Netweb Technologies India has TTM P/E ratio 74.80 as compared to the sector P/E of 17.79.