GOLD – Unshaken Through Chaos - 50 new all-time highs🟡 GOLD – Unshaken Through Chaos | A Structural Bull Run Backed by Global Repricing

Gold isn’t just rallying — it’s sending a message.

Over the past 12 months, gold has set over 50 new all-time highs, a breakout sequence unmatched in over a decade. This is now officially the longest bullish streak in 12 years, and the third longest in modern history, only behind the volatile 1979–1980 period — a time when the global economy was grappling with runaway inflation, stagnant growth, and widespread unemployment.

But what makes this current bull cycle unique is not just the price action, but the structural shift behind the move.

📈 The Numbers Speak for Themselves:

YTD 2024 performance: +16%

12-month gain: +39%

Price range: From ~$1,200 to nearly $1,600/oz

3rd consecutive bullish year

These gains are not speculative pumps — they are a response to systemic instability. The macro backdrop is screaming uncertainty:

Sticky, structural inflation

Slowing global economic growth

Real interest rates still hovering around zero or negative

Geopolitical risk escalating in nearly every region of the world

This isn’t a short squeeze. It’s a capital migration.

🏦 The Central Bank Bid: The Silent Giant

What separates this rally from past cycles is who’s buying.

Unlike the 2011 gold run — driven heavily by retail FOMO and speculative ETF flows — today’s surge is institutionally anchored.

The strongest force in the current trend? Central banks.

Led by China, Russia, Turkey, and several BRICS nations, central banks have been accumulating gold at a record pace, shifting reserves away from USD exposure and hedging long-term geopolitical and economic risks. This isn't just diversification — it's a statement of monetary sovereignty.

Their consistent demand is forming a strong floor under price, insulating gold from violent retracements even during short-term corrections.

🔍 The Psychology of this Bull Market

This isn’t the kind of rally that fades on CPI noise.

The capital flow is defensive, not aggressive.

Funds are rotating into gold not to chase yield, but to preserve value. In times when fiat devaluation, sovereign debt instability, and political fragmentation are on the rise — gold doesn’t just shine, it leads.

The market is re-pricing systemic risk.

Investors are no longer reacting to inflation headlines. They are positioning for longer-term fragility in global monetary policy. That’s why even when inflation prints soften temporarily, gold still holds ground.

📌 What Comes Next?

Yes, technically, a pullback is healthy — even expected.

Extended breakouts are often followed by short-term consolidations. But the medium- to long-term structure remains intact.

Gold is not in a bubble. It’s in rotation.

In a world full of uncertainty, inflation volatility, and central bank crossfire — gold remains the most trusted asset for capital protection. And this rally? It’s not the end of something.

It’s just the beginning of a new monetary cycle.

— AD | Money Market Flow

📢 Join our community of serious traders.

Let’s grow, learn, and win together inside the MMFlow Trading Channel.

Tap in and be part of the flow.

Fundamental-analysis

Gold Rallies Ahead of Critical PCE Report – Is a Reversal ComingAs expected, Gold reached a new all-time high (ATH) following the bullish momentum we anticipated yesterday.

However, this upside move seems to have arrived earlier than projected — potentially a pre-positioning move before a major correction triggered by tonight’s PCE inflation data and profit-taking ahead of the weekend.

With current momentum, Gold could easily target $3100 as global stock markets — from the US to Asia — are sharply declining.

This reflects rising concerns over a global economic slowdown, and highlights the growing demand for safe haven assets like Gold.

📰 Tonight’s PCE data will offer key insights into inflation in the current macro context.

If PCE inflation decreases, Gold is likely to continue its rally.

However, if PCE shows higher inflation, we could see heavy sell pressure enter the market — leading to a sharp drop in XAUUSD.

That said, recent CPI and PPI data suggest that inflation may already be easing, supporting the bullish case — or at least explaining the early price surge.

🟡 Strategy for Today:

Look for early BUY entries during Asia & London sessions at key lower supports.

Avoid SELL positions for now — wait for price to reach major psychological resistance levels like $3100 before considering a short setup.

🧭 Key Levels:

🔻 Support: 3064 – 3055 – 3048 – 3040 – 3032

🔺 Psychological Resistance: 3090 – 3100 – 3106 – 3110

🎯 Trade Zones – 29/03:

BUY ZONE: 3056 – 3054

SL: 3050

TP: 3060 – 3064 – 3068 – 3072 – 3076 – 3080 – ???

🔴 SELL ZONE: 3100 – 3102

SL: 3107

TP: 3096 – 3090 – 3086 – 3082 – 3078 – 3074 – 3070

🧠 Final Reminder:

It’s Friday — and PCE inflation data tonight is crucial.

If you feel unsure or your trading psychology is shaky, stay out and wait for clarity post-news.

As always, respect your SL/TP levels and protect your capital at all costs.

Good luck, homies! Let’s trade smart.

— AD | Money Market Flow

Gold Awaits – A Major Move Is Just Around the CornerGold has shown consistent structure since the start of this week.

Today, there are no major economic events, so price is likely to continue moving sideways within the current range, as previously analyzed in AD’s plan.

📌 Important Events Coming Up:

🔸 Thursday: US Quarterly GDP data

🔸 Friday: PCE Inflation Report (Key inflation indicator)

👉 These are the two most impactful news releases this week, and essentially wrap up Q1/month-end flows.

→ Global traders will be closely watching Thursday & Friday, so stay extra cautious during these two sessions.

🔄 Today’s Market Behavior:

Gold continues to range within the same channel shared earlier this week.

There is no clear breakout or strong directional move yet.

The market is essentially waiting for Thursday & Friday's data — which could act as the catalyst for a stronger bearish correction, in line with AD’s mid-term outlook.

🔍 Current Trading Strategy:

As shared from the beginning of the week, AD continues to trade reactions at key support and resistance zones.

Without a confirmed breakout, the approach remains:

→ Trade the range. React to both ends of the zone.

🧭 KEY LEVELS TO WATCH:

🔺 Resistance: 3,010 – 3,036 – 3,046 – 3,057

🔻 Support: 3,010 – 3,001 – 2,988

🎯 TRADE ZONES:

BUY ZONE: 2988 – 2986

SL: 2982

TP: 2992 – 2996 – 3000 – 3004 – 3008 – 3015

SELL ZONE: 3045 – 3047

SL: 3051

TP: 3042 – 3038 – 3034 – 3030 – 3026 – 3020

🧠 Final Reminder:

There is no breakout confirmation yet → market is still in accumulation mode.

Be patient, avoid FOMO, and watch price reaction closely at each zone.

➡️ Trade clean levels. Enter only when setups are clear — stay out if not.

Protecting your capital always comes first.

— AD | Money Market Flow

Bitcoin (BTC/USD) 4H Chart Analysis: Bullish Breakout Ahead?📈 Ascending Channel:

🔹 The price is moving upward within a parallel trend channel.

🔹 Blue arrows (🔵) indicate resistance points where the price struggled.

🔹 Red circles (🔴) highlight support areas where the price bounced.

🟦 Fair Value Gap (FVG) Zone:

🔸 The blue-shaded area (FVG zone) suggests a possible retracement before a bullish move.

🔸 If the price dips into this zone, it may find liquidity and bounce back up.

📊 Projected Price Movement:

⚡ Expected pullback → into FVG zone (🔽), then a bullish push (🚀) towards $90,686.72 🎯.

🟡 Yellow arrow shows the anticipated price path.

📉 Support & Resistance Levels:

✅ Support: Around $86,000 - $86,500 (FVG zone).

🚀 Target: $90,686.72 (next major resistance).

📌 Exponential Moving Average (DEMA - 9):

🔹 The blue line (DEMA 9) at $87,414.57 is acting as dynamic resistance.

🔹 A break above this could confirm further upside movement.

💡 Conclusion:

🔸 Bullish bias remains strong 📈.

🔸 Watch for a dip into the FVG zone before a potential rally 🚀.

🔸 If Bitcoin holds support, it may reach $90K+ soon 🎯🔥.

Advanced Technical ConceptOn the other hand, hidden divergence occurs when the price makes a lower low, but the RSI indicator makes a higher low, signaling a potential trend continuation. RSI Divergence occurs when the price movement and the RSI indicator move in opposite directions, signaling a potential reversal in the current trend.

Divergence within RSI through price movements is a powerful indication that there will be reversals in the market. There are two types of divergences: bullish divergences and bearish divergences. 1. Bullish divergence

Financial Markets Financial Markets include any place or system that provides buyers and sellers the means to trade financial instruments, including bonds, equities, the various international currencies, and derivatives.

Some examples: bank or credit unions, for loans or savings accounts. securities markets, such as the New York Stock Exchange or the American Stock Exchange, for businesses to acquire investment capital, mutual funds, or bonds.

Video For Traders Options trading is a type of financial trading that allows investors to buy or sell the right to purchase or sell an underlying asset at a fixed price, at a future date. Options trading operates on the basis that the buyer has the option to exercise the contract but is not under any obligation to do so.

Trading options offers a number of benefits for an active trader: Options can offer high returns and do so over a short period, allowing you to multiply your money quickly if your wager is right. With options, it can cost less to get the same exposure to a stock's price movement than it does to buy the stock directly.

Advanced Patterns Trading Chart patterns are visual representations of price movements used in technical analysis to predict future market behavior, categorized as continuation, reversal, or bilateral, and can signal potential trend continuation, reversal, or volatility.

Top Picks: The Most Successful, Profitable, and Reliable Chart Patterns

Head and Shoulders Pattern.

Double Tops and Double Bottom.

Cup and Handle.

Ascending/Descending Triangles.

Bullish and Bearish Flags.

Wedge Patterns (Rising/Falling Wedges)

Triple Tops and Triple Bottoms.

Symmetrical Triangles.

Advanced Swing Trading Strategy with Pcr Part-1So, an average put-call ratio of 0.7 for equities is considered a good basis for evaluating sentiment. In general: A rising put-call ratio, or a ratio greater than 0.7 or exceeding 1, means that equity traders are buying more puts than calls. It suggests that bearish sentiment is building in the market.

The Put-Call Ratio (PCR) is a popular technical indicator used by investors to assess market sentiment. It is calculated by dividing the volume or open interest of put options by call options over a specific time period. A higher PCR suggests bearish sentiment, while a lower PCR indicates bullish sentiment.

Divergence Trading With ProfessionalsDivergence in an uptrend occurs when price makes a higher high but the indicator does not. In a downtrend, divergence occurs when price makes a lower low, but the indicator does not. When divergence is spotted, there is a higher probability of a price retracement.

Divergence signals tend to be more accurate on the longer time frames. You get fewer false signals. This means fewer trades but if you structure your trade well, then your profit potential can be huge. Divergences on shorter time frames will occur more frequently but are less reliable.

Advanced Swing Trading Strategy with Pcr Part-2The Put-Call Ratio (PCR) is a popular technical indicator used by investors to assess market sentiment. It is calculated by dividing the volume or open interest of put options by call options over a specific time period. A higher PCR suggests bearish sentiment, while a lower PCR indicates bullish sentiment.

So, an average put-call ratio of 0.7 for equities is considered a good basis for evaluating sentiment. In general: A rising put-call ratio, or a ratio greater than 0.7 or exceeding 1, means that equity traders are buying more puts than calls. It suggests that bearish sentiment is building in the market.

All Financial MarketIn India, there exists broadly two types of Financial Markets which are further classified : Money Market is a market that deals with short-term funds. The capital market is a market that deals with long-sighted funds. Lenders and borrowers can trade funds through the financial system.

Different types of financial markets include stock markets, bond markets, forex markets, and commodities markets. Stock markets facilitate the buying and selling of company shares, while bond markets deal with debt securities. Forex markets enable currency exchange, and commodities markets trade physical goods.29 Aug 2024

Trading with Professionals Identifying the trend. This is the first step in technical analysis for traders because trading strategies can either follow the trend or go against the trend. ...

Drawing support and resistance levels. ...

Establishing entry and exit points. ...

Position sizing and risk management.

What exactly are the two types of technical analysis? Chart patterns and technical (statistical) indicators are the two main types of technical analysis. Chart patterns are a subjective type of technical analysis in which technicians use certain patterns to indicate regions of support and resistance on a chart.

Gold Outlook – Breakout or Pullback in the Final Week of March?🧠 Final Week of March: Will Gold Break Out or Pull Back? Complete Market Outlook + Trade Plan for XAUUSD

🌐 1. Fundamental Overview – Macro Factors Driving Gold

Gold experienced a sharp $50+ correction last week after printing new all-time highs. The recent price action was shaped by several key macroeconomic factors:

🔸 The Federal Reserve held interest rates steady and delivered a more cautious tone — suggesting no immediate rate cuts, which strengthened the USD and put pressure on gold.

🔸 US Dollar Index (DXY) recovered above the 104 mark, adding bearish momentum for XAUUSD.

🔸 Upcoming US inflation data (PCE this Friday) is the main event of the week — market participants are positioning cautiously ahead of this.

🔸 End-of-quarter fund flows may trigger erratic moves and profit-taking, especially as institutions rebalance portfolios.

Despite this pullback, late-week buying activity suggests that buyers are still defending key zones, and the medium- to long-term bullish structure remains intact.

📈 2. Technical Analysis – Chart Structure & Price Action

✅ Market Context:

Price broke out of the short-term ascending channel but is still respecting the major uptrend structure

Currently testing support zones with potential for either continuation or deeper correction

Key zone around 3,013.67 is holding for now, but volatility is expected

🆕 Monday Opening (March 25, 2025) Update:

Gold opened with weakness after a brief end-of-week bounce

Price is currently stalling at a key Fibonacci retracement area (0.5–0.618) on H1/H2

Buyers have lost momentum, suggesting a consolidation or second leg down may be forming

🔁 Scenarios:

🟢 Bullish Scenario:

Price holds above 3,000 / 2,987 zone

Rebound to test 3,031.80 → breakout → targets 3,046.38 and 3,057.58

🔴 Bearish Scenario:

Failure to hold 3,000 → break below 2,987 → opens downside continuation

Price could revisit deeper demand zones below (e.g., 2,970–2,950)

📌 Key Levels:

Resistance: 3,031- 3,046 - 3,057

Support: 3,013 - 3,000.33 - 2,987

🎯 TRADE PLAN – XAUUSD

BUY ZONE: 3000 – 2998

SL: 2994

TP: 3004 – 3008 – 3012 – 3016 – 3020

SELL ZONE: 3030 – 3032

SL: 3036

TP: 3026 – 3022 – 3018 – 3014 – 3010 – 3000

Trade within reaction zones. Prioritize partial profits and always protect your capital with tight SLs.

✅ Conclusion:

Gold is still technically bullish but in a corrective phase

Market awaits confirmation from either bulls or bears before a clean breakout

News flow + macro data (PCE) will be key catalysts this week

Stay patient, trade the levels, and let price action lead

— AD | Money Market Flow

WHY DO 97% OF TRADERS LOSE MONEY IN THE MARKET?🧠 WHY DO 97% OF TRADERS LOSE MONEY IN THE MARKET?

And what should you truly prepare before you begin?

You’ve probably heard this one before:

“97% of traders lose money.”

Not because they’re not smart.

Not because they lack a good strategy.

But because they enter the market with the wrong mindset and unrealistic expectations.

❌ The market is not a gold mine — not for everyone

Many people step into trading thinking:

“Forex is a money printer. Anyone can just come in and take what they want.”

But here’s the truth:

👉 The market doesn’t hand out profits. It takes money from the unprepared and gives it to the disciplined.

It doesn’t care about your dreams — it only respects your readiness.

💸 You will lose money — and it will sting

Even if you believe your strategy is solid, it will fail at some point.

And when it does, the price you pay is real money — your own money.

And because it’s your hard-earned money, you’ll feel the pain. You’ll get emotional.

You’ll want to get it back. You’ll enter trades impulsively.

And that’s exactly when the market will drag you by the nose.

⚠️ The biggest mistake: thinking a good strategy is enough

Most new traders believe:

“Once I have a working strategy, I’ll be consistently profitable.”

But the truth is:

Every strategy fails sometimes

The market doesn’t follow your logic

A bad entry isn’t what ruins you — refusing to cut the loss is

🧘♂️ So what should you actually prepare before trading?

If you’re about to start trading — or afraid to fail early — make sure to prepare:

✅ A solid foundation of knowledge

✅ A mindset that accepts loss without losing control

✅ The ability to say: “It’s okay to lose a trade — I just need to survive long enough to learn and grow.”

📌 Other people’s strategies won’t make you profitable

Yes, I often share my outlooks, plans, and even potential entry zones.

But always remember:

My view is just a perspective — not a guarantee of success.

Trading is personal.

You’ll only become consistently profitable when:

You trust in a system you’ve practiced yourself

You take trades because you see the logic, not because someone else agrees with you

🔄 Trading is a process: Try – Fail – Learn – Repeat

I’ve lost. I’ve been stubborn. I’ve gotten emotional.

And I learned:

You don’t need to win all the time.

You just need to survive your losses and come back smarter.

A stop-loss isn’t failure.

It’s the most mature decision you can make in a chaotic environment.

🤝 I won’t promise that you’ll make money

The knowledge I share — the views I post —

may not make you rich.

But I believe:

They can help you avoid losing money needlessly.

Don’t believe anyone 100% — not even me.

Take what you learn, test it, and turn it into your own conviction.

That’s how you grow.

❤️ Final thoughts

Trading isn’t a game of prediction — it’s a test of psychology.

You don’t have to be the best trader.

You just need to protect your capital, protect your mindset, and keep showing up.

Wishing you all a peaceful weekend with your loved ones.

Tomorrow, we return to the market — sharper, calmer, and more disciplined.

The market will always be there. The real question is: will you still be here to trade it next month, next year?

— AD | Money Market Flow

Advanced Technical Analysis #DivergenceDivergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. Divergence warns that the current price trend may be weakening, and in some cases may lead to the price changing direction.

Trading Management and PsychologyWhat are the components of trading psychology?

In this blog, we’ll examine the essential components of trading psychology and offer techniques for cultivating a winning attitude. 1. The Role of Emotions in Trading 2. The Psychology of Risk Management 3. Overcoming Cognitive Biases 4. Developing a Trading Mindset 5. Dealing with Trading Losses 6. The Role of Discipline and Patience 7.

WEEKLY GOLD OUTLOOK – BIG PICTURE VIEW FOR THE HOMIES!🔍 Let’s take a quick look at Gold on the higher timeframes (W1 & D1) —

The weekly and daily candles are showing long upper wicks, indicating strong rejections from the highs due to last Friday’s correction.

📉 Gold dropped more than 50 points toward the end of the week, but later bounced back with a late-session recovery.

Looking at the W1 and D1 candles, there are early signs of a possible reversal, but momentum still seems not strong enough, as prices retraced over 20 points into the close, making the candle bodies close above 50% of the full D1/W1 range.

🧭 From AD’s perspective, price has now reacted at the all-time high zone, and we need to wait for Monday to confirm whether the bulls can push higher again — only then can we establish a full directional bias for the upcoming week.

We're now stepping back to get a broader view of price action and macro sentiment, reviewing all the latest news & market developments before entering the final week of the month...

📈 Current View from AD:

Gold is still moving inside its main bullish channel on the higher timeframes. However, in order for a true reversal to form, strong selling pressure must come in, triggering larger volumes and pushing price down into low-liquidity zones.

That said, buyers stepped back in near the weekly close, so we’ll need to closely watch:

Possible weekend gaps

Price action around the Sunday night open

This will help us determine the most accurate direction heading into Monday.

⚠️ There’s a chance we’ll see another drop, as this current bullish retracement is reaching the 0.5 – 0.618 zones on H1 and H2.

But like AD said, the real story unfolds on Monday once the leftover weekend volume gets absorbed and clean market structure reveals itself.

📌 Key Levels to Watch:

Resistance: 3025 – 3033 – 3040 – 3046 – 3056

Support: 3014 – 3005 – 3000 – 2993 – 2986

📊 Based on the MA indicators AD uses, short-term moving averages are starting to cross over mid- and long-term MAs, indicating a potential major trend shift on higher timeframes.

💡 If this structure holds into early next week, we might get early SELL opportunities, so stay alert and stick close to candle structure.

📍AD has already marked the key levels on the chart —

These are high-probability zones for entry or breakout traps, so don’t miss out on golden opportunities. Save them. Watch them.

💬 Wishing everyone a warm and joyful weekend with your family and loved ones.

AD will drop a post tomorrow on market psychology — if you’re interested, drop a boost and leave a comment!

GOOD WEEKEND HOMIES! 💛

Gold Analysis -MMF- Profit-Taking Signals Opportunity🚀 Critical Levels Today! 📊

✅ Yesterday’s Recap: Our previous analysis hit around 90% accuracy 🎯, with gold responding perfectly at historical highs, prompting traders to book profits early in the European session. The bearish momentum is continuing into today's Asian session. 📉

📌 Market Sentiment:

Profit-taking is the primary driver at these historic highs. Investors are carefully eyeing lower liquidity zones for re-entry, positioning themselves strategically for future gains as global economies lean towards rate-cut cycles and an era of cheaper money. Historically, such cycles strongly favor gold prices. 🌟💰

📌 Technical View:

Technical signals align closely with fundamentals: reversal signals at recent highs are mild, suggesting cautious profit-taking rather than aggressive short-selling. Gold traders are merely scouting temporary peaks cautiously, not heavily bearish yet. ⚠️🔍

📉 Critical Levels:

🛑 Resistance: 3038 | 3046 | 3056 | 3070

🟢 Support: 3030 | 3025 | 3014 | 3005

Currently, gold has broken the bullish H1 channel, testing immediate support at 3025. A strong breakdown below this level could trigger deeper bearish moves, especially today—Friday volatility could drive intense movements targeting lower liquidity zones. 🔻🔥

🎯 Strategic Trading Zones:

🚨 BUY ZONE: 📈

Entry: 3006 - 3004

Stop Loss (SL): 3000 🛡️

Take Profit (TP): 3010 | 3015 | 3020 | 3025 | 3030 🎯

🚨 SELL ZONE: 📉

Entry: 3056 - 3058

Stop Loss (SL): 3062 🛡️

Take Profit (TP): 3052 | 3048 | 3044 | 3040 | 3035 | 3030 🎯

⚡ Today’s Action Plan:

Focus closely on Asian & European sessions. Updates will be provided ahead of the US session, anticipating high volatility and profit-booking activities. Stay disciplined, strictly adhere to your TP & SL to protect your account! 🙌💼

Advanced Technical Analysis 'Support' and 'resistance' are terms for two respective levels on a price chart that appear to limit the market's range of movement. The support level is where the price regularly stops falling and bounces back up, while the resistance level is where the price normally stops rising and dips back down.

Support is a price point below the current market price that indicate buying interest. Resistance is a price point above the current market price that indicate selling interest. S&R can be used to identify targets for the trade. For a long trade, look for the immediate resistance level as the target.

Advanced Candlesticks Part -2Candlestick patterns provide insight into price action at a glance. While the basic candlestick patterns may provide some insight into what the market is thinking, these simpler patterns often generate false signals because they are so common. Below, we will look at more advanced candlestick patterns that offer a higher degree of reliability.

The Tweezer Top candlestick pattern is a bearish reversal pattern that signals a potential shift from an uptrend to a downtrend, characterized by two consecutive candlesticks with nearly identical highs, suggesting buyers are losing control and sellers are gaining ground.

Technical Analysis Advanced candlesticks These advanced candlesticks are associated with strong price moves, and often gaps, which cause sharp shifts in direction. Traders can participate by noticing these patterns and acting quickly to get in as the price moves in the new direction. Candlestick patterns do not have price targets, which means traders shouldn't get greedy.

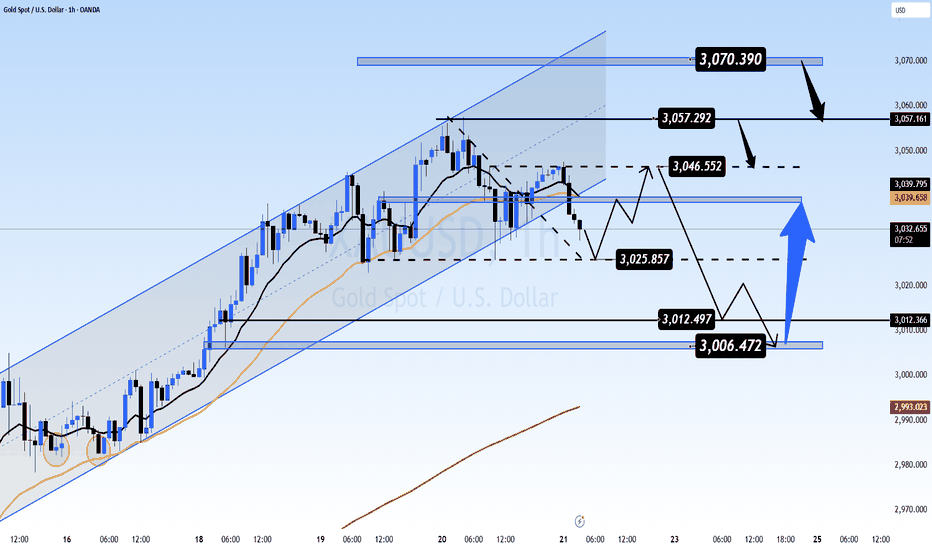

GOLD (XAU/USD) Trading Plan: Will Gold Break $3100? 🚀Published by MMFlowTrading on March 20, 2025

Overview 📊

Gold (XAU/USD) is in a strong uptrend on the H1 timeframe, with price action moving within a clear ascending channel 📈. The recent breakout above the $3000 psychological level signals robust bullish momentum 💪. However, key resistance levels are approaching, and upcoming economic events might influence the next move. Let’s dive into the technical and fundamental factors to craft today’s trading plan! 🧠

Technical Analysis 🔍

Ascending Channel:

Gold is trading within a well-defined ascending channel (highlighted in orange on the chart) 📉📈. The price has respected both the upper and lower boundaries, indicating a healthy uptrend. Currently, the price is near the upper channel resistance at $3070.612 🚧.

Key Resistance Levels (VPOC High):

The nearest resistance is at $3070.612, a high-volume node (VPOC) where sellers might step in 🛑.

If this level is broken, the next targets are $3081.053 and $3097.774, with a potential push toward the psychological $3100 mark 🎯.

Key Support Levels:

The closest support is at $3031.774, aligning with the lower channel boundary and a previous VPOC level 🛡.

A deeper pullback could test $3024.254 or even $3017.197, where buyers previously stepped in (marked by yellow circles on the chart) 📍.

Additional Key Levels:

Resistance: $3054 - $3061 - $3070 🚧

Support: $3044 - $3038 - $3031 - $3026 🛡

Fundamental Analysis 🌍

US Dollar Strength:

Gold has an inverse relationship with the USD 💱. On March 20, 2025, the market is awaiting the US Jobless Claims data and Fed speeches, which could impact the USD 📅. If the data indicates a weaker US economy, the USD might weaken, supporting Gold’s rally toward $3100 🚀.

Geopolitical Tensions:

Ongoing global uncertainties (e.g., Middle East tensions, US-China trade talks) continue to drive demand for safe-haven assets like Gold 🛡. This fundamental factor supports the bullish bias in the short term.

Interest Rates:

The Fed’s recent dovish stance on interest rates (as of early 2025) has reduced the opportunity cost of holding Gold, further fueling its uptrend 📉.

Trading Plan 📝

Buy Setup (BUY ZONE: $3032 - $3030) 🟢

Stop Loss (SL): $3026 ⛔️.

Take Profit (TP): $3038 - $3042 - $3046 - $3050 - $3060

Sell Setup (SELL ZONE: $3069 - $3071) 🔴

⛔️Stop Loss (SL): $3075

Take Profit (TP): $3065 - $3060 - $3055 - $3050

Market Note ⚠️

The market has been hitting all-time highs (ATH) after the FOMC storm early this morning 🌪. Traders, please stay cautious and strictly follow your TP/SL to keep your accounts safe! 🛡💡

Conclusion 🏁

Gold is at a critical juncture near $3070. A breakout above this level could pave the way to $3100, driven by strong technicals and supportive fundamentals 🚀. Alternatively, a rejection might lead to a pullback to the $3032 - $3030 buy zone. Stay disciplined and trade smart! 💪

What do you think about this setup? Drop your thoughts in the comments below! 👇 For more daily trading ideas, follow me on TradingView