FED HAWKISHNESS VS TECHNICAL FAIR VALUE GAPS – BIG MOVE COMING?GOLD PLAN 21/05 – FOMC HAWKISHNESS VS TECHNICAL FAIR VALUE GAPS – BIG MOVE COMING?

The recent surge in gold has paused just as traders digest the latest Federal Reserve signals. Despite rising geopolitical risks and weakening U.S. economic data, Fed officials continue to project a “higher-for-longer” rate stance, keeping the dollar afloat and adding pressure on gold’s rally.

📉 However, the technical structure tells another side of the story.

⚙️ TECHNICAL OUTLOOK: Bearish Trap or Hidden Bullish Opportunity?

On the 1H timeframe, XAU/USD is showing signs of consolidation after tapping into a major Fair Value Gap (FVG) around the 3328–3356 area. We now observe two key FVG zones above and below current price, highlighting high volatility and potential liquidity grabs.

🔍 A short-term bullish scenario is forming if gold retraces towards 3250–3252 support, where trendline confluence and dynamic support suggest strong demand.

Conversely, any strong rejection from 3354–3356 SELL ZONE could activate a bearish play back towards the lower structure levels.

💹 TRADE SETUPS FOR TODAY:

🔵 BUY ZONE:

Entry: 3252–3250

Stop Loss: 3246

Take Profit Targets:

3256 – 3260 – 3264 – 3268 – 3272 – 3280 – 3300 – ???

🔵 BUY SCALP:

Entry: 3277–3275

Stop Loss: 3272

Take Profit Targets:

3280 – 3284 – 3288 – 3292 – 3296 – 3300

🔻 SELL ZONE:

Entry: 3354–3356

Stop Loss: 3360

Take Profit Targets:

3350 – 3346 – 3342 – 3338 – 3334 – 3330 – 3320

🔻 SELL SCALP:

Entry: 3328–3330

Stop Loss: 3334

Take Profit Targets:

3324 – 3320 – 3316 – 3310 – 3305 – 3300

🌍 MACRO INSIGHT:

Fed’s hawkish tone is weighing on precious metals, but gold remains attractive under geopolitical uncertainty and de-dollarization trends.

China and other central banks continue their accumulation, suggesting long-term bullish pressure is intact.

Watch for U.S. data this week – especially PMI and jobless claims – which could provide short-term catalysts.

📌 Stay cautious and disciplined. Stick to your zones and manage risk tightly – volatility is increasing.

👉 If you found this useful, don’t forget to like, comment and follow for daily gold insights!

Fundamental-analysis

GOLD MARKET UPDATE - BE READY FOR BIG MOVES!🔥 GOLD MARKET UPDATE – FED'S HAWKISH STANCE SHAKES INVESTORS | BE READY FOR BIG MOVES!

Gold experienced a sharp drop following the latest hawkish comments from the Federal Reserve, as they reaffirmed that current monetary conditions remain stable and tight. This has caused confusion and panic among many investors, leading to a wave of sell-offs during the U.S. and early Asia sessions.

📉 On the higher timeframes, Gold appears to be forming a bearish flag pattern – a classic consolidation structure before a potential continuation move. Despite the strong bullish momentum seen during the Asian and European sessions yesterday, the key resistance near 325x held firm, preventing any major breakout.

For now, Gold seems to be trapped in a new sideways range, and unless price decisively breaks above 325x, we may continue to see choppy price action within this zone.

⚠️ However, if the current selling momentum persists and the price breaks down below the lower trendline support, the bearish flag setup could play out, with up to 80% probability, signaling a potential strong continuation of the downtrend.

Traders should stay extremely alert – a major price movement could happen at any moment!

🔑 Key Support Levels:

3205

3294

3280

3262

🔑 Key Resistance Levels:

3244

3262

3278

3286

💹 Scalping Setup – BUY:

Entry: 3294–3292

Stop Loss: 3288

Take Profit Targets:

3298 – 3302 – 3306 – 3310 – 3315 – 3320 – 3330

🟢 BUY ZONE:

Entry: 3272–3270

Stop Loss: 3266

Take Profit Targets:

3276 – 3280 – 3284 – 3288 – 3292 – 3296 – 3330

🔻 Scalping Setup – SELL:

Entry: 3242–3244

Stop Loss: 3248

Take Profit Targets:

3238 – 3234 – 3230 – 3226 – 3220 – 3210

🔻 SELL Zone:

Entry: 3276–3278

Stop Loss: 3282

Take Profit Targets:

3272 – 3268 – 3264 – 3260 – 3250 – 3240

📌 Remember to always follow your TP/SL strategy to protect your capital!

GOLD DAILY PLAN MAY 19: IS THIS THE START OF A MASSIVE BULLISH GOLD DAILY PLAN – MAY 20: IS THIS THE START OF A MASSIVE BULLISH RUN?

Gold opened the new trading week with a powerful GAP UP of over 20 USD, followed by an additional 50 USD rally during the Asia session. This explosive move is being fueled by geopolitical tensions and macroeconomic uncertainty, setting the tone for what could be a highly volatile and profitable week for gold traders.

🔥 Key Fundamental Drivers Behind This Gold Rally:

1️⃣ Putin rejects peace talks – Increased war risks reignite gold’s safe-haven appeal.

2️⃣ U.S. credit rating downgraded – Rising debt and bond yields are pushing investors back to gold.

3️⃣ Trump threatens new trade tariffs – Even a softer version of “Trade War 2.0” could shock global markets, making gold a top hedge.

➡️ With no clear resolutions in sight, gold may soon retest the all-time high of $3,500.

🧠 Technical Analysis: Bullish Signals Are Confirming

EMA13 has crossed above EMA34 and EMA200 on the M30 chart — a classic reversal confirmation.

The main trendline was broken, and price is now retesting the breakout zone.

Momentum remains strong, and price structure is shifting bullish. Priority is now to BUY the dips rather than sell counter-trend.

📌 Key Price Levels to Watch:

🔺 Resistance Zones:

3254 – 3277 – 3288

(If price breaks above 3287, we may quickly see a move toward 3350–3500.)

🔻 Support Zones:

3204 – 3193 – 3186 – 3174 – 3163

(Best areas to watch for confirmation to BUY.)

🎯 Suggested Trade Ideas:

BUY Zone: 3186 - 3184

Stop-Loss (SL): 3180

Take-Profit (TP): 3190 → 3195 → 3200 → 3210 → 3220 → 3230

BUY Scalp: 3194 - 3192

Stop-loss: 3189

Take-Profit: 3200 - 3204 - 3210 - 3215 - 3220

SELL Zone: 3287 - 3289 Only scalp or take quick profits near resistance zones

Stop-Loss (SL): 3293

Take-Profit (TP): 3285 → 3280 → 3285 → 3280 → 3270

(Note: Avoid holding SELLs, only scalp on strong bearish signals.)

⚠️ Trading Notes:

Market is highly sensitive to geopolitical headlines. One comment from Trump or Putin could move gold 50–100 USD in minutes.

No need to chase price. Let it come to your zones — and only enter on clear confirmations.

📌 Summary:

✅ Structure has turned bullish across M30 and H4.

✅ Focus on buying dips, not shorting into strength.

✅ Medium-term target zones: 3350 → 3400 → 3500, depending on continued macro pressure.

📣 Follow AD for live trading plans, market sentiment, and smart entry zones every session!

Good luck & stay disciplined.

Critical Reversal or Breakdown? | XAU/USD at Make-or-Break Zone 📉 Chart Overview:

Instrument: XAU/USD (assumed from chart context)

Timeframe: 4H or Daily (based on candlestick size)

Indicators Used:

📏 EMA 50 (Red): 3,247.86

📏 EMA 200 (Blue): 3,221.42

🔍 RSI (14): Currently at 45.90 (below midline, showing weak momentum)

🔎 Key Zones:

🧱 Support Zone: ~3,180 – 3,220

Price is currently sitting on this key demand zone.

Price previously bounced here sharply ➡️ indicating buyer interest.

📦 Resistance Block: ~3,260 – 3,280

Short-term resistance, price has been repeatedly rejected from here.

🎯 Target Zone: ~3,420 – 3,460

If price breaks out from the support-resistance squeeze, this is the potential bullish target 🎯.

🧭 EMA Analysis:

EMA 50 is still above EMA 200 ➡️ Golden Cross formation (medium-term bullish bias) ✅

However, price is currently below both EMAs, signaling short-term weakness ❌

📉 Bearish Scenario (📍Blue Arrow Down):

If price breaks below the support zone at ~3,180, we could see a sharp drop toward the next support at ~3,032 🔻.

RSI is trending down near 40, close to oversold territory ⚠️

🚀 Bullish Scenario (📈 Blue Arrow Up):

A successful retest and bounce from this support area (currently forming a rounded bottom 🥄) could lead to a bullish move toward the target zone.

This is further supported by the potential RSI bounce from the 40 area, signaling renewed momentum 🔋.

✅ Bias & Conclusion:

Neutral-to-Bullish Bias 🤝: As long as the price holds above the major support zone (~3,180), buyers have a chance to reclaim higher levels.

Look for confirmation breakout above the local resistance (~3,260) for a move toward 3,400+ 🚀.

A breakdown below support would invalidate the bullish thesis and target 3,030 instead 📉.

🛠️ Trading Plan (not financial advice!):

Long Entry: On bullish breakout & retest of ~3,260 ✅

Stop-Loss: Below ~3,180 ⚠️

Target: ~3,420 – 3,460 🎯

GOLD Pullback or Bull Trap? This Move for the WEEK⚡️Will the Recovery Hold or Just a Retest Before Another Drop?

🧠 Macro Backdrop:

Geopolitical tension: US-China trade headlines and Russia-Ukraine negotiations continue to stir uncertainty, but risk appetite is still cautious.

US CPI and PPI data this week came in weaker than expected → inflation remains soft, but no signal yet for immediate rate cuts from the Fed.

Gold has been under pressure for 2 weeks but may be stabilizing as DXY loses steam and equity markets show hesitation.

🔍 Technical Outlook (Chart: M30–H1):

Gold is forming a rising wedge within a broader corrective pattern. Yesterday’s rebound from the 3,163 zone has pushed price back above the 20 EMA (black) and is testing the 3,208–3,210 zone.

This area is key for today: breakout or rejection?

🔑 Key Levels to Watch:

🔺 Resistance:

3,221 → Local structure neckline

3,235 → Previous supply + Fibo confluence

3,251 → Strong upper bound resistance

🔻 Support:

3,184 → Minor support (demand block)

3,173 → Swing low (key reaction zone)

3,163 → Final line of defense

📈 Trade Scenarios:

⚠️ Scenario A – Bullish Push Above 3,221:

If price breaks and holds above 3,221, we may see a bullish continuation to 3,235 and even 3,251.

Momentum confirmation: Price must stay above 3,210 on pullbacks.

🔹 Entry: 3,222 – 3,224

🔹 SL: 3,216

🔹 TP: 3,235 → 3,251

⚠️ Scenario B – False Break & Bearish Rejection:

If price fails to hold above 3,221 and reverses below 3,208 → potential short opportunity targeting lower liquidity zones.

🔻 Entry: 3,220 – 3,218 (after rejection)

🔻 SL: 3,228

🔻 TP: 3,184 → 3,173 → 3,163

⚠️ Scenario C – Range Play:

If price remains between 3,208 and 3,184, scalp inside the range and wait for breakout confirmation.

💬 Follow for real-time setups and live strategy updates during major market sessions.

GOLD OUTLOOK – MAY 16: MARKET TRAP OR LEGITIMATE RECOVERY?GOLD OUTLOOK – MAY 17: MARKET TRAP OR LEGITIMATE RECOVERY?

Gold is closing out the week with unpredictable volatility, following two extreme sessions where prices dropped over 100 pips, only to rebound aggressively. Are recent news headlines just justifying the price action, or is this a well-orchestrated market trap?

🔍 Technical Breakdown (D1 & H4)

On the daily and 4-hour charts, we can clearly see a sharp breakdown, followed by an immediate rebound into the 325x area.

🎯 Key Level to Watch: 3254 – 3256

If price remains below 3256, sellers continue to dominate.

If 3256 is broken to the upside, we could see a quick move toward 327x–328x.

This zone acts as a decisive barrier between continuation and reversal.

🌐 Macro Perspective – Market Triggers

US inflation data continues to disappoint, weakening the USD and halting DXY recovery.

US-China tensions flare up again after short-lived optimism, especially around tariff talks and rare earth restrictions.

With mixed geopolitical cues, this market is prone to fakeouts and liquidity sweeps, especially ahead of the weekend.

📌 Key Levels to Monitor

🔺 Resistance Zones: 3237 – 3251 – 3261 – 3276 – 3287

🔻 Support Zones: 3205 – 3188 – 3170 – 3143

🎯 Trading Plan

🔵 BUY SCALP:

Entry: 3172 – 3170

SL: 3166

TP: 3176 → 3180 → 3184 → 3188 → 3192 → 3200

🔵 BUY ZONE:

Entry: 3142 – 3140

SL: 3136

TP: 3146 → 3150 → 3154 → 3158 → 3170 → 3180 → 3190

🔴 SELL SCALP:

Entry: 3160 – 3162

SL: 3166

TP: 3156 → 3152 → 3148 → 3144 → 3140 → 3130

🔴 SELL ZONE:

Entry: 3276 – 3278

SL: 3282

TP: 3272 → 3268 → 3264 → 3260 → 3255 → 3240

⚠️ Key Notes:

Friday sessions often bring major liquidity grabs and false breakouts.

Be disciplined with SL/TP management – especially in such volatile conditions.

Wait for candle confirmation before reacting — don’t trade emotionally.

BTC/USD DAILY PLAN – Will Bitcoin Hit 110K Before Reversing?BTC/USD DAILY PLAN – Will Bitcoin Hit 110K Before Reversing?

After a strong bullish impulse, BTC is now consolidating in a tight range between 103K–106K on the H4 chart. The ascending parallel channel remains intact, but bullish momentum is fading — a sign of potential distribution at the top.

🧠 Macro Context

BTC pumped recently thanks to ETF news and institutional inflows.

However, volume is decreasing, suggesting smart money may be offloading.

DXY and U.S. bond yields are ticking up → this could add pressure on BTC in the short term.

📊 Technical Outlook (H4 Chart)

BTC remains inside an ascending channel. Key levels to watch:

🔺 Resistance:

106,000 – local range high (H4)

110,576 – extended target if price breaks out

🔻 Support:

101,775 – bottom of current range; a breakdown here confirms weakness

94,473 – strong demand zone + EMA200

84,371 – key structural support zone if deeper correction occurs

⚠️ BTC may fake a rally toward 110K and then reverse sharply if broader macro conditions worsen.

🎯 Trading Scenarios

🔹 SCALP BUY:

Entry: 101,800 – 102,000

Stop-Loss: 100,800

Take-Profits: 103,200 → 104,000 → 105,000 → 106,000

Only enter long if price holds above 101.7K and shows strong rejection candles.

🔸 SELL ZONE:

Entry: 110,000 – 110,500

Stop-Loss: 111,200

Take-Profits: 107,000 → 105,000 → 101,775 → 94,473

Watch for exhaustion or false breakout patterns at this psychological zone.

🟢 LONG-TERM BUY ZONE:

Entry: 94,500 – 94,000

Stop-Loss: 92,500

Take-Profits: 96,000 → 98,000 → 100,000 → 103,000

Ideal for swing entries if BTC retraces into the broader demand zone.

⚠️ Key Notes:

BTC is showing signs of “rise slowly – dump fast” behavior.

Keep close watch on 101,775 – a decisive level for intraday direction.

No Fed rate cuts in sight → big money may still stay cautious.

✅ Conclusion:

Stick to trading range setups: BUY at channel base – SELL at distribution zones

Avoid FOMO and only enter trades after clear price action confirmation.

Risk management is essential during this high-trap environment.

DOUBLE TOP IN PLAY? IS $3000 THE NEXT STOP?DOUBLE TOP IN PLAY? IS $3000 THE NEXT STOP?

Gold (XAU/USD) is showing signs of one of the most bearish patterns on the daily chart – the Double Top formation. After reaching an all-time high near $3,500, the metal has entered a sharp correction phase, now hovering dangerously close to the psychological support at $3,200.

🕯️ Technical Breakdown:

A clear Double Top pattern is visible on the Daily (D1) chart, with two peaks forming near the same resistance level – a classical signal of bullish exhaustion.

If today's daily candle closes below the $3,200 zone, we may see a sharp drop toward the $3,000 level in the short to medium term.

The neckline of this pattern aligns with the critical support at 3196–3200 – a must-watch area for potential breakdown confirmation.

💸 What the Smart Money Is Doing:

Investors are pulling out of Gold and rotating into risk-on assets like equities and crypto, chasing higher yields and growth potential.

This shift suggests more than just technical correction – it may reflect a broader macro sentiment change, especially if the Fed continues to maintain its hawkish tone and delays rate cuts.

📊 Suggested Trade Scenarios:

🔻 If Daily Close is Below $3,200:

High probability sell setup based on Double Top

Potential downside targets: 3120 → 3050 → 3000

🔺 If Price Holds Above $3,200 and Bounces:

Watch for retracement to 3250–3278 for potential reversal signals

Short-term BUY scalp towards 3300–3320 with tight SL below 3190

⚠️ What to Watch This Week:

Key US data including CPI, PPI, and a speech from the Fed Chair are expected — which could cause high volatility.

Market is extremely reactive — avoid emotional trades and wait for clear structure confirmations.

Risk management is key, especially in current uncertain market conditions.

📌 Final Thoughts:

The Double Top on Gold is becoming a strong technical signal for potential trend reversal. A confirmed break below $3,200 could open the door to a deeper correction toward $3,000.

📣 Stay connected with AD for more real-time updates, technical levels, and smart trading setups every session.

GOLD Will the Correction Continue or Will We See a Reversal?GOLD UPDATE – Will the Correction Continue or Will We See a Reversal?

📊 Market Analysis:

Yesterday’s sharp decline in gold prices indicates a temporary easing in geopolitical tensions, particularly the ongoing conflict and political issues. It seems that the global environment has become slightly less tense recently, which could be a key factor in the correction we are seeing in gold.

From a political and trade perspective, the current price trend appears rational, but it is important to note that nothing is set in stone just yet. Further negotiations are expected, and these could lead to significant agreements. After the sharp drop, gold has managed to find some momentum for recovery, filling liquidity gaps and returning to areas of lower liquidity.

🔍 Current Outlook:

At the moment, I’m still expecting a possible rebound in gold, but the best opportunity might be to focus on sell positions for the time being. Yesterday’s plan, although bearish, enabled us to catch key levels for potential buy entries. Today, sell entries might be more favorable than buying.

The price is likely to continue adjusting as we await more macroeconomic news, especially regarding the US Federal Reserve’s actions. We’ve seen the Fed avoid Trump’s pressure, and there is speculation that interest rate cuts might be postponed until later in the year rather than mid-year as previously expected. If this is the case, gold could potentially revisit the $3000/oz mark in the near future.

🔮 Short-Term Strategy:

For now, we will continue trading according to the market’s correction wave. Sell positions might offer a better risk-to-reward ratio in this environment. We may still see some bounces, but they would likely be short-lived unless we see more positive macroeconomic data.

💡 Key Resistance Levels:

3264

3278

3307

3328

💡 Key Support Levels:

3241

3207

3196

3172

3156

🎯 Trade Setup:

BUY SCALP:

Entry: 3196 – 3164

SL: 3190

TP: 3200 → 3204 → 3208 → 3212 → 3216 → 3220

BUY ZONE:

Entry: 3158 – 3156

SL: 3152

TP: 3162 → 3166 → 3170 → 3174 → 3178 → 3182 → 3190

SELL SCALP:

Entry: 3278 – 3280

SL: 3284

TP: 3274 → 3270 → 3266 → 3260 → 3250 → 3240

SELL ZONE:

Entry: 3328 – 3330

SL: 3334

TP: 3324 → 3320 → 3316 → 3312 → 3308 → 3300 → 3290 → 3280

📅 Key Event: CPI Announcement

Today, we are also expecting the CPI report, a critical piece of data for the month. Be aware that there’s not much to analyze yet regarding this report, but we will update everyone once the data comes out later today.

💼 Risk Management:

Given the volatility we’re seeing, proper risk management is essential. Stick to your TP/SL levels to protect your account and avoid unnecessary risks.

📈 Final Thoughts:

Gold is currently facing corrections, but with geopolitical tensions easing, it could lead to more stability and potential breakout opportunities. Keep your trades aligned with key levels and macro news. Keep an eye on CPI and adjust accordingly.

💬 Good luck to everyone! Keep your positions safe and be patient for the right opportunities.

GOLD PRICE PLUNGES ON WEEKLY OPEN RETRACEMENT OR NEW BEAR TREND?📉 GOLD PRICE PLUNGES ON WEEKLY OPEN – RETRACEMENT OR NEW BEAR TREND?

Gold started the week with a sharp gap down, breaking below key levels after weekend developments signaled easing geopolitical tensions and positive progress in US-China trade talks. This calm has dampened safe-haven demand, triggering an aggressive selloff in early Asian hours.

🔍 Technical Outlook – M30 Parallel Channel

Gold is currently respecting a descending parallel channel on the M30 chart. Price is pushing lower and has yet to fill the weekend’s gap around the 3326–3328 zone. This remains a critical Key Level for any potential short-term recovery.

🗓️ This Week’s Macro Focus

Traders should brace for high volatility as the US economic calendar is packed with top-tier releases:

Tuesday: CPI (Consumer Price Index)

Thursday: PPI (Producer Price Index)

Thursday Night: Fed Chair Powell speaks

Meanwhile, ongoing tariff policy updates and geopolitical headlines will continue to stir price action unpredictably.

📌 Trading Bias

For now, the dominant trend is bearish. Unless we see a strong bullish reversal pattern or key breakout confirmation, the preference remains selling on rallies. Only if buyers reclaim control around the gap zone (3326–3328) should we look for long setups.

🔺 Key Resistance Levels:

3288 – 3308 – 3328

🔻 Key Support Levels:

3262 – 3246 – 3236 – 3200

🎯 Trade Setups

🔵 BUY ZONE: 3246 – 3244

SL: 3240

TP: 3250 → 3254 → 3258 → 3262 → 3266 → 3270 → 3280

🔴 SELL ZONE: 3326 – 3328

SL: 3332

TP: 3322 → 3318 → 3314 → 3310 → 3305 → 3300

🔴 SELL SCALP: 3306 – 3308

SL: 3312

TP: 3300 → 3296 → 3290 → 3286 → 3282 → 3278 → 3270

⚠️ Final Thoughts

Gold remains highly reactive to macro news and liquidity traps, especially with so many risk events this week. Trade with caution, follow your TP/SL rules, and stay flexible with your strategy. The market may deliver unexpected volatility—manage your risk smartly.

🟡 Let price guide you — not emotions.

🚨 Stay disciplined. Stay profitable.

BTC/USD – Daily Trade Plan | 10 May 2025🟢 BTC/USD – Daily Trade Plan | 10 May 2025

"Breakout Incoming? Price Coiling Tighter Near Key Resistance!"

🔍 Market Overview:

Bitcoin has shown strong upward momentum after breaking past the $99,000 mark, reaching a short-term high at $104,269.47. Since then, price has consolidated within a narrowing range. The daily structure remains bullish, but short-term selling pressure is visible — especially ahead of the weekend and macro uncertainty.

🧭 Technical Landscape:

🔺 Resistance Zones:

$104,269.47 – Local top, price has failed to break this level several times.

$105,765 – $106,917 – Previous rejection zone + Fibonacci confluence.

$108,045 – Possible extension target if breakout confirms.

🔻 Support Zones:

$102,301 – Immediate intraday support; likely first retest.

$99,379 – Strong mid-range support, aligned with Moving Average & FVG.

$97,093 – Long-term trendline & high-demand zone.

📊 Scenario 1: Bullish Breakout Continuation

If BTC holds above $102,300 and breaks H4 resistance:

🔵 Buy Entry: $102,500 – $102,300

🎯 Targets: $104,000 → $105,700 → $106,900 → $108,000

🛑 Stop Loss: $101,800

📉 Scenario 2: Liquidity Grab & Deep Pullback

If BTC loses $102,300 support, expect a move to collect liquidity around $99K:

🔵 Buy Entry: $97,200 – $97,000

🎯 Targets: $99,000 → $101,000 → $102,500

🛑 Stop Loss: $96,400

⚠️ Key Market Considerations:

🧊 DXY Recovery: Short-term USD strength may cap BTC upside.

🏦 Fed Policy Tone: Remains hawkish. Any USD volatility can shift crypto sentiment.

🔼 Long-Term Trend: Still bullish. Focus on buy-the-dip setups rather than chasing highs.

📝 Final Thoughts:

Bitcoin is entering a coiled zone, awaiting high-volume confirmation. Breakouts or sharp rejections from the current range will decide the next leg.

🚀 Stay patient — Wait for clean candle closes (H4 preferred)

🔒 Stick to your SL/TP — Discipline defines success

💡 Avoid mid-range FOMO. Let price tell the story.

Gold Plunges from 3435 After China Rate Cut FOMC Storm Incoming?Gold Plunges from 3435 After China Rate Cut – FOMC Storm Incoming?

📅 May 7, 2025 | XAU/USD Intraday Outlook

Gold faced a sharp decline in early sessions today, dropping nearly 800 PIPS from 3,435 down to the 3,36x range. While the fall appeared aggressive, the macro backdrop may provide clues — especially ahead of tonight's high-stakes FOMC meeting.

🔍 What Triggered the Sell-off?

1️⃣ China Cuts Rates by 10bps Unexpectedly:

Just ahead of U.S.–China trade talks, China slashed its benchmark interest rate by 10bps. While the move supports Chinese markets, it also boosts the U.S. Dollar (DXY), creating headwinds for gold.

2️⃣ Investors Awaiting FOMC Clarity:

Traders are hesitant to buy gold near recent highs, especially with the Fed expected to signal rate direction tonight. There’s growing speculation that today's events are part of a broader setup for potential Fed easing.

3️⃣ Geopolitical Tensions Not Helping Gold – Yet:

Despite renewed tensions between India and Pakistan, and a volatile global climate, gold hasn't responded bullishly — a sign that technicals and macro shifts are temporarily outweighing news-based fear.

📈 Technical Analysis – Dual Scenarios in Play

Gold is now moving in a wide, volatile range. Liquidity grabs at both ends are likely, and traders should adopt a flexible, confirmation-based approach rather than sticking to one directional bias.

🔺 Key Resistance Zones:

3,390

3,402

3,416

3,432

3,444

3,468

🔻 Key Support Zones:

3,365

3,356

3,332

3,314

🎯 Trade Plan – May 7, 2025 (Pre-FOMC Strategy)

🔵 BUY SCALP

• Entry: 3,355

• SL: 3,350

• TP: 3,360 → 3,364 → 3,368 → 3,372 → 3,376 → 3,380

🔵 BUY ZONE

• Entry: 3,332 – 3,330

• SL: 3,326

• TP: 3,336 → 3,340 → 3,344 → 3,348 → 3,352 → 3,358 → 3,365

📌 KEY BUY LEVEL to Watch:

→ 3,314 – 3,312

⚠️ This is a critical Fibonacci zone. If broken, trend structure may be compromised. Use wide SL (~6 PIPS) with open TP structure.

🔴 SELL SCALP

• Entry: 3,430 – 3,432

• SL: 3,436

• TP: 3,425 → 3,420 → 3,415 → 3,410 → 3,400

🔴 SELL ZONE

• Entry: 3,468 – 3,470

• SL: 3,474

• TP: 3,464 → 3,460 → 3,455 → 3,450 → 3,445 → 3,440 → 3,430

⚠️ Final Thoughts:

Today’s FOMC statement will likely dominate market direction for the rest of the week. Volatility is expected to increase sharply. With both macro and geopolitical catalysts in play, risk management is non-negotiable.

🔐 Stick to key zones. Avoid trading the news blindly. Wait for price action confirmation — and remember: capital protection beats every setup.

📌 Follow this post to get real-time updates after FOMC and new breakout zones for Thursday.

XAUUSD Bullish Continuation Setup 📊 Chart Overview:

Asset: Unspecified (likely XAUUSD or a crypto asset).

Timeframe: Looks like 4H or Daily.

Tools Used:

EMA 50 (🔴 Red Line) — 3,283.978

EMA 200 (🔵 Blue Line) — 3,185.603

Resistance & Support Zones (🔴 Highlighted boxes)

Price: 3,335.415

🔍 Technical Analysis:

🟩 Trend Direction:

📈 Uptrend Confirmed: Price is above both EMA 50 and EMA 200 → Strong bullish momentum.

✅ Golden Cross: EMA 50 is above EMA 200, confirming long-term bullish bias.

📌 Key Levels:

🧱 Main Support Zone (🟥 Bottom Box - ~2,950–3,050):

Historical strong bounce zone.

Acts as a bullish base in case of a deeper pullback.

🔄 Mid Resistance/Support (~3,180–3,260):

Now acting as support after price bounced above it.

Also aligns with EMA 200 ➕🟦 – adds confluence.

📌 Main Resistance Zone (~3,300–3,380):

Current area of consolidation.

If broken, price likely to retest upper resistance.

🚧 Top Resistance Zone (~3,450–3,500):

Target area if bullish breakout continues.

✈️ Next take-profit zone for bulls.

🧭 Market Forecast:

🔁 Retest Expected: Price might pull back slightly to the main resistance area (~3,300), retesting previous resistance as support.

🚀 Upside Potential: Upon successful retest, price is projected to head toward the upper resistance (~3,480).

📉 Bearish Scenario: If price breaks back below 3,260 and EMA 50, expect a dip toward 3,180 or even the main support zone.

📈 Summary:

Bias: ✅ Bullish

Watch for:

🔍 Retest of 3,300 zone

✅ Breakout above 3,380

❌ Breakdown below 3,260 invalidates bullish scenario

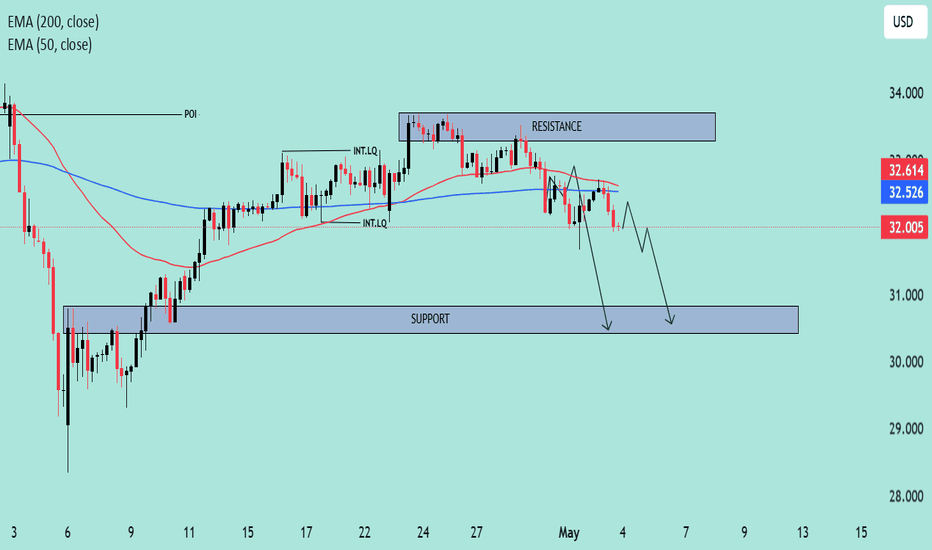

"Silver – Bearish Move Toward Support"🧠 Market Overview:

Instrument: Likely Silver (based on file name).

Chart Context: The price is currently trading below both the 50 EMA (red) and 200 EMA (blue), indicating bearish momentum and a possible shift in market structure.

📊 Key Technical Components:

🔹 Exponential Moving Averages (EMA):

50 EMA (32.614) is above the 200 EMA (32.526) but both are above the current price.

This crossover is recent and could indicate the beginning of a larger downtrend if confirmed by continued price action below both EMAs.

🔹 Market Structure:

POI (Point of Interest) marks a previous swing high where selling pressure emerged.

The chart shows internal liquidity (INT.LQ) sweeps both above and below consolidation areas, hinting at smart money manipulation to grab liquidity before making a move.

🔹 Resistance Zone:

Clearly defined between approx. 33.4–34.0, where price was rejected after a failed attempt to break higher.

Multiple rejections from this zone show strong selling pressure.

🔹 Support Zone:

Sitting between approx. 30.8–31.2.

Price previously consolidated here before a bullish move, making it a likely target for a return test or a potential bounce.

📉 Bearish Scenario & Projection:

The price broke below a short-term structure and failed to hold above EMAs.

The current price action shows a bearish pullback likely to form a Lower High (LH).

The projected path shows a pullback to previous support-turned-resistance, followed by a breakdown targeting the support zone.

✅ Bias:

Short-term bias: Bearish

Medium-term bias: Bearish, unless price reclaims the 200 EMA and consolidates above the resistance zone.

🔍 Confluences Supporting Bearish Outlook:

Price below EMAs (dynamic resistance).

Failed higher highs with liquidity sweeps (indicating smart money selling).

Clear market structure shift to the downside.

Anticipated retest of support zone around 30.8–31.2.

Management and Psychology Trading psychology is the emotional component of an investor's decision-making process, which may help explain why some decisions appear more rational than others. Trading psychology is characterized primarily by the influence of both greed and fear. Greed drives decisions that might be too risky.

NASDAQ Eyes Higher Highs Bullish Reversal in Play 📈 NASDAQ Outlook: Bullish Momentum Builds Up

✅ Breakout Confirmed: Price action has broken above the descending channel, signaling a reversal from the previous downtrend.

📊 EMA Crossover: The 50 EMA is crossing above the 200 EMA (a golden cross), historically a bullish indicator.

🔼 Momentum Strong: Price is accelerating above EMAs with a steep upward trajectory, suggesting buyers are in control.

🔮 Potential Target: With sustained momentum, price could aim for the 21,000+ region in the short term.

If the price sustains above the 19,500 zone, dips could be considered buying opportunities in the current bullish structure.

XAU/USD Market Outlook – Key Levels & Scenarios (May 2025)📊 Market Overview

Asset: XAU/USD (Gold vs. USD) – likely

Timeframe: 🕒 4H or Daily

EMAs:

🔴 50 EMA = 3,281 (short-term trend)

🔵 200 EMA = 3,179 (long-term trend)

🧱 Key Zones

🔺 Main Resistance Zone (🚫 Supply Area)

📍 ~3,320–3,400

🔍 Observation: Strong rejection zone with multiple failed attempts. 🚧 Price struggles to break and hold above here.

⚖️ Mid Support & Resistance Zone

📍 ~3,200–3,250

🧭 Current Action: Price is consolidating here. This is a key decision zone. A bounce or breakdown will likely decide the next big move. 🤔

🟦 Main Support Zone

📍 ~2,980–3,030

🛑 Observation: Major demand zone. If price falls here, it might attract buyers 👥 for a potential rebound.

📉 EMA Analysis

🔴 50 EMA is above 🔵 200 EMA → Trend still technically bullish ✅

🟡 BUT: Price is currently below 50 EMA, showing short-term weakness ⚠️

⚡️ 200 EMA is nearby (~3,179): Acting as dynamic support — a critical bounce zone! 🛡️

🔮 Scenarios

🐂 Bullish Path

✅ If price bounces from 3,200 support zone and reclaims 🔴 50 EMA:

🎯 Target: Retest of 3,320–3,400 🔺 zone

📈 Confirmation: Strong candle closing above 3,281 🔴 EMA

🐻 Bearish Path

🚨 If price breaks below 3,200 & 200 EMA:

🕳️ Expect drop towards 2,980–3,030 🟦 zone

📉 Confirmation: Candle closes below 3,179 with weak retest

✅ Conclusion

📍 Key Level to Watch: 3,200

⚖️ Market Sentiment: Neutral → Bearish bias unless price reclaims 50 EMA

🔒 Risk Tip: Avoid longs until price confirms bullish structure again 🔐

How to Find any Top or Bottom in Stocks or Index with Data A call option writer stands to make a profit if the underlying stock stays below the strike price. After writing a put option, the trader profits if the price stays above the strike price. An option writer's profitability is limited to the premium they receive for writing the option (which is the option buyer's cost).

Learn Intestinal Level TradingIf you're looking for a simple options trading definition, it goes something like this: Options trading gives you the right or obligation to buy or sell a specific security on or by a specific date at a specific price. An option is a contract that's linked to an underlying asset, such as a stock or another security.

Several factors contribute to this high failure rate: Lack of Knowledge and Education: Many traders enter the options market without a thorough understanding of how options work. Options can be complex financial instruments, and trading them without proper education can lead to significant losses

Option trading is largely a skill requiring knowledge of market trends, strategies, and risk management techniques. While there is an element of uncertainty in the markets, successful traders rely on analysis, planning, and discipline rather than luck.