GNFC

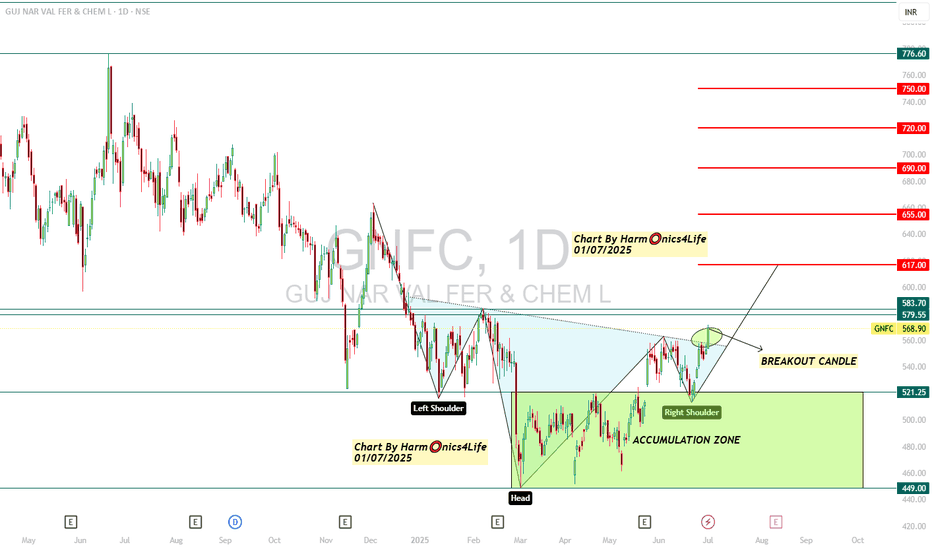

GNFC INVERTED HEAD AND SHOULDER BREAKOUT !NSE:GNFC (Gujarat Narmada Valley Fertilizers & Chemicals)

LTP 568.9

Inverted Head & Shoulder breakout on chart !

Buy here and accumulate in zone of 520---450

For Target🎯 617 / 625 / 655++

#Positional Target🎯 690 / 720 / 750++

==============================================

Positional Breakout chart

===============================================

Technical Setup:

1) More than 30% down from recent highs of 815 levels

2) Inverted Head & Shoulder breakout on chart

3) Came out of a tight consolidation range

4) Available at cheap valuations

5) Indication of Bottoming Out with High Volumes !!!

===============================================

Regards,

Harm⭕️nics4Life

01/07/2025

===============================================

Disclaimer & Risk Warning

I am not sebi registered analyst.

My studies shared here are for educational purposes .. Do Consult Your Financial advisor Before Taking any Trade.....Good Luck!

GNFC By KRS ChartsDate: 20th June 2024

Time: 1:45 pm

WHY BULLISH ON GNFC ?

1. On Daily TF it clearly shows and Successfully Breakout W pattern or Double Bottom Pattern with Strong Volume Green Candle.

2. On Weekly TF C&H Chart Pattern is clearly visible once its breakout with big candle with Good Volume, Long term Target on GNFC will be ~1137 Rs.

3. To support both the above points 100 EMA is right underneath and Price has taken support from 100 EMA multiple times.

So, First Target as per W pattern will be 868 Rs. for short term investors while for Long Term Investors Target will be 1137 once it breaks out.

Thank You!!

Double Bottom pattern breakout in GNFCGujarat Narmada Valley Fertilizers & Chemicals Limited.

Key highlights: 💡⚡

✅On 1 Day Time Frame Stock Showing Breakout of Double Bottom Pattern.

✅Strong Bullish Candlestick Form on this timeframe.

✅It can give movement up to the Breakout target of 865+.

✅Can Go Long in this Stock by placing a stop loss below 687-.

GNFC good to studyNSE:GNFC

Nice formation of CUP & Handle

On the verge of BO

Good to keep on the radar

Always respect SL & position sizing

========================

Trade Secrets By Pratik

========================

Disclaimer

SEBI UNREGISTERED

This is our personal view and this analysis

is only for educational purposes

Please consult your advisor before

investing or trading

You are solely responsible for any decisions

you take on basis of our research.

GNFC Best Swing Idea! 🔥Greetings traders!📈 Today, I'm thrilled to present an intriguing setup on GNFC, showcasing a positional breakout scenario complemented by volume analysis. Here's a closer look at the setup:

📈 Setup: HORIZONTAL BREAKOUT SETUP

🔍 Analysis: Extensive analysis across various timeframes confirms the breakout potential.

📊 Indicator Support: Momentum indicators are providing robust backing to the bullish momentum.

📈 Keywords: Strong volume participation, comprehensive multi-timeframe analysis, bolstered by momentum indicators.

Stay tuned as GNFC gears up for potential bullish momentum! Remember to conduct your own analysis and deploy effective risk management techniques.

#GNFC #VolumeAnalysis #TechnicalAnalysis #TradingView #StockMarket 🚀

GNFC 2H CHART ANALYSIS FOR REVERSALNSE:GNFC

#GNFC 2H Chart Analysis🧐

🔹Trend : Down

🔹View : Upside Reversal

🔹Structure : Bear trend + Inverse Head & Shoulder formation near trendline resistance.

🔹Entry : Breakout trade Above 642.50

Detailed analysis on chart Study it and mark levels on your chart.

Keep Learning

Happy Trading.

GNFC - Bullish Swing Reversal with VolumesNSE: GNFC is closing with a bullish swing reversal candle supported with volumes.

Today's volumes and candlestick formation indicates strong demand and stock should move to previous swing highs in the coming days.

The stock has been moving along the horizontal and trendline support for the past few days which is indicating demand.

One can look for a 13% to 20% gain on deployed capital in this swing trade.

The view is to be discarded in the event of the stock breaking previous swing low.

#NSEindia #Trading #StockMarketindia #Tradingview #SwingTrade

GNFCGNFC :- Cup and handle pattern has formed, wait for the breakout.

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

GUJARAT NARMADA, cypher pattern creationGUJARAT NARMADA stock is showing weakness at the major resistance zone, it formed evening star with various Doji and bearish candlestick patterns in 1h TF also the harmonic pattern suggests that this stock might make a correction.

Note- Please do your own research this is not a financial advice

Confluence of reversal signs in GNFCGNFC has given a very strong weekly closing on Friday.600-610 was acting as a strong resistance and the stock has managed to close above it. A trendline breakout is also seen in the stock.

The chart is showing strong bullish trend after retesting the weekly demand zone of 500-520 followed by strong reversal from weekly support trendline.

Positional traders can buy the stock at CMP and add on dips till 580 with an SL of 530 DCB.

Targets are 730, 780, 900++.

Chemical stocks, have shown good bullish trend in past few days and GNFC can continue the rally even further.

Idea shared strictly for educational purposes.

Gnfc chart studyGnfc spot around 755

weekly time frame

Bearish bat pattern formation

exact text book pattern formation.

counter might face resistance going ahead,

keep buffer of 2% on higher side,

if sustains above that levels than view get negated,

else as per harmonic pattern counter might retrace by 7-10%

GNFC - Long Setup, Move is ON..NSE:GNFC

✅ #GNFC trading above Resistance of 732

✅ Next Resistance is at 890

Related charts:

Charts are self-explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

GNFC - Break Out TradeDate : 4-Sep-2023

Rating : Buy

LTP : Rs. 623.40

Target : Rs. 665 --> 695 --> 735

SL : 600 on closing basis

Exit Plan : Follow the 7/13/26 DEMA cross down on closing basis.

NSE:GNFC has given multiple break outs on the chart.

1. Break out from primary down trend.

2. Break out from long time resistance at 614 level.

3. Break out from the neck line of double bottom pattern.

MACD and 7/13 DEMA has already given a bullish cross over. RSI is showing good strength in current uptrend.

Disclaimer : I am not a SEBI registered analyst/consultant and not recommending anyone to take any BUY or SELL position in stock market. Investing in stock market is risky and one should do a self analysis and validation before investing in stock market.

GNFC multi time frame analysisGNFC on monthly time frame gave a breakout of rounding bottom in Feb'22 and immediate next month it gave more than 50% upside momentum. Since then it has went into correction mode and is taking support now from last few months at the previous resistance / breakout level on monthly closing basis.

Monthly candle so far is looking good and since Oct'22, it is probably first time price is trading above its previous month's high.

On Weekly time frame -

The stock is showing positive divergence with an anticipated falling channel breakout on weekly closing basis

On daily time frame

On daily time frame stock has already given a channel breakout here with some good volumes

On hourly time frame

On hourly time frame stock seems to have given a ascending triangle breakout and looking in good momentum currently

GNFC 580CE

580CE is trading above vwap & avwap levels and showing signs of some short covering, with highest OI placed at 600 it may be good idea to track this for a momentum trading.

No reco for buy and sell, this is just an education post