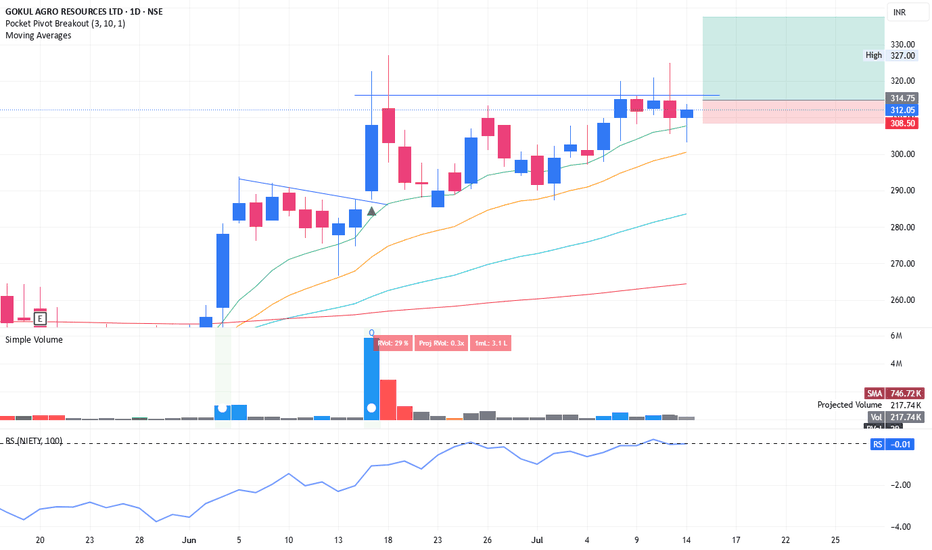

GOKUL

Swing trading opportunity with good risk : reward in GOKULAGROAgain coming up with swing trade idea. tight consolidation in range of 2-4% within last 5-6 days. Price is hovering around short term EMA. Looks like weak hands are exiting. Breaking above the pivot line could lead to significant push when crossing with good volume.

SL is somewhere around 3% (Refer the long position drawn over the chart).

One can invest 10% portfolio size as per following calculations

Position sizing and managing risk is the key.

Portfolio is: 1,00,000

Position size: 10,000

Risk 3%: 300. Which means only 0.3% of overall portfolio value is under risk.

Stay connected for commentary for coming days.

Disclaimer:

The information provided herein is for educational and informational purposes only and should not be construed as investment advice. The stock analysis and recommendations are based on publicly available information, data sources believed to be reliable, and our interpretation at the time of writing.

Investing in equities involves risks, including the risk of loss of capital. Past performance is not indicative of future results. Readers and investors are advised to conduct their own research or consult a qualified financial advisor before making any investment decisions.

The author(s), affiliates, or associated entities may hold positions in the stocks mentioned, and such positions are subject to change without notice.

We do not guarantee the accuracy, completeness, or timeliness of any information presented, and we disclaim any liability for financial losses or damages resulting from the use of this content.

GOKUL REFOILS : Trending stock#GOKUL #swingtrade #breakout #momentumtrading #trendingstock

GOKUL REFOILS : Swing Pick

>> Volume Dry setup

>> Trending setup

>> Momentum Building up

>> Good Strength

>> Low Risk High Reward Trade

Swing Traders can lock profit at 10 % and keep trailing

Pls give this Trade Idea a Boost, Comment and Follow us for more Learning

Disclaimer : Charts shared are for Study purpose, not a Trade recommendation. Consult your Financial advisor and do your own analysis before taking position in this stock.

GOKUL AGRO RESOURCESCompany is in manufacturing and processing of various kinds of Edible, Non-Edible oils and meals. Company has manufacturing facility in Gandhidham, Gujarat, India.

Its edible oil portfolio includes includes brands like Vitalife, Mahek & Zaika. Vanaspati portfolio includes brands like Richfield & Puffpride.

FII and Promoters have increased their holdings in last quarter.

Company is expected to give good quarter

Company has delivered good profit growth of 66.1% CAGR over last 5 years

Promoter holding has increased by 1.06% over last quarter.

GOKUL Daily looking bullishGOKUL daily looking bullish, it has trendline breakout/flag and pole breakout.

Good for positional..

*********************************

This is purely for training and educational purposes. We shall not be responsible for your profit or loss.

The stocks discussed or recommended here, may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial position.

GOKUL AGRO KI TRAIN NIKAL PADI NEXT PLATFORM 50GOKUL AGRO KI TRAIN NIKAL PADI NEXT PLATFORM 50... Those who want to PICK catch the train and enjoy.

all technical reason mark

after squeeze Monthly Blast observed on Gokul AGRO

in.tradingview.com

Daily and 30 Min Band squeeze breakout also observed.

mcpriceaction

#MAYURUNIQ CMP 470.45 #Target 569(20%+) $Profit $GLD $MAYURUNIQ#MAYURUNIQ

NSE: MAYURUNIQ

CMP 470.45

Target 20% = 569

SL : 430

Time Frame < 4 months

Factors:

Trend Following

Rising Volume with rising Prices.

Flag pattern breakout.

Pennant Pattern Breakout with Bullish Candle.

Retest Successful.

Higher Highs & Higher Lows.

Broken above RESISTANCE levels

Trading at SUPPORT levels

Earnings are strong.

Bullish Wedge Breakout

Risk Return Ratio is healthy.

And

Rising from Double Bottom Pattern to Flag Pattern forming.

If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations.

With 💚 from Rachit Sethia

#EMAMILTD CMP 525.75 TARGET 668(25%+) $GLD $NIFTY $EMAMILTD $GS#EMAMILTD

NSE: EMAMILTD

CMP 527.75

Target 1: 596 +

Target 2: 668++

SL 495

Time Frame < 7 months

Can hold the stock after booking in parts.

Factors:

Trend Following

Rising Volume with rising Prices.

Flag pattern breakout.

Pennant Pattern Breakout with Bullish Candle.

Retest Successful.

Higher Highs & Higher Lows.

Broken above RESISTANCE levels

Trading at SUPPORT levels

Earnings are strong.

Bullish Wedge Breakout

Risk Return Ratio is healthy.

And

Rising from Double Bottom Pattern to Flag Pattern forming.

If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations.

With 💚 from Rachit Sethia