Gold Hits Projected Target ZoneThe price is currently within the projected topping area that I marked on chart and We're seeing increased volatility in the 3,100-3,150 zone, expecting that the bullish momentum may continue for another 1-2 days as no significant weakness is visible on higher timeframes,After the current push, expect the projected correction phase to begin and we have to wait for higher time frame to confirm this, This upcoming correction should be viewed as a healthy reset within the longer-term bull market rather than a trend reversal.

Gold

Silver Going Parabolic Silver tried to break out of the horizontal range thrice (marked on chart), but was finally successful only in its third attempt on 6th Jan 2025 and did a retest too.

Post 6th Jan 2025, Silver has been in uptrend keeping up with the Gold in terms of trajectory.

It looks like there is more room upwards as geopolitical events (Tariffs, trade wars etc) shape coming months and uncertainty remains high.

Lets see how it plays out.

Trade Safe

Gold target hit at 3100: Still looking strong My previously projected path from the beginning of the year has played out with remarkable accuracy, validating our bullish outlook since January 2025 and we have captured every buy move with great precision .

We've seen consistent higher highs and higher lows within this uptrend.Recent price action shows increased volatility near to current price zone 3100-10.

The market is now entering my projected topping area (red circle),The market has followed projected path and is now entering a critical decision zone (This week or next) after this I am expecting a subsequent correction phase as marked on chart.

GOLD – Unshaken Through Chaos - 50 new all-time highs🟡 GOLD – Unshaken Through Chaos | A Structural Bull Run Backed by Global Repricing

Gold isn’t just rallying — it’s sending a message.

Over the past 12 months, gold has set over 50 new all-time highs, a breakout sequence unmatched in over a decade. This is now officially the longest bullish streak in 12 years, and the third longest in modern history, only behind the volatile 1979–1980 period — a time when the global economy was grappling with runaway inflation, stagnant growth, and widespread unemployment.

But what makes this current bull cycle unique is not just the price action, but the structural shift behind the move.

📈 The Numbers Speak for Themselves:

YTD 2024 performance: +16%

12-month gain: +39%

Price range: From ~$1,200 to nearly $1,600/oz

3rd consecutive bullish year

These gains are not speculative pumps — they are a response to systemic instability. The macro backdrop is screaming uncertainty:

Sticky, structural inflation

Slowing global economic growth

Real interest rates still hovering around zero or negative

Geopolitical risk escalating in nearly every region of the world

This isn’t a short squeeze. It’s a capital migration.

🏦 The Central Bank Bid: The Silent Giant

What separates this rally from past cycles is who’s buying.

Unlike the 2011 gold run — driven heavily by retail FOMO and speculative ETF flows — today’s surge is institutionally anchored.

The strongest force in the current trend? Central banks.

Led by China, Russia, Turkey, and several BRICS nations, central banks have been accumulating gold at a record pace, shifting reserves away from USD exposure and hedging long-term geopolitical and economic risks. This isn't just diversification — it's a statement of monetary sovereignty.

Their consistent demand is forming a strong floor under price, insulating gold from violent retracements even during short-term corrections.

🔍 The Psychology of this Bull Market

This isn’t the kind of rally that fades on CPI noise.

The capital flow is defensive, not aggressive.

Funds are rotating into gold not to chase yield, but to preserve value. In times when fiat devaluation, sovereign debt instability, and political fragmentation are on the rise — gold doesn’t just shine, it leads.

The market is re-pricing systemic risk.

Investors are no longer reacting to inflation headlines. They are positioning for longer-term fragility in global monetary policy. That’s why even when inflation prints soften temporarily, gold still holds ground.

📌 What Comes Next?

Yes, technically, a pullback is healthy — even expected.

Extended breakouts are often followed by short-term consolidations. But the medium- to long-term structure remains intact.

Gold is not in a bubble. It’s in rotation.

In a world full of uncertainty, inflation volatility, and central bank crossfire — gold remains the most trusted asset for capital protection. And this rally? It’s not the end of something.

It’s just the beginning of a new monetary cycle.

— AD | Money Market Flow

📢 Join our community of serious traders.

Let’s grow, learn, and win together inside the MMFlow Trading Channel.

Tap in and be part of the flow.

Gold silver update next Our Spot #Gold Range Prediction from 31/03/2025 to 04/04/2025 is as under.

Gold Spot : 3023$-3126$

Gold INR : 88100-91050

Our Spot #Silver Range prediction from 31/03/2025 to 04/04/2025 is as under.

Silver Spot: 33.44$-35.05$

Silver INR: 98400-103200

It must be remembered that price of precious metal depends on so many world wide factors like inflation, Fed interest rate, trade barrier, geopolitical tension, demand, supply, bond yield, dollar index , GDP, payroll data, CPI, currency fluctuation, debt ceiling , expected tax & duty changes, other commodity price crude oil etc. etc. and hence there can not be any accurate barometer of predicting precious metal price.

Gold INR has been calculated taking Gold Spot international price and converting the same assuming fixed Indian rupee rate. However, this is not accurate method as change in rupee value to dollar can substantially impact Gold INR price. Pl. note that price of commodity doesn't depend upon performence of company but depend upon performence of world economy, hence it is extremely risky to trade in commodities. Commodities market also become more volatile during contract expiry.

These are not a recommendation for buy or sell. This view is only for educational purpose. You are requested to consult your financial advisor before entering in to any trade.

Gold silver update Our Spot #Gold Range Prediction from 31/03/2025 to 04/04/2025 is as under.

Gold Spot : 3023$-3126$

Gold INR : 88100-91050

Our Spot #Silver Range prediction from 31/03/2025 to 04/04/2025 is as under.

Silver Spot: 33.44$-35.05$

Silver INR: 98400-103200

It must be remembered that price of precious metal depends on so many world wide factors like inflation, Fed interest rate, trade barrier, geopolitical tension, demand, supply, bond yield, dollar index , GDP, payroll data, CPI, currency fluctuation, debt ceiling , expected tax & duty changes, other commodity price crude oil etc. etc. and hence there can not be any accurate barometer of predicting precious metal price.

Gold INR has been calculated taking Gold Spot international price and converting the same assuming fixed Indian rupee rate. However, this is not accurate method as change in rupee value to dollar can substantially impact Gold INR price. Pl. note that price of commodity doesn't depend upon performence of company but depend upon performence of world economy, hence it is extremely risky to trade in commodities. Commodities market also become more volatile during contract expiry.

These are not a recommendation for buy or sell. This view is only for educational purpose. You are requested to consult your financial advisor before entering in to any trade.

Good silver next wives Our Spot #Gold Range Prediction from 31/03/2025 to 04/04/2025 is as under.

Gold Spot : 3023$-3126$

Gold INR : 88100-91050

Our Spot #Silver Range prediction from 31/03/2025 to 04/04/2025 is as under.

Silver Spot: 33.44$-35.05$

Silver INR: 98400-103200

It must be remembered that price of precious metal depends on so many world wide factors like inflation, Fed interest rate, trade barrier, geopolitical tension, demand, supply, bond yield, dollar index , GDP, payroll data, CPI, currency fluctuation, debt ceiling , expected tax & duty changes, other commodity price crude oil etc. etc. and hence there can not be any accurate barometer of predicting precious metal price.

Gold INR has been calculated taking Gold Spot international price and converting the same assuming fixed Indian rupee rate. However, this is not accurate method as change in rupee value to dollar can substantially impact Gold INR price. Pl. note that price of commodity doesn't depend upon performence of company but depend upon performence of world economy, hence it is extremely risky to trade in commodities. Commodities market also become more volatile during contract expiry.

These are not a recommendation for buy or sell. This view is only for educational purpose. You are requested to consult your financial advisor before entering in to any trade.

Gold Rallies Ahead of Critical PCE Report – Is a Reversal ComingAs expected, Gold reached a new all-time high (ATH) following the bullish momentum we anticipated yesterday.

However, this upside move seems to have arrived earlier than projected — potentially a pre-positioning move before a major correction triggered by tonight’s PCE inflation data and profit-taking ahead of the weekend.

With current momentum, Gold could easily target $3100 as global stock markets — from the US to Asia — are sharply declining.

This reflects rising concerns over a global economic slowdown, and highlights the growing demand for safe haven assets like Gold.

📰 Tonight’s PCE data will offer key insights into inflation in the current macro context.

If PCE inflation decreases, Gold is likely to continue its rally.

However, if PCE shows higher inflation, we could see heavy sell pressure enter the market — leading to a sharp drop in XAUUSD.

That said, recent CPI and PPI data suggest that inflation may already be easing, supporting the bullish case — or at least explaining the early price surge.

🟡 Strategy for Today:

Look for early BUY entries during Asia & London sessions at key lower supports.

Avoid SELL positions for now — wait for price to reach major psychological resistance levels like $3100 before considering a short setup.

🧭 Key Levels:

🔻 Support: 3064 – 3055 – 3048 – 3040 – 3032

🔺 Psychological Resistance: 3090 – 3100 – 3106 – 3110

🎯 Trade Zones – 29/03:

BUY ZONE: 3056 – 3054

SL: 3050

TP: 3060 – 3064 – 3068 – 3072 – 3076 – 3080 – ???

🔴 SELL ZONE: 3100 – 3102

SL: 3107

TP: 3096 – 3090 – 3086 – 3082 – 3078 – 3074 – 3070

🧠 Final Reminder:

It’s Friday — and PCE inflation data tonight is crucial.

If you feel unsure or your trading psychology is shaky, stay out and wait for clarity post-news.

As always, respect your SL/TP levels and protect your capital at all costs.

Good luck, homies! Let’s trade smart.

— AD | Money Market Flow

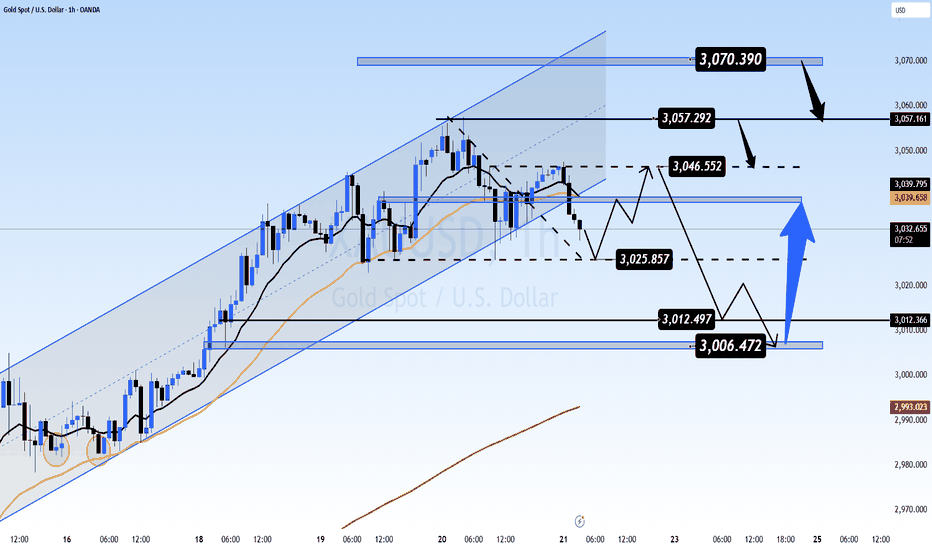

Gold short-term analysisGold has slightly risen and fallen back during the day, and the overall trend remains in a volatile trend. Gold is currently maintaining a narrow range of fluctuations on the daily trend, but the short-term moving average has begun to gradually diverge downward, and there are signs of weakening in the short term on the daily line. The 4-hour level trend is temporarily maintained in a volatile state, and the price is temporarily compressed between 3010-3038!

It is necessary to pay attention to the continued downward trend after a small break in the 4-hour level trend. In the small-level cycle trend, after touching the previous support band, there are signs of stabilization. Pay attention to the short-term adjustment.

From the overall situation, gold is definitely in the bull market stage. At present, there is strong buying defense at the 3000 mark, and the "W" double bottom has appeared below. If it successfully breaks through the 3035 watershed, it is expected to test the pressure near 3045 and the historical high of 3057. Now the low point of the callback begins to move up slowly, showing a small upward trend. Note that if 3038 breaks and stabilizes, it may continue to break upward in the short term. Follow the trend after the break!

Key points:

First support: 3016, second support: 3008, third support: 2993

First resistance: 3030, second resistance: 3038, third resistance: 3046

Operation ideas:

3010-3013, SL: 3002, TP: 3025-3035;

3036-3038, SL: 3049, TP: 3018-3010;

Gold Facing Market Storm: Will The Uptrend Continue?The gold market is witnessing strong fluctuations as money flows continuously between safe-haven assets. Gold prices briefly jumped above $3,030/ounce in overnight trading, but profit-taking pressure quickly appeared, pushing prices down to $3,018 this morning. However, the overall trend is still leaning towards the uptrend as supportive factors continue to dominate the market.

Bank of America forecasts that gold could reach an average of $3,063/ounce this year and go further to $3,350/ounce in 2026. The main driving force comes from central banks increasing their gold reserves, especially from China. At the same time, economic instability and strong adjustments in the US stock market are stimulating money flows to precious metals.

On the technical chart, gold is fluctuating in the accumulation zone after the previous strong increase. If the price stays above $3,030 and breaks short-term resistance, the possibility of rising to higher levels is completely possible. However, fluctuations will still occur when investors take advantage of price increases to take short-term profits. Overall, with a solid support foundation from the macro economy, gold still has room to continue its upward momentum in the coming time.

Gold Awaits – A Major Move Is Just Around the CornerGold has shown consistent structure since the start of this week.

Today, there are no major economic events, so price is likely to continue moving sideways within the current range, as previously analyzed in AD’s plan.

📌 Important Events Coming Up:

🔸 Thursday: US Quarterly GDP data

🔸 Friday: PCE Inflation Report (Key inflation indicator)

👉 These are the two most impactful news releases this week, and essentially wrap up Q1/month-end flows.

→ Global traders will be closely watching Thursday & Friday, so stay extra cautious during these two sessions.

🔄 Today’s Market Behavior:

Gold continues to range within the same channel shared earlier this week.

There is no clear breakout or strong directional move yet.

The market is essentially waiting for Thursday & Friday's data — which could act as the catalyst for a stronger bearish correction, in line with AD’s mid-term outlook.

🔍 Current Trading Strategy:

As shared from the beginning of the week, AD continues to trade reactions at key support and resistance zones.

Without a confirmed breakout, the approach remains:

→ Trade the range. React to both ends of the zone.

🧭 KEY LEVELS TO WATCH:

🔺 Resistance: 3,010 – 3,036 – 3,046 – 3,057

🔻 Support: 3,010 – 3,001 – 2,988

🎯 TRADE ZONES:

BUY ZONE: 2988 – 2986

SL: 2982

TP: 2992 – 2996 – 3000 – 3004 – 3008 – 3015

SELL ZONE: 3045 – 3047

SL: 3051

TP: 3042 – 3038 – 3034 – 3030 – 3026 – 3020

🧠 Final Reminder:

There is no breakout confirmation yet → market is still in accumulation mode.

Be patient, avoid FOMO, and watch price reaction closely at each zone.

➡️ Trade clean levels. Enter only when setups are clear — stay out if not.

Protecting your capital always comes first.

— AD | Money Market Flow

GOLD short-term analysis, where will it fall?Yesterday, gold hit a high of 3033 before falling back. After the rebound, the downward trend continued. The daily line continued to fall, the RSI indicator turned downward, and the price fell to the current MA10 daily moving average. The price of the four-hour chart and the hourly chart runs along the middle and lower tracks of the Bollinger Bands.

The short-term moving average of the K-line on the 4-hour chart currently maintains a relatively good oscillating downward trend. The current rebound has basically completed the technical form repair. Pay attention to the possible secondary decline trend after the rebound repair is completed.

The current gold daily chart shows that the gold price has peaked and retreated, and the Bollinger Bands are opening downward, but the gold price is still running at a high level. The KDJ indicator on the disk is glued to the upper overbought area to form a dead cross. On Monday, the gold price did not clearly indicate the direction of rise and fall, and it was more in a consolidation pattern. It is recommended to pay attention to the pressure and support of the MA5 and MA10 moving averages in the range of 3035-3000 US dollars, and try to trade with the trend after breaking.

The 4-hour gold chart shows that the SAR indicator resistance point has moved down to around $3035, and the daily MA5 moving average overlaps to form a double suppression in the short term. If the bulls want to restart, they still need to break through this position strongly. If the 4-hour real candle falls below the 3000 mark, refer to last week's low of 2981 and the weekly MA5 moving average support point of 2960. The trading ideas and direction remain unchanged. The main strategy is to sell at high levels and hold in the medium term, and then consider buying at short-term lows!

Key points:

First support: 3002, second support: 2993, third support: 2980

First resistance: 3018, second resistance: 3030, third resistance: 3046

Operation ideas:

Buy: 2990-2993, SL: 2982, TP: 3010-3020;

Sell: 3027-3030, SL: 3038, TP: 3010-3000;

Gold at the Crossroads: Will 3000 Hold ?Technical Observations

1. Support Levels

- Immediate Support: 3,000 (Psychological Level)

- Additional Support Levels:

- Potential Re-Buy Area: Around 2,900-2,910

2. Resistance Levels

- Current ATH zone marked with a question mark

Market Sentiment

- Bulls remain in control above 3,000

- Potential scenarios:

a) Hold above 3,000: Possibility of retesting or creating new ATH

b) Break and close below 3,000: Potential short to mid-term correction

Key Trading Considerations

- Critical Level to Watch: 3,000 support

- Bullish Scenario: Sustained trading above 3,000

- Bearish Warning: Decisive break and close below 3,000

Gold (XAU/USD) Bearish Outlook: Key Levels to WatchBuddy'S dear friend SMC Trading Signals Update 🗾 🗺️

This chart represents the price action of Gold (XAU/USD) on a 1-hour timeframe, showing potential areas of resistance, support, and liquidity zones. Here’s a breakdown of the analysis:

Analysis of the Chart:

1. Resistance Level (3,023-3,030 zone)

The price has reacted multiple times (red arrows), indicating strong selling pressure.

A fair value gap (FVG) is present, suggesting potential mitigation before further movement.

2. Current Price (3,011.76)

The price is trending downward after rejecting the resistance level.

It is approaching the diamond zone, a potential short-term support before continuation.

3. Key Support Levels:

Diamond Zone (~3,000 region)

Could cause a temporary bounce before further decline.

Order Block (~2,952-2,938 zone)

This is a strong demand zone and a potential target area for price action.

4. Target Levels:

The analyst expects a downward move toward 2,952, aligning with a liquidity grab scenario.

5. RSI Indicator:

RSI is at 44.27, suggesting bearish momentum, with the possibility of further downside.

A break below 40 RSI may confirm more selling pressure.

Mr SMC Trading point

Risk Management Considerations:

Entry: A possible short entry could be around the FVG level (~3,020-3,030) if price retraces.

Stop Loss: Above 3,035 to avoid being trapped in a fake breakout.

Take Profit: Around 2,952-2,938 as per the target point.

USD Update & Impact on Gold:

If USD strengthens, gold may drop further due to their inverse correlation.

Key upcoming economic data (interest rate decisions, inflation reports) could increase volatility.

Pales support boost 🚀 analysis follow)

Gold (XAU/USD) – Possible Reversal from Resistance XAU/USD (Gold Spot vs. U.S. Dollar) on the 1-day timeframe and shows an ascending channel with key price levels and technical annotations.

Key Observations:

Trend Direction:

The price has been in a strong uptrend since late 2024.

It is currently near the upper boundary of the ascending channel.

Liquidity & Market Structure:

INT.LQ (Internal Liquidity): This suggests an area where liquidity is expected to be taken before a potential move.

MB Unfilled (Market Balances Unfilled): These indicate inefficiencies in price movement that the market may revisit.

Projected Price Action:

The chart shows a potential short-term pullback from the upper boundary.

Expected retracement towards the "fair value range" around $2,800–$2,850.

If this scenario plays out, it would align with price rebalancing and a healthier uptrend continuation.

Key Levels:

Resistance: Around $3,050, which aligns with the upper trendline.

Support Zones: Around $2,950 and deeper at $2,800.

Potential Trading Strategy:

Bearish Case: If rejection occurs at $3,050, short opportunities could exist targeting $2,900–$2,850.

Bullish Case: If price retraces and finds strong support in the fair value range, it could resume its uptrend.

XAU/USD Analysis: Bearish Pullback Towards $3,000 SupportXAU/USD (Gold Spot vs. U.S. Dollar) Technical Analysis - 1H Chart

1. Price Action & Trend Analysis

The market has been in a strong uptrend, characterized by higher highs and higher lows.

Recently, the price faced resistance near the $3,040 level, leading to a rejection.

A pullback is currently in progress, suggesting a possible retracement to a demand zone.

2. Key Levels

Resistance Zone (Supply Zone): Around $3,040 - $3,045 where price has been rejected multiple times.

Support Zone (Demand Zone): Around $3,000 - $3,005, a previous accumulation area.

Current Price: $3,023.695

3. Market Structure & Expected Move

The price tested the resistance zone, failed to break above, and is now reacting downward.

A bearish projection (as shown in the chart) suggests a potential move toward the $3,000 - $3,005 support zone.

If the price reaches this level and finds buying pressure, we could see a reversal or continuation of the uptrend.

4. Indicators & Confluence Factors

Support-Resistance Flip: The previous support at $3,000 could act as a strong support again.

Bearish Momentum: Short-term price action suggests sellers are gaining control after rejection at resistance.

Liquidity Zones: The highlighted purple zones represent institutional order blocks where significant buy/sell orders exist.

5. Trading Plan & Strategy

Bearish Scenario: If price breaks below $3,000, we could see further downside pressure.

Bullish Scenario: A bounce from $3,000 could provide buying opportunities for another attempt at breaking $3,040.

6. Conclusion

The market is currently retracing from resistance, and a short-term bearish move is expected toward $3,000.

Traders should watch for price reaction at $3,000 to determine if it holds as support or breaks for further downside.

xau/usd short now Hello! Here is an effective strategy for short selling in gold (XAUUSD), including entry price, exit price, and stop loss. This strategy is designed for today's intraday trading, so that you can take advantage of the market dip.

Entry, Exit, and Stop Loss for Short Selling

Entry Price (Sell Level):

When gold is between 3037-3039, short sell (i.e. sell).

Example: If gold is at 3038, then sell here.

Stop Loss:

Place a stop loss at 3042. If gold moves above this level, close the position to minimize losses.

Example: Sold at 3038 and gold moves up to 3042, then close the position to avoid losses.

Exit Price (Profit Target):

Close your position gradually and take profit at the following levels:

1st Target: 3034

2nd Target: 3025

3rd Target: 3015

4th Target: 3005

Example: If gold falls to 3034, take some profit; If it falls to 3025, take more profit.

Strategy Summary

Entry Price: 3037-3039

Stop Loss: 3042

Exit Price: 3034, 3025, 3015, 3005

This strategy will help you profit from the fall in gold prices. Watch the market carefully and do not risk more than 1-2% of your capital. Good luck!

XAU#25: Is the correction over? What's next?Prices OANDA:XAUUSD stabilized around $3,022/ounce after a slight decline two days ago, reflecting strong safe-haven demand due to economic and geopolitical uncertainty. So is this correction over? Let's look at the next plan FOREXCOM:XAUUSD :

1️⃣ **Fundamental analysis:**

📊 Risks of economic recession and war conflict still exist:

🔹The Trump administration's reciprocal tariff policy may be more moderate than expected, reducing concerns about trade conflicts, but Wall Street is still betting on a 50% chance of a US recession due to slow currency circulation. This is one of the factors supporting Gold's rise

🔹 Risks from the Middle East and Ukraine are still unknown. Negotiations are still reaching certain agreements, but the impact on market confidence is insignificant. The fear psychology is still pushing money into Gold as a safe haven asset.

2️⃣ **Technical analysis:**

🔹 **D Frame**: The uptrend remains unchanged. Closing the session last Friday with a bearish candle is considered a profit-taking move after a series of days of gold price increase.

🔹 **H4 Frame**: The 3000 area is playing an effective support role when the price bounces back. However, the correction wave has not shown any signs of ending.

🔹 **H1 Frame**: The bearish price structure is very clear. If the 301x area is still held, the price may seek the resistance zones above to confirm the price reaction.

3️⃣ **Trading plan:*

✅ From the basic information to the reflected horizontal line, it can be seen that at the present time, the price can still continue to decrease. However, there are certain risks when FOMO establishes a SELL position in the current area. The price may not drop deeply to the lower area immediately but will sweep SL at both ends. We can wait for the price reaction in the upper resistance area to find a safer position.

💪 **Wishing you success in achieving profits!**

Gold Next Move: 3000 Loading... Key Observations to Current Price Action:

- Recent price action shows a strong impulsive move up from the green support zone (2770-90)

- The current structure suggests that we're potentially entering a corrective phase followed by continuation of the bullish trend as marked with black arrows.

- The green zone that I marked on chart can act as an institutional support level or "fair value zone" where significant trading activity has occurred,The recent breakout above this level with strong momentum suggests institutional buying pressure

- The anticipated pullback could represent a potential "discount" zone where smart money might accumulate or re enter.

The pullback, if it materializes, should ideally hold above the green support zone to maintain bullish market structure.

The overall price action still showing a bullish bias with a potential short-term correction before continuing higher. The green zone will be crucial for maintaining this bullish scenario.

I am still holding buy trade on Gold and Silver and will add more if I see confirmation from lower area (Marked in Red circle) for the target of 3000.

Gold Analysis -MMF- Profit-Taking Signals Opportunity🚀 Critical Levels Today! 📊

✅ Yesterday’s Recap: Our previous analysis hit around 90% accuracy 🎯, with gold responding perfectly at historical highs, prompting traders to book profits early in the European session. The bearish momentum is continuing into today's Asian session. 📉

📌 Market Sentiment:

Profit-taking is the primary driver at these historic highs. Investors are carefully eyeing lower liquidity zones for re-entry, positioning themselves strategically for future gains as global economies lean towards rate-cut cycles and an era of cheaper money. Historically, such cycles strongly favor gold prices. 🌟💰

📌 Technical View:

Technical signals align closely with fundamentals: reversal signals at recent highs are mild, suggesting cautious profit-taking rather than aggressive short-selling. Gold traders are merely scouting temporary peaks cautiously, not heavily bearish yet. ⚠️🔍

📉 Critical Levels:

🛑 Resistance: 3038 | 3046 | 3056 | 3070

🟢 Support: 3030 | 3025 | 3014 | 3005

Currently, gold has broken the bullish H1 channel, testing immediate support at 3025. A strong breakdown below this level could trigger deeper bearish moves, especially today—Friday volatility could drive intense movements targeting lower liquidity zones. 🔻🔥

🎯 Strategic Trading Zones:

🚨 BUY ZONE: 📈

Entry: 3006 - 3004

Stop Loss (SL): 3000 🛡️

Take Profit (TP): 3010 | 3015 | 3020 | 3025 | 3030 🎯

🚨 SELL ZONE: 📉

Entry: 3056 - 3058

Stop Loss (SL): 3062 🛡️

Take Profit (TP): 3052 | 3048 | 3044 | 3040 | 3035 | 3030 🎯

⚡ Today’s Action Plan:

Focus closely on Asian & European sessions. Updates will be provided ahead of the US session, anticipating high volatility and profit-booking activities. Stay disciplined, strictly adhere to your TP & SL to protect your account! 🙌💼

Gold short-term analysis and buying planJudging from the current market situation, short-term bulls continue to take the initiative, which will undoubtedly increase the probability of gold prices hitting the 3070-3080 area, but we also need to be prepared for high-level bulls to leave the market and make profits, and be prepared for the trend to change.

Today, Friday, since the market is still in the trend bullish structure channel, coupled with yesterday's bottoming and rebounding trend, we need to pay attention to Friday's re-high action. Trading ideas: Buy at a low position during the intraday correction, and sell after the historical high or new high is under pressure. It is planned to trade in the 3030-3060 range.

For intraday operations, it is recommended to buy on pullbacks without buying at high positions. For the support below, pay attention to the 3030-3032 area. As long as the price can keep running above, the probability of seeing the 3050-3060 area during the day is very high. On the contrary, if the support breaks down, it will most likely test the 3023 area. As for the resistance, pay attention to the 3060 area. It is expected that the possibility of a breakthrough today is very small. However, considering that the current support has moved up, it is only recommended to participate in the sale when the price approaches 3055 for the first time.

Key points:

First support: 3040, second support: 3032, third support: 3023

First resistance: 3054, second resistance: 3060, third resistance: 3077

Operation ideas:

Buy: 3031-3035, SL: 3022, TP: 3050-3060;

Sell: 3055-3057, SL: 3066, TP: 3020-3030;

More signals will be updated in the VIP group

Gold PA on week close : Profit-Taking or Trend Reversal? Gold is currently showing signs of a pullback after its strong bullish run, trading at 3,031.975 . This consolidation was anticipated in yesterday's update as a "healthy pause" following the impressive momentum .

Current current PA Status:

- Gold has pulled back from recent highs and is currently trading below the R2 resistance level (3,046.317)

- Price action is showing some selling pause in rally but remains within the projected consolidation range (3,030-3,060) that shared yesterday

- The higher high (HH) structure on the daily timeframe remains intact despite yesterday's pullback

Technical Observations

- The pullback is occurring exactly as predicted in yesterday's secondary scenario

- Current price action suggests profit-taking after reaching near the R2 level

- Gold is still trading well above the psychological 3,000 support level

- The pullback appears orderly rather than panic-driven

Updated Projections

**Primary Scenario (Bullish After Consolidation)**

- Current pullback represents normal profit-taking after the strong upward move

- Support around 3,000 should hold if bullish momentum remains intact or price need to break above yesterady high to see continuation.

- Once consolidation completes, gold likely resumes its upward trajectory toward R3 (3,136.323) as I am still execting one more week of strenth as per daily cycle timing.

Secondary Scenario (Correction)

- If today's close remains weak, we could see further pullback toward the 3,000 psychological level

- A break below 3,000 would suggest a deeper correction toward R1 (2,952.228)

Key Levels to Monitor

- Immediate resistance: R2 (3,046.317)

- Current support: 3,030 and then 3000 area

- Critical support: 3,000 psychological level and previous week low

Today's price action confirms yesterday's analysis about potential consolidation. Wait for today's closing price to determine if this is merely a pause in the bullish trend or the beginning of a deeper correction. The overall trend remains bullish as long as the price stays above 3,000 and the HH structure on the daily timeframe remains intact.