Goldlong

price increase, gold price towards 3385Plan XAU day: 14 July 2025

Related Information:!!!

An already fragile global risk sentiment has deteriorated further in response to renewed tariff threats from US President Donald Trump targeting two of the country’s major trade partners—Mexico and the European Union. In separate letters sent on Saturday to European Commission President Ursula von der Leyen and Mexican President Claudia Sheinbaum, President Trump announced the potential for new tariffs, adding to more than 20 similar notices issued since last Monday.

This latest development has dampened investor appetite for riskier assets, as reflected in the broadly weaker tone across global equity markets, and may continue to provide support for safe-haven assets such as gold. However, mixed signals regarding the Federal Reserve’s near-term interest rate trajectory are preventing XAU/USD bulls from making aggressive moves or extending the recent rally to multi-week highs

personal opinion:!!!

Trade tensions between two major regions: the US and the EU, have made gold prices positive again, and market concerns that DXY and EURO will restrain each other's value.

Important price zone to consider : !!!

resistance zone point: 3385 zone

Sustainable trading to beat the market

XAUUSD - 1H SHORT (GOLD)FOREXCOM:XAUUSD

Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. wait for more Smart Money to develop before taking any position . I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied...

Keep trading

Hustle hard

Markets can be Unpredictable, research before trading.

Disclaimer: This trade idea is based on Smart money concept and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions. Informational only!!!

GOLD SHOWING A GOOD UP MOVE WITH 1:8 RISK REWARD GOLD SHOWING A GOOD UP MOVE WITH 1:8 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

(XAU/USD) 3H Chart – Bearish Reversal Setup from Resistance Zone1. Entry Point (Sell):

Marked at 3,335.03

This is a key resistance level where price is expected to reverse downward.

2. Stop Loss:

Placed above at 3,354.88

This acts as a protection level in case the trade goes against the direction.

3. Take Profit Targets (EA Target Points):

TP1 (Downside): 3,245.65

TP2 (Upside - if Stop Loss is hit): 3,455.76 (in case of reversal or long position)

4. Price Action Observation:

Price is currently around 3,320.56, climbing back toward the entry zone.

The red 50-period moving average (EMA) and blue 200-period MA show convergence, often preceding volatility.

---

📉 Bearish Scenario (Main Setup)

Sell Bias is expected from the 3,335 region.

If price respects the resistance zone and breaks down again, the target is 3,245.65, yielding approximately 90-point move.

This is a risk-reward favorable setup, with:

Risk: ~20 points

Reward: ~90 points

RRR ≈ 1:4.5

---

⚠️ Bullish Invalidity (Stop Loss Hit)

If the price breaks and closes above 3,354.88, it invalidates the bearish setup.

Then, the market may shift towards targeting 3,455.76 — about 100 points to the upside.

---

🔧 Technical Factors Supporting the Setup

Supply zone marked by the purple box around the entry.

Trend previously bearish — recent upward move may just be a retracement.

Confluence with MAs: Price is testing MAs — rejection here would add bearish confirmation.

---

✅ Summary of Trade Setup

Element Value

Entry 3,335.03

Stop Loss 3,354.88

Take Profit 3,245.65

Alt Target 3,455.76 (if SL hit)

Risk-Reward ~1:4.5

Bias Bearish (Sell Setup)

XAUUSD | Expected Swing Movement 07/07/2025Hi,

I am sharing my view on XAUUSD swing movement. After series of consolidation at current level. If gold breaks 3315 and retest the 3306 to 3308 with pullback, it can show sharp upside move upto 3336 to 3338 level where major we can see major supply.

Disclaimer: This is only for educational purpose.

Thanks

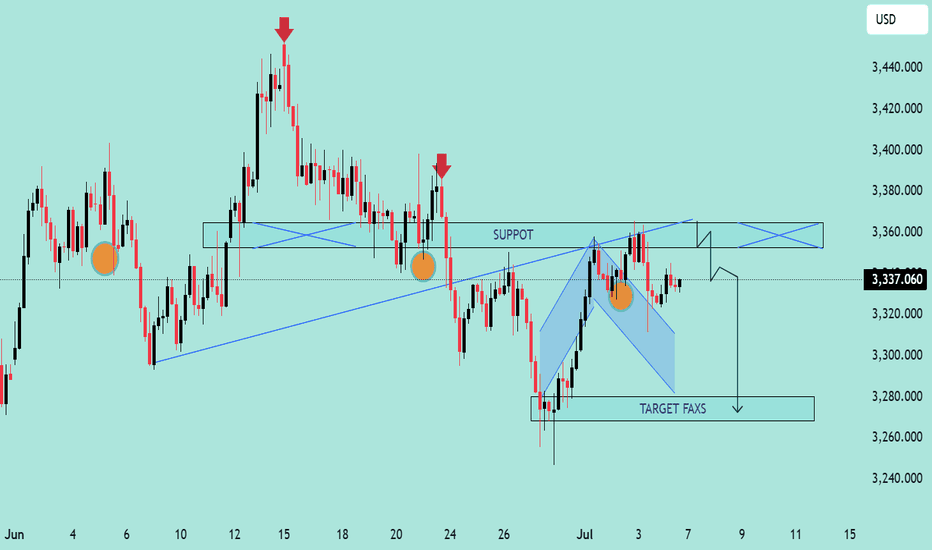

GOLD/USD Bearish Rejection From Resistance Zone – Potential DropGOLD/USD Bearish Rejection From Resistance Zone – Potential Drop Ahead! 🎯

📊 Technical Analysis Summary:

The chart illustrates a bearish setup forming after multiple rejection points near a key resistance zone around 3,360–3,380 USD.

🔍 Key Observations:

🔴 Double Rejection Pattern:

Red arrows highlight strong bearish rejections from resistance.

Indicates sellers are defending this zone aggressively.

🟠 Support Turned Resistance:

The previous support (labelled as "SUPPOT") is now acting as resistance.

Classic bearish retest behavior.

🔷 Bearish Flag Formation:

Price consolidates in a descending flag pattern.

Breakdown below the flag suggests continuation to the downside.

🎯 Target Zone:

If breakdown confirms, price may drop towards target area near 3,275–3,280 USD (marked as “TARGET FAXS”).

🟧 Important Reaction Zones:

Multiple orange circles indicate zones of high reaction – historically significant for both buyers and sellers.

📌 Conclusion:

Unless bulls reclaim the 3,360–3,380 resistance zone convincingly, the bias remains bearish, and the next leg down may target the 3,280 USD area.

🔔 Traders should watch for a clean break below 3,320 to confirm bearish continuation.

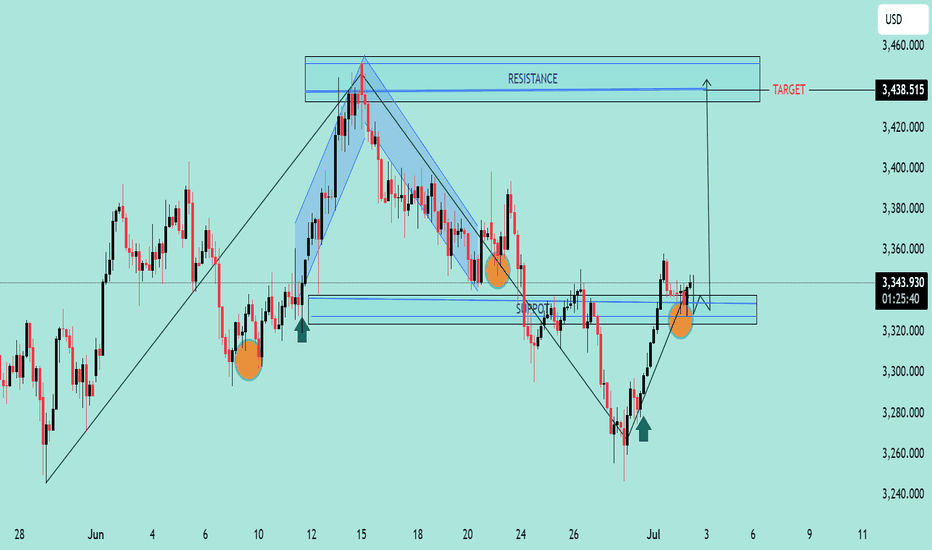

GOLD/USD Bullish Reversal and Breakout Target GOLD/USD Bullish Reversal and Breakout Target 🎯 ✨📈

🔍 Technical Analysis Overview:

The chart illustrates a clear bullish reversal pattern following a strong downtrend, with price reacting from a key support zone (highlighted in blue).

Multiple bullish rejection wicks and confirmation candles (green arrows) indicate buying interest at this support.

The recent higher low formation confirms shift in market structure towards bullish bias.

📌 Key Zones:

🟦 Support Zone: Around 3,280 – 3,320 USD

Price respected this zone multiple times (marked with orange circles), confirming its strength.

🟥 Resistance Zone / Target: 3,430 – 3,460 USD

This area aligns with previous swing highs and is the projected target for this bullish move.

📈 Chart Structure:

Break of descending trendline and bullish momentum above support suggests potential continuation towards the marked target.

Falling wedge breakout also aligns with reversal logic.

🎯 Price Target:

3,438.515 USD (resistance area), as labeled on chart with arrow and breakout projection.

🛑 Invalidation Level:

A sustained break below the support zone (3,280 USD) would invalidate this bullish outlook.

📌 Conclusion:

Gold is exhibiting strong bullish behavior with confirmation from price action and structure break. As long as price sustains above support, the path toward 3,438 remains

Bullish Reversal Setup on GOLD/USD Bullish Reversal Setup on GOLD/USD 💰📈

🔍 Chart Analysis:

The chart illustrates a clear bullish reversal structure forming off a strong support zone:

📌 Key Observations:

Multiple Rejections at Support 🟠

The price has reacted to the 3,300 - 3,280 USD support zone multiple times, forming a triple bottom pattern, indicating strong buyer interest.

Bullish Harmonic Pattern ✅

A bullish harmonic pattern (likely a Bat or Gartley) completed right at the support level, triggering a strong reversal with a bullish engulfing candle.

Break of Minor Structure 📊

Price broke through minor resistance near 3,340 USD, confirming bullish momentum. The breakout is supported by a retest shown with the green arrow 🟢.

Target Point Identified 🎯

The projected target is 3,460 USD, marked clearly as the next significant resistance zone. This aligns with previous price rejection areas, making it a high-probability target.

📈 Trading Outlook:

✅ Buy Confirmation: Break and retest of 3,340 USD zone.

🎯 Target: 3,460 USD.

🛡️ Support Zone: 3,300 – 3,280 USD (watch for any breakdown below this).

📌 Conclusion:

The chart signals a high-probability bullish continuation, with strong support, harmonic confluence, and structural breakout. Traders may look for buy opportunities on pullbacks with the target set at 3,460 USD. 🚀📊

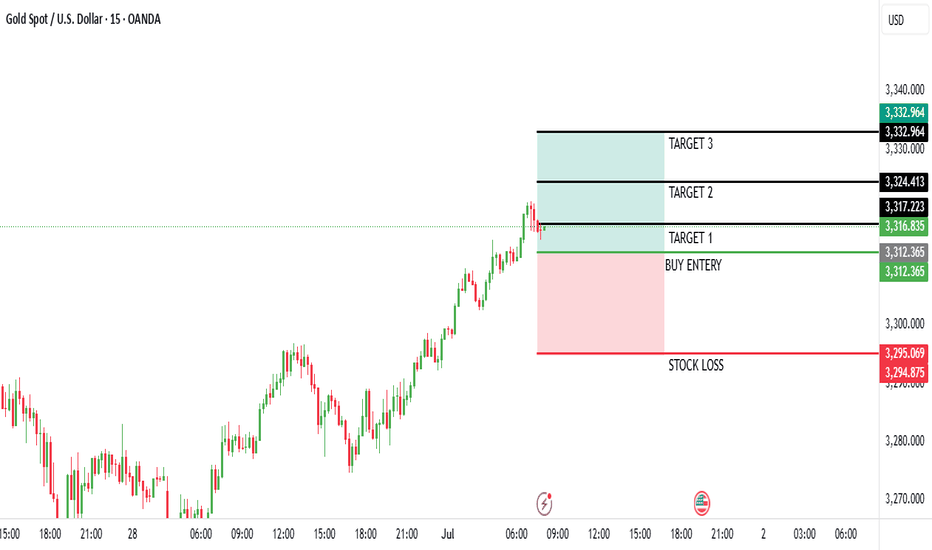

Trading Analysis for Gold Spot / U.S. Dollar (15-Minute Chart)

Based on the provided 15-minute chart for Gold Spot / U.S. Dollar (XAU/USD), published by NaviPips on TradingView.com on June 30, 2025, at 17:53 UTC, here’s a suggested trading setup for a buy position:

Current Price and Trend: The current price is 3,241.875, with a slight increase of +0.250 (+0.01%). The chart shows a recent downtrend that appears to be stabilizing near the current level, suggesting a potential reversal point.

Buy Entry: Enter a buy position at 3,312.875 (current price), as it aligns with a support zone where the price has found a base, indicated by the horizontal dashed line and recent consolidation.

Stop Loss: Place a stop loss at 3,295.250, below the recent low, to protect against further downside. This level is approximately 10.625 points below the entry, defining the risk.

Take Profit Levels:

Take Profit 1: 3,317.875, a conservative target about 20.000 points above the entry, aligning with a minor resistance zone.

Take Profit 2: 3,324.750, a mid-range target approximately 31.875 points above the entry.

Take Profit 3: 3,332.500, a deeper target about 45.625 points above the entry, indicating a potential trend reversal.

Price Action: The chart indicates a downtrend with a possible bottoming pattern near the current level. The support zone and upward candlestick suggest a buy opportunity if the price holds.

Risk-Reward Ratio: The distance to the stop loss (10.625 points) compared to the take profit levels (20.000 to 45.625 points) offers a favorable risk-reward ratio, ranging from approximately 1:1.9 to 1:4.3.

Conclusion

Enter a buy at 3,241.875, with a stop loss at 3,295.250 and take profit levels at 3,317.875, 3,324.750, and 3,332.500. Monitor the price action for confirmation of an upward move, and be cautious of a potential continued downtrend if the price breaks below the stop loss level. (Note: I assume "take profot" was a typo for "take profit" and have corrected it accordingly.)

Trading Analysis for Gold Spot / U.S. Dollar (15-Minute Chart)

Based on the provided 15-minute chart for Gold Spot / U.S. Dollar (XAU/USD), published by NaviPips on TradingView.com on June 27, 2025, at 17:53 UTC, here’s a suggested trading setup for a sell position:

Current Price and Trend: The current price is 3,278.385, with a slight increase of +2.500 (+0.08%). The chart shows a recent uptrend that appears to be exhausting near the current level, suggesting a potential reversal point.

Sell Entry: Enter a BUY position at 3,26O TO 3270 (current price), as it aligns with a resistance zone where the price has peaked and started to show signs of decline.

Stop Loss: Place a stop loss at 3,240.526, below the recent low, to protect against an upward continuation. This level is approximately 37.859 points below the entry, defining the risk.

Take Profit Levels:

Take Profit 1: 3,300.898, a conservative target about 35.513 points above the entry.

Take Profit 2: 3,305.203, a slightly lower target approximately 34.818 points above the entry.

Take Profit 3: 3,313.816, a mid-range target about 17.431 points above the entry.

indicating a potential trend reversal.

Price Action: The chart indicates an uptrend with a recent peak followed by a bearish candle, suggesting a possible reversal. The horizontal dashed line marks a key level, supporting the sell setup at the current resistance.

Risk-Reward Ratio: The distance to the stop loss (37.859 points) compared to the take profit levels (14.440 to 35.513 points) presents a mixed risk-reward profile. Take Profit 1 offers a near 1:1 ratio, while Take Profit 4 results in a negative ratio, indicating a high-risk trade against the recent uptrend.

Trading Analysis for Gold Spot / U.S. Dollar (15-Minute Chart)Based on the provided 15-minute chart for Gold Spot / U.S. Dollar (XAU/USD), published by NAVIPIPS on TradingView.com on June 28, 2025, at 20:42 UTC, here’s a suggested trading setup for a sell position. Note that the chart indicates a buy setup, but since you requested a sell analysis, I will interpret a potential sell scenario based on the current price action and levels.

Current Price and Trend: The current price is 3,274.175, with a slight decline of -0.580 (-0.02%). The chart shows a recent uptrend that may be exhausting near the current level, with a potential reversal suggested by the downward trendline.

BUY Entry: Enter a sell position at 3,274.175 (current price), as it aligns with a resistance zone where the price has struggled to break higher, indicated by the buy entry level being a potential reversal point for a sell.

Stop Loss: Place a stop loss at 3,263.740, below the recent low, to protect against an upward continuation. This level is approximately 10.435 points below the entry, defining the risk.

Take Profit Levels:

Take Profit 1: 3,295.816, a conservative target about 21.641 points above the entry.

Take Profit 2: 3,280.254, a mid-range target approximately 6.079 points above the entry.

Take Profit 3: 3,263.825, a deeper target about 10.350 points below the entry, aligning with a support zone.

Price Action: The chart indicates an uptrend with a potential peak near the current level, supported by the downward trendline. The buy setup suggests a bounce, but a sell could be viable if the price fails to sustain upward momentum.

Risk-Reward Ratio: The distance to the stop loss (10.435 points) compared to the take profit levels (6.079 to 21.641 points) presents a mixed risk-reward profile. Take Profit 1 offers a 1:2 ratio, while Take Profit 3 results in a negative ratio, indicating a high-risk sell against the buy setup.

Conclusion

Enter a BUY at 3,274.175, with a stop loss at 3,263.740 and take profit levels at 3,295.816, 3,280.254, and 3,263.825. This is a counter-trend trade against the indicated buy setup, so confirm the reversal with additional indicators (e.g., candlestick patterns or RSI) and be prepared for potential upward momentum if the price breaks above the stop loss level.

Gold (XAU/USD) Bearish Trade Setup – June 27, 2025Entry Point: Around 3,300.98 USD

Stop Loss (SL): ~3,312.20 USD

Take Profit (TP): 3,229.33 USD

Current Price: 3,286.15 USD

Risk-Reward Ratio: ~1:6.3

(Potential reward ≈ 71.65 pts; risk ≈ 11.22 pts)

Technical Breakdown:

Trend:

The price is in a short-term downtrend, supported by:

Lower highs and lower lows.

Price trading below both 50 EMA (red) and 200 EMA (blue), confirming bearish momentum.

Bearish Breakout:

Price broke below a key support-turned-resistance zone near 3,300–3,302, triggering sell pressure.

Resistance Area:

Strong rejection at 3,302–3,312 zone, which is now acting as resistance.

SL is placed just above this zone to protect against false breakouts.

Target Zone:

TP set at 3,229.33, aligning with a previous support zone — a logical area for price to react.

Strategy Notes:

Bias: Bearish

Entry confirmation: Already triggered.

Risk Management: SL placement is tight and strategic; RR ratio is highly favorable.

Next support below TP: If 3,229 breaks, further downside could follow.

Summary:

This setup shows a well-defined bearish continuation with a clean break of support, a controlled SL above resistance, and a strong RR ratio. A suitable trade for trend-following strategies, but price must not retrace above 3,312 for this idea to remain valid.

Trading Analysis for Gold Spot / U.S. Dollar (15-Minute Chart)

Based on the provided 15-minute chart for Gold Spot / U.S. Dollar (XAU/USD), published by NaviPips on TradingView.com on June 27, 2025, at 09:20 UTC, here’s a suggested trading setup for a sell position:

1. **Current Price and Trend**: The current price is 3,295.890, with a slight decline of -0.235 (-0.10%). The chart shows a recent uptrend that appears to be exhausting near the current level, with a potential reversal indicated by the EMA crossing and a bearish candle.

2. **Sell Entry**: Enter a sell position at 3,295.890 (current price), as it aligns with the resistance zone where the price has peaked and started to decline, supported by the "FULL RISKY TRADE MUST BE ENTER OPPOSITE TREND TRADE" label.

3. **Stop Loss**: Place a stop loss at 3,275.012, below the recent low, to protect against an upward continuation. This level is approximately 20.878 points below the entry, defining the risk.

4. **Take Profit Levels**:

- **Take Profit 1**: 3,326.453, a conservative target about 30.563 points above the entry, aligning with a minor resistance zone.

- **Take Profit 2**: 3,315.522, a mid-range target approximately 19.632 points above the entry.

- **Take Profit 3**: 3,301.216, a deeper target about 5.326 points above the entry.

- **Take Profit 4**: 3,287.605, the furthest target, approximately 8.285 points below the entry, indicating a potential trend reversal.

5. **Price Action**: The chart shows an uptrend with a recent peak followed by a bearish reversal signal. The EMA crossover and the "opposite trend trade" label suggest a high-risk sell setup against the prevailing uptrend.

6. **Risk-Reward Ratio**: The distance to the stop loss (20.878 points) compared to the take profit levels (5.326 to 30.563 points) presents a mixed risk-reward profile. Take Profit 1 offers a 1:1.5 ratio, while lower targets like Take Profit 4 result in a negative ratio, highlighting the high-risk nature of this trade.

### Conclusion

Enter a sell at 3,295.890, with a stop loss at 3,275.012 and take profit levels at 3,326.453, 3,315.522, 3,301.216, and 3,287.605. This is a high-risk trade due to the "opposite trend" strategy, so confirm the reversal with additional indicators and be prepared for potential continued upward momentum if the stop loss is hit.

BULL DIVERGENCE IN GOLD AT OVERSOLD ZONE IN LOW RSI LEVELAt lower price, bulls are buying with bulk quantity. We can see on the RSI indicator that the value is increasing. At the same time, the price of gold is decreasing. This suggests that the bulls are getting ready to come back at some level. That is why we are buying gold.

XAUUSD Setup Short Trade Opportunity Below ResistanceCurrent Price: 3,327.56 USD

Entry Point: 3,332.67 USD

Stop Loss: 3,342.45 USD

Take Profit Levels:

Target 1 (Downside): 3,294.45 USD (-1.17%)

Target 2 (Upside): 3,393.78 USD (+1.50%)

🔧 Technical Indicators & Tools

Trade Line: Upward sloping trendline connecting higher lows, supporting recent bullish structure.

Moving Averages:

Red: Short-term (likely 50-period EMA)

Blue: Long-term (likely 200-period EMA)

Price is still trading below the long-term MA, suggesting broader bearish pressure.

Resistance Zone: 3,334.96–3,341.30 — a key supply area marked in purple.

Support Zone: 3,294.45 — identified as a previous demand level.

⚖️ Risk-Reward Analysis

Short Setup:

Entry: 3,332.67

Stop Loss: 3,342.45 (Risk ~10 USD)

Target: 3,294.45 (Reward ~38 USD)

R:R Ratio ≈ 1:3.8, which is favorable for a short trade.

📌 Summary

Bias: Bearish intraday

Setup Type: Short-sell at resistance zone

Confirmation: Price rejection or bearish candle near 3,334–3,342 zone

Invalidation: Break and close above 3,351.06 (upper resistance)

Trading Analysis for Gold Spot / U.S. Dollar (15-Minute Chart)

Based on the provided 4-hour chart for Gold Spot / U.S. Dollar (XAU/USD), published by NaviPips on TradingView.com on June 24, 2025, at 19:14 UTC, here’s a suggested trading setup for a buy position:

Current Price and Trend: The current price is 3,300.955, reflecting a decline of -13.870 (-0.42%). The chart shows a recent downtrend with a potential support level forming near the current price.

Buy Entry : Enter a buy position at 3,300.955 (current price), as it aligns with a potential support zone where the price has stabilized. This level could serve as a base for a reversal or bounce.

Stop Loss: Place a stop loss at 3,293.294, below the recent low, to protect against further downside. This level is approximately 7.661 points below the entry, defining the risk.

Take Profit Levels:

Take Profit 1: 3,317.960, a conservative target about 17.005 points above the entry, aligning with a minor resistance zone.

Take Profit 2: 3,324.255, a mid-range target indicating a moderate upward move.

Take Profit 3: 3,344.000, a deeper target reflecting a stronger bullish reversal.

Price Action: The chart indicates a downtrend with a possible exhaustion near the current level, supported by the horizontal dashed line (potential support). A break above the recent consolidation could confirm the buy setup.

Risk-Reward Ratio: The distance to the stop loss (7.661 points) compared to the take profit levels (17.005 to 43.045 points) offers a favorable risk-reward ratio, particularly for Take Profit 3.

Conclusion

Enter a buy at 3,300.955, with a stop loss at 3,293.294 and take profit levels at 3,317.960, 3,324.255, and 3,344.000. Monitor the price action for confirmation of a reversal, and be cautious of potential continued bearish momentum given the recent trend.

Analysis of Gold Spot / U.S. Dollar (1-Minute Chart)

The provided chart for Gold Spot / U.S. Dollar (XAU/USD) on a 1-minute timeframe, published by NaviPips on TradingView.com on June 24, 2025, at 15:11 UTC, presents a short-term trading setup with the following insights:

Current Price and Trend: The current price is 3,322.030, with a slight increase of +0.410 (+0.01%). The chart shows a recent downward trend followed by a potential reversal or consolidation phase.

Entry Level: The entry point is not explicitly marked, but the chart suggests a buy opportunity near the current price level of 3,322.030, aligning with the recent low and a possible support zone.

Stop Loss: The stop loss is implied at 3,319.229, below the recent low, providing protection against further downside. This level is approximately 2.801 points below the current price, defining the risk.

Take Profit Levels (Green Lines):

Take Profit 1: 3,325.848, a conservative target about 3.818 points above the entry, aligning with a resistance zone.

Take Profit 2: 3,327.405, a mid-range target indicating a moderate upward move.

Take Profit 3: 3,329.317, a deeper target suggesting continued bullish momentum.

Take Profit 4: 3,330.000, a further target reflecting a stronger upward trend.

Take Profit 5: 3,332.290, the furthest target, indicating a significant short-term rally.

Price Action: The chart displays a descending pattern with a recent bounce from a low (around 15:00), followed by a projected upward move. The dotted line indicates a potential trendline break, supporting a bullish outlook.

Risk-Reward Ratio: The distance to the stop loss (2.801 points) compared to the take profit levels (3.818 to 10.260 points) offers a favorable risk-reward ratio, especially for higher targets.

Conclusion

This setup anticipates a bullish move from the current level of 3,322.030, with multiple take-profit levels marked by green lines and a stop loss at 3,319.229 to manage risk. Traders should confirm the entry with a breakout above the recent low and monitor for potential reversals given the short timeframe.

XAU/USD Double Bottom Breakout Bullish Momentum Incoming!🔄 XAU/USD Double Bottom Breakout 💥 | 🚀 Bullish Momentum Incoming!

Analysis:

🟡 Double Bottom Pattern: Two clear lows have formed around the $3,340 support, signaling a potential reversal.

🟦 Accumulation Zone: The price consolidated in a range, indicating strong buying interest before the breakout.

🟣 Bullish Momentum: Recent aggressive bullish candles show strong buying pressure.

📈 Breakout & Retest Zone: If the price holds above $3,370, a bullish continuation toward $3,409 and possibly $3,445 is expected.

🧭 Target Area: Marked with a blue box, the upside potential is clearly projected.

Conclusion:

A successful retest of the breakout level may lead to a strong bullish run. Keep an eye on $3,370 as the pivot zone. 🎯

Gold XAU/USD Bullish Reversal Setup – Targeting $3,454.65Price: $3,384.41

Strategy: Buy/Long

🟦 Key Levels:

Entry Zone: Around $3,345.76

This level aligns with a previously tested support zone marked in purple.

Stop Loss: $3,331.56

Below the support zone, providing downside protection if the setup fails.

Target (TP): $3,454.65

Marked as EA TARGET POINT, suggesting a potential upside of 3.16% (~$105.83 gain).

📊 Technical Indicators:

Moving Averages:

200 EMA (blue): Near the entry level, adds strength to the support zone.

50 EMA (red): Recently crossed below price, indicating early bullish momentum.

Price Action:

Sharp bounce from support suggests buying interest.

Potential inverse head and shoulders pattern forming, which is a bullish reversal pattern.

🧠 Trade Idea:

Buy near $3,345.76,

Stop Loss at $3,331.56,

Take Profit at $3,454.65

Risk/Reward Ratio ≈ 1:3.3 — favorable setup for long positions.

Analysis of Gold Spot / U.S. Dollar (XAU/USD) 15-Minute Chart

Historical Trend: The chart displays the price movement of Gold Spot / U.S. Dollar (XAU/USD) on a 15-minute timeframe from June 21 to June 24, 2025. The price followed a downtrend, defined by a descending trendline, after peaking around $3,367.574, with a recent decline toward $3,367.255 as of 16:04 UTC on June 23.

Key Levels:

Stock Loss: Set at $3,360.820 (red line), indicating the upper limit to exit a short position if the price reverses upward.

Entry: Positioned at $3,367.574 (gray line), marking the entry point for a potential short trade near the trendline.

Target 1: $3,375.557 (green line), the first profit-taking level above the entry.

Target 2: $3,388.090 (green line), the second profit-taking level for a larger gain.

Support: The $3,390.915 level (green line) acts as a potential support zone if the downtrend continues.

Recent Price Action: The price approached the downtrend line and showed a rejection, forming a potential shorting opportunity (highlighted with a yellow circle). The price is currently testing the $3,367.255 level, suggesting continued bearish momentum after breaking below the entry zone.

Projected Movement: The downward projection suggests the price could decline toward the $3,360.820 stop loss level if the bearish trend persists. A break below this could lead to further drops, while a bounce might target the $3,375.557 or $3,388.090 resistance levels.

Volume and Indicators: The chart includes Bollinger Bands (O3,367.260 H3,367.810 L3,366.747 C3,367.255) with a -0.040 (-0.00%) change, indicating low volatility. The trendline break suggests selling pressure, though specific volume data is not detailed.

Outlook: The chart outlines a shorting strategy with a clear entry and stop loss. The price is in a bearish phase, with potential targets at $3,375.557 and $3,388.090 if the downtrend continues. Monitor for a break above $3,360.820 to reassess the trade, as it would signal a bullish reversal.

GOLD/USD Falling Wedge Breakout PotentialChart Analysis:

The chart illustrates a Falling Wedge Pattern, a bullish reversal setup typically signaling a breakout to the upside.

📌 Key Observations:

📉 Downward Channel: Price has been compressing within a falling wedge (highlighted in blue), indicating potential exhaustion of sellers.

💪 Support Zone: Strong support observed near the 3,340 level, with price rejecting this zone multiple times (highlighted with orange circles).

🔼 Bullish Signals: Price recently tested the lower wedge boundary and bounced, suggesting potential reversal.

🎯 Breakout Target: Projected target after breakout is around 3,453.453 USD, aligned with previous resistance zone.

🟢 Buy Pressure Arrows: Green arrows signal previous bullish reactions from similar demand zones.

📈 Conclusion:

If price breaks above the wedge’s upper boundary with volume confirmation, a bullish rally toward 3,453 is expected. Keep an eye on breakout retest for entry validation.

✅ Trading Plan Suggestion:

Entry: On breakout above wedge resistance

SL: Below recent swing low (~3,330)

TP: 3,453 zone 🎯

🔔 Note: Wait for a confirmed breakout before entering to avoid false signals.

Analysis of Gold Spot / U.S. Dollar (XAU/USD) 15-Minute Chart

Historical Trend: The chart displays the Gold Spot / U.S. Dollar (XAU/USD) price movement on a 15-minute timeframe from June 19 to June 22, 2025. The price was in a clear downtrend, defined by a descending trendline, until a recent shift.

Key Levels:

Resistance: The $3,395.724 level (green line) has emerged as a significant resistance following the breakout. A break above this could confirm further upside.

Support: The $3,350.743 level (red line) acted as a major support during the downtrend and was recently breached upward.

Recent Price Action: The price broke above the downtrend line (highlighted with a yellow circle and labeled "TREND LINE BREAKOUT" in red), indicating a potential reversal. This breakout occurred around 12:00 on June 21, followed by a sharp upward move into a consolidation zone (light green).

Projected Movement: The upward projection (blue arrow) suggests the price could target levels around $3,380.00-$3,400.00 if the breakout momentum continues. The consolidation above $3,350.743 supports the bullish outlook.

Volume and Indicators: The chart includes Bollinger Bands (O3,368.320 H3,369.500 L3,367.660 C3,368.750) with a -0.360 (-0.01%) change, indicating low volatility. The breakout suggests increasing buying interest, though specific volume data is not detailed.

Outlook: The trend line breakout signals a potential shift from bearish to bullish momentum. Maintaining above $3,350.743 is crucial for the uptrend to continue. A failure to hold this level could see the price retest the downtrend line or lower supports. Monitor for confirmation of sustained momentum above resistance.