Will Gold Return to 3400?Market Context

Price has registered multiple bullish break of structure, confirming short-term bullish momentum.

A supply zone around 3449 – 3451 may trigger liquidity-driven reactions.

The fair value gap between 3360 – 3310 is still open and could pull price down before continuation.

Key Levels

Supply Zone: 3449 – 3451

Buy Zone 1: 3396 – 3400 (Stop Loss: 3390)

Buy Zone 2: 3310 – 3315 (Stop Loss: 3303)

FVG Zone: 3360 – 3310

Trading Scenarios

Primary Buy Setup

Entry: 3396 – 3400

Stop Loss: 3390

Target: 3449 – 3460 liquidity sweep

Secondary Buy Setup

Entry: 3310 – 3315

Stop Loss: 3303

Target: 3396 – 3449

Counter-trend Sell

Entry: 3449 – 3451, provided rejection is visible

Stop Loss: above 3458

Target: 3400 demand

Summary

The overall bias stays bullish with two key demand zones in play: 3400 for a shallow retracement and 3310 for a deeper liquidity sweep. Short positions near supply remain valid only as quick counter-trend trades.

Goldprediction

Gold (XAUUSD) Testing Support Before Potential Move HigherAnalysis:

The chart for Gold Spot (XAUUSD) on the 1-hour timeframe shows a strong uptrend within a rising channel, supported by higher lows.

Support Level: Price is currently testing a key support around 3,404–3,405. This level also aligns with the trendline, making it an important zone to hold.

Resistance Zone: The next major resistance lies between 3,430–3,445, where selling pressure could emerge.

Trend Outlook: As long as the support level holds, the bullish momentum remains intact, with potential for price to continue higher toward the resistance zone.

Risk Factor: A breakdown below the support and trendline could weaken the bullish structure and may trigger a pullback toward 3,390.

📈 Bias: Bullish above support, targeting resistance at 3,430–3,445.

📉 Invalidation: Bearish pressure may come into play if price closes below 3,390.

Gold 29/08: Smart Money Looks at 3444 or 3395 LevelsMarket Context (SMC View):

Gold faced rejection from the 3423 liquidity zone and is now pulling back.

Demand is seen near 3397–3395, which can give a bounce if price tests it.

Premium supply zones above 3422 and 3442 are good areas to look for selling opportunities.

🔼 BUY SCENARIO

Buy Zone: 3397 – 3395

Stop Loss: 3389

Targets: 3405 → 3415 → 3425

🔽 SELL SCENARIO 1 (Price Action)

Sell Zone: 3422 – 3424

Stop Loss: 3430

Targets: 3412 → 3400

🔽 SELL SCENARIO 2 (Swing)

Sell Zone: 3442 – 3444

Stop Loss: 3452

Targets: 3425 → 3412 → 3400

📌 Conclusion & Notes

Bias: Buy near 3397–3395, then watch for possible liquidity grabs at 3422–3424 or a bigger sweep near 3442–3444 to go short.

Key Levels: 3422–3424 is the first intraday supply zone, while 3442–3444 is the major swing sell zone.

Tip: Wait for rejection candles or confirmation before selling.

Risk: Gold is very volatile; use strict stop losses and manage capital carefully.

Divergence has appeared at H4 – TOP IS ABOUT TO BE FORMEDGold SMC Daily Plan – 28/08

Market Context (SMC view):

Gold is trading near 3395–3396 after a sharp bullish rally. Early bearish divergence is visible on H4, hinting at a short-term top.

Key resistance is at 3400 – a clean breakout above may trigger liquidity sweep towards 342x–343x, retesting the old ATH.

On the downside, if 3370 support breaks, price may correct deeper into 335x BUY zone for a strong bullish setup.

Key Levels:

Resistance: 3396–3400 (Sell Zone), 342x–343x (Liquidity sweep area)

Support: 3370, 3354–3352 (Buy Zone), 3325 (SL for longs)

SMC Zones & Liquidity Pools:

BUY ZONE 1: 3354–3352 (below liquidity sweep under 3370)

SL: 3347

TP: 3365 → 3375 → 3385 → 3395 → 3400+

BUY ZONE 2: 3380–3382

SL: 3374

TP: 3390 → 3400 → 3415 → 3430 → 3450+

SELL ZONE: 3408–3410 (above recent high)

SL: 3416

TP: 3390 → 3380 → 3375 → 3360

Trading Plan & Scenarios:

Sell Setup (Primary Bias – Divergence Play):

Look for liquidity grab above 3396–3399 (into resistance).

Enter short with SL above 3403.

Partial profits at 3390–3380–3375; keep runner towards 3360 if support breaks.

Buy Setup (Counter Play – Break & Retest):

If price dips into 3354–3352 BUY zone, wait for bullish confirmation (choch/BOS on lower TF).

Enter long with SL below 3347.

Targets: 3365 → 3375 → 3385 → 3395 → 3400+

Confluences:

H4 bearish divergence signalling possible exhaustion at top.

Liquidity pools above 3396 and below 3370 remain untapped.

FVG and imbalance align with 335x buy zone.

Gold (XAU/USD) Targets $3,397 – $3,406 Amid Bullish MomentumAnalysis:

The 4H chart of Gold (XAU/USD) shows strong bullish momentum after a corrective phase. Price has broken above consolidation and is currently trading around $3,382, with upside targets at $3,397 and $3,406 (highlighted resistance zone).

The supply zone on the higher timeframe remains intact below $3,280, acting as a long-term support.

Immediate support levels lie at $3,371, $3,356, and $3,348. A break below these could shift momentum bearish.

Current bullish structure suggests that as long as price holds above $3,371, buyers may drive the price higher toward the resistance levels.

A rejection from $3,406 may lead to a pullback toward the mid-support zone before another attempt higher.

Gold 27/08: Smart Money Targets 3405 or Sweeps 3355?Gold SMC Daily Plan – 27/08

Market Context (SMC View):

Price is consolidating around 3378, holding the liquidity trendline with multiple BOS and ChoCH, indicating strong smart money activity.

Key resistance: 3393–3406 (supply & liquidity pool).

Key support: 3352–3358 (demand zone) with an Order Block (OB) near 3325.

A possible liquidity sweep could happen above 3405 or below 3355 before confirming the next trend move.

📊 Key Liquidity Zones & Entries

✅ Sell Zone: 3402–3406

SL: 3410

TP: 3390 → 3380 → 3360

✅ Buy Zone 1: 3352–3358

SL: 3345

TP: 3360 → 3375 → 3385 → 3395

✅ Buy Zone 2 (intraday pullback): 3376–3380

SL: 3370

TP: 3385 → 3395 → 3405

SMC Scenarios for 27/08

Scenario 1 – Liquidity Grab at Resistance:

If price sweeps 3402–3406, look for fake breakout signals.

Short from this zone with the TP levels mentioned above.

Scenario 2 – Buy on Dip (Demand Zone):

If price retraces deeper to 3352–3358, wait for bullish confirmation to go long.

If price respects the trend and holds 3376–3380, consider intraday buy opportunities.

SMC Notes:

Focus on buying dips unless a liquidity grab occurs first at 3402–3406.

Keep an eye on price action near the trendline & OB at 3325 for potential high-probability reversal setups.

XAUUSD Price Action Analysis Current Market Overview

Price is trading at 3,371.67 🟢, showing bullish momentum after bouncing from the highlighted support zone (purple box).

The support zone (3,358 – 3,348) is currently holding strongly, converting old resistance into support 🔄.

🔑 Key Levels to Watch

Support Zone (3,358 – 3,348) 🛡️ → Price respected this area, confirming it as a demand zone.

Immediate Support: 3,358.65 🟪

Secondary Supports: 3,348.60 📉 | 3,325.99 📉 | 3,311.63 📉

📈 Bullish Scenario

If buyers maintain momentum above 3,358, price may attempt a move toward 3,380+ 🚀.

Break above 3,380 could signal continuation to new highs 📊✨.

📉 Bearish Scenario

A strong break back below 3,358 could re-test 3,348 → 3,325 → 3,311 ⬇️.

Failure to hold support may trigger deeper correction.

✅ Professional Takeaway

Market sentiment is bullish as long as price stays above 3,358 support zone 🟩.

Traders may look for buy opportunities on dips near support with targets toward 3,380 – 3,390 🎯.

Watch price reaction closely at the purple zone for confirmation before entering.

Gold Technical Analysis: Navigating Key Support ?The Gold chart shows a 30-minute timeframe analysis, highlighting recent price consolidation and potential future trends. The analysis suggests a potential V-shape recovery for gold.

Key Levels: The price is currently at a critical juncture, having tested a support zone around 3,326 - 3,333 USD. This zone has proven to be a strong base. Above it, a significant resistance zone is identified between 3,349 - 3,353 USD. Further up, another major resistance is at approximately 3,389 USD.

Price Action: The price has recently experienced a sharp decline and is now in a consolidation phase. The chart projects a potential bounce from the current levels, indicated by the black curved arrow, with the target being the upper resistance zone around 3,389 USD. The green shaded box illustrates the potential upward movement from the current position.

Conclusion: Gold appears to be at a key support level and could be poised for a rally if it successfully breaks above the immediate resistance zone.

Bitcoin (BTC/USDT) 4-Hour Chart Analysis

The Bitcoin chart shows a 4-hour timeframe analysis, focusing on a short-term uptrend channel.

Key Levels: The price is trading within an ascending channel. A significant support zone is identified between 112,000 - 114,000 USDT. A "weak supply zone" is marked around 118,000 USDT, which is currently acting as support. A major resistance is at approximately 124,564 USDT.

Price Action: After a strong push towards the channel's upper boundary, the price has pulled back and is now retesting the "weak supply zone." The blue and red arrows project two possible scenarios: a bounce back up towards the channel's high, or a deeper retracement towards the channel's lower trendline. The price movement appears to be following the blue projected path.

Indicators: The Ichimoku cloud and RSI strategy are used to confirm the trend and identify entry/exit points. The price is above the Ichimoku cloud, indicating a bullish trend.

Conclusion: Bitcoin is at a pivotal point within its uptrend channel. Its ability to hold the 118,000 USDT level will be crucial for a potential re-test of the 124,564 USDT resistance.

Gold Futures – Support Breakdown on the RadarGold Futures (MCX) is currently hovering near a critical support zone around ₹98,600. Price action shows repeated testing of this level, and the latest candles indicate weakening momentum. A decisive breakdown below this support could trigger further downside pressure.

📉 Technical View:

Key support: ₹98,600

Breakdown below this zone may open room towards ₹95,300–₹96,000 levels.

Resistance: ₹100,000–₹100,650 zone (selling pressure expected if price pulls back).

The highlighted range suggests that the market is at an inflection point, and traders should watch closely for confirmation of a support breakdown, which could accelerate bearish momentum in the coming sessions.

Gold - Bearish ? Double Top with RSI DivergenceGold was bullish only due to empty words from Trump saying no gold in US, its missing, no one audited for 40 years, no doors and no windows in the store house etc etc. He never took efforts to go and check it or ask for audit report. so in my view its empty words from Trump. It must have helped Russia to offload its tons and tons of Gold accumulated long before the war, Thats the biggest gift Trump given to Putin to book profits in Gold. It has formed double top with clear Bearish Divergence in RSI. In my view its a Sell now and many be buy at lower levels later. No war, no covid and why any one hold Gold at these very high price ?

Gold form double top bearish pattern,Bearish Patterns Annotated:

Double Top: A classic bearish reversal pattern resembling an "M" shape. It occurs when price hits resistance twice at similar levels (here, approximately $3,437 and $3,448 in July and August) and fails to break higher. This signals potential exhaustion of buyers and a shift to sellers.

Evening Star: A three-candle bearish reversal pattern marked near the recent high. It typically consists of a large green candle (up day), followed by a small-bodied candle (indecision), and then a large red candle closing below the midpoint of the first candle. This suggests bulls are losing control.

Engulf Candle (Bearish Engulfing): A red candle that completely "engulfs" the body of the prior green candle, indicating strong selling pressure overriding previous buying. It's marked near the top, reinforcing the reversal theme.

Opportunity: - As per chart it can short 3380-3350 with stop loss 3400 above for the targets of double bottom pattern 3260 and 3160.

XAUUSD Bullish Trend Continuation: Potential Move to $3,400!The price action shows a higher high ("high") and a higher low ("low"), which are characteristic of an uptrend. An upward trendline has been established, connecting a series of higher lows, which is acting as a dynamic support level. A significant horizontal support zone has also been identified around the $3,260 - $3,280 price range, where the price previously found support.

Recently, the price experienced a pullback and bounced off the upward trendline. The analysis anticipates a continuation of the upward momentum toward a key resistance zone. This resistance zone is located around the $3,400 - $3,420 level. A specific target price of $3,408.833 is highlighted within this zone, suggesting a potential area where the upward movement might pause or reverse.

The chart includes a potential corrective wave pattern labeled with "C"s, indicating a recent three-wave pullback within the larger trend. The current price is shown at $3,353.520, positioned above both the horizontal support and the upward trendline, reinforcing the bullish sentiment.

XAU/USD Bullish Bounce from Demand Zone !Gold (XAU/USD) on the 4H chart is showing a potential bullish reversal setup. Price has pulled back into a Fair Value Gap (FVG) and high supply/demand zone near 3,329–3,315, aligning with the 0.382–0.5 Fibonacci retracement.

Key Points:

Support Zone: 3,329–3,315 (demand + FVG).

Bullish Rejection Expected: Price may bounce from this zone, targeting upper resistance levels.

Upside Targets:

TP1: 3,356

TP2: 3,375

TP3: 3,440–3,459 (major resistance)

Invalidation: A daily close below 3,315 could open room for deeper downside toward 3,278–3,245.

Indicators: EMA(9) and Ichimoku showing potential for trend resumption if price closes above 3,362.

Overall, the chart suggests a buy setup on bullish confirmation, aiming for the 3,375–3,459 zone.

"Gold at the Tipping Point: Will $3,350 Spark the Next Rally?""Gold at the Tipping Point: Will $3,350 Spark the Next Rally?"

Gold (XAUUSD) is currently consolidating after a series of higher lows, signaling sustained bullish momentum from the strong support region around $3,280–$3,300. Price has respected key structural points, forming a clean market structure with:

BOS (Break of Structure) confirming bullish intent after reclaiming prior resistance.

Bullish FVG (Fair Value Gap) acting as a liquidity zone for potential re-entries.

Multiple Higher Lows, highlighting strong buyer defense levels.

The chart indicates a possible short-term retracement into the $3,350–$3,357 entry zone, which aligns with demand structure. From this zone, buyers are expected to push toward the $3,400–$3,415 resistance target.

Key technical levels:

Entry Zone: $3,350–$3,357 (demand area)

Stop Loss: Below $3,340 to protect against deeper pullbacks

Take Profit: $3,400 psychological level and $3,414 structural resistance

Market Sentiment:

The combination of a strong support base, sustained higher lows, and bullish imbalance zones suggests a favorable risk–reward setup for long positions. A clean breakout above $3,415 could trigger a larger bullish leg toward the $3,440 resistance zone.

📈 Bias: Bullish above $3,350

💡 Watch for a reaction at the entry zone before committing to positions.

GOLDHello & welcome to this analysis

Comex GOLD appears to have completed its triangle and is now likely to give a breakout above 3439 for an upside target of 3750.

The triangle goes invalid if we witness a sell off from current levels and it breaks 3250 on the downside.

MCX Gold appears to have a Cup & Handle formation (similar to a triangle) and is now likely to confirm a breakout above 101075 for upside targets of 103750 - 106200 (will depend a lot on $:INR).

The Cup and Handle pattern goes invalid if we witness a sell off from current levels and breaks 99250 on the downside.

Overall use dips to add/trail, shorting (intra day would be a different scenario) overnight from here looks like a very risky trade.

All the best

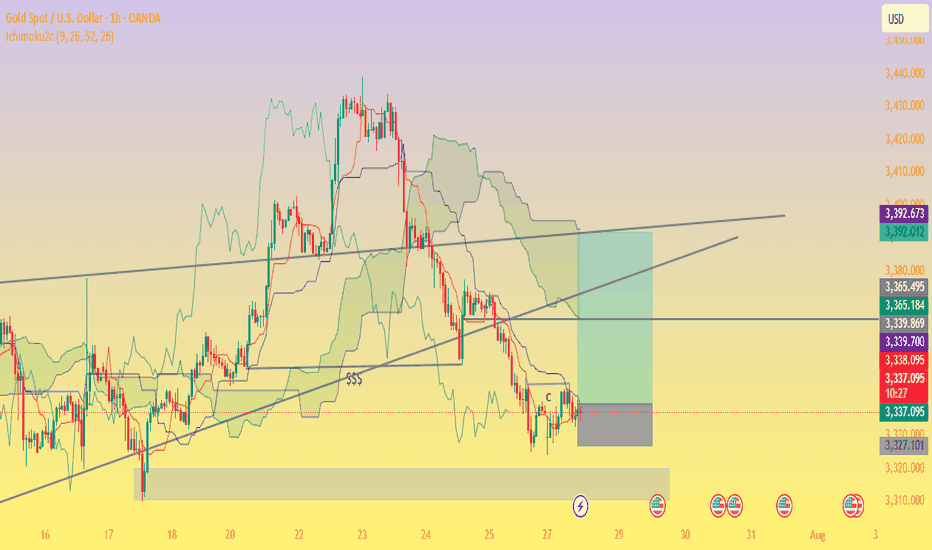

XAU/USD 1H – Range Consolidation Below Ichimoku Cloud. Chart Review & Technical Insight

1. Ichimoku Cloud & Overall Structure

Price is below the Ichimoku Cloud, with the cloud ahead sloping downward—indicative of bearish short‑term momentum and resistance overhead as long as the cloud holds above price.

The Kijun-sen (blue) line is above the Tenkan-sen (red), reinforcing the bearish bias on this timeframe.

2. Price Action & Key Zones

A support zone around 3,327–3,330 USD/oz is visible, underpinned by multiple rejection taps and price consolidation (“$$$” zone). A clean break below could open the path toward the 3,320’s or lower imbalance region.

On the upside, resistance lies near 3,339–3,340, backed by the cloud’s lower boundary and the Kijun-sen level.

The highlighted green rectangle appears to signal a potential bullish breakout target zone toward 3,365–3,392, contingent on recovery above the cloud.

3. Momentum & Trade Considerations

Momentum is weak, with price moving sideways inside a low‑volatility rectangle on diminishing volume and few directional impulses.

Possible ABC corrective structure is forming as marked, suggesting price may oscillate sideways or continue correcting within established bounds.

A bullish scenario would require clearing the Ichimoku Cloud and resistance at 3,340–3,360 USD.

Conversely, a bearish breakdown below ~3,327 could confirm continuation deeper into the 3,320s or toward the next significant demand zone near 3,300 USD.

✅ Summary

Bias: Slightly bearish to neutral until price can clear the Ichimoku Cloud.

Key Levels to Watch:

Support: 3,327–3,330 (immediate), then 3,320–3,300.

Resistance: 3,339–3,365, cloud top near 3,365, further target zone 3,392.

Scenarios:

Bullish breakout: Close above cloud → potential rally toward 3,365–3,392.

Bearish breakdown: Close below 3,327 → deeper correction toward 3,320 and lower imbalance areas.

Critical Breakdown: BTC/USD Poised to Fall — Waiting on H4 CloseAnalysis of the BTC/USD 4‑Hour Chart

From the chart you provided, here's how the technical situation looks:

Ascending trendline support has been tested multiple times and was recently breached this afternoon, signaling a possible shift from the bullish setup to a bearish continuation.

The price is now trapped within a descending triangle formation beneath a well‑defined swing high resistance zone. This reflects indecision in the market, with neither buyers nor sellers in clear control

Business Insider

+15

Fxglory Ltd

+15

Bitcoin News

+15

.

Key levels to monitor:

Support zone: ~$115,500, extending down to ~$111,300 and ~$105,600 as deeper targets if bearish momentum strengthens.

Resistance zone: ~$119,000–120,000 area, forming strong overhead supply

Economies.com

DailyForex

Bitcoin News

.

The chart’s annotations align with a classic breakout strategy—with the caveat: wait for a confirmed close below the trendline before considering short positions (as noted in your “wait for this candle to close in red” comment).

Breakout confirmation would likely pave the way toward your indicated profit zones near ~$111k and ~$105k, with a larger potential down to ~$99.8k if further downside pressure builds.

🔍 What the Broader Market Signals

Technical sentiment from sources covering today’s analysis shows BTC/USD hovering just under $120,000, stuck within the defined range of $115.5k support to $120k resistance

Economies.com

.

While there’s still neutral momentum in indicators like RSI and MACD, the short-term direction leans bearish if the breakdown is confirmed on the H4 timeframe

Fxglory Ltd

.

Analysts emphasize that sustained movement above $116.5k could retarget resistance near $119–120k. A failure there and a move below $115.5k may thrust price deeper toward your downside zones

DailyForex

.

✅ Trading Strategy Overview

Scenario Trigger Target Levels

Bearish Breakdown H4 candle closes below trendline ~$115.5k $111.3k → $105.6k → possible $99.8k zone

Bullish Rejection Bounce back above ~$116.5k and trending above resistance $119k–120k retest, potential breakout if sustained

Neutral / Wait-and-see No decisive candle close yet Hold for confirmation

⛳ Final Thoughts

chart highlights a critical point: don’t act prematurely. Wait for a decisive H4 candle close below the trendline before committing to shorts. Confirmed bearish action around the breakout could open the path to the lower targets you identified. However, if price rebounds above support and climbs above $116.5k, a short-term retest of $119k–120k is still in range.

Traders should maintain prudent risk management—watching the unfolding price action around these pivot points without overreaching. Let me know if you'd like help crafting entry/exit zones or risk profiles for this setup!