How Smart Money Moves Gold (XAUUSD)Every spike, every fake breakout, every sharp reversal… it’s all part of a bigger plan by smart money (institutions) to trap emotional traders and collect liquidity.

Let’s break it down 👇

⚡ 1️⃣ Liquidity Grab (The Trap Phase)

Before any real move, gold sweeps stop-losses above highs or below lows.

Retail traders think it’s a breakout — but it’s actually a liquidity hunt.

Smart money fills large positions here while emotions run high.

⚡ 2️⃣ Market Structure Shift (The Clue)

After collecting liquidity, watch for a BOS (Break of Structure) or CHoCH (Change of Character) — these reveal when the real move is starting.

⚡ 3️⃣ Smart Money Entry (The Real Move)

Once the trap is set, gold often makes a strong impulsive push.

This is where institutions enter — and where smart traders follow with confirmation, not emotion.

⚡ 4️⃣ Emotional Traders Lose, Logical Traders Win

The market doesn’t hate you — it simply feeds on emotional reactions.

Be patient, wait for liquidity sweep ➜ structure shift ➜ confirmation entry.

🧭 Pro Tip:

👉 Stop chasing candles.

👉 Study liquidity and market structure.

👉 Let the chart show who’s trapped — and then trade against them.

💬 Remember:

“The market rewards patience, not panic.”

💎 Gold (XAUUSD) moves on liquidity — not luck.

#TradeSmart #ThinkLikeInstitutions #XAUUSD

Goldstrategy

Gold (XAU/USD) Targets $3,397 – $3,406 Amid Bullish MomentumAnalysis:

The 4H chart of Gold (XAU/USD) shows strong bullish momentum after a corrective phase. Price has broken above consolidation and is currently trading around $3,382, with upside targets at $3,397 and $3,406 (highlighted resistance zone).

The supply zone on the higher timeframe remains intact below $3,280, acting as a long-term support.

Immediate support levels lie at $3,371, $3,356, and $3,348. A break below these could shift momentum bearish.

Current bullish structure suggests that as long as price holds above $3,371, buyers may drive the price higher toward the resistance levels.

A rejection from $3,406 may lead to a pullback toward the mid-support zone before another attempt higher.

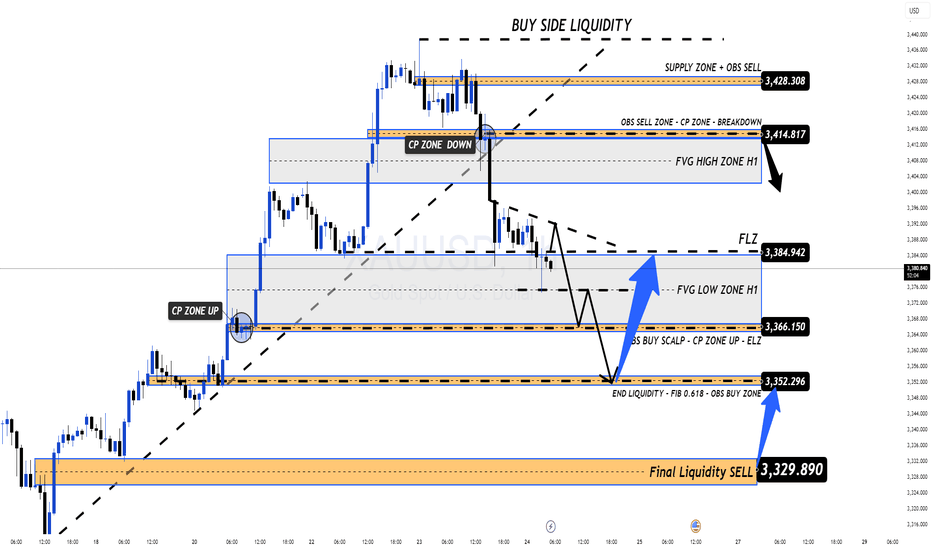

XAUUSD Weekly Plan Final Bullish Push Before a Liquidity Sweep?XAUUSD Weekly Plan – Final Bullish Push Before a Liquidity Sweep?

1. Market Context

Last week, Gold kept moving inside the H2–H4 bullish channel, pushing into the FVG High Zone and approaching the major resistance at 3426–3428 (OBS Sell Zone).

Momentum is fading – candles are compressing, and volume is dropping – signaling potential distribution.

2. Macro Outlook (High-Impact USD Data Ahead)

CPI – Aug 12 → Primary driver.

PPI – Aug 14 → Usually a leading signal for CPI.

Unemployment Claims – Aug 14 → Short-term impact.

Expectations:

CPI & PPI likely better than previous month → USD strength → Gold correction (liquidity sweep to the downside).

Weaker-than-expected CPI/PPI → USD weakness → Gold could spike for one last bullish leg before reversing.

3. Technical Overview

H2 bullish channel top aligns with FVG High Zone → big players’ sell limit & profit-taking area.

Main scenario: Test 3426–3428 → Bearish reaction → Channel breakdown → Retest 3395–3400 (VPOC) → Drop toward liquidity pools below.

4. Key Levels

SELL Zone: 3426 – 3428

SL: 3434

TP: 3420 → 3415 → 3410 → 3405 → 3400 → 3395 → 3390 → 3380 → 3370 → 3360

BUY Zone: 3330 – 3328

SL: 3322

TP: 3335 → 3340 → 3350 → 3360 → 3370 → 3380

5. Trading Plan

🔹 Primary SELL Setup:

Wait for price to reach 3426–3428 with H1/H2 bearish candle confirmation.

Take profits gradually at each downside target.

🔹 Counter-trend BUY:

Enter only if price sweeps liquidity into 3330–3328 with strong bullish reaction.

6. Trader’s Notes

Gold may still push $30–$40 higher early next week before hitting OBS Sell Zone.

Expect large SELL volume once in this zone (profit-taking + top-picking by big players).

This should be a short-term correction, not a full trend reversal.

Best to SELL from highs and hold after a confirmed channel breakdown.

7. Risk Note

High-impact week → Possible false breaks before/after CPI & PPI.

Avoid oversized positions during news releases.

A break & hold above 3434 with strong volume invalidates SELL scenario → wait for new structure.

📌 Summary:

Bias: SELL from 3426–3428 → Target liquidity pools down to 3360.

Backup Plan: BUY from 3330–3328 if liquidity grab confirmed.

Manage risk tightly, especially during high-volatility events.

— MMFlow Trading

Gold Pulls Back as Expected, Long-Term Buying Opportunity Ahead🟡 XAUUSD 24/07 – Gold Pulls Back as Expected, Long-Term Buying Opportunity Ahead

🧭 Market Overview

Gold dropped sharply from the 343x area, exactly as anticipated, after breaking the rising channel on the H1 chart and starting to sweep liquidity zones below.

Key factors influencing price action today:

Global markets are awaiting the final outcome of US-EU-China tariff negotiations.

Focus now shifts to next week’s FOMC meeting, where talks of potential rate cuts are intensifying.

Tonight’s PMI and Jobless Claims from the US could introduce unexpected volatility.

📊 Technical Outlook

While the broader trend remains bullish on D1 and H4 timeframes, the short-term H1 chart shows a clear break in structure. Price is currently exploring key FVG zones and OBS levels below.

If these liquidity zones are fully filled, it could set up a highly attractive long-term BUY opportunity, especially as markets price in future Fed rate cuts.

🎯 Today’s Trading Strategy

📌 Short-Term SELL Opportunity

→ Look for early entries at resistance zones, but only with proper confirmation.

📌 Long-Term BUY Setup

→ Target strong technical confluences at deeper levels. Be patient — focus on clean RR setups, don’t rush into early longs.

🔎 Key Price Levels to Watch

🔺 Resistance Zones (Above):

3393 – 3404 – 3414 – 3420 – 3428

🔻 Support Zones (Below):

3375 – 3366 – 3352 – 3345 – 3330

🔽 Trade Scenarios

✅ BUY ZONE: 3352 – 3350

SL: 3345

TP: 3356 → 3360 → 3364 → 3370 → 3375 → 3380 → 3390 → 3400

🔻 SELL ZONE: 3414 – 3416

SL: 3420

TP: 3410 → 3406 → 3400 → 3395 → 3390 → 3380

⚠️ News Alert

Stay cautious with tonight’s US PMI and Jobless Claims releases — these could cause sharp spikes.

✔️ Use proper SL/TP

✔️ Avoid emotional trades

✔️ Let structure confirm before entries

📣 From MMF Team – Trade Smarter Together

If you find this analysis helpful and want more daily trading plans like this:

👉 Follow the MMF channel right here on TradingView — we deliver real, actionable market strategies, not just generic analysis.

🎯 Updated daily. Straight from the charts. Built for traders.

GOLD TRADING POINT UPDATE >READ THE CHAPTIAN Buddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Gold traders SMC trading point update you on New technical analysis setup for Gold 🪙 Gold list week take a New All Time high ATH 2817 ) Gold Traders SMC-Trading Point still ses a bullish trend 📈 🚀 this week take a New 🆕 ATH 2837 fisrt take support breakdown moving 😃 up trand that expect it. Next week Two strong 🪨💪 support level 2785 2772 that entry buying said if close below 👇 that level that expect Short Trade. 2724 2703 )

Key Resistance level 2817+ 2837

Key Support level 2785 - 2772 - 2724 - 2703

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

GOLD TRADING POINT UPDATE < READ THE CHAPTIANBuddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Gold traders SMC trading point update you on New technical analysis setup for Gold 🪙 After FOMC meeting 🤝💯 trot aril analysis setup breakout one said that entry open 👐 target 2766 close above more Bull Trend target 2780 2803 if close below 👇 2740 next target we'll see 2730 2692 MA support

Key Resistance level 2766 + 2772 + 2786 + 2803 New ATH

Key support 2730 2692

Support 💫 My hard analysis setup like And Following 🤝 me that star ✨ game 🎮

Gold - US presidential electionAs everyone is expecting gold to break alltime high $2075 before US presidential election, the chart says gold will slide & trade in the range of $1736-1802 (demand zone) before making any further move upside.

Long term demand zone $1560-1682

Fibo extension supply zone @2158-2460-2685

Expecting gold not to break $2075 within 3 months of time frame.

Symmetric again - Long/ Short only on break.Last time we have seen a symmetric triangle ( look into related ideas) and it breaks the trend line but it din't break our levels.

This time also formed a symmetric triangle and hopefully it will break with good volumes and breaks our levels. Long / Short, Enter only on breakouts