Goldtrade

GOLD H1HI GUYS,

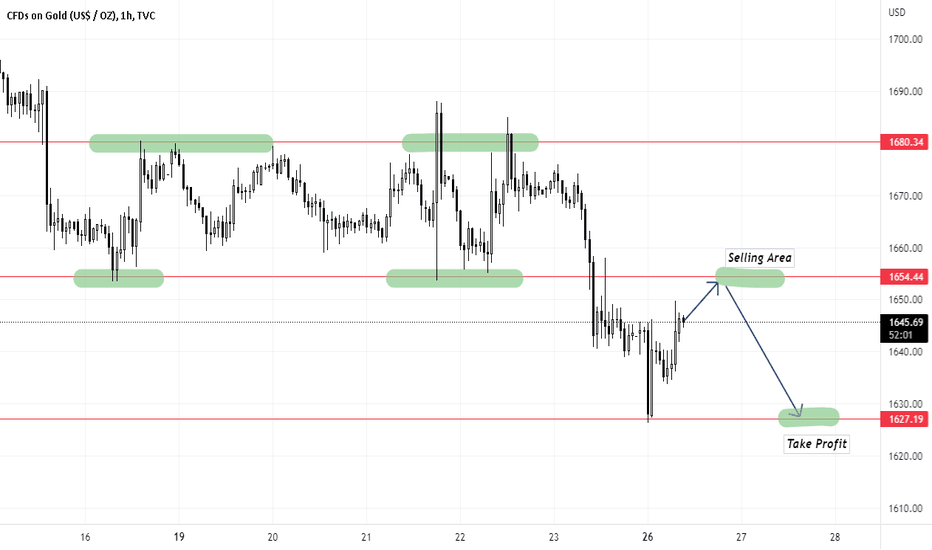

i hope all of us diong very well gold h1 chart update last few days we are posting chart analysis its hit ratio alomst 99%,we analysis the market move after move very closely every day , we are using pure price action and fundamental ,use this information wisley more accuracy on your trading

bullish targets

1757,1753 this zone HOLDING above the price next target open on 1767

1771,1767 this zone HOLDING above the price next targets open on 1780

bearish targets

1757,1753 this zone HOLDING below the price next target open on 1757

1757,1753 this zone HOLDING below the price next target open on 1747

thank you so much... guys use this informtion wisley

Pockets are Full of $$$$. Will Blood Bath in Gold for Bulls Over

As per the previous updates on the blog & other social media that Gold will soon HIT $1285. Today trading at $1285, So further in this week. If closes below $1275 Then the further move will towards $1257 & $1244. So, For Bears Today is a Good day to book there shorts with $60 points & sit relax for a new entry. For Bulls they can put the stop loss of closing below $1275 for their long position.

Utsav Babbar