Ultra cheap Gold buying opportunity as we can see the gold is totally overbought right now,

as the stock market crash gold will also crash with it in a short term into 1300 usd

and then the next bull run will start that will lead 3200 top

as per my research.

its a nice idea to have some gold in your portfolio in this pandemic

Goldusd

Don't miss the great sell opportunity in XAUUSDTrading suggestion:

. There is still a possibility of temporary retracement to suggested resistance line (1703.5). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XAUUSD is in a range bound and the beginning of downtrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 28.

Take Profits:

TP1= @ 1664.75

TP2= @ 1641.00

TP3= @ 1624.80

TP4= @ 1588.45

TP5= @ 1565.40

SL: Break Above R2

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated! ❤️

💎 Want us to help you become a better Forex trader?

Now, It's your turn!

Be sure to leave a comment let us know how do you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

Don't miss the great sell opportunity in XAUUSDTrading suggestion:

. There is still a possibility of temporary retracement to suggested resistance line (1731.0). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XAUUSD is in a range bound and the beginning of downtrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 27.

Take Profits:

TP1= @ 1711.43

TP2= @ 1691.60

TP3= @ 1670.30

SL: Break Above R2

XAUUSD Weekly analysis , May 4-8, 2020, May shines !Gold against dollar recovered from the lows month of April. The Journey towards 1800 is on . and the chances looks bright in this month of May.

In the monthly chart ,it breaks the long term resistance of 1675 and spikes up.. but this week it expected to do small retest on 1657 and go higher..

thats a historical chart, which shows gold will be @5000 till thats a historical chart, which shows gold will be @ $5000+ till 2025 ... if any thingcan be concluded from the fractal going from 2005-2011 ...we r exactly at the same place or we may see gold touching 1800-1900 in short run then consolidate to 1300-1450 zone & then again make a ride towards new life time highin end 2021 -begining 2022 & keep on increasing till - 2024-2025

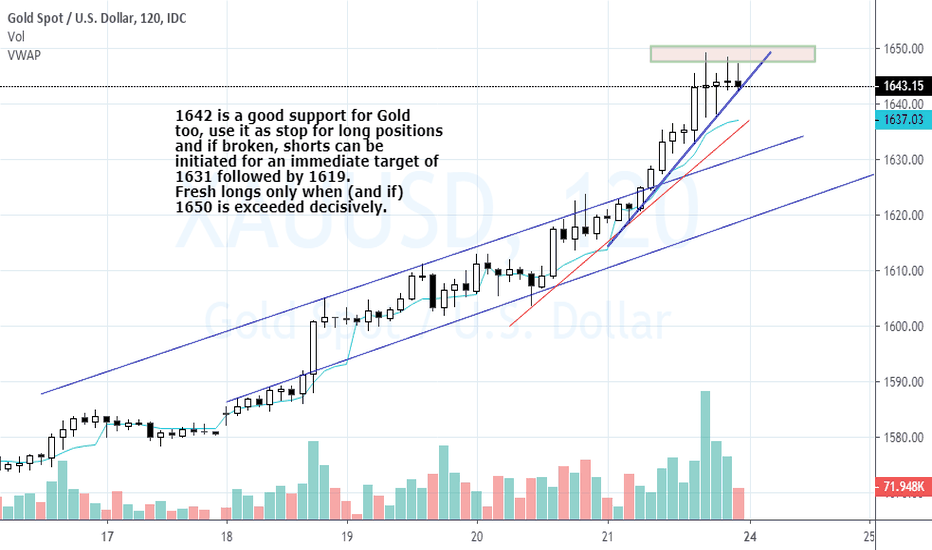

Gold - 1642 is important to be held for bulls. 1642 is a good support for Gold too, use it as stop for long positions

and if broken, shorts can be initiated for an immediate target of 1631 followed by 1619.

1650 can be used as stop.

1642's rupee equivalent would be 42300-350 level.

Fresh longs only when (and if) 1650 is exceeded decisively.

Time to buy Gold, will it touch $2400?!Looking at weekly chart, down trend of gold was long over and has recently break out long side trend as well. Gold has formed breakout pattern on weekly chart, where it has surpassed strong resistance of $1365 (facing since February 2016).. If we look at long-term investment horizon 3-4 years, Gold is ready to take off for new all-time high. Targets are determined using fib retracement from previous downtrend; alternatively, green lines show target /resistance it will hit in its uptrend.