Part 3 Learn Institutional Trading Delta

Measures how much the option price moves with the underlying.

Call delta: 0 to 1

Put delta: -1 to 0

Higher delta = more responsive to underlying movement.

Theta

Measures time decay.

Options lose value as expiry nears.

Sellers benefit from theta; buyers lose value over time.

Vega

Measures sensitivity to volatility.

Higher volatility = higher option premiums.

Gamma

Measures how fast delta changes.

High near expiry, especially for ATM options.

Rho

Measures change in premium due to interest rates.

Harmonic Patterns

Part 2 Ride The Big Moves Why Traders Use Options

a) Hedging

Investors use options to protect their portfolio.

Example: Buying put options to protect against market crashes.

b) Speculation

Traders use leverage to take directional bets with small capital.

c) Income Generation

Selling options (covered calls, cash-secured puts) allows traders to earn regular premium income.

d) Risk Management

Options reduce downside risk more effectively than futures.

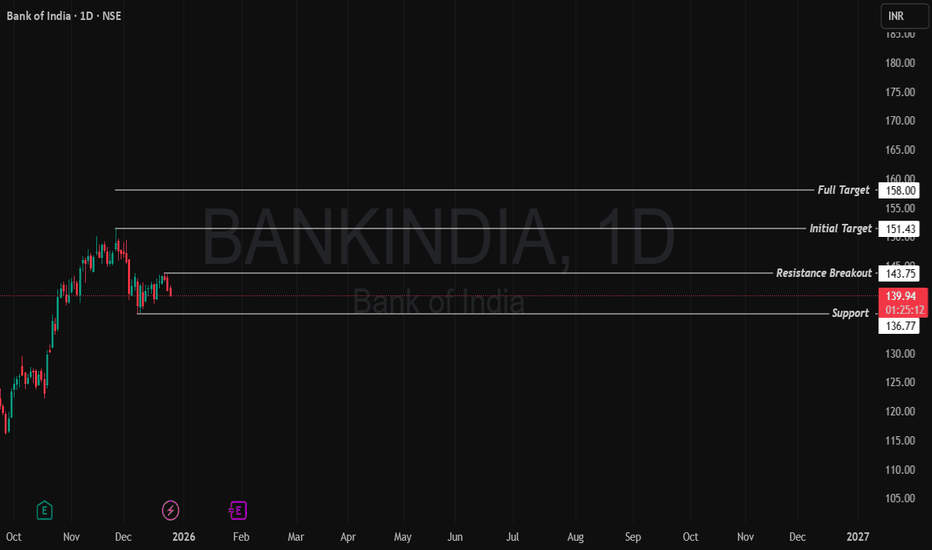

Bank of India: Bullish Continuation SetupBank of India has shown resilience near its current support after recent consolidations. A sustained breakout above 143.75–144.00 would confirm short-term bullish strength, opening up higher targets near 151.43 and eventually 158.00 if momentum sustains.

Price continuing above the 136.77 support suggests buyers are defending major demand, which keeps the structure constructive. Positive breadth and banking sector flows could help the stock extend gains toward the next resistance bands, especially if macro remains supportive.

Recent DEC 2025 News Supporting a Positive Outlook

Analyst sentiment & performance: Bank of India has shown an overall uptrend this year with strong returns and remains actively traded, reflecting ongoing interest from the market. Recent average prices around ₹142–143 show recovery and participation.

Sector outlook & liquidity: RBI’s aggressive liquidity support and repo rate cuts in December 2025 aim to bolster credit growth and economic activity. Such policy easing generally benefits banking stocks by reducing funding costs and boosting loan demand.

Macro environment: Forecasts from brokerages suggest broader market strength into 2026, which could support banking names like Bank of India if earnings and credit metrics improve

Note: News on Bank of India specifically from the last week of December 2025 is limited; however, macro and sector catalysts provide supportive context for banks.

Trade View (Bullish)

Buy on Breakout Above: 144.00

Stop-Loss: 136.50

Target 1: 151.43

Target 2: 158.00

Bullish Structure: Above support and breaking short-term resistance shows buyers regaining control. Risk to Watch: Breakdown below 136.77 could invite near-term weakness.

Disclaimer: aliceblueonline.com

Part 1 Ride The Big Moves Strike Price, Premium, and Expiry

Understanding these three elements is essential for option trading:

Strike Price

This is the predetermined price at which the underlying asset can be bought (call) or sold (put). Different strike prices allow traders to choose how far their view is from the current market price.

Premium

This is the price of the option, paid by the buyer to the seller. Premiums are influenced by:

Volatility

Time remaining to expiry

Current underlying price

Interest rates

Market demand

The seller receives the premium upfront.

Expiration Date

Options are time-bound instruments. In markets like India (NSE), expiry can be:

Weekly

Monthly

Quarterly

As the option approaches expiry, its value decays—a phenomenon called time decay (theta).

PCR Trading Strategies What Are Options?

An option is a contract between two parties—a buyer and a seller—based on an underlying asset such as a stock, index, commodity, or currency. The key feature is that the buyer of the option has rights, while the seller has obligations.

There are two types of options:

a) Call Option

A call option gives the buyer the right to buy the underlying asset at a fixed price, called the strike price, within a set period.

Buyers of calls are bullish—they expect the price to go up.

Sellers of calls are bearish or neutral—they don’t expect much upside.

b) Put Option

A put option gives the buyer the right to sell the underlying asset at the strike price within a set period.

Buyers of puts are bearish—they expect prices to fall.

Sellers of puts expect stability or upward movement.

HINDCOPPER 1 Week Time Frame 📍 Current Price (Indicative)

The stock is trading around ₹400–₹430 levels recently — near 52‑week highs due to strong momentum.

📊 Weekly Timeframe Levels (1‑Week Outlook)

🔹 Key Weekly Resistances

1. Primary Resistance: ~₹415 – ₹422

— Immediate upside facing selling pressure.

2. Higher Resistance: ~₹428 – ₹432

— Near recent short‑term top and swing highs.

Bullish scenario: Sustained closes above ₹415 – ₹422 may prompt further gains toward ₹430+.

🔸 Key Weekly Supports

1. Immediate Support: ₹382 – ₹381

— Near recent pullback region / pivot area.

2. Intermediate Support: ₹375 – ₹376

— Short‑term demand zone if price cools off.

3. Stronger Support: ₹370 – ₹371

— Important weekly base — breakdown below this may weaken trend.

📌 1‑Week Scenarios to Watch

🟢 Bullish

Close above ~₹415–₹422 → Next upside target ~₹428–₹432+

🔄 Range / Consolidation

Range ~₹382–₹415 → Price may chop sideways before a definitive break

🔴 Bearish

Weekly close below ~₹375–₹370 → Risk of deeper pullback toward ₹360–₹350

360ONE 1 Day Time Frame 📊 Daily Price Range

Typical intraday range: ~₹1,124–₹1,150 (varies per session) — recent daily highs/lows seen in this band.

📈 Important Daily Support Levels

Support 1: ~₹1,134–₹1,135 — near recent intraday lows.

Support 2: ~₹1,102 — secondary downside support.

Support 3: ~₹1,084 — deeper support level if broader sell‑off unfolds.

👉 These are key levels where the stock has found buying interest on the daily chart. Breach below them may indicate more downside pressure.

📉 Important Daily Resistance Levels

Resistance 1: ~₹1,184 — immediate upside barrier.

Resistance 2: ~₹1,202 — next layer of sellers.

Resistance 3: ~₹1,234 — stronger upside pivot.

👉 These are areas where the stock may struggle to move higher on the daily timeframe.

🔧 Technical Bias on Daily Timeframe

Daily indicators (RSI, MACD, moving averages) are currently showing buy/strong‑buy signals, meaning short‑term trend is tilted bullish.

📌 Daily Pivot Reference (Approximate)

Pivot ~₹1,152–₹1,155 — central daily pivot based on recent session price action.

MANAPPURAM 1 Day Time Frame 📌 Live Reference Price (approx)

• Current trading price on NSE is around ₹292–₹295 (varies slightly by data source and market timing).

📊 Daily Pivot & Intra‑Day Levels (1‑Day Time Frame)

Daily Pivot Zone (key zone for daily bias):

• Pivot Point: ~₹284–₹287 (central pivot zone where buyers/sellers balance)

🔼 Resistance Levels

• R1: ~₹289–₹290 (first resistance — break above signals strength)

• R2: ~₹292–₹293 (secondary resistance — near current price zone)

• R3: ~₹296–₹298 (major resistance from higher pivot calculations)

🔽 Support Levels

• S1: ~₹281–₹283 (first support — good short‑term buy zone)

• S2: ~₹276–₹278 (deeper support if S1 breaks)

• S3: ~₹273–₹275 (strong buffer support)

📈 Interpretation for Intraday / Daily Trading

Bullish scenario

Above pivot (~₹285–₹287) → positive bias today.

Above R1 (~₹289–₹290) → look for moves toward R2 & R3 (~₹293–₹298).

Bearish scenario

Below pivot (~₹284–₹287) → weakness coming in.

Break below S1 (~₹281) → next stop S2 (~₹276–₹278).

📍 Quick Intraday Ranges (Observed Today)

• Intraday high range today ~₹292–₹294 and low near ₹281–₹284 in recent sessions.

DIXONDIXON

Bullish trend is Showing on the chart.

Buy signals in technical indicators and chart pattern.

1) Falling Wedge Chart Pattern.

1) Bullish BAT Harmonic Chart Pattern.

BUYING RANGE 13200/13250

Watch for a breakout above 13200/13250 to sustain the bullish trend. If the resistance holds, there could be a retest towards 12700/12800 and an uptrend from here.

ASIANTILES 1 Day Time Frame 📊 Current Price Context

Asian Granito India is trading around ₹72–73 on the NSE in today’s session.

📈 1‑Day Key Levels (based on recent pivot/technical data)

🔹 Pivot Point (daily reference): ~ ₹73 (central level)

📌 Resistance Levels:

R1: ~ ₹75 – Immediate upside hurdle (recent 52‑week high area)

R2: ~ ₹77 – Secondary resistance if price breaks above R1

R3: ~ ₹79 – Extended resistance zone

📉 Support Levels:

S1: ~ ₹72 – Nearest support below the pivot

S2: ~ ₹70 – Short‑term support zone

S3: ~ ₹68 – Deeper support if market weakens

🛠️ How to Use These Levels

Bullish entry: Above the daily pivot (~₹73) with volume confirmation.

Stop loss: Below ₹70–₹68 if long.

Profit targets: ₹75 → ₹77 → ₹79 on sustained upside.

Candle Patterns Candlestick charts represent price movement in a visually intuitive way. Each candle shows:

Open

High

Low

Close

The color (green or red) indicates bullish or bearish sentiment. Patterns form when candles combine to express a strong market bias.

Why Candle Patterns Matter

They show real-time market sentiment

Provide early entry signals

Indicate trend continuation or reversal

Help identify trap candles and false breakouts

Crucial for Volume Profile & Market Structure traders to read participant behaviour

Candlestick patterns are classified into:

A. Bullish Reversal Patterns

B. Bearish Reversal Patterns

C. Continuation Patterns

D. Indecision / Neutral Patterns

NMDC 1 Week Time Frame 📊 Current Price Context

NMDC is trading around ₹81–₹82 on NSE currently.

📉 Weekly Support Levels

1. Primary Support: ~₹79–₹77 zone

Weekly pivot region and short‑term support clustered here.

2. Next Support: ~₹76–₹74 region

A key technical support band on weekly charts and potential “re‑entry” level if near‑term support breaks.

3. Lower Support Floor: ~₹69–₹68 (longer weekly support)

If the ₹74 region fails decisively, the next significant weekly demand zone is here.

📈 Weekly Resistance Levels

1. Immediate Resistance: ~₹82–₹83

Near the current trading range high and recent pivot resistance.

2. Higher Resistance: ~₹84–₹86

Represents a zone where weekly price has previously stalled.

3. Major Breakout Level: Above ₹88‑₹90

Crossing and closing above this weekly zone can signal stronger bullish continuation.

📌 Trading Tip:

Bullish view: Weekly close above ₹82–₹83 strengthens upside potential.

Bearish risk: Weekly break below ₹76–₹74 weakens structure and could target lower supports.

KAYNES 1 Week Time Frame 📌 Current Price Snapshot (Latest Available)

NSE price around ₹4,140–₹4,185 recently.

📊 Key Levels (1‑Week Short‑Term)

Pivot (Weekly Reference)

Pivot Point: ~₹4,184–₹4,186

Resistance (Upside Targets)

R1: ~₹4,243–₹4,252

R2: ~₹4,299–₹4,320

R3: ~₹4,440–₹4,450

Support (Downside Floors)

S1: ~₹4,128–₹4,130

S2: ~₹4,070–₹4,064

S3: ~₹4,014–₹3,876

Quick Note: These are pivot‑based intraday/weekly support‑resistance estimates used by traders to gauge short‑term boundaries.

📈 1‑Week Trading Guide (Contextual)

Bullish if:

Price decisively closes above ₹4,250–₹4,300 with buying volume → next objective is near ₹4,440.

Bearish if:

Price breaks and sustains below ₹4,070–₹4,014 → deeper support near ₹3,876 zone.

Sideways/Choppy if:

Price holds between ₹4,070 ↔ ₹4,250 — suggests range trading this week.

Chart Patterns CHART PATTERNS

Chart patterns represent big-picture market structures formed over dozens or hundreds of candles. They reveal accumulation, distribution, reversal, and continuation phases.

Patterns are grouped into:

A. Reversal Chart Patterns

B. Continuation Chart Patterns

C. Bilateral / Indecisive Patterns

Chart Patterns

Larger structures for strong trades

Indicate trend continuation or reversal

Higher reliability when combined with candles

Help set clear targets & stop-loss levels

Swing Trading in India: Profiting from Medium-Term Market MovesSwing trading has emerged as one of the most popular trading styles in India, especially among retail traders who want to participate actively in the stock market without the intense pressure of intraday trading. Positioned between day trading and long-term investing, swing trading focuses on capturing price movements that unfold over several days to a few weeks. In the Indian context—where markets are influenced by global cues, domestic economic data, corporate earnings, and policy decisions—swing trading offers a balanced and flexible approach to wealth creation.

Understanding Swing Trading

Swing trading is a strategy that aims to profit from short- to medium-term price “swings” within a broader trend. Instead of holding positions for years like investors, or closing all positions within the same day like intraday traders, swing traders typically hold trades for anywhere from two or three days to several weeks. The core idea is simple: identify a trend, enter at a favorable point during a pullback or breakout, and exit when the expected price move is achieved.

In India, swing trading is widely used in equities, index derivatives (NIFTY and BANK NIFTY), stock futures, commodities, and even currency markets. The strategy is particularly attractive because it does not require constant screen monitoring throughout the trading day.

Why Swing Trading Works Well in India

Indian markets are structurally well-suited for swing trading due to their strong trend characteristics. Stocks often move in sustained directional phases driven by earnings cycles, government policies, sectoral rotation, and foreign institutional investor (FII) flows. Events such as RBI policy announcements, Union Budget, global interest rate decisions, and geopolitical developments frequently create multi-day price movements—ideal conditions for swing traders.

Additionally, India’s growing participation of retail traders, increased liquidity in large-cap and mid-cap stocks, and the availability of derivatives provide ample opportunities to express swing trading views with leverage or hedging.

Instruments Used for Swing Trading

Most swing traders in India focus on:

Equity Cash Segment: Popular among beginners due to lower risk compared to derivatives. Delivery-based swing trading avoids time decay and margin pressure.

Stock Futures: Suitable for experienced traders who want leverage, but they come with higher risk and margin requirements.

Index Futures and Options: NIFTY and BANK NIFTY are highly liquid and responsive to macro cues, making them ideal for swing setups.

Commodities and Currencies: Gold, crude oil, USD/INR, and other instruments offer strong trending opportunities aligned with global markets.

Role of Technical Analysis

Technical analysis forms the backbone of swing trading. Indian swing traders rely heavily on charts, indicators, and price action to identify high-probability setups. Commonly used tools include:

Trend Indicators: Moving averages (20, 50, 100 EMA/SMA) to identify trend direction.

Momentum Indicators: RSI, MACD, and Stochastic to assess strength and potential reversals.

Support and Resistance: Key price levels derived from previous highs, lows, and consolidation zones.

Chart Patterns: Flags, triangles, head and shoulders, and double tops/bottoms.

The goal is not to predict the market, but to react to price behavior and align trades with the prevailing trend.

Fundamental Triggers and News Flow

While swing trading is largely technical, fundamentals still play an important supporting role in India. Earnings announcements, management commentary, sectoral news, and macroeconomic data often act as catalysts for swing moves. For example, strong quarterly results can trigger a multi-week rally in a stock, while regulatory changes can cause sustained declines.

Smart swing traders track corporate calendars, economic events, and policy announcements to avoid unnecessary risk or to position themselves ahead of potential breakouts.

Risk Management: The Core of Success

Risk management is what separates successful swing traders from consistent losers. Indian markets can be volatile, especially during global uncertainty or unexpected news. Effective swing traders strictly define their risk before entering any trade.

Key principles include:

Stop-Loss Discipline: Every trade must have a predefined stop-loss to limit downside.

Position Sizing: Risking only a small percentage of total capital on each trade (often 1–2%).

Risk–Reward Ratio: Ensuring potential reward is at least two to three times the risk taken.

Avoid Overtrading: Focusing only on high-quality setups rather than trading every market move.

Psychology and Patience

Swing trading demands emotional control and patience. Trades may take days to play out, and short-term fluctuations can test a trader’s confidence. In India, where social media tips and market noise are abundant, the ability to stick to a well-defined plan is critical.

Fear of missing out (FOMO), revenge trading after losses, and premature profit booking are common psychological pitfalls. Successful swing traders cultivate discipline, maintain trading journals, and continuously review their performance.

Swing Trading vs Intraday Trading in India

Compared to intraday trading, swing trading is less stressful and more forgiving. Intraday traders must deal with noise, high transaction costs, and constant monitoring, whereas swing traders can plan trades calmly using end-of-day charts. Brokerage costs are also lower relative to potential profits, especially in delivery-based swing trades.

However, swing trading involves overnight risk—news released outside market hours can lead to gap-ups or gap-downs. This makes proper position sizing and diversification essential.

Regulatory and Practical Considerations

In India, swing traders must also be aware of SEBI regulations, margin rules, and taxation. Delivery-based equity trades enjoy favorable tax treatment compared to frequent intraday or derivative trading. Understanding settlement cycles, margin obligations, and corporate actions is crucial to avoid operational surprises.

Conclusion

Swing trading in India is a powerful strategy for traders who want consistent opportunities without the intensity of full-time day trading. By combining technical analysis, awareness of fundamentals, disciplined risk management, and strong trading psychology, swing traders can capitalize on the natural rhythm of Indian markets. While it is not a shortcut to quick riches, swing trading—when practiced with patience and structure—offers a sustainable path to long-term trading success in India’s dynamic financial landscape.

Physiology-Driven Trading SuccessHow Your Body Shapes Profitable Decisions

Trading success is often discussed in terms of strategy, charts, indicators, and market knowledge. While these elements are important, they represent only one side of the equation. The other, often ignored side, is physiology—the way your body, nervous system, hormones, and energy levels influence your decisions. In reality, markets do not just test your analytical skills; they test your biology. Understanding and mastering your physiology can be a decisive edge that separates consistent traders from those who struggle despite strong technical or fundamental knowledge.

The Mind–Body Connection in Trading

Trading is a high-pressure performance activity, similar to professional sports or competitive chess. Every trading decision is processed through the brain, which is directly influenced by physiological signals such as heart rate, blood sugar levels, sleep quality, hydration, and stress hormones. When your body is calm and balanced, your brain operates in a rational, disciplined state. When your body is stressed or fatigued, your brain shifts into survival mode, leading to impulsive and emotional decisions.

This explains why traders often break rules during volatile markets or after a string of losses. It is not always a lack of discipline—it is the body reacting to perceived threat.

Stress Hormones and Market Decisions

Two hormones play a major role in trading behavior: cortisol and adrenaline. When markets move sharply or positions go against you, cortisol levels rise. Cortisol is useful in short bursts, as it sharpens focus and reaction speed. However, prolonged exposure impairs memory, reduces logical thinking, and increases fear-based behavior.

Adrenaline, on the other hand, fuels excitement and risk-taking. During winning streaks, adrenaline can create overconfidence, leading traders to increase position sizes irrationally. This is why many traders give back profits after a strong run—physiology pushes them to seek the emotional high rather than follow the plan.

Successful traders learn to recognize these physiological states and regulate them before placing the next trade.

Heart Rate Variability and Emotional Control

Heart rate variability (HRV) is a powerful indicator of how well your nervous system adapts to stress. High HRV reflects calm focus and emotional flexibility, while low HRV signals fatigue, anxiety, or over-arousal. Traders with higher HRV tend to recover faster from losses and avoid emotional spirals.

Simple breathing techniques—such as slow nasal breathing or box breathing—can rapidly improve HRV. Just a few minutes before market open can shift the nervous system from reactive to responsive, improving decision quality significantly.

Sleep: The Hidden Trading Indicator

Sleep deprivation is one of the most underestimated causes of trading failure. Lack of sleep impairs risk assessment, increases impulsivity, and weakens memory recall. A sleep-deprived trader may technically “know” their strategy but fail to execute it consistently.

Quality sleep restores prefrontal cortex function, which is responsible for planning, discipline, and logical thinking. Traders who prioritize sleep often report fewer revenge trades, better patience, and improved ability to sit through drawdowns without panic.

In many cases, improving sleep can deliver better results than changing indicators or timeframes.

Nutrition and Energy Stability

Blood sugar fluctuations directly affect emotional stability. Skipping meals or relying on high-sugar foods can lead to sudden energy crashes, irritability, and poor concentration. During these states, traders are more likely to overtrade or exit positions prematurely.

A physiology-driven trader focuses on steady energy—balanced meals, adequate protein, hydration, and minimal stimulants during trading hours. The goal is not peak excitement but sustained clarity.

The Nervous System and Risk Tolerance

Each trader has a unique nervous system sensitivity. Some can tolerate large drawdowns without emotional disturbance, while others feel intense stress even on small losses. This is not a weakness—it is a biological reality.

Successful traders design position sizing and strategies that align with their nervous system capacity. A strategy that looks profitable on paper but overwhelms your physiology will fail in real execution. Trading success improves dramatically when risk is adjusted not just to capital, but to emotional and physiological tolerance.

Recovery and Reset Between Trades

Professional traders understand the importance of recovery. After a loss or a volatile session, the nervous system needs time to reset. Jumping immediately into another trade while emotionally charged often leads to compounding mistakes.

Short breaks, movement, stretching, or even stepping away from screens can reset physiology. This allows the trader to return to the market with objectivity rather than emotional residue.

Physiology Over Willpower

Many traders rely on willpower to control emotions. However, willpower is limited and easily depleted under stress. Physiology-driven trading focuses on creating conditions where discipline becomes natural rather than forced.

When your body is calm, rested, and regulated, following rules feels effortless. When your body is stressed, no amount of motivation can maintain consistency for long.

Building a Physiology-Driven Trading Routine

Successful traders build daily routines that support their nervous system. This may include morning breathing exercises, light physical activity, structured breaks, hydration schedules, and strict sleep routines. These practices are not optional extras—they are performance tools.

Over time, this approach creates emotional resilience. Losses are processed quickly, wins do not create overconfidence, and decision-making remains stable across different market conditions.

Conclusion

Physiology-driven trading success is about recognizing that every trade is filtered through your body. Charts do not make mistakes—humans do, often because their physiology is out of balance. By managing stress, sleep, nutrition, breathing, and recovery, traders can dramatically improve consistency and performance.

In the long run, the market rewards not just the smartest traders, but the most regulated ones. When your body is aligned, your mind follows—and profitable decisions become a natural outcome rather than a constant struggle.

INR vs USD / EUR / JPY: Dynamics of the Indian Trading MarketImportance of INR in the Indian Trading Market

India is a rapidly growing economy with strong links to global trade, energy imports, capital flows, and services exports. The INR is a partially convertible currency, meaning it is closely monitored and managed by the Reserve Bank of India (RBI). Unlike fully free-floating currencies, INR movements are influenced not just by market forces but also by central bank intervention. For Indian traders, movements in INR against USD, EUR, and JPY directly impact import costs, export competitiveness, inflation, interest rates, and stock market sentiment.

USD/INR: The Most Influential Currency Pair

Among all currency pairs, USD/INR dominates the Indian forex landscape. The US Dollar is the world’s primary reserve currency, and most of India’s trade—especially crude oil imports, technology services exports, and foreign institutional investments—is denominated in USD.

When USD strengthens against INR, imports become costlier, particularly crude oil, which increases India’s trade deficit and fuels inflation. On the other hand, exporters such as IT services, pharmaceuticals, and textiles benefit from a weaker rupee as their dollar-denominated revenues translate into higher rupee earnings.

From a trading perspective, USD/INR is relatively stable compared to emerging market currencies, largely due to RBI intervention. However, it still responds sharply to global factors such as US Federal Reserve interest rate decisions, inflation data, bond yields, geopolitical tensions, and risk-on/risk-off sentiment. Domestic factors like India’s current account deficit, GDP growth, foreign exchange reserves, and capital inflows also play a decisive role.

EUR/INR: Reflecting Europe–India Trade Relations

The EUR/INR pair represents the relationship between the Indian economy and the Eurozone. Europe is one of India’s largest trading partners, particularly in sectors like engineering goods, chemicals, automobiles, and luxury products. Movements in EUR/INR are influenced by both USD/INR dynamics and EUR/USD trends.

If the euro strengthens globally due to improving European economic data or tighter European Central Bank (ECB) policy, EUR/INR tends to rise even if INR remains stable against the dollar. Conversely, economic slowdowns in Europe, debt concerns, or dovish ECB policies can weaken the euro, impacting EUR/INR.

For Indian traders, EUR/INR is often more volatile than USD/INR due to layered influences from two major economies. Exporters to Europe and companies with euro-denominated receivables actively hedge this pair. From a speculative trading standpoint, EUR/INR offers wider ranges and better opportunities but carries higher risk due to sudden global macro shifts.

JPY/INR: The Safe-Haven Influence

The Japanese Yen holds a unique position in global finance as a traditional safe-haven currency. The JPY/INR pair is influenced less by direct trade volumes and more by global risk sentiment, interest rate differentials, and Japan’s ultra-loose monetary policy.

Japan is a major investor in India, particularly in infrastructure, automobiles, and manufacturing. When global markets face uncertainty—such as financial crises, geopolitical conflicts, or sharp equity corrections—the yen tends to strengthen as investors seek safety. This causes JPY/INR to rise even if INR fundamentals remain unchanged.

However, Japan’s long-standing low-interest-rate environment often weakens the yen during risk-on phases, making JPY/INR less volatile compared to EUR/INR but more sentiment-driven than USD/INR. For Indian traders, JPY/INR is often used as a diversification tool rather than a primary trading pair.

Role of RBI in Currency Management

A defining feature of the Indian trading market is the active role played by the RBI. The central bank intervenes in forex markets to reduce excessive volatility rather than targeting specific exchange rate levels. By using its vast foreign exchange reserves, the RBI smoothens sharp moves in USD/INR, indirectly influencing EUR/INR and JPY/INR as well.

Interest rate policy, liquidity management, and forward market operations are tools frequently employed by the RBI. For traders, this means INR pairs may not trend as aggressively as fully free-floating currencies, but they also offer relatively predictable behavior during stable macro conditions.

Impact on Stock Markets and Commodities

Currency movements significantly affect Indian equity markets. A weakening INR often benefits export-oriented sectors such as IT and pharmaceuticals, while hurting import-dependent industries like aviation and oil marketing companies. Conversely, a strengthening INR attracts foreign portfolio investments, supporting equity indices like NIFTY and SENSEX.

Commodities, especially crude oil and gold, are closely tied to USD/INR. Rising USD/INR typically leads to higher domestic commodity prices, impacting inflation and consumer demand. This interconnection makes currency analysis essential for traders across asset classes.

Trading and Hedging Opportunities in India

In India, currency trading is primarily conducted through exchange-traded currency derivatives on NSE, BSE, and MCX-SX, as well as through the interbank forex market. Retail traders mainly focus on USD/INR, EUR/INR, and JPY/INR futures and options.

Corporates use these instruments for hedging foreign exchange exposure, while traders use technical analysis, macroeconomic data, and global cues for speculation. Due to regulated trading hours and margin requirements, Indian currency markets are relatively disciplined compared to offshore forex markets.

Conclusion

The INR’s relationship with USD, EUR, and JPY forms the backbone of India’s interaction with the global financial system. USD/INR reflects capital flows and macro stability, EUR/INR captures Europe-related trade dynamics, and JPY/INR mirrors global risk sentiment. Together, these pairs provide deep insight into India’s economic health, policy direction, and global integration.

For Indian traders and investors, understanding these currency pairs is not just about forex profits—it is about anticipating broader market trends, managing risk, and aligning strategies with both domestic fundamentals and global developments. In an increasingly interconnected world, INR vs USD/EUR/JPY remains a critical lens through which the Indian trading market can be analyzed and navigated effectively.

Xagusd SilverXagusd chart Analysis .........24/12/2025

The XAGUSD XABCD harmonic target is at the 73.4 level. You can book your profits here, and if a reversal candle forms, you can also consider taking a short position with a stop-loss above the high of that candle.

ENJOY !

Note: This is my analysis for educational purposes only. If you incur any profit or loss, you are solely responsible for it.

ASTER Seeing early signs of a bullish reversal - ASTER is compressing into a make or break zone after a steep selloff and this is where reversals usually start forming.If this wedge resolves upward, the next leg could quickly reclaim major levels.

1. Pattern Overview

We’re trading inside a falling wedge (tightening lower highs + lower lows).

That structure often signals seller exhaustion: bears keep pushing, but each push gets weaker as liquidity dries up. When price breaks the wedge, it’s usually because buyers finally absorb the remaining supply, triggering a squeeze back into prior resistance.

2. Key Levels

Support

- 0.6800 (current pivot) — price is trying to base here; holding this keeps the “reversal attempt” alive

- 0.6540 (invalidation / sweep zone) — lose this and the market is telling you demand failed at the lows

Resistance

- 0.7269 (first decision level) — this is the near-term ceiling; a close above shifts momentum bullish

- 1.0014 (major reclaim level) — prior structure level; if reclaimed, it often flips into support and accelerates continuation

3. Market Outlook

Bias leans cautiously bullish while price holds above 0.6540 and keeps compressing inside the wedge.

Momentum shifts cleanly bullish on a daily close above 0.7269 + successful retest. That’s typically where institutions get involved not on the first spike, but on the confirmation + pullback, when risk is defined.

4. Trade Scenarios

🟢 Bullish Scenario

Entry trigger: Daily close above 0.7269 (or wedge breakout) + retest holding

First target: 1.0014

Second target: 1.3985

Why: Breakout from compression often leads to a fast move back into prior supply zones as shorts unwind and buyers step in.

🔻 Bearish Scenario

Breakdown trigger: Daily close below 0.6540

Target: 0.55 → 0.50 demand zone

Why: Losing the sweep/invalidation level usually means the “base” failed and liquidity below gets targeted next.

- Final Note

Don’t chase the first breakout candle wait for the daily close + retest to keep risk tight.

If you want more clean, level-based breakdowns like this, follow me for daily chart setups.

XAUUSD (Gold) Intraday Outlook - 23/12/2025XAU/USD Trend: Strong Bullish

Current Price: $4,491.99

Key Levels:

Support: $4,486 / $4,479

Resistance: $4,497 / $4,501 / $4,508

Pivot: $4,490

Strategy:

Buy on dips: $4,486–$4,479 → Target $4,497–$4,501

Breakout buy: Above $4,497 → Target $4,501–$4,508

Sell only if below $4,486

Gold remains bullish; prefer buying on dips or breakouts, keep stops tight near support.

Disclaimer: Trading involves risk. This analysis is for educational purposes only and is not financial advice. Trade responsibly.

$VELO IS ONE OF THE MOST MISPRICED TOKENS IN CRYPTONASDAQ:VELO IS ONE OF THE MOST MISPRICED TOKENS IN CRYPTO

$120M mcap.

BlackRock-backed stablecoin.

1M+ real users.

Backed by CP Group (7-Eleven Thailand) + Stellar.

Down 99.7% from ATH while building real PayFi rails in SE Asia’s $396B Cross-Border Market.

IEO: $0.05 → ATH: $2.07 (40x)

Now at $0.0067 🤯

High inflation? Yes.

High risk? Absolutely.

If RWA + PayFi runs and a Binance Main Listing Lands… This Won’t Stay at $120M.

⚠️ Disclaimer: Not financial advice. Do your own research. Crypto is volatile & You Can Lose Everything.