COALINDIA 1 Week Time Frame 📌 Current Price (approx)

Coal India is trading around ₹385 – ₹402 in live market data (varies with feed) — recent reports show it trading near ~₹400 after news‑driven moves.

📈 Weekly Time Frame — Key Levels

🔸 Immediate Resistance

1. ₹400 – ₹405 — Primary upside zone where supply historically shows selling pressure.

2. ₹405 – ₹410 — Secondary resistance if momentum continues.

3. ~₹416 – ₹420 — Broader upper range resistance (near yearly highs).

🔻 Immediate Support

1. ₹380 – ₹385 — Main weekly support zone. A weekly close above this strengthens bullish bias.

2. ₹375 – ₹378 — Next support if price dips below the main zone.

3. ~₹368 – ₹370 — Deeper demand area on stronger pullbacks.

📊 Weekly Pivot & Range

Weekly Pivot ~around ₹385–₹387 — central reference for bias (above = bullish, below = bearish for the week).

Range Expectation for the Week:

Bearish Scenario: down toward ₹370–₹375

Bullish Scenario: up toward ₹400–₹405+

🧠 How to Use These Levels

Bullish bias if weekly close > ₹400.

Neutral/Range trade between ₹380–₹400.

Bearish pressure increases only on sustained close < ₹375.

Harmonic Patterns

TRENT 1 Day Time Frame 📌 Current Price Snapshot (Indicative Daily Range)

Approx Current Price: ~₹4,050 – ₹4,290 on Daily charts (varies by data source) — shows recent traded range around this zone.

📊 Daily Support & Resistance (Reliable Pivot/Levels)

🔹 Pivot Points & Classic Levels

Pivot (Daily): ~ ₹4,112–₹4,113

Resistance 1 (R1): ~ ₹4,081–₹4,100

Resistance 2 (R2): ~ ₹4,100–₹4,128

Support 1 (S1): ~ ₹4,034–₹4,055

Support 2 (S2): ~ ₹4,006–₹4,023

Support 3 (S3): ~ ₹3,987

(These are typical daily pivots used by day traders and pivot traders.)

🔹 Alternate Support/Resistance Zones

Immediate stronger support: ~ ₹4,034–₹4,006

Next downside zone: ~ ₹3,987 (52‑wk low) / psychological support

Upside resistance: ~ ₹4,081 – ₹4,128 – ₹4,266–₹4,326 (if momentum resumes)

📌 Intraday Reaction Levels (1‑Day Focus)

These reflect where price often reacts intraday (from recent trading data):

Near‑term support watch: ~ ₹4,220–₹4,260 — hold above this for bounce potential.

Breakdown trigger: below ~ ₹4,220 → watch next lower support ~ ₹4,160+.

Near‑term upside trigger: above ~ ₹4,416–₹4,470 for short‑term strength.

Retail Trading Profits: Reality, Drivers, Sustainable StrategiesIntroduction: Understanding Retail Trading Profits

Retail trading refers to individual investors buying and selling financial instruments such as stocks, derivatives, forex, commodities, and cryptocurrencies using personal capital. With the rise of digital trading platforms, low brokerage costs, and easy access to market data, retail participation has grown significantly, especially in emerging markets like India. However, while success stories often highlight quick gains, the reality of retail trading profits is complex, demanding discipline, knowledge, and risk management. This article explores how retail traders generate profits, the challenges they face, and the strategies that lead to sustainable success.

The Nature of Retail Trading Profits

Retail trading profits are the net gains earned after accounting for transaction costs, taxes, slippage, and losses. Unlike institutional traders, retail traders operate with limited capital, fewer information advantages, and higher emotional involvement. Profits in retail trading are usually non-linear, meaning periods of gains are often followed by drawdowns. Sustainable profitability depends less on occasional big wins and more on consistent execution over time.

Key Markets Where Retail Traders Seek Profits

Retail traders operate across multiple asset classes:

Equity Markets: Long-term investing, swing trading, and intraday trading in stocks.

Derivatives (F&O): Futures and options offer leverage but also increase risk.

Forex Markets: Highly liquid, 24-hour markets attractive for short-term traders.

Commodities: Gold, crude oil, and agricultural commodities provide diversification.

Cryptocurrencies: High volatility offers profit potential but carries significant risk.

Each market has a different risk-reward profile, and retail profits depend on choosing instruments aligned with one’s skill and risk tolerance.

Role of Knowledge and Skill in Profit Generation

Profitable retail trading is fundamentally skill-based. Traders who invest time in understanding technical analysis, price action, market structure, and basic macroeconomics are better positioned to make informed decisions. Over time, traders develop pattern recognition, execution discipline, and the ability to adapt to changing market conditions. Profits are rarely accidental; they are the outcome of preparation, testing, and experience.

Risk Management: The Foundation of Retail Trading Profits

Risk management is the most critical factor separating profitable traders from unprofitable ones. Retail traders who survive and grow typically follow strict rules such as:

Limiting risk per trade (often 1–2% of capital)

Using stop-loss orders consistently

Maintaining a favorable risk-to-reward ratio

Avoiding over-leverage and excessive position sizing

Even a profitable strategy can fail without proper risk control. Long-term retail trading profits are more about capital preservation than aggressive profit chasing.

Psychological Factors Influencing Profits

Trading psychology plays a decisive role in retail trading outcomes. Emotions like fear, greed, revenge trading, and overconfidence often lead to impulsive decisions. Many retail traders lose money not due to poor strategies but due to emotional reactions to wins and losses. Profitable traders cultivate discipline, patience, and emotional neutrality, treating trading as a business rather than a gambling activity.

Technology and Tools Enhancing Retail Profits

Modern technology has significantly improved the ability of retail traders to compete. Charting platforms, real-time data, algorithmic tools, screeners, and backtesting software allow traders to refine strategies and reduce guesswork. Access to educational content, market analytics, and automated alerts has made trading more data-driven, improving the probability of consistent profits when used responsibly.

Common Mistakes That Erode Retail Trading Profits

Many retail traders struggle due to avoidable mistakes, including:

Overtrading driven by excitement or boredom

Ignoring transaction costs and taxes

Following tips without independent analysis

Trading without a defined plan

Expecting quick and unrealistic returns

These mistakes gradually erode capital and confidence, making profitability difficult to achieve over time.

Consistency Over Big Wins: The Profitability Mindset

One of the most misunderstood aspects of retail trading profits is consistency. Professional retail traders focus on steady, repeatable returns rather than chasing jackpot trades. Small but consistent gains, compounded over time, lead to meaningful wealth creation. This mindset shifts the focus from short-term excitement to long-term sustainability.

Regulatory Environment and Its Impact on Profits

Regulatory frameworks influence retail trading profitability through margin rules, leverage limits, taxation, and compliance requirements. While regulations may restrict excessive risk-taking, they also protect retail traders from systemic risks and unethical practices. Understanding regulatory norms helps traders plan trades more efficiently and avoid unexpected financial burdens.

Long-Term Sustainability of Retail Trading Profits

Sustainable retail trading profits are achievable but require continuous learning and adaptation. Markets evolve due to economic cycles, policy changes, and technological advancements. Traders who regularly review performance, update strategies, and remain flexible are more likely to remain profitable across different market phases.

Conclusion: The Real Path to Retail Trading Profits

Retail trading profits are not a myth, but they are far from easy or guaranteed. They are the result of disciplined execution, sound risk management, emotional control, and continuous skill development. While many retail traders enter the market seeking fast money, only those who approach trading as a serious profession achieve long-term success. In essence, retail trading profits are earned not by predicting markets perfectly, but by managing uncertainty intelligently and consistently over time.

Institutional Trading Win: Big Money Dominates Financial MarketsIntroduction: Understanding Institutional Trading Power

Institutional trading refers to market activity conducted by large organizations such as mutual funds, hedge funds, pension funds, insurance companies, investment banks, and sovereign wealth funds. These institutions control massive pools of capital and operate with sophisticated strategies, advanced technology, and deep market access. When institutions “win” in the market, it is not by chance—it is the result of structural advantages, superior information flow, disciplined execution, and long-term planning. Understanding how institutional trading works is crucial for grasping modern market dynamics and for retail traders aiming to align with smart money rather than trade against it.

Who Are Institutional Traders?

Institutional traders represent entities that manage money on behalf of clients or beneficiaries. Their primary objective is not short-term speculation but consistent returns with controlled risk. Unlike retail traders, institutions must adhere to mandates, regulations, and risk frameworks. Examples include:

Mutual funds managing public investments

Hedge funds employing aggressive alpha-seeking strategies

Pension funds focused on long-term capital preservation

Banks and proprietary desks providing liquidity and market-making

Their sheer size means their trades can move markets, influence price trends, and define support and resistance zones.

Capital Advantage: Size That Shapes Markets

The most obvious institutional advantage is capital. Institutions trade in volumes that far exceed retail participation. This allows them to accumulate positions over time, absorb market volatility, and withstand temporary drawdowns. Large capital enables:

Position scaling across multiple price levels

Long-term holding without emotional pressure

Strategic accumulation during low-volatility phases

Because of this, institutions often create the very trends that retail traders attempt to follow.

Information Edge and Research Depth

Institutional wins are driven by superior research. Institutions employ teams of economists, analysts, quants, and sector specialists. Their research covers:

Macroeconomic trends (inflation, interest rates, GDP)

Corporate fundamentals (earnings, balance sheets, cash flow)

Sector rotation and inter-market analysis

Policy decisions and global capital flows

This depth of analysis allows institutions to position themselves well before information becomes mainstream.

Technology and Algorithmic Execution

Modern institutional trading relies heavily on technology. Algorithms help institutions execute large orders without disturbing the market. Instead of placing one large order, they break it into smaller chunks using:

VWAP (Volume Weighted Average Price)

TWAP (Time Weighted Average Price)

Iceberg and dark pool executions

This stealth execution enables institutions to enter and exit positions efficiently while minimizing slippage and detection.

Market Structure Knowledge and Liquidity Control

Institutions understand market microstructure better than any participant. They know where liquidity resides—near highs, lows, round numbers, and breakout zones. Retail traders often place stop-loss orders in predictable areas, and institutions use these zones to build positions.

This leads to phenomena like:

False breakouts

Stop-loss hunting

Liquidity sweeps before trend continuation

What appears as manipulation is often institutional positioning driven by liquidity needs.

Psychological Discipline and Risk Management

Institutional trading success is built on discipline. Decisions are rule-based, not emotional. Risk management is central to every trade, including:

Defined maximum loss per position

Portfolio diversification across assets

Hedging using derivatives

Scenario-based stress testing

Retail traders often focus on entry points, while institutions focus on risk first, return second. This mindset difference is a key reason institutions win consistently.

Time Horizon Advantage: Patience Beats Speed

Institutions trade across multiple time horizons—intraday, swing, positional, and long-term. Unlike retail traders chasing quick profits, institutions are patient. They may hold positions for months or years if the macro thesis remains intact.

This patience allows institutions to:

Ride major trends

Ignore short-term noise

Benefit from compounding

Markets reward patience, and institutions are structured to wait.

Institutional Footprints in Price Action

Even without access to proprietary data, institutional activity leaves footprints on charts. These include:

Strong volume spikes at key levels

Consolidation before big moves

Breakouts followed by retests

Sustained trends with shallow pullbacks

Smart retail traders learn to read price action and volume to align with institutional flows rather than predict tops and bottoms.

Why Retail Traders Often Lose Against Institutions

Retail traders usually lose not because markets are unfair, but because they lack structure. Common mistakes include:

Overleveraging

Emotional trading

Chasing breakouts without confirmation

Ignoring higher time-frame trends

Institutions exploit these behavioral patterns, intentionally or unintentionally, as part of normal market functioning.

How Retail Traders Can Benefit from Institutional Wins

Retail traders cannot compete with institutions, but they can follow institutional direction. Strategies include:

Trading with the trend, not against it

Using higher time-frame levels

Focusing on liquidity zones

Being patient with entries and exits

When retail traders align their trades with institutional momentum, probabilities improve significantly.

Conclusion: Institutional Trading Wins Define Market Reality

Institutional trading wins are not about beating retail traders—they are about capital efficiency, discipline, and strategic execution. Institutions shape market trends, control liquidity, and define price direction through informed decision-making and advanced infrastructure. For anyone participating in financial markets, understanding institutional behavior is no longer optional—it is essential.

Markets move not on opinions, but on capital. And institutional capital, when deployed intelligently, almost always wins in the long run.

Shares Explained in the Indian Market1. Introduction to Shares

Shares represent ownership in a company. When an individual buys a share of a company, they become a part-owner (shareholder) of that company in proportion to the number of shares held. In the Indian market, shares are the most common instruments for wealth creation, capital appreciation, and participation in the country’s economic growth.

Companies issue shares to raise capital for expansion, debt reduction, research, infrastructure, and operational needs. Investors buy shares with the expectation of earning returns through price appreciation and dividends.

2. Meaning and Definition of Shares

A share is a unit of ownership in a company’s share capital. It gives shareholders certain rights, such as:

Right to vote (in most cases)

Right to receive dividends

Right to participate in company growth

Right to claim assets during liquidation (after creditors)

In India, shares are governed by:

Companies Act, 2013

SEBI (Securities and Exchange Board of India) Regulations

3. Types of Shares in the Indian Market

a) Equity Shares

Equity shares are the most common type of shares traded in the Indian stock market.

Represent ownership

Carry voting rights

Dividends are variable

High risk, high return

Equity shareholders benefit directly from the company’s growth but also bear losses.

b) Preference Shares

Preference shares provide preferential treatment over equity shares.

Fixed dividend

Priority during liquidation

Generally no voting rights

Lower risk compared to equity shares

Preference shares are suitable for investors seeking stable income.

4. How Shares Are Issued in India

a) Initial Public Offering (IPO)

An IPO is when a company offers its shares to the public for the first time.

Converts private company into public company

Regulated by SEBI

Investors apply via ASBA through banks or brokers

b) Follow-on Public Offer (FPO)

Existing listed companies issue additional shares to raise more capital.

c) Rights Issue

Shares offered to existing shareholders at a discounted price in proportion to their holdings.

d) Bonus Issue

Free shares issued from company reserves to existing shareholders.

5. Indian Stock Exchanges

a) National Stock Exchange (NSE)

Largest exchange in India by volume

Benchmark index: NIFTY 50

b) Bombay Stock Exchange (BSE)

Oldest stock exchange in Asia

Benchmark index: SENSEX

Shares are traded electronically through these exchanges under strict regulatory oversight.

6. Role of SEBI in the Share Market

SEBI is the market regulator responsible for:

Protecting investor interests

Preventing fraud and insider trading

Regulating IPOs, brokers, and mutual funds

Ensuring transparency and fair practices

SEBI regulations have made the Indian market safer and more investor-friendly.

7. Share Trading Mechanism

a) Demat Account

Shares are held in electronic form through:

NSDL or CDSL

Eliminates physical certificates

Mandatory for trading

b) Trading Account

Used to buy and sell shares through stockbrokers.

c) Settlement Cycle

India follows T+1 settlement, meaning shares and funds are settled one day after trade execution.

8. Price Determination of Shares

Share prices in India are determined by:

Demand and supply

Company financial performance

Economic indicators (GDP, inflation, interest rates)

Global markets

Corporate actions and news

Investor sentiment

Prices fluctuate continuously during market hours based on real-time orders.

9. Benefits of Investing in Shares

a) Capital Appreciation

Long-term growth potential outperforms most asset classes.

b) Dividend Income

Some companies pay regular dividends.

c) Ownership and Voting Rights

Investors can influence company decisions.

d) Liquidity

Shares can be easily bought and sold.

e) Inflation Hedge

Equities generally beat inflation over the long term.

10. Risks Associated with Shares

a) Market Risk

Prices fluctuate due to economic and market conditions.

b) Business Risk

Company-specific issues can impact share value.

c) Volatility

Short-term price movements can be unpredictable.

d) Liquidity Risk

Some shares may have low trading volumes.

Risk management through diversification and research is essential.

11. Types of Share Market Investors in India

a) Retail Investors

Individual investors investing small to moderate amounts.

b) Institutional Investors

Includes mutual funds, insurance companies, banks, and FIIs.

c) Foreign Institutional Investors (FIIs)

Overseas investors who influence market liquidity and trends.

12. Fundamental vs Technical Perspective

Fundamental Analysis

Focuses on:

Company earnings

Balance sheet

Industry growth

Management quality

Used for long-term investing.

Technical Analysis

Focuses on:

Price charts

Volume

Indicators and patterns

Used for short-term trading.

Both methods are widely used in the Indian market.

13. Taxation on Shares in India

Short-Term Capital Gains (STCG)

Holding period less than 1 year

Taxed at 15%

Long-Term Capital Gains (LTCG)

Holding period more than 1 year

Gains above ₹1 lakh taxed at 10%

Dividends are taxed as per individual income tax slab.

14. Importance of Shares in Indian Economy

Shares play a vital role by:

Funding corporate growth

Encouraging savings and investments

Supporting employment generation

Improving capital formation

Reflecting economic health

A strong equity market strengthens India’s financial system.

15. Conclusion

Shares form the foundation of the Indian capital market and offer investors a powerful tool for wealth creation. While they come with risks, informed investing, long-term discipline, and regulatory safeguards make equity participation rewarding. With increasing digital access, regulatory transparency, and financial awareness, the Indian share market continues to attract millions of investors, making it a key pillar of India’s economic progress.

Production Linked Incentive (PLI) Scheme WinnersHow India’s Production Linked Incentive Is Creating Global Champions

India’s Production Linked Incentive (PLI) Scheme is one of the most ambitious industrial policy initiatives undertaken by the country in recent decades. Launched with the objective of boosting domestic manufacturing, reducing import dependence, and positioning India as a global production hub, the PLI scheme rewards companies with financial incentives tied directly to incremental production and sales. Since its rollout across multiple sectors, the scheme has produced clear winners—companies and industries that have successfully leveraged policy support to scale up capacity, adopt advanced technologies, attract investments, and integrate into global value chains.

This article explains who the PLI scheme winners are, why they succeeded, and what their success means for India’s economic future.

Understanding the PLI Scheme

The PLI scheme is performance-based. Unlike traditional subsidies, incentives are given only after companies achieve incremental output or sales targets. This ensures accountability, efficiency, and results-oriented growth. The scheme currently covers sectors such as electronics, pharmaceuticals, automobiles and EVs, telecom equipment, solar modules, food processing, textiles, specialty steel, and semiconductors.

The winners under the PLI scheme are not merely firms receiving incentives; they are enterprises that have demonstrated scalability, competitiveness, and long-term commitment to manufacturing in India.

Electronics Manufacturing: The Biggest PLI Success Story

The electronics sector—especially mobile phone manufacturing—has emerged as the most visible PLI winner. Global giants like Apple’s contract manufacturers (Foxconn, Pegatron, and Tata Electronics) have significantly expanded operations in India. Domestic firms such as Dixon Technologies and Lava have also benefited immensely.

As a result of the PLI scheme:

India has become one of the world’s largest mobile phone producers.

Smartphone exports have surged dramatically.

High-value electronics manufacturing has shifted from assembly to component-level production.

These companies succeeded because they combined scale, export orientation, strong supply-chain integration, and compliance with stringent PLI targets.

Pharmaceuticals and APIs: Reducing Import Dependence

Another major set of winners comes from the pharmaceutical and active pharmaceutical ingredient (API) sector. Indian pharma companies such as Sun Pharma, Dr. Reddy’s, Cipla, Lupin, and Aurobindo Pharma have used PLI incentives to invest in domestic API manufacturing.

Historically, India depended heavily on imports—particularly from China—for critical APIs. The PLI scheme encouraged:

Backward integration

Development of fermentation-based and chemical APIs

Strengthening of bulk drug parks

PLI winners in this sector are improving India’s drug security while also positioning the country as a reliable global supplier.

Automobiles and EVs: Driving the Future of Mobility

The automobile and electric vehicle (EV) sector has also produced significant PLI winners. Companies such as Tata Motors, Mahindra & Mahindra, Bajaj Auto, TVS Motor, and global auto component players have used PLI incentives to invest in advanced automotive technologies.

Key areas of success include:

Electric drivetrains

Advanced battery technology

Hydrogen and alternative fuel solutions

High-efficiency internal combustion engines

The winners here are companies that aligned PLI benefits with long-term trends in sustainable and green mobility.

Solar Manufacturing: Building Energy Independence

In the renewable energy space, solar PV module manufacturers are emerging as strong PLI winners. Companies like Adani Solar, Reliance New Energy, Waaree Energies, and Vikram Solar are setting up large-scale integrated solar manufacturing facilities.

PLI incentives helped overcome initial cost disadvantages and enabled:

Integrated manufacturing from polysilicon to modules

Reduced reliance on imported solar components

Expansion of domestic renewable energy infrastructure

These firms are not just beneficiaries but strategic partners in India’s clean energy transition.

Telecom Equipment: Strengthening Digital Infrastructure

The telecom PLI scheme has enabled companies like Tejas Networks, HFCL, Nokia India, Samsung, and Ericsson India to scale up local manufacturing. Winners in this segment have contributed to:

Indigenous 4G and 5G equipment development

Export of telecom hardware

Strengthening of national digital infrastructure

This sector’s success is particularly important from a strategic and security standpoint.

Textiles and Man-Made Fibres: Value-Added Growth

In textiles, PLI winners are companies that moved up the value chain—especially in man-made fibres (MMF) and technical textiles. Firms investing in large-scale, integrated operations with global quality standards have gained the most.

These winners are helping India transition from low-margin textile exports to high-value, performance-based fabrics used in sportswear, industrial applications, and healthcare.

What Makes a PLI Winner?

Across sectors, common traits define PLI scheme winners:

Scale and Efficiency – Ability to meet large production targets.

Export Orientation – Focus on global markets, not just domestic demand.

Technology Adoption – Investment in automation, R&D, and advanced manufacturing.

Strong Balance Sheets – Capacity to invest upfront before incentives are realized.

Long-Term Vision – Alignment with global industry trends rather than short-term gains.

Companies lacking these characteristics often fail to fully capitalize on the scheme.

Economic Impact of PLI Winners

The success of PLI winners has broader macroeconomic implications:

Job creation across manufacturing and allied sectors

Growth in exports and foreign exchange earnings

Development of domestic supplier ecosystems

Increased investor confidence in India as a manufacturing hub

These outcomes reinforce India’s vision of becoming a global manufacturing powerhouse under initiatives like Make in India and Atmanirbhar Bharat.

Challenges Ahead

Despite the success, PLI winners still face challenges such as infrastructure gaps, logistics costs, regulatory complexity, and global demand volatility. Sustained policy support, ease of doing business, and skill development will be critical for maintaining momentum.

Conclusion

The PLI scheme winners represent a transformative shift in India’s industrial landscape. From electronics and pharmaceuticals to EVs and renewable energy, these companies have demonstrated that targeted incentives, when combined with scale and strategy, can deliver global competitiveness. More than just beneficiaries of government support, PLI winners are becoming champions of India’s manufacturing resurgence, laying the foundation for long-term economic growth, technological self-reliance, and global leadership.

Part 7 Trading Master Class1. Start with Buying Options

Risk is limited → good for beginners.

2. Learn Greeks

Greeks are the foundation of professional trading.

3. Use Spreads

Spreads reduce cost and risk.

4. Avoid Trading Near Expiry Initially

Premium decay is extremely fast.

5. Always Keep Stop-Loss

Especially for sellers.

6. Track IV (Implied Volatility)

Decide if an option is overpriced or underpriced.

7. Focus on Liquid Indices

NIFTY, BANKNIFTY, FINNIFTY have tight spreads.

Part 6 Learn Institutional Trading Risks in Option Trading

a) Time Decay

Buyers lose money as time passes.

b) Volatility Crush

After major events (earnings, budgets), volatility collapses, reducing option value.

c) Unlimited Risk for Option Sellers

Especially for naked call sellers.

d) Low Liquidity

Some strikes may have poor liquidity and wider spreads.

e) Emotional Trading

Fast movement can lead to panic or overtrading.

XAUUSD (Gold) Technical Outlook - 24/12/2025XAUUSD – Gold Technical Snapshot (Intraday)

Gold remains bullish across higher timeframes (Daily–Monthly). Price is trading near 4,492, close to the day’s high, with all major moving averages aligned upward. Momentum indicators support the uptrend, though overbought conditions suggest possible short-term pullbacks.

Key_Levels

Support: 4,480 / 4,465

Pivot: 4,495

Resistance: 4,520 → 4,550 → 4,575

Outlook & Strategy

Bias stays bullish above 4,480

Buy pullbacks near support or breakouts above 4,520

Below 4,465, expect a corrective move toward 4,440–4,410

Disclaimer: This analysis is for educational purposes only and not financial advice. Trading involves risk—always manage your risk and do your own research.

Part 3 Learn Institutional Trading Delta

Measures how much the option price moves with the underlying.

Call delta: 0 to 1

Put delta: -1 to 0

Higher delta = more responsive to underlying movement.

Theta

Measures time decay.

Options lose value as expiry nears.

Sellers benefit from theta; buyers lose value over time.

Vega

Measures sensitivity to volatility.

Higher volatility = higher option premiums.

Gamma

Measures how fast delta changes.

High near expiry, especially for ATM options.

Rho

Measures change in premium due to interest rates.

Part 2 Ride The Big Moves Why Traders Use Options

a) Hedging

Investors use options to protect their portfolio.

Example: Buying put options to protect against market crashes.

b) Speculation

Traders use leverage to take directional bets with small capital.

c) Income Generation

Selling options (covered calls, cash-secured puts) allows traders to earn regular premium income.

d) Risk Management

Options reduce downside risk more effectively than futures.

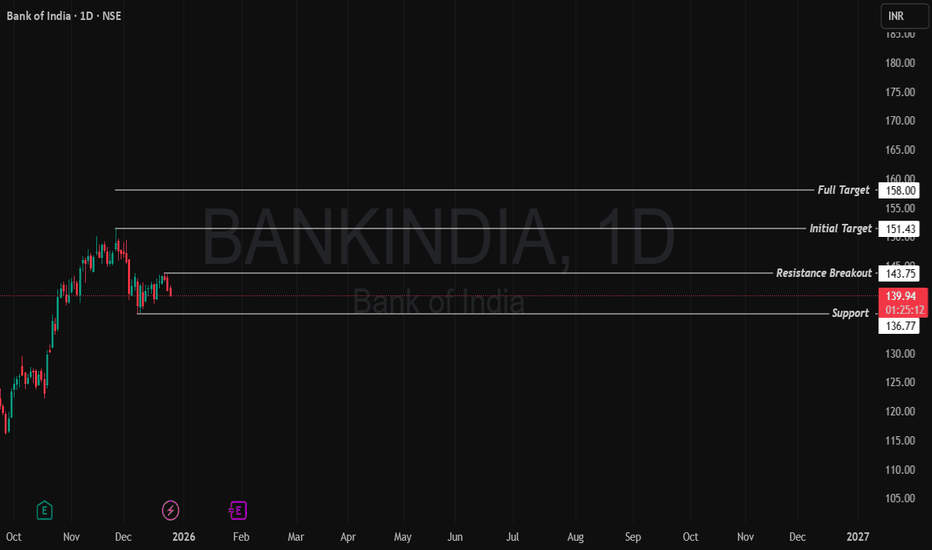

Bank of India: Bullish Continuation SetupBank of India has shown resilience near its current support after recent consolidations. A sustained breakout above 143.75–144.00 would confirm short-term bullish strength, opening up higher targets near 151.43 and eventually 158.00 if momentum sustains.

Price continuing above the 136.77 support suggests buyers are defending major demand, which keeps the structure constructive. Positive breadth and banking sector flows could help the stock extend gains toward the next resistance bands, especially if macro remains supportive.

Recent DEC 2025 News Supporting a Positive Outlook

Analyst sentiment & performance: Bank of India has shown an overall uptrend this year with strong returns and remains actively traded, reflecting ongoing interest from the market. Recent average prices around ₹142–143 show recovery and participation.

Sector outlook & liquidity: RBI’s aggressive liquidity support and repo rate cuts in December 2025 aim to bolster credit growth and economic activity. Such policy easing generally benefits banking stocks by reducing funding costs and boosting loan demand.

Macro environment: Forecasts from brokerages suggest broader market strength into 2026, which could support banking names like Bank of India if earnings and credit metrics improve

Note: News on Bank of India specifically from the last week of December 2025 is limited; however, macro and sector catalysts provide supportive context for banks.

Trade View (Bullish)

Buy on Breakout Above: 144.00

Stop-Loss: 136.50

Target 1: 151.43

Target 2: 158.00

Bullish Structure: Above support and breaking short-term resistance shows buyers regaining control. Risk to Watch: Breakdown below 136.77 could invite near-term weakness.

Disclaimer: aliceblueonline.com

Part 1 Ride The Big Moves Strike Price, Premium, and Expiry

Understanding these three elements is essential for option trading:

Strike Price

This is the predetermined price at which the underlying asset can be bought (call) or sold (put). Different strike prices allow traders to choose how far their view is from the current market price.

Premium

This is the price of the option, paid by the buyer to the seller. Premiums are influenced by:

Volatility

Time remaining to expiry

Current underlying price

Interest rates

Market demand

The seller receives the premium upfront.

Expiration Date

Options are time-bound instruments. In markets like India (NSE), expiry can be:

Weekly

Monthly

Quarterly

As the option approaches expiry, its value decays—a phenomenon called time decay (theta).

PCR Trading Strategies What Are Options?

An option is a contract between two parties—a buyer and a seller—based on an underlying asset such as a stock, index, commodity, or currency. The key feature is that the buyer of the option has rights, while the seller has obligations.

There are two types of options:

a) Call Option

A call option gives the buyer the right to buy the underlying asset at a fixed price, called the strike price, within a set period.

Buyers of calls are bullish—they expect the price to go up.

Sellers of calls are bearish or neutral—they don’t expect much upside.

b) Put Option

A put option gives the buyer the right to sell the underlying asset at the strike price within a set period.

Buyers of puts are bearish—they expect prices to fall.

Sellers of puts expect stability or upward movement.

HINDCOPPER 1 Week Time Frame 📍 Current Price (Indicative)

The stock is trading around ₹400–₹430 levels recently — near 52‑week highs due to strong momentum.

📊 Weekly Timeframe Levels (1‑Week Outlook)

🔹 Key Weekly Resistances

1. Primary Resistance: ~₹415 – ₹422

— Immediate upside facing selling pressure.

2. Higher Resistance: ~₹428 – ₹432

— Near recent short‑term top and swing highs.

Bullish scenario: Sustained closes above ₹415 – ₹422 may prompt further gains toward ₹430+.

🔸 Key Weekly Supports

1. Immediate Support: ₹382 – ₹381

— Near recent pullback region / pivot area.

2. Intermediate Support: ₹375 – ₹376

— Short‑term demand zone if price cools off.

3. Stronger Support: ₹370 – ₹371

— Important weekly base — breakdown below this may weaken trend.

📌 1‑Week Scenarios to Watch

🟢 Bullish

Close above ~₹415–₹422 → Next upside target ~₹428–₹432+

🔄 Range / Consolidation

Range ~₹382–₹415 → Price may chop sideways before a definitive break

🔴 Bearish

Weekly close below ~₹375–₹370 → Risk of deeper pullback toward ₹360–₹350

360ONE 1 Day Time Frame 📊 Daily Price Range

Typical intraday range: ~₹1,124–₹1,150 (varies per session) — recent daily highs/lows seen in this band.

📈 Important Daily Support Levels

Support 1: ~₹1,134–₹1,135 — near recent intraday lows.

Support 2: ~₹1,102 — secondary downside support.

Support 3: ~₹1,084 — deeper support level if broader sell‑off unfolds.

👉 These are key levels where the stock has found buying interest on the daily chart. Breach below them may indicate more downside pressure.

📉 Important Daily Resistance Levels

Resistance 1: ~₹1,184 — immediate upside barrier.

Resistance 2: ~₹1,202 — next layer of sellers.

Resistance 3: ~₹1,234 — stronger upside pivot.

👉 These are areas where the stock may struggle to move higher on the daily timeframe.

🔧 Technical Bias on Daily Timeframe

Daily indicators (RSI, MACD, moving averages) are currently showing buy/strong‑buy signals, meaning short‑term trend is tilted bullish.

📌 Daily Pivot Reference (Approximate)

Pivot ~₹1,152–₹1,155 — central daily pivot based on recent session price action.

MANAPPURAM 1 Day Time Frame 📌 Live Reference Price (approx)

• Current trading price on NSE is around ₹292–₹295 (varies slightly by data source and market timing).

📊 Daily Pivot & Intra‑Day Levels (1‑Day Time Frame)

Daily Pivot Zone (key zone for daily bias):

• Pivot Point: ~₹284–₹287 (central pivot zone where buyers/sellers balance)

🔼 Resistance Levels

• R1: ~₹289–₹290 (first resistance — break above signals strength)

• R2: ~₹292–₹293 (secondary resistance — near current price zone)

• R3: ~₹296–₹298 (major resistance from higher pivot calculations)

🔽 Support Levels

• S1: ~₹281–₹283 (first support — good short‑term buy zone)

• S2: ~₹276–₹278 (deeper support if S1 breaks)

• S3: ~₹273–₹275 (strong buffer support)

📈 Interpretation for Intraday / Daily Trading

Bullish scenario

Above pivot (~₹285–₹287) → positive bias today.

Above R1 (~₹289–₹290) → look for moves toward R2 & R3 (~₹293–₹298).

Bearish scenario

Below pivot (~₹284–₹287) → weakness coming in.

Break below S1 (~₹281) → next stop S2 (~₹276–₹278).

📍 Quick Intraday Ranges (Observed Today)

• Intraday high range today ~₹292–₹294 and low near ₹281–₹284 in recent sessions.

DIXONDIXON

Bullish trend is Showing on the chart.

Buy signals in technical indicators and chart pattern.

1) Falling Wedge Chart Pattern.

1) Bullish BAT Harmonic Chart Pattern.

BUYING RANGE 13200/13250

Watch for a breakout above 13200/13250 to sustain the bullish trend. If the resistance holds, there could be a retest towards 12700/12800 and an uptrend from here.

ASIANTILES 1 Day Time Frame 📊 Current Price Context

Asian Granito India is trading around ₹72–73 on the NSE in today’s session.

📈 1‑Day Key Levels (based on recent pivot/technical data)

🔹 Pivot Point (daily reference): ~ ₹73 (central level)

📌 Resistance Levels:

R1: ~ ₹75 – Immediate upside hurdle (recent 52‑week high area)

R2: ~ ₹77 – Secondary resistance if price breaks above R1

R3: ~ ₹79 – Extended resistance zone

📉 Support Levels:

S1: ~ ₹72 – Nearest support below the pivot

S2: ~ ₹70 – Short‑term support zone

S3: ~ ₹68 – Deeper support if market weakens

🛠️ How to Use These Levels

Bullish entry: Above the daily pivot (~₹73) with volume confirmation.

Stop loss: Below ₹70–₹68 if long.

Profit targets: ₹75 → ₹77 → ₹79 on sustained upside.

Candle Patterns Candlestick charts represent price movement in a visually intuitive way. Each candle shows:

Open

High

Low

Close

The color (green or red) indicates bullish or bearish sentiment. Patterns form when candles combine to express a strong market bias.

Why Candle Patterns Matter

They show real-time market sentiment

Provide early entry signals

Indicate trend continuation or reversal

Help identify trap candles and false breakouts

Crucial for Volume Profile & Market Structure traders to read participant behaviour

Candlestick patterns are classified into:

A. Bullish Reversal Patterns

B. Bearish Reversal Patterns

C. Continuation Patterns

D. Indecision / Neutral Patterns

NMDC 1 Week Time Frame 📊 Current Price Context

NMDC is trading around ₹81–₹82 on NSE currently.

📉 Weekly Support Levels

1. Primary Support: ~₹79–₹77 zone

Weekly pivot region and short‑term support clustered here.

2. Next Support: ~₹76–₹74 region

A key technical support band on weekly charts and potential “re‑entry” level if near‑term support breaks.

3. Lower Support Floor: ~₹69–₹68 (longer weekly support)

If the ₹74 region fails decisively, the next significant weekly demand zone is here.

📈 Weekly Resistance Levels

1. Immediate Resistance: ~₹82–₹83

Near the current trading range high and recent pivot resistance.

2. Higher Resistance: ~₹84–₹86

Represents a zone where weekly price has previously stalled.

3. Major Breakout Level: Above ₹88‑₹90

Crossing and closing above this weekly zone can signal stronger bullish continuation.

📌 Trading Tip:

Bullish view: Weekly close above ₹82–₹83 strengthens upside potential.

Bearish risk: Weekly break below ₹76–₹74 weakens structure and could target lower supports.