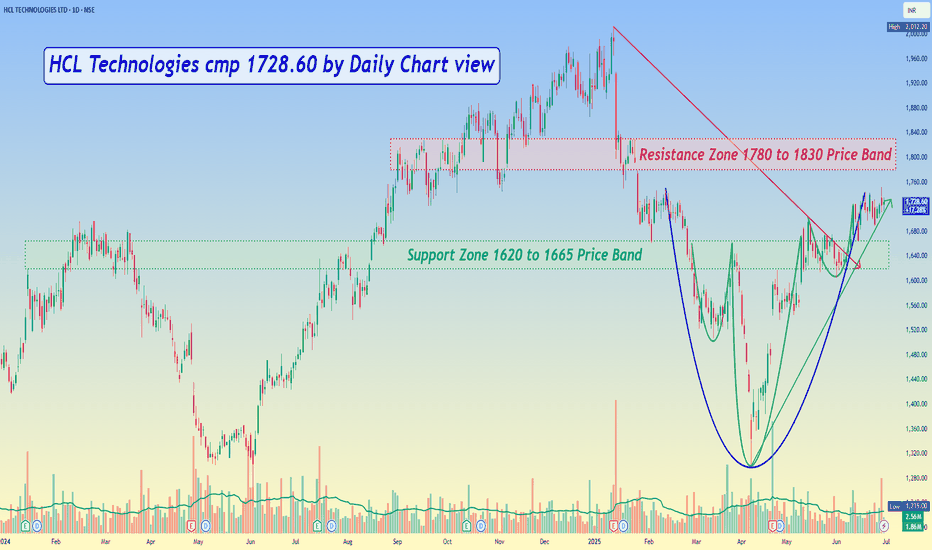

HCL Technologies cmp 1728.60 by Daily Chart viewHCL Technologies cmp 1728.60 by Daily Chart view

- Support Zone 1620 to 1665 Price Band

- Resistance Zone 1780 to 1830 Price Band

- Bullish Rounding Bottom and faintly considerate Head & Shoulder too

- Volumes have been spiking regularly well above the average traded quantity over past few weeks

Hcltechnologies

HCL Tech: Channel Breakout Above 2000Details:

Asset: HCL Technologies (HCLTECH)

Breakout Level: Sustaining above 2000

Potential Target: To be determined based on breakout momentum

Stop Loss: Below 2000 or as per risk tolerance

Timeframe: Medium-term

Rationale: HCL Tech is holding strong above 2000, signaling the possibility of a channel breakout. Sustained buying above this level could trigger a significant upward move.

Market Analysis:

Technical Setup: The stock is poised for a breakout with sustained levels above 2000, supported by consistent volume and positive price action.

Sector Outlook: As a leading IT company, HCL Tech benefits from strong global demand for digital services and software solutions.

Risk Management:

Implement a stop loss slightly below 2000 to minimize downside risk in case of reversal.

Timeframe:

Medium-term move anticipated, contingent on sustained momentum and market conditions.

Risk-Reward Ratio:

Favorable setup with a strong breakout level and potential for significant upside.

Keep an eye on market sentiment and sector performance for additional confirmation.

HCL TechnologiesBreakout at 1830 will create new highs.

Positive candle closing above 1830 will be a buy Target will be 1899.

All important points are marked.

𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫: 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐢𝐧 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐢𝐞𝐬 𝐦𝐚𝐫𝐤𝐞𝐭 𝐚𝐫𝐞 𝐬𝐮𝐛𝐣𝐞𝐜𝐭 𝐭𝐨 𝐦𝐚𝐫𝐤𝐞𝐭 𝐫𝐢𝐬𝐤𝐬, 𝐫𝐞𝐚𝐝 𝐚𝐥𝐥 𝐭𝐡𝐞 𝐫𝐞𝐥𝐚𝐭𝐞𝐝 𝐝𝐨𝐜𝐮𝐦𝐞𝐧𝐭𝐬 𝐜𝐚𝐫𝐞𝐟𝐮𝐥𝐥𝐲 𝐛𝐞𝐟𝐨𝐫𝐞 𝐢𝐧𝐯𝐞𝐬𝐭𝐢𝐧𝐠. 𝐒𝐭𝐨𝐜𝐤𝐬 𝐬𝐮𝐠𝐠𝐞𝐬𝐭𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐠𝐫𝐨𝐮𝐩 𝐚𝐫𝐞 𝐟𝐨𝐫 𝐞𝐝𝐮𝐜𝐚𝐭𝐢𝐨𝐧 𝐩𝐮𝐫𝐩𝐨𝐬𝐞. 𝐖𝐞 𝐝𝐨𝐧𝐭 𝐦𝐚𝐤𝐞 𝐚𝐧𝐲 𝐩𝐫𝐨𝐟𝐢𝐭𝐬 𝐟𝐫𝐨𝐦 𝐭𝐡𝐢𝐬 𝐫𝐞𝐜𝐨𝐦𝐦𝐞𝐧𝐝𝐚𝐭𝐢𝐨𝐧𝐬 𝐞𝐯𝐞𝐫𝐲𝐭𝐡𝐢𝐧𝐠 𝐬𝐡𝐚𝐫𝐞𝐝 𝐡𝐞𝐫𝐞 𝐚𝐫𝐞 𝐜𝐨𝐦𝐩𝐥𝐞𝐭𝐞𝐥𝐲 𝐨𝐟 𝐟𝐫𝐞𝐞 𝐨𝐟 𝐜𝐨𝐬𝐭.

HCLTECH - 1 Year targetsThis post is for educational purpose only, please take any trade at your own risk.

C&H pattern targets already achieved, now flag pattern on monthly need to be achieved, for now 1680 seems near term target, 1880 medium term target and 2080 long term target (6 months to 1 Yr most likely)

HCL Technologies Ltd | A IT Sector Momentum StockHCL Technologies Ltd | A IT Sector Momentum Stock

HCL Tech is a leading global IT services company, which is ranked amongst the top five Indian IT services companies in terms of revenues

Financial :Strong

Market Cap n= 3,96,928 Cr. ROCE = 28.3 % ROE = 23.0 %

Debt to equity = 0.08 Promoter holding = 60.8 % Quick ratio = 2.56

Current ratio = 2.56 Piotroski score = 8.00 Profit Var 3Yrs = 10.2 %

Sales growth 3Years = 12.8 % Return on assets = 16.1 %

HCL Tech is strong fundamental stock with right now in monthly basis have strong momentum.

also all IT sector is in bullish trend .This is ready to going in uncharted territory space.

so we have to closely watch this stock for future.

Note: I am not SEBI registered financial Adviser. I solely present my views on chart .I do not charge any kind of service. This is not buy sell recommendation.

If you like my ideas than like boost and follow me for more ideas.

Thanks and comment freely

HCL Tech - Pullback post breakoutNote: This is for educational purpose only. Please do not trade based on this. I am not a registered SEBI professional. These are just views for study purpose.

There seems to be a pullback post break out in HCL Tech. Moreover, the RSI and Relative strength is in bullish zone. There is a build up near resistance as well.

SL: 1100

HCLTech downtrend movement potential with RISK:REWARD 2.1 HCLTech downtrend movement potential with RISK:REWARD 2.1

Symbol :HCLTech

Time frame :1 hour

Analysis: Break out from the symmetrical Triangle and rallied downside, re-tested, and again rallying on a downside.So, We can expect a SELL call. SELL below 1070 with stop loss 1108 and target 990.

HOPE our analysis is adding value to your Trading Journey.

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading

#stockmarket, #sensex, #bse, #sharemarket, #nse

#stockmarketnews

#niftyfifty, #nifty ,#stockmarket, #sensex, #bse, #sharemarket, #nse ,#banknifty, #intraday ,#indianstockmarket ,#stockmarketindia ,#intradaytrading ,#investing, #trading, #stockmarketnews

HCLTECH Downtrend movement potential with RISK:Reward 3.3#HCLTECH #stockmarketindia #HCLTECHanalysis #tradingstrategy

Symbol:HCL Tech

Time frame: 2 hours

what is the analysis?

Breakout from the symmetrical Triangle for downtrend movement.

Moving average condition is checked,RSI condition is checked, so the call is fulfilled for a downtrend/sell call with Risk:reward ratio of 3.3.

Stoploss is 27 points and the target 91 points.

sell at 1086 with SL 1115 and target 995.

HOPE our analysis is adding value to your Stock market trading Journey.

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading

HCLTECH - Possible Swing TradeDaily chart: If we look at the daily time frame, we can see that the stock is trading above the 50 and 200 moving averages.

You may also notice that the stock is currently trading in a very strong zone since January 2021, which is about two years.

75-Minute Chart: if we look at the 75-minute chart, we can see that the stock has broken the rectangle &retested the breakout.

currently trading below the 200EMA and trading in the strong zone that we mentioned earlier.

If the zone and 200 EMA were broken with a bullish candle, we might consider planning a buy entry.

We can see a gap on the chart, so if a buy entry occurs, we can set our target price below the resistance area that is located exactly at the gap.

On the chart, I have noted targets 1 and 2, and a stop loss should be placed below the strong zone.

"Wave Volume Divergence" indicator has also given us a buy signal, must try this indicator for confirmation.

I hope this analysis was helpful to you. If so, I would appreciate it if you would like it and follow me on TradingView for more of these kinds of analysis.

Disclaimer : Simply an educational post, I am not a SEBI-registered person.

#StockMarket #StockIdeas #StocktoWatch #StockToBuy #positionalHCL TECHNOLOGIES

On daily chart Stock trading in a Channel and now at bottom of channel

Keep on watchlist for any side moveand took trade for4-7%

Also keep on watch for Intraday, with 5min chart for Targets and SL; based on support/resistance

In case of Gap up or Gap down, avoid Intraday trade

----

Note:

Above levels are for education purposes only

Do your own analysis before taking any trade

Please Like & Follow

HCL Tech flag and pole patternOn a daily time frame, the stock after a bull Run has been consolidating.

The flag and pole pattern is a bullish pattern and once it breaks out of the parallel channel it will give good targets.

Support :- 1150, 1138

Resistance:- 1223, 1254

Wait for the break out of the parallel channel