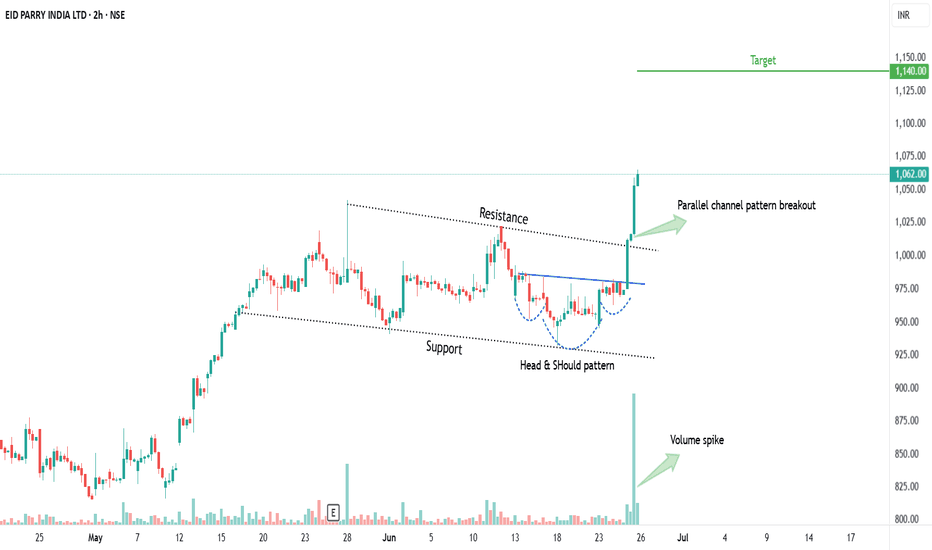

BUY TODAY SELL TOMORROW for 5% - BTST STOCK OPTIONDON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST Stock Option trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

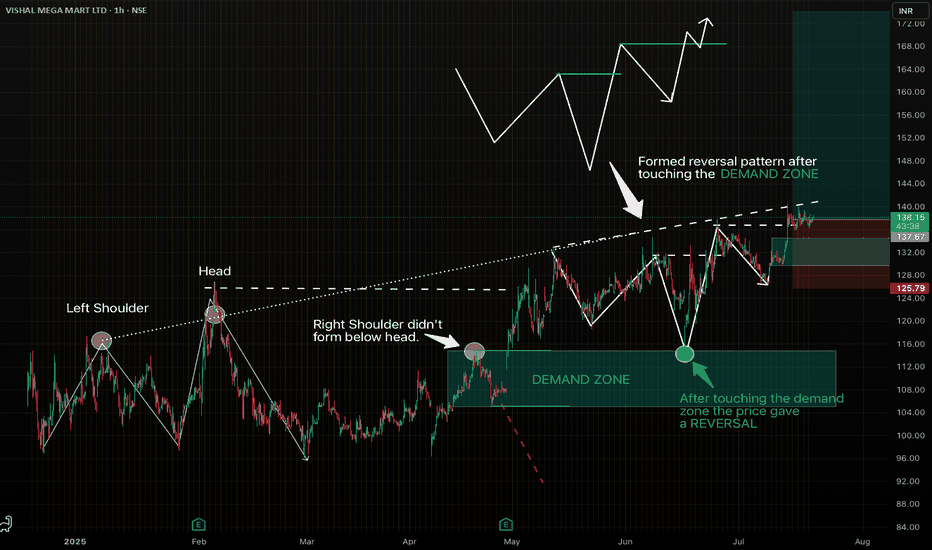

- Head & Shoulder Breakout in IIFL

BUY TODAY, SELL TOMORROW for 5%

I