XAUUSD – Brian | M15 Liquidity ReactionXAUUSD – Brian | M15 Liquidity Reaction & Short-Term Structure

Gold is currently trading within a short-term recovery leg after sweeping downside liquidity earlier in the week. The rebound from the lows shows clear liquidity absorption, but price is now approaching a critical sell-side reaction zone, where sellers previously defended aggressively.

On the M15 structure, price has formed a sequence of higher lows, indicating short-term strength. However, this move is still unfolding inside a broader corrective phase, not a confirmed trend reversal. The upper zone around 5034 – 5067 remains a key SELL liquidity area, aligned with prior distribution and intraday resistance.

From a fundamental perspective, recent news around the US commitment to partial UN payments helped stabilize risk sentiment but did not create strong directional conviction. This supports the view of range-based trading rather than impulsive continuation.

Key zones to watch:

Sell zone: 5034 – 5067 (liquidity & resistance)

Intraday reaction zone: current consolidation area

Demand support: previous liquidity sweep lows below

➡️ Scenario:

Price may attempt a final push into upper liquidity before facing rejection. Failure to hold above intraday support would open the door for a pullback back into demand.

In this phase, reaction at liquidity zones matters more than prediction. Patience and structure confirmation remain key.

Follow the TradingView channel to stay updated on real-time market structure and liquidity behavior.

Ictconcepts

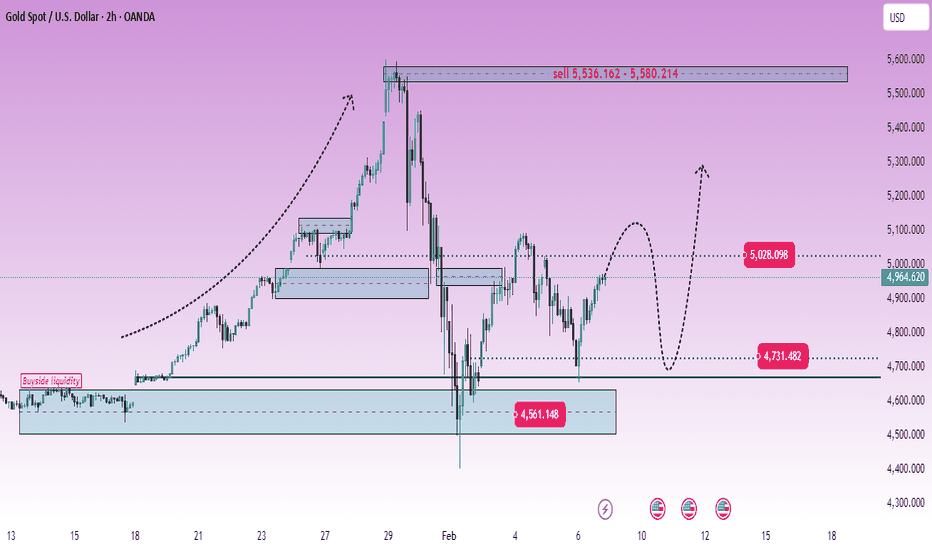

XAUUSD (H2) – Liam's AnalysisXAUUSD (H2) – Liam View

Rally into supply | Volatility risk rising

Gold is rebounding from the 4550–4600 demand base, but the broader H2 structure still points to a selling environment. The current move higher looks corrective, driven by short covering and liquidity rotation rather than a confirmed trend reversal.

From the chart, price is rotating back toward 4900–5030, a zone where previous distribution and liquidity rest. Unless price can accept above this area, rallies should be treated as selling opportunities, not breakout confirmation.

Key technical zones

Major selling zone: 5536 – 5580 (HTF supply)

Near-term reaction zone: 5000 – 5030

Key demand / base: 4550 – 4600

Intraday support: ~4730

Market context

Recent US political headlines and institutional reviews add another layer of headline-driven volatility, increasing the risk of sharp swings and liquidity sweeps. In such conditions, gold often reacts erratically intraday, but higher-timeframe structure tends to reassert itself once the noise fades.

Outlook

As long as price stays below 5030, the bias remains sell-side dominant.

Failure to hold above 4730 would reopen downside risk toward the demand base.

Only a clean H2 acceptance above 5030 → 5100 would neutralize the bearish structure.

Execution note

Avoid chasing momentum in news-driven sessions.

Let price come to levels. Trade the reaction, not the headlines.

— Liam

XAUUSD – H1 Outlook: Buying InterestXAUUSD – H1 Outlook: Liquidity Build While Risk Premium Supports Gold | Lana ✨

Gold is holding firm after a clean rebound from the sell-side liquidity sweep, and the current price action suggests the market is now building structure rather than trending aggressively.

📌 Technical picture (SMC/flow-based)

Price has transitioned from the sell-side sweep into a steady climb, now respecting the upper trendline.

The 4,940–4,970 region is acting as a short-term balance / re-accumulation zone where price is pausing and collecting liquidity.

Above the current range, buyside liquidity is visible near the recent highs, with a key magnet around 5,015.

A healthy pullback into 4,920–4,940 would still keep the bullish intraday structure intact and often provides a better re-entry opportunity than chasing highs.

🎯 Scenarios to watch

Bullish continuation: Hold above 4,940–4,970 → reclaim highs → seek liquidity toward 5,015, then extension higher if the price accepts.

Corrective dip first: A brief sweep below the range toward 4,920–4,940 → bounce back into the trendline → continuation to highs.

🌍 Macro backdrop (short & relevant)

ETF inflows into oil are rising sharply as US–Iran tensions increase, which typically lifts the geopolitical risk premium. When risk sentiment tightens, gold often benefits as a defensive hedge — supporting the idea that pullbacks may remain corrective, not reversal-driven.

✨ Stay patient, trade the levels, and let liquidity guide the next expansion. Follow Lana for more intraday updates and share your view in the comments.

XAUUSD (H2–H4) – Liam Market AnalysisXAUUSD (H2–H4) – Liam Market View

Gold at a critical decision zone as macro pressure builds

Gold is currently trading inside a broad corrective range, with price struggling to reclaim key supply after the previous impulsive sell-off. The recent rebound remains technical in nature, driven by short-term liquidity rotation rather than a confirmed trend reversal.

🔍 Technical Structure (from the chart)

Price is capped below the mid-range resistance around 5000–5050, showing weak acceptance.

The 5386 – 5580 zone remains the dominant sell-side supply, aligned with higher-timeframe distribution.

Downside liquidity is clearly defined near 4730 – 4760, acting as the primary demand base.

As long as gold trades below 5386, the structure continues to favour selling on rallies rather than breakout continuation.

This keeps the market in a range-to-bearish rotation, where rallies are corrective unless proven otherwise.

🌍 Macro & Cross-Market Context (Today)

Rising expectations of faster BOJ rate hikes are supporting JPY and adding pressure across USD pairs.

At the same time, USD strength remains a headwind for gold, limiting upside expansion.

Ongoing warnings about JPY volatility intervention add uncertainty to FX markets, increasing the probability of liquidity-driven swings across risk assets and commodities.

With global central banks shifting toward tighter policy paths, gold is struggling to sustain upside momentum despite its safe-haven role.

🎯 Scenarios to Watch

Primary bias – Sell the rally

Rejections into 5000 → 5386 favour rotation back toward 4730 liquidity.

Alternative scenario – Range continuation

Price may oscillate between 4730 and 5050 as markets wait for clearer macro catalysts.

Bullish invalidation

Only a clean acceptance above 5386 would shift the bias and reopen upside toward higher supply.

🧠 Liam’s Take

This is a market of levels, not emotions.

Gold is reacting to macro pressure and liquidity mechanics, not trending freely. Until price proves acceptance above supply, patience and level-based execution remain key.

Trade the structure.

Let liquidity show intent.

— Liam

EURUSD Technical Overview (1H Timeframe)EURUSD remains positioned within a corrective market structure following a strong bearish displacement from the higher-timeframe supply zone. The sharp rejection from the 1.1830 to 1.1850 region highlights the validity of the identified bearish order block, indicating active institutional supply and reinforcing a short-term downside bias.

Market Structure

The broader structure suggests that the recent decline was impulsive, while the ongoing upside movement appears corrective in nature. Price action has transitioned into a consolidation range, reflecting temporary balance rather than a confirmed reversal. The absence of strong bullish displacement further supports the view that buyers currently lack sufficient momentum to shift order flow.

Smart Money Perspective

From a liquidity standpoint, the current upward movement is likely engineered to target buy-side liquidity resting above recent highs. A controlled push into the premium zone would allow larger participants to optimize short positioning and potentially establish a lower high.

A rejection from the supply area would confirm continued institutional control and strengthen the probability of bearish continuation.

Key Levels to Monitor

Supply / Bearish Order Block: 1.1830 – 1.1850

Immediate Liquidity Target (Upside): Equal highs above the recent range

Downside Objective: 1.1760 discount zone, where sell-side liquidity is expected to rest

Trade Narrative

Primary Scenario:

A liquidity sweep into the order block followed by bearish confirmation could initiate the next leg lower, maintaining alignment with the prevailing order flow.

Invalidation Scenario:

A decisive break and sustained acceptance above the supply zone would weaken the bearish thesis and signal the potential for a deeper retracement, possibly shifting short-term structure toward bullish conditions.

Directional Bias

Short-Term Bias: Bearish while price remains below the order block.

Expectation: Corrective rally into supply followed by continuation to the downside.

Weekly Analysis with buy/Sell scenarios in Nifty👋👋👋 Friends, What's your view on Nifty???

Nifty was in big pressure during previous weeks because of global events and higher tariffs from US. But last week was good recover week because of big events of IndoEU trade deal and more importantly confirmation on IndoUS FTA. These events pushed positivity in the market and price shown upside move of ~1500 points and finally closed above 25600 (@25693)

On Tuesday Price gaped up ~1200 points and fell sharply losing ~ 600 points from high of the day. Price went on range bound for remaining three days, however price closed in slightly positive mode on Friday.

FIIs/DIIs both were net buyer at the end of week. FIIs - 2,645.53 and DIIs - 2,892.14.

Considering all these factors Nifty should move up side. Our first target level should be 26000 and then all-time high.

Critical points ……………….

1. Price closed positively after sharp fall from the high of Tuesday.

2. Currently price at critical level and most probably it will go upside.

3. Critical Support level is 25500.

4. We should see some really good bullish price formation if price willing to go upside.

5. We should patiently wait for the formation of entry model at least at 1H/15m)

6. If Global sentiments are positive and price gets support from volume at key level, we may see some really good buy scenarios.

Note – if you liked this analysis, please boost the idea so that other can also get benefit of it.

Also follow me for notification for incoming ideas.

Also Feel free to comment if you have any input to share.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) and check with your financial advisor before making any trading decisions.

XAUUSD (H45) – Liam's AnalysisXAUUSD (H45) – Liam View

Geopolitical risk rising | Gold reacting from demand

Gold is stabilizing around the 4745 demand zone, where price is reacting from the rising trendline after a corrective sell-off. The current structure suggests short-term accumulation, with buyers defending value rather than aggressive selling continuation.

From a macro perspective, escalating tensions between the US and Iran—especially risks around the Strait of Hormuz, a key global oil route—are increasing geopolitical uncertainty. Historically, this type of risk environment tends to support safe-haven demand, keeping downside pressure on gold limited while volatility expands.

Technical structure (from the chart)

Key buy zone: 4745 (trendline + demand alignment)

Immediate resistance / liquidity: 5000 – 5100 (buyside liquidity)

Upper imbalance (FVG): 5250 – 5300

Major supply: 5575 (higher-timeframe sell zone)

Price holding above 4745 keeps the bounce scenario active, with potential rotation toward 5000–5100 to rebalance liquidity. Acceptance above this zone would open a path toward the FVG area, where sell-side reactions are expected.

Failure to hold 4745 would invalidate the short-term bullish thesis and reopen downside exploration.

Liam’s takeaway

This is not blind risk-on buying — it’s a measured response to rising geopolitical stress and technical demand.

Trade the zones.

Respect the volatility.

Let price confirm before committing.

— Liam

Fall incoming? I don't think so.Hello traders!

Long time no see... With the Japanese elections just around the corner, there are certain speculations of an incoming fall. My analysis does not agree with that. I think JPY is heading for 159.500 buyside liquidity . Even if it is heading lower, it is highly unlikely that it goes now.

There are two scenarios here. If market consolidates around the weekly gap marked on the chart for few more days, we might see a fall. If it doesn't, we're going for higher targets. The two pink zones are daily support levels which can be expected to push prices higher.

Now, when I say two scenarios it doesn't mean I'm saying anything could happen. The major possibility is the 159.500 buyside. The second scenario is just a fail-safe.

Also, note that this is a directional analysis and NOT a trade idea. Trades require much more sophistication than this.

GLGT,

Satya.

XAUUSD – H4 Technical and Macro AnalysisXAUUSD – H4 Technical & Macro Outlook: Liquidity Compression Ahead of Fed Expectations | Lana ✨

Gold is currently trading in a tight compression structure, while macro conditions are beginning to tilt in favour of precious metals. Weak US labour data and a growing probability of Fed rate cuts are putting pressure on the US Dollar, creating an important backdrop for the next move in gold.

At the same time, price action on XAUUSD suggests the market is approaching a key liquidity-driven decision point.

📈 Technical Structure & Price Behaviour

After failing to sustain above the upper supply zone near 5,200–5,300, gold entered a corrective decline and is now trading inside a descending wedge, bounded by falling resistance and rising support.

Price is currently holding around 4,800–4,830, a short-term balance area.

Repeated rejections from descending resistance indicate supply remains active.

At the same time, sell-side liquidity is clearly resting below the structure, near 4,570–4,550.

This behaviour suggests the market is not trending yet, but preparing for a liquidity expansion.

🔍 Key Levels to Monitor

Near-Term Resistance: ~5,070 – 5,130

A key reaction zone aligned with Fibonacci retracement and prior structure.

Compression Pivot: ~4,800 – 4,830

Holding above this area keeps price in consolidation mode.

Sell-Side Liquidity: ~4,570 – 4,550

A likely downside target if the structure breaks lower.

Major Supply (Higher TF): ~5,500

Still the upper boundary for any medium-term bullish continuation.

🎯 Likely Scenarios

Scenario 1 – Liquidity Sweep Lower (Base Case):

If price fails to hold the rising support, gold may dip toward 4,570–4,550 to clear sell-side liquidity. Such a move would likely be corrective, not a trend reversal, especially given the macro backdrop.

Scenario 2 – Bullish Break from Compression:

If price accepts above 5,070–5,130, the descending structure would be invalidated, opening the door for a recovery toward higher resistance zones.

🌍 Macro Context: USD Weakness & Fed Expectations

Recent US labour data has reinforced concerns about economic momentum:

JOLTS job openings fell sharply below expectations.

ADP employment growth slowed significantly.

CME FedWatch now shows a rising probability of a March rate cut, up from earlier in the week.

As a result, the US Dollar Index (DXY) has struggled to extend its weekly gains, trading slightly lower while remaining near recent highs. This environment is typically supportive for gold, especially during corrective phases.

Upcoming NFP data will be a key catalyst and may act as the trigger for the next liquidity expansion.

🧠 Lana’s View

Gold is currently in a waiting phase, balancing between technical compression and shifting macro expectations. The focus should remain on how price reacts at the edges of the structure, rather than predicting direction too early.

Patience is essential here. The next move is likely to be fast and liquidity-driven once the market commits.

✨ Respect the structure, follow the levels, and let the market reveal the next expansion.

XAUUSD – Brian | H1 Weekend AnalysisXAUUSD – Brian | H1 Weekend Outlook: Volatility Reset & Range Opportunities

Gold delivered a sharp volatility spike in early Asia on Feb 6, flushing down toward the 4,680 area before quickly reclaiming ground as risk sentiment stabilized and the USD softened. The earlier drop looks driven by position reduction and portfolio rebalancing (traders covering equity losses), rather than a clean trend continuation. The recovery back above 4,830 confirms that buyers are still active when price returns to value.

Market Structure (H1)

On the H1 chart, price has transitioned into a two-way environment:

We’ve moved from an impulsive drop into a descending channel / corrective structure.

The rebound is strong, but still behaves like a corrective bounce inside the larger pullback.

This sets up a high-probability range/rotation into the weekend, where liquidity runs and mean-reversion moves can appear.

Key Zones To Watch

1) Upper Supply / Sell Pressure

5,100 – 5,200 zone (overhead supply)

This is the main area where rallies may face profit-taking and sell pressure. If price tags this zone and stalls, the market may rotate back down.

2) Mid-Range Reaction Area

~4,820 – 4,900 (current balance / pivot area)

This is the “decision zone.” Holding above it supports another push higher; losing it increases the probability of a deeper pullback.

3) Lower Demand / Liquidity Floor

4,650 – 4,700 (demand + volatility base)

The prior flush low area. If the market revisits this zone, watch for absorption and a potential rebound—especially if volatility spikes again.

Weekend Game Plan (Brian Mindset)

Primary expectation: sideways rotation with spikes (weekend-style volatility)

Best approach: trade reactions at the zones, not in the middle of the range

Bias handling:

Above the pivot → favor pullback-buys toward resistance

Into supply → be alert for rejection and rotation sells

Into demand → watch for absorption before considering longs

In a volatility-reset phase, levels and reactions matter more than prediction.

✅ Follow the TradingView channel to catch the next structure update early and exchange ideas with Brian.

XAUUSD (H2) – Liam ViewXAUUSD (H2) – Liam View

USD strength continues to limit gold | Sell-side structure still active

Quick summary

Gold remains under pressure on the H2 timeframe as a firm US Dollar keeps weighing on precious metals. The recent rebound looks corrective and lacks solid acceptance above supply. With markets positioning ahead of the delayed US Non-Farm Payrolls on Feb 11, volatility may increase, but structure still favours selling rallies.

Macro context

A stronger USD generally acts as resistance for gold and silver.

If the current USD rebound sustains, downside pressure on gold can continue.

Positioning ahead of US labour data increases the risk of liquidity-driven moves.

Technical view (H2)

After a sharp sell-off, price bounced from demand but stalled below previous distribution.

Key zones

Major sell zone: 5115 – 5130, extending toward 5535

Current reaction area: around 5000

Key demand / liquidity base: 4550 – 4580

Lower highs below resistance keep sell-side control intact unless price reclaims 5115 decisively.

Trading scenarios

Primary: Sell rallies into 5000 → 5115, targeting 4550

Continuation: Clean break below 4550 opens further downside

Invalidation: Only strong H2 acceptance above 5115 shifts bias bullish

Execution notes

Expect stop runs near data releases.

Wait for level reaction, not candle chasing.

Bias: sell rallies until structure changes.

— Liam

EURUSD | 15M | Smart Money Concept OutlookMarket Structure:

Price is currently delivering a short-term bullish repricing following a displacement from the internal range low near 1.1775. The sequence of higher highs and higher lows confirms an intraday shift in structure, suggesting that buy-side liquidity has been engineered to facilitate a move into premium pricing.

Liquidity Narrative:

The recent impulsive leg cleared multiple internal liquidity pools, including prior equal highs and resting stop clusters. Price is now trading directly into a well-defined supply zone that aligns with a higher-timeframe premium array. This region is a classic smart money distribution pocket where late buyers often become liquidity for institutional positioning.

Order Flow & Imbalance:

The rally shows clear displacement characteristics with minimal overlap, leaving behind inefficiencies that may act as a magnet should price rotate lower. Additionally, the current consolidation beneath resistance resembles a potential buy-side liquidity build-up. A sweep of these highs would complete the liquidity engineering phase before a probable bearish expansion.

POI (Point of Interest):

Premium supply zone: ~1.1830 to 1.1845

Internal resistance acting as a distribution ledge

Untapped sell-side liquidity resting below 1.1780

Execution Model:

The preferred scenario involves a liquidity sweep above the short-term highs followed by bearish market structure shift on the lower timeframe. Confirmation through displacement and fair value gap formation would strengthen the short thesis.

Draw on Liquidity:

If the distribution unfolds as anticipated, price is likely to rebalance toward the sell-side liquidity pool near 1.1775, completing a premium-to-discount delivery cycle.

Invalidation:

Sustained acceptance above the supply zone with strong displacement would indicate continuation, signaling that the market is seeking higher external liquidity rather than distributing.

Summary:

Price is trading in premium territory after a liquidity-driven expansion. The environment favors patience, allowing smart money to reveal intent. Watch the highs carefully; what appears as breakout fuel often becomes the trapdoor.

US100 | 15MNarrative Overview:

Following an aggressive sell-side liquidity raid, price delivered a reactive displacement from a higher-timeframe demand cluster, signaling the presence of institutional buy orders defending discount pricing. The rejection wick into the demand zone suggests a classic liquidity engineering event rather than genuine bearish continuation.

Market Structure:

The broader intraday flow remains rotational; however, the recent reaction establishes a potential short-term structure shift. The failure to achieve sustained acceptance below the demand zone implies seller exhaustion and the likelihood of a mean reversion toward premium.

Liquidity Map:

Sell-Side Liquidity: Resting below 25,250, now partially mitigated after the sweep.

Internal Liquidity: Compression above current price indicates stop accumulation from early longs.

Buy-Side Targets: 25,380 to 25,420 aligns with prior distribution and inefficient pricing.

Imbalance & Order Flow:

The impulsive bullish candle emerging from the zone created a micro fair value gap, reinforcing the probability of algorithmic repricing higher. When displacement originates from discount, it often signals smart money transitioning from accumulation to expansion.

Trade Logic:

The optimal execution model favors continuation toward premium, provided price maintains acceptance above the reclaimed demand.

Bullish Path:

A controlled retracement into the imbalance or the upper boundary of demand could offer refined entries targeting external liquidity. This would complete a discount-to-premium delivery cycle.

Risk Scenario:

A decisive break with displacement below the demand zone would invalidate the accumulation thesis and expose deeper sell-side liquidity, likely inviting bearish continuation.

Key Insight:

What appears to be a simple bounce is structurally more significant; institutions rarely defend a level without intent. Monitor how price behaves during pullbacks. Strong markets do not revisit deeply mitigated demand unless distribution is underway.

XAUUSD – Brian | H4 Technical AnalysisXAUUSD – Brian | H4 Technical Outlook – Selling Bias After Exhaustion Rally

Gold has completed a strong upside expansion and is now showing clear signs of trend exhaustion on the H4 timeframe. After printing a sharp impulse leg higher, price failed to sustain acceptance above the recent highs and quickly transitioned into a deep corrective move, signalling a shift in short-term market control.

From a structural perspective, the market has moved from impulse → distribution → correction, favouring a selling bias while price remains capped below key resistance.

Market Structure & Fibonacci Context

The recent rally stalled near the upper resistance zone, followed by an aggressive rejection.

Price has retraced deeply into the Fibonacci 0.618–0.75 area, confirming that the move lower is not a minor pullback but a meaningful correction.

Current price action suggests lower highs are forming, keeping selling pressure active on rebounds.

As long as price fails to reclaim and accept above the prior breakdown levels, the bearish structure remains valid.

Key Zones to Watch

Primary SELL Zone

5,716 – 5,866

This is the major supply and sell-liquidity zone on H4. Any corrective rally into this area is likely to attract sellers, especially if price shows hesitation or rejection.

Intermediate Reaction Zone

Around the 0.5–0.618 Fibonacci retracement area, where short-term rebounds may stall before continuation lower.

Downside Targets / Demand

The lower support zone near 4,800–4,850 remains the first key downside area to monitor.

Deeper continuation would expose the 4,600–4,500 region, where broader demand may attempt to absorb selling pressure.

Macro Context (Brief)

Fundamentally, gold is facing headwinds from persistent uncertainty around interest rate expectations. Recent central bank commentary continues to signal caution toward near-term rate cuts, keeping real yields supported and limiting gold’s upside in the short term. This backdrop aligns with the current technical correction and distribution phase.

Trading Outlook

Bias: Selling / sell-on-rallies

Focus: Selling corrective rebounds into resistance zones

Risk note: Avoid chasing price at lows; let structure and levels guide entries

In this phase, patience is key. Selling strength at predefined zones offers higher probability than predicting bottoms.

Refer to the chart for Fibonacci levels, structure shift, and highlighted sell zones.

✅ Follow the TradingView channel to receive early updates on market structure, liquidity shifts, and high-probability zones.

USDCHF – M15 | Sell-Side Purge → Mitigation Rally → ContinuationPrice completed a textbook sell-side liquidity sweep, flushing weak longs below the range. The impulsive push down was real displacement. What followed is a forced bounce, driven by short covering and mitigation, not fresh demand.

Current price is retracing into a discounted supply / imbalance zone, where previous bearish orderflow originated. Structure remains bearish unless proven otherwise.

Market Narrative

Range highs → distribution

Sharp sell-side run = intent revealed

Bounce = mitigation into prior inefficiency

Execution Bias

Shorts favored into the marked retracement zone

Ideal entries on signs of rejection / bearish shift

Invalidation only on clean M15 acceptance above the green level

Targets

Recent sell-side lows

External liquidity below the range

Deeper discount expansion if momentum accelerates

CAD/JPY – 15 Min CADJPY is currently auctioning into a well-defined premium array, approaching clustered buy-side liquidity resting just beneath the 114.00 psychological handle. The recent impulsive expansion exhibits the characteristics of a liquidity engineering move, suggesting the objective may be stop collection rather than authentic bullish continuation.

Price is interacting with a refined bearish order block, aligned with the upper boundary of the active dealing range. The lack of efficient acceptance beyond this region implies potential institutional distribution, positioning the market for a rotational move back toward value.

Market Structure Assessment

Gradual expansion into equal highs signals buy-side liquidity buildup

Current test of premium favors distribution over accumulation

Any rejection here would likely confirm a lower timeframe market structure shift (MSS)

Downside delivery could accelerate as price seeks internal inefficiencies

Order flow at this elevation suggests vulnerability to a liquidity-driven retracement.

Current Dealing Range Logic

With price trading at the upper extreme of the range, the market sits firmly in premium territory, where risk-reward increasingly favors short positioning.

The highlighted zone should be interpreted as a distribution / mitigation area, not evidence of bullish acceptance. Unless price can reprice higher with displacement, this region remains tactically favorable for fade setups.

Scenario Framework

Primary Thesis | Rotation Toward Discount

Initial draw on liquidity rests near 113.55, the first internal support

A break lower exposes the fair value gap (FVG) around 113.20, aligning with equilibrium

Failure to stabilize there increases probability of continuation into 113.10, where deeper sell-side liquidity may reside

The projected move would represent a classic premium-to-discount rebalancing

Risk / Invalidation

Sustained acceptance above 114.05 would invalidate the distribution thesis

Such price behavior would signal successful buy-side continuation and a shift in order flow toward bullish expansion

📌 Bias: Short while price operates in premium after a probable buy-side sweep

📌 Context: Liquidity buildup → premium test → distribution potential

📌 Market Condition: Range-bound environment with elevated probability of rotational mean reversion

XAUUSD – Brian | H2 Technical AnalysisXAUUSD – Brian | H2 Technical Outlook – Consolidation & Range-Building Phase

After the recent sharp sell-off, gold is now transitioning into a consolidation phase on the H2 timeframe. The strong bearish impulse has slowed, and current price action suggests the market is shifting from directional movement into range-building and accumulation, rather than continuing lower immediately.

This type of behavior is typical after aggressive volatility, as the market reassesses value and balances supply and demand.

Market Structure & Current Behavior

Structurally, price has broken below the prior bullish leg and is now trading within a defined value range:

Selling pressure has eased following the downside expansion.

Price is rotating around the VAL and lower value areas, indicating acceptance rather than rejection.

Momentum is no longer impulsive, pointing to sideways development rather than trend continuation.

As long as price remains inside this value range, range trading conditions dominate.

Key Value & Liquidity Zones Upper Resistance / Supply

Sell Liquidity: 5,330

Sell Zone POC: 5,045

These zones act as overhead supply where upside attempts may be capped during consolidation.

Lower Support / Demand

VAL zone

Buy scalping POC: 4,673

This lower area represents short-term demand, where downside moves are more likely to stall during the accumulation phase.

Intraday Expectation

For today’s session:

Primary expectation: Sideways consolidation within the established range

Price is likely to rotate between value extremes rather than trend strongly

Breakouts require clear acceptance above resistance or below support to shift bias

Until such acceptance occurs, patience and range awareness are more effective than directional conviction.

Key Takeaway

After strong volatility, markets often pause to rebuild structure. For now, gold appears to be absorbing orders and forming balance, making consolidation the higher-probability scenario.

Refer to the chart for highlighted value zones and projected range behavior.

✅ Follow the TradingView channel to receive early market structure updates and intraday outlooks.

XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Scenario 3 – Corrective Rebound Before the Next Decision | Lana ✨

Gold is showing signs of stabilization after a strong sell-off, and today’s price action may favor Scenario 3: a corrective rebound. This is not a full trend reversal yet, but a likely recovery phase into key imbalance zones, where the market will decide whether to continue lower or rebuild structure for a broader rebound.

📈 Market Structure & Context

The recent move down was impulsive, clearing multiple supports and creating a clear bearish displacement.

Price is now reacting from a lower base, suggesting selling pressure is slowing and a technical retracement can develop.

In this environment, the focus is on how price reacts at FVG/supply zones above, not on chasing moves in the middle of the range.

🔍 Key Zones to Watch Today

Buy Liquidity / Base Support: 4640 – 4645

This is the current stabilization area and the most important zone to defend for any rebound scenario.

FVG Support Zone: 4953 – 4958

First major upside target for a corrective rebound. This zone may act as a magnet for price, but also as a reaction area.

Sell FVG (Upper Supply): ~5250 – 5320

If the rebound extends, this becomes the next resistance zone where selling pressure may return.

Strong Resistance: ~5452

A higher objective only possible if price shows clear acceptance and trend rebuilding above key levels.

Structural Pivot: ~5104

A key mid-level. Acceptance above it would strengthen the rebound thesis.

🎯 Scenario 3 – Corrective Rebound Plan

If price holds above 4640–4645 and continues to build higher lows, the market may attempt a push back into imbalance:

First recovery path: 4640–4645 → 4953–4958

If price accepts above the mid-structure: → 5104

Extension (only with strong acceptance): → 5250–5320

Higher target (less likely today): → 5452

This is a structure-first environment: the rebound is valid as long as price defends the base and prints cleaner bullish follow-through.

🧠 Lana’s View

Today’s setup leans toward a retracement-driven rebound, where price rebalances into key zones after a sharp drop. The best approach is to stay patient, track reactions at 4953–4958 and 5250–5320, and let structure confirm whether this rebound is only corrective or the start of a broader recovery.

✨ Stay calm, respect the zones, and let price confirm the next move.

XAUUSD (H2) – Liam Bearish TrendXAUUSD (H2) – Liam Bearish Outlook

Structure broken | Selling pressure remains dominant

Quick summary

Gold has shifted into a clear bearish phase after failing to hold key support levels. The strong sell-off has broken the prior bullish structure, and recent rebounds show signs of weakness rather than accumulation.

At this stage, the market is no longer in a buying/entry environment. The priority is selling rallies, not catching bottoms.

Market structure

The previous uptrend has been decisively invalidated by a sharp downside impulse.

Price is now trading below former support, which has flipped into resistance.

Recent recovery attempts lack follow-through and are corrective in nature.

This keeps the broader intraday-to-short-term bias bearish.

Key technical zones

Primary sell zone: 5100 – 5110

Former support turned resistance. This area favours sell reactions if price retests.

Secondary sell / liquidity zone: 4860 – 4900

A corrective bounce into this zone is likely to attract sellers again.

Near-term support: 4690 – 4700

A weak support area that may give way if selling pressure resumes.

Deeper downside targets:

4400 – 4450, then 4120 if the bearish momentum expands.

Trading plan (Liam style: sell the structure)

Primary scenario – SELL rallies

As long as price remains below 5100, any rebound should be treated as corrective. Sell reactions are preferred at resistance and liquidity zones, targeting further downside continuation.

Secondary scenario – Breakdown continuation

Failure to hold 4690 – 4700 would confirm continuation lower, opening the path toward deeper value zones.

Invalidation

Only a strong reclaim and acceptance back above 5100 – 5150 would force a reassessment of the bearish bias.

Key notes

Volatility remains elevated after the breakdown.

Avoid premature buying/entry against structure.

Let price come into resistance, then execute.

Trend and structure first, opinions second.

Focus for now:

Selling rallies while structure remains bearish.

No bottom fishing.

— Liam

EUR/USD – 1H EURUSD is trading at a discounted price area after a sharp impulsive sell-off, where price has swept sell-side liquidity (LA) and is now stabilizing near equal lows. The recent bearish leg looks exhaustive, suggesting downside momentum is weakening.

Price is currently holding above a key intraday demand / liquidity pocket, forming a base that favors a mean-reversion move rather than continuation lower.

Key Structure & Narrative

Sell-side liquidity taken below prior lows (LA)

Bearish impulse completed, followed by compression and basing

Discount zone respected, aligning with smart-money accumulation logic

Upside Scenario (Primary Bias)

A bullish displacement from current levels can open a path toward the prior H1 supply / imbalance zone (blue)

Acceptance above this zone may lead to a trend continuation toward the higher-timeframe premium area, with projected targets near the 1.2050–1.2080 region

Pullbacks during the move are expected to be corrective, not impulsive

Invalidation

Sustained acceptance below the liquidity sweep low would invalidate the bullish thesis and imply further downside exploration

📌 Bias: Bullish reversal from sell-side liquidity

📌 Framework: Liquidity sweep → accumulation → displacement → expansion

📌 Market State: Transition from markdown to re-accumulation

XAUUSD – H4 Outlook: Liquidity ResetFebruary has opened with heightened volatility across global markets, and gold is no exception. After a strong upside run, XAUUSD has experienced a sharp corrective move, driven largely by deleveraging flows rather than a structural trend reversal.

Current price action suggests gold is entering a rebalancing phase, where liquidity is being cleared before the market can attempt a renewed push higher.

📈 Market Structure & Higher-Timeframe Context

Gold previously traded in a strong bullish structure, but the recent sell-off marked a clear market structure shift (MSS) on the H4 timeframe.

The impulsive decline swept sell-side liquidity below prior consolidation zones, a typical behavior after an extended rally.

Despite the speed of the drop, price is now approaching key support and demand areas, where selling pressure may begin to slow.

This type of move often reflects position reduction and risk-off behavior, not the end of the broader bullish narrative.

🔍 Key Zones to Monitor

Primary Support / Buy Zone: ~4,280 – 4,350

This area represents a strong demand zone where price may stabilize and form a base.

Short-Term Reaction Zone: ~4,450 – 4,500

A zone where price could oscillate during consolidation, suitable for short-term reactions rather than trend trades.

Sell-Side Liquidity Cleared:

The recent drop has already taken liquidity below previous lows, reducing immediate downside pressure.

Upside Rebalance Zones (FVG / Supply):

~4,850 – 4,900

~5,200 – 5,350

These areas are likely to act as resistance during any recovery phase.

🎯 Market Scenarios

Scenario 1 – Controlled Correction (Base Case):

Gold may continue to range or dip modestly into the 4,280–4,350 support zone, allowing the market to complete its liquidity reset. Holding this area would keep the broader bullish structure intact.

Scenario 2 – Recovery After Stabilization:

Once selling pressure is absorbed, price may begin a gradual recovery, targeting the 4,850–4,900 zone first. Acceptance above this level would open the door toward higher resistance areas.

Scenario 3 – Deeper Reset (Lower Probability):

A clean break below the main support would suggest a deeper correction, but at this stage, such a move would still be viewed as corrective within a larger cycle, not a full trend reversal.

🌍 Macro Backdrop (Brief)

The sharp sell-off in gold, silver, equities, and crypto reflects a global deleveraging wave, intensified by rising geopolitical risks and shifting risk sentiment. In such environments, gold often experiences short-term drawdowns, even as its longer-term role as a hedge remains intact.

This reinforces the idea that the current move is more about resetting positioning than changing long-term direction.

🧠 Lana’s View

Gold is not in a hurry.

After a powerful run, the market often needs to pause, rebalance, and absorb liquidity before the next meaningful expansion.

Lana remains patient, focusing on how price behaves around key H4 support zones, rather than reacting emotionally to volatility.

✨ Let the correction do its work. Structure will guide the next move.

XAUUSD - Brian | H1 AnalysisXAUUSD – Brian | H1 Technical Outlook – SELL Bias Aligned With the Main Trend

Gold is entering a strong corrective phase after forming a short-term top, with the H1 structure clearly shifting to the downside. The latest bearish leg is impulsive in nature, reflecting active position unwinding and short-term distribution following the prior extended rally.

In this environment, the preferred approach is to prioritize sell setups in line with the dominant intraday trend, focusing on reactions around key psychological and value-based levels.

Market Structure & Price Behaviour

The previous bullish structure has been invalidated by a sharp downside break, confirming a structure shift on H1.

Price is now trading below prior value areas, suggesting a transition from expansion into pullback and continuation to the downside.

Upward moves at this stage are likely to be corrective rallies rather than trend reversals, offering potential sell opportunities.

Key Psychological & Technical Zones

1) Trend-Following SELL Zone

Sell VAL: 5,048 – 5,051

This zone represents the lower value area of the most recent distribution range and is acting as a psychological resistance within the current bearish context. Reactions here are critical for assessing sell-side continuation.

2) Near-Term Balance Level

The 5,000 psychological level remains a focal point for intraday volatility. How price behaves around this round number will help determine momentum continuation.

3) Deeper BUY Zone (Not a Day-Trade Focus)

Buy Zone VAL: 4,450 – 4,455

This is a broader structural support area and should be treated as an observation zone rather than an active buying entry during the current session.

Intraday Trading Bias

Primary bias: SELL, aligned with the current H1 trend

Strategy: Look to sell corrective pullbacks into key psychological and value zones

Risk note: Avoid counter-trend buying positions while the bearish structure remains intact

In volatile conditions, following the dominant structure and waiting for price reactions at key levels is more effective than attempting to pick bottoms.

Refer to the chart for a detailed view of structure and highlighted zones.

Follow the TradingView channel for early market structure updates and ongoing analysis.

If you want:

a shorter intraday note,

a more neutral tone, or

an alternative version in UK / Indian English,

just say the word and I’ll adjust it for you 👌

XAUUSD – D1 Mid-Term AnalysisXAUUSD – D1 Mid-Term Outlook: Volatility Reset Before the Next Structural Move | Lana ✨

Gold has just experienced a sharp and aggressive sell-off from the highs, marking a clear shift from expansion into a volatility reset phase. While the broader bullish trend has not been fully invalidated, price action now suggests the market is entering a medium-term rebalancing process, where liquidity and structure will play a decisive role.

At this stage, the focus moves away from short-term noise and toward key daily levels that will define the next swing direction.

📈 Higher-Timeframe Structure (D1)

The strong vertical rally has been followed by a deep corrective candle, indicating distribution and profit-taking at premium levels.

Price has broken below short-term momentum support but is still trading above major higher-timeframe trend structure.

This behavior is typical after an extended rally, where the market needs time to absorb supply and reset positioning before choosing the next medium-term direction.

The current structure favors range development or a corrective swing, rather than immediate continuation to new highs.

🔍 Key Daily Zones to Watch

Major Resistance Zone: ~5400 – 5450

This area represents strong overhead supply. Any recovery into this zone is likely to face selling pressure and should be treated as a reaction zone, not a breakout zone.

Strong Liquidity Level: ~5100

A key magnet for price. Acceptance above or rejection below this level will heavily influence medium-term bias.

Sell-Side Liquidity Zone: ~4680 – 4700

This is a critical downside target where stops and unfilled liquidity are resting.

High-Liquidity Buy Zone: ~4290

A major higher-timeframe demand area. If price reaches this zone, it would complete a deep correction within the broader bullish cycle and open the door for medium-term accumulation.

🎯 Medium-Term Trading Scenarios

Scenario 1 – Corrective Recovery, Then Sell Pressure (Primary):

Price may attempt a rebound toward 5100 or even the 5400–5450 resistance zone. As long as price remains below this resistance, rallies are more likely to be corrective, offering opportunities to reassess shorts or reduce long exposure.

Scenario 2 – Continuation of the Correction:

Failure to reclaim 5100 increases the probability of a continued move lower toward 4680–4700, where sell-side liquidity is resting.

Scenario 3 – Deep Reset and Structural Buy:

If downside momentum accelerates, a move toward the 4290 high-liquidity zone would represent a full medium-term reset. This area is where stronger buyers may re-enter and where the next swing-long narrative could begin to form.

🌍 Market Context (Medium-Term View)

Such sharp daily moves often occur during periods of macro repricing and sentiment shifts, forcing the market to rebalance expectations. In these environments, gold tends to oscillate between liquidity zones, rather than trend cleanly in one direction.

This makes patience and level-based execution more important than prediction.

🧠 Lana’s Perspective

The market is no longer in a “buy-every-dip” phase.

This is a transition environment, where gold needs to finish its liquidity work before the next sustained move develops.

Lana stays neutral-to-cautious in the medium term, focusing on reactions at daily liquidity zones, not emotional bias.

✨ Let the structure reset, let liquidity clear, and wait for the market to show its hand.