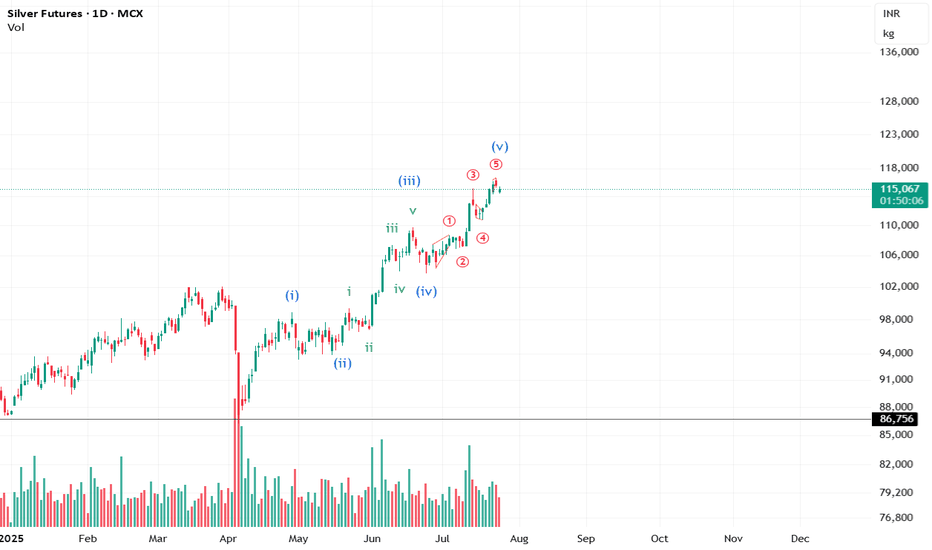

Is the move over for Silver? #CommodityIt looks like the impulse for Silver is about to end. However, we still need the price action to confirm the view.

**This analysis is based on the Elliott Wave Principle.

This analysis is for educational purposes only and not investment advice.

Please consult your SEBI-registered advisor before making any investment decisions. Markets are subject to risk.**

Indiancommodities

MCX Natural Gas Analysis for medium termMCX:NATURALGAS1! looks bullish.

If we look at the daily chart carefully, we will see it retraced a lot and tested 125. Then it is mostly a range bound from 140 to 280.

Now this 280 level is also the 23% Fib retracement level.

Around this level the price hits already 5 times, after breakdown almost one and half year back. However this time it has created a W pattern. (or one can say a rounding bottom pattern).

After testing the 280 level in one week back, it retraces back a bit and most likely creating a nice Cup and Handle pattern.

Here are the expectations:

NG will test 280 level once more.

After that if it able to brakes it out 280, it will go to test the next resistance.

The next resistance is 400 level, positionally.

Also fundamentally, per the estimation of International Energy Agency (IEA) Global Gas Security Review, the Natural Gas demand is forecasted to rise by over 2.5 per cent in 2024, with similar growth expected in 2025. And it will be steady for next few years even with 1.5 degree Paris Weather convocation.

So stay alert. Above 280 sustains means it's a Buy on Dip on Natural Gas. Till then: Wait and Watch.

MCX CRUDEOIL - POSITIONAL LONG TRADESymbol - CRUDEOIL (MCX)

CRUDEOIL is currently trading at 5690

I'm seeing a trading opportunity on buy side.

Buying CRUDEOIL Futures at CMP 5690

I will be adding more if 5550 comes & will hold with SL 5420

Targets I'm expecting are 6320 - 6585

Disclaimer - Do not consider this as a buy/sell recommendation. I'm sharing my analysis & my trading position. You can track it for educational purposes. Thanks!

Crude Oil (MCX): Monday - 24/10/22This is done using the multi-timeframe, multi-period technique we were discussing last Friday’s call.

Chart:

Analysis:

Levels:

Support: 7000, 6900, 6750

Resistance: 7080, 7150, 7220

OI Data:

Highest OI Call in Crude per OI data: 7500

Highest OI Put in Crude per IO data: 6500

Nearest Major Resistance in Crude per OI data: 7200

Nearest Major Support in Crude per IO data: 7000/6900

Trade setup:

1. Today MCX is open in the evening slot (5:00 PM to 11:30 PM)

2. Upto Daily timeframe Crude is sideways. The William Alligator is sleeping, so you should also sleep. Trading range: 6900-7200 for today.

3. So ideally you can do scalping. Any directional trade to be taken only above 6900-7200 breakdown/breakout.

Copper-Sell (Positional)Feels like a fall as per my technical analysis.

Sell copper around CMP (712.45-712.5)

SL>719.3

TGT as marked

Note it's not an intraday trade.

Disclaimer: These are just my views, I am only SHARING my views - kindly do NOT trade blindly with these levels, please do your own research before entering/ or as per advice from your own financial adviser.