"XAUUSD at Critical Support – Bullish Continuation or Pullback 🔍 Market Overview

The chart shows a technical setup with clear support and resistance zones, alongside key Exponential Moving Averages (EMAs) to guide directional bias.

📊 Key Technical Levels

Resistance Zone: ~$3,445–$3,460

This is a historically reactive area where price has reversed sharply in the past. A breakout above this zone would suggest strong bullish continuation.

Strong Supporting Zone: ~$3,375–$3,390

Currently being tested. If the price holds here, it could act as a launchpad for a bullish move toward resistance.

Support Zone: ~$3,320–$3,340

If the strong support breaks, the next downside target would be this zone, which aligns with the 200 EMA (blue line) — a dynamic support level.

📈 Moving Averages

50 EMA (Red): Currently at $3,345.60, serving as a short-term dynamic support.

200 EMA (Blue): Currently at $3,304.13, marking a critical longer-term support. Price staying above this EMA reflects a bullish bias.

🔀 Probable Scenarios

Bullish Case (Preferred Scenario)

If price holds the strong supporting zone and breaks above current highs (~$3,395), it could rally toward the resistance zone at $3,445–$3,460.

Break and close above resistance may open the door for further upside continuation.

Bearish Case

A rejection from current levels or a break below $3,375 would likely lead to a retracement toward the support zone ($3,320–$3,340).

A break below the support zone and the 200 EMA would shift the structure into bearish territory.

✅ Bias & Recommendation

Current Bias: Cautiously Bullish

As long as the price remains above the strong supporting zone and 50 EMA, bulls have the upper hand.

Look for confirmation with a higher low or bullish engulfing candle before entering long.

Trade Idea:

Long Entry: On bullish confirmation above $3,395

Target: $3,445–$3,460

Stop Loss: Below $3,375 (support break)

Indicators

(DXY) Short Setup: Reversal Expected from Resistance Zone1. Entry Point: ~102.430

The price is currently below this level at 101.583, suggesting a potential short setup once the entry level is reached or confirmed.

2. Stop Loss: ~103.196

This is the price level where losses are limited if the trade moves against the intended direction. It's placed above a strong resistance zone.

3. Resistance Point: ~100.580

This was a previous resistance level which has now been broken, indicating a bullish push. The current price is above this, which may signal a breakout.

4. EA Target Point: ~97.857

The take-profit level, significantly lower, indicating a bearish target. This suggests a short position is intended from the entry point.

Indicators and Signals

The chart uses moving averages (likely 50 EMA and 200 EMA), and the price has surged above them, often a bullish signal.

However, the analysis seems to anticipate a reversal from the 102.430 level, expecting a drop back down toward 97.857.

The move from the current price to the target would be a 4.40% decline, a significant move for an index.

Trade Plan Summary

Trade Type: Likely a short/sell from the 102.430 level.

Risk: ~0.77 (103.196 - 102.430)

Reward: ~4.57 (102.430 - 97.857)

Risk-to-Reward Ratio: Approx. 1:6, which is favorable if the setup works out.

(XAU/USD) Bearish Trade Setup – Targeting $3,222 with 1:6 Risk/R(Sell) setup.

Entry Point: Around 3,409.33 - 3,408.41 USD.

Stop Loss: 3,437.87 USD.

Target (Take Profit): 3,222.53 USD.

Risk/Reward Ratio: Approximately 1:6, which is favorable.

📉 Price Action & Trend Analysis:

A rising wedge (or channel) appears to have formed and broken to the downside — a bearish signal.

The current price at 3,341.47 has broken below a minor support zone (highlighted in purple), indicating bearish momentum.

Price is now approaching the 200 EMA, which is acting as potential dynamic support.

📌 Key Levels Highlighted:

Support Zones: Near 3,347.47 (previous minor support) and 3,222.53 (main target zone).

Resistance Zones: At the entry level and above, near 3,437.87 (Stop Loss zone).

🔄 Indicators:

Moving Averages (Red and Blue Lines): Shorter-term moving average (red) is below the longer-term (blue), indicating downward pressure.

Momentum Shift: The sharp drop suggests a likely continuation of the bearish trend.

EUR/USD Buy Setup1. Entry Point:

Marked at: 1.12243

This is the suggested price level to enter a long (buy) trade.

2. Stop Loss:

Set at: 1.11542

Placed below a support zone, it limits the downside risk if the trade moves against the position.

3. Target Points:

EA Target Point One: 1.13891

EA Target Point (Final): 1.15929

These levels are profit-taking zones, with the first being a conservative target and the second being a more extended move.

4. Technical Indicators:

Moving Averages:

A red shorter-term moving average (possibly 20 EMA)

A blue longer-term moving average (possibly 200 EMA)

Price is currently below both, indicating bearish momentum, though the long setup is anticipating a reversal.

5. Support/Resistance Zones:

Purple Zones: Highlighted as key demand and supply areas.

The lower purple zone supports the entry and stop-loss area.

The upper purple zones mark resistance areas aligning with the target levels.

6. Current Price:

Around 1.12459, slightly above the entry zone.

Conclusion:

This setup is a bullish trade idea with a clearly defined:

Entry (1.12243),

Stop-loss (1.11542), and

Two take-profit levels (1.13891 and 1.15929).

Gold (XAU/USD) 3H Chart Analysis – Bullish Setup Toward $3,500 TCurrent Price: $3,254.26

EMA 70: $3,285.50 (Price is below EMA – cautious zone)

Bias: Bullish 📈 (if demand zone holds)

Key Zones:

🟦 Demand Zone: $3,200 – $3,260

✅ Strong buy interest expected here

⚠️ Good place to look for entry signals

🟥 Resistance Zone: $3,223.60 – $3,323.84

🔄 Price is currently testing this zone

A breakout here can lead to bullish momentum

🎯 Target Point: $3,500 – $3,529 💰

📌 Defined as "Target Point 3500"

High potential for profit-taking here

⛔ Stop Loss: $3,161.32

🚫 Placed below demand zone for risk control

❗ Important to exit if price drops here

Trade Idea 💡

📥 Buy Entry: Near or above $3,223.60

✅ Hold as long as price respects demand zone

🎯 Target: $3,500

⛔ Stop Loss: $3,161.32

⚖️ Risk:Reward ratio looks favorable!

Quick Summary:

🟢 Bullish Setup

💪 Demand zone is strong

📈 Breakout above resistance may fuel a rally

⏳ Wait for confirmation before entry!

S&P 500 Bearish Reversal Setup: Short Entry Below Key ResistanceEntry Point: Around 5,678.79

Stop Loss: Around 5,833.61 (above recent resistance zone)

Target Point: Around 4,831.37 (indicating a bearish target)

2. Technical Patterns:

The price hit a resistance zone (highlighted in purple) and reversed—this is often a bearish signal.

The trendline break (marked with the orange dot and blue arrow down) suggests a potential trend reversal.

The moving averages (likely 50 EMA and 200 EMA) indicate the price is still above the support zone but weakening.

3. Risk/Reward Ratio:

Risk (Stop Loss – Entry): ~154.82 points

Reward (Entry – Target): ~847.42 points

Risk/Reward Ratio: Approximately 1:5.5, which is favorable for shorting.

4. Trade Sentiment:

Bearish bias based on the breakdown from the resistance zone and confirmation from chart patterns.

If the price fails to hold above 5,682.87, a short trade may be validated with the target at 4,831.37.

BTC at Key Inflection Zone – Breakout or Rejection Ahead?Asset: BTC/USD

Timeframe: 4H or Daily (based on visual pattern structure)

As of: May 6, 2025

Indicators:

50 EMA (Red): $91,615.79

200 EMA (Blue): $89,305.75

Key Technical Zones:

🔴 Resistance Zone: ~$104,000 – $108,000

This area has historically acted as a major supply zone.

Price has been rejected from this level multiple times, indicating strong selling pressure.

🔁 Flip Zone (Resistance turned Support/Support turned Resistance): ~$95,500 – $100,000

The current price ($95,234.23) is testing this zone from below.

A confirmed break and hold above could signal continuation toward the higher resistance.

🟢 Strong Support Zone: ~$88,000 – $91,000

Confluence of 50 EMA and 200 EMA adds strength to this demand zone.

Previous breakout level and accumulation area.

EMA Outlook:

50 EMA > 200 EMA: Short-term bullish crossover is active, indicating bullish momentum.

Both EMAs are sloping upward slightly, suggesting trend strengthening.

Price is currently above both EMAs, which acts as dynamic support.

Potential Scenarios:

✅ Bullish Scenario:

If price reclaims the $95,500–$100,000 resistance-turned-support zone:

Expect upward momentum to continue.

Target: $104,000–$108,000 zone.

Break of $108K could lead to a macro bull continuation.

⚠️ Bearish Scenario:

If price rejects the current zone and fails to hold above the $91,000 support:

Look for retest of $88,000–$89,000 area (confluence with EMAs).

Breakdown below that zone would invalidate bullish structure and signal potential deeper correction.

Summary:

Bias: Bullish above $91K, Neutral between FWB:88K –$91K, Bearish below $88K.

Key Confirmation Needed: Daily close above $100,000 for strong bullish continuation.

Risk Management: Watch for fakeouts within the $95K–$100K range due to past volatility.

XAUUSD Bullish Continuation Setup 📊 Chart Overview:

Asset: Unspecified (likely XAUUSD or a crypto asset).

Timeframe: Looks like 4H or Daily.

Tools Used:

EMA 50 (🔴 Red Line) — 3,283.978

EMA 200 (🔵 Blue Line) — 3,185.603

Resistance & Support Zones (🔴 Highlighted boxes)

Price: 3,335.415

🔍 Technical Analysis:

🟩 Trend Direction:

📈 Uptrend Confirmed: Price is above both EMA 50 and EMA 200 → Strong bullish momentum.

✅ Golden Cross: EMA 50 is above EMA 200, confirming long-term bullish bias.

📌 Key Levels:

🧱 Main Support Zone (🟥 Bottom Box - ~2,950–3,050):

Historical strong bounce zone.

Acts as a bullish base in case of a deeper pullback.

🔄 Mid Resistance/Support (~3,180–3,260):

Now acting as support after price bounced above it.

Also aligns with EMA 200 ➕🟦 – adds confluence.

📌 Main Resistance Zone (~3,300–3,380):

Current area of consolidation.

If broken, price likely to retest upper resistance.

🚧 Top Resistance Zone (~3,450–3,500):

Target area if bullish breakout continues.

✈️ Next take-profit zone for bulls.

🧭 Market Forecast:

🔁 Retest Expected: Price might pull back slightly to the main resistance area (~3,300), retesting previous resistance as support.

🚀 Upside Potential: Upon successful retest, price is projected to head toward the upper resistance (~3,480).

📉 Bearish Scenario: If price breaks back below 3,260 and EMA 50, expect a dip toward 3,180 or even the main support zone.

📈 Summary:

Bias: ✅ Bullish

Watch for:

🔍 Retest of 3,300 zone

✅ Breakout above 3,380

❌ Breakdown below 3,260 invalidates bullish scenario

EUR/USD Long Trade Setup – Buy Zone at 1.12757 with Targets at 11. Entry Point:

1.12757 is marked as the proposed buy entry zone, situated at the bottom of a consolidation range.

The price is currently just above this level, suggesting a potential reversal setup is forming.

2. Stop Loss:

Placed at 1.12413, which is below the support zone. This protects the position if the price breaks down further.

3. Target Points:

EA Target Point One: 1.14207 – this is the first take-profit target, aligned with a previous resistance zone.

EA Target Point: 1.1582 – this is the extended target, aligned with a stronger resistance area from a prior high.

4. Risk-to-Reward Consideration:

Risk: From 1.12757 to 1.12413 (approx. 34 pips).

Reward 1: Up to 1.14207 (approx. 145 pips).

Reward 2: Up to 1.1582 (approx. 306 pips).

This gives an excellent risk-to-reward ratio (>4:1 to the first target, >9:1 to the second target).

5. Market Context:

Price is trading below both the 50-period (blue) and 20-period (red) moving averages, indicating bearish short-term momentum.

However, this strategy anticipates a bounce off support, possibly a reversal or correction to the upside.

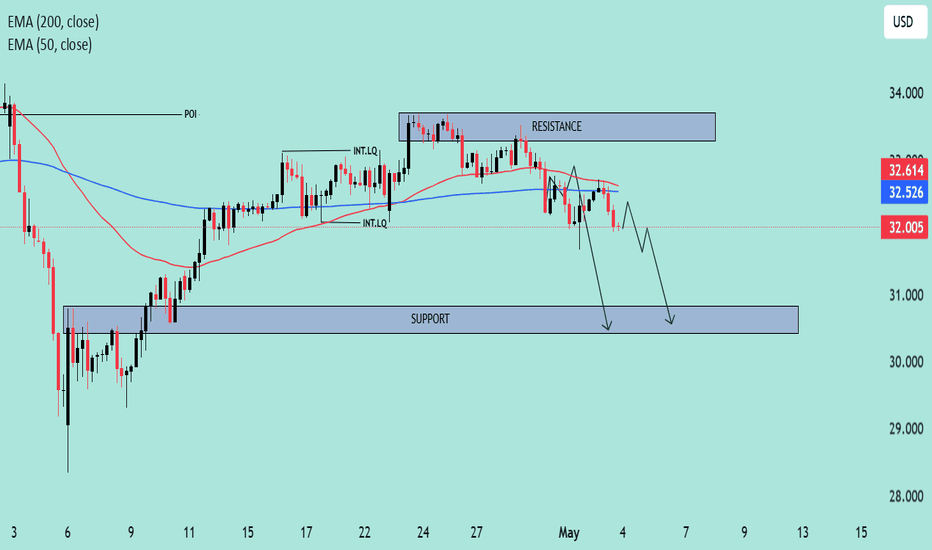

"Silver – Bearish Move Toward Support"🧠 Market Overview:

Instrument: Likely Silver (based on file name).

Chart Context: The price is currently trading below both the 50 EMA (red) and 200 EMA (blue), indicating bearish momentum and a possible shift in market structure.

📊 Key Technical Components:

🔹 Exponential Moving Averages (EMA):

50 EMA (32.614) is above the 200 EMA (32.526) but both are above the current price.

This crossover is recent and could indicate the beginning of a larger downtrend if confirmed by continued price action below both EMAs.

🔹 Market Structure:

POI (Point of Interest) marks a previous swing high where selling pressure emerged.

The chart shows internal liquidity (INT.LQ) sweeps both above and below consolidation areas, hinting at smart money manipulation to grab liquidity before making a move.

🔹 Resistance Zone:

Clearly defined between approx. 33.4–34.0, where price was rejected after a failed attempt to break higher.

Multiple rejections from this zone show strong selling pressure.

🔹 Support Zone:

Sitting between approx. 30.8–31.2.

Price previously consolidated here before a bullish move, making it a likely target for a return test or a potential bounce.

📉 Bearish Scenario & Projection:

The price broke below a short-term structure and failed to hold above EMAs.

The current price action shows a bearish pullback likely to form a Lower High (LH).

The projected path shows a pullback to previous support-turned-resistance, followed by a breakdown targeting the support zone.

✅ Bias:

Short-term bias: Bearish

Medium-term bias: Bearish, unless price reclaims the 200 EMA and consolidates above the resistance zone.

🔍 Confluences Supporting Bearish Outlook:

Price below EMAs (dynamic resistance).

Failed higher highs with liquidity sweeps (indicating smart money selling).

Clear market structure shift to the downside.

Anticipated retest of support zone around 30.8–31.2.

NASDAQ Eyes Higher Highs Bullish Reversal in Play 📈 NASDAQ Outlook: Bullish Momentum Builds Up

✅ Breakout Confirmed: Price action has broken above the descending channel, signaling a reversal from the previous downtrend.

📊 EMA Crossover: The 50 EMA is crossing above the 200 EMA (a golden cross), historically a bullish indicator.

🔼 Momentum Strong: Price is accelerating above EMAs with a steep upward trajectory, suggesting buyers are in control.

🔮 Potential Target: With sustained momentum, price could aim for the 21,000+ region in the short term.

If the price sustains above the 19,500 zone, dips could be considered buying opportunities in the current bullish structure.

"EUR/AUD Bearish Channel with Key Support Ahead"📉 Market Structure Analysis (Bearish Bias)

Current Trend:

The pair is trading within a well-defined descending channel, indicating a bearish trend. Price action is forming lower highs and lower lows, adhering to the channel boundaries.

Moving Averages (EMA):

EMA 50 (Red) at 1.77491 is above the price, acting as dynamic resistance.

EMA 200 (Blue) at 1.73338 is close to current price, likely to act as a support area in the short term.

The bearish crossover between the 50 EMA and current price supports the continuation of downward momentum.

🔍 Key Zones:

Weak Resistance Zone:

Located around 1.7740 – 1.8000, previously a support area, now acting as resistance.

Price rejection from this zone multiple times indicates sellers' strength.

Support Zone:

Located around 1.6950 – 1.7100, where demand may return.

This zone coincides with the lower boundary of the descending channel, making it a likely reaction zone.

📊 Forecast / Expectation:

The chart projects a bear flag / corrective pullback before another leg downward toward the support zone.

If price breaks and sustains below the EMA 200, it will likely accelerate bearish pressure.

The descending channel suggests potential continuation to the downside unless price breaks out of the upper boundary with momentum.

✅ Trade Implications:

Bearish Setup:

Look for short opportunities on intraday pullbacks near the resistance or EMA 50.

Bullish Invalidations:

A breakout above the descending channel and sustained move above 1.7800 would invalidate the bearish outlook.

Conclusion:

This chart presents a technically clean bearish setup. The confluence of a descending channel, EMA rejection, and defined resistance/support zones suggests the EUR/AUD may continue lower, especially if it loses the 1.7300 level decisively.

XAU/USD Market Outlook – Key Levels & Scenarios (May 2025)📊 Market Overview

Asset: XAU/USD (Gold vs. USD) – likely

Timeframe: 🕒 4H or Daily

EMAs:

🔴 50 EMA = 3,281 (short-term trend)

🔵 200 EMA = 3,179 (long-term trend)

🧱 Key Zones

🔺 Main Resistance Zone (🚫 Supply Area)

📍 ~3,320–3,400

🔍 Observation: Strong rejection zone with multiple failed attempts. 🚧 Price struggles to break and hold above here.

⚖️ Mid Support & Resistance Zone

📍 ~3,200–3,250

🧭 Current Action: Price is consolidating here. This is a key decision zone. A bounce or breakdown will likely decide the next big move. 🤔

🟦 Main Support Zone

📍 ~2,980–3,030

🛑 Observation: Major demand zone. If price falls here, it might attract buyers 👥 for a potential rebound.

📉 EMA Analysis

🔴 50 EMA is above 🔵 200 EMA → Trend still technically bullish ✅

🟡 BUT: Price is currently below 50 EMA, showing short-term weakness ⚠️

⚡️ 200 EMA is nearby (~3,179): Acting as dynamic support — a critical bounce zone! 🛡️

🔮 Scenarios

🐂 Bullish Path

✅ If price bounces from 3,200 support zone and reclaims 🔴 50 EMA:

🎯 Target: Retest of 3,320–3,400 🔺 zone

📈 Confirmation: Strong candle closing above 3,281 🔴 EMA

🐻 Bearish Path

🚨 If price breaks below 3,200 & 200 EMA:

🕳️ Expect drop towards 2,980–3,030 🟦 zone

📉 Confirmation: Candle closes below 3,179 with weak retest

✅ Conclusion

📍 Key Level to Watch: 3,200

⚖️ Market Sentiment: Neutral → Bearish bias unless price reclaims 50 EMA

🔒 Risk Tip: Avoid longs until price confirms bullish structure again 🔐

(BTC/USD) 1H Trade Setup – Key Entry, Stop Loss & Dual TargetEntry Point: 95,431

Stop Loss: 95,264

Target Points:

Upside (Target 1): 100,674 (Potential gain: +5.36%)

Downside (Target 2): 86,614 (Potential loss: -7.57%)

Trade Setup:

Risk-Reward Ratio:

Approx. 1:0.7 (Not ideal; the reward is smaller than the potential loss)

Support Zones:

Highlighted in purple beneath the entry zone — this indicates a historically strong support area.

Resistance Zones:

The upper purple zone marks the next significant resistance around 100,000–100,795.

Technical Indicators:

50 EMA (Blue Line): Indicates mid-term trend support, currently holding price action.

Price Action: BTC appears to be retracing toward support after a bullish rally.

Interpretation:

The setup implies a long (buy) position with a very tight stop loss.

The price is nearing a support zone, and if it holds, there's potential for an upward move to the target at 100,674.

However, if price breaks below 95,264, a sharp drop to 86,614 is anticipated.

XAU/USD) Bullish Trade Setup – Targeting $3,506.52 with Entry atEntry Point: $3,221.19

Stop Loss: $3,169.80

Resistance Zone: Around $3,277.98 to $3,280.64

Target (TP) Point: $3,506.52 (Approx. 9.05% upside)

📊 Technical Indicators and Markings:

Moving Averages:

Likely a 50-period (blue) and 200-period (red) moving average.

Price is currently below both MAs, signaling a short-term downtrend.

Support & Resistance Zones:

Strong support around $3,207.67–$3,221.19 (entry area).

Resistance at $3,244.25–$3,280.64.

Stop-loss is strategically placed below support to limit downside risk.

Target Area:

Projected upside target is $3,506.52, with a potential 9.05% gain from the entry.

This is marked as the EA (Expert Advisor) Target Point, possibly suggesting this is a strategy from an automated trading system.

Orange Circles:

Likely indicate swing highs and lows, used to identify trend patterns and potential reversal points.

📈 Trading Idea Summary:

Bullish Setup: Buying at support, aiming for breakout above resistance to reach target.

Risk-Reward Ratio: Favorable, assuming price holds above $3,207.

Watch for Confirmation: Price needs to break above resistance around $3,280 for momentum continuation.

Gold (XAU/USD) Intraday Buy Setup with High Reward-to-Risk Ratio1. Entry Point Zone: Around 3,271.79 USD

This is identified as a potential buy entry area, marked in purple.

2. Stop Loss: Below the entry point at 3,257.71 USD

Risk management level in case the trade moves against the setup.

3. Target Point One: Between 3,313.75 and 3,317.07 USD

A short-term take-profit level, likely based on previous resistance.

4. Final Target (EA Target Point): Around 3,373.04 USD

A more ambitious take-profit, possibly based on a major resistance level or Fibonacci extension.

5. Trade Range:

Risk: 3,271.79 - 3,257.71 = 14.08 USD

Reward to First Target: ~42 USD

BTC/USD) Short Setup: Triple Top Formation Targeting 86,023 USD You’re seeing a potential Head and Shoulders structure (or at least a triple top) — with the orange circles marking failure to break higher around $95K.

The neckline (support) is slightly diagonal down toward the $94K region.

A breakdown is anticipated once the neckline fails.

2. EMAs Interaction:

30 EMA (red) is currently flattening, showing weakening momentum.

200 EMA (blue) is far below, around 88,181 USD, acting as a major support zone — and it aligns with the projected EA TARGET POINT.

EMA compression usually precedes a strong move.

3. Zones and Key Price Levels:

Entry Point: ~95,145.60 USD → high-probability short sell.

Stop Loss: ~96,000–96,957 USD → protects against unexpected breakout.

Target: ~86,023 USD → aligns with past accumulation zone and EMA200.

4. Risk/Reward Ratio:

Potential reward is about 9–10%.

Risk (from entry to stop) is about 1–2%.

Excellent Risk/Reward (>4:1).

5. Momentum and Volume (implied, not shown):

Given the topping pattern and lack of higher highs, buying momentum is weakening.

If volume increases on a breakdown, confirmation will be strong.

📊 Strategic Points:

Aspect Analysis

Trend Still bullish, but topping signs visible

EMA Behavior Short-term EMA flattening, long-term EMA rising slowly

Pattern Formed Triple Top / Head and Shoulders

Risk/Reward Very good (>4:1)

Recommendation Short bias around entry level, with strict stop-loss

⚡ Quick Trading Plan:

Entry: Short at ~$95,145

Stop Loss: ~$96,000–96,957

Target: ~$86,023

EUR/USD Bullish Trade Setup – Targeting 1.18089 with Strong RiskEntry Point: 1.13860

Stop Loss Zone: 1.13642 to 1.12578

Resistance Point: 1.14320

Target (TP) Point: 1.18089

🔍 Observations

Support Zone: Marked in purple near the entry and stop-loss area, suggesting a strong demand zone.

Resistance Zone: Around 1.14320, indicating a potential breakout level.

Trend: Short-term uptrend after a consolidation range.

Risk/Reward Ratio: Quite favorable, targeting a move of approximately 470+ pips (4.20% gain) from entry to target.

📊 Technical Indicators

Moving Averages:

Red (likely 20 EMA): Price recently crossed above, showing bullish momentum.

Blue (likely 50 or 200 EMA): Serving as dynamic support.

Price Action: Formation suggests a potential breakout from resistance toward the 1.18 target.

🧠 Conclusion

This is a long (buy) setup expecting a bullish breakout:

Buy entry above the support zone.

Stop-loss placed below major support (1.12578).

Target set significantly higher, aligning with prior structure or resistance at 1.18089

"(XAU/USD) Bullish Setup: Demand Zone Bounce with 5.89% tgr ptnl🔵 Current Price: $3,451.03

🟡 EMA (9): $3,457.20

🔻 Price is just below EMA — short-term pressure.

Zones & Key Levels:

🟦 Demand Zone:

🔽 Price bounced here before — strong buyer interest!

📍 Zone Range:

* Top: $3,442.38

* Bottom (Stop Loss): $3,395.87

* 🔴 Stop Loss set here to limit risk.

🟨 Entry Point:

* Entry suggested at $3,457.20

* Just above the current price and EMA — needs confirmation

* ⚠️ Wait for bullish candle or price action signal above EMA

🟩 Target Point:

🎯 Target: $3,645

* 📈 Potential gain: +202.78 pts (5.89% upside)

* 🚀 Aiming to break previous ATH (All-Time High)

Visual Trade Plan Summary:

* ✅ Buy Entry: $3,457.20

* ❌ Stop Loss: $3,395.87

* 🎯 Target: $3,645.00

* ⚖️ Risk-to-Reward: Solid, over 3:1

Sentiment:

* If price respects demand zone and reclaims EMA — bullish setup

* 🕵️♂️ Watch for volume or confirmation candle near entry

HAVELLS STRONG READY TO FLY 193 POINTS Havells strong zone above only 1567

Short term buy zone

Wait for Active

Buy above 1567

Stoploss.......1530....37 points

Target1.........1620...53 points

Target2.........1660...93 points

Target3.........1760...193 points

Disclaimer- This level only educational purpose and paper trade only. Do ur own analysis

USD/JPY Bullish Reversal Setup – Long Entry at 141.964 Targeting ahemdsaeed25: USD/JPY Long Setup – Eyeing 150.537 Target"

"Potential Bullish Reversal on USD/JPY"

"Swing Trade Alert: USD/JPY Long from 141.964"

"USD/JPY Breakout Play – Buy Zone Identified"

Let me know your tone preference (technical, casual, professional, etc.) and I can tailor the title further.

ahemdsaeed25: This chart is for the USD/JPY (U.S. Dollar / Japanese Yen) pair on the 1-hour timeframe, and it's displaying a bullish setup with a clear trade idea. Here's a breakdown of the analysis:

Key Components:

Current Price: Around 142.574.

Entry Point: 141.964

Stop Loss: 140.547

Take Profit / Target Point: 150.537

Reward-to-Risk Ratio: Favorable (approximately 5.94% upside, large potential move).

Indicators:

EMA 50 (Red Line): 142.798 — acting as near-term dynamic resistance.

EMA 200 (Blue Line): 144.699 — major resistance and a trend filter (downward trend visible).

Zone Analysis:

Support Zone (Purple Box near 141.964 - 140.547): This is the accumulation/buy zone.

Gold (XAUUSD) Trade Setup: Bullish Breakout Toward $3,637 TargeCurrent Price: $3,309.18

EMA 30 (Red Line): $3,265.00

EMA 200 (Blue Line): $3,163.35

Trend Direction: Strong uptrend (price above both EMAs)

Timeframe: 1-hour (short-term analysis)

📍 Key Levels

Entry Point: Around $3,266.63 (just above EMA 30)

Stop Loss: Around $3,265.00

Target (EA Target Point): $3,637.23

Potential Profit: +$365.01 or +11.16%

🔍 Technical Patterns & Zones

Rising Channel: Price is moving within a rising wedge or channel, indicating bullish momentum but with narrowing range — a potential reversal signal if broken.

Support Zone: Highlighted purple box around the entry point; likely a demand zone.

Resistance Zone: $3,637.23 area marked as the EA Target Point — previous resistance or Fibonacci extension level.

✅ Bullish Signals

Price is consistently making higher highs and higher lows.

EMAs are aligned in a bullish formation (short EMA above long EMA).

Clear breakout above consolidation range recently.

Trade setup shows favorable risk-to-reward ratio.

⚠️ Risks / Caution

Rising wedge can sometimes break down — watch for volume drop or divergence.

Potential pullback to the entry zone is expected (indicated by the arrow).

News Events: Symbols below the chart indicate upcoming USD economic data, which could bring volatility.

📈 Strategy Summary

Buy on pullback to $3,266.63 with tight stop at $3,265.00.

Target: $3,637.23 — potential 11% gain.

Risk: Minimal if stop is respected, tight stop-loss.

XAUUSD 3210.50 TO 3235 CHANCE 25 POINTSXAUUSD strong zone buy above only 3210.50

There is no resistance upto +

Buy above 3210.50

Stoploss.............3200.....10.50

Target1...............3220.....9.50 points

Target2................3225.....14.50 points

Target3..............3235....25 points

Disclaimer - this level only for education purpose only