Indigo potential long opportunityNSE:INDIGO

Hello all!

There is a pole and flag pattern forming in Indigo. The stock has been consolidating inside the flag since November 2020.

I see a long opportunity here and there are two major reasons for that. The first being pure price action i.e the stock being at the bottom of the flag. The second being that the stock is taking support from its 50 week EMA.

The targets can be set at the top flag trendline and can be pushed further to the top of the upper channel if the stock breaks out. Also, the Reward to Risk ratio is decent.

Would love to hear your thoughts on this!!

HAPPY TRADING!!

*NOT A CALL*

Indigo

✈🛫🛬 indigo NSE:INDIGO

wait for conformation what ever side it give breakout that side it will go . trade with stop loss as per your trading strategy.

******whatever charts or levels sharing here are just for educational purpose only not a recommendation. please do your own analysis before taking any trade on them. we are not SEBI registered.

Possible Channel Breakout in IndigoNotes:

Indigo has been trading in a channel since the 10th of November 2020 (1500-1790) possibly due to COVID and the near term outlook of the industry being a factor.

However, since the last week of April, its been in a steady uptrend, and is now back at the top of the channel (1785-1830 almost a 2.5% zone)

Owing to the long consolidation period and the fact that second wave is more or less under control, we could see Indigo testing previous high of 1900 in the coming sessions if the zone is broken.

Please note - Not a SEBI Registered Advisor/Analyst. Only for Educational Purposes. Please Consult your financial advisor before you take any action.

INDIGO - Consolidation Continue or Breakout? Where to takeoff ?It has been observed that the price action is consolidating for last 6 months between the range of 300 points from 1500 to 1800 levels.

Flight 01 (Up)

Investors who want to enter in the stock can wait for a breakout above 1800 levels on daily chart with good volumes in order to confirm the up trend in the stock. In my opinion, the company needs some positives news to support the breakout that could be

"Foreign countries open up for Indian travelers" "India's recovery from Covid19" "Rate-cut in fuel pricing"

I believe it may take another 2-3 months to hear such good news, therefore price action will keep consolidating for a while.

Boarding: Once price action breaks above 1800, next destination 2000 levels.

Flight 02 (Down)

A correction can be seen from current levels as the price action is at previous resistance zone where previous sellers will again offload their holdings and increase supply in the market. It may further take down the price action to around 1600 levels.

Some of the bad news hovering around the stock that may push the price action further down.

"Fuel cost went up" "Net loss widens" "Third Wave may come" "Restrictions on travelling"

Until we see improvement in next quarter results, I believe price action may still continues to consolidate.

Boarding: Below 1720, Destination 1670 & 1620, SL - 1770

I shall be updating the stock direction and targets once I notice clear breakouts on either side.

For now, keep it handy in your trade watch list.

Appreciate your time, Regards

SHORT SWING TRADE IN INDIGOHello guys i had find this setup which is in sideways trend and had given a good selling opportunity in 4h timeframe lit is a swing trade with good RR ratio you can go for sell when it break trendline and also i had done some fundamental analysis on it that i had give the bad quarter result and i request you all do your own analysis before taking any position in market. if you guys like my analysis plzz like share and follow thank you

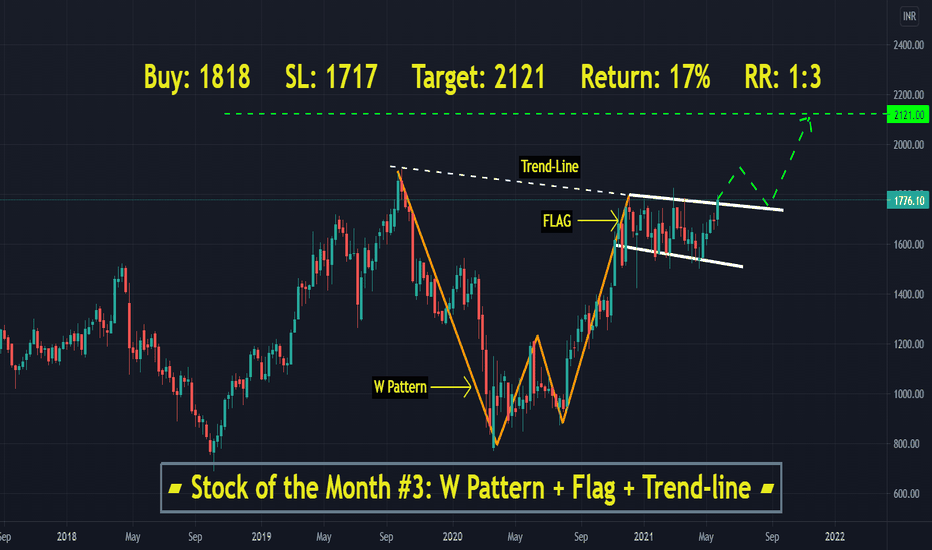

▰ Stock of the Month #3: INGIDO ▰▰ Stock of The Month #3: JUNE ▰

📌 I have found 15 new patterns on the charts. These are original and unique patterns that can achieve their target almost 80-90% times. Here, I have posted one of my favourite 💕 chart patterns.

☆ I will post the remaining patterns one by one every month. For more, you can check out my previous studies 😍 as well. Kindly see my announcement section for all the latest.

▣ Key Highlights:

➟ Time frame Weekly ₩

➟ W pattern ⓦ

➟ Trend line ⍩

➟ Flag Pattern 🎌

➟ Unique Confluence Ⓤ

📌 Levels are:

Entry: ▲ 1818

SL: ☢ 1717

Target: ➚ 2121

RR: ☈ 1:3

Return: 17%+

☆ Follow me @ tradingview for more updates. Kindly like the chart 💗 & share this analysis.

☆ Thank you. Happy Trading!!!

Best Regards,

𝘿𝙧. 𝙎𝙝𝙖𝙢𝙧𝙖𝙟𝙖 𝙉𝙖𝙙𝙖𝙧

𝙋𝙝𝘿 𝙞𝙣 𝙏𝙚𝙘𝙝𝙣𝙤𝙡𝙤𝙜𝙮.

✮ Disclaimer ✮

--------------------------------------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

--------------------------------------------------------

INDIGO: Bullish Triangle BreakoutAfter a long consolidation for almost 6 months , finally the stock has given a breakout of the triangular structure. Assuming wave (e) completed around 1655 , Indigo is ready to give an upthrust out of the bullish triangular wave.

One should buy the stock on cmp and add on dips (if any), maintain the SL of 1655 which is the area of wave(e) and look for the target of 1880/1960/2020

INDIGO : HIGH BETA SCRIPTNote:

1. Views are personal and for educational purposes only. Recheck and take the trade as per your RR.

2. Always remember SL is your lifeline, not the big target...

3.Follow us for more patterns and like, share so that we feel it is helpful to many and share more patterns...

3. Views given here is not a tip rather it is for educational purpose... Aftermarket opens, the condition might change so learn to handle different conditions...

4. To learn more about patterns, Psychology behind the trade, and price action trading... contact us... Thanks...

Keep an eye ladies and gentlemen. Cheers and Happy Trading.