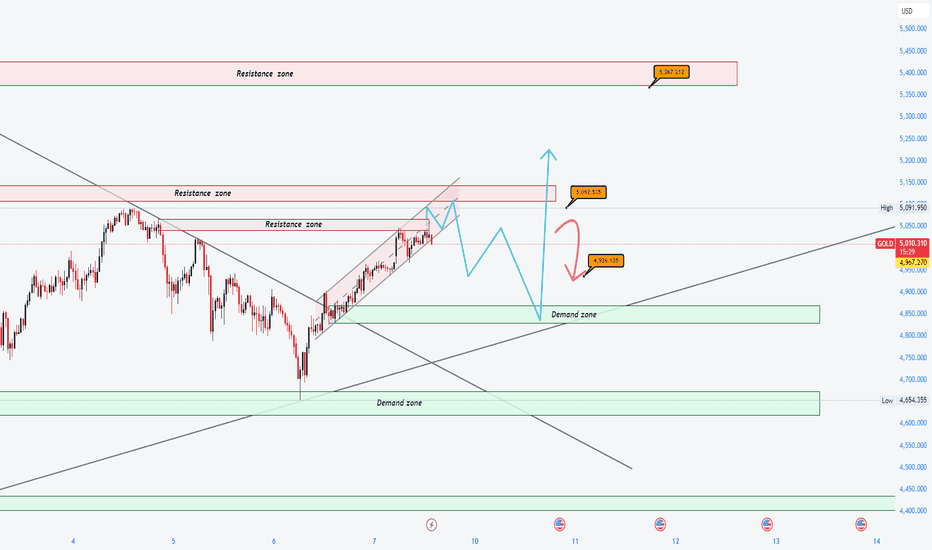

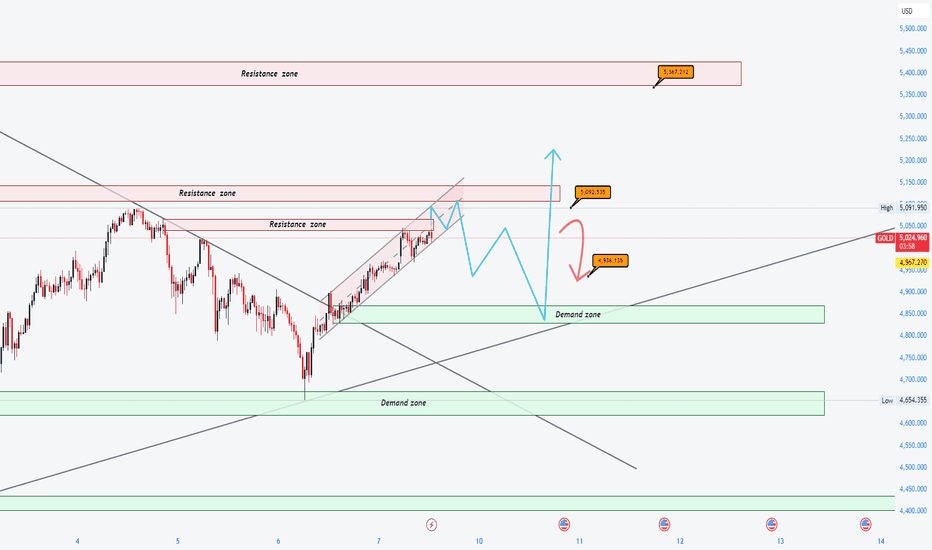

Breakdown or Breakout – Gold Compression Phase🔎 Market Context

• Gold is compressing within the 5000 – 5080 range

• Accumulation phase after the previous sharp sell-off

• Volatility is contracting → expansion is likely soon

• CPI & Non-Farm Payrolls are key catalysts

➡ Do not predict direction. Wait for a confirmed breakout.

📌 Strategic Zones

Resistance: 5078–5080 | 5100 | 5148 | 5200 | 5300 | 5345

Support: 5000 | 4980 | 4850 | 4830 | 4600 | 4400

• 5078–5080: Upper boundary of the range

• 5000: Lower boundary of the range

• 4980: Market structure decision level

⚖ Trading Bias

• Above 5080 → Favor upside continuation (Wave C extension)

• Below 4980 → Bullish structure breaks → favor downside

• Inside 5000–5080 → Compression phase, avoid FOMO

⚠ Key Notes

• Major data releases may cause false breakouts

• Wait for candle close confirmation

• Volatility likely to increase → manage risk carefully

• Avoid trading mid-range without clear edge

Intraday

Axis Bank | Gann Square of 9 Intraday Observation | 12/03/2022Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 12 March 2024

Time Frame: 15-Minute Chart

Method: Gann Square of 9 (Price Capacity & Time Study)

This post documents a historical intraday observation based on the Gann Square of 9, focusing on how early completion of price capacity can coincide with temporary market pressure.

📊 Market Structure & Reference Selection

Axis Bank opened with upward momentum during the first 15-minute candle.

In such conditions, the low of the opening candle (~1100) was treated as the 0-degree reference level, following Gann methodology.

This level served as the base point for measuring the session’s upward price capacity.

Accurate identification of the reference point is essential for reliable Square of 9 observations.

🔢 Square of 9 Level Mapping

Based on the selected reference:

0 Degree: ~1100

45 Degree (Observed Normal Capacity): ~1117

The 45-degree level often reflects the normal intraday price expansion range under regular conditions.

⏱️ Price–Time Behavior (Observed)

Price interacted with the 45-degree level early in the session (around 9:30 AM).

Completion of normal price capacity well before the later part of the trading day has historically been associated with short-term exhaustion.

After reaching this zone, the market showed temporary selling pressure and downside expansion.

This aligns with a commonly observed Gann principle:

When expected price capacity is completed early in time, the probability of a reaction may increase.

📘 Educational Takeaways

Gann Square of 9 helps define intraday price limits in advance

Early completion of price capacity can signal temporary trend fatigue

Time alignment strengthens interpretation of price-degree levels

The method encourages structured observation over prediction

Focus remains on process, not precision

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Axis Bank | Gann Square of 9 Intraday Observation | 15 March 202Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 15 March 2024

Time Frame: 15-Minute Chart

Method : Gann Square of 9 (Price Capacity & Time Study)

This post documents a historical intraday market observation using the Gann Square of 9, focusing on how price capacity, trend context, and time alignment can highlight potential intraday reaction zones.

📉 Market Context & Reference Point Selection

Axis Bank showed downside pressure from the opening 15-minute candle.

In such conditions, the high of the first 15-minute candle (~1050) was treated as the 0-degree reference level, following Gann methodology.

This level acts as the starting point for measuring the intraday downward price cycle.

Correct trend identification and reference selection are essential before applying Square of 9 calculations.

🔢 Square of 9 Price Mapping

Based on the selected reference:

0 Degree: ~1050

45 Degree (Observed Normal Capacity): ~1034

The 45-degree level often represents the normal intraday price expansion range under regular market conditions.

⏱️ Price–Time Interaction (Observed Behavior)

Price interacted with the 45-degree level early in the session (around the third 15-minute candle).

Completion of normal price capacity well before the later part of the trading day has historically shown signs of temporary downside exhaustion.

After reaching this zone, the market displayed short-term stabilization followed by upward expansion.

This aligns with a commonly observed Gann concept:

When expected price capacity is completed early in time, the probability of a directional reaction may increase.

📘 Educational Takeaways

Gann Square of 9 helps define intraday price limits in advance

Trend context determines how reference points are selected

Time alignment adds confirmation to price-degree levels

Normal (45-degree) reactions are more frequent than rare cases

The approach encourages rule-based observation over emotional reaction

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Axis Bank | Gann Square of 9 Intraday Observation | 18 March 202Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 18 March 2024

Time Frame: 15-Minute Chart

Method Used: Gann Square of 9 (Price–Time Study)

This post documents a historical intraday market observation using the Gann Square of 9, focusing on how price movement capacity and time alignment can highlight potential intraday reaction zones.

📊 Initial Market Structure

Axis Bank displayed upward momentum from the opening 15-minute candle.

The low of the first 15-minute candle (~1043) was treated as the 0-degree reference level.

This reference point marks the start of the intraday price cycle and is used for further Square of 9 calculations.

Correct identification of the 0-degree level is a key requirement for consistent Square of 9 analysis.

🔢 Square of 9 Level Mapping

Using Square of 9 price-degree relationships, the following levels were observed:

0 Degree: ~1043

45 Degree (Observed Normal Capacity): ~1057

The 45-degree level often reflects the normal intraday price expansion range under regular market conditions.

⏱️ Price & Time Interaction (Observed Behavior)

Price interacted with the 45-degree level early in the session (around the second 15-minute candle).

Completion of the normal price capacity well before the later part of the trading day has historically shown temporary price pressure.

After reaching this zone, the market displayed rejection behavior followed by short-term downside expansion.

This observation aligns with a commonly studied Gann principle:

Early completion of expected price capacity may increase the probability of a market reaction.

📘 Educational Takeaways

Gann Square of 9 helps define logical intraday price limits

Normal (45-degree) reactions occur more frequently than exceptional cases

Time context adds important confirmation to price levels

Minor price deviations around calculated levels are part of normal market behavior

The method supports rule-based observation, not prediction

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

GOLD before Non-Farm: Sideways or a Trap?🌍 Macro Background

Continuing to monitor U.S. – Iran tensions and whether escalation occurs.

Japan: maintaining a weak JPY → USD remains supported.

A heavy news week ahead:

FED speeches (today)

Labor market data

Inflation data later this week

👉 Market sentiment remains cautious, waiting for a clearer directional catalyst.

📈 Trend & Structure

Overall price structure remains unchanged: Gold is in the final phase of a corrective rebound.

Upside momentum still exists, but limited, while reversal risk is increasing.

Price is consolidating near resistance → sideways conditions are favored.

🔴 Resistance – 🟢 Support

🔴 Resistance: 5,050 – 5,100

🟢 Near support: 4,980 – 4,950

🟢 Additional support: 4,930 – 4,936

🟢 Deeper support: 4,880 – 4,850

📊 Trading Scenarios

✅ Primary scenario (higher probability): Sideways – range trading

Sell reactions around 5,050

Condition: rejection candles / bearish confirmation

Buy technical pullbacks at support zones

Focus on M15 – H1, quick and disciplined trades.

⚠️ Alternative scenario (lower probability): Bullish breakout

Mandatory condition: H1 close clearly above 5,100

Only then consider buying the breakout.

🧠 Risk Management

Avoid holding large positions during:

FED speeches

Labor market & inflation releases

No FOMO — wait for candle confirmation.

Axis Bank | Gann Square of 9 Intraday Study (Normal Case)Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 12 November 2024

Time Frame: 15-Minute Chart

This post presents a historical intraday observation using the Gann Square of 9, focusing on how normal price movement capacity and time alignment can highlight potential reaction zones.

📊 Market Structure at the Open

Axis Bank displayed upward strength from the first 15-minute candle.

The low of the opening candle (~1166) was used as the 0-degree reference level, following Square of 9 methodology.

This level acts as the base point for mapping the day’s upward price vibration.

Correct identification of the 0-degree reference is essential for consistent Square of 9 studies.

🔢 Square of 9 Level Mapping

Based on Square of 9 calculations:

0 Degree: ~1166

45 Degree (Observed Normal Capacity): ~1183

In intraday analysis, the 45-degree level often represents the stock’s normal price expansion range under typical market conditions.

⏱️ Price & Time Interaction (Observed Behavior)

Price reached the 45-degree level early in the session (around the second 15-minute candle).

Completion of the normal price capacity well before the later part of the trading day has historically shown temporary price pressure.

After interacting with this zone, the market displayed rejection behavior followed by short-term downside expansion.

This aligns with a commonly observed Gann concept:

Early completion of expected price capacity may increase the probability of a reaction.

📘 Educational Takeaways

Gann Square of 9 helps define logical intraday price limits

Normal (45-degree) reactions occur more frequently than exceptional cases

Combining price structure with time context improves market clarity

Small deviations around calculated levels are part of normal market behavior

This approach supports rule-based observation, not prediction

📌 Shared strictly for educational and historical chart-study purposes.

Axis Bank | Gann Square of 9 Intraday Study (Normal Case)Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 13 November 2024

Time Frame: 15-Minute Chart

This post documents a historical intraday observation using the Gann Square of 9, focusing on how normal price movement capacity interacts with time to highlight potential reaction zones.

📊 Initial Market Structure

Axis Bank showed upward momentum from the first 15-minute candle.

The low of the opening candle (~1148) was treated as the 0-degree reference level, following standard Square of 9 practice.

This reference point acts as the base for mapping the day’s expected upward vibration.

Correct identification of the 0-degree is essential for meaningful Square of 9 observations.

🔢 Gann Square of 9 Level Mapping

Based on Square of 9 calculations:

0 Degree: ~1148

45 Degree (Observed Normal Capacity): ~1165

In intraday studies, the 45-degree level often represents a stock’s normal price expansion range under regular market conditions.

⏱️ Price & Time Interaction (Observed Behavior)

Price reached the 45-degree level early in the session (around the second 15-minute candle).

Completion of the normal price capacity well before the later part of the trading day has historically shown temporary price pressure.

After interacting with this zone, the market displayed rejection behavior and short-term downside expansion.

This reflects a commonly observed Gann principle:

Early completion of expected price capacity can increase the probability of a reaction.

📘 Key Educational Takeaways

Square of 9 helps define logical intraday price limits

Normal (45-degree) reactions occur more frequently than rare cases

Combining price structure with time context improves clarity

The method supports rule-based observation, not prediction

Small variations around levels are part of normal market behavior

📌 Shared purely for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #TechnicalAnalysis #PriceTime

GOLD before US Jobs & Inflation Data: Key Scenarios?🌍 Macro Context & Market Expectations

This week, the market is closely focused on:

US employment data

US inflation data (CPI / PCE)

Additionally, traders are monitoring:

Developments in US–Iran negotiations

US Supreme Court rulings related to trade tariffs

→ These factors may amplify short-term volatility, especially around key technical levels.

📈 Trend & Market Structure

Medium-term trend: BULLISH

Price has rebounded strongly from the ~4,700 low to around 5,04x

Last week printed a bullish Hammer candle, confirming long-term buying interest

On the H12 timeframe, the A–B–C corrective structure is not yet complete

Short term: price is consolidating within a tightening range, waiting for a clear breakout

🔑 Key Price Levels

🟢 Support:

5,000 | 4,950 | 4,930 | 4,850 | 4,700 | 4,650

🔴 Resistance:

5,050 | 5,095 | 5,100 | 5,110 | 5,200 | 5,300

🎯 Primary Scenarios

✅ Bullish continuation

Price holds above 4,930 and breaks decisively above 5,050

→ Potential upside toward 5,095 – 5,100, and further to 5,200 – 5,300

❌ Failed breakout / Pullback

Price fails to clear 5,050 and closes below 4,930

→ Likely correction toward 4,850, with deeper pullback to 4,700 – 4,650

🧭 Trading Strategy

Prioritize buy-the-dip opportunities in line with the trend

Avoid counter-trend shorts unless clear reversal signals appear at resistance

Stay patient and avoid FOMO — only trade when risk–reward is clearly defined

Price Acceptance & Volume Distribution Study (PWL | 1H)Intraday Market Structure & Volume Profile Study (1H)

This idea presents an intraday market structure study of

PhysicsWallah Ltd. on the 1-hour timeframe, using Volume Profile

to analyze price acceptance and participation.

A Fixed Range Volume Profile has been applied from the onset of the

impulsive decline to the most recent hourly price action, allowing

observation of how value has evolved over time.

Key Observations:

1) A clearly defined value area (VAH–VAL) is visible, indicating

where the majority of intraday participation has occurred.

2) Price has repeatedly rotated within this value area across

multiple sessions, suggesting a balance phase rather than a

directional trend.

3) The Point of Control (POC) highlights the price level where the

highest concentration of trading activity took place, serving as

a reference for accepted value.

4) Attempts to move above the value area have shown limited

continuation, implying that supply remains active at higher

prices.

5) Recent price action is interacting with a previously tested

demand zone below value, where intraday risk becomes more clearly

defined.

Critical Structural Shift:

Price is currently trading below the Value Area Low (VAL).

This is not a neutral condition.

Trading outside value indicates rejection of previously accepted

prices and a shift from balance to imbalance.

As long as price remains below VAL, the market is not accepting

higher value and is actively exploring lower prices.

Any bullish assumption without re-acceptance back into value

remains structurally weak.

GOLD before US Jobs & Inflation Data: Key Scenarios?🌍 Macro Context & Market Expectations

This week, the market is closely focused on:

US employment data

US inflation data (CPI / PCE)

Additionally, traders are monitoring:

Developments in US–Iran negotiations

US Supreme Court rulings related to trade tariffs

→ These factors may amplify short-term volatility, especially around key technical levels.

📈 Trend & Market Structure

Medium-term trend: BULLISH

Price has rebounded strongly from the ~4,700 low to around 5,04x

Last week printed a bullish Hammer candle, confirming long-term buying interest

On the H12 timeframe, the A–B–C corrective structure is not yet complete

Short term: price is consolidating within a tightening range, waiting for a clear breakout

🔑 Key Price Levels

🟢 Support:

5,000 | 4,950 | 4,930 | 4,850 | 4,700 | 4,650

🔴 Resistance:

5,050 | 5,095 | 5,100 | 5,110 | 5,200 | 5,300

🎯 Primary Scenarios

✅ Bullish continuation

Price holds above 4,930 and breaks decisively above 5,050

→ Potential upside toward 5,095 – 5,100, and further to 5,200 – 5,300

❌ Failed breakout / Pullback

Price fails to clear 5,050 and closes below 4,930

→ Likely correction toward 4,850, with deeper pullback to 4,700 – 4,650

🧭 Trading Strategy

Prioritize buy-the-dip opportunities in line with the trend

Avoid counter-trend shorts unless clear reversal signals appear at resistance

Stay patient and avoid FOMO — only trade when risk–reward is clearly defined

Swing Trade - SOLEX BUYTechnical Trade Set up

1) Sorted Ema's shows Higher timeframe Bullish sentiment

2) Price Bounced from strong Demand Zone

3) Aggresive trade active / Conservative entry wait for Price action

4) RSI in Oversold zone

Tgts wld be 1152 / 1297 / 1786

Stoploss 865 / 630 on candle closing Basis

Disclaimer: Educational purposes only. Not financial advice. DYOR and consult a professional before investing.

USDCAD | 1H Market Structure OutlookUSDCAD is currently trading within a well-defined short-term distribution range after engineering a strong impulsive rally from the late-January lows. The recent expansion into the 1.3700 handle appears to have tapped into a premium supply zone, where price printed rejection wicks, signaling the presence of institutional sell-side liquidity.

From an SMC / ICT perspective:

Price swept relative equal highs before showing displacement to the downside, hinting at a classic buy-side liquidity grab.

The rejection from the marked supply suggests smart money may be positioning for a retracement toward inefficiencies left below.

Internal structure is beginning to shift bearish on the lower timeframe, though confirmation would require a decisive break of structure (BOS) beneath the 1.3620 support.

Key Levels to Watch

Supply / Premium: 1.3695 to 1.3710

Intermediate Support: ~1.3620 (range floor)

Higher-Timeframe Demand: 1.3580 to 1.3600, aligning with the visible demand block and potential mitigation zone.

Projected Path

If price fails to reclaim the supply region, the probability favors a corrective move lower, potentially delivering a measured draw on liquidity into the demand zone. A brief pullback into a lower high followed by continuation would further validate bearish order flow.

Invalidation Scenario:

Sustained acceptance above 1.3710 would negate the bearish premise and open the door for continuation toward higher liquidity pools.

Bias: Short-term bearish while below supply, with expectations of liquidity engineering toward discounted pricing.

Axis Bank | Gann Square of 9 Intraday Observation | 11 March 202Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 11 March 2024

Time Frame: 15-Minute Chart

Method: Gann Square of 9 (Price Capacity & Time Alignment)

This post shares a historical intraday observation showing how price interacted with a normal Square of 9 capacity level, leading to a temporary reaction when time and price aligned.

📊 Market Context & Reference Selection

Axis Bank displayed upward momentum after the completion of the first 15-minute candle.

In such market conditions, the low of the first 15-minute candle (~1104) was treated as the 0-degree reference level, following Gann methodology.

This reference point was used to study the session’s expected price expansion.

Correct identification of the reference level is critical for objective Square of 9 analysis.

🔢 Square of 9 Level Mapping

Based on the selected reference:

0 Degree: ~1104

45 Degree (Observed Normal Capacity): ~1121

The 45-degree level often represents the normal intraday movement range under regular market conditions.

⏱️ Observed Price–Time Behavior

Price approached the 45-degree level well before the later part of the trading session.

Early completion of normal price capacity has historically been associated with short-term trend fatigue.

After interacting with this zone, price showed temporary selling pressure and moved lower.

A minor variation around the calculated level was observed, which is common in live market conditions.

This aligns with a widely observed Gann concept:

When expected price capacity is completed early in time, the probability of a reaction may increase.

📘 Educational Takeaways

Square of 9 helps define logical intraday price limits

Early capacity completion can indicate temporary exhaustion

Time plays a supporting role in validating price-degree levels

Small price deviations are normal and should be viewed structurally

The method promotes rule-based observation over prediction

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Axis Bank | Gann Square of 9 Intraday Observation | 15 March 202Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 15 March 2024

Time Frame: 15-Minute Chart

Method: Gann Square of 9 (Price Capacity & Time Study)

This post documents a historical intraday market observation using the Gann Square of 9, focusing on how price capacity, trend context, and time alignment can highlight potential intraday reaction zones.

📉 Market Context & Reference Point Selection

Axis Bank showed downside pressure from the opening 15-minute candle.

In such conditions, the high of the first 15-minute candle (~1050) was treated as the 0-degree reference level, following Gann methodology.

This level acts as the starting point for measuring the intraday downward price cycle.

Correct trend identification and reference selection are essential before applying Square of 9 calculations.

🔢 Square of 9 Price Mapping

Based on the selected reference:

0 Degree: ~1050

45 Degree (Observed Normal Capacity): ~1034

The 45-degree level often represents the normal intraday price expansion range under regular market conditions.

⏱️ Price–Time Interaction (Observed Behavior)

Price interacted with the 45-degree level early in the session (around the third 15-minute candle).

Completion of normal price capacity well before the later part of the trading day has historically shown signs of temporary downside exhaustion.

After reaching this zone, the market displayed short-term stabilization followed by upward expansion.

This aligns with a commonly observed Gann concept:

When expected price capacity is completed early in time, the probability of a directional reaction may increase.

📘 Educational Takeaways

Gann Square of 9 helps define intraday price limits in advance

Trend context determines how reference points are selected

Time alignment adds confirmation to price-degree levels

Normal (45-degree) reactions are more frequent than rare cases

The approach encourages rule-based observation over emotional reaction

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Axis Bank | Gann Square of 9 Intraday Observation | 18 March 202Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 18 March 2024

Time Frame: 15-Minute Chart

Method Used: Gann Square of 9 (Price–Time Study)

This post documents a historical intraday market observation using the Gann Square of 9, focusing on how price movement capacity and time alignment can highlight potential intraday reaction zones.

📊 Initial Market Structure

Axis Bank displayed upward momentum from the opening 15-minute candle.

The low of the first 15-minute candle (~1043) was treated as the 0-degree reference level.

This reference point marks the start of the intraday price cycle and is used for further Square of 9 calculations.

Correct identification of the 0-degree level is a key requirement for consistent Square of 9 analysis.

🔢 Square of 9 Level Mapping

Using Square of 9 price-degree relationships, the following levels were observed:

0 Degree: ~1043

45 Degree (Observed Normal Capacity): ~1057

The 45-degree level often reflects the normal intraday price expansion range under regular market conditions.

⏱️ Price & Time Interaction (Observed Behavior)

Price interacted with the 45-degree level early in the session (around the second 15-minute candle).

Completion of the normal price capacity well before the later part of the trading day has historically shown temporary price pressure.

After reaching this zone, the market displayed rejection behavior followed by short-term downside expansion.

This observation aligns with a commonly studied Gann principle:

Early completion of expected price capacity may increase the probability of a market reaction.

📘 Educational Takeaways

Gann Square of 9 helps define logical intraday price limits

Normal (45-degree) reactions occur more frequently than exceptional cases

Time context adds important confirmation to price levels

Minor price deviations around calculated levels are part of normal market behavior

The method supports rule-based observation, not prediction

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Axis Bank | Gann Square of 9 Intraday Study (Normal Case)Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 12 November 2024

Time Frame: 15-Minute Chart

This post presents a historical intraday observation using the Gann Square of 9, focusing on how normal price movement capacity and time alignment can highlight potential reaction zones.

📊 Market Structure at the Open

Axis Bank displayed upward strength from the first 15-minute candle.

The low of the opening candle (~1166) was used as the 0-degree reference level, following Square of 9 methodology.

This level acts as the base point for mapping the day’s upward price vibration.

Correct identification of the 0-degree reference is essential for consistent Square of 9 studies.

🔢 Square of 9 Level Mapping

Based on Square of 9 calculations:

0 Degree: ~1166

45 Degree (Observed Normal Capacity): ~1183

In intraday analysis, the 45-degree level often represents the stock’s normal price expansion range under typical market conditions.

⏱️ Price & Time Interaction (Observed Behavior)

Price reached the 45-degree level early in the session (around the second 15-minute candle).

Completion of the normal price capacity well before the later part of the trading day has historically shown temporary price pressure.

After interacting with this zone, the market displayed rejection behavior followed by short-term downside expansion.

This aligns with a commonly observed Gann concept:

Early completion of expected price capacity may increase the probability of a reaction.

📘 Educational Takeaways

Gann Square of 9 helps define logical intraday price limits

Normal (45-degree) reactions occur more frequently than exceptional cases

Combining price structure with time context improves market clarity

Small deviations around calculated levels are part of normal market behavior

This approach supports rule-based observation, not prediction

📌 Shared strictly for educational and historical chart-study purposes.

Axis Bank | Gann Square of 9 Intraday Study (Normal Case)Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 13 November 2024

Time Frame: 15-Minute Chart

This post documents a historical intraday observation using the Gann Square of 9, focusing on how normal price movement capacity interacts with time to highlight potential reaction zones.

📊 Initial Market Structure

Axis Bank showed upward momentum from the first 15-minute candle.

The low of the opening candle (~1148) was treated as the 0-degree reference level, following standard Square of 9 practice.

This reference point acts as the base for mapping the day’s expected upward vibration.

Correct identification of the 0-degree is essential for meaningful Square of 9 observations.

🔢 Gann Square of 9 Level Mapping

Based on Square of 9 calculations:

0 Degree: ~1148

45 Degree (Observed Normal Capacity): ~1165

In intraday studies, the 45-degree level often represents a stock’s normal price expansion range under regular market conditions.

⏱️ Price & Time Interaction (Observed Behavior)

Price reached the 45-degree level early in the session (around the second 15-minute candle).

Completion of the normal price capacity well before the later part of the trading day has historically shown temporary price pressure.

After interacting with this zone, the market displayed rejection behavior and short-term downside expansion.

This reflects a commonly observed Gann principle:

Early completion of expected price capacity can increase the probability of a reaction.

📘 Key Educational Takeaways

Square of 9 helps define logical intraday price limits

Normal (45-degree) reactions occur more frequently than rare cases

Combining price structure with time context improves clarity

The method supports rule-based observation, not prediction

Small variations around levels are part of normal market behavior

📌 Shared purely for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #TechnicalAnalysis #PriceTime

Axis Bank | Intraday Price Behaviour Using Square-Based GeometryDisclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered adviser. This is not financial advice.

Educational Case Study | 7 February 2025

This idea presents an educational intraday case study on Axis Bank, focusing on how price movement capacity and time awareness can be observed using square-based geometric methods commonly referenced in classical market studies.

The purpose of this post is to study historical chart behavior, not to suggest trades or outcomes.

📊 Chart Context

Instrument: Axis Bank Ltd. (NSE)

Date: 7 February 2025

Timeframe: 15-minute (Intraday)

During the early part of the session, Axis Bank showed strong downward momentum. A structured framework was applied to observe how price behaved relative to predefined reference levels as the session progressed.

🔍 Observational Framework

The initial high of the session was treated as a reference point (around 1024.45)

From this reference, square-based projections were observed

A level near 1008 aligned with a 45-degree projection, often associated with normal intraday price reach in historical studies

This level was treated as a potential reaction zone, not a guaranteed support

All levels were used strictly as areas of observation.

📈 Observed Market Behavior

Price moved toward the projected zone during the morning session

Near this area, the market showed temporary pressure and a short-term response

The behavior aligned with previously observed historical interactions around similar geometric zones

Time context was noted as part of the observation, without implying causation

No trade execution, direction, or performance outcome is implied.

📘 Educational Insights from This Case

Square-based geometry can help outline normal intraday price movement capacity

Certain projected levels may act as areas where price behavior changes

Time awareness can provide additional context when studying intraday charts

This approach emphasizes structure and observation over indicators or predictions

All insights are based on historical chart study only.

📌 Important Note

This case study is shared strictly for learning and research purposes.

Geometric levels and time windows do not guarantee outcomes and should be treated as contextual analytical tools.

Market responses may include:

Temporary pauses

Short-term pressure

Continuation or expansion depending on broader structure

🚀 Summary

This intraday case study demonstrates how price geometry and time alignment can be used to observe market behavior in a structured and objective manner.

More educational chart studies will follow.

Automotive Axles - ATH Breakout - Investment Ideas#Automotive Axles Limited - Technical Analysis

Current Price: 1,790.80

#Breakout & Retest = Opportunity

#Technical Setup

Strategy: Swing to Short Term Trade

✅ **ATH Breakout + Retest** - Successfully retested breakout zone

✅ **Higher High Formation** - Clear uptrend structure

✅ **EMAs Sorted** - Bullish alignment confirmed

✅ **Trendline Breakout** - Long-term resistance conquered

#Key Levels

Support: 1,520 (Tight SL) | 1,504 (Major support)

Swing Targets:

- T1: 2,078

- T2: 2,189

- T3: 2,284

Short-Term Targets:

- T1: 2,546

- T2: 2,800

- T3: 2,933

- Grand T4: 3,125

#tradesetup

Entry: Current levels (1,790 - 1,800)

Stop Loss: 1,520 (daily closing basis)

Risk-Reward: 1:3+ (excellent)

Timeframe: 2-6 months

Disclaimer: For educational purposes only. Not investment advice. Trading involves substantial risk. Consult a SEBI-registered financial advisor before making investment decisions. Past performance doesn't guarantee future results.

#AutomotiveAxles #SwingTrading #BreakoutTrading #TechnicalAnalysis #NSE #AutoStocks #ShortTermTrading #StockMarket #ATHBreakout #IndianStocks

If You Want to Catch the Bottom, First Wait for RSI.To Do Nothing.

Right now, staying out is already a win.

The market is moving fast, noisy, and uncomfortable. Both buyers and sellers are getting trapped — not because direction is unclear, but because the market has not finished its process yet.

This is a moment to stay calm and observe, not to force a trade.

Observe how price begins to slow down.

Observe how selling pressure fades.

Note:

Stay focused on RSI behavior. When price decelerates and RSI shows clear convergence / stabilization, that’s when it makes sense to start thinking about potential long ideas — not before.

Until then, observation comes first.

Sometimes, doing nothing is the most disciplined decision you can make.

Gold ATH after FOMC: Reaction or New Wave?Before the FOMC meeting, the market shared the same question:

would gold rally ahead of the meeting and then face a sharp sell-off afterward, or continue breaking higher and extend the trend?

After the FOMC, the Fed kept interest rates unchanged — which was not a surprise.

What really mattered was the Fed’s tone, and Powell clearly chose a balanced stance:

neither too dovish nor too hawkish.

More importantly, the Fed has effectively ruled out further rate hikes, while still maintaining a high interest-rate environment.

As a result, gold did not experience a heavy sell-off after the FOMC, and continues to hold its structure near the highs.

At this stage, market focus is shifting toward external risk factors:

The risk of a U.S. government shutdown

U.S.–Iran tensions

Ongoing trade war risks with major partners

Questions surrounding the independence of the Fed

👉 The current macro backdrop is not bearish for gold.

👉 SELL setups are reactionary, not the core narrative of the trend.

⏱️ H1 Observation Range

Lower bound: 5,415

Upper bound: 5,600

Price is consolidating near the highs with a wide range and may gradually push toward higher round-number levels.

🟢 Support / BUY zones

5,505 – 5,410 – 5,310 – 5,250 – 5,100

🔴 Resistance / Key observation zones

5,660–5,665 – 5,700 – 5,800 – 6,000

🧠 Primary scenario

Wide volatility → risk management is key.

SELLs are only short-term reactions at resistance.

BUY pullbacks to support to ride the broader move, not to pick the top.

⚠️ Key notes for the current phase

Reading the chart is a skill.

Reading the Fed is a strategy.

Reading Trump’s statements is survival.

Markets don’t reward being right —

they reward discipline and alignment with the trend.

👉 SELL to react — BUY to stay in the game.

📌 Follow me to track macro scenarios, key price levels, and the ongoing journey of finding opportunities in the market.

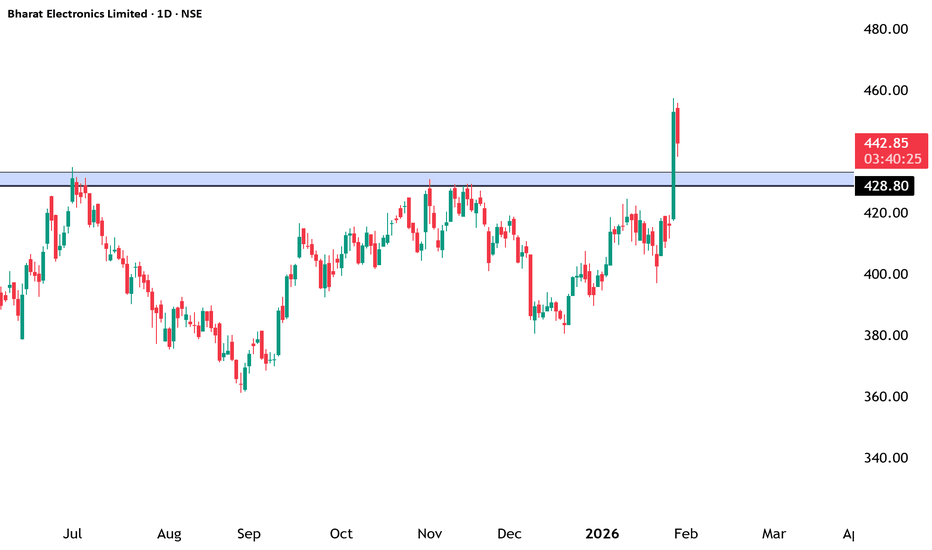

Bharat Electronics Ltd (BEL) – Bullish Structure BreakoutNSE:BEL

🔹 Technical View

Price has decisively broken above a major supply / resistance zone (~₹428–432) after multiple rejections in the past.

Strong bullish momentum candle indicates institutional participation and demand dominance.

Previous resistance now likely to act as strong support on any pullback.

Structure shows higher highs & higher lows, confirming an ongoing uptrend.

Immediate levels to watch:

Support: ₹428–420

Upside potential: ₹460 → ₹480 (positional)

🔹 Volume & Price Action

Breakout supported by healthy volume expansion, validating the move.

No major selling pressure visible near breakout zone so far.

🔹 Fundamental View

BEL is a Navratna PSU and a key player in defence electronics.

Strong order book driven by:

Defence modernization

Indigenous manufacturing (Make in India / Atmanirbhar Bharat)

Consistent revenue visibility, healthy margins, and improving ROE.

Virtually debt-free balance sheet adds financial stability.

🔹 Future Growth Prospects

Long-term beneficiary of India’s rising defence spending.

Increasing focus on:

Radar systems

Electronic warfare

Missile & naval electronics

Export opportunities and private-defence collaboration act as additional growth triggers.

Well-positioned for sustainable compounding over the next few years.

🔹 Conclusion

Technically strong breakout + fundamentally robust business.

Suitable for positional & long-term investors on dips near support.

Trend remains bullish as long as price sustains above ₹420–428 zone.

==============

⚠️ Disclaimer:

==============

This content is shared strictly for educational and informational purposes.

We are not SEBI-registered investment advisors or analysts.

The views expressed are personal opinions, based on publicly available data and market observations.

Please consult a SEBI-registered investment advisor before taking any investment or trading decisions.

Any actions taken based on this content are entirely at your own risk and responsibility.

========================

Trade Secrets By Pratik

========================

Gold at ATH before FOMC shakeout first or straight breakout?🧭 Macro Snapshot

Donald Trump maintains a hardline stance, increasing military presence in the Middle East → geopolitical risk remains elevated.

Tonight’s key focus: Federal Reserve

Political pressure and questions around Fed independence.

DXY continues to weaken, retesting major historical support (2020–2022) → supportive for gold.

👉 Conclusion: Geopolitics + a weaker USD set the bullish bias, while the Fed determines short-term volatility.

📊 Intraday Range to Watch

Upper range: 5,280 – 5,305

Lower range: 5,190 – 5,160

→ High probability of range trading and liquidity absorption ahead of the Fed decision.

🟢 Support

5,220–5,225 | 5,150–5,165 | 5,080–5,085 | 5,050–5,060

🔴 Resistance

5,280–5,294 | 5,300 | 5,315 | 5,380–5,385

⚠️ Strategy Notes

Expect possible fake moves / stop hunts within the range.

Avoid chasing highs or catching tops without confirmation.

Focus on price reaction at key levels and stay disciplined.

Summary: Gold is fundamentally supported, but today the key is how price reacts within 5,160–5,305.

Be patient — wait for confirmation — trade the reaction.