Gold Pulls Back as Expected, Long-Term Buying Opportunity Ahead🟡 XAUUSD 24/07 – Gold Pulls Back as Expected, Long-Term Buying Opportunity Ahead

🧭 Market Overview

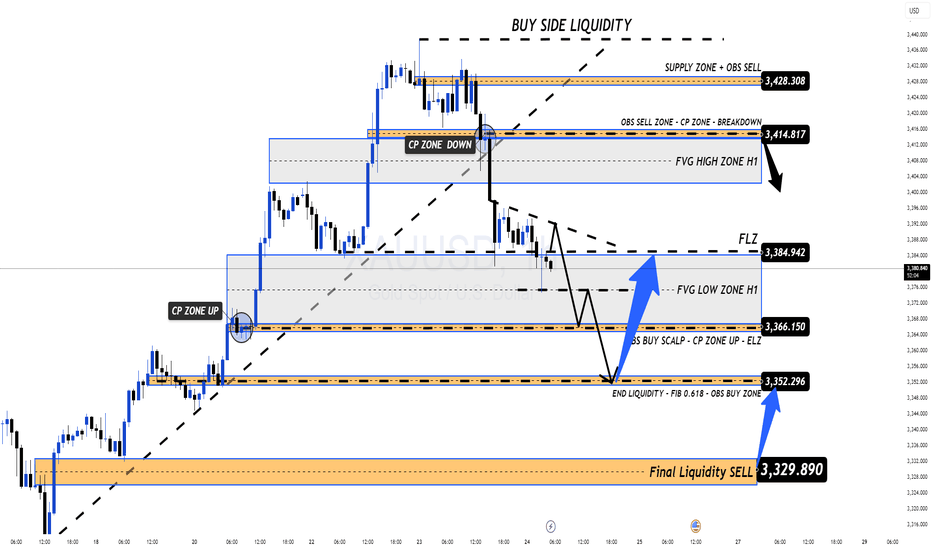

Gold dropped sharply from the 343x area, exactly as anticipated, after breaking the rising channel on the H1 chart and starting to sweep liquidity zones below.

Key factors influencing price action today:

Global markets are awaiting the final outcome of US-EU-China tariff negotiations.

Focus now shifts to next week’s FOMC meeting, where talks of potential rate cuts are intensifying.

Tonight’s PMI and Jobless Claims from the US could introduce unexpected volatility.

📊 Technical Outlook

While the broader trend remains bullish on D1 and H4 timeframes, the short-term H1 chart shows a clear break in structure. Price is currently exploring key FVG zones and OBS levels below.

If these liquidity zones are fully filled, it could set up a highly attractive long-term BUY opportunity, especially as markets price in future Fed rate cuts.

🎯 Today’s Trading Strategy

📌 Short-Term SELL Opportunity

→ Look for early entries at resistance zones, but only with proper confirmation.

📌 Long-Term BUY Setup

→ Target strong technical confluences at deeper levels. Be patient — focus on clean RR setups, don’t rush into early longs.

🔎 Key Price Levels to Watch

🔺 Resistance Zones (Above):

3393 – 3404 – 3414 – 3420 – 3428

🔻 Support Zones (Below):

3375 – 3366 – 3352 – 3345 – 3330

🔽 Trade Scenarios

✅ BUY ZONE: 3352 – 3350

SL: 3345

TP: 3356 → 3360 → 3364 → 3370 → 3375 → 3380 → 3390 → 3400

🔻 SELL ZONE: 3414 – 3416

SL: 3420

TP: 3410 → 3406 → 3400 → 3395 → 3390 → 3380

⚠️ News Alert

Stay cautious with tonight’s US PMI and Jobless Claims releases — these could cause sharp spikes.

✔️ Use proper SL/TP

✔️ Avoid emotional trades

✔️ Let structure confirm before entries

📣 From MMF Team – Trade Smarter Together

If you find this analysis helpful and want more daily trading plans like this:

👉 Follow the MMF channel right here on TradingView — we deliver real, actionable market strategies, not just generic analysis.

🎯 Updated daily. Straight from the charts. Built for traders.

Intradayanalysis

Trent - Best Intraday stocks for tomorrow 14 Oct 2024 Trent has outperformed Nifty in past days and there is high probability of continuation of its performance.

So for tomorrow in my opinion it will be best for intraday trading but when to trade?

Condition 1- If price falls or opens gapdown then it will best to buy after support creation.

Condition 2- if opens flat or Little gapdown and moves upside towards previous trading sessions resistance then, price should take a halt at resistance levels then it will be good opportunity to buy at resistance break.

Condition 3- if price opens Gapup and creates a selling swing and test previous trading sessions resistance (which may act as a support) then after creating support or W PATTERN price will bounce

Nifty intraday movmentif price sustain above 16230 look for buy side up to 16485

if any 15min candle successfully closes below the level 16230 then look for sell side

once price touches 16485 wait a little and watch.. is price sustaining above this level if not you can look for small correction from 16485

PVR Intraday SetupPVR is moving in a channel on a 30m, 1hr & 2hr timeframe.

It gave and breakdown of channel but then moved up back into the channel with momentum.

Inverted H&S pattern can be seen on place of breakdown.

Buy if you see a momentum.

Targets mentioned in the chart above as horizontal line on the right.

AXIS BANK INTRADAY SETUP FRIDAYAxis Bank simple price-action trade setup for Friday 23 July, if global markets remain bullish tomorrow, can expect good upside momentum.

Keep Trading simple as much as you can.

If you like my trading setups, please give me follow back and hit like button. It really motivates me in analyzing more and more charts for you guys.

Thanks