Intradaytrading

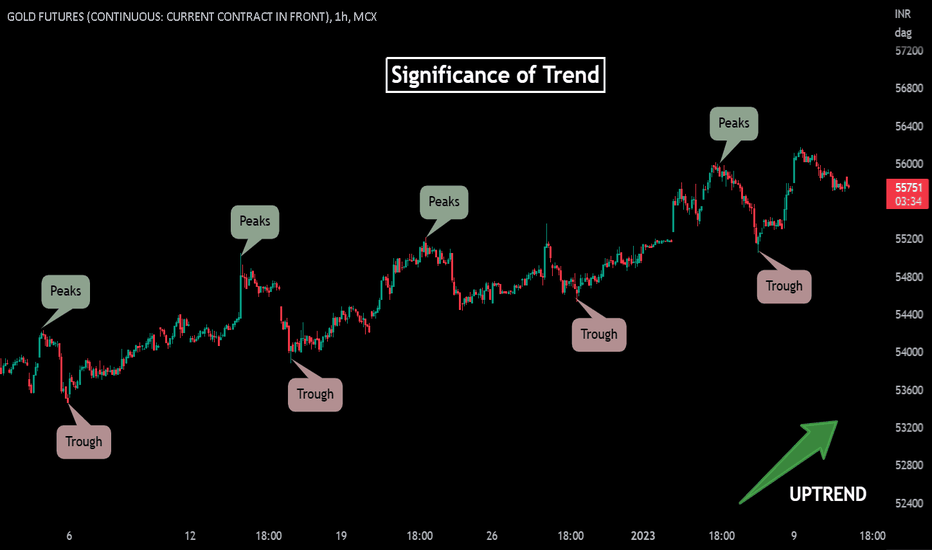

Trend Analysis and its Characteristics.MCX:GOLD1!

What is Trend and how to identify it?

A trend is the overall direction of a market or an asset's price.

an uptrend is defined using peak and trough analysis. An uptrend is represented by a series of successively higher highs (peaks) and lows (troughs), while a downtrend is represented by a series of successively lower highs and lows.

->One can identify it by determining peaks and troughs.

->By using trendlines

->Price remaining above or below an overlay indicator.

we can quickly identify the general direction of a market or an asset by looking at the price chart but what we have to learn is to identify the quality of the current trend and how we can do that, by gauging the strength of the trend.

Here are some significant points which help us in understanding the mood and quality of a trend.

The highest skill any trader can aspire to is the ability to read pure price action.

1. Cycle Amplitude

Look for decreasing cycle amplitude in uptrends and downtrends.

A decrease in cycle amplitude in an uptrend is an early indication that there may potentially be an underlying weakness in the uptrend.

In a similar fashion, a decrease in cycle amplitude in a downtrend is regarded as a bullish indication.

2. Cycle Period

A gradual reduction in the cycle period during an uptrend is an early indication that there may potentially be an underlying weakness in the uptrend and a gradual reduction in the cycle period during the downtrend is a bullish indication.

3.Average Bar Range

A decrease in the average bar range in an uptrend and downtrend is an early indication of potential weakness in the current trend.

-> you can track the bar range using the average true range (ATR) oscillator

4.Bar Retracement Symmetry

A change in the number of bars in a retracement is also an early indication of a potential change in trend behaviour.

5. Average Candlestick Real Body to Range Ratio

A gradual decrease in the real body to candlestick range is also an early indication of potential weakness in a Trend.

6. Angular Symmetry and Momentum

Any change in the Angle of trend is significant:-

i.) An upside acceleration in price is bullish whereas an upside deceleration in price is bearish

ii.) A downside acceleration in price is bearish whereas a downside deceleration in price is bullish.

#It should be noted that although an upside acceleration in price is bullish, the uptrend may not be self‐sustaining if the rate of ascent was excessive. Such rapid increases in price usually end in a blow-off or buying climax with prices subsequently collapsing. Similarly, downside acceleration in prices may also end in a selling climax.

7. Frequency and Depth of Trend-Based Oscillations

When a trend moves with reasonable retracements not too short and not too big, it indicates a healthy trend which has profit taking along the way as the trend unfolds.

Traders and investors tend not to react as emotionally and irrationally at higher prices where the risk of losing pent‐up and unrealized profit is greater.

8.Relative Measure of Consolidation Size and Duration

Trend interruptions are more significant if:

■ Price formations are of greater magnitude (taller chart patterns).

■ Price formations develop over a longer period (wider chart patterns).

Larger trend interruptions normally tend to lead to a greater probability of a reversal. In a strong uptrend, a larger head and shoulders formation would be deemed more bearish than a smaller formation. Similarly, a larger rounding bottom formation would be more bullish than a smaller one in a downtrend.

In short, size takes precedence over form. Moreover, the longer it takes for a consolidation to unfold, the greater will be its disruptive power with respect to the trend, should a reversal occur.

By considering these characteristics while analysing trend will give a in depth insight and helps in making more informed and rational decisions.

I Hope you found this helpful.

Please like and comment.

Keep Learning,

Happy Trading!

TRIVENI TURBINE - DAY CHART - 07.01.2023 - BAHAVAN CAPITALTRIVENI TURBINE as per Day Chart Analysis Stock

ABOVE 256 TARGET 260

Three consecutive days market fall due to increased selling pressure by FII Net selling 2902.46 Cr and DII Net Buying at 1083.17 Cr.

Monday Nifty may take a support at 17771 and Bank Nifty may take a support at 41677 then form a bullish or an inside bar candle.

So next week onwards market may move upwards due to quartely results announcement of various companies like TCS, HCL, WIPRO, INFOSYS etc...

Happy Weekend...

MOREPEN LABORATORIES - DAY CHART - 24.12.2022 - BAHAVAN CAPITALMOREPEN LABORATORIES posted on 22.12.2022 ABOVE 38.20 TARGET 40.20 and TARGET HIT on 23.12.2022 Stock made a high of 43.70 and closed at 42.65.

New Target for 26.12.2022

Stock ABOVE 44 TARGET 46.

Though DII been in selling spree but DII Buying had been highly to be noted

DATE FII DII

21.12.2022 1119.11 cr (Net Selling) 1757.37 cr (Net Buying)

22.12.2022 928.63 cr (Net Buying) 2206.59 cr (Net Buying)

23.12.2022 706.84 cr (Net Selling) 3398.98 cr (Net Buying)

Happy Profitable Trading to All.....

TATA MOTORS - DAY CHART - 12.12.2022 - BAHAVAN CAPITALTATA MOTORS as per Day Chart Analysis have chances to move uptrend Stock ABOVE 418 TARGET 423.

As such Nifty is in Downtrend Mode up to 18325 to create fresh demand and Bank Nifty is in Uptrend Mode.

So trade carefully for this week.

Happy Profitable Trading to All.

JSW ENERGY - DAY CHART - 12.12.2022 - BAHAVAN CAPITALJSW ENERGY as per Day Chart Analysis have chances to move uptrend Stock ABOVE 300 TARGET 305.

As such Nifty is in Downtrend Mode up to 18325 to create fresh demand and Bank Nifty is in Uptrend Mode.

So trade carefully for this week.

Happy Profitable Trading to All...

STATE BANK OF INDIA - DAY CHART - 12.12.2022 - BAHAVAN CAPITALSTATE BANK OF INDIA as per Day Chart Analysis have chances to move uptrend Stock ABOVE 620 TARGET 623.

As such Nifty is in Downtrend Mode up to 18325 to create fresh demand and Bank Nifty is in Uptrend Mode.

So trade carefully for this week.

Happy Profitable Trading to All...

DEVYANI INTERNATIONAL - DAY CHART - 12.12.2022 - BAHAVAN CAPITALDEVYANI INTERNATIONAL as per Day Chart Analysis have chances to move uptrend Stock ABOVE 191 TARGET 194.

As such Nifty is in Downtrend Mode up to 18325 to create fresh demand and Bank Nifty is in Uptrend Mode.

So trade carefully for this week.

Happy Profitable Trading to All...

TATA MOTORS - DAY CHART - 12.12.2022 - BAHAVAN CAPITALTATA MOTORS as per Day Chart Analysis have chances to move uptrend Stock ABOVE 418 TARGET 423.

As such Nifty is in Downtrend Mode up to 18325 to create fresh demand and Bank Nifty is in Uptrend Mode.

So trade carefully for this week.

Happy Profitable Trading to All.

ICICI BANK - DAILY CHART - 08.12.2022 - BAHAVAN CAPITALICICI BANK as per day Chart Analysis Stock ABOVE 933 TARGET 940

FII Net selling at 1131.67 Cr and DII Net Buying at 772.29 Cr. As such FII are in selling mode and need to wait watch for next week.

Had Posted on 07.12.2022 for the stocks HIKAL, FACT, GUJARAT AMBUJA EXPORTS, GOKUL AGRO RESOURCES & ITC and among these ITC never went to our entry price and rest all stocks have HIT the TARGET. Iam glad most of the targets had showed good movement.

Happy Profitable trading to all...

BANK OF BARODA - DAY CHART - 08.12.2022 - BAHAVAN CAPITALBANK OF BARODA as per Day Chart Analysis Stock ABOVE 192 TARGET 196

FII Net selling at 1131.67 Cr and DII Net Buying at 772.29 Cr. As such FII are in selling mode and need to wait watch for next week.

Had Posted on 07.12.2022 for the stocks HIKAL, FACT, GUJARAT AMBUJA EXPORTS, GOKUL AGRO RESOURCES & ITC and among these ITC never went to our entry price and rest all stocks have HIT the TARGET. Iam glad most of the targets had showed good movement.

Happy Profitable trading to all...

HIKAL - DAY CHART - 08.12.2022 - BAHAVAN CAPITALHIKAL posted on 07.12.2022 Stock ABOVE 394 TARGET 404. Today 08.12.2022 Stock Made a high 404 and closed at 393.

TARGET HIT

FII Net selling at 1131.67 Cr and DII Net Buying at 772.29 Cr. As such FII are in selling mode and need to wait watch for next week.

Had Posted on 07.12.2022 for the stocks HIKAL, FACT, GUJARAT AMBUJA EXPORTS, GOKUL AGRO RESOURCES & ITC and among these ITC never went to our entry price and rest all stocks have HIT the TARGET. Iam glad most of the targets had showed good movement.

Happy Profitable trading to all...

GUJARAT AMBUJA EXPORTS -DAY CHART - 08.12.2022 - BAHAVAN CAPITALGUJARAT AMBUJA EXPORTS posted on 07.12.2022 Stock ABOVE 259 TARGET 266. Today 08.12.2022 Stock Made a High 267 and Closed at 262.

TARGET HIT

FII Net selling at 1131.67 Cr and DII Net Buying at 772.29 Cr. As such FII are in selling mode and need to wait watch for next week.

Had Posted on 07.12.2022 for the stocks HIKAL, FACT, GUJARAT AMBUJA EXPORTS, GOKUL AGRO RESOURCES & ITC and among these ITC never went to our entry price and rest all stocks have HIT the TARGET. Iam glad most of the targets had showed good movement.

Happy Profitable trading to all...

GUJARAT AMBUJA EXPORTS -DAY CHART - 07.12.2022 - BAHAVAN CAPITALGUJARAT AMBUJA EXPORTS as per Day Chart Analysis Stock ABOVE 259 TARGET 266.

Today 07.12.2022 Again FII Net selling continue to 1241.87 Cr and DII Net Buying at 388.85 Cr.

There is a Possibility for Nifty to touch 18425 Level. So lets wait and watch...

Happy Profitable Trading to All...

GOKUL AGRO RESOURCES - DAY CHART - 07.12.2022 - BAHAVAN CAPITAL GOKUL AGRO RESOURCES as per day chart analysis Stock ABOVE 139 TARGET 145.

Today 07.12.2022 Again FII Net selling continue to 1241.87 Cr and DII Net Buying at 388.85 Cr.

There is a Possibility for Nifty to touch 18425 Level. So lets wait and watch...

Happy Profitable Trading to All...

HIKAL - DAY CHART - 07.12.2022 - BAHAVAN CAPITALHIKAL as per Day Chart Analysis Stock ABOVE 394 TARGET 404.

Today 07.12.2022 Again FII Net selling continue to 1241.87 Cr and DII Net Buying at 388.85 Cr.

There is a Possibility for Nifty to touch 18425 Level. So lets wait and watch...

Happy Profitable Trading to All...

ITC - DAY CHART - 07.12.2022 - BAHAVAN CAPITALITC as per Day Chart Analysis Stock ABOVE 345 TARGET 348.

Today 07.12.2022 Again FII Net selling continue to 1241.87 Cr and DII Net Buying at 388.85 Cr.

There is a Possibility for Nifty to touch 18425 Level. So lets wait and watch...

Happy Profitable Trading to All...

POWER FINANCE CORPORATION - DAY CHART - 07.12.2022POWER FINANCE CORPORATION posted on 04.12.2022 Stock ABOVE 140 TARGET 142. Today Stock made a high 143 and closed at 142.

TARGET HIT

Today 07.12.2022 Again FII Net selling continue to 1241.87 Cr and DII Net Buying at 388.85 Cr.

There is a Possibility for Nifty to touch 18425 Level. So lets wait and watch...

Happy Profitable Trading to All...