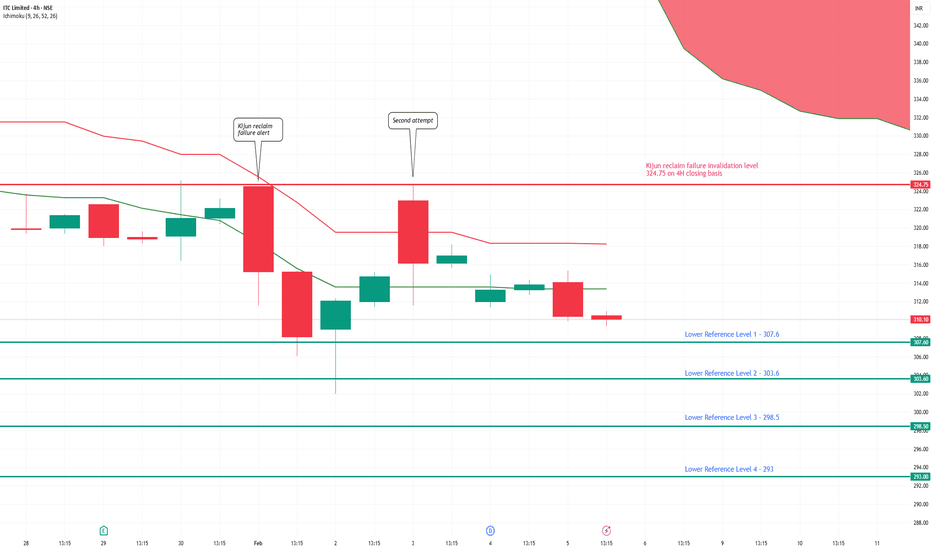

ITC 4H Kijun Failure: Is the Downtrend Louder Than the Dividend?The dividend adjustment is complete — price action now carries the final verdict .

On the 4H chart, ITC attempted a Kijun reclaim but failed to gain acceptance. The probe above equilibrium was sold into, followed by compression and a delayed but decisive close back below Kijun. Weekly price action remains under the Kumo , keeping HTF bias firmly bearish.

As long as price fails to close above 324.75 on a 4H basis (high of the reclaim attempt), the bearish structure remains intact.

Downside reference zones: 307.6 → 303.6 → 298.5 → 293.0

Bottom line:

The dividend narrative has faded. The structure hasn’t.

ITC

ITC - WyckoffITC – Weekly Wyckoff Distribution (Schematic #2) in Play

ITC’s weekly structure appears to be unfolding as a Wyckoff Distribution – Schematic #2, suggesting a transition from demand dominance to supply control.

Key observations from the chart :

Preliminary Supply (PSY) marked the first sign of large supply entering after a strong uptrend.

Buying Climax (BC) followed by an Automatic Reaction (AR) confirmed the start of a trading range.

Secondary Test (ST) failed to make new highs, indicating weakening demand.

Upthrust (UT) and subsequent Lower Highs (LPSY) signal repeated absorption of demand by smart money.

Recent breakdown below the range indicates Sign of Weakness (SOW) and confirms Phase D/E behavior.

📉 Implication:

The structure favors distribution completion, with risk skewed to the downside unless price reclaims the prior range convincingly.

📌 Key levels to watch:

Breakdown area as resistance

Major demand zone near ₹277–₹262 (weekly support)

This is a reminder that time spent at the top often precedes the move down.

ITC Limited - EW AnalysisITC Limited Complete analysis in EW theory now in correction phase of super cycle degree expected correction minimum fib retrace of wave1 38.2 % (Super cycle degree) already 30% over so expected reversal possible at 320-280 price level good opportunity for long term Investors and traders

ITC – Sell on Rise | Major Support Zone Ahead📉 ITC – Sell on Rise | Major Support Zone Ahead

Stock: ITC Ltd

Timeframe: Daily

Trend: Bearish (Short-term)

🔍 Technical Analysis

ITC has decisively broken all major support levels, indicating a clear shift in market structure from sideways to bearish. The recent breakdown is accompanied by weak price action, suggesting sellers are in control on rallies.

Post breakdown, the stock is now below key moving averages and struggling to reclaim lost support zones, confirming a sell-on-rise structure.

🔻 Trend Structure

Breakdown of multiple supports

Lower highs formation on daily timeframe

Pullbacks likely to face selling pressure

🔻 Volume Behavior

Breakdown occurred with expanding volumes

Indicates distribution, not panic selling

Any bounce without volume likely to fail

🟢 Strong Buy Support Zone (High Probability Demand Area)

📍 ₹280 – ₹295 zone

This zone is technically important due to:

Fibonacci 0.50 retracement level

Anchored VWAP support

Prior price acceptance area

This zone is expected to act as a strong demand zone where buyers may attempt a reversal or consolidation.

🧠 Trading Plan

🔹 Sell on Rise

Look for rejection signals near broken supports

Avoid fresh longs above resistance until structure improves

🔹 Buy Only at Support

Aggressive longs only if strong price reaction is seen in ₹280–₹295 zone

Look for:

Bullish reversal candle

Volume expansion on bounce

Failure of price to sustain below VWAP

⚠️ Risk Management

Avoid positional longs until price reclaims key resistances

Keep strict stop loss below support zone if attempting counter-trend longs

This is a zone-based trade, not blind buying

📌 Conclusion

ITC remains bearish in the short term and is best approached with a sell-on-rise strategy. A meaningful buying opportunity may emerge only near the ₹280–₹295 strong support zone, supported by Fibonacci 0.50 and Anchored VWAP confluence.

📉 Trade the trend. Respect levels. Manage risk.

Possible support levels for ITCExpecting ITC to hit the mentioned levels for a potential reversal as RSI is sloping downwards and there is Negative news in market the mentioned levels can be used for potential long term investing but only after doing your own research, this is not a buy or sell recommendation

#ITC

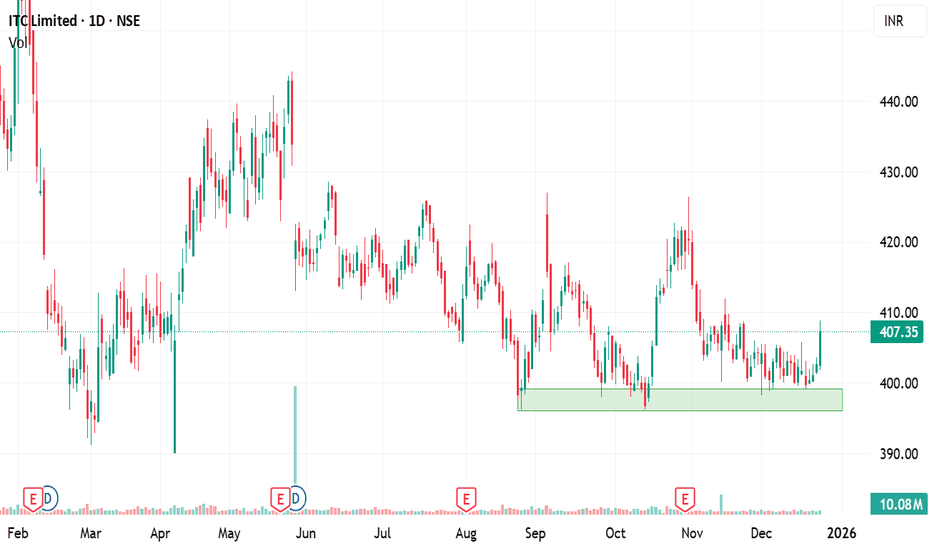

ITC – Technical SetupITC is showing a strong technical structure near the ₹400–₹395 zone, which is acting as a solid support area on the charts. The stock has tested this zone multiple times and has managed to hold, indicating strong demand at lower levels.

Over the last several sessions, ITC was trading in a tight consolidation range, reflecting accumulation. Today’s close above this multi-day consolidation is a positive sign and suggests a potential breakout, with momentum now shifting in favor of the bulls.

The price action indicates that buyers are gaining control, and as long as ITC sustains above the breakout level and the support zone remains intact, the setup looks favorable for an upside move.

Trade Plan:

Buy: As close as 395

Stop Loss: ₹395

Target: ₹425

A close below ₹395 would weaken the structure, so strict stop-loss discipline is advised.

Trade with proper risk management.

NTPC 1D Time frameCurrent Snapshot

Current Price: ₹340.25

52-Week High: ₹447.75

52-Week Low: ₹292.80

Strategy & Outlook

Bearish Bias: The stock is in a short-term downtrend with negative momentum indicators.

Selling Opportunity: Consider selling near resistance zones (₹343–₹345) with a target towards ₹335–₹340.

Risk Management: Place stop-loss orders above the resistance levels to manage potential upside risks.

LT 1D Time frameCurrent Snapshot

Current Price: ₹3,670.30

52-Week High: ₹3,963.50

52-Week Low: ₹2,965.30

Strategy & Outlook

Bullish Bias: The stock is in a short-term uptrend with positive momentum indicators.

Buying Opportunity: Consider entering near support zones (₹3,600–₹3,650) with a target towards ₹3,700–₹3,750.

Risk Management: Place stop-loss orders below the support levels to manage potential downside risks.

BHARTIARTL 1D Time frameCurrent Price: ~₹1,867

52-Week High: ~₹2,045

52-Week Low: ~₹1,511

Explanation

At ₹1,867, Airtel is just above immediate support (₹1,840–1,850).

If buyers hold this support, stock may bounce back toward ₹1,900+.

But if ₹1,840 breaks, then downside may open toward ₹1,800–1,750.

For bulls, a clean breakout above ₹1,920–2,000 is needed for fresh rally.

BRITANNIA 1D Time frameCurrent Price: ~₹5,953.50

Day’s Range: ₹5,939.50 – ₹6,036.00

52-Week Range: ₹4,506.00 – ₹6,469.90

📏 Key Levels

Immediate Resistance: ~₹6,300

Next Resistance: ~₹6,470 (52-week high)

Immediate Support: ~₹5,800

Next Supports: ~₹5,600 and ₹5,300

🧠 Insights

If Britannia breaks above ₹6,300 with volume, it may push toward ₹6,470+ (new highs).

If it fails to break resistance, expect sideways movement or a pullback toward ₹5,800.

A break below ₹5,800 would signal weakness and can drag it down toward ₹5,600–₹5,300 levels.

HDFCBANK 1D Time frameOpening Price: ₹950.30

Closing Price: ₹960.45

Day Range: ₹946.00 – ₹961.40

Previous Close: ₹950.30

🧠 Price Action Insights

The stock is trading below key moving averages, confirming the bearish trend.

No significant reversal pattern has formed, suggesting the downtrend may continue.

Watch for a breakout above ₹970.00 for a potential trend reversal.

HINDZINC 1D Time frameDay Range: ₹478.35 – ₹488.40

52-Week Range: ₹378.15 – ₹575.40

Volume: 284,459 shares traded

📉 Trend Analysis

The stock is in a downtrend, characterized by:

Lower highs and lower lows.

Failure to break above resistance levels.

The short-term trend remains bearish.

🔮 Conclusion

Hindustan Zinc is in a downtrend with weak momentum.

Break below ₹470.00 could lead to further decline toward ₹460.00.

Break above ₹495.00 would indicate a potential trend reversal.

HEROMOTOCO 1D Time frame📌 Current Status

Closing Price: ₹5,410

Day Change: –35 points (–0.64%)

Day’s High: ₹5,470

Day’s Low: ₹5,380

52-Week Range: ₹4,800 – ₹6,050

🔍 Chart & Price Action Insights

Price is moving sideways, bouncing between support and resistance.

Bulls are defending ₹5,380

Sellers resist above ₹5,470

Watch for a break above ₹5,470 for potential upward momentum

Break below ₹5,380 may trigger a short-term decline toward ₹5,330

ASIANPAINT 1D Time frameCurrent Price Snapshot

Current Price: ₹2,345.50

Day’s Range: ₹2,342.00 – ₹2,388.80

52-Week Range: ₹2,124.75 – ₹3,358.00

Technical Indicators

RSI (14-day): 44.19 — indicates a neutral to slightly bearish momentum.

MACD: -4.010 — suggests bearish momentum.

Moving Averages:

5-day: ₹2,396.00 — indicates a Sell signal.

50-day: ₹2,389.00 — indicates a Sell signal.

200-day: ₹2,350.00 — indicates a Neutral signal.

Technical Summary: Predominantly Sell signals across various indicators.

Summary

Above ₹2,388.80: Potential rise toward ₹2,400 – ₹2,420.

Below ₹2,342.00: Potential fall toward ₹2,320 – ₹2,300.

Between ₹2,300 – ₹2,380: Likely range-bound movement.

ICICIBANK 1D Time frame₹1,345.80 (NSE)

Day’s Range: ₹1,342.60 – ₹1,356.60

52-Week Range: ₹1,186.00 – ₹1,500.00

📉 Technical Overview

Trend: The stock is trading below its 200-day moving average, indicating a mildly bearish trend.

RSI: Currently at 26.6, suggesting the stock is in the oversold zone.

MACD: At -10.01, reinforcing the bearish momentum.

Moving Averages: A strong sell signal is indicated, with 0 buy signals and 12 sell signals across various timeframes.

🔼 Potential Upside (Rise)

Immediate Resistance: ₹1,355 – ₹1,365

Breakout Target: Above ₹1,365, the next resistance is around ₹1,380 – ₹1,390.

Bullish Confirmation: A close above ₹1,390 could signal a reversal or consolidation.

🔽 Potential Downside (Fall)

Immediate Support: ₹1,340 – ₹1,330

Breakdown Target: Below ₹1,330, the stock may test ₹1,310 – ₹1,300.

Bearish Confirmation: A close below ₹1,300 would strengthen the bearish outlook.

✅ Summary

Above ₹1,365: Potential rise toward ₹1,380 – ₹1,390.

Below ₹1,330: Potential fall toward ₹1,310 – ₹1,300.

Between ₹1,330 – ₹1,365: Likely range-bound movement.

TATAMOTORS 1D Time frameCurrent Market Snapshot

Current Price: ₹675.60

Opening Price: ₹684.00

Day’s Range: ₹673.00 – ₹685.00

Previous Close: ₹672.90

🔑 Technical Indicators

Relative Strength Index (RSI): 48.5 – indicating a neutral condition.

Moving Average Convergence Divergence (MACD): -3.20 – suggesting bearish momentum.

Moving Averages: Trading below the 50-day and 200-day moving averages, indicating a bearish trend.

📈 Key Support & Resistance Levels

Immediate Support: ₹673

Immediate Resistance: ₹685

Pivot Point: ₹679

📉 Market Sentiment

Trend: The stock is trading below its 50-day and 200-day moving averages, indicating a bearish trend.

Volume: Trading volume is higher than average, suggesting increased investor activity.

📈 Strategy (1D Timeframe)

1. Bullish Scenario

Entry: Above ₹685

Stop-Loss: ₹673

Target: ₹690 → ₹695

2. Bearish Scenario

Entry: Below ₹673

Stop-Loss: ₹685

Target: ₹665 → ₹660

⚠️ Risk Management

Limit risk to 1% of capital per trade.

Always use stop-loss to protect against unexpected market movements.

Monitor broader market trends and sector-specific news that may impact stock performance.

RELIANCE 1D Time frameCurrent Market Snapshot

Current Price: ₹1,383.30

Opening Price: ₹1,381.60

Day’s Range: ₹1,379.00 – ₹1,386.90

Previous Close: ₹1,377.60

🔑 Technical Indicators

Relative Strength Index (RSI): 49.76 – indicating a neutral condition.

Moving Average Convergence Divergence (MACD): -3.20 – suggesting bearish momentum.

Moving Averages: Mixed signals; trading slightly below the 50-day and 200-day moving averages, indicating a neutral to bearish trend.

📈 Key Support & Resistance Levels

Immediate Support: ₹1,379

Immediate Resistance: ₹1,387

Pivot Point: ₹1,383

📉 Market Sentiment

Recent Performance: Reliance Industries experienced a decline of 0.82% on September 25, 2025, underperforming the broader market.

Volume: Trading volume is higher than average, suggesting increased investor activity.

📈 Strategy (1D Timeframe)

1. Bullish Scenario

Entry: Above ₹1,387

Stop-Loss: ₹1,379

Target: ₹1,395 → ₹1,400

2. Bearish Scenario

Entry: Below ₹1,379

Stop-Loss: ₹1,387

Target: ₹1,370 → ₹1,365

⚠️ Risk Management

Limit risk to 1% of capital per trade.

Always use stop-loss to protect against unexpected market movements.

Monitor broader market trends and sector-specific news that may impact stock performance.

ITC 1D Time frame📊 Updated Snapshot

Current Price: ~₹405

Day Range: ₹402 – ₹410

52-Week High: ₹499

52-Week Low: ₹399

📈 Technical Outlook

Support Zones:

Strong support at ₹405 (current zone)

Next support at ₹398

Resistance Zones:

Immediate resistance at ₹410–₹416

Next resistance at ₹421

Trend Bias: Weak bearish → stock is near 52-week low, testing crucial support.

📌 Step-by-Step View

If it holds above ₹405–₹398: Buyers may step in, possible bounce toward ₹416–₹421.

If it breaks below ₹398: More downside risk opens, weakness can extend further.

Upside revival only above ₹421 closing: That will change trend toward bullish.

INFY 1D Time frameCurrent Zone: Around ₹1,448 – 1,450 (important support area).

Support Levels:

First support: ₹1,440 – ₹1,448

Next deeper support: ₹1,410 – ₹1,420

Resistance Levels:

Immediate resistance: ₹1,475 – ₹1,485

Strong resistance: ₹1,500 – ₹1,510

Trend Outlook:

Holding above ₹1,448 can trigger a short-term bounce.

Weakness below ₹1,440 may drag it toward ₹1,410.

A close above ₹1,485 would open upside toward ₹1,510+.

ICICIBANK 1D Time frameClosing Price: ₹1,363.00

Day's Range: ₹1,357.00 – ₹1,372.70

Previous Close: ₹1,375.80

Volume: 18,342,280 shares traded

Market Cap: ₹971,186 crore

52-Week High: ₹1,500.00

52-Week Low: ₹1,186.00

Face Value: ₹2.00

Beta: 0.90

🧾 Financial Highlights

P/E Ratio (TTM): 18.36

P/B Ratio: 3.12

EPS (TTM): ₹74.04

Dividend Yield: 0.81%

ROE: 17.05%

Book Value: ₹436.56

📈 Technical Insights

Trend: The stock is approaching its 200-day moving average, a key technical indicator. A bounce from this level could signal a buying opportunity, while a breakdown may suggest further downside risk.

Support Levels: ₹1,357.00, ₹1,350.00

Resistance Levels: ₹1,375.00, ₹1,400.00

📌 Key Takeaways

Recent Performance: ICICI Bank's stock declined by 0.91%, underperforming the broader market.

Analyst Sentiment: Despite recent volatility, ICICI Bank remains a top pick among analysts for long-term investment.

SENSEX 1D Time frameCurrent Snapshot

Closing / Current Level: ~ ₹ 80,426.46

Day’s Range: High ~ ₹ 81,033, Low ~ ₹ 80,332

Open: ~ ₹ 80,956

⚡ Strategy Thoughts

Bullish approach:

If it recovers above ~80,700 and holds, targets can be 81,000 → 81,300.

Bearish / defensive view:

If Sensex fails near 80,700–81,000, or breaks below ~80,300, downside toward 79,800 and lower comes into play.

Range play:

Between 80,300 and 80,700, you can trade both sides — buy near the bottom of the range, short near resistance — but use tight stops.

LT 1D Time frameClosing Price: ₹3,644.40

Day’s Range: ₹3,635.70 – ₹3,704.00

Previous Close: ₹3,657.60

Change: Down –0.80%

52-Week Range: ₹2,965.30 – ₹3,963.50

Market Cap: ₹5.13 lakh crore

P/E Ratio (TTM): 32.31

Dividend Yield: 0.93%

EPS (TTM): ₹112.81

Beta: 1.20 (indicating moderate volatility)

🔑 Key Technical Levels

Immediate Support: ₹3,635 – ₹3,640

Immediate Resistance: ₹3,700 – ₹3,710

52-Week High: ₹3,963.50

52-Week Low: ₹2,965.30

📈 Technical Indicators

RSI (14-day): 45.2 – indicating a neutral condition.

MACD: Negative, suggesting bearish momentum.

Moving Averages: Trading below the 50-day and 200-day moving averages, indicating a bearish trend.

📉 Market Sentiment

Recent Performance: L&T experienced a decline of 0.80% on September 25, 2025, underperforming the broader market.

Volume: Trading volume was significantly higher than its 20-day average, indicating increased investor activity.

📈 Strategy (1D Timeframe)

1. Bullish Scenario

Entry: Above ₹3,700

Stop-Loss: ₹3,635

Target: ₹3,750 → ₹3,800

2. Bearish Scenario

Entry: Below ₹3,635

Stop-Loss: ₹3,700

Target: ₹3,600 → ₹3,550

AXISBANK 1D Time frame📊 Daily Snapshot

Closing Price: ₹1,166.10

Day’s Range: ₹1,153.40 – ₹1,171.80

Previous Close: ₹1,158.80

Change: Up +0.28%

52-Week Range: ₹933.50 – ₹1,281.65

Market Cap: ₹3.59 lakh crore

P/E Ratio: 12.9

Dividend Yield: 1.2%

EPS (TTM): ₹90.00

Beta: 1.1 (moderate volatility)

🔑 Key Technical Levels

Immediate Support: ₹1,153.33

Immediate Resistance: ₹1,153.33

Weekly Outlook: Immediate support at ₹1,109.23; major support at ₹1,082.57; immediate resistance at ₹1,153.33; major resistance at ₹1,170.77.

📈 Analyst Insights

Intrinsic Value: Estimated at ₹1,511.77 based on median valuation models, suggesting the stock is trading below its fair value.

📈 Strategy (1D Timeframe)

1. Bullish Scenario

Entry: Above ₹1,153.33

Stop-Loss: ₹1,109.23

Target: ₹1,170.77 → ₹1,200.00

2. Bearish Scenario

Entry: Below ₹1,109.23

Stop-Loss: ₹1,153.33

Target: ₹1,082.57 → ₹1,050.00