HCLT - Buy - Technical Analysis#HCL Technologies Limited - Technical Analysis

Price: 1,683.00 |

#Trade Setup - Bullish Reversal

#Outlook

Strong bullish setup with 4-35% upside potential. The failed bearish head & shoulder pattern combined with monthly demand zone bounce suggests institutional accumulation. Breakout above 1,745 opens path to 1,951 and beyond.

Pattern Analysis:

1. Bounced from monthly demand zone - Strong support established

2. Made higher low in monthly chart - Trend reversal signal

3. Failed Bearish Head & Shoulders pattern - Bears trapped, bullish continuation

4. Breakout confirmed on weekly chart - Momentum shift

5. Typical double bottom formation - Classic reversal pattern

Technical Structure:

- Monthly higher low at 1,390 confirms bullish structure

- Failed H&S pattern invalidation is highly bullish

- Price now targeting previous resistance zones

Target Levels:

- Target 1: 1,745.00

- Target 2: 1,951.25

- Target 3: 2,272.70

Support: 1,572 - 1,551 (critical zone)

⚠️ DISCLAIMER

**NOT investment advice.** Educational analysis only. Trading involves substantial risk of loss. Past patterns don't guarantee future results. Always do your own research and consult a SEBI-registered financial advisor. Author assumes no responsibility for losses.

#HCLTech #StockMarket #NSE #TechnicalAnalysis #ITStocks #IndianStockMarket #SwingTrading #Trading #FinTwit #TradingView #ChartAnalysis #StocksToWatch #Nifty50 #TechStocks

Itsector

ITBEES Long The chart shows a simple story of how price and RSI are behaving together. The shaded boxes mark two past trade setups. In the first setup, price formed a bottom, RSI started rising from oversold levels, and after that the price moved up strongly. The second shaded box on the right shows a similar type of setup forming again. Price has bounced from the recent low and is now trying to move above the previous small consolidation.

The arrows on the RSI highlight two important points. Both arrows show moments where RSI started rising sharply from the lower zone, showing momentum coming back into the stock. When RSI moves up from the 40–45 area, it often signals early strength. This happened in the earlier rally and is happening again now. The rising volumes in the recent candles also support this move, indicating that buyers are becoming active.

Overall, the marking on the chart shows a possible repeat pattern: price forming a base, RSI turning up, and volumes increasing. This combination suggests that the stock may attempt another upward move if momentum continues.

DIXON Technologies - Swing Trade Analysis

#Dixon Technologies (India) Ltd. - Technical Analysis Report

Current Price:15,697.00

Timeframe: Weekly Chart Analysis

Market Structure Overview

Dixon Technologies is currently trading at 15,697, showing signs of potential #bullish #momentum after a period of #consolidation. The #stock has been forming a significant base pattern following its decline from #all-time highs near 18,177.

#Key Technical Levels

#Support Zones

- Primary Support: 13,800 - 14,311 (Conservative Stoploss zone)

- Secondary Support: 13,260 - 13,280

- Critical Support: 12,000 (major psychological level)

#Resistance Zones

- Immediate Resistance: 16,102 - 16,505

- Key Resistance 1: 17,445 (Target 1)

- Key Resistance 2: 19,148 (Target 2)

- Major Resistance: 20,866 - 22,000 (Target 3 & 4 zone)

#Chart Pattern Analysis

The weekly chart reveals a **potential bullish reversal pattern** with the following characteristics:

1. Hidden Divergence: The chart shows hidden bullish divergence on momentum indicators, suggesting underlying strength despite recent price consolidation

2. Consolidation Box: A clear accumulation zone has formed between 13,800 and 16,500

3. Trend Channel: A rising trend channel indicates the potential for continued upward movement toward the 20,000+ zone

#Trading Strategies

#Aggressive Buy Setup

- Entry Zone: 16,505 - 16,102 (on breakout confirmation)

- Target Sequence: 17,445 → 19,148 → 20,866

- Stop Loss: Below 15,311 on candle closing basis

- Risk-Reward: Favorable 1:3+ ratio

#Conservative Buy Setup

- Entry Zone: 15,697 - 15,311 (current levels)

- Target Sequence: 17,445 → 19,148

- Stop Loss: Below 14,311 on candle closing basis (Conservative Stoploss)

- Risk-Reward: Approximately 1:2.5 ratio

#Momentum Indicators

The lower panel indicators suggest:

- Recovery from oversold conditions

- Building positive momentum

- Potential for sustained upward movement if key resistance levels are breached

#Fibonacci Levels

Key Fibonacci retracement/extension levels marked on the chart:

- 1.618 Extension: 20,882

- 1.414 Extension: 19,989

- 1.272 Extension: 19,367

- 1.000 Level: 18,177

#Outlook

Bullish Scenario: A sustained move above 16,505 with strong volume could trigger momentum toward 17,445 initially, with extended targets at 19,148 and potentially 20,866+. The stock appears to be in an accumulation phase with potential for a significant upside breakout.

Bearish Scenario: Failure to hold above 14,311 on a closing basis would invalidate the bullish setup and could lead to a retest of 13,260-13,280 support zone.

#Risk Management.

- Always use stop-loss orders on a candle closing basis - Position sizing should not exceed 2-3% of total portfolio value - Avoid overleveraging in options or futures - Monitor volume confirmation on breakout levels

DISCLAIMER

This analysis is for educational and informational purposes only and should NOT be considered as financial advice or a recommendation to buy or sell securities.

- Past performance is not indicative of future results - Trading and investing in stocks involves substantial risk of loss - All investment decisions should be made based on your own research, risk tolerance, and financial situation - Please consult with a SEBI-registered financial advisor before making any investment decisions - The author/analyst is not responsible for any profits or losses incurred based on this analysis - Technical analysis has limitations and should be combined with fundamental analysis - Market conditions can change rapidly, and all levels mentioned are subject to change

**Trade at your own risk. Always do your own due diligence.**

*Analysis created using TradingView charts | Not SEBI Registered Investment Advice*

Kfin Tech - Low Risk Long SetupCMP 1067 on 04.10.25

All important levels are marked on the chart.

The price has been traveling in a parallel channel and presently resting at the lower edge of the channel.

Also, a double bottom pattern was formed, with a bottom of around 1000.

First target is 1160, considering the stop loss of 1000.

If it crosses 1180 and sustains above, it will gain more strength.

If it sustains below 1000 levels, the setup will go weak.

One should keep the position size in accordance with the risk capacity.

All these illustrations are only for learning and observation purposes; they should not be considered as trading recommendations.

All the best.

LONG IN KPITTECHA long trade can be taken in KPIT TECH. After a bullish run last week Kpit tech showed some profit booking but couldn't break the low of the candle from where it started its bullish reversal. Now it has formed a double bottom and hence a swing trade on the buy side can be taken.

Follow for more such analysis.

Entry- 1250-1254

Support- 1245-1242

Target- 1270, 1275, 1290

Disclaimer- This is just for educational purposes.

Jai Shree Ram

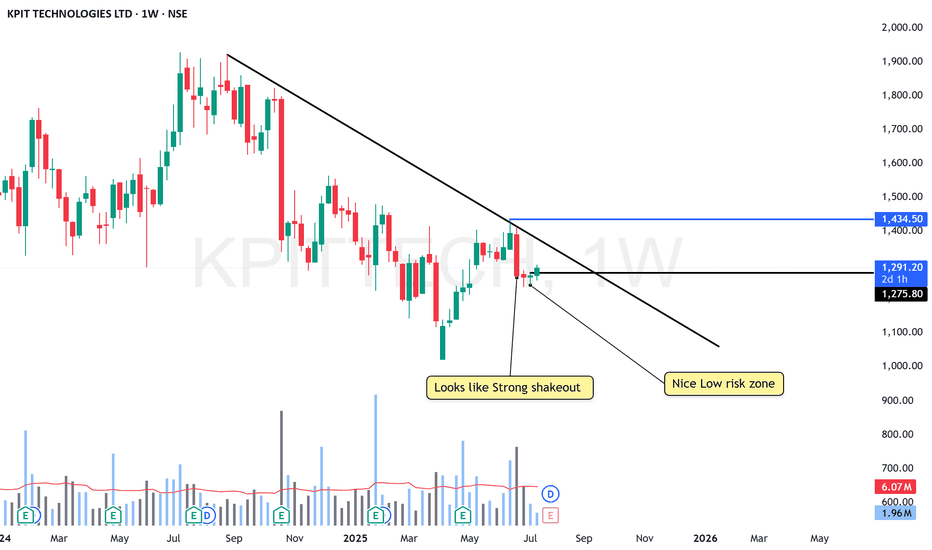

KPIT At low risk Zone - Getting ready to BlastNSE:KPITTECH

Its at Nice low risk Zone

KEEP IN MIND: The 6Rs Dividend Announced at QTR is on 28th JULY

Good to keep on the radar

Always respect SL & position sizing

========================

Trade Secrets By Pratik

========================

Disclaimer

NOT SEBI REGISTERED

This is our personal view and this analysis

is only for educational purposes

Please consult your advisor before

investing or trading

You are solely responsible for any decisions

you take on basis of our research.

INFOSYS LTD Making higher high trend on daily time frame.Indian IT Sector is witnessing a recovery as most of the IT stocks closed on a postive note. Infosys Ltd being one of the secotral leader is seen making higher highs and higher lows trend on daily time frame as the with above average volume of 42 days (approx 2 Months).

The stock has closed above an important level of 1628 which acted as a hurdle. Now the stocks has suatianed above 1628 level a next resistance level of 1666.40 and 1684.25 seems to be achivabele.

MACD Indicator is alredy trading above zero line which signals postive momentum and alog with it ADX indicator is at 25.95 where +DI is trading above -DI which indicates strenghth in momentum.

let me know your thought in comment below.

MphasisHello & welcome to this analysis

Stock could be forming a cup & handle pattern in the monthly time frame with the lower leg of the handle coming to an end.

2000 is an extremely important level for the stock in the short term, while it has loads of resistance between 2300-2800 on the upside as it attempts to complete the handle.

Overall weakness continues below 2000, else one could expect stock to rise steadily towards completion of the bullish pattern

SONATA SOFTWARE - Expecting ATH | 40% upside potential Price Analysis & Overview:

1. Prices have taken support from the fib golden zone.

2. EMA are also supporting the trend.

3. Minimum ATH resistance level will be expected.

4. Above 720 RSI will show further strength for bullish momentum.

5. RRR is favourable.

6. Retracement based trade setup.

Trade Plan:

1. ENTRY = CMP 590

2. SL = 10% 530

3. TARGET = 40% 800++

- Stay tuned for further insights, updates and trade safely!

- These are my personal views.

- If you liked the analysis, don't forget to leave a comment and boost the post. Happy trading!

Disclaimer: This is NOT a buy/sell recommendation. This post is meant for learning purposes only. Please, do your due diligence before investing.

Thanks & Regards,

Anubrata Ray

IT SECTOR OVERVIEW: Super Bullish!Observation & Overview:

1. The IT Index was beaten down in late 2022.

2. After 2023 it formed a bottom and prices started gaining strength.

3. 2024 price started forming Higher Highs & Higher Lows, touched the previous 2022 ATH and currently, taking support from the 50% of the swing and also bouncing from a D tf demand.

4. It is acting as a major support zone and good weekly candle rejection can be noticed.

5. Signs of buyers getting dominant and it should break the ATH soon.

6. I'm expecting a minimum 15% ROI from this sector turnaround.

7. Hopefully, with sector rotation this sector is going to gain momentum eventually.

- Stay tuned for further insights, updates and trade safely!

- If you liked the analysis, don't forget to leave a comment and boost the post. Happy trading!

Disclaimer: This is NOT a buy/sell recommendation. This post is meant for learning purposes only. Please, do your due diligence before investing.

Thanks & Regards,

Anubrata Ray

INFY - Price Observation & overview1. Consolidating within the trendline, soon or later a strong breakout of the trendline and ATH will be expected. It gonna take its sweet time!

2. Whenever the IT sector stats moving we can expect IT stock to start outperforming, till then it is just accumulation for the long term.

- Stay tuned for further insights, updates and trade safely!

- If you liked the analysis, don't forget to leave a comment and boost the post. Happy trading!

Disclaimer: This is NOT a buy/sell recommendation. This post is meant for learning purposes only. Please, do your due diligence before investing.

Thanks & Regards,

Anubrata Ray

Birlasoft - Positional setupCMP 599 on 12.10.24

A Pole and Flag pattern-like formation is in progress on the chart. But a trade setup should be backed by other parameters too.

The range of 550-580 has been acting as a good support zone for a long time. This time, it reversed from the zone again—a good time for a buy setup with a favorable risk-reward ratio.

Immediate targets seem 670, 710, and 740.

The setup fails if the price sustains below 550-540 levels.

Position size should be following risk management.

This is only for learning and sharing purposes, not trading advice in any form.

All the best.

TCS FOR SWING TRADETCS Swing Trade Idea

Timeframe: Weekly

Observation:

TCS has entered a strong demand zone on the weekly chart, indicating a potential reversal or continuation of an upward trend. The price action suggests that buyers are actively defending this zone, providing a solid risk-to-reward opportunity.

Analysis:

Demand Zone: Clearly visible on the weekly timeframe, supported by historical price reactions.

Volume Profile: Higher buying volumes observed near the demand zone, adding conviction.

Risk-Reward Setup: Place a stop-loss slightly below the demand zone with targets at key resistance levels (based on Fibonacci or previous highs).

Disclaimer: This is for educational purposes and not financial advice. Please do your due diligence before trading.

LTIM - Getting ReadyThe chart is self explanatory. Since Nov. 21, the price has been forming a Triangular pattern. Already given a breakout of that.

Since Jan. 24, A Cup & Handle pattern is formed and a breakout is seen on the charts.

At present time, we can observe the retest of the both breakouts.

If the price gives a bounce back from present range of 6000-5800 and sustains above, may see a bullish run upto 7000/7500 and even more.

If sustains below 5600, the setup goes weak.

One should mind the position size according the risk-management.

The above illustration is my own view, only for learning and sharing purposes, not a trading advice in any form.

All the best.

Affle India for 60%+ gainsDate: 6 Nov’24

Symbol: AFFLE

Timeframe: Weekly

Affle India seems to be in Wave V of 3 which may end around 1850. And after correction in Wave IV, the price is likely to head to 2450 (60%+ from where Wave IV ends) as seen in the chart. Once the prices go past 2000, five waves of Wave 5 will be more visible. Wave 5 could even extend and head towards 2800+; will review this as waves develop.

This is not a trade recommendation. Please do your own analysis. And I have the right to be wrong.

HINGLISH VERSION

Aisa chart dekhke lagta hai ki Affle India 3 ki Wave V mein hai jo 1850 ke aaspaas samaapt ho sakti hai. Aur Wave IV mein giraavat ke baad, keemat 2450 (60%+ jahaan Wave IV samaapt hotee hai) tak pahunchane kee sambhaavana hai. Ek baar jab keematen 2000 ke paar chalee jaengee, to Wave 5 kee paanch waves adhik dikhaee dengee. Wave 5 extend bhi ho sakta hai aur 2800+ kee taraf badh sakta hai; wave vikasit hone par isakee sameeksha karenge.

Yah koee trade lene ki salah nahin hai. Kripya apana vishleshan khud karein. Aur mujhe galat hone ka adhikaar hai.

NIFTY IT Break Down Before US ElectionNifty IT is currently break down and negative trend in before the us election. In the current market correction this is the one of the most positive and attractive sector in the indian market but this week the price is fall Nifty IT Company in the FII Friendly but Huge selling in the FII Less impact in the market.

Now currently my point of the view after the US Election ( If Donald Trump Win ) One time this is show in the deep correction, but we are bullish because this is the more beneficial of the Interest rate cut

Infosys ready for Flag pattern breakout in coming daysNSE:INFY Ready for flag pattern breakout in coming days

Consolidated pattern since many days now ready for breakout in coming days

Follow for more trading signals or analysis.

Target 10% approx

Stoploss 3%

Do as directed in the chart

This is not the trading recommendation or advise 🚨

Do your analysis before taking any step.

Tech-Finance Synergy Could Boost Nifty This Week!Nifty It NSE:CNXIT

The IT index has been in a consolidation phase for an extended duration and developed a Cup & Handle pattern.

After breaking out, the index has effectively retested the breakout level and is now on an upward trajectory.

In the past week, the index gained approximately 3% and is showing robust strength, with expectations for further upward movement.

Nifty Private Bank NSE:NIFTYPVTBANK

The Private Bank index is currently experiencing a positive upward trend.

It previously established a Cup & Handle pattern, and following a breakout, the index saw substantial gains, consistently recording higher highs and lows.

After hitting an all-time high near the 26,650 level, the Private Bank index retraced to its immediate support zone and is now rising once more.

With a significant increase of almost 2.7% last week, the index seems to be in a bullish phase at present.

KPIT Tech: Is This High-Conviction Pattern Set to Deliver?This is purely a technical play in NSE:KPITTECH

The chart is showing a high-conviction inverse head and shoulders pattern, suggesting a potential bullish reversal. A volume breakout and close on a lower timeframe above 1882 could provide a solid entry point.

For this trade one can maintain a strict stop loss of 1790. The targets to aim for are 2054 and 2105, which align with the expected move from this setup .

This is a short-term trade idea, but monitor price action and volume for confirmation of the breakout. Additionally, consider any other technical indicators or tools that could further validate this setup.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risks and is not suitable for everyone. Always conduct your own research and consult with a financial advisor before making any investment decisions. The author is not responsible for any losses incurred.

Coforge Swing Idea Weekly timeframe is bullish

Daily timeframe is bullish and price has tapped into daily demand zone and reacted positively

4HR is also bullish

Also, Nifty and CNX IT is also bullish

Company is also 10% away from all time highs because of that the stock can rip high

Note : this is not Financial advise