Itstock

HCLTECH, Stock of the WeekAfter a strong hammer candle from the low, the price has formed a three soldiers pattern.

Also the price has given the breakout of the LTMA band.

CMP:1,431.50

R1-1,531.45

S1-1,350.90

Disclaimer : This is my pre market analysis and my trading journal. Not a suggestion to buy or sell.

MINDTREE - Another Giant Getting Ready - Cup & Handle BreakOutNSE:MINDTREE has given breakout of cup and handle pattern along with gaining 200 EMA on DTF. I would wait for a retest candle before initiating long trade. SL would be 3274 for possible targets marked on the chart

Let's see which way the story unfolds. Happy Trading!

Disclaimer -

- The view expressed here are my personal views. I am publishing this for my own records and what I see on charts.

- If you're referring to this, please consider this ONLY FOR educational & research purposes.

- Past performance is not a guarantee for future predictions

- Any decision you take, you need to take responsibility for the same. DO NOT consider this as an investment suggestion.

- It's your hard earned money. Treat it wisely

- Trade / Invest keeping in mind your trading style, goals and objectives, time horizon & risk tolerance

- Do your own analysis and consult your financial advisor before investing.

TIA!

COFORGE - Getting Ready For UpmoveNSE:COFORGE has managed to close above all EMAs 20/50/100/200 along with a spurt in volume . After making double bottom in Sept 2022, it seems the trend is changing with an up-move seen in IT index. Considering the momentum in NSE:CNXIT , this could move towards 4800, 5100 and 5900 levels. Also something interesting is that relative strength is almost at 0 as compared to Nifty50.

Seems COFORGE is getting ready. SL should be 3200 on DCB

Let's see which way the story unfolds. Happy Trading!

Disclaimer -

- The view expressed here are my personal views. I am publishing this for my own records and what I see on charts.

- If you're referring to this, please consider this ONLY FOR educational & research purposes.

- Past performance is not a guarantee for future predictions

- Any decision you take, you need to take responsibility for the same. DO NOT consider this as an investment suggestion.

- It's your hard earned money. Treat it wisely

- Trade / Invest keeping in mind your trading style, goals and objectives, time horizon & risk tolerance

- Do your own analysis and consult your financial advisor before investing.

TIA!

My vision on Naukri (Info Edge).Hello Traders .....

Correction in the price is very important for the traders, it gives us the opportunity to enter a stock before a new trend.

Because we always see a correction before the start of the new trend.

The same styled correction is seen in Naukri.

Naukri is corrected more than 50% from the highs.

And now we see the signs of the completion of that correction, as the price successfully tested its 200ema.

The stock takes about 1 year to complete its correction on the weekly chart. So, we can say that it's a healthy correction.

Now it's time to track the stock for the buying opportunity.

We have to wait for the price to settle above all moving averages.

And for the event when it gives a breakout of the nearest resistance.

From that level the price has the potential to be doubled.

So, keep tracking the stock and don't miss the golden opportunity.

And don't forget to manage your trades with an exit strategy.

Happy and Safe Trading

Thanks

Er. Simranjit Singh Virdi

Coforge | Short Term Buy | Symmetrical triangle | IT StockCoforge has been consolidating in a range from 4800 to 5800 from sometime and it formed a symmetrical triangle.

1. Buy only above 5625

2. Stop loss - 4800

3. Target 1 - 6,400

4. Target 2 - 6,800

Disclaimer : I am not a SEBI registered and this is just my analysis and sharing for education only. Do trade or invest at your own risk. I am not responsible for any profits/losses. I would suggest do your own research/consider your financial advisor before any trade/investment decision.

Breakout by Bluechip #bbbBreakout by Bluechip #bbb

HCLTECH gave breakout from this pattern with avg. volume and we saw a retest with good volumes.

High volume than the breakout candle.

This is not a good indication.

Retail traders may get trap at higher levels.

Waiting for the strong indication of bullish trend is the best option for now.

Nifty is near all time high.

I will not expect higher target at this levels.

But thinking to capture a small swing scalp with strict stoploss.

This post is for information purpose only.

Cigniti Technologies Resistance Breakout with good VolumeCigniti Technologies making Higher Highs & Resistance Breakout with good Volume. We can go for Buying at Retracement levels for Swing Trade.

TGT 1- 616

TGT 2- 680

-> Always Enter With good confirmation & Maintain proper Risk Reward.

*******Knowledge Purpose only********

--->> Visit my Ideas Page for Daily Stock Analysis and check my previous stock analysis performance. I usually prefer Swing & Intraday Trades with Good Breakout confirmations and Best Risk Reward Stocks.

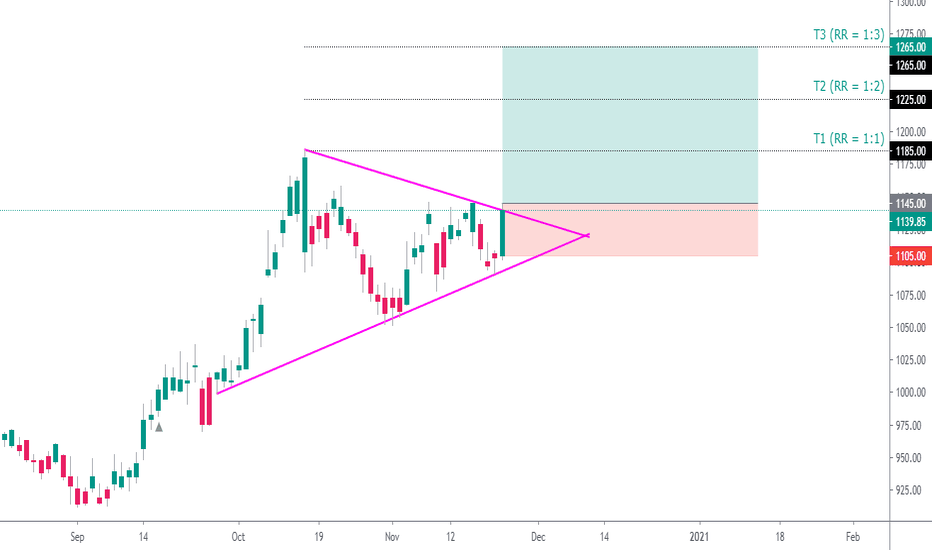

INFOSYS(Swing / Positional Trade) | RR 1:3+ | Type:- Breakout

Reasons To Trade 🤔 :- NIFTY IT(Main Index) + Stock's Triangle Pattern Breakout , Bullish Sector , Uptrend Stock , Above 200DMA.

Entry :- 1145 (Look For Clear Entry)

Stop Loss :- 1105

Targets :- 1stT. = 1185 , 2ndT. = 1225 , 3rdT. = 1265

(Risk Must Be Managed.)

Keep Your Eyes On Index

😜Follow For More ✔

Give Me A Thumbs Up...👍

--Any Suggestions--

WIPRO : ALGO BUY SIGNALHOW TO FOLLOW ALGO SIGNAL:

Deciding buy/sell

1.Strictly use only on 1 hour time frame.

2.Wait for a ‘X’ sign before mind make up. A red ‘X’ means look for selling opportunity , a green ‘X’ means look for buying opportunity.

Taking a position:

3.Wait for an arrow before entering into any position. A red arrow on upside of a bar pointing downward means open short position. A green arrow below the bar pointing upward means open buy position.

4.NOTE: Only after the the signalling of X , look for arrow. Do not buy/sell if you see any arrow before the signal of X.

5.STOP LOSS should be the most recent swing high/low or most recent STRONG CANDLE’S high/low.

While maintaining the position :

6.The small triangles after the each bar completion tells you to hold the position. The red triangles appearing upside on the bar tells you to hold the short position, whereas the green triangles appearing below the bars tells you to hold the long position.

Exiting the position:

7.After you create a buy position , if you see a green arrow above any bar pointing downward, then you should either book partially/leave the position for sometime. You will get another signal to re-enter.

8.Similarly, after you create a sell position , if you see a red arrow below any bar pointing upward, then you should either book partially/leave the position for sometime. You will get another signal to re-enter.

9.While being in position if you see any X signal which is opposite of your trade , then leave your position immediately.

10.When you see a big red circle dot then you must exit all your short positions. Contrary , when you see a big green circle dot , you must exit all your long positions. And then wait for a X-signal.

No Trading Zone:

11.When you get frequent X-signals in green-red-green-red & that too very close, then its means that stock is going to form a range. One should wait for the range break & move away to another stock. (THIS IS WHERE YOU WILL REQUIRE A PRACTICE TO IDENTIFY THE RANGE)