GOLD hits a new all-time high at $4,200 for the first time ever.🚨JUST IN: GOLD hits a new all-time high at $4,200 for the first time ever.

Now here’s the real question:

Will Gold retrace back to the $3,000–$2,500 zone soon?

That region aligns perfectly with the 0.382 Fibonacci retracement, a level where Gold has historically cooled off before launching its next major bull rally.

Eyes on the golden pullback before the next explosion.

J-XAU

Gold Outlook – Short-Term Pullback, Long-Term StrengthGold has shown a strong bullish phase over recent weeks after a long consolidation. The market moved from accumulation into expansion, reflecting renewed participation by larger players. This upward momentum indicates strong capital inflows, supported by macroeconomic uncertainty and shifting investor sentiment.

Technically, price has broken out of a prolonged range and established a clear upward trajectory. Market structure suggests that buyers remain in control, though current price levels are showing signs of potential exhaustion, which could trigger short-term corrective moves before the broader trend resumes.

Fundamentally, global economic pressures continue to boost gold’s role as a safe-haven asset. Concerns over inflation, central bank policy adjustments, and currency volatility are keeping investor demand elevated. With global risk sentiment fluctuating, gold is likely to remain an attractive hedge, sustaining its medium-term bullish outlook despite short-term pullbacks.

Conclusion: Gold is in an expansion cycle, supported by both technical momentum and fundamental demand. Short-term corrections are expected, but the broader trajectory remains upward.

Trade Management Systems: Comparing Two Methods

📌 Method 1 – Normal SL & TP

Entry → Open trade at ENTRY.

Stop Loss (SL) → Fixed (below ENTRY for buy / above ENTRY for sell).

Take Profits (TP1 & TP2) → Both active.

When TP1 is hit → Book partial position.

SL stays the same → risk remains on the rest of the trade.

✅ Advantage:

More potential profit if market extends to TP2.

❌ Risk:

If price reverses after TP1, the remaining position can still hit SL → reducing overall profit.

📌 Method 2 – Breakeven Stop (SL = ENTRY after TP1)

Entry → Open trade at ENTRY.

SL initially fixed.

When TP1 is hit → Book 50% profit, then move SL to ENTRY (breakeven).

Remaining position:

If TP2 is hit → book extra profit.

If price falls back → exit at ENTRY (no loss).

✅ Advantage:

Trade becomes risk-free after TP1.

❌ Risk:

Sometimes market hits TP1 then pulls back, causing breakeven exit → missing bigger gains compared to Method 1.

📌 Enhanced System (Your Version with Fixed Risk)

Initial SL → Always set at 2R.

TP1 → When reached, book 50% profit (+1R on half).

Then move SL to ENTRY (breakeven) for the remaining 50%.

📊 Possible Outcomes:

Scenario Result

Price hits SL (before TP1) –2R loss

Price hits TP1, then reverses to ENTRY +0.5R profit

Price hits TP1, then TP2 +2R total profit

⚖️ Summary

Method 1 (Normal SL & TP) → More profit potential, but carries more risk on the remaining position.

Method 2 (SL = ENTRY after TP1) → Safer, risk-free after TP1, but sometimes cuts off bigger gains.

Your Enhanced Version → A defensive system:

Losers are limited (–2R).

Small winners (+0.5R) happen often.

Big winners (+2R) balance out losses.

💡 With consistent discipline, even a 40–45% win rate can make this system profitable.

Breaking 3322, gold price continues to recoverPlan XAU day: 29 July 2025

Related Information:!!!

Gold prices (XAU/USD) advance to a new intraday high during the first half of the European session on Tuesday, recovering from the nearly three-week low around the $3,300 level reached the previous day. As market participants absorb the latest wave of trade-related optimism, lingering uncertainty ahead of this week’s key central bank events and high-impact US macroeconomic releases continues to lend support to the safe-haven precious metal.

At the same time, the US Dollar (USD) has eased slightly from its highest level since June 23, providing an additional tailwind for gold. Nonetheless, the increasingly widespread expectation that the Federal Reserve (Fed) will maintain elevated interest rates for an extended period is likely to limit any significant USD correction. Consequently, this may act as a headwind for the XAU/USD pair as attention turns to the highly anticipated FOMC meeting set to commence later today.

personal opinion:!!!

Gold price recovered, broke 3322. Good buying power, continued to recover and accumulate above 3300

Important price zone to consider : !!!

Support zone point: 3322, 3302 zone

Sustainable trading to beat the market

Gold price accumulation, price reduction rangePlan XAU day: 28 July 2025

Related Information:!!!

Gold prices (XAU/USD) have stalled their intraday rebound from a more than one-week low and are trading around the $3,335 level during the early European session on Monday, marking a decline for the third consecutive day. Renewed strength in the US Dollar (USD) continues to weigh on the precious metal, serving as a primary headwind. Additionally, a broadly positive market sentiment—supported by recent trade-related optimism—is further limiting the upside potential for the safe-haven asset.

That said, USD bulls may exercise caution and refrain from initiating aggressive positions ahead of further clarity on the Federal Reserve’s (Fed) monetary policy outlook. As such, market participants are expected to closely monitor the outcome of the upcoming two-day FOMC meeting concluding on Wednesday, which is likely to influence USD dynamics and provide fresh directional impetus for non-yielding gold. Moreover, this week’s key US macroeconomic data releases will be instrumental in determining the next leg of movement for the XAU/USD pair

personal opinion:!!!

Very important news this week, gold price is forecast to continue to fall sharply below 3300 with the almost certain result that the FED will continue to keep the current interest rate unchanged.

Important price zone to consider : !!!

resistance zone point: 3340, 3358 zone

Sustainable trading to beat the market

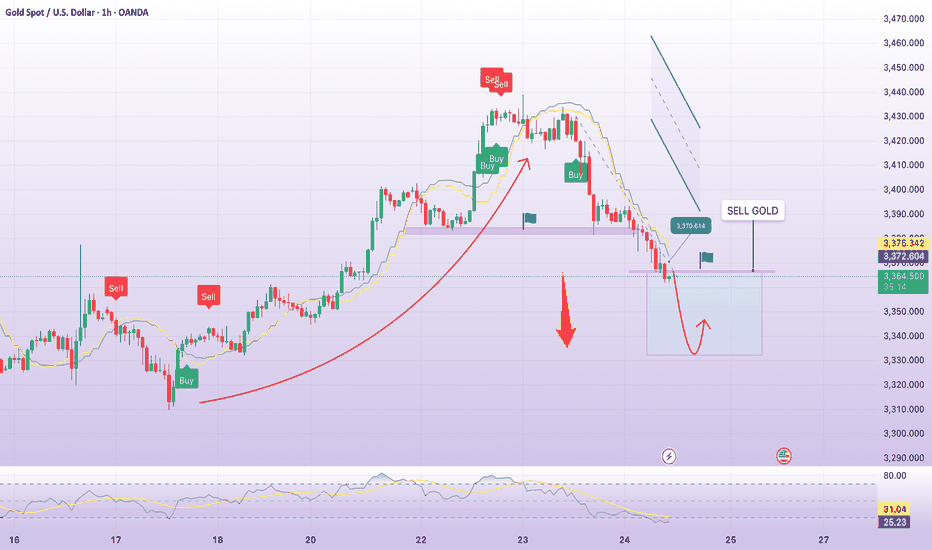

SELL GOLD 3370 ! downtrend todayPlan XAU day: 24 July 2025

Related Information:!!!

US President Donald Trump announced late Tuesday that his administration had reached a trade agreement with Japan. In addition, reports suggesting progress toward a 15% trade deal between the United States and the European Union have bolstered investor confidence, exerting downward pressure on the safe-haven appeal of gold for the second consecutive session on Thursday.

Despite President Trump’s persistent calls for lower borrowing costs, markets do not anticipate an interest rate cut from the Federal Reserve in July. In fact, President Trump has continued his public criticism of Fed Chair Jerome Powell, including personal attacks on his stance regarding interest rates and repeated calls for his resignation.

personal opinion:!!!

Tariff negotiations between countries and the US, the catalyst for the sharp drop in gold prices, continued selling pressure.

Important price zone to consider : !!!

resistance zone point: 3370 zone

Sustainable trading to beat the market

XAUUSD - 1H SHORT (GOLD)FOREXCOM:XAUUSD

Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. wait for more Smart Money to develop before taking any position . I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied...

Keep trading

Hustle hard

Markets can be Unpredictable, research before trading.

Disclaimer: This trade idea is based on Smart money concept and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions. Informational only!!!

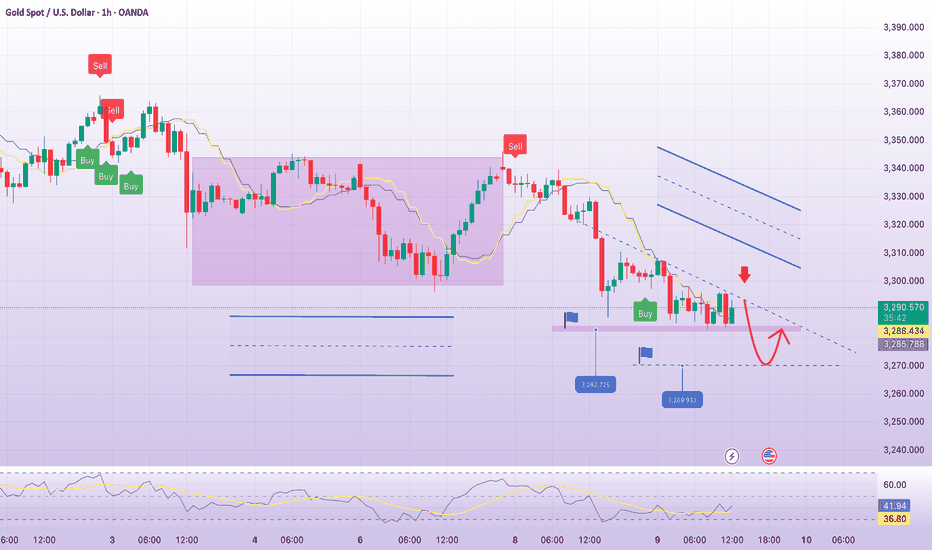

Selling pressure, gold downtrendPlan XAU day: 09 July 2025

Related Information:!!!

Gold (XAU/USD) continues to extend its decline on Wednesday for a second consecutive session, as the US Dollar (USD) and US Treasury yields strengthen ahead of the release of the Federal Open Market Committee (FOMC) Meeting Minutes.

The US Dollar Index (DXY) has climbed to a two-week high, exerting downward pressure on XAU/USD, which has fallen below the $3,300 level at the time of writing.

The forthcoming release of the FOMC Minutes from the June meeting is anticipated to provide insight into the Federal Reserve’s internal discussions regarding the future course of monetary policy.

In June, the central bank chose to maintain its benchmark interest rate within the 4.25% to 4.50% range, citing continued labor market resilience and persistent inflationary pressures.

personal opinion:!!!

Gold price is in the accumulation zone below 3300, big selling pressure. Pay attention to selling gold according to the trend line 3294

Important price zone to consider : !!!

support zone point: 3274; 3252 zone

Sustainable trading to beat the market

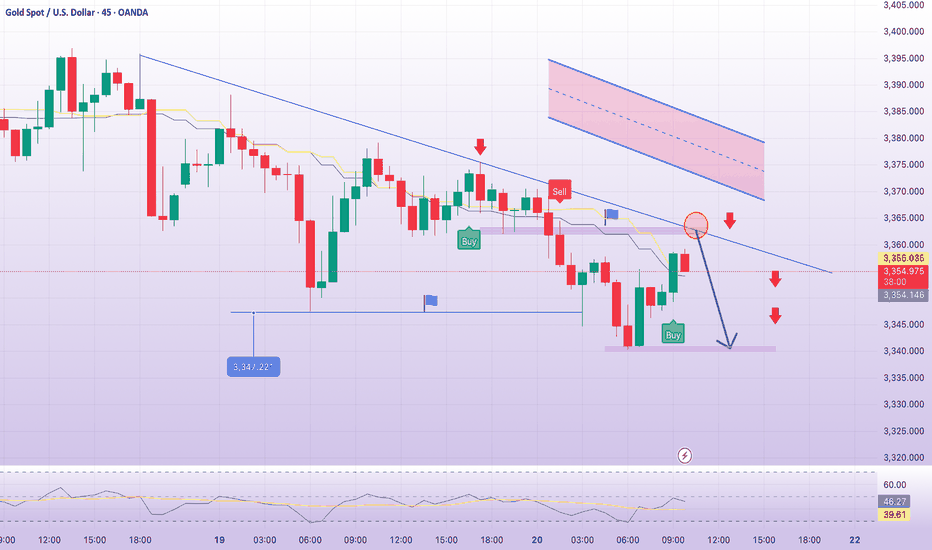

Fibonacci extension, sell gold 3375Plan XAU day: 23 June 2025

Related Information:!!!

Gold price (XAU/USD) maintains its bearish tone during the first half of the European session, although it lacks strong momentum due to mixed fundamental signals. The US attack on Iran’s nuclear facilities on Sunday increases the risk of a wider conflict in the Middle East and reinforces the US Dollar's (USD) position as the global reserve currency. In addition, the Federal Reserve’s (Fed) hawkish stance is seen as another factor supporting the greenback and putting downward pressure on the non-yielding yellow metal.

personal opinion:!!!

Gold price recovered and continued to accumulate, using extended fibonacci to find selling points to adjust wave 4 on H1 frame

Important price zone to consider : !!!

SELL point: 3375 zone

Sustainable trading to beat the market

Gold price returns to 3363 price zone, gold selling pointPlan XAU day: 20 June 2025

Related Information:!!!

Gold price (XAU/USD) is seen consolidating its intraday losses to over a one-week low and is trading just below the $3,350 level during the first half of the European session. Earlier this week, the US Federal Reserve (Fed) trimmed its outlook for rate cuts in 2026 and 2027, which is seen as a tailwind for the US Dollar (USD) and is weighing on demand for the non-yielding yellow metal.

In addition, a generally positive tone in European equity markets is another factor putting pressure on Gold prices. However, rising geopolitical tensions in the Middle East may cap market optimism amid ongoing trade-related uncertainties and help limit losses for the safe-haven XAU/USD, which remains on track for weekly losses

personal opinion:!!!

Gold price in sell zone, trend line 3362

Important price zone to consider : !!!

SELL point: 3362 zone

Sustainable trading to beat the market

Gold’s New All-Time High Could Be #Bitcoin Signal🚨 Gold’s New All-Time High Could Be #Bitcoin Signal 🟡

And if history repeats, Bitcoin could be next.

Every time #Gold moves first, Bitcoin usually follows with a major rally. If that happens again, we could see a new Bitcoin ATH in Q2-Q4 of 2025.

Are you ready for the next big move? 🚀

CRYPTOCAP:BTC #BullMarket

Gold hits important support. Is the downtrend over?

📊 Trump's "reciprocal tariffs" policy is affecting the entire financial market in general and gold prices in particular. The trade war is approaching and the market continued to fall sharply on Monday. Not staying out of the game, OANDA:XAUUSD is also inevitable to sell off when market volatility increases. Let's analyze the next developments of gold from the perspective of **Technical Analysis:** and the opportunity to find profits at this time:

🔹 **Frame D**: After 3 consecutive days of decline, FOREXCOM:XAUUSD prices have temporarily maintained the upward price trend. And currently the price is at an important support area, the old peak area 1 month ago. Whether the correction ends here or not, we will need to consider further in the next time frames

🔹 **H4 frame**: The important key zone has been broken, the bearish price structure has not changed, it is not yet possible to confirm that this downtrend has ended.

🔹 **H1 frame**: The bearish price structure is very clear, however, the selling force is not as strong as before. The support area still brings a cautious mentality to the bears, plus the profit-taking action for SELL positions after the past 3 days.

✅**Trading plan:*

Looking at the price structure, although the price is at an important support area, we are still not sure that this downtrend has ended, so the BUY option will not be considered. However, the current area is no longer suitable for setting up a SELL position. The priority at the moment is to wait for the price to return to the marked resistance area to TRADE WITH THE MEDIUM TERM TREND. The market volatility is very high at the moment so pay attention to reduce the corresponding Volume and Stoploss with the loss you can accept.

💪 **Wishing you success in achieving profits!**

XAU#25: Is the correction over? What's next?Prices OANDA:XAUUSD stabilized around $3,022/ounce after a slight decline two days ago, reflecting strong safe-haven demand due to economic and geopolitical uncertainty. So is this correction over? Let's look at the next plan FOREXCOM:XAUUSD :

1️⃣ **Fundamental analysis:**

📊 Risks of economic recession and war conflict still exist:

🔹The Trump administration's reciprocal tariff policy may be more moderate than expected, reducing concerns about trade conflicts, but Wall Street is still betting on a 50% chance of a US recession due to slow currency circulation. This is one of the factors supporting Gold's rise

🔹 Risks from the Middle East and Ukraine are still unknown. Negotiations are still reaching certain agreements, but the impact on market confidence is insignificant. The fear psychology is still pushing money into Gold as a safe haven asset.

2️⃣ **Technical analysis:**

🔹 **D Frame**: The uptrend remains unchanged. Closing the session last Friday with a bearish candle is considered a profit-taking move after a series of days of gold price increase.

🔹 **H4 Frame**: The 3000 area is playing an effective support role when the price bounces back. However, the correction wave has not shown any signs of ending.

🔹 **H1 Frame**: The bearish price structure is very clear. If the 301x area is still held, the price may seek the resistance zones above to confirm the price reaction.

3️⃣ **Trading plan:*

✅ From the basic information to the reflected horizontal line, it can be seen that at the present time, the price can still continue to decrease. However, there are certain risks when FOMO establishes a SELL position in the current area. The price may not drop deeply to the lower area immediately but will sweep SL at both ends. We can wait for the price reaction in the upper resistance area to find a safer position.

💪 **Wishing you success in achieving profits!**

XAU#24: Gold hits $3,000. Will there be a correction?💎 💎 💎 So OANDA:XAUUSD has successfully achieved the $3,000 mark thanks to tariffs and economic growth concerns. Let's continue to plan for gold FOREXCOM:XAUUSD : 💎 💎 💎

1️⃣ **Fundamental analysis:**

📊 The trade war due to tariffs as well as expectations of slowing inflation and concerns about economic growth will push the Federal Reserve to cut interest rates this year are the main drivers of gold's safe-haven demand.

2️⃣ **Technical analysis:**

🔹 **D Frame**: Gold broke through the resistance area of 2955 strongly and reached the 3000 mark the next day. The uptrend is very clear. Although the weekend closed with a pinbar, this is likely to be short-term profit-taking pressure as the market enters the weekend trading day and comes from the 3000 round mark

🔹 **H4+H1 frame**: the price returns to a strong uptrend after accumulating the 2900~292x area. The price reaction at the psychological level of 3000 is weak when the price does not have a clear corrective reaction.

3️⃣ **Trading plan:*

✅ There is still no clear sign of adjustment. Gold prices will continue to increase if trade tensions escalate from tariff retaliation orders. Although touching the psychological resistance of 3000, the price reaction is insignificant, showing that market sentiment is still optimistic about the prospect of gold's increase. The top priority is not to FOMO according to the price line. We can wait for the price to return to the support area to look for trading opportunities.

💪 **Wishing you success in achieving profits!**

XAU#23: Gold Continues SW – Waiting for a Boost from CPI News?🔥 Immediately after the decline FOREXCOM:XAUUSD , there was a recovery with a large amplitude. Looking at the price reaction, we will plan the next step OANDA:XAUUSD : 🔥

1️⃣ **Fundamental analysis:**

📊Gold rises on tariff concerns, but is under pressure from the Ukraine-Russia ceasefire agreement

🔹Gold prices rise on a weaker USD and increased demand for safe-haven, as concerns about a US economic recession become more evident.

🚀The US market faces risks from Trump's tax policy, Fed interest rates and slowing growth of large technology companies. Weak CPI & PPI data could prompt the Fed to ease policy, creating conditions for gold prices to continue to be supported.

📌 In recent days, trade wars and geopolitics have continuously coordinated the price of gold. Continuous declarations of tax imposition, response and withdrawal have caused the price to fluctuate strongly.

2️⃣ **Technical analysis:**

🔹 **Frame D**: The bullish price structure has not changed. Yesterday's price increase brought momentum to the prospect of gold's increase. However, to break out of the SW zone, we will need strong enough momentum from both news and price structure.

🔹 **Frame H4**: The downtrend has been confirmed when the price reacted strongly in the resistance zone. The price continues to be in the old SW zone. We will have to wait for confirmation from the price structure in this area to predict the trend and wait for the opportunity to establish a position.

🔹 **Frame H1**: The bearish price structure has been established and yesterday was a recovery to the resistance zone. It is too early to say that the price will break through the SW area.

3️⃣ **Trading plan:*

⛔ At the current price range, the price line is likely to SW waiting for today's CPI news. If we have not established a position, we should not FOMO at this time. Because the information given at this time can change at any time and the price line has not been clearly confirmed.

✅ An ideal scenario when the price has a correction to retest the H4 trendline. The upward momentum will be clearer when the price bounces from support. However, yesterday's price increase has not ended yet, so we should wait for the price structure to appear more clearly to place an order.

💪 **Wishing you successful trading!**

XAU#22: Gold SW for 3 Days! What's Next?🔥 OANDA:XAUUSD has been SW for the past 3 days of the weekend. Today we will look at the next scenario for FOREXCOM:XAUUSD to look for trading opportunities: 🔥

1️⃣ **Fundamental analysis:**

📊Trump's erratic tariff policy increases uncertainty, boosting demand for safe havens.

🔹USD falls sharply to a 4-month low, making gold more attractive to international investors.

🚀India steps up investment in gold, with jewelers and retail investors using gold options for speculation and hedging.

📌Gold remains a safe haven asset, especially amid concerns about India's economic growth and global instability.

2️⃣ **Technical analysis:**

🔹 **D frame**: 3 consecutive SW days, however, it can be seen that the upward trend of gold has not changed. The SW price zone is also quite high compared to the most recent bottom, indicating an upward prospect for gold

🔹 **H4 frame**: The temporary bullish price structure was broken and there was a strong reaction at the most recent peak area with a previous pinbar.

🔹 **H1 frame**: In the H1 frame, we can see the hesitation more clearly. Although the previous price continuously set higher bottoms, the upward momentum is weakening. If the price breaks through 2905. There is a high possibility that we will see a correction to the lower support zone

3️⃣ **Trading plan:*

⛔The current area is no longer safe to establish a BUY position. We will wait for a clearer opportunity in the lower support zone

✅ The current priority is to look for a SELL position. The expected scenario is that if the price breaks through 2905, we can completely establish a position.

💪 **Wishing you successful trading!**

XAU#21: Gold is soaring. Will it break the top and trading plan💎 💎 💎 The "bulls" are back as analyzed in the previous article. The price OANDA:XAUUSD has passed the trendline and there is no sign of stopping. Let's plan the next trading FOREXCOM:XAUUSD : 💎 💎 💎

1️⃣ **Fundamental analysis:**

📊Warning of short-term inflation shock: The market is pricing in the US CPI to remain around 3% for the next 7 months, reflecting a sudden increase in inflation. The 25% tax on imports from Canada and Mexico could increase consumer costs, putting pressure on inflation.

🚀Unstable context: US tariffs, war in Ukraine, inflationary pressure ... are causing concerns about an economic recession. This has pushed the gold price up again in the past 2 days.

2️⃣ **Technical analysis:**

🔹 **D frame**: The bullish price structure is still continuing, however, in my personal opinion, this increase is not sustainable.

🔹 **H4 frame**: The key down zone was broken last week and the price has returned to the resistance zone. The price reaction in this area is currently not positive. The bulls are still dominating as the previous H4 was a long-bodied candle.

🔹 **H1 frame**: The current price structure is bullish and there are no signs of a reversal.

3️⃣ **Trading plan:*

⛔ Although the price is in the resistance zone, the price reaction is weak enough to set up a SELL order. Currently, the fundamental information and short-term price structure are supporting the bulls. However, it should be noted that if the price increases continuously without recovering and breaks the peak once again, we will likely have a correction phase.

✅ BUY positions in the lower area can completely wait for better profits. In addition, when the price finds the support zones below, we can completely wait for the opportunity to establish the next position when the price structure appears in the smaller time frame. Note that

💪 **Wishing you success in achieving profits!**

XAUUSD/GOLD WEEKLY PROJECTION 03.03.25A primary reason for gold price falls is a strong US dollar, as gold has an inverse relationship with the dollar, meaning when the dollar strengthens, gold prices tend to decrease; other factors include rising interest rates, which can make alternative investments more attractive to investors, leading to decreased demand for gold, and a stable economic environment that reduces the need for gold as a safe haven asset

XAU#20:Gold plunges sharply,but will the“Bull Market"end easily?

💎 💎 In the previous article, the clear divergence in the H1 frame was confirmed by a correction of Gold. Now we will come up with the next plan: 💎 💎 💎

1️⃣ **Fundamental analysis:**

📊The main reasons for the decline of gold: profit taking by investors, a stronger USD and unsurprising US inflation data, which has curbed expectations of the Fed cutting interest rates.

🔹The Russia-Ukraine war is nearing its end as the final agreements are being negotiated.

🚀If there is a situation of high inflation but a weak economy (stagflation), gold prices may continue to rise sharply.

📌Some experts believe that gold prices are about 15% higher than fair value, but new factors such as central bank gold purchases and strong demand from China can still push prices to continue to rise.

2️⃣ **Technical analysis:**

🔹 **D frame**: 4 consecutive days of decline of about 120 USD, but looking at the overall price structure of gold, it is still stable. This correction with the goal of retesting the support zone below

🔹 **H4 frame**: The price structure has been broken. However, to get down to the support zone below, if there is no unexpected news, we still need a recovery to gain momentum. The pinbar at the end of the 6th session and the subsequent increase are supporting this option.

🔹 **H1 frame**: The price structure is very clear. The recovery at the end of the 6th session is the profit-taking action of the sell position forming a weekly candlestick wick.

3️⃣ **Trading plan:*

⛔ Currently the price structure is still decreasing. We should not trade against the trend at this time. Especially at this time, information about reaching an agreement on the Russia-Ukraine war can appear at any time

✅ Waiting for the price to reach important resistance zones to trade in line with the trend is the top priority. This is also the profit-taking area for the case where we establish a position when the price line confirms a recovery with the price structure.

💪 **Wishing you success in achieving profits!**

XAU#19: Gold's rally slows down, what's the reason?OANDA:XAUUSD demand soars but price growth slows down, risk of correction increases. However, let's look at the fundamentals and price structure to plan for FX:XAUUSD next move:

1️⃣ **Fundamental analysis:**

📊 The decline of the USD is an important sign ahead:

🔹European politics and impact on the USD: German elections could strengthen the EUR, putting more pressure on the USD

🔹USD faces downward pressure: The factors that caused the USD to plummet in 2017 (trade policy, global growth, European politics) could recur in 2025, threatening the strength of the greenback.

🔹Trump Tariffs: Lower-than-expected tariffs have limited the USD's gains, but investors remain concerned about upcoming trade policy.

🚀India's gold imports in February are expected to fall 85% year-on-year to a 20-year low as record bullion prices dampened demand. ''

📌 We have seen the first signs of market sentiment that gold prices are already too high. However, in the game of buying and selling, increasing demand while lacking supply is always the driving force for prices to rise further.

2️⃣ **Technical Analysis:**

🔹 **Frame D**: Yesterday was a pinbar that was forecast to be a strong driver for gold's price increase. However, today's price action shows the opposite. The decline is not over yet.

🔹 **H4 Frame**: The price has been SW at the peak for too long without a breakout. Although the price structure is still increasing, the current support area is showing a weak price reaction.

🔹 **H1 Frame**: As you can see the clear divergence on the MACD indicator. It is highly likely that we will have a slight correction to the support area below

3️⃣ **Trading plan:*

⛔ In the current area, we do not have a clear confirmation, whether BUY or SELL at this time is high risk. Currently, we should not FOMO if there is no clear confirmation from the price structure.

✅ Waiting for the price structure to be broken and then looking for a position when the price rebounds is a wise choice at this time. Or we can simply wait for the price reaction when it reaches the support zones below to trade in accordance with the main trend

💪 **Wishing you success in making profits!**

XAU#18: Latest Update: Gold Price Continues Its Upward Journey?💎 💎 💎 OANDA:XAUUSD once again surpassed a new peak. However, there was a slight correction yesterday. So let's analyze whether OANDA:XAUUSD will continue to set a new peak today: 💎 💎 💎

1️⃣ **Fundamental analysis:**

📊Gold exports from Singapore to the US increased dramatically. Gold futures prices on the New York COMEX floor are higher than physical gold prices in London, promoting the flow of gold from other markets into the US to benefit from this difference.

🔴Fed meeting minutes | No rush to cut interest rates, consider slowing down or pausing the balance sheet reduction. Interest rate policy: The Fed kept interest rates unchanged (4.25%-4.50%) and has no plans to cut interest rates soon. The first cut is expected in July or later.

🚀 There is a turning point in the ceasefire between Russia and Ukraine, and investors are betting ahead! Investors are positioning for an early end to the Russia-Ukraine conflict after US President Donald Trump and Russian President Vladimir Putin discussed the issue.

📌Overall, we can see that the fundamentals are not supporting the gold price increase. However, the gold price increase is still coming from the uncertainty about US tariff policies and concerns about the weakening economy.

2️⃣ **Technical analysis:**

🔹 **D frame**: the previous day's increase is currently a bit hesitant like yesterday's candle. However, gold is still in a strong uptrend.

🔹 **H4 frame**: the bullish price structure is too clear. We had a slight correction at the end of yesterday but recovered immediately afterwards, showing that market sentiment is still very optimistic about the prospect of gold's increase.

🔹 **H1 frame**: Looking at the chart, everyone can see that H1 is temporarily in a decreasing channel. However, the decreasing structure has not been confirmed. The price can still accumulate and bounce to break the peak at any time

3️⃣ **Trading plan:*

⛔ The current price structure is still supporting the bulls, but we also need to pay attention to important information at this time about the Russia-Ukraine war. If there is official information about the ceasefire agreement, it will cause gold prices to decrease.

✅ Prioritize BUY following the main trend. The target of the 3000 area from previous articles analyzed is very close. You can refer to the plan in the H1 frame to set up a position

💪 **Wish you successful trading!**

XAU#11: Gold continues to hit new highs but ......

💎 💎 💎 Did you make a profit in the previous article #10? Please like and follow the channel to follow the earliest trading plan. 💎 💎 💎

🔥So FOREXCOM:XAUUSD OANDA:XAUUSD TVC:GOLD has corrected and broken the peak as predicted in analysis #10. Now let's plan the next step:🔥

1️⃣ **Fundamental analysis:**

📊US employment, new orders, and inventory indicators achieved good data.

🔴 Mexican President Sheinbaum previously announced that he had a good meeting with Trump and reached some agreements, the imposition of US tariffs will be postponed for a month.

🔴Trump said the call with Canadian Prime Minister Trudeau went well.

🚀 . The US government deficit is supporting both gold and stocks, but stock returns may have peaked.

📌 Gold continues to be a safe haven asset, attracting more safe haven capital flows

2️⃣ **Technical analysis:**

🔹 **Frame D**: Yesterday's candle showed a very good price reaction at the old peak. If we follow price action, we may see gold continue to set new peaks

🔹 **Frame H4**: The bullish price structure is still maintained. However, we still need to pay attention to guard against price traps. I will analyze the reasons in detail in the trading plan

🔹 **Frame H1**: The bullish trend is clearly shown. There are currently no signs of a structure break

3️⃣ **Trading plan:**

⛔ Looking at the current price structure, we can see that the bulls are completely dominating. However, yesterday's increase has not yet seen distribution to be able to continue to establish a new peak.

✅ In my personal opinion, today we will wait for the price reaction in the 279x area and should not FOMO BUY this peak. The price line has increased continuously although market sentiment has improved thanks to information that Trump's meetings all had good results. We have not seen any correction to gain sustainable momentum. It is likely that it will appear today. This will be an opportunity for us to have a better position than the current price

💪🚀 **Wish you successful trading! **

📌 For any questions, please contact directly. I'm ready to answer you for free

#trading #trade #xauusd #newtrader #newbie #xau #forex #tradingview #plants #trader #tradingforex

Gold for the week starting 4th nov 2024Trading Strategy: Buy Above 2,745 / Sell Below 2,731

Current Price: 2,742.00 USD

Key Levels:

Buy Signal: If the price closes above 2,745 on the one-hour candle, it indicates a potential upward trend, suggesting a good time to consider buying.

Sell Signal: If the price closes below 2,731 on the one-hour candle, it suggests a potential downward trend, indicating it might be a good time to consider selling.

Market Analysis:

The current price is hovering around 2,742.00 USD, just below the buy signal level.

The market is showing signs of bullish momentum, but it's important to monitor the price closely.

Recommendations:

Buy: If the price sustains above 2,745 on the one-hour candle close, consider entering long positions with targets at 2,780 and 2,800.

Sell: If the price breaks below 2,731 on the one-hour candle close, consider short positions with targets at 2,700 and 2,680.

Disclaimer: This is only for educational purposes. You may do your own analysis before taking any trading decisions.