Master Institutional TradingInstitutional trading refers to the buying and selling of financial assets—stocks, bonds, derivatives, commodities, currencies—by organizations that invest large sums of money. These trades are typically large in volume and value and are executed through private negotiations or electronic networks designed for block trading.

Key Characteristics:

High volume orders

Priority on stealth execution

Access to premium data

Quantitative modeling

Advanced algorithms

Jio

Sensex Dives Below ₹82,600 — IT Stocks Drag Index DownFrom a technical standpoint, Sensex breaking below ₹82,600 is important. This was seen as a short-term support level. Now that it's broken, ₹82,280 and ₹82,060 are the next zones to watch for.

Moving Averages:

Sensex has slipped below its 20-day moving average, which is often used as a trend indicator.

This shows short-term weakness and signals caution for traders.

RSI (Relative Strength Index):

RSI is heading lower but not yet in oversold territory.

This means there could be more downside before a potential bounce.

MACD:

The MACD indicator is also showing bearish crossover – another sign that the market could stay weak in the near term.

What Should Traders & Investors Do Now?

For Traders:

This is a time to stay cautious.

Avoid taking aggressive long positions unless Sensex reclaims ₹83,000+ with strong volume.

Focus on stock-specific opportunities in sectors like FMCG, pharma, or even PSU banks.

For Long-Term Investors:

Don’t panic. Corrections like these are common.

Instead of trying to time the market, look for quality stocks at attractive valuations.

IT stocks are fundamentally strong, so long-term investors can accumulate slowly on dips, especially if they fall further.

Global Factors at Play

What happens in the global economy directly affects Indian markets. Here are some international cues that are influencing Sensex:

US Interest Rates:

The US Federal Reserve may raise interest rates again to fight inflation.

Higher rates make borrowing expensive, slow down spending, and can trigger a global slowdown.

China's Economic Data:

Slower growth in China has worried global investors.

A slowdown in Asia’s biggest economy has ripple effects on global demand.

Geopolitical Tensions:

Trade issues, especially between the US and China, are creating uncertainties.

Wars or unrest in regions like Ukraine or the Middle East also cause global instability.

What to Watch in Coming Days

Key Events:

More Q1 results from major companies

Global inflation data releases

FII (Foreign Institutional Investors) activity – whether they continue selling or start buying

Crude oil price movement – as it affects inflation and currency

RBI commentary on interest rates

📢 Final Thoughts

The fall in Sensex below ₹82,600 is a signal for caution, not panic. The IT sector’s weakness has triggered the fall, but the overall market is still stable when compared to global peers.

For serious investors, this is a good time to review portfolios, build a watchlist, and focus on quality stocks and sectors that show relative strength. Defensive sectors like FMCG and pharma are showing signs of leadership.

Market cycles are natural – after every fall, there's a recovery. The key is to stay updated, stay disciplined, and not let emotions drive your decisions.

NIFTY Slips Below 25,200 The Nifty closed today at 25,149, down by around 205 points.

It has broken an important support level near 25,330, which could be a warning sign for traders and investors.

The market is showing signs of weakness – key technical indicators like RSI and MACD are also turning negative.

If Nifty slips below 25,000, we might see more downside movement in the coming days.

👉 For now, it’s better to stay cautious.

Long-term investors should wait for stability.

Short-term traders should manage risk and avoid over-trading.

Keep an eye on upcoming Q1 earnings and global market trends.

This is not the time to panic – it’s the time to stay informed and plan smartly.

Caption Highlights (optional for post tags or image text):

Nifty breaks 25,330 support

Watch 25,000 as next key level

Bearish signals on technical charts

Caution advised for traders

Market waiting for fresh cues

Dip-buying in quality large-caps & sectorsDip-Buying in Quality Large-Caps & Sectors: A Simple Investor's Guide

One of the hottest topics in today’s stock market is dip-buying in quality large-cap stocks and sectors. If you’ve been following the market even casually, you’ve probably heard this term thrown around a lot. But what does it really mean? And more importantly, how can you use this strategy to your advantage in a way that’s smart and simple?

This guide breaks it down in plain English, so whether you're new to investing or have been in the game a while, you'll understand exactly how dip-buying works, why it's trending, and what sectors and stocks are currently worth your attention.

What Is Dip-Buying?

"Buying the dip" means purchasing stocks when their prices temporarily fall, with the belief that they will rise again. Think of it like a sale at your favorite store. The item (in this case, a stock) hasn’t lost its value; it’s just cheaper for now. Smart investors take advantage of these moments to buy strong companies at a discount.

But there's a catch. Not every dip is worth buying. That’s why it's important to focus on quality large-cap stocks and strong sectors — companies and industries that have a solid track record, strong financials, and the ability to bounce back from short-term declines.

Why Is Dip-Buying So Popular Right Now?

Market Volatility: Global markets are swinging more than usual due to geopolitical tensions, inflation, interest rate changes, and currency pressure. This creates more short-term dips.

Economic Stability: Despite the ups and downs, long-term economic fundamentals in countries like India are still positive. Sectors like banking, pharma, and FMCG are showing resilience.

Pro Investor Strategy: Top fund managers and seasoned investors often use dip-buying to accumulate high-quality stocks at better prices. Retail investors are now catching on to this technique.

Better Risk-Reward: When you buy during a dip, you increase your chances of getting higher returns when the stock rebounds, while minimizing downside risk (if chosen wisely).

What Makes a Stock "Quality"?

Not every large-cap stock is a safe bet. Here are key signs that a company is worth buying on dips:

Consistent Revenue and Profit Growth

Strong Brand Recognition (like HUL, TCS, Infosys)

Good Corporate Governance

Low to Moderate Debt

Regular Dividends

Presence in a Growing Industry

These are the kinds of stocks that recover quickly after market corrections.

Sectors Worth Watching for Dip-Buying

Let’s break down a few of the most popular sectors where investors are buying dips:

1. FMCG (Fast-Moving Consumer Goods)

These are companies that sell everyday products like soap, toothpaste, and food.

Why it's strong: Demand is stable even in bad times.

Examples: HUL (Hindustan Unilever), Nestle, Dabur, Britannia.

Strategy: Buy during quarterly results disappointment or short-term inflation impact.

2. Pharma & Healthcare

Why it's strong: Healthcare is essential; global export markets offer growth.

Examples: Sun Pharma, Dr. Reddy’s, Cipla, Glenmark.

Strategy: Buy on regulatory setback or global pressure — long-term story is still intact.

3. Private Banking & Financials

Why it's strong: Credit growth is picking up; digital transformation is boosting profits.

Examples: HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Axis Bank.

Strategy: Accumulate on market-wide corrections or temporary bad loan fears.

4. IT & Tech

Why it's strong: Digital services, AI, and automation are booming worldwide.

Examples: TCS, Infosys, Wipro, HCL Tech.

Strategy: Buy during global slowdown fears or margin pressure.

5. Auto & EV-Related Stocks

Why it's strong: Strong demand post-COVID, and EV boom is real.

Examples: Maruti Suzuki, Tata Motors, M&M, Bajaj Auto.

Strategy: Use monthly sales dips or raw material price spikes to enter.

How to Actually Do Dip-Buying (Without Stress)

Make a Watchlist: Pick 10–15 quality large-cap stocks across sectors.

Use Alerts or Apps: Set price alerts so you know when a stock drops 5–10% from recent highs.

Check the News: Was the dip due to a real problem or just market mood swings?

Start Small: Don’t put all your money at once. Invest in chunks. That’s called SIP (Systematic Investment Plan) in stocks.

Stay Updated: Re-evaluate your picks every quarter. Replace weak stocks.

Hold with Patience: Dip-buying is not about overnight returns. Give your stocks 6–12 months at least.

Common Mistakes to Avoid

Buying Every Dip: Not every fall is a buying opportunity. Some companies have deeper problems.

Ignoring Fundamentals: Always check financial health.

Getting Greedy: Don’t try to time the exact bottom.

Panic Selling: If you’ve done your homework, trust your process.

Real Example (as of July 2025)

Let’s say HUL dropped from ₹2,800 to ₹2,580 after weak results. If you believe in the company’s long-term story, that 8% drop is a buying opportunity. Maybe you buy 20% of your planned quantity now, and wait to add more if it drops further to ₹2,450. If it rebounds, great — you already entered.

Another example: Glenmark Pharma recently jumped 14% due to a global licensing deal. It had dipped earlier due to export pressure. Those who bought during that dip are now sitting on solid gains.

Final Thoughts

Dip-buying in quality large-cap stocks isn’t just a smart strategy; it’s also a calm one. It helps you invest without chasing highs or making emotional decisions. It works best when you combine common sense, basic research, and patience.

Markets will always move up and down. But strong companies bounce back. If you can learn to spot those temporary drops in quality businesses, you can grow your wealth steadily and confidently.

Happy Investing!

Banknifty 1day time frame📊 Current Status (as of today)

Bank Nifty is trading around: ₹56,750 – ₹56,800

It's just below its all-time high, which is around ₹57,628.

The trend is still positive (bullish), but it’s taking a breather after a big rally.

🛡️ Strong Support Zones (Buy on Dip Areas)

These are the price areas where Bank Nifty may bounce back if it falls:

₹55,500 – ₹55,700 → Minor support

₹54,300 – ₹54,500 → Stronger support zone (good for long-term entry)

₹52,500 – ₹53,000 → Very strong base; ideal for adding long-term positions if market corrects

🚀 Resistance Levels (Where Price Might Struggle)

These are areas where it might face selling pressure:

₹57,000 – ₹57,200 → Near-term resistance

₹57,600 – ₹57,800 → All-time high zone

Above ₹58,000 → Fresh breakout, could fly to new levels if crossed with volume

✅ What You Can Do (If You’re a Long-Term Investor)

If you already hold: Stay invested. Trend is still up.

If you want to buy:

Wait for a dip to around ₹54,300–₹55,000 for a safer long-term entry.

Or, buy small now and add more on dips.

Breakout Strategy: If Bank Nifty closes above ₹57,800, it may start a new rally.

📌 Summary in One Line:

“Bank Nifty is near its highs — still bullish, but don’t chase. Buy dips around ₹54,500 or add more only if it breaks above ₹57,800.”

KOTAKBANKKotak Bank has been weak for a while but now it's trying to form a bottom. The stock is not yet in a strong uptrend, but it's showing early signs of a possible recovery.

Good Price to Invest

If you're looking to invest, a good range to start buying is around:

Here are the current daily price levels for Kotak Mahindra Bank (KOTAKBANK) on NSE:

Last traded price: ₹ 2,220.60, up

Today's range: ₹ 2,198.60 – ₹ 2,225.00

52‑week range: ₹ 1,679.05 – ₹ 2,301.90

Intraday Pivot Levels (Approximate)

According to Equity Pandit, today's pivot-based support and resistance likely fall at:

Immediate Supports:

• S1 ≈ ₹ 2,204

• S2 ≈ ₹ 2,188

• S3 ≈ ₹ 2,178

Resistances:

• R1 ≈ ₹ 2,231

• R2 ≈ ₹ 2,241

• R3 ≈ ₹ 2,257

Drilling deeper, a key intraday level is ₹ 2,184:

If the stock closes below ₹ 2,184, the short-term trend could weaken—potential signal to lighten downside risk.

As long as it stays above ₹ 2,184, the positive momentum may hold.

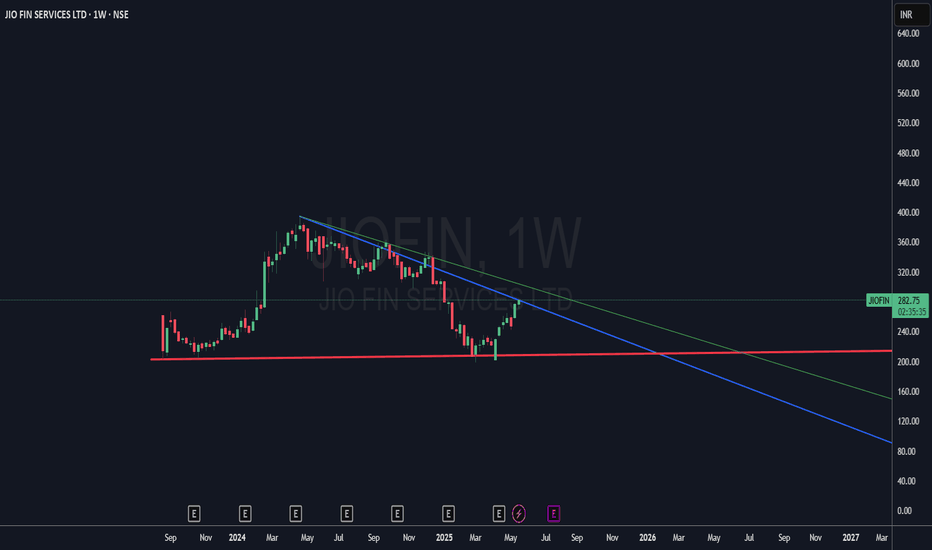

Jio Financial ---- Deep AnalysisJIOFIN -- High Probability Reversal Setup Based on ICT & SMC Concepts

Timeframe - Daily

Projection -- High Probability Reversal Setup expected.

Price Action Overview --

Stock is currently Respecting an internal bullish structure without breaking higher lows.

And stock is currently moving towards High probability POI zone along with --

Order block + FVG is 330-340 levels

Liquidity zone just below the Order block

Liquidity & POI Zone ----

Immediate Liquidity is resting above the levels of 290-300

Imbalance ---

Downside VOlume imbalance between 250-260 levels

below that there is breaker block support zone

RSI ----

Rsi divergence observed at bottom, which shows a bullish move

Rsi showing potential exhaustion or say confluence for reversal after POI is tapped.

Final projection for next 2-3-4 months view -----

Main Target (High Probability) -- Price likely to sweep buy-side liquidity above 300-310

tapping into orderblock + FVG zone 330-340 levels

Expecting strong rejection and sell-off towards Volume imbalance(255) and Breaker block(235)

If main Target Does not go well --- If rejection occures earlier around 300-310 then a partial distribution may trigger

earlier dump into volume imbalance without reaching to Orderblock.

This setup is just reflecting classic Buy-side liquidity grab >>>>> Sell off into imbalance.

Your views or comments are really welcomed. Also just give comments for any confusion or clarification.

#Nifty #Sensex #Jio #Reliance

YOUR EVERYDAY BANKJio Financial - CMP 280

JFSL was originally incorporated as Reliance Strategic Investments Private Limited in July, 1999 under the Companies Act 1956. Jio Financial Services Limited was incorporated in July, 23. JFSL is a NBFC-ND-SI registered with RBI. The company is a holding company and will operate its financial services business through its consumer-facing subsidiaries namely Jio Finance Limited (JFL), Jio Insurance Broking Limited (JIBL), and Jio Payment Solutions Limited (JPSL) and joint venture namely Jio Payments Bank Limited (JPBL). Jio Financial Serv

This is just to boost my confidence. No Suggestions for buying. I will keep checking and updating my mistake if last post gone wrong...

Disclosure: I am not SEBI registered. The information provided here is for educational purposes only. I will not be responsible for any of your profit/loss with these suggestions. Consult your financial Adviser before making any decisions.

Long Reliance Industries Between 2585 - 2660 Target 3500Reliance forming bullish Butterfly Harmonic Pattern on weekly charts and going no where up till November 20th. Good Time to accumulate.

Targets marked on charts with horizontal line. Once point B is breached and closed then rally will start.

Few triggers -

Giga factory opening in December.

JIO price hike effect

Hydrogen plant

Windfall tax removal effect

No stop loss as fall is limited.

JIO FINANCE - GO LONG, STAY LONG!This stock is going to be bigger then Bajaj Finance in very near future. Cost of borrowing funds for this NBFC is going to be the lowest for any in its peer group.

In future (few years from now) there is a chance of JIO AMC and other potential demerger.

Wait for lower levels as marked and hold on to this gem.

JIOFIN Analysis & PredictionThis is the analysis of JIOFIN in Daily Time Frame. Watch carefully. The chart explains itself.

In DTF JIOFIN formed Cup & Handle Pattern. JIOFIN closed above the green up line of Suraranjan Trading Band indicator but facing resistance at immediate level. If it breaks and sustains above the level, good for the stock.

There are some prediction levels. These Levels act as Support and Resistance according to position of price. You have to trade according to level breakout or breakdown.

Always maintain your risk management.

Book your profit according to your “STOMACH”.

Disclaimer:

This is not investment advice. I am not a SEBI Registered Analyst. Anything posted here is my own analysis and views. This is created for educational purposes only. Always consult your Financial Advisor before taking any decision or trade.

Happy trading.

About JIOFIN:

Jio Financial Services Ltd. operates as a non-banking financial company. It offers finance, trading and investment services. The company was founded on July 22, 1999 and is headquartered in Mumbai, India.