Jiofinanalysis

Jio Financial Services Ltd - Breakout OpportunityDate : 30-Jul-2025

LTP : Rs. 320.30

Targets: (T1) Rs. 368 --> (T2) Rs. 394 --> (T3) Rs. 437

SL : Rs. 282

Technical View:

• NSE:JIOFIN was going through primary downtrend since Apr 2024. From it's lifetime high of 394.70 in Apr 2024, it has retraced 50% to 198.65 in Mar 2025.

• From Apr 2025, NSE:JIOFIN has started moving in secondary uptrend within its primary downtrend and had given a breakout from its primary downtrend on 26-Jun-2025 with higher than average volume.

• on 28-Jul-2025, NSE:JIOFIN has re-tested the downtrend line and bounced back closing above 20 DEMA.

• NSE:JIOFIN is currently trading above 20 DEMA and 50 DEMA.

• MACD is trading at 2.38 and RSI is trading at 56.18.

• Looking good to continue the current momentum.

If you have liked this analysis, please Boost/Like this idea and follow my ID for more ideas.

JIO FIN SERVICES - Swing ContenderOn the larger scheme of this this stock has been beaten down and the trajectory is deep negative. However, in the very short term the stock can correct its trajectory and as a trader one can make use of these opportunities.

A volatility contraction has happened forming a base on shorter timeframe. Expecting this stock to perform well over the next 2 days.

Jio Finance: A Strong Potential Stock for Long-Term InvestmentJio Finance, listed in August 2023, has been on a steady uptrend, with a notable rally in the first half of 2024. The stock has reached an all-time high of 395, but has since entered a downtrend with lower highs. Despite this, the stock has maintained strong support around 310, indicating a potential buying opportunity.

Fundamental Strength

Jio Finance has a strong fundamental backing, with Jio(Reliance) and BlackRock providing investment services. The company has launched its JioFinance App, which integrates digital banking and provides various financial services, including UPI transactions, bill payments, insurance advisory, and more in Oct 2024. The app's future plans focus on investing in AI/ML and collaborating with FinTech startups, making it a promising candidate for long-term investment.

Technical Analysis

The weekly chart shows a downtrend, with the stock currently trading below its all-time high. However, the stock has maintained strong support around 310, which could be a good entry point for long-term investors. If the stock breaks below 295, it could potentially fall to 270, making it essential to have a strategy in place.

Action Plan

For investors looking to enter in this stock:

Wait for a breakout above the downtrend line on the daily chart before entering the market.

Consider adding more quantity at the 310 support level if its taking support at this levels in daily chart.

Set a stop loss at 295 to limit potential losses, with a view to enter again if 270 support holds strong

Once stock crosses levels of 370 and 395 shifting stop loss higher to just below immediate support on weekly chart should be good.

By following this action plan, investors can potentially capitalise on the long-term potential of Jio Finance while managing risk.

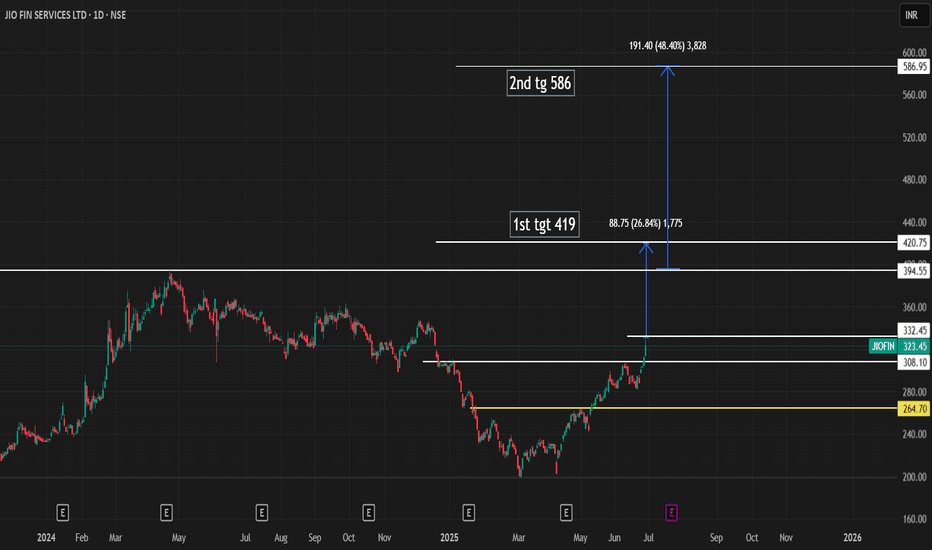

JIOFIN BULLISH VIEWJIOFIN BULLISH VIEW

ELLIOTT WAVE THEORY

JIOFIN showing the fractal nature , completed 1st wave and 2nd wave higher degree

showing upward signs , high volume traction can move 3rd wave to equality around 500 or even upto 1.618 around 620.

let it gain some traction

Wave 1 is considered using 17 leg formation to avoid further classification of inner counts , easy to count in case extension and prominent impulsive moves.

This is for educational purpose only, in case of any suggestion you are welcome.

Jio Financial Services Ltd - Breakout OpportunityDate : 2-Sep-2024

LTP : Rs. 344.90

Resistance Level/s: (R1) Rs. 368 --> (R2) Rs. 394 --> (R3) Rs. 447

Support Level/s : (S1) Rs. 310 --> (S2) Rs. 295.70

Technical View:

• NSE:JIOFIN is in strong uptrend since Nov-2023. It was recently going through it's secondary downtrend within primary uptrend.

• After touching the high of 394.70 on 23-Apr-2024, it has retraced 21% to 310 level.

• On 2-Sep-2024, NSE:JIOFIN has broke out from it's secondary downtrend with higher than average volume.

• NSE:JIOFIN has managed to close above 20 DMA and 50 DMA on 2-Sep-2024.

• RSI has entered buy zone and trading at 61.42.

• Both RSI and MACD are showing positive divergence on daily chart.

• Looking good to start a new swing from here.

Like the analysis? Boost/Like this idea and follow my ID.

Disclaimer : I am not a SEBI registered analyst/consultant and not recommending anyone to take any BUY or SELL position in stock market. Investing in stock market is risky and one should do a self analysis and validation before investing in stock market. My ideas are published for learning purpose only and are available to everyone at no cost/charge.

Jio Financial Services Ltd - Breakout OpportunityDate : 20-Jun-2024

Rating : Buy - Positional Trade

LTP : Rs. 365.55

Targets: (1) Rs. 394 --> (2) Rs. 448

SL : Rs. 335 on daily close basis

Technical View:

• NSE:JIOFIN is in it's primary uptrend and was recently going through it's secondary downtrend.

• After touching the high of 394.70 on 23-Apr-2024, it has retraced 22% to 307.30 level.

• On 20-Jun-2024, NSE:JIOFIN has broke out from its secondary down trend with higher than average volume.

• NSE:JIOFIN is trading above 20 DMA, 50 DMA and 21 DEMA.

• RSI is trading at 56.16 and MACD is trading at 0.98.

• Looking strong to start a new swing from here.

Disclaimer : I am not a SEBI registered analyst/consultant and not recommending anyone to take any BUY or SELL position in stock market. Investing in stock market is risky and one should do a self analysis and validation before investing in stock market. Ideas are published for learning purpose only.

Jio Financial Services Ltd. - Short Term TradeDate : 18-Mar-2024

Rating : Buy - Short Term Trade

LTP : Rs. 352.55

Targets: Rs. 409

SL : Rs. 335

Technical View:

• NSE:JIOFIN is in its primary uptrend since Oct-2023.

• After touching a life time high of 374 on 12-Mar-2024, it has retraced up to 15% to 318 level.

• NSE:JIOFIN has broke out from its secondary down trend on 18-Mar-2024.

• RSI is at 65.22 and MACD is at 18.80. Both are indicating good momentum and strength to move the price up.

Disclaimer : I am not a SEBI registered analyst/consultant and not recommending anyone to take any BUY or SELL position in stock market. Investing in stock market is risky and one should do a self analysis and validation before investing in stock market.

Jio Financial Services Ltd.Note : Publishing this 2nd idea on NSE:JIOFIN in continuation to my 1st one (link given below), to provide analysis with updated chart and targets.

Suggested on : 23-Nov-2023

Rating : Buy (Mid Term as well as Long Term Opportunity)

LTP on 23-Nov-2023 : Rs. 221.90

Targets Achieved : (1) Rs. 233 --> (2) Rs. 266 --> (3) 288 --> (4) 295 --> (5) 318

Next Targets: (6) Rs. 348 --> (7) Rs. 373

Technical View :

NSE:JIOFIN is in primary uptrend since end of Oct-2023. Since then, it has seen multiple ups and downs keeping the primary uptrend intact. Recently, it touched the life time high of 348 on 26-Feb-2024. Post that it went in to minor retracement and again started showing strength in last couple of days. MACD and RSI are bullish. After every minor retracement, RSI crossover to RSI-based MA has given a bullish outcome, which has happened again on 2-Mar-2024. Also, it has given break out from its minor retracement on 1-Mar-2024. Looking good for further rally from here onwards.

Disclaimer : I am not a SEBI registered analyst/consultant and not recommending anyone to take any BUY or SELL position in stock market. Investing in stock market is risky and one should do a self analysis and validation before investing in stock market.

JIOFIN Analysis & PredictionThis is the analysis of JIOFIN in Daily Time Frame. Watch carefully. The chart explains itself.

In DTF JIOFIN formed Cup & Handle Pattern. JIOFIN closed above the green up line of Suraranjan Trading Band indicator but facing resistance at immediate level. If it breaks and sustains above the level, good for the stock.

There are some prediction levels. These Levels act as Support and Resistance according to position of price. You have to trade according to level breakout or breakdown.

Always maintain your risk management.

Book your profit according to your “STOMACH”.

Disclaimer:

This is not investment advice. I am not a SEBI Registered Analyst. Anything posted here is my own analysis and views. This is created for educational purposes only. Always consult your Financial Advisor before taking any decision or trade.

Happy trading.

About JIOFIN:

Jio Financial Services Ltd. operates as a non-banking financial company. It offers finance, trading and investment services. The company was founded on July 22, 1999 and is headquartered in Mumbai, India.