Jio Financial Services Ltd - Breakout OpportunityDate : 30-Jul-2025

LTP : Rs. 320.30

Targets: (T1) Rs. 368 --> (T2) Rs. 394 --> (T3) Rs. 437

SL : Rs. 282

Technical View:

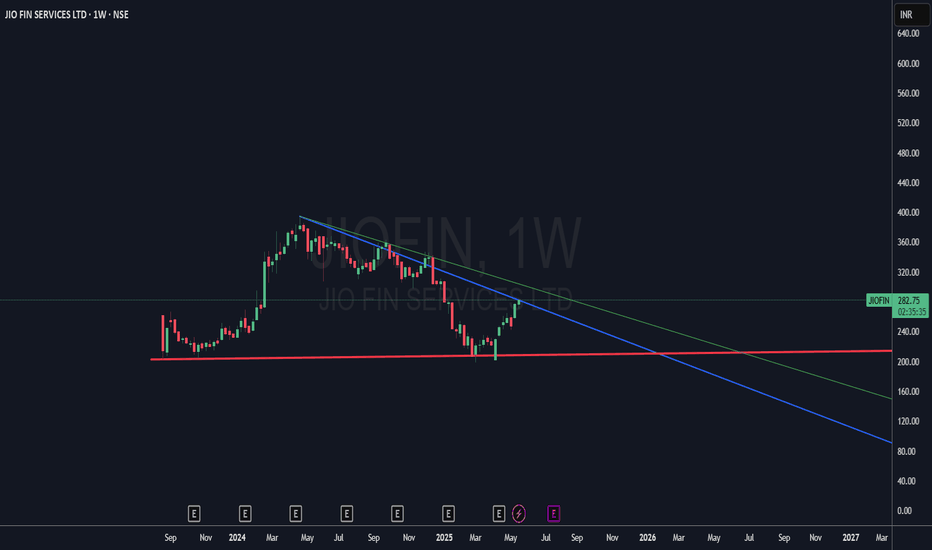

• NSE:JIOFIN was going through primary downtrend since Apr 2024. From it's lifetime high of 394.70 in Apr 2024, it has retraced 50% to 198.65 in Mar 2025.

• From Apr 2025, NSE:JIOFIN has started moving in secondary uptrend within its primary downtrend and had given a breakout from its primary downtrend on 26-Jun-2025 with higher than average volume.

• on 28-Jul-2025, NSE:JIOFIN has re-tested the downtrend line and bounced back closing above 20 DEMA.

• NSE:JIOFIN is currently trading above 20 DEMA and 50 DEMA.

• MACD is trading at 2.38 and RSI is trading at 56.18.

• Looking good to continue the current momentum.

If you have liked this analysis, please Boost/Like this idea and follow my ID for more ideas.

Jiofinance

JIOFIN | Cup & Handle Breakout! Target ₹324 Here is the **technical analysis** for **JIO FIN SERVICES LTD (NSE)** based on your chart:

---

### 📊 **Technical Analysis – JIO FIN SERVICES LTD**

**Pattern Identified:** Cup and Handle

**Breakout Level:** ₹262.85

**Target Price:** ₹324.05

**Current Market Price:** ₹281.75

**Potential Upside:**15% from current levels

---

### ✅ **Bullish Signals:**

* **Cup and Handle Formation:** A textbook bullish continuation pattern signaling accumulation followed by a breakout.

* **Breakout Confirmation:** Price has broken above the resistance zone (₹262.85) with strength and follow-through buying.

* **Volume Confirmation:** Breakout was accompanied by higher-than-average volume, reinforcing the validity of the pattern.

* **Measured Move Target:** Based on the cup depth (₹61), the projected target is ₹324.05.

---

### 📌 **Key Levels:**

* **Immediate Resistance:** ₹324.05 (target zone)

* **Support Zones:**

* ₹262.85 (handle breakout support)

* ₹201.57 (previous swing low, base of cup)

---

### 📈 **Conclusion:**

JIO FIN SERVICES is displaying strong bullish momentum after confirming a **Cup and Handle** breakout. As long as the price holds above ₹262.85, the stock may trend toward ₹324+. A retest of the breakout zone can be a good opportunity to accumulate.

---

YOUR EVERYDAY BANKJio Financial - CMP 280

JFSL was originally incorporated as Reliance Strategic Investments Private Limited in July, 1999 under the Companies Act 1956. Jio Financial Services Limited was incorporated in July, 23. JFSL is a NBFC-ND-SI registered with RBI. The company is a holding company and will operate its financial services business through its consumer-facing subsidiaries namely Jio Finance Limited (JFL), Jio Insurance Broking Limited (JIBL), and Jio Payment Solutions Limited (JPSL) and joint venture namely Jio Payments Bank Limited (JPBL). Jio Financial Serv

This is just to boost my confidence. No Suggestions for buying. I will keep checking and updating my mistake if last post gone wrong...

Disclosure: I am not SEBI registered. The information provided here is for educational purposes only. I will not be responsible for any of your profit/loss with these suggestions. Consult your financial Adviser before making any decisions.

Jio Finance: A Strong Potential Stock for Long-Term InvestmentJio Finance, listed in August 2023, has been on a steady uptrend, with a notable rally in the first half of 2024. The stock has reached an all-time high of 395, but has since entered a downtrend with lower highs. Despite this, the stock has maintained strong support around 310, indicating a potential buying opportunity.

Fundamental Strength

Jio Finance has a strong fundamental backing, with Jio(Reliance) and BlackRock providing investment services. The company has launched its JioFinance App, which integrates digital banking and provides various financial services, including UPI transactions, bill payments, insurance advisory, and more in Oct 2024. The app's future plans focus on investing in AI/ML and collaborating with FinTech startups, making it a promising candidate for long-term investment.

Technical Analysis

The weekly chart shows a downtrend, with the stock currently trading below its all-time high. However, the stock has maintained strong support around 310, which could be a good entry point for long-term investors. If the stock breaks below 295, it could potentially fall to 270, making it essential to have a strategy in place.

Action Plan

For investors looking to enter in this stock:

Wait for a breakout above the downtrend line on the daily chart before entering the market.

Consider adding more quantity at the 310 support level if its taking support at this levels in daily chart.

Set a stop loss at 295 to limit potential losses, with a view to enter again if 270 support holds strong

Once stock crosses levels of 370 and 395 shifting stop loss higher to just below immediate support on weekly chart should be good.

By following this action plan, investors can potentially capitalise on the long-term potential of Jio Finance while managing risk.

JIOFIN BULLISH VIEWJIOFIN BULLISH VIEW

ELLIOTT WAVE THEORY

JIOFIN showing the fractal nature , completed 1st wave and 2nd wave higher degree

showing upward signs , high volume traction can move 3rd wave to equality around 500 or even upto 1.618 around 620.

let it gain some traction

Wave 1 is considered using 17 leg formation to avoid further classification of inner counts , easy to count in case extension and prominent impulsive moves.

This is for educational purpose only, in case of any suggestion you are welcome.

Jio Financial Services Ltd - Breakout OpportunityDate : 2-Sep-2024

LTP : Rs. 344.90

Resistance Level/s: (R1) Rs. 368 --> (R2) Rs. 394 --> (R3) Rs. 447

Support Level/s : (S1) Rs. 310 --> (S2) Rs. 295.70

Technical View:

• NSE:JIOFIN is in strong uptrend since Nov-2023. It was recently going through it's secondary downtrend within primary uptrend.

• After touching the high of 394.70 on 23-Apr-2024, it has retraced 21% to 310 level.

• On 2-Sep-2024, NSE:JIOFIN has broke out from it's secondary downtrend with higher than average volume.

• NSE:JIOFIN has managed to close above 20 DMA and 50 DMA on 2-Sep-2024.

• RSI has entered buy zone and trading at 61.42.

• Both RSI and MACD are showing positive divergence on daily chart.

• Looking good to start a new swing from here.

Like the analysis? Boost/Like this idea and follow my ID.

Disclaimer : I am not a SEBI registered analyst/consultant and not recommending anyone to take any BUY or SELL position in stock market. Investing in stock market is risky and one should do a self analysis and validation before investing in stock market. My ideas are published for learning purpose only and are available to everyone at no cost/charge.

Jio Financial Services Ltd - Breakout OpportunityDate : 20-Jun-2024

Rating : Buy - Positional Trade

LTP : Rs. 365.55

Targets: (1) Rs. 394 --> (2) Rs. 448

SL : Rs. 335 on daily close basis

Technical View:

• NSE:JIOFIN is in it's primary uptrend and was recently going through it's secondary downtrend.

• After touching the high of 394.70 on 23-Apr-2024, it has retraced 22% to 307.30 level.

• On 20-Jun-2024, NSE:JIOFIN has broke out from its secondary down trend with higher than average volume.

• NSE:JIOFIN is trading above 20 DMA, 50 DMA and 21 DEMA.

• RSI is trading at 56.16 and MACD is trading at 0.98.

• Looking strong to start a new swing from here.

Disclaimer : I am not a SEBI registered analyst/consultant and not recommending anyone to take any BUY or SELL position in stock market. Investing in stock market is risky and one should do a self analysis and validation before investing in stock market. Ideas are published for learning purpose only.