USD/JPY Bullish Reversal AnalysisUSD/JPY Bullish Reversal Analysis 📈💹

🔍 Technical Overview:

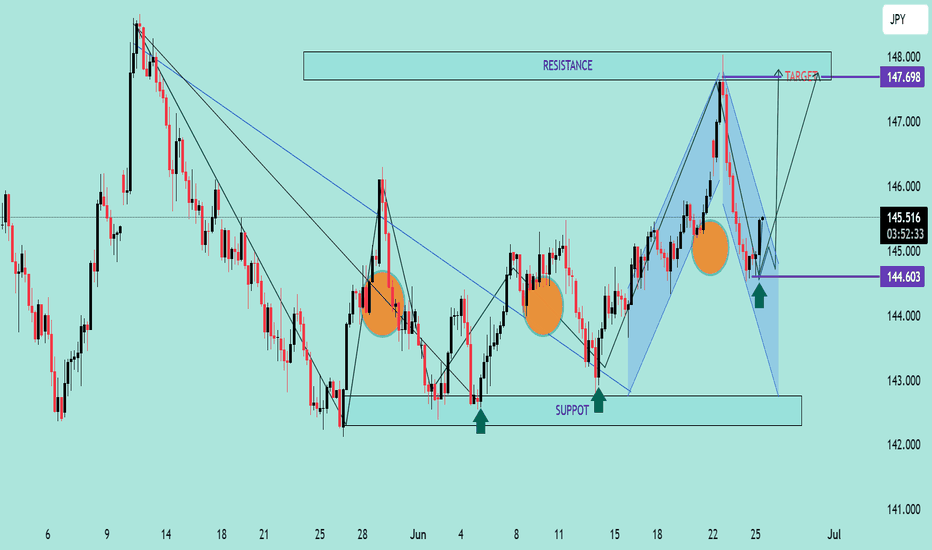

The chart illustrates a strong bullish reversal pattern forming on USD/JPY after price reacted from a key support zone at 144.600. This level has held firm multiple times, marked by green arrows, signaling strong buying interest.

📐 Chart Patterns & Structure:

✅ A bullish harmonic pattern (possibly a bullish Bat or Gartley) is completing near the 144.600 zone.

🔄 Multiple rejection wicks and bullish engulfing patterns indicate a potential upside reversal.

🔵 Descending trendlines have been broken, confirming momentum shift.

🔁 Previous resistance turned support (near 145.000) is acting as a possible launchpad for the next move.

🎯 Upside Target:

The projected move targets the resistance zone at 147.698, aligning with previous highs and a significant supply area.

If price breaks above 145.900 convincingly, continuation toward this resistance is expected.

🔻 Downside Risk:

A break below 144.600 would invalidate the bullish setup and expose price to the lower support range near 142.000–143.000.

📊 Conclusion:

USD/JPY is showing signs of bullish reversal from a strong demand zone. If price sustains above 145.000 and breaks the minor consolidation, the pair could rally toward 147.698 🎯.

Bias: Bullish ✅

Support: 144.600

Resistance: 147.698

Jpyusdforexsignal

JPY/USD 30-Min Chart – Bearish Setup from Resistance Zone with 2200 EMA (blue): 0.0067930

30 EMA (red): 0.0068478

Current Price: 0.0068313

Price Position: Currently between the EMAs, showing consolidation and potential indecision.

🟪 Key Zones Identified

Entry Zone (Sell Area): Around 0.0068740

Stop Loss Zone: Above the resistance area at 0.0069118

First Target Zone (EA Resistance Point Target): Around 0.0067636

Final Target Zone (EA Target Point): Around 0.0066745

📉 Short Trade Plan

Entry Point: Price re-tests the resistance zone at 0.0068740

Stop Loss: Above key resistance at 0.0069118

Target 1 (TP1): 0.0067636

Target 2 (TP2): 0.0066745

Risk-to-Reward: Approx. 2.89x, with a -2.89% drop expected from entry to final target.

📊 Price Structure & Trend Insight

The chart shows bearish intent, with repeated rejections from the resistance zone.

A break below the 200 EMA and the support near 0.0067930 would signal stronger downside momentum.

The downward arrow and projection reflect a swing short setup based on market structure and key zones.

✅ Strategy Confirmation

Watch for:

Price rejection from the 0.0068740 level.

Bearish candlestick patterns in that zone (like bearish engulfing or shooting star).

Volume confirmation or momentum slowdown at resistance.