USD/JPY Bullish Reversal AnalysisUSD/JPY Bullish Reversal Analysis 📈💹

🔍 Technical Overview:

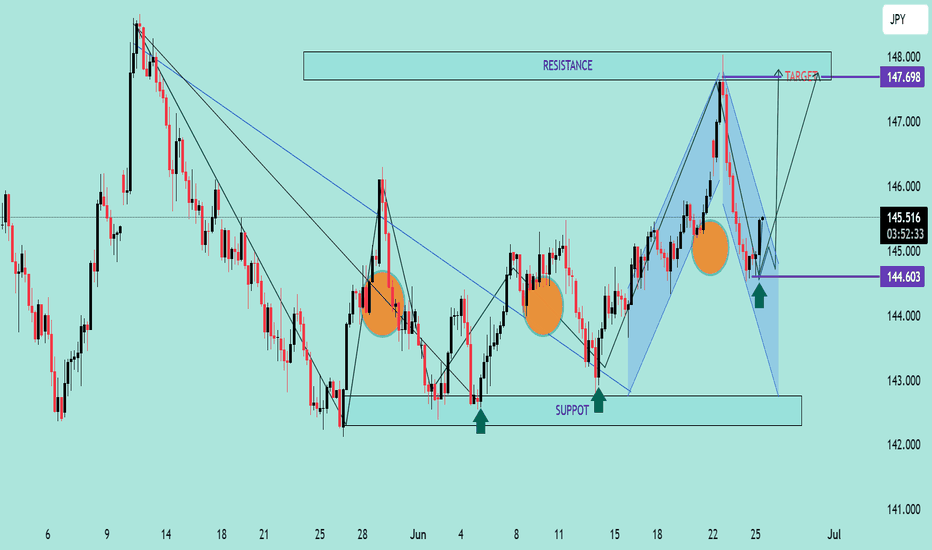

The chart illustrates a strong bullish reversal pattern forming on USD/JPY after price reacted from a key support zone at 144.600. This level has held firm multiple times, marked by green arrows, signaling strong buying interest.

📐 Chart Patterns & Structure:

✅ A bullish harmonic pattern (possibly a bullish Bat or Gartley) is completing near the 144.600 zone.

🔄 Multiple rejection wicks and bullish engulfing patterns indicate a potential upside reversal.

🔵 Descending trendlines have been broken, confirming momentum shift.

🔁 Previous resistance turned support (near 145.000) is acting as a possible launchpad for the next move.

🎯 Upside Target:

The projected move targets the resistance zone at 147.698, aligning with previous highs and a significant supply area.

If price breaks above 145.900 convincingly, continuation toward this resistance is expected.

🔻 Downside Risk:

A break below 144.600 would invalidate the bullish setup and expose price to the lower support range near 142.000–143.000.

📊 Conclusion:

USD/JPY is showing signs of bullish reversal from a strong demand zone. If price sustains above 145.000 and breaks the minor consolidation, the pair could rally toward 147.698 🎯.

Bias: Bullish ✅

Support: 144.600

Resistance: 147.698

Jpyusdsignal

JPY/USD Bullish Breakout – Targeting 0.0072802 After Retest (AprEntry Point: ~0.0069539

Take Profit (TP): 0.0072802

Stop Loss (SL): 0.0068579

Risk/Reward Ratio:

Risk: ~0.000096

Reward: ~0.000326

Approx. R/R = 1:3.4 → Excellent reward-to-risk

🧠 Strategy Insight

Trade Type: Long (Buy)

This is a bullish continuation setup aiming for higher highs after a breakout from a consolidation range.

Price Action:

Strong bullish trend visible since early April.

Price consolidated in a purple zone (likely a demand/support zone), then broke out and is now retesting that zone — classic breakout and retest pattern.

Indicators:

Two moving averages (likely 50 EMA in red and 200 EMA in blue) are in bullish alignment:

Price is above both EMAs.

50 EMA is above the 200 EMA, confirming bullish momentum.

Support & Resistance Zones:

Entry near previous resistance turned support — solid structure for long positioning.

TP zone near prior highs, possibly based on historical resistance (purple shaded zone above).

SL placed below the most recent demand zone and 200 EMA — a conservative and safe stop.

🔁 Trade Scenarios

✅ Bullish Outcome (Preferred):

Price respects the retest zone and pushes toward 0.0072802.

Strong momentum or fundamental catalysts could support the breakout continuation.

❌ Bearish Risk:

Price dips below the entry and breaks the demand zone and EMAs.

SL at ~0.0068579 helps manage this risk effectively.

🧩 Summary

This is a well-structured trend continuation long setup with textbook breakout-retest logic. The high R/R makes it an attractive opportunity assuming bullish conditions persist.

📌 Suggested Title

"JPY/USD Long Trade Setup – Breakout Retest Toward 0.0072802 (April 11, 2025)"

USDJPY TRADING POINT UPDATE > READ THE CAPTAIN Buddy'S dear friend 👋

USD JPY SMC Trading Signals 🗺️🗾 Update USD JPY ready for down 👇 trend 📉 technical analysis update USD Already done with.109:600 back down 👇 JPY closed below 157.067

Next support level 156.00

Analysis target we'll see 156.00

MR SMC trading point

Support 💫 My hard analysis Setup like And Following 🤝 me that star ✨ game 🎮