Kinnari

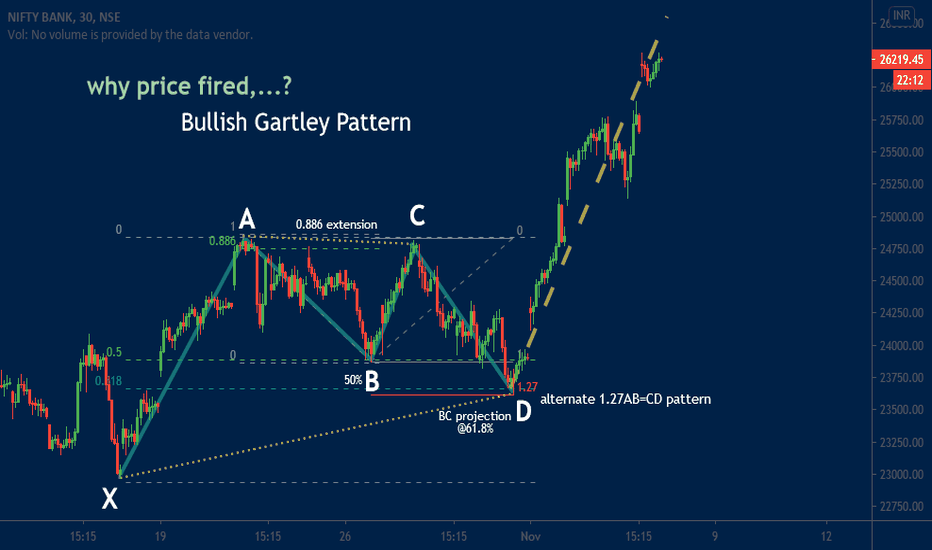

Question for Harmonic Trader & Why price fired? BANKNIFTYQuick reversals from Bat pattern PRZs are quite common.

The mid-point "B" at exactly 50% retracement.

Alternate 1.27AB=CD pattern.

BC projection @61.8%.

The price quickly reversal seen after "D".

Question of Harmonic Trader/Analyst is ,

Bat Or Gartley?

Why did birth to this question?

- The Gartley Pattern required point "B "50% and 1.27AB=CD pattern required. In essence, One of the most important numbers in the pattern is the completion of point D at the 0.786 of XA.

- The Bat utilizes a BC projection that is at least 1.618 & the BC projection must not be a 1.27 but in this case, we have 1.27 AB = CD .

Indigo, Weekly TimeFrame and 4Hrs TimeFrame Overview.Value High is good to sell this stock 1372 below for targets 1287(Control Price 2) and Weekly chart 1210.

Target 1210 if the price sustain below 1360

As per the weekly chart, Buy INDIGO for targets 1480 nearby only if price close 1350 +

Param ount Underline is st ronger resistance and price can fall that why don't you suggest trade heavy volume.

if you are a log term investor you can invest. Disclaimer :- this is a educational call don't trade and invest in my recommendation.

buy tata motors every down tick, next thing you can invest in it till it is hinged above 190

buying range is 200 - 210 , take a stop loss around 190 , target @ 275 for 3 months prospective

Disclosure :- I have invested at 175 level in this stock altaid.