Kinnari_prajapati

T-Bar(trade-executable) reversal zone, for SBIN!How to determine the target after T-Bar ?

By utilizing Fib. Retracement, target can 38.2% first and 61.8% second. There's also important how to ride your profit which depends on many factors such as trailing SL, Volume, etc.

Targets are 227.55 and 211.75.

My previous work on this stock :

SOLD: (247-249): - I have activated to sell in TimeLine Notification .

First posted pattern:

Hindalco coming under-pressure, Thirty sellers watching Hindalco

Today's high 228 which is not far from Thursday sellers .

The 235.2 (fib. ratio - 78.6%) nearby stops to moving price upward.

The upper band of the channel's hurdle at 231 which can push the price for " Gravitation Line ".

The "6" point of Gravitation area is 204 to 206 in range.

The Precise 13096 number, 1.27AB = CD Alternate Harmonic!By the observing from left to the right-hand side for AB = CD and 1.27/1.618AB=CD most precise Potential Reversal Zones ( PRZ ) of alternate Harmonic Pattern.

The next important level for, Alternate 1.27AB = CD at 13096 can be used to determine other potential Reversal Points.

1.27 AB = CD 13096

AB = CD was at 12765 and the price slightly crossover it.

1) High Potential to win : (Selling Ran ge of NIFTY)

2) High Potential to win : (Selling level 13086 )

Below Links is my deepest research for you as usual.

The Break-Down Trade-Strategy with Wave Counting!Hello, Friends...!

How are you?

After a long time, I've used here Break-Down Strategy...

The Control Price is too far from the current price level.

The price is trading near the Value Low area which is near 11476 .

No Activity Zone is the upper side of the Control Price.

The Wave COUNTING: our wave counting direction is up-ward therefore, the price will take support shortly to move up-direction.

Thank you.

AB=CD at 12798 for NIFTY.This defined the 12798 area as critical short-term resistance. It is important to note that the stock reversed after the AB=CD completion point will test. Although the BC projection was an important calculation within the PRZ of the pattern, the completion of the equivalent AB=CD structure was the defining limit. The chart of the price action in the PRZ shows the near-perfect reversal just the PRZ at 12798 nearby expecting...

I outlined that important level is at 12798 a nd Terminal Bar will decide for reversal confirmation.

I have mixed use Breakdown + Elliott Modied Basic Rules...

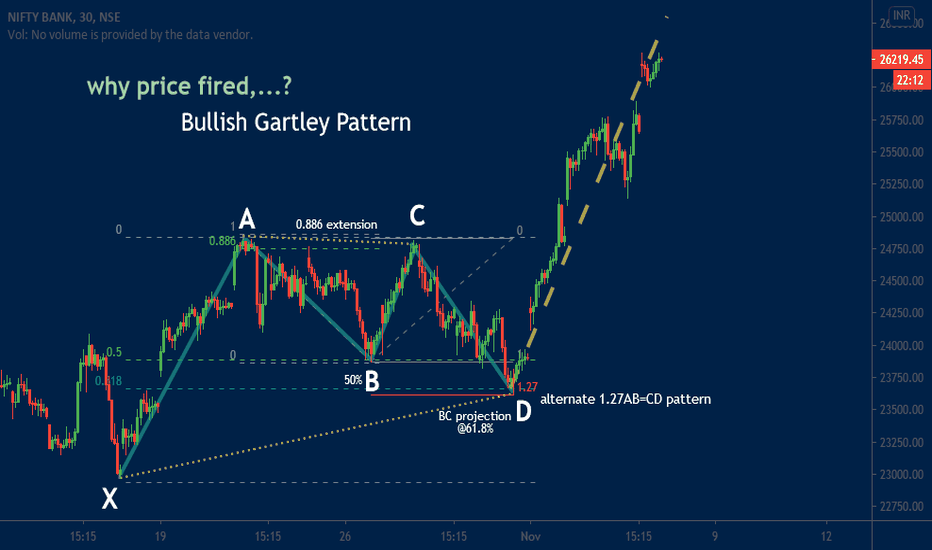

Question for Harmonic Trader & Why price fired? BANKNIFTYQuick reversals from Bat pattern PRZs are quite common.

The mid-point "B" at exactly 50% retracement.

Alternate 1.27AB=CD pattern.

BC projection @61.8%.

The price quickly reversal seen after "D".

Question of Harmonic Trader/Analyst is ,

Bat Or Gartley?

Why did birth to this question?

- The Gartley Pattern required point "B "50% and 1.27AB=CD pattern required. In essence, One of the most important numbers in the pattern is the completion of point D at the 0.786 of XA.

- The Bat utilizes a BC projection that is at least 1.618 & the BC projection must not be a 1.27 but in this case, we have 1.27 AB = CD .