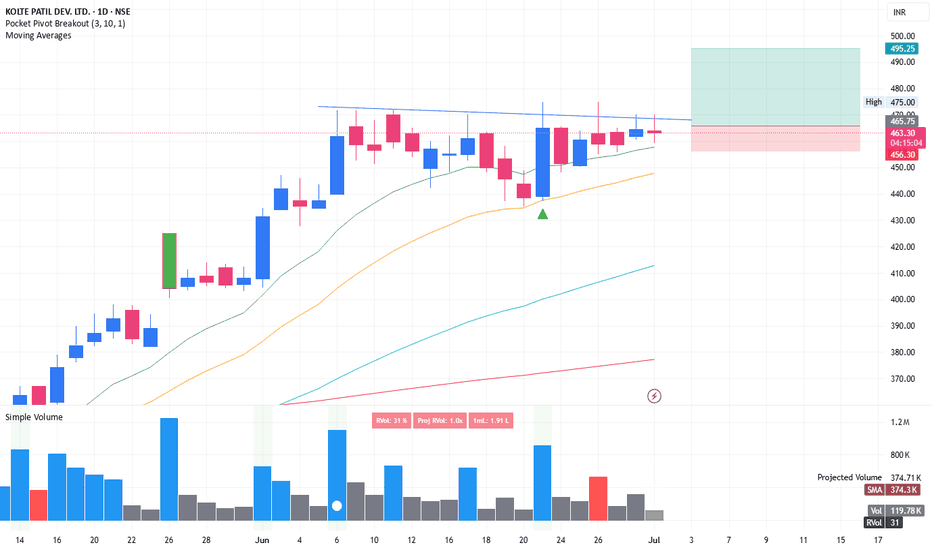

Swing trade opportunity in KOLTEPATILKOLTEPATIL: Tight consolidation with inner bar structure is formed in last 5-6 days. Breaking above the pivot line could lead to significant push when crossing with good volume.

SL is somewhere around 3% (Refer the long position drawn over the chart).

One can invest 10% portfolio size as per following calculations

Position sizing and managing risk is the key.

Portfolio is: 1,00,000

Position size: 10,000

Risk 3%: 300. Which means only 0.3% of overall portfolio value is under risk.

Stay connected for commentary for coming days

Disclaimer:

The information provided herein is for educational and informational purposes only and should not be construed as investment advice. The stock analysis and recommendations are based on publicly available information, data sources believed to be reliable, and our interpretation at the time of writing.

Investing in equities involves risks, including the risk of loss of capital. Past performance is not indicative of future results. Readers and investors are advised to conduct their own research or consult a qualified financial advisor before making any investment decisions.

The author(s), affiliates, or associated entities may hold positions in the stocks mentioned, and such positions are subject to change without notice.

We do not guarantee the accuracy, completeness, or timeliness of any information presented, and we disclaim any liability for financial losses or damages resulting from the use of this content.

KOLTEPATIL

KOLTEPATIL AT DAILY DEMAND ZONEKOLTEPATIL (KOLTE-PATIL DEVELOPMENT)

About the company

The company has been creating landmarks for over 3 decades and has developed and constructed over 50 projects including residential complexes, commercial complexes and IT Parks covering a saleable area of ~20 million square feet across Pune, Mumbai and Bengaluru.

Kolte-Patil is a trusted name with an established reputation for high quality standards, design uniqueness and transparency.

Stock is at Daily Demand Zone Look At the chart👇👇

Trade Setup-

LTP 429

any dip upto 400 can be bought

For targets🎯 457 / 483 / 505 / 521++

Above 525 it would be a breakout.....

Breakout Targets🎯 555 / 581 / 600 / 625+++

WEEKLY SUPPORT 380---370

Tecnical Analysis...

1) Formation in progress of..Falling Wedge pattern on Daily Charts...

2) Volume addition

3) At good and strong numbers

4) Daily and Weekly Support

Regards...

Harm⭕️nics4Life

17/07/2024

Disclaimer & Risk Warning

I am not sebi registered analyst.

My studies shared here are for educational purposes .. Do Consult Your Financial advisor Before Taking any Trade.....Good Luck!

Weekly Flag Breakout in Kolte Patil DevelopersIntroduction:

The company has been creating landmarks for over 3 decades and has developed and constructed over 50 projects including residential complexes, commercial complexes and IT Parks covering a saleable area of ~20 million square feet across Pune, Mumbai and Bengaluru.

Kolte-Patil is a trusted name with an established reputation for high quality standards, design uniqueness and transparency. Headed by a team of visionaries and dynamic leaders, the long-lasting mission of the company is to create spaces which are present-perfect and future-proof, blend well with the surroundings, and exude vitality and aesthetic appeal. Honesty, innovation, excellence, sustainability, value creation, and commitment to timely delivery are the core values of our company, which are perfectly aligned with every sq. ft. we build.

The Company’s long-term bank debt and non-convertible debentures have been rated ‘STABLE’ by CRISIL, the highest rating accorded by CRISIL to any publicly listed residential real estate player in India.

Analysis

A Weekly Bullish Flag and Pole pattern is visible on the charts of NSE:KOLTEPATIL

The Flag and Pole pattern is a bullish continuation pattern and it is visible in charts after a meaningful appreciation in the price.

MACD gave Positive crossover on Daily, Weekly and Monthly chart. So, expecting the momentum to continue.

One can look to create a fresh position in the scrip near Rs. 540.-550 levels with the stoploss of Rs. 480 on weekly closing basis. The 1st target will be 601.25 , 2nd target will be 666.60, 3rd target will be 710.60 and 4th target will be 740.20.

Risk Disclaimer:

The trading ideas and analyses presented here are for educational purposes only and do not constitute financial advice. Trading and investing in financial markets involve risk. You should carefully consider your own financial situation, risk tolerance, and investment objectives before making any investment decisions.

The information provided in this analysis is based on my personal interpretation of market conditions and the available data at the time of writing. It is subject to change without notice, and I cannot guarantee the accuracy, completeness, or timeliness of the information provided.

Trading and investing carry the risk of substantial losses, and past performance is not indicative of future results. Always be aware that markets can be unpredictable, and prices may move against your trade or investment.

It is advisable to seek advice from a qualified financial professional and to conduct your own research before making any investment decisions. You should only invest funds that you can afford to lose.

I am not responsible for any trades or investments made based on the information presented in this analysis. By reading and using this information, you acknowledge and accept that you are solely responsible for any losses you may incur.

KOLTEPATIL - Ichimoku Bullish Breakout Stock Name - Kolte - Patil Developers Limited

Ichimoku Cloud Setup :

1). Today's close is above the Conversion Line

2). Future Kumo is Turning Bullish

3). Chikou span is slanting upwards

All these parameters are showing bullishness at Current Market Price

and more bullishness AFTER crossing 332.

#This is not Buy and Sell recommendation to any one. This is for education purpose and a helping hand to learn trading in Market.

# Cloud Trading

# Ichimoku Cloud

# Ichimoku Followers

I hope you all like my analysis.

Please do share your thoughts into comment section.

Please give a like, it motivates me to do analysis.

NSE KoltePatil Stocks Prior Uptrend ResumeNSE KoltePatil stock overwhelmed today, and it hiked +34.10 ( +12.30% ). Technically, the A B C correction of the Elliott Wave is over. We can expect impulsive moves ahead. Today's volume spike and breakout of EMA 100 indicate bulls are stepping in. The uptrend can extend up to 322 - 340 - 350+ target price for intraday traders.

Further information I will update soon.

KOLTEPATIL (NSE) Trend Breakout with Momentum? The study...is based upon Volume Price Spread Analysis and Momentum

Kolte-Patil has shown both Trend Breakout with Momentum

Close: 347.80

EP: 350.00 <

SL: 329

TP: 356/383/Open

Disclaimer: This study does not constitutes Buy/Sell per say. Please consult your financial advisor before making any trading/investing decision

koltepatil developersshare name : koltepatil develper

call type : poistional

- share is forming pole and flag pattern

- After a good consolidation in between prices

270 - 210 stock is retesting the resistance zone

- we can accumulate this share at level 300-250

with sl of 260

- Approchable targets 360, 415

thanks

Positional Buy Trade Opportunity | MID TERM |KOLTE PATILNSE:KOLTEPATIL

Given breakout of 320 level.

Any dip above 300 seems good buying opportunity.

SL can be 280. Probable Targets are mentioned Charts.

-----------------------------------------

***************Please note this is my own study/opinion, it is not a trade recommendation**********************

Please Consult your financial advisor before making any investment.

KOLTEPATIL :: LONG KOLTEPATIL :: LONG BUILDUP

---------------------------------

Buy levels 332 - 340 (price should sustain to these levels on breakout / retrace )

Initial S/L 310

Add more near near 345-350 on retrace

Trail using SuperTrend Indicator

Reasons for the probability

-----------------------------

Flag Breakout / RSI Trendline breakout

/**

Caution : Smallcap RealEstate stock... Prefer allocating <5% of your capital.

This is just a probability and trade only if you know about "Risk Management".

Consult your financial advisor to know more about the risks associated with buying / selling shares.

**/

KOLTE PATIL BREAKOUT SWING TRADING SETUPKolte Patil has recently broke out its swing highs and heading towards new highs

Great setup to trade is breakout and retest strategy

So the pullback is coming with a bullish gartley harmonic pattern around 276-280 levels with stop loss below 270

Expecting targets of all time high in kolte patil i.e 400 levels

Trade accordingly

Follow for more regular content